India has currently over 350 mn people transacting online shopping across ecom, travel, hospitality and so on. Unlike the western markets, India has traditionally been a “use cash / in-hand money first” instead of “use credit”. However, with the Banks, NBFCs and new age Fintechs aggressively promoting their EMI options, the mindset of the Indian consumers are slowly changing. Consumers are also on the lookout for how to buy premium brands and are increasingly looking at affordable options via EMI. To just put some numbers into perspective, almost 60-70% of the premium smartphones are purchased via emi.

The Credit Card penetration in India is low and about 3% much below the global average. This is prompting merchants to explore other avenues for giving financing options to the users like Cardless EMIs and Instant Loans. Since cardless emis work on pre-approval by issuers (which is a restricting factor to scale up), merchants are actively pursuing ways to bring more loan providers as their partners to finance high ticket size purchases. This foray into instant loans comes with its own set of challenges which we plan to cover in this post.

The below article is based on the valuable inputs that we got from some merchants and the consumers on their platform, who were trying to purchase products using loans. It highlights some of the problems faced and how a Lender Orchestrator platform can solve these, thereby enabling merchants to take giant strides in the path of providing Instant Loans to its users.

Before we delve into these inputs, let us establish some baselines as to how the Loan process is very different from a conventional payment.

What makes Loan Process Different from Payment

Normal payment

A payment transaction can roughly happen in two ways.

Case 1:

For conventional payment methods - you know your eligibility (NB, UPI, CC etc). So the customer mostly chooses a payment method that he knows he is eligible with. Steps in this kind of payment journey are as follows :

- Choose an instrument. Example CC

- Initiate a payment by entering card details.

- Eligibility check happens

- If eligible and auth is done, payment happens

Case 2:

Customer eligibility is checked upfront before a transaction is initiated. Here the eligibility check is a seamless and quick process, where your eligibility is mostly checked against the mobile number. Paylater is a good example of this kind of eligibility check. Steps in this kind of payment journey are as follows :

- Eligibility checked upfront. Eg: Paylater

- Choose an instrument

- Initiate payment

- Auth.

Loans

However, in the case of Loans, the story is slightly different. A basic loan journey can be broken into the below steps

- Long drawn eligibility process - the user has to check with a lender to check his eligibility and it is not a 1 or 2 step process. The number of hops needed to check eligibility is not even standardized and varies from one loan provider to the next. It also needs a lot more variables and cannot be done on the basis of just a mobile number.

- Approval flow which leads to the instrument creation i.e the Loan. This again includes multiple steps like KYC, Repayment Setup, Agreement signing and so on. All of these are mandatory steps and cannot be skipped

- Transaction / Payment is just the last step in the process and probably the most simplest. Issuers will directly disburse the loan to the merchant’s account on T+1/T+2 days as per the contract.

The fastest loan process which we have seen so far is 21 mins and that is light years slower compared to the slowest payment transaction!

Now that we have discussed the basic loan journey, let’s look at the key issues faced by merchants and the consumers with online financing journeys.

Problems faced by end users in Loan Origination Journeys

Take any current Loan Origination Journey and you will find that the drop off is maximum in the first step where the user has to enter the details and it is as high as 30-40%.

These are some of the common pain points that we have heard from the users trying to avail loans on the fly.

1. Data Entry Problems :

Let’s look at some of the excerpts that we have got from some users.

User Category 1

“When I am applying for a loan, I need to enter a whole lot of data including my PAN, Address, DOB, Gender, Salary etc. This list is very long. When I take any other form of EMI, I don’t need to enter all these. Why do I need to give all these details?”

User Category 2

“I had already given my Name, Address, Gender details to the Insurer but when I am applying for a loan, I have to give these details again to the lender. Why do I need to give all these details again?”

User Category 3

“I had already given my Name, Address, Gender details to the Insurer but when I applied for the Loan with Lender A. Lender A rejected me later and now when I am trying to apply for a lender B, I have to give these details again. Why do I need to give all these details again and again?”

What needs to be solved :

The key learnings from these three categories of users are -

- Simplified Journey - Data points to be captured from the user should be reduced.

- Reuse Data - Data once captured, whether on the merchant side or any of the Lender side should be reused.

2. Lender selection

Again some excerpts from users

User Category 1

“I saw multiple loan options and selected one of them thinking I would get a loan. But I got rejected after filling in a bunch of details. I tried with one more option and got rejected again. If I was not eligible for these lenders, why are these options shown to me?”

User Category 2

“Unlike HDFC, ICICI, SBI which are well known names, some of the lenders on your platform are names that I have not heard of. I am not able to decide on the basis of their names as to whom I should choose. Some assistance here would have been helpful”

What needs to be solved :

The key learnings from these categories of users are -

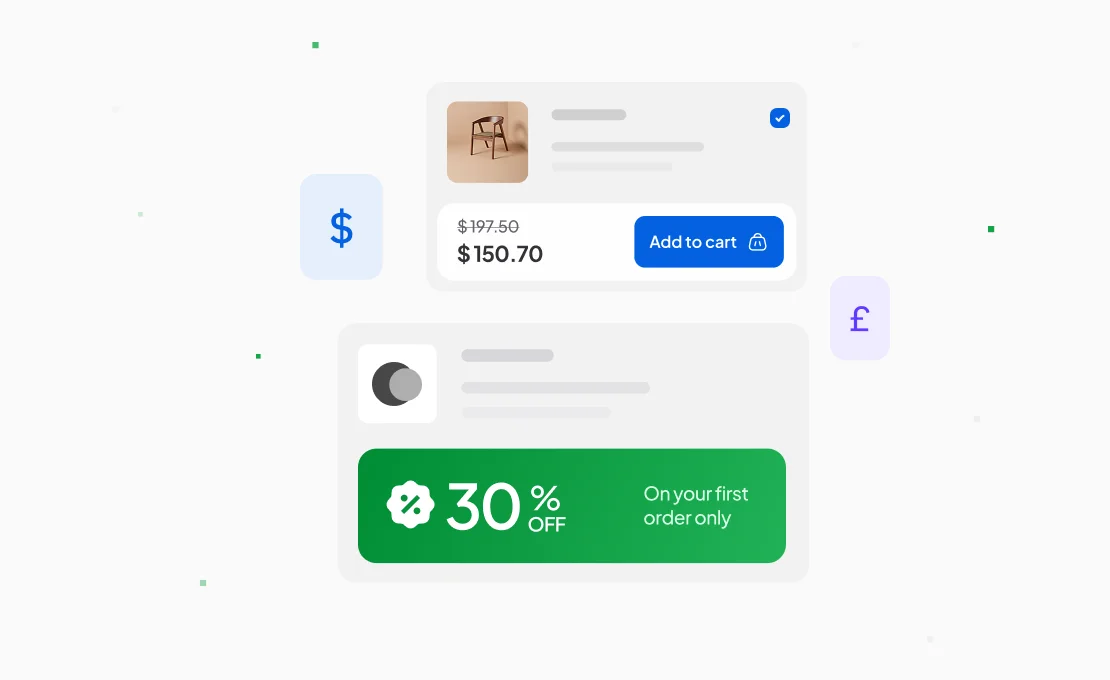

- Filter out non eligible lenders - Do not show lenders where the user has no chance of getting a loan.

- More upfront information - For all lenders, try to show some upfront information like APR, Downpayment is required, Tenure options available etc so that the users have some data points to make a choice based on rather than just logos.

3. Document Sharing

Let’s look at some of the feedback shared by the user.

User Category 1:

“I have been asked to share so many documents. I am not even sure, if i will get an offer”

User Category 2:

“I am not comfortable sharing my Aadhaar and any other identity document over messaging channels. I am afraid as it has chances to be misused.”

What needs to be solved :

The key learnings from these categories of users are -

- Check loan eligibility without any documentation: Users shall be able to check their loan eligibility without submitting any sensitive documents.

- Reduce document Uploads/sensitive information: The users are not comfortable uploading identity documents. The loan journey shall reduce the number of such document uploads.

- Provide safe and secure sharing of sensitive information/documents without storing: User shall be able to share the sensitive information/documents with the end lender securely. User shall be educated about the purpose of such information/documents and be assured that data shall not be stored by any third party except for the loan facilitation and processing.

Problems faced by merchants in Loan Origination Journeys

These are some insights that we gained during interaction with some of our merchants. Some of the real pain points that they face are:

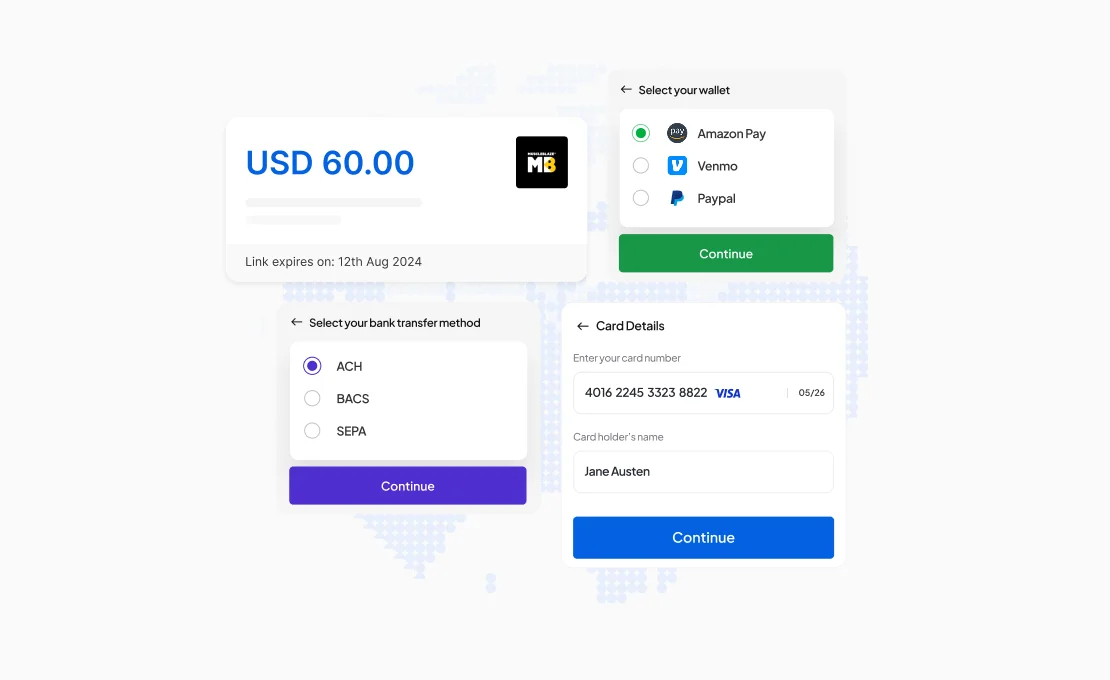

1. Integration with multiple lenders

Given the long loan journey, there are a lot (and I mean a lot) of APIs that need to be integrated to cover an end-end loan origination. The number of APIs get lesser if the lender works on a redirection based approach.

One of our merchant contacts told us - “The number of APIs in the flow were so many that we needed 3 sessions to fully get clarity on the flow. Building a native loan origination journey in-house is too much of an effort. We ended up building a lender selection followed by full redirection (a suboptimal journey) because of this ”

2. Data transformation

There is no standardization of the APIs used by different lenders. So for every new lender, the merchant will have to create a transformer on top of their data. While everything today in tech works on top of transformation, there was an interesting excerpt from one of our merchants.

“We partnered with a payment orchestrator because we did not want to manage the complexity of managing all the PA/PG integrations. Hopefully, someone can solve the problem of handling all lender integrations and provide a unified experience across payments and loans.”

That pretty much sums it up well.

3. Visibility

Most of the merchants who currently partner with lenders for financing options work on pretty much an offline model. They create whatsapp groups with lenders where the lead details are shared, post which the lender agents assist the user to complete the loan process. Sounds straightforward and easy for the merchant right?

The real challenge here lies because of the disconnect existing between the merchant system and lender system as they are not talking on a real-time basis. To know where the user has reached, merchant agents have to ask for updates on whatsapp / call up lender agents which is a sub par flow. Given the long duration of the loan journey, the agent might get a “Process Completed” update after a couple of hours. It creates a lot of confusion and unnecessary time loss for the merchant agents.

4. Reconciliation

The lender makes the settlement to the merchant account on T+1 day. The settlement file shared with the merchant will have the Loan id and the Settlement amount (after considering the DP, subvention etc). The merchant’s accounting team will have to use this excel to tally the settlement files against their system and identify discrepancies if any.

This again leads to manual interventions and back and forths, in case discrepancies are identified between merchant and lender. Our merchants wanted an automated solution, which keeps their system updated with the Reconciliation details including UTR number.

5. Analytics

Merchants are increasingly looking for data around how well their partnership with a lender is performing. They want detailed analysis of approval rates, drop off funnels, pin code coverage, lender rules which cause maximum users to get rejected and so on. Everyone wants to know how they can improve the approval rates with a lender and can there be parameters that can be tweaked. And these are just barely scratching their analysis requirements.

6. Audits

Lenders like to conduct audits on any partner that they are integrating with which includes security, compliance, data purging policies among other things. These checks are very stringent and a lot of time and effort goes in adhering to all their requirements. Another problem here is that all these checks vary based on the lender that you are partnering with. Maintaining a fully compliant tech stack is a big headache for a merchant and a continuous distraction everytime a new lender needs to onboarded to their platform.

7. Unauthorized Data Leakage

When checking eligibility of the user, the user ends up sharing personal details and a few documents with the merchant’s sales agent. Since these information and documents are exchanged offline, the security of the same is compromised. Regulators like RBI, and data empowerment and protection acts have become stricter requiring to share data in a secured manner. Adhering to these regulations adds complexity in the business operations.

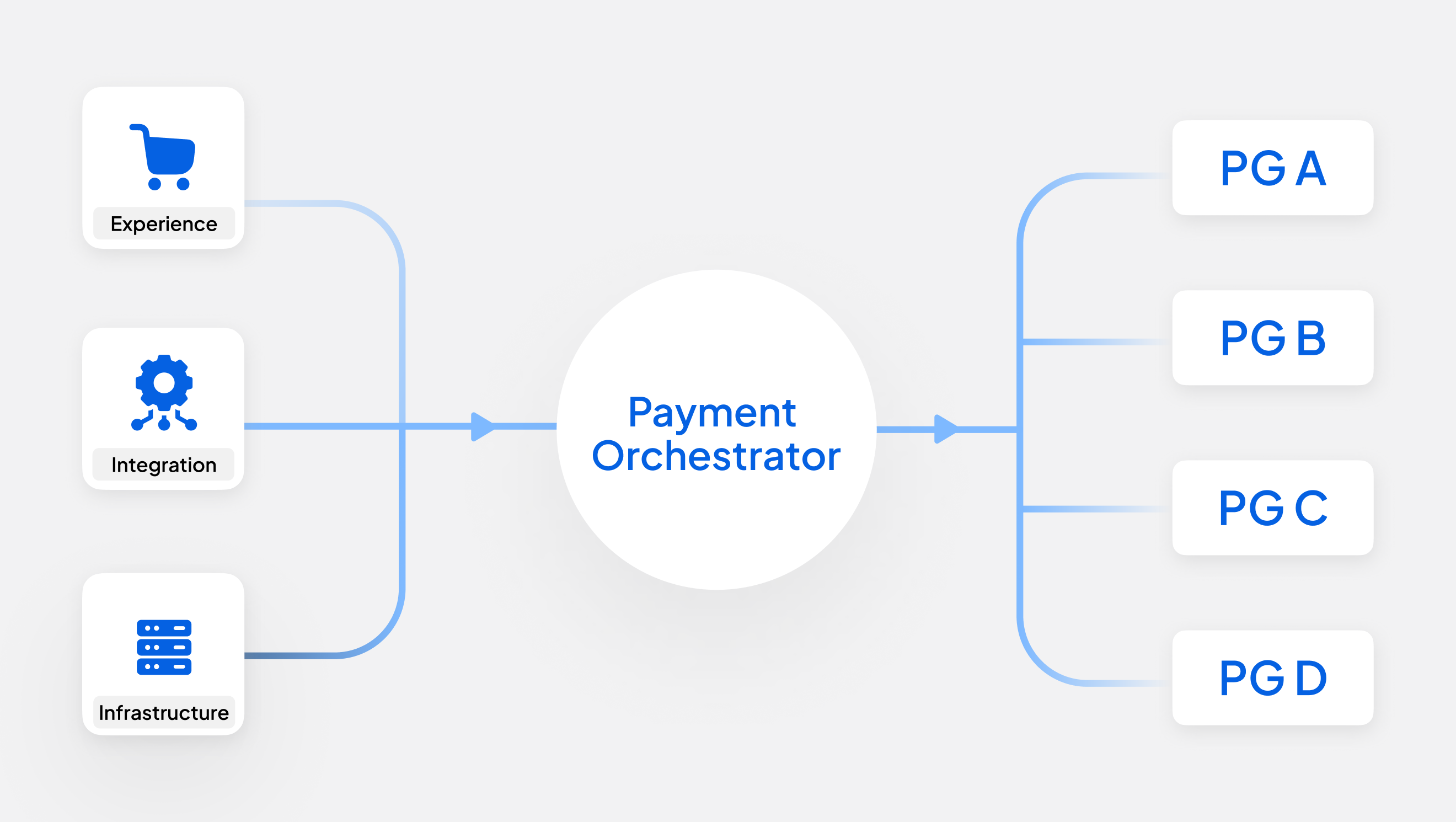

Your One stop solution - Juspay Hypercredit

With so many different problems to be solved, the need of the hour is an entity who can heavylift all these challenges for the merchants and become a partner for them who can give a simplified and unified experience across the whole gamut of lenders. This entity can play a middle man between the merchant and lenders and “orchestrate” the whole journey. Such orchestrator entities are existing in the payments ecosystem and Juspay is at the forefront there. All the learnings from our payment stack have been infused into building a new tech stack for enablement of merchants wanting to build a digital lending infrastructure. We call this product Juspay Hypercredit.

Juspay hypercredit, built over the past 2+ years, is currently integrated with 15+ lenders and has been able to solve all the merchant and consumer issues addressed above. Our merchants have seen significant increments in the share of their orders getting fulfilled via Loans. They have also seen a remarkable step up in the efficiency of their sales agents as they are able to close loans at a much faster turnaround time thanks to the digital journey. The positive feedback that we have got from our partner merchants also reinforces our belief in the value proposition of Hypercredit.

For a detailed understanding of how we have solved these problems and how we can help you scale your checkout Loan journey, please feel free to connect with our BD team on their email creditbiz@juspay.in 🙂