Frictionless Authentication

& Liability Shift

Juspay's intelligent authentication system shifts liability

to the issuer and reduces customer friction by smartly

managing payment authentication.

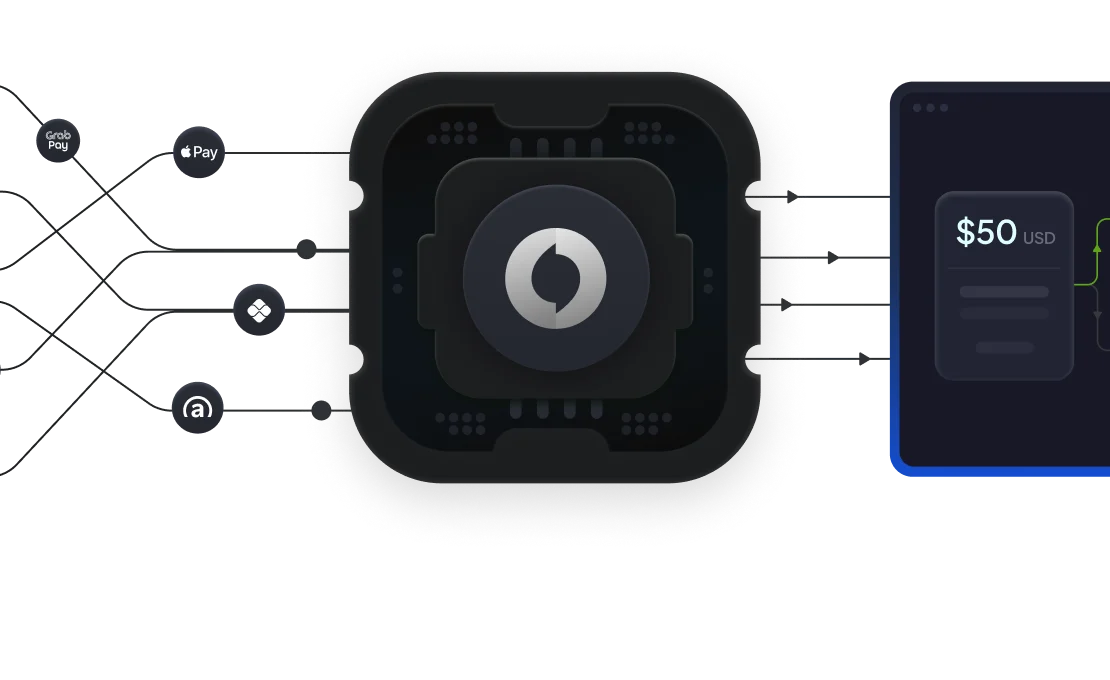

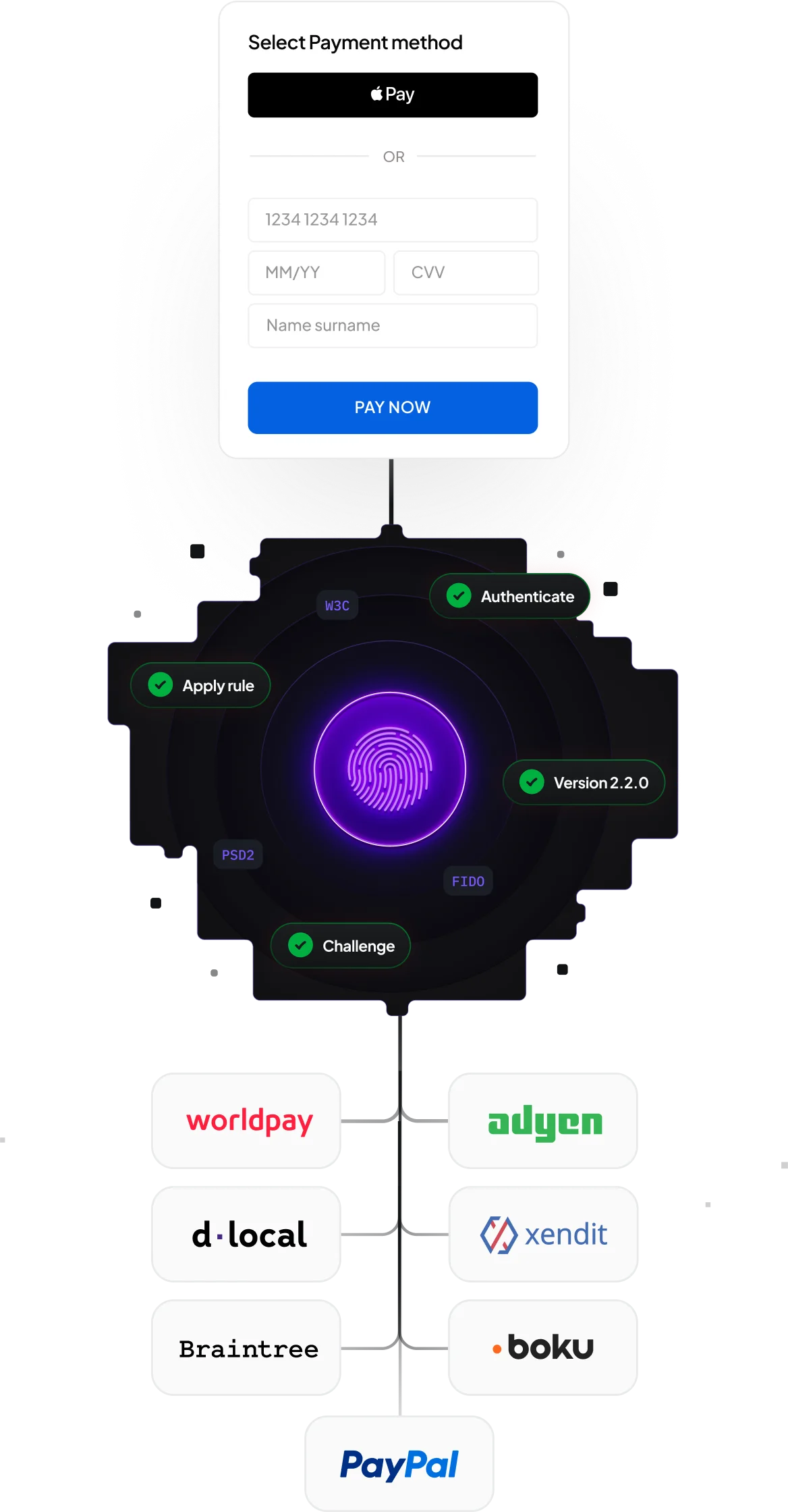

Streamline payment authentication worldwide

Streamline SCA, PSD2, and 3DS. Simplify authentication globally and adapt to region-specific regulations and behaviours to offer frictionless authentication everywhere.

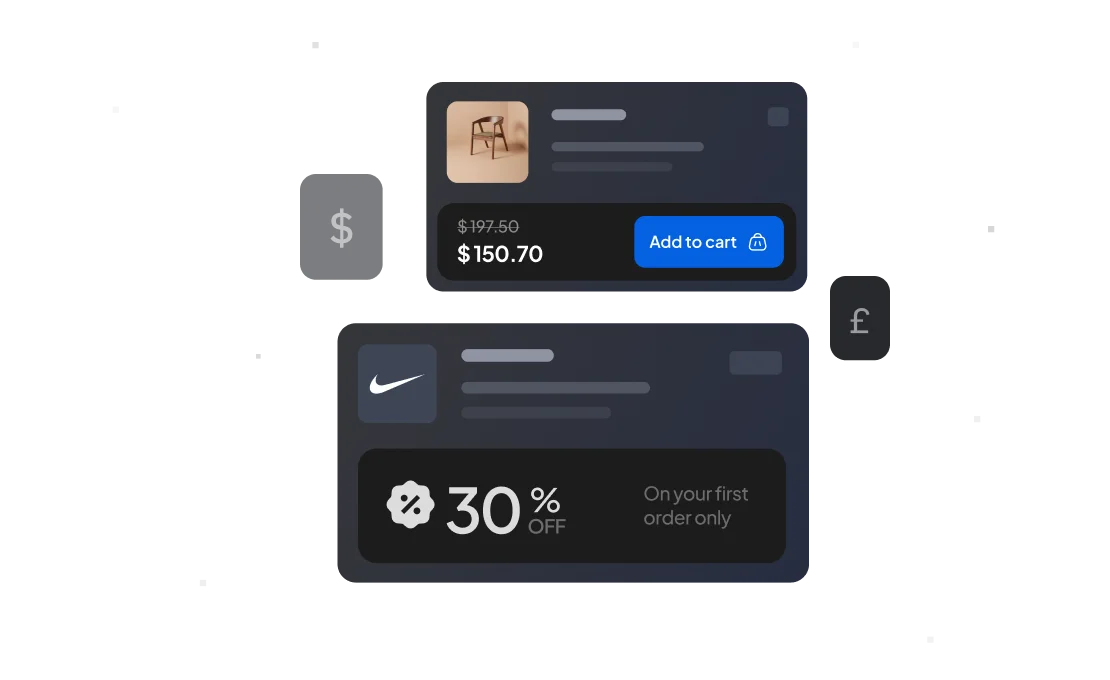

Click to Pay

Click to Pay simplifies online card payments to just one simple click

- Eliminate the need for your customers to enter payments data manually

- Seamless customer experience to improve checkout conversion rates

- Advanced security measures like network tokenisation and encryption

Adaptive 3DS

3DS engine that adapts to transaction & customer data

- Eliminate the need for your customers to enter payments data manually

- Configure 3DS triggers across transaction parameters

- Configure 3DS exempt & challenge flows as per your use cases

Paze wallet

Paze consolidates consumer's cards into a single wallet for better authentication & experience

- Additional layer of security with network tokenisation

- Higher Approval Rates with network tokens

Apple Pay

Apple Pay includes built-in SCA compliance and doesn’t require additional authentication

- Optimised pre-authorised payment experiences for recurring payments

- Payment cryptograms for dynamic security

Google Pay

Google Pay enables users to authenticate on their mobile devices without redirections

- Authentication via device-bound token and biometric/PIN

- SCA compliant and eligible for liability shift

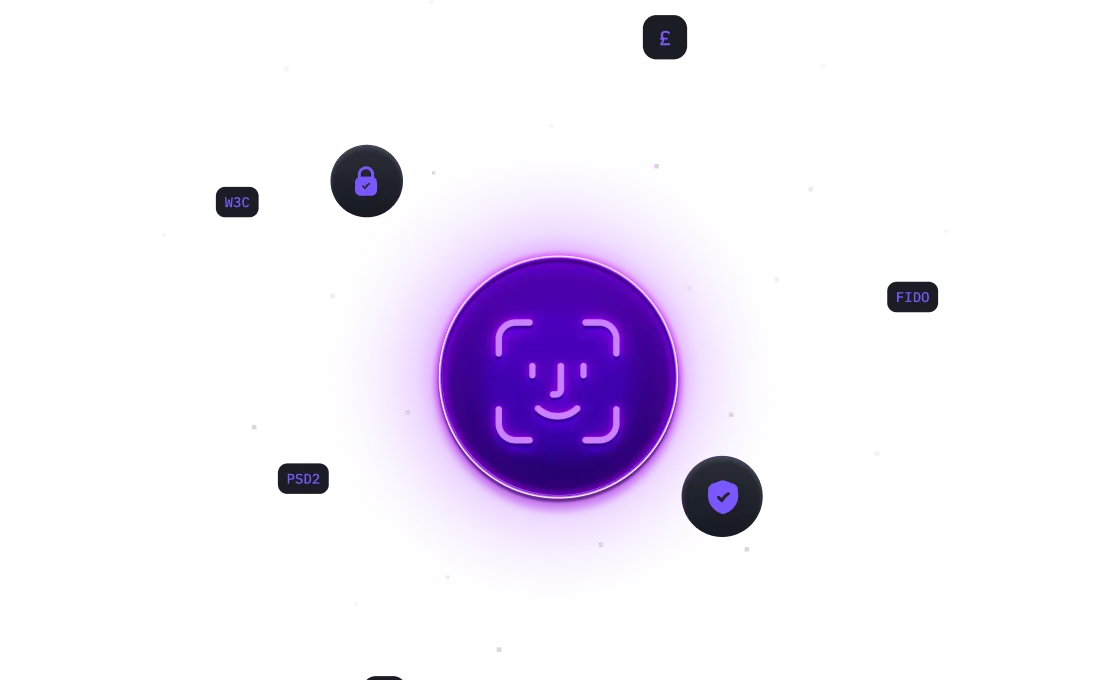

Payment Passkeys

Streamlined card not present (CNP) authentication built to FIDO standards

- 1-click checkout experience with Device-based biometric payment authentication

- Can be used with EMV® 3-D Secure (3DS)

- Helps meet PSD2 SCA requirements in the EU

Bank App Authentication

Streamlined Authentication experience for Bank Transfers

- Out of Band/Notification based flows

- Passkey based Authentication

- Time based One Time Password (TOTP) based Authentication

Click to Pay

Click to Pay

- Eliminate the need for your customers to enter payments data manually

- Seamless customer experience to improve checkout conversion rates

- Advanced security measures like network tokenisation and encryption

Paze wallet

Paze wallet

- Additional layer of security with network tokenisation

- Higher Approval Rates with network tokens

Apple Pay

Apple Pay

- Optimised pre-authorised payment experiences for recurring payments

- Payment cryptograms for dynamic security

Payment Passkeys

Payment Passkeys

- 1-click checkout experience with Device-based biometric payment authentication

- Can be used with EMV® 3-D Secure (3DS)

- Helps meet PSD2 SCA requirements in the EU

Google Pay

Google Pay

- Authentication via device-bound token and biometric/PIN

- SCA compliant and eligible for liability shift

Bank App Authentication

Bank App Authentication

- Out of Band/Notification based flows

- Passkey based Authentication

Adaptive 3DS

3DS engine that adapts to transaction & customer data

- Eliminate the need for your customers to enter payments data manually

- Configure 3DS triggers across transaction parameters

- Configure 3DS exempt & challenge flows as per your use cases

SUPPORTED FOR

Payment Passkeys for the most secure & seamless authentication

1-click Payments

Passkeys power OTP-free, one-click card payments with secure biometric authentication built on industry standards.

Secure

Passkeys use the same technology used to unlock personal devices (eg. smartphones). User's biometric data never leaves the device and is not shared.

Single setup

User can enrol their mastercard or visa card once and use their payment passkey anytime they pay online.

across all PSPs

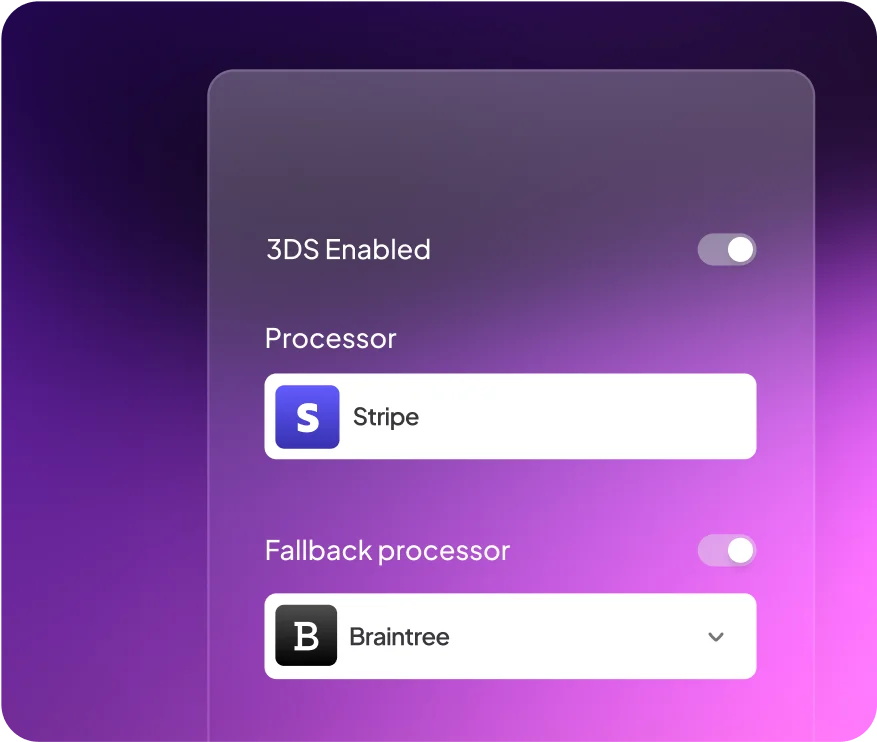

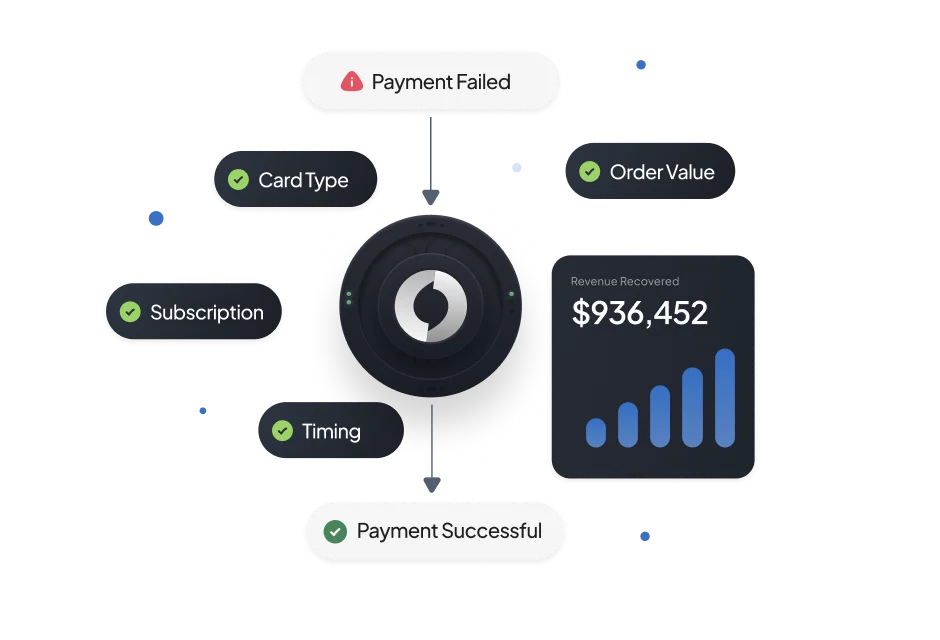

Take 360° control of 3DS authentication

Build your payment authentication strategy, control when 3DS is triggered, minimise payment fees and streamline customer experience.

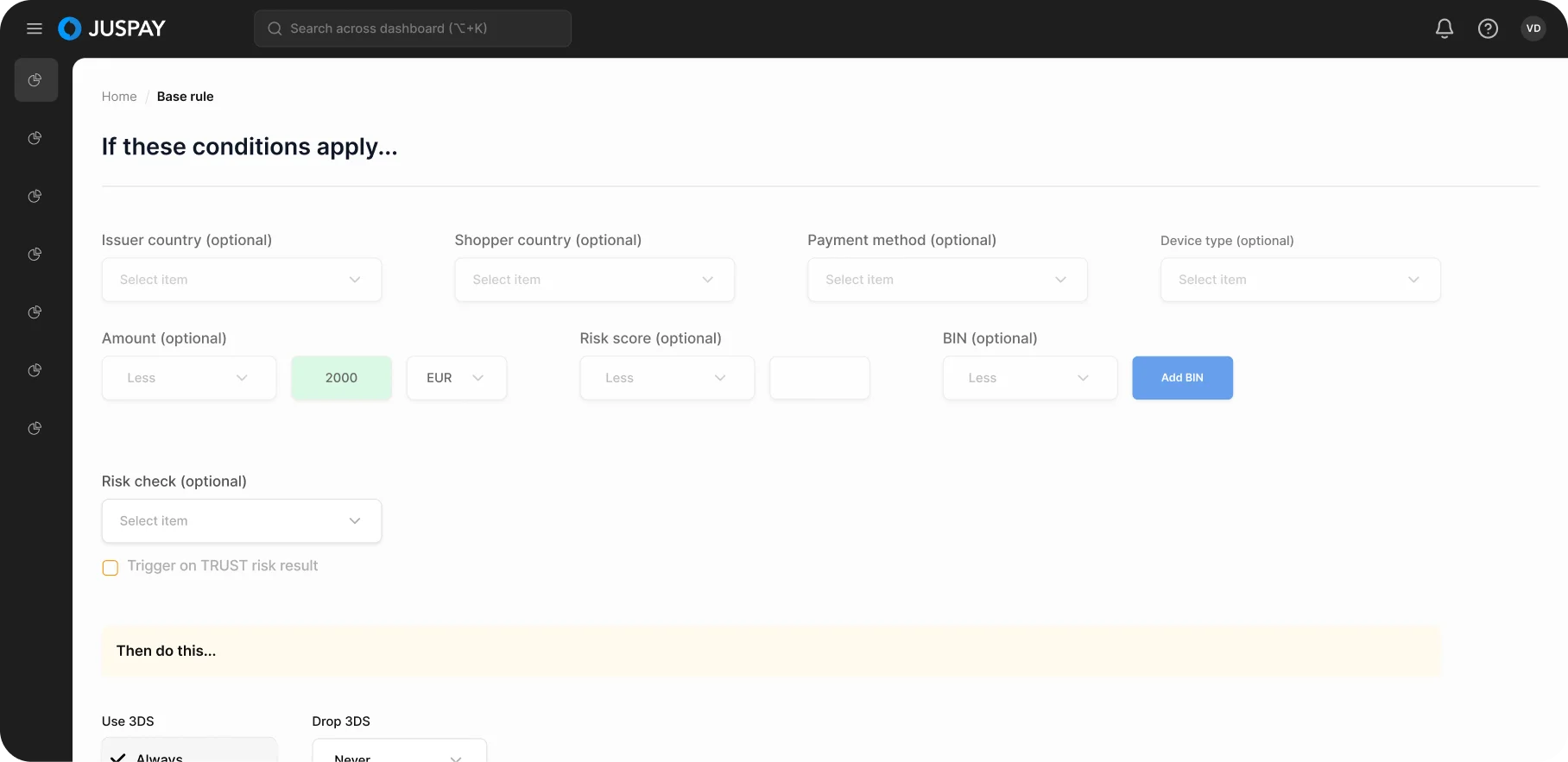

Exhaustive configurability

Build 3DS rules across parameters including issuer country, shopper country, payment method, device type, amount, and more.

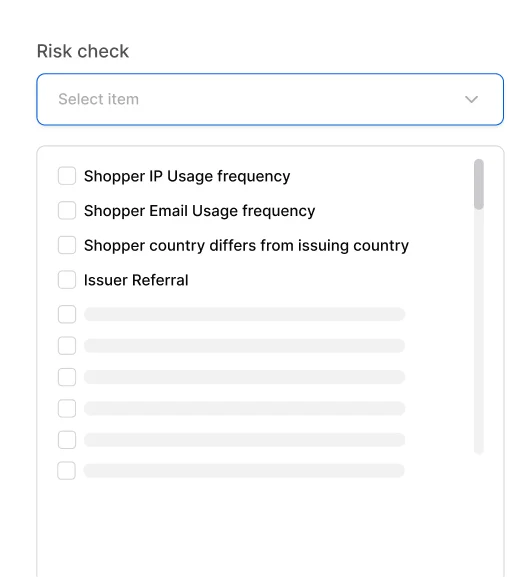

Extensive risk checks

Improve customer authentication with additional set of risk checks.

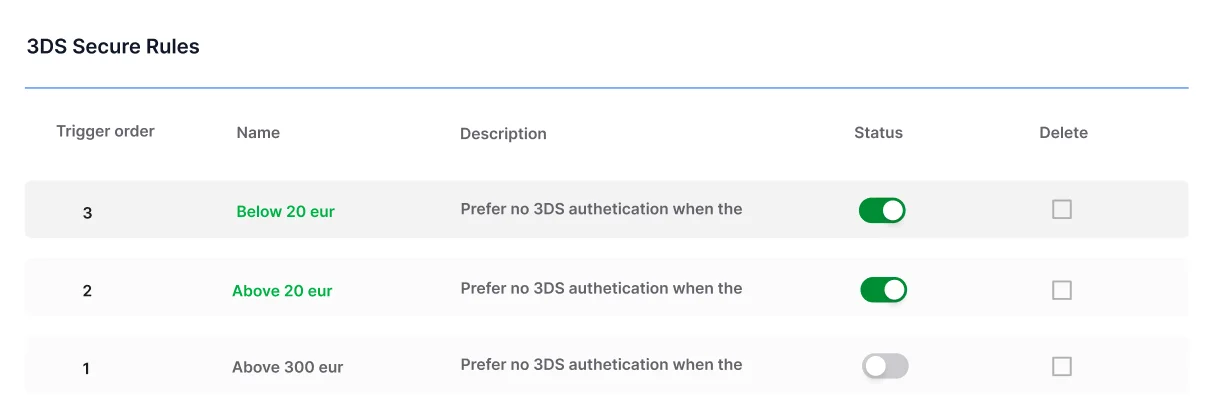

Create & manage 3DS rules

Configure & manage rules to trigger 3D secure authentication across payment flows without code.

Improve UX & Acceptance rates with 3DS 2.2 SDK

Juspay SAFE is the world's first 3DS optimised SDK. Power smooth 3DS experiences and improve acceptance rates with optimised bank 3DS pages and auto-otp read & submit.

default

default

Frictionless 2 factor authentication

Reliable auto OTP capture , optimising page UX, handling network issues, catching pre-loaded data, auto-filling forms from history.

EMVCo certified lightweight SDK

Lowest SDK size in market at <400kB with multiple authentication type support across geographies.

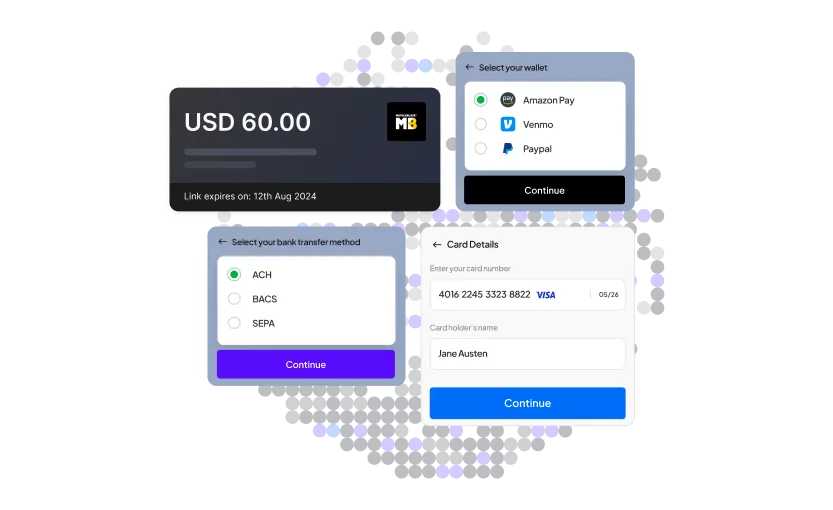

Seamless Authentication for Bank Transfers

Users can pay directly from a bank account powered by seamless authentication mechanisms for a frictionless checkout.

Out of Band / Notification flow

Seamless Authentication with the issuer bank app.

Notification approval on the issuer app through swipe or biometrics.

- Notification approval on the Issuer app through swipe or biometrics

- Platform-agnostic, with forced notifications support on Android for better user experience

- Notifications powered by the SDK for users with Issuer bank app and device authentication enrolment

Passkey based Authentication

Merchant agnostic device binding & biometric based authentication.

Biometric authentication via face ID or fingerprint

- For every new card enrolled the browser will do a new enrolment with ACS post an OTP led 2FA

- Biometric authentication via Face ID or Fingerprint

- Available across platforms - Android, iOS, web

Tap & Pay via Bank App

Seamless & Secure Tap & Pay User Experience with support for all major Card Schemes.

Seamless & secure tap & pay user experience.

- Fast & frictionless Tap & Pay experience for contactless payments

- Compatible with all major card schemes (Visa, Mastercard, etc.)

- Advanced Security with Tokenisation, Encryption and real time fraud detection

TOTP based Authentication

Seamless TOTP flow for offline authentication with additional risk checks and challenge flows.

Seamless TOTP flow for offline authentication with additional risk checks.

- Offline Authentication Experience for consumers in low mobile network coverage areas

- Additional authentication flow for high risk transactions

- Custom TOTP flows including user specific code for transaction confirmation and Signed TOTP (Transaction specific) flows

Maximise Payment

Acceptance Rates

with

Smart Retries

Improve conversions with seamless retries and intelligently route payments to another PSP in case of a soft decline, without asking customers to re-authenticate.