Every penny and minute counts in today’s dynamic and highly competitive business landscape, especially for small-scale businesses. Payment links have become crucial for small business owners, providing a simple and effective means to gather payments. These connections connect the world of conventional payment approaches with the rapid digital age, guaranteeing that even the tiniest businesses can participate equitably.

Payment links simplify the payment process for both businesses and customers. Small business proprietors can swiftly generate these links, allowing them to smoothly accept payments, whether running a physical store or an online retail outlet. Furthermore, these links obviate the necessity for expensive in-store transaction systems or intricate online selling platforms, rendering them an economical alternative for fledgling enterprises and small businesses with limited means. In this article, we will delve into the realm of payment links, exploring their nature, how to create payment links and the reasons behind their transformative impact on businesses of varying sizes. Whether you’re an aspiring businessperson or a well-established entrepreneur, grasping the concept of payment links is vital for streamlining your payment procedures and enhancing customer contentment.

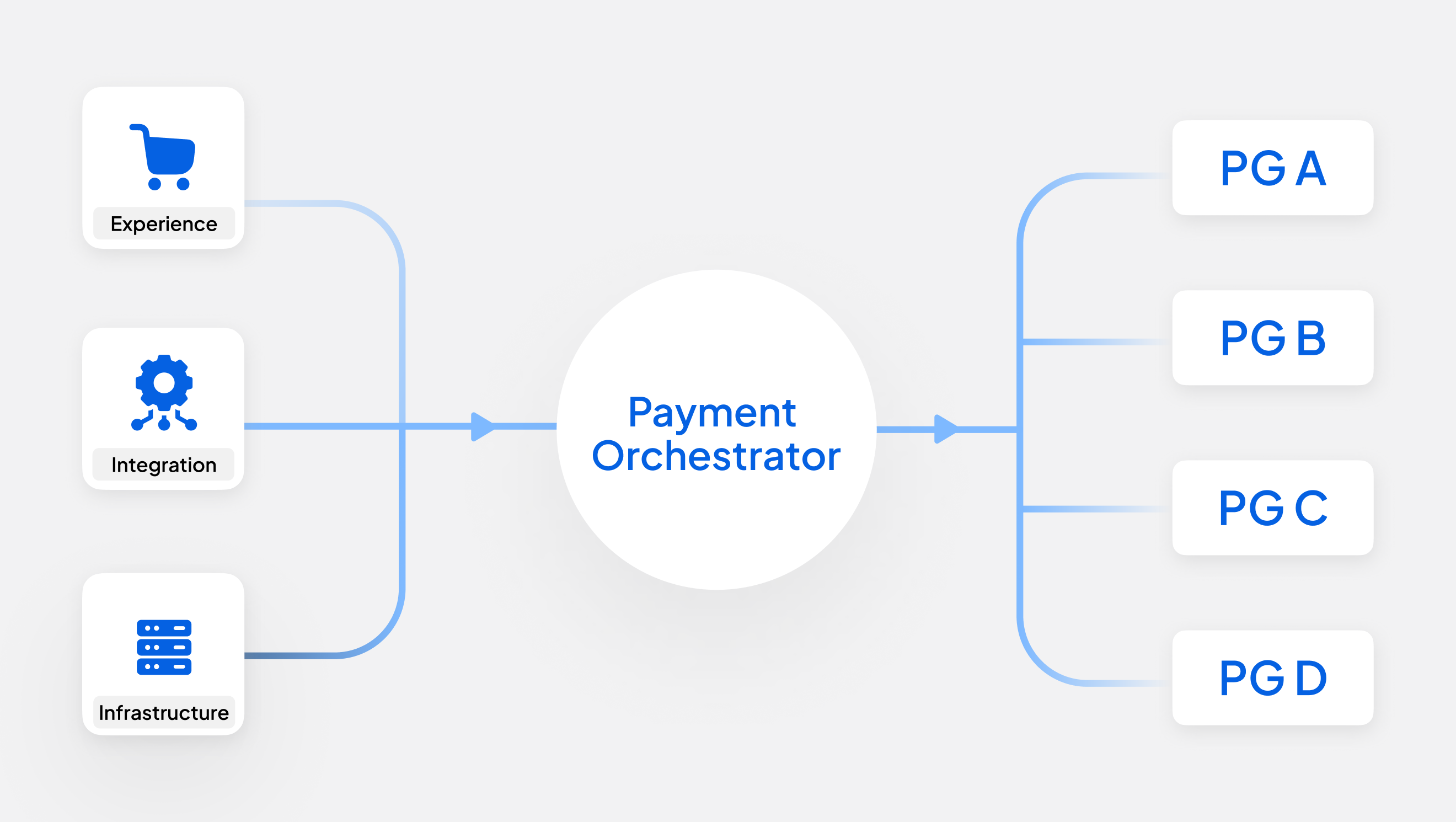

Juspay payment links offer end to end payment experience within the platform without any additional browser redirections. Explore Juspay HyperUPI!

What Is a Payment Link?

In the world of modern business, simplicity and efficiency reign supreme. In this context, payment links have emerged as invaluable tools for businesses of all sizes, from neighbourhood shops to e-commerce giants. But what exactly is a payment link?

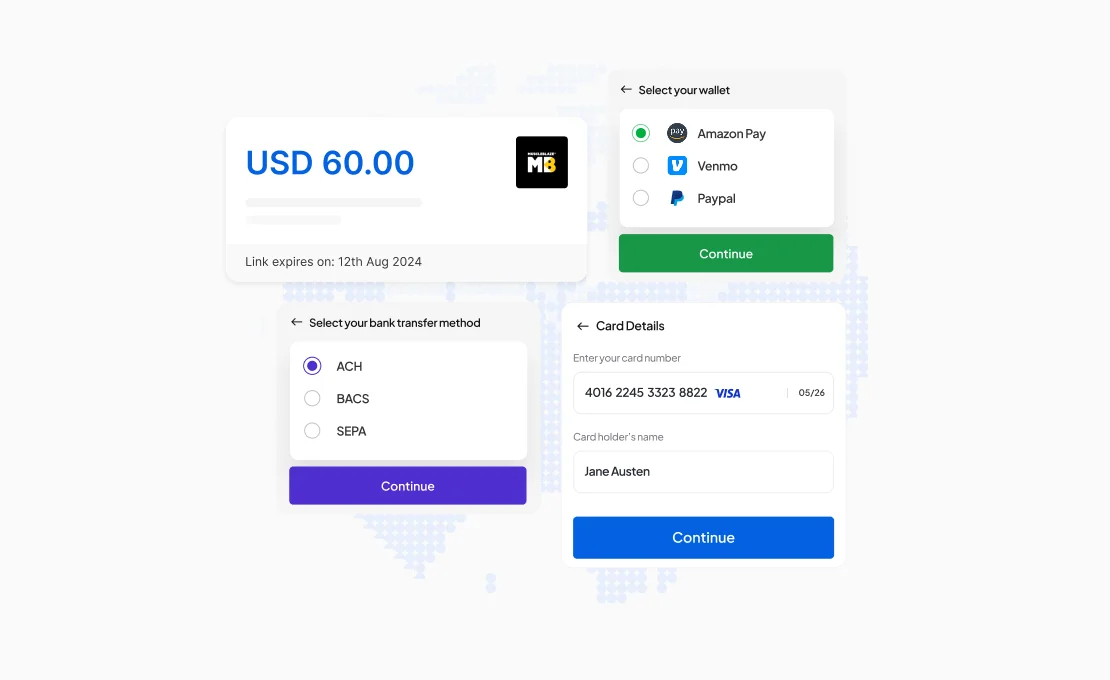

A payment link is a digital shortcut to the payment process. Think of it as a personalised and convenient “Pay Now” button for your customers. Instead of navigating through complex websites or dealing with cash, customers receive a clickable link that takes them directly to a payment page. Here, they can securely enter their payment details and complete the transaction hassle-free. Payment links are incredibly versatile. They are used by many businesses, from local artisans selling handmade crafts to multinational corporations collecting invoices. Regardless of your industry or business size, payment links can be tailored to your needs. Companies are no longer limited to their local vicinity. Through the use of the internet, they can reach customers on a global scale. Payment links accommodate this global reach effortlessly, allowing customers from various locations to make payments in their preferred currency.

What Are the Benefits of Payment Links?

Now that we understand what payment links are, let’s dive deeper into the many benefits they offer to businesses in India and worldwide.

- Enhanced Efficiency

Picture a scenario where a visitor arrives at your store or website and demonstrates curiosity about a particular item or service. By employing payment connections, you can promptly produce a URL and transmit it to them through text, email, or any messaging app. This eradicates the necessity for manual payment handling, conserving time and minimizing the probability of inaccuracies.

- Accessibility for All Businesses

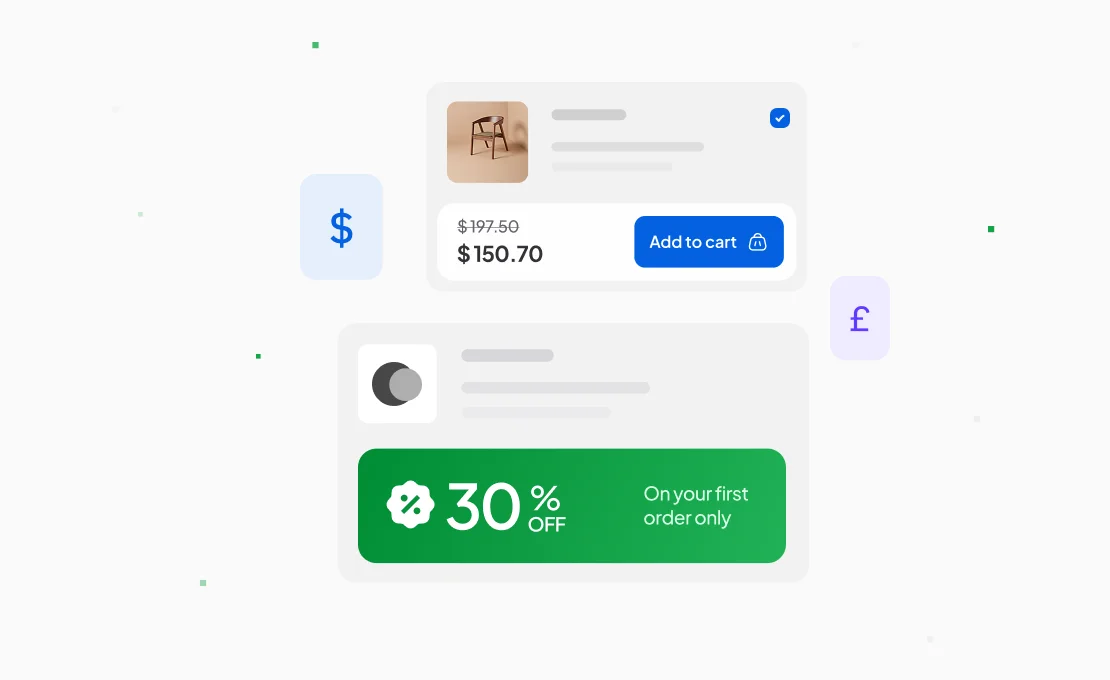

Payment links level the playing field for businesses of all sizes. Whether you run a neighbourhood grocery store or an emerging e-commerce platform, these links can be expanded and adjusted accordingly. They offer a straightforward and budget-friendly approach to receiving payments, ensuring that companies in any development phase can gain advantages.

- Cashless Transactions:

The global trend is shifting towards an economy less reliant on physical currency, and payment links are crucial in advancing this movement. By allowing customers to execute digital transactions, you accommodate their inclinations and decrease the vulnerabilities of managing tangible money.

- Enhanced Customer Experience

Customer satisfaction is paramount for any business. Payment links simplify the payment process, offering customers a hassle-free experience. They don’t need to remember bank details or carry cash; a simple click on the link completes the job. This convenience translates into happier, more loyal customers.

- Improved Record Keeping

Payment links generate a digital record of transactions, making accounting and record-keeping more manageable. This digital trail can be invaluable for reconciling payments, managing taxes, and evaluating your business’s financial health.

- Global Reach

Businesses often serve customers beyond their immediate geographic location in an interconnected world. Payment links facilitate this global reach by allowing customers to make payments in their preferred currency. This opens up new markets and revenue streams for your business.

- Reduced Costs

Traditional payment methods come with various costs, such as transaction fees, maintenance of point-of-sale systems, and handling cash. Payment links are cost-effective. They eliminate the need for expensive hardware and reduce overhead costs associated with payment processing.

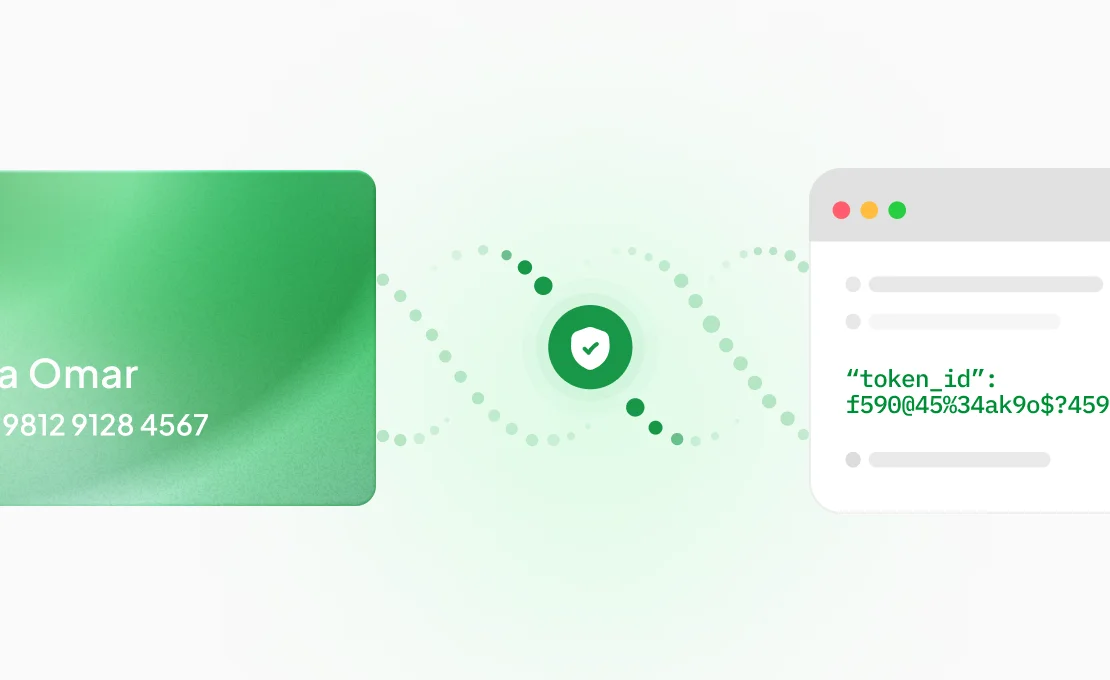

- Security

Security is a paramount concern in the digital age. Payment links typically employ robust encryption and security protocols to protect customer data. This safeguards your customers’ information and builds trust, making them more likely to engage with your business.

- Sales Analytics

Payment links provide valuable data about your sales trends. You can track which products or services are selling well and tailor your offerings accordingly. This data-driven approach can significantly boost your business’s profitability.

- Convenience for Recurring Payments

For businesses offering subscription services, payment links are a game-changer. Customers can set up recurring payments easily, ensuring a steady income stream for your business.

Payment links are a boon to businesses in India and across the globe. They enhance efficiency, offer convenience, and improve customer satisfaction. Embracing payment links can catapult your business into the modern era of commerce, allowing you to thrive in a cashless, digital world.

Who Uses Payment Links and Why?

Payment links have swiftly become indispensable tools for many businesses in India and beyond. Let’s explore who these savvy users are and why they have embraced payment links with open arms:

- Local Retailers and Neighbourhood Stores

From the local Kirana shop to the corner bakery, small-scale retailers in India are increasingly turning to payment links. Why? They provide a straightforward way to accept digital payments, eliminating the need for customers to carry cash or remember bank details. This convenience encourages more sales and enhances the customer experience.

- Online Sellers and E-commerce Platforms

The surge in e-commerce within India has been truly noteworthy. Payment links are the backbone of many online businesses. Sellers on platforms like Flipkart, Amazon, and independent online stores use payment links to facilitate secure transactions. It simplifies the purchasing process for customers, ultimately driving sales.

- Service Providers

Professionals offering services, such as freelancers, consultants, and repair technicians, often rely on payment links. They can send a link to their clients, who can conveniently pay for the services rendered. It’s a win-win situation, ensuring prompt payments and a hassle-free experience for both parties.

- Government Agencies

Even government agencies in India are adopting payment links to collect fees, taxes, and fines. This move towards digital payments reduces the use of physical currency and streamlines government revenue collection.

Payment links are incredibly versatile and cater to various businesses and organisations. They are the go-to choice for anyone looking to simplify payment processes, enhance customer experiences, and boost efficiency. In the rapidly evolving landscape of Indian commerce, payment links are the tools of the future, empowering businesses of all sizes to thrive.

How to Use Payment Links?

Payment links are a powerful tool for businesses in India, but knowing how to use them effectively across various platforms is vital to maximising their benefits. We’ll explore the practical aspects of implementing payment links in your business strategy.

- Social Media

- Facebook: If you use Facebook to promote your products or services, you can share payment links directly in your posts. Simply create a compelling post, add a product image, and include the payment link. Customers can click and make payments without leaving the platform.

- Instagram: Instagram allows you to add payment links to your business profile. This is especially useful for influencers, artists, or anyone selling products on Instagram. Users can click the link in your bio to make purchases effortlessly.

- WhatsApp: WhatsApp is widely used for business communication in India. You can send payment links to customers via WhatsApp, making it easy for them to complete transactions. Whether you run a small community shop or offer services, WhatsApp is useful for distributing payment links.

- Other Messaging Apps: Aside from WhatsApp, other messaging apps like Telegram and Signal are also used for business communication. Like WhatsApp, you can send payment links through these apps to close deals and swiftly accept payments.

Email marketing is a tried-and-true method for reaching your audience. When sending promotional or invoice emails, include payment links. Ensure your emails are clear and visually appealing, with a prominent “Pay Now” button linked to your payment page. This encourages recipients to take action immediately.

- Websites and E-commerce Platforms

Adding payment links is quite simple if you own a website or engage with e-commerce solutions such as Shopify or WooCommerce. You can create product pages with payment options or embed payment links directly into your website’s checkout process. This provides customers with a seamless payment experience while browsing your offerings.

- Invoicing

For service-based businesses, invoicing is common. Instead of traditional paper invoices, consider sending digital invoices with payment links. This makes it convenient for clients to settle their bills electronically, saving time and resources.

- QR Codes

QR codes are gaining popularity in India. You can generate QR codes linked to payment pages and display them in your physical store or on your product packaging. Customers can scan the code with their smartphones and make payments instantly.

- Payment Apps

Utilise popular payment apps like Google Pay, PhonePe, or Paytm to send payment links. These apps often offer features for businesses, allowing you to create and share payment links with ease. Customers can open the links directly within the app and complete transactions securely.

- SMS Marketing

SMS marketing remains effective in India. Send payment links via SMS to customers who have opted in to receive your messages. Include a concise message with the link, enticing them to make payments swiftly.

The key to using payment links effectively is to make them easily accessible to your customers on their preferred platforms. Integrating payment links into your social media, email, website, and various communication channels will streamline the payment process, enhance customer convenience, and ultimately boost your business’s revenue. Embrace these diverse methods, and you’ll find that payment links are a versatile and indispensable tool in your business toolkit.

How to Create Payment Links?

Creating payment links is a straightforward process, and it’s a skill every business in India can benefit from. Let’s dive into the details of generating shareable payment links with your customers and understand the associated payment link fees.

- Generating Shareable Payment Links

Step 1: Choose a Payment Gateway: You’ll need a reliable payment gateway to create payment links. Many options are available in India, such as Razorpay, Instamojo, and PayU. Select one that suits your business needs.

Step 2: Sign Up and Verify: Register for an account on your chosen payment gateway. Complete the necessary verification process, often providing business documentation and bank details.

Step 3: Access the Payment Link Generator: After completing your registration and verification, you will usually be granted access to a payment link generator within your payment gateway dashboard that enables the creation of payment links.

Step 4: Enter Payment Details: Complete the required payment information in the link generator. This encompasses the payment amount, a concise note or identifier for the transaction, and any pertinent data. Some gateways also allow you to set expiry dates for the link.

Step 5: Generate the Payment Link: After inputting the necessary information, click the “Generate” or “Create” button. The payment gateway will generate a unique payment link for the transaction.

Step 6: Share the Link: Copy the generated payment link and share it with your customers through the platform of your choice. You can distribute the link through social media, email, messaging apps, or your website.

Step 7: Customers Complete the Payment: As customers follow the payment link, they will be guided to a secure payment page. At this juncture, they can select their preferred payment mode, input their particulars, and finalise the transaction.

- Payment Link Fees

Payment link fees can vary depending on the payment gateway you choose and the type of transaction. Here’s what you need to know:

- Transaction Fees: Payment gateways typically charge a transaction fee for processing payments. This fee is a percentage of the transaction amount and may vary based on factors like the payment method used (credit card, debit card, net banking, UPI, etc.).

- Setup and Maintenance Fees: Some payment gateways may have setup or ongoing maintenance fees for using their services. Be sure to check the fee structure of your chosen gateway.

- Integration Costs: There may be additional integration costs if you integrate payment links into your website or app. This can include development work to ensure seamless integration.

- Currency Conversion Fees: If you deal with international customers and accept payments in different currencies, currency conversion fees may apply.

- Withdrawal Fees: When you transfer funds from your payment gateway account to your bank account, withdrawal fees might be associated with this process.

- Refund Fees: Some gateways charge refund fees if you need to process a refund for a customer.

- Monthly Fees: Depending on your payment gateway plan, you may have a monthly subscription fee.

It’s vital to grasp the pricing model of your selected payment gateway and incorporate these expenses into your pricing strategy. While fees linked to payment links are an inherent aspect of business operations, the ease and effectiveness they bring to your operations and clientele make them a valuable investment. By becoming proficient in crafting easily distributable payment links and comprehending the connected charges, your enterprise can simplify its payment procedures, lower operational expenses, and deliver a user-friendly payment encounter to clients, ultimately bolstering your standing in the fiercely competitive market.

A Real-Life Example: How Payment Links Benefit Indian Businesses

To truly understand the power of payment links, let’s take a look at a practical example from the perspective of an Indian business owner. Meet Ramesh, a Mumbai electronics store owner. He faced the challenge of handling cash payments and sought a better way. He opted for a popular payment link generator provided by a well-known payment solution provider.

- Embracing Payment Links: Ramesh turned to a payment link generator, simplifying transactions. He created links for customers, who could pay with digital wallets, cards, or net banking.

- Customer Convenience: Customers loved the convenience, and Ramesh gained their trust.

Record-Keeping: Payment links streamlined record-keeping and analytics, helping Ramesh manage his business efficiently. - Cost-Effective: Despite nominal fees, payment links saved money and time, making them a wise choice.

Expanding Reach: Ramesh’s business grew, even reaching online customers, thanks to the ease of payment links.

In short, payment links transformed Ramesh’s business, simplifying transactions, enhancing customer experience, and boosting growth.

FAQs About Payment Links

1. Are payment links safe?

Yes, payment links are safe. They use secure encryption to protect transactions and customer data, ensuring a secure payment process.

2. What is the difference between payment links and an invoice?

Payment links are direct links to a payment page, allowing immediate payment. Invoices are detailed bills that may require manual payment via various methods and are often sent before payment links.

3. How Do Payment Links Work?

Payment links are URLs that lead to a secure payment page. Customers click the link, enter payment details, and complete transactions swiftly.

4. Can I Customise Payment Links with My Branding?

Yes, many payment gateways, like Juspay, allow you to customise payment links with your branding, creating a consistent customer experience.

5. Are Payment Links Compatible with Mobile Devices?

Absolutely, payment links are mobile-friendly. Customers can use smartphones or tablets to conveniently click, pay, and complete transactions.

6. Do Payment Links Work Internationally?

Yes, payment links are versatile and can handle international transactions, making them ideal for businesses with global customers.

7. What Fees Are Associated with Using Payment Links?

Fees vary depending on your payment gateway. Typically, there are transaction fees, setup costs, and possibly withdrawal or integration fees.

8. Is It Safe to Share Payment Links on Social Media?

Yes, it’s safe to share payment links on social media. However, ensure that your payment gateway is reputable and provides secure transactions.

9. Can Payment Links Be Used for Recurring Payments?

Yes, many payment gateways support recurring payments through payment links, making them suitable for subscription-based services.

10. What if a Customer Doesn’t Use Digital Payments?

Payment links often allow multiple payment options, including cash on delivery (COD) or bank transfers, accommodating customers who prefer traditional methods.