As digital commerce expands across borders, customer expectations around payments have fundamentally changed. While traditional card payments once dominated online checkouts, today’s consumers expect flexibility. Whether it is UPI in India, Klarna in Europe, or PIX in Brazil, payment preferences are no longer uniform.

Yet most merchants still treat Alternative Payment Methods (APMs) as optional. This oversight is no longer just a user experience issue. It impacts revenue, conversion rates, and market expansion strategies.

In this blog, we explore why the absence of alternative payment methods has become a critical blind spot for enterprise merchants and how Hyperswitch helps solve this without adding complexity to your stack.

What happens when you ignore Alternative Payment Methods

Customers Drop Off at Checkout

Modern checkout is not just a transaction step, it is a conversion gateway. When a customer reaches the payment page and does not see their preferred payment option, trust breaks. This often results in cart abandonment.

In emerging markets, many users do not use cards at all. Alternative payment methods such as mobile wallets, local bank debits, or Buy Now Pay Later services are their default modes of payment. Not offering these options means losing otherwise interested customers.

Expanding Globally Without Supporting Local Payments

Merchants entering new geographies often spend months preparing localized content, logistics, and compliance. However, they miss a foundational element, enabling local payment methods.

For example:

- In the Netherlands, over sixty percent of payments are made through iDEAL

- In Brazil, PIX and Boleto are more popular than credit cards

- In India, UPI is used in daily transactions by over three hundred million users

Not supporting these methods restricts user choice during checkout in these markets.

Alternative payment method Integrations are a Developer Bottleneck

One of the biggest blockers to APM adoption is the integration overhead. Each method comes with its own SDKs, authentication flows, callback patterns, and compliance nuances. Routing logic and reconciliation often require backend changes. For lean engineering teams or fast-growing product lines, this complexity becomes a backlog.

Most merchants end up integrating one or two alternative payment adoption through their PSP and leaving the rest. The result? Partial coverage, rising engineering costs, and lost conversions.

The Core Challenge: Fragmentation

Alternative Payment Methods are not just numerous, they are fragmented. Klarna has a different integration pattern than UPI, which is different again from PayPal or SEPA Debit.

Without a unified system, managing these integrations becomes an ongoing challenge. You need a framework that:

- Offers a single integration to support multiple payment methods

- Adapts to the user’s geography and context

- Handles the routing, settlement, and reconciliation complexity

- Offers flexibility in turning methods on or off per market or use case

Hyperswitch: One Widget, Global Alternative Payment Method Coverage

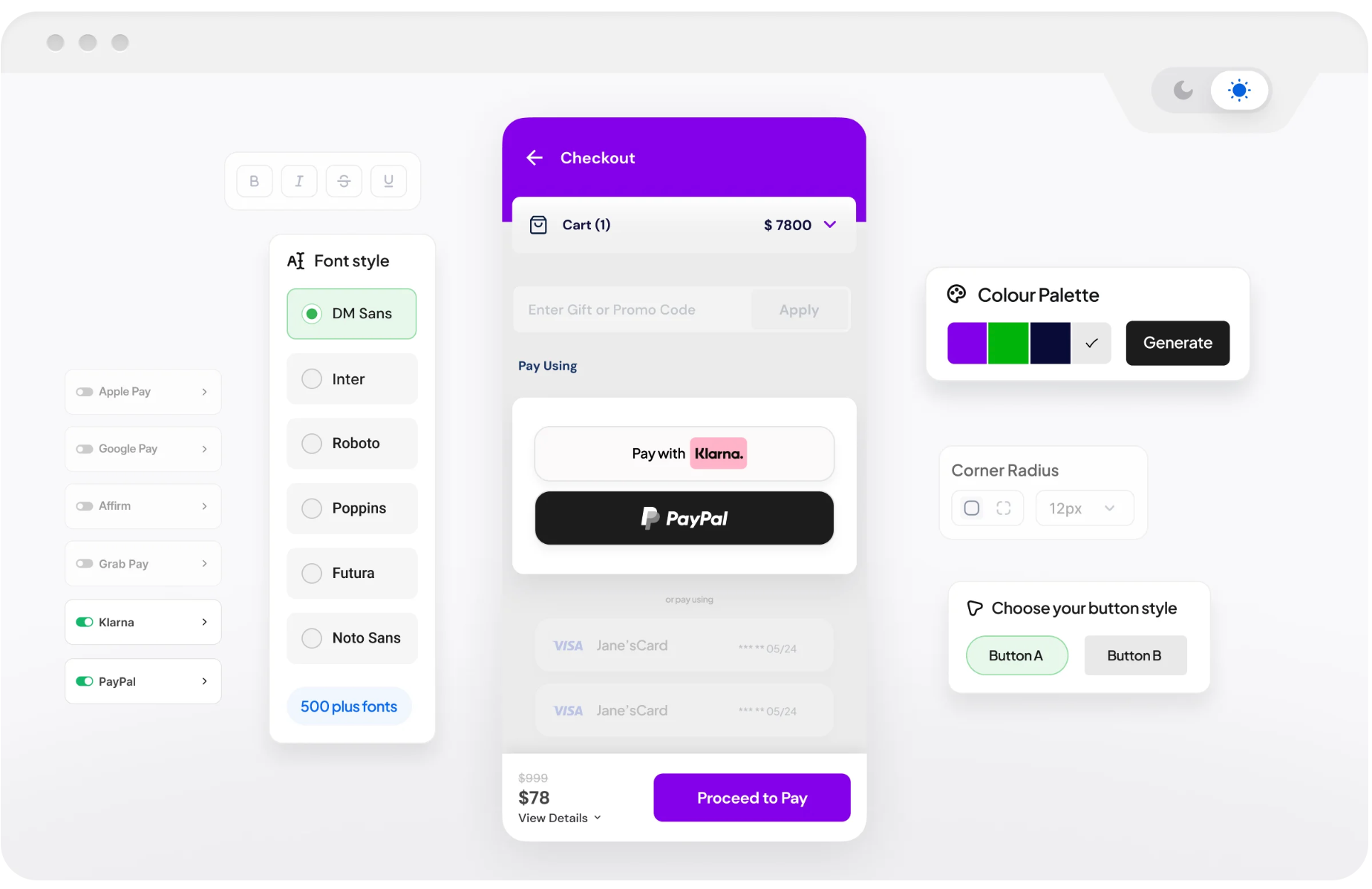

Hyperswitch simplifies alternative payment methods integration by offering a prebuilt, modular widget that can be dropped into your existing checkout with zero layout refactoring.

Merchants do not need to rework their frontend payment forms, alter routing logic, or build separate flows for each method. A single configuration enables alternative payment methods on your checkout and displays them contextually based on user geography and device.

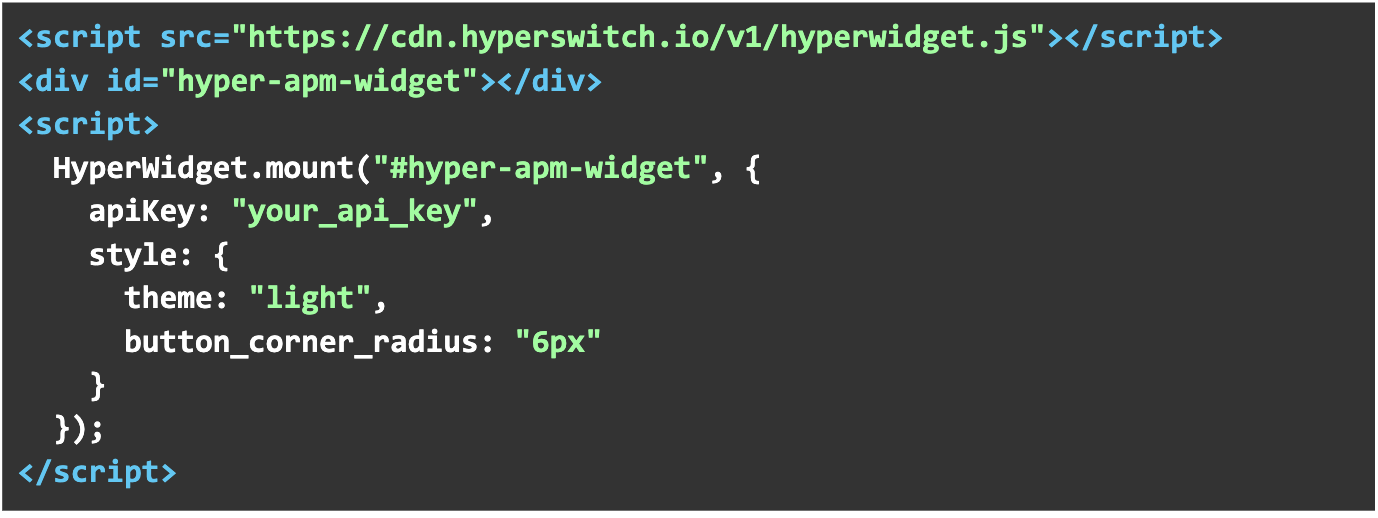

Quick Integration Example:

Adding alternative payment methods to your checkout with Hyperswitch can be done in minutes. Here’s a simple HTML-based integration that demonstrates how easy it is to get started:

For production-grade apps, Hyperswitch provides a fully featured SDK with components, hooks, and callbacks. Explore the Integration Guide

What you get with Hyperswitch Alternative Payment Method Widget

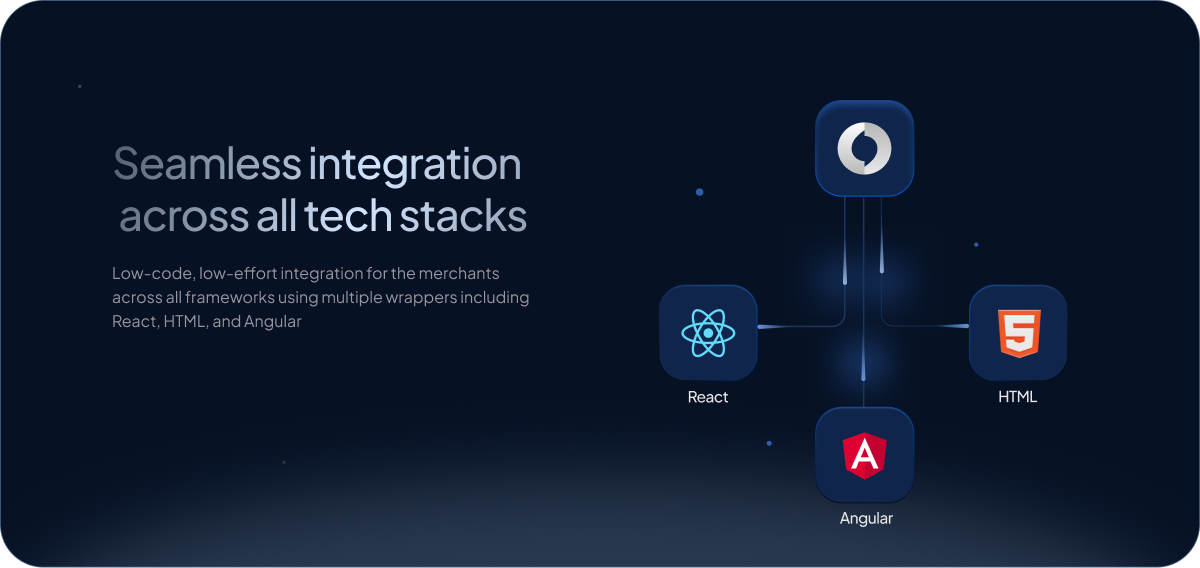

- Seamless Across Frameworks - Hyperswitch is designed to work with modern frontend stacks, including React, Angular, and plain HTML.Whether you are integrating into a legacy checkout or a modern SPA, Hyperswitch provides low-code wrappers and easy configuration.

- Drop-in Widget with No Layout Overhaul - The alternative payment method widget is designed to sit alongside your existing payment fields. It does not require layout changes or UI rebuilds.

- Modular and Developer Friendly - Built into the existing Hyperswitch SDK, the APM module requires no additional libraries or setup. Everything works out of the box.

- Consistent UX with Flexible Styling - Keep your brand’s look and feel while using a common underlying engine for different methods.

- Unified Callback Handling - Payment retries, captures, and success flows are normalized. You do not need to handle separate logic for each alternative payment method.

- Built for the Future - The widget is designed to support emerging alternative payment methods and new PSPs with no changes to your code. This makes it ideal for merchants scaling across markets or launching new product lines.

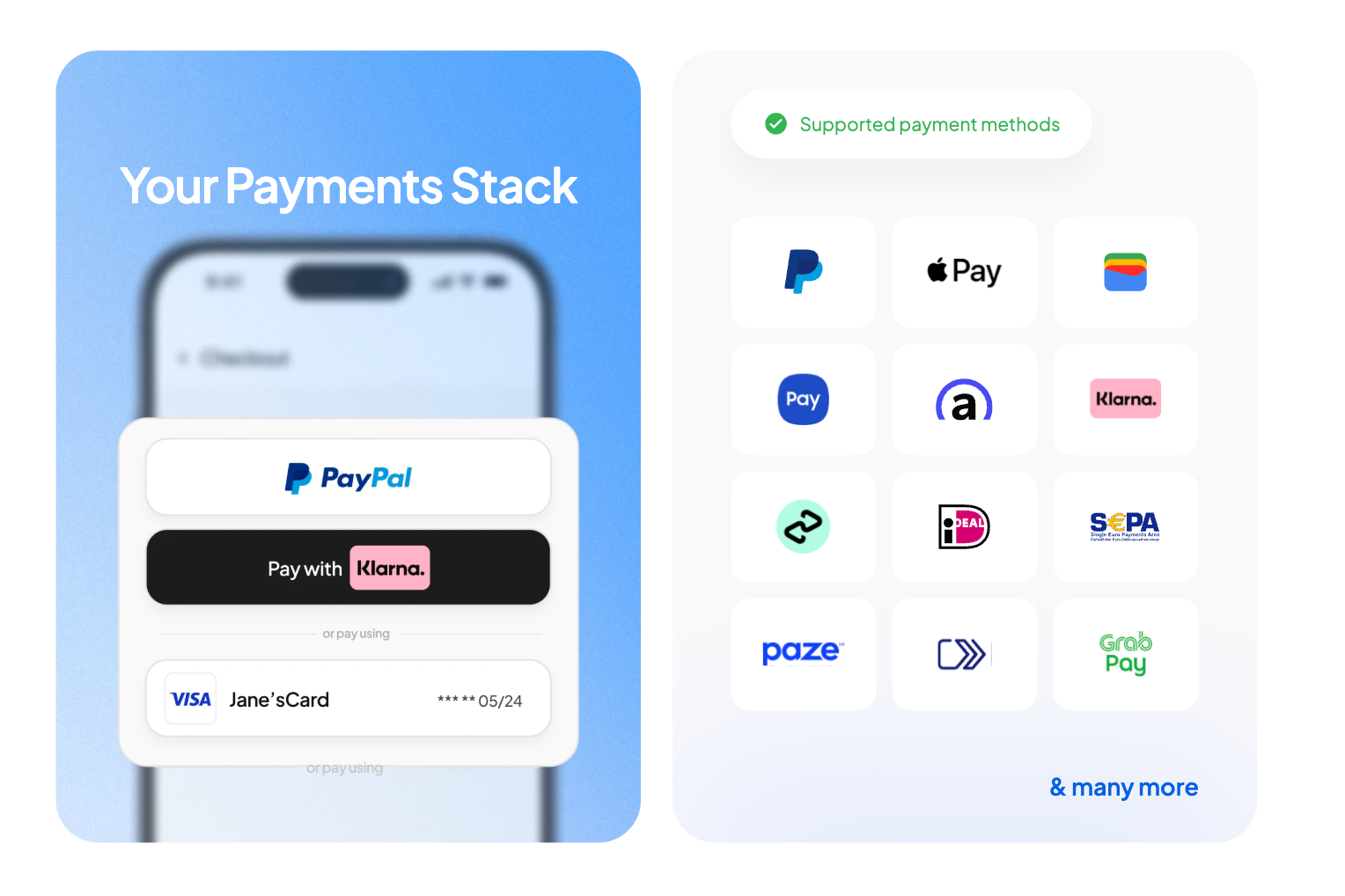

Supported Alternative Payment Methods

Hyperswitch supports a wide range of alternative payment methods, including:

- Apple Pay and Google Pay

- iDEAL (Netherlands)

- Klarna and Afterpay

- PIX (Brazil)

- SEPA Debit (Europe)

- PayPal

- and others based on market demand

The list is continuously expanding based on regional demand and merchant feedback.

By adding a single toggle to your checkout, you unlock access to region-specific payment methods, improve conversion rates across diverse geographies, and reduce the operational overhead of managing multiple alternative payment methods.

Whether you're entering new markets or optimizing conversions in existing ones, alternative payment methods support through Hyperswitch gives your payment stack the flexibility and reach it needs, with none of the usual integration burden.

You can get started by following our developer guide.