Next-Generation payment acceptance for banks

Modern, modular, and proven infrastructure for banks to deliver enterprise-ready payment acceptance solutions for their clients. Best-in-class capabilities without legacy constraints or overheads, enabling banks to reliably compete on speed, cost, and performance.

Engineered for your global scale

Enterprise-grade reliability, scale, and support.

99.999%

Reliability

50000

Transactions per second support

300 Mn+

Transactions processed every day

<100ms

Payment latency

Global acquiring -

Cards, APMs and RTP

Modernise Your Payments Infrastructure with Juspay’s Cards Payment Gateway. Simplify multi-country operations, merchant management, risk prevention, and more.

Payment gateway

Payment acceptance

Seamless global payment method coverage including major card schemes, and alternate payment methods.

Fraud & risk management

Detect fraud in real time with advanced machine learning and rule based risk modules.

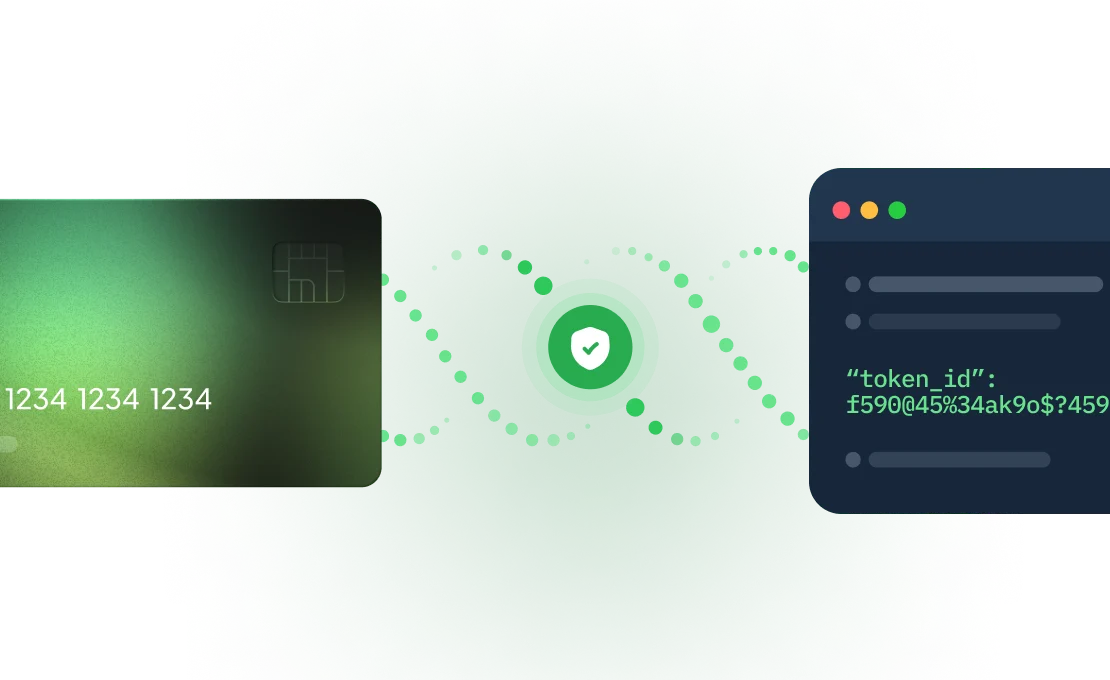

Token requestor

Tokenize cards directly with the card schemes with Juspay's network token API.

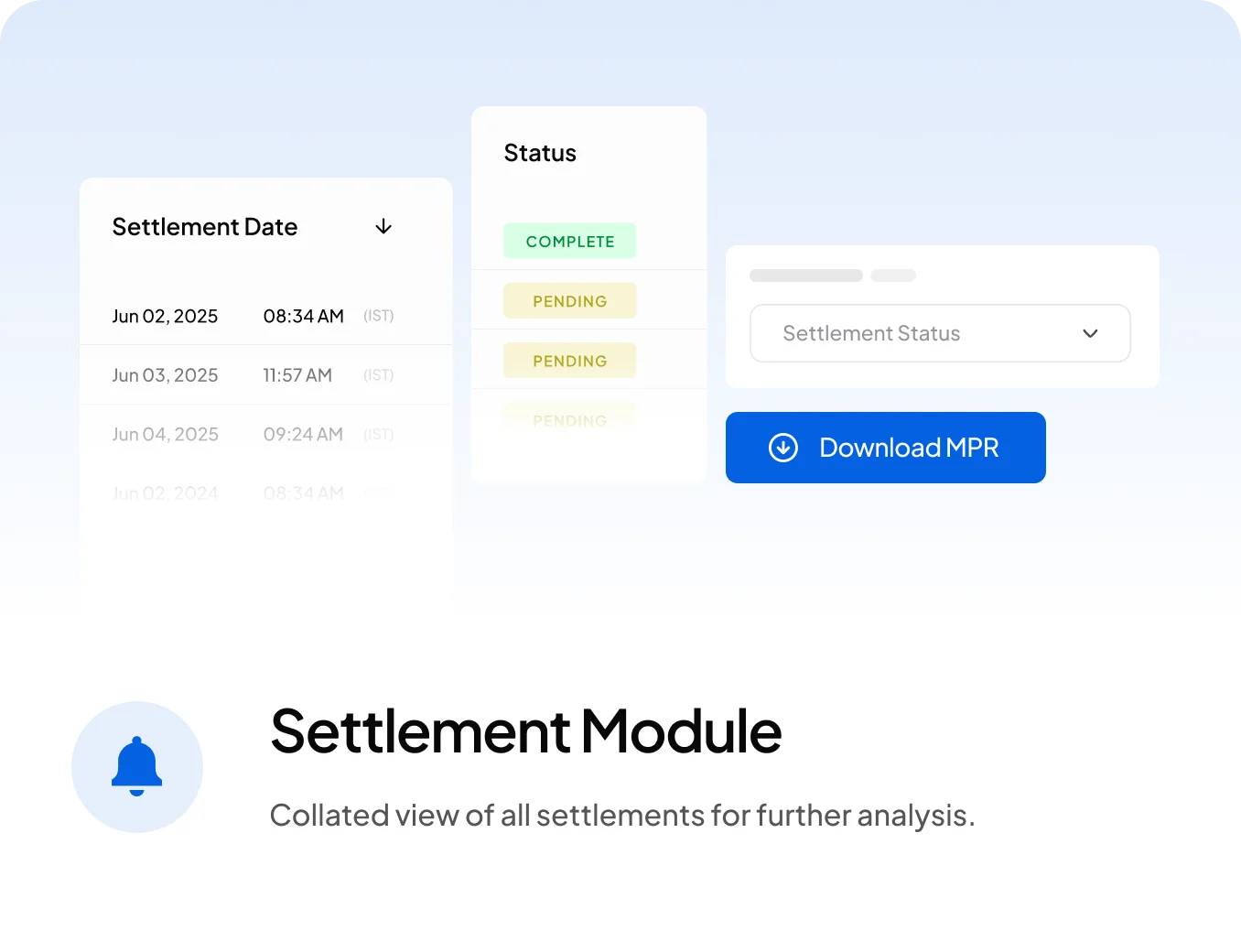

Reconciliation & settlements

Automated 3-way reconciliation across your payments stack, PSPs, and bank along with a custom settlement report.

Dispute management

Manage and defend disputes via dashboards smart 3DS and Juspay's operations teams.

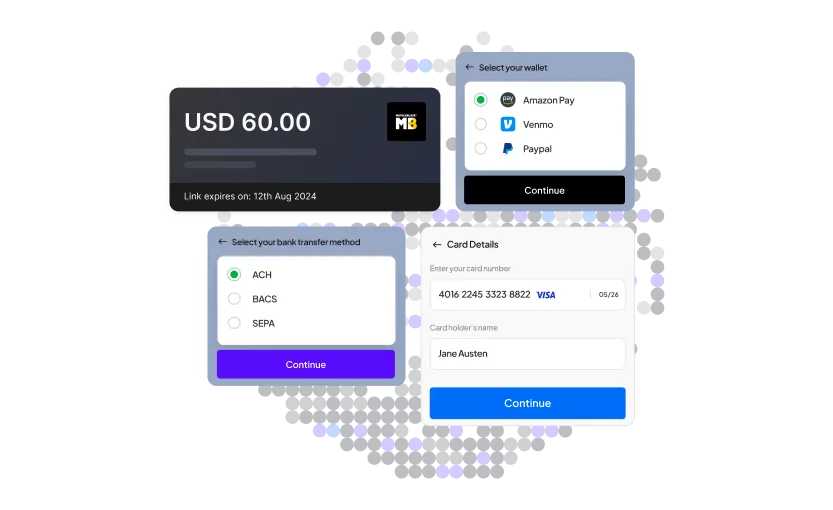

Checkout experience

Power superior customer checkout experience via a Hosted Payment Page and seamless 1-Click Authentication.

KYC onboarding

Seamless self onboarding powered by best-in-class KYC/KYB modules.

Control center & analytics

Get deeper visibility and control of your payments via dashboards.

Bank-grade security & compliance

Bank-grade security

& compliance

Working with global financial institutions, Juspay powers bank grade compliance, adheres to best practices for information security and helps mitigate fraud risk.

Streamline payment authentication worldwide

Tackle authentication globally and adapt to region-specific regulations and behaviours to offer seamless authentication everywhere.

Click to Pay

Click to Pay simplifies online card payments to just one simple click

- Eliminate the need for your customers to enter payments data manually

- Seamless customer experience to improve checkout conversion rates

- Advanced security measures like network tokenisation and encryption

Adaptive 3DS

3DS engine that adapts to transaction & customer data

- Eliminate the need for your customers to enter payments data manually

- Configure 3DS triggers across transaction parameters

- Configure 3DS exempt & challenge flows as per your use cases

Paze wallet

Paze consolidates consumer's cards into a single wallet for better authentication & experience

- Additional layer of security with network tokenisation

- Higher Approval Rates with network tokens

Apple Pay

Apple Pay includes built-in SCA compliance and doesn’t require additional authentication

- Optimised pre-authorised payment experiences for recurring payments

- Payment cryptograms for dynamic security

Google Pay

Google Pay enables users to authenticate on their mobile devices without redirections

- Authentication via device-bound token and biometric/PIN

- SCA compliant and eligible for liability shift

Payment Passkeys

Streamlined card not present (CNP) authentication built to FIDO standards

- 1-click checkout experience with Device-based biometric payment authentication

- Can be used with EMV® 3-D Secure (3DS)

- Helps meet PSD2 SCA requirements in the EU

Bank App Authentication

Streamlined Authentication experience for Bank Transfers

- Out of Band/Notification based flows

- Passkey based Authentication

- Time based One Time Password (TOTP) based Authentication

Click to Pay

Click to Pay

- Eliminate the need for your customers to enter payments data manually

- Seamless customer experience to improve checkout conversion rates

- Advanced security measures like network tokenisation and encryption

Paze wallet

Paze wallet

- Additional layer of security with network tokenisation

- Higher Approval Rates with network tokens

Apple Pay

Apple Pay

- Optimised pre-authorised payment experiences for recurring payments

- Payment cryptograms for dynamic security

Payment Passkeys

Payment Passkeys

- 1-click checkout experience with Device-based biometric payment authentication

- Can be used with EMV® 3-D Secure (3DS)

- Helps meet PSD2 SCA requirements in the EU

Google Pay

Google Pay

- Authentication via device-bound token and biometric/PIN

- SCA compliant and eligible for liability shift

Bank App Authentication

Bank App Authentication

- Out of Band/Notification based flows

- Passkey based Authentication

Adaptive 3DS

3DS engine that adapts to transaction & customer data

- Eliminate the need for your customers to enter payments data manually

- Configure 3DS triggers across transaction parameters

- Configure 3DS exempt & challenge flows as per your use cases

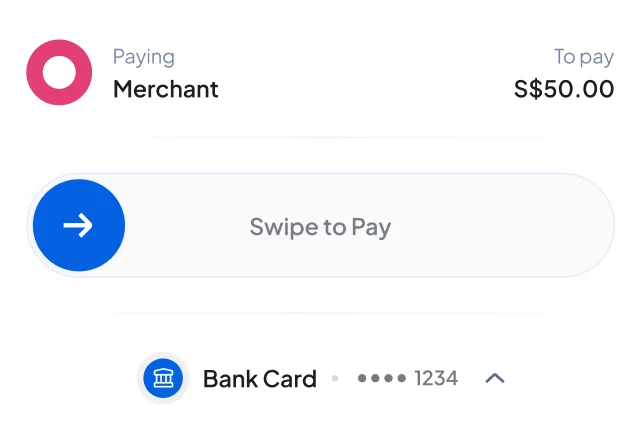

Frictionless bank

transfer payments

Enable end-users to pay directly from a bank account powered by seamless authentication mechanisms for a frictionless checkout.

Out of Band / Notification flow

Users can approve notifications in the Issuer app via a quick swipe or biometric authentication, such as fingerprint or face recognition

Tap & Pay via Bank App

Offers a seamless and secure Tap & Pay experience with support for all major card schemes, ensuring convenience and reliability for users.

TOTP based Authentication

Provides a seamless TOTP-based flow for offline authentication, enhanced with additional risk checks and challenge mechanisms for added security.

Passkey based Authentication

Enables merchant-agnostic device binding along with biometric-based authentication for a consistent and secure user experience across platforms.

Out of Band / Notification flow

Users can approve notifications in the Issuer app via a quick swipe or biometric authentication, such as fingerprint or face recognition

Tap & Pay via Bank App

Offers a seamless and secure Tap & Pay experience with support for all major card schemes, ensuring convenience and reliability for users.

TOTP based Authentication

Provides a seamless TOTP-based flow for offline authentication, enhanced with additional risk checks and challenge mechanisms for added security.

Passkey based Authentication

Enables merchant-agnostic device binding along with biometric-based authentication for a consistent and secure user experience across platforms.

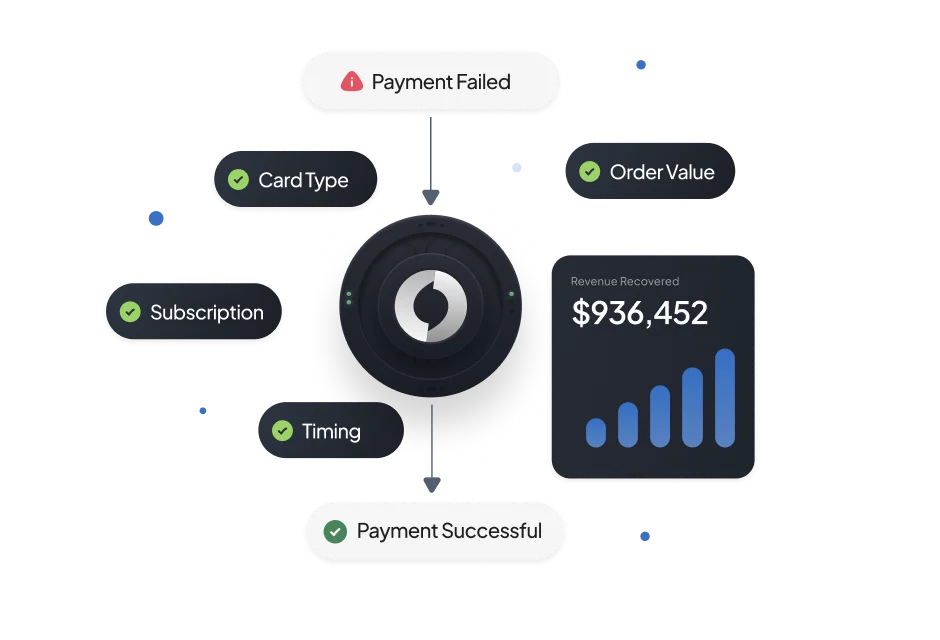

Mitigate fraud risk in

merchant acquiring

Real-time rules engine to manage fraud during transaction processing coupled with best-in-class application and process security.

Transaction Processing

Fraud Risk Management

- Rules Engine to define and customize rules based on specific requirements

- Risk Assessment that evaluates each transaction against the defined rules

- Advanced machine learning models to identity fraud in real time

3DS Integration & Security

- All outbound/inbound calls via proxy IPs

- End-to-end encryption for API calls and PII in DB

- HTTPS mandates for all communication

Application Security

Authentication

- API Keys

- Session Tokens

- IP Whitelisting

- Mandatory MFA

- Password Rotation

Integrity

- Hash verification ; integrity checks based on amount & order ID

Session Management

- Order transaction level expiry; card token expiry; JWT based login

Auditability

- Audit trail for transaction records; agent actions

Process Security

Data Security

- Application Layer Encryption

- Data at Rest encryption

- Audit Trail of Data Success

Change Management

- Marker checker process

- Automated Regression Testing

- Version Deployments

Access Control

- Mandatory MFA

- AWS Audit logs

- Access Control Policy

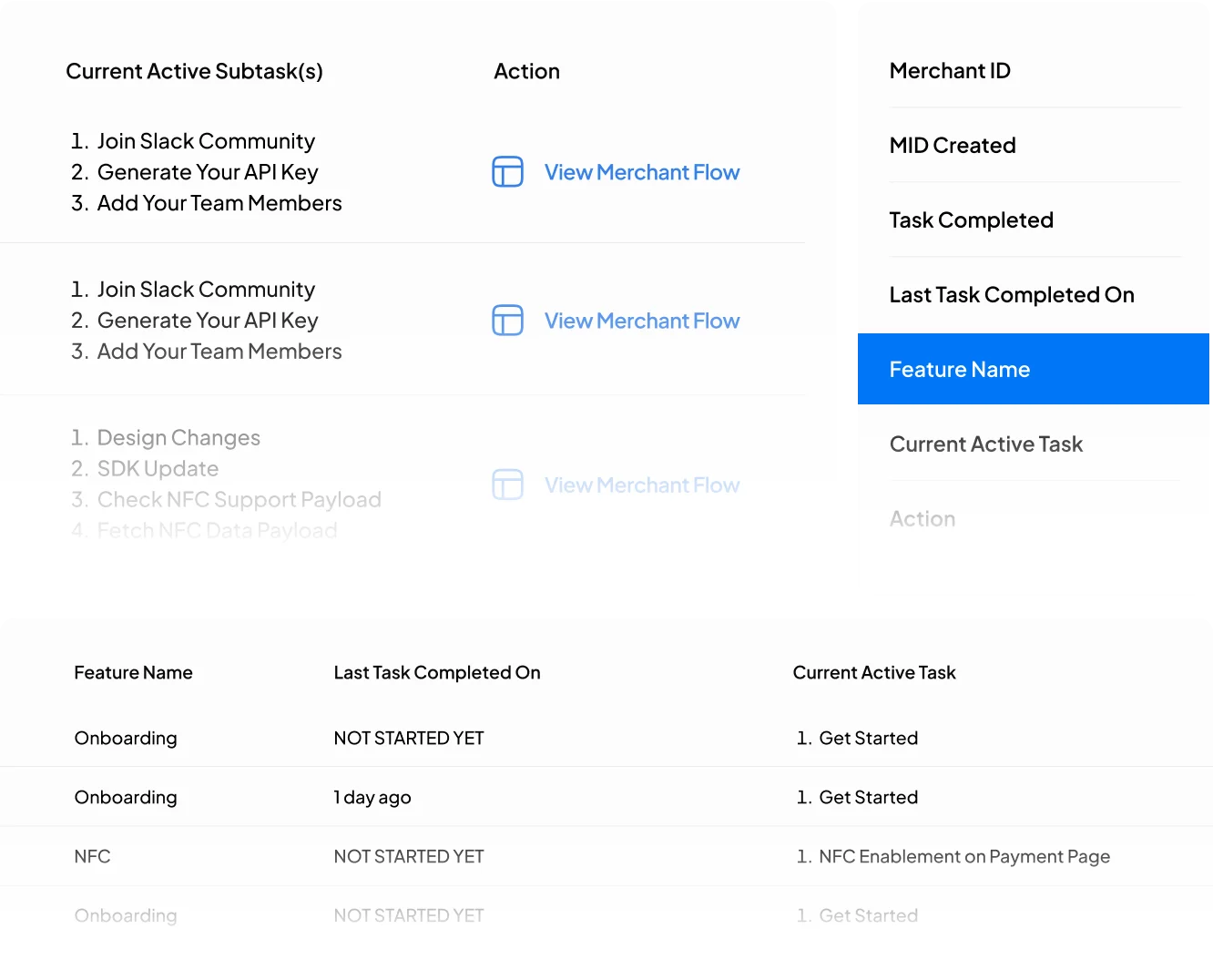

Seamless merchant

onboarding & management

Manage merchant onboarding, configurations, pricing, reporting, and more through a single, centralized dashboard.

Merchant onboarding and configuration

- MID & MCC generation for Merchants

- Merchant network registration

- Complete Merchant KYC via dashboard

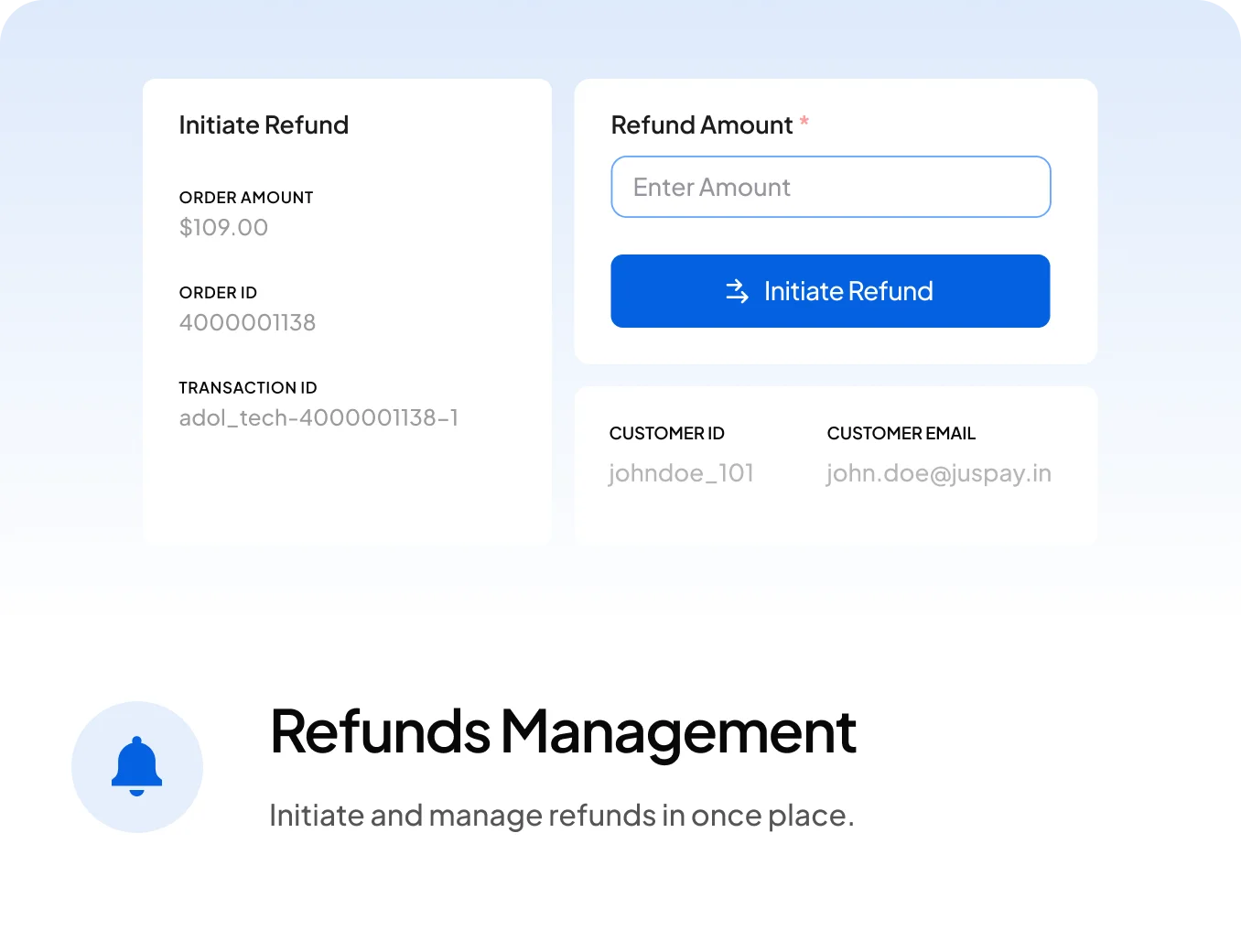

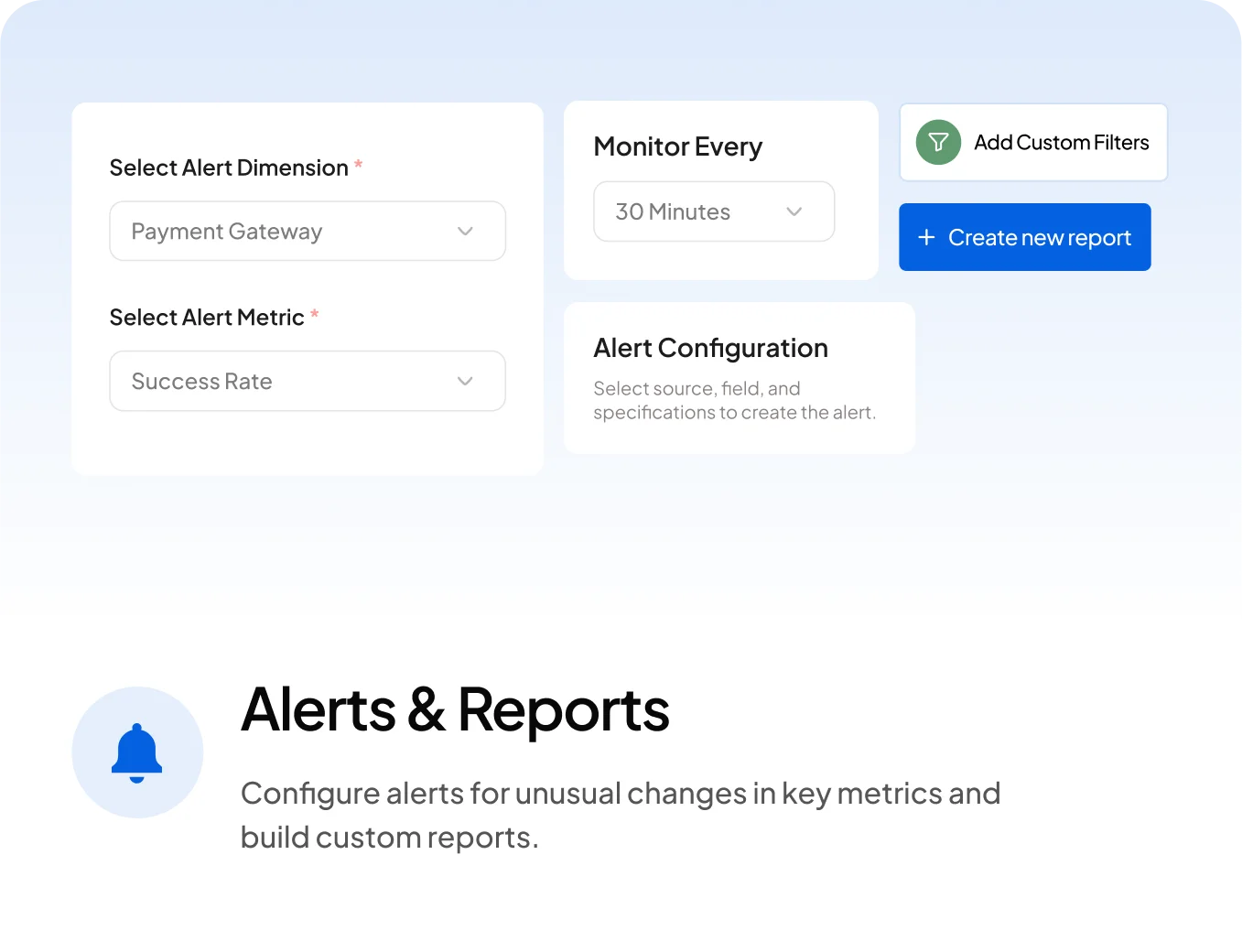

Robust & data-rich

dashboard for merchants

Empower your merchants with a robust dashboard for enhanced operational control.

The most versatile

white-label payments stack

Juspay's White-label Payments Stack is built upon a decade of experience in sophisticated payments engineering.

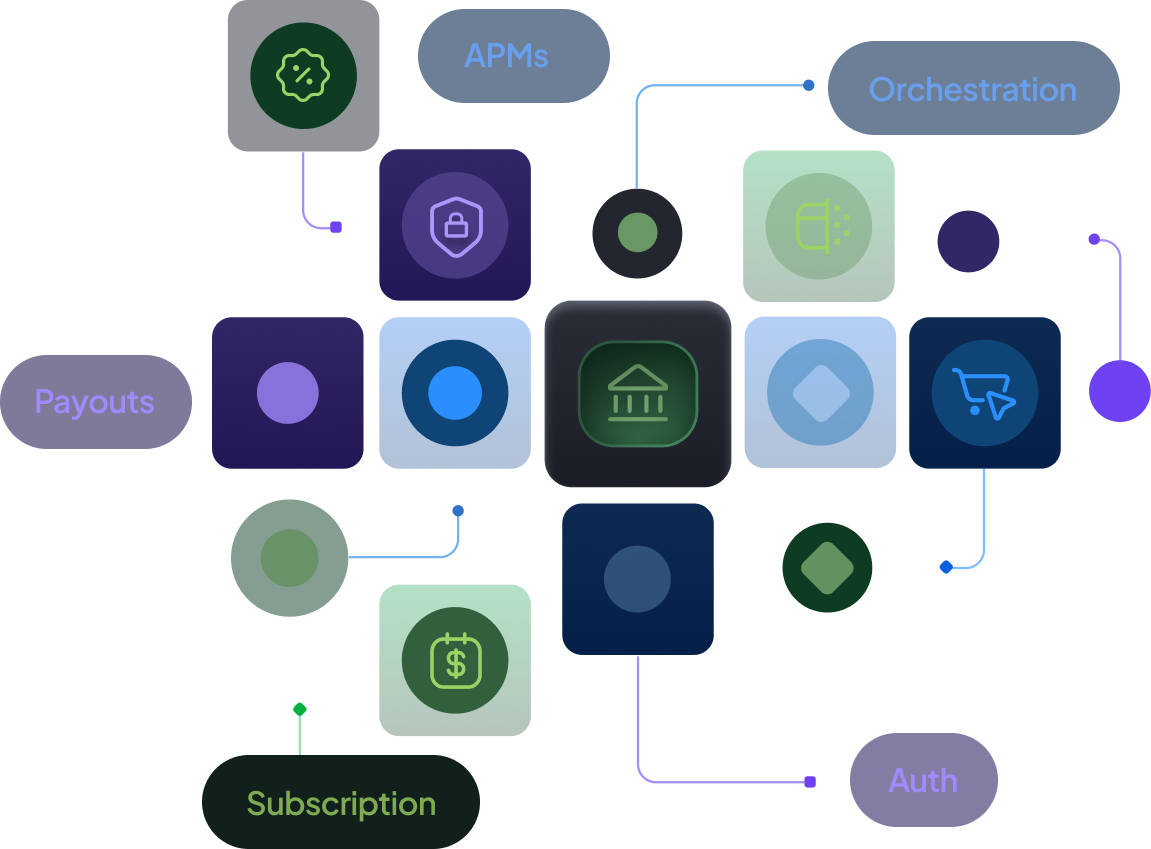

Orchestration

- 300+ Local Payment Methods

- Rules & ML based Intelligent Routing

- Tokenization

- Fraud & Risk engine

Smart Processing

- On-Us/Off-Us processing

- Mandate / Subscriptions

- Cross-Border Payments

- Local Acquiring

Control

- Merchant Dashboard

- Unified Reconciliations

- Transaction Monitoring

- Unified Reporting

- Analytics

- Alerts & Custom Reports

- Payment Insights Engine

Operations

- Recon & Settlement

- Disputes & Chargebacks

- Merchant & Bank Support

- PCI DSS V4 Compliance

- PSD2 Compliance

- ISO 27001 : 2022

- SOC 2 Type 2

- GDPR Compliance