Acquiring customers in today's world has become ever so difficult. Be it e-commerce, healthcare, insurance, banking, or travel, the competition has grown significantly. Businesses in every sector spend a lot of resources to optimize their customer acquisition cost. Before moving forward, let us first understand customer acquisition cost and why it is important for businesses.

Customer acquisition cost (CAC) refers to the total monetary resources a business invests to acquire a new customer. CAC is crucial for every business as it is inversely proportional to the profitability of the business; the higher the CAC, the lower the profitability. That's why businesses aim to optimize and reduce their CAC, but in today's highly competitive environment, the CAC keeps going up.

Imagine investing all that money to acquire a customer only to discover that they have left your website/app without completing a transaction. Through your marketing/sales activation, you've convinced your customers to buy a product/service from you, the customer goes through your website/app and selects the product/service of their choice, but before completing the transaction, they drop off; this is known as cart abandonment. Let's understand cart abandonment from a wider lens.

In a Glance

What is cart abandonment?

Cart abandonment refers to a situation where a prospective customer starts a transaction journey- for instance, by selecting their desired products/services and adding them to their shopping cart, but before completing the transaction, they exit from the website/app, leaving the products/services in their shopping cart. This results in lost revenue for the businesses.

Cart abandonment can happen due to various reasons. To get a better understanding of these reasons, let’s categorize them into three phases: pre-checkout, during checkout, and post-checkout.

Reasons for cart abandonment and how businesses can prevent them

Phase 1 - Pre checkout phase

This is the phase of the transaction journey where the customer has not reached the checkout/payment page. Lets take a look at the cart abandonment reasons during this phase -

- Mandatory new user account creation - Users can drop off from the transaction journey if they are forced to create a new user account to check out. While gathering user data is vital for retention and retargeting, creating unnecessary friction by asking users to create a user account might be a deterrent, leading them to drop off. According to a research conducted by Baymard Institute, 26% of the customers abandon their carts due to new user account creation. Solution - Businesses should offer guest checkout to their customers in order to reduce friction. The user data can be collected post order completion as well. Providing customers with an option to “get email updates of your order” or “track your order” is a good way to collect user info.Alternatively, businesses can also implement OAuth flows enabling users to sign-in using their Gmail (or other social media platforms). Implementing OAuth flows is crucial for streamlining the login/sign-up process and reducing barriers to purchase.

- Lack of product information/support - Many customers abandon their carts if they are unable to find the required details about the product. Some products/services require additional support in order to convince a customer to complete the purchase. Take insurance for instance, it requires additional support to build trust, clarify complex details, and personalize solutions to convince customers to purchase.Solution - Provide your customers with clear instructions on using the product, create informational articles about the product on your website, and answer FAQs. Offering instant chat/call support to customers is also a great way to provide a final push to users to complete their purchases.

- Unclear return policies - Customers might stop their transaction journey if they are not sure about the return/exchange policies of the product. 18% users abandon their carts due to ambiguous return policies.Solution - Clearly mention all the return/exchange/warranty related policies on the website/app and the steps required by the customers to claim their refund.

- Elongated delivery time - Delivery is a vital component of the transaction journey, an elongated delivery time can lead to customer frustration which leads to drop offs. A research conducted by Baymard Institute shows that 23% customers drop off due to slow delivery time. Solution - Provide multiple delivery options to the customers (for example - standard delivery and express delivery options). Inform customers about the order processing time to instill confidence.

- Poor Website/app user experience - A complicated user experience creates unnecessary friction during the transaction journey. Frequent crashes, errors and tough to navigate UI might frustrate the customers, leading them to drop off. Solution - Frequently test the UI of your website/app and analyze the steps where users are dropping off. Ensure minimal load time, responsiveness across devices and avoid page crashes.

- Out of stock items - Imagine a customer visiting your website/app, selecting a product, only to find it's out of stock. This frustrating experience could discourage them from future visits. Solution - Clearly mark out-of-stock items in your product catalog page and on product pages, offer a filter to hide these items from view and collect customer email addresses on product pages to notify them when out-of-stock items are available again.

Phase 2 - During checkout phase

- Additional/unexpected costs - Additional costs like shipping charges, processing fee, handling fee etc. might make the customer rethink their purchase decision and can cause them to abandon their carts. Research shows that this is the leading cause of cart abandonment among US customers with almost 48% of them dropping off due to too high extra costs .Solution - Disclose all the additional costs upfront during the start of the transaction journey. Offer free shipping to the customers or provide compelling discounts on the extra cost added.

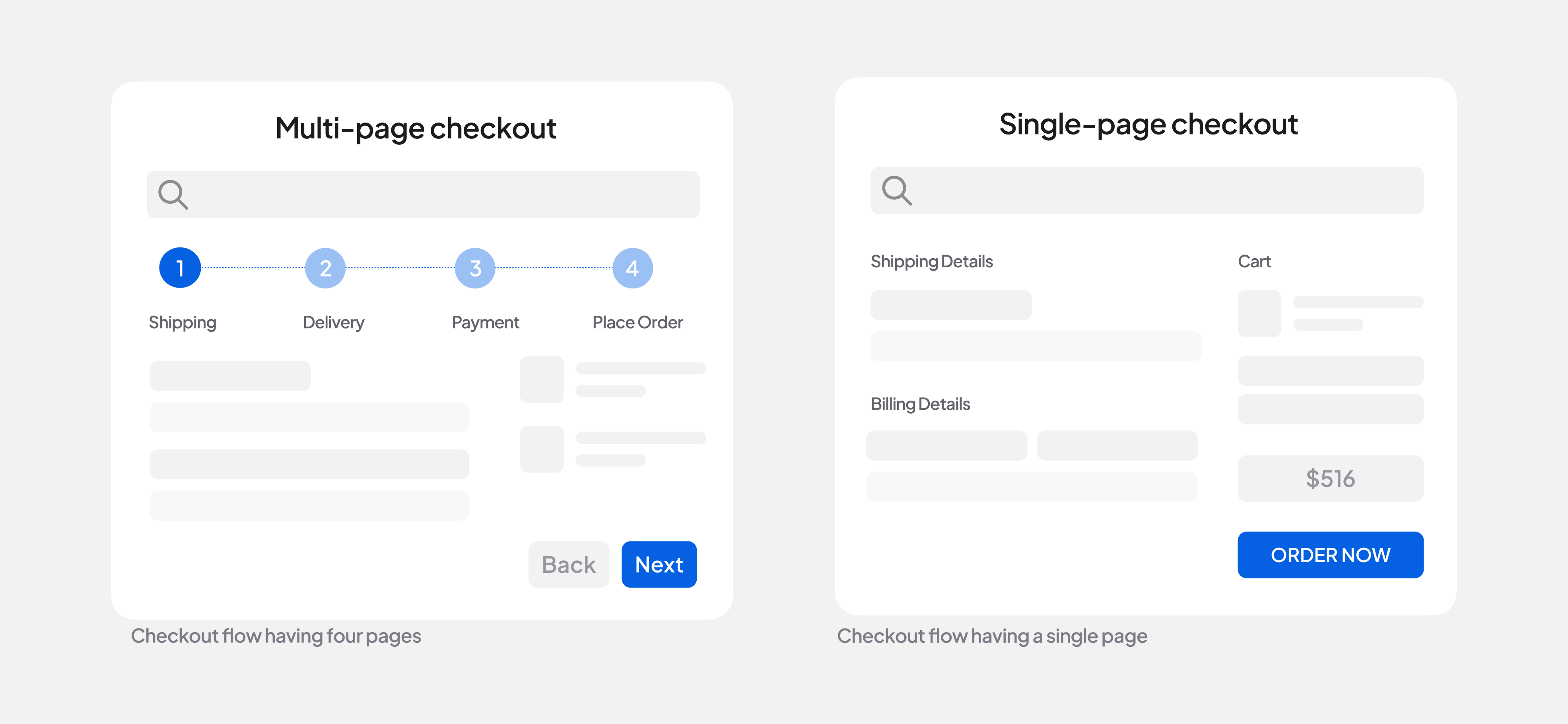

- Complex checkout experience - A complex checkout experience with multi page checkout flow might frustrate customers leading them to abandon their carts. The checkout page is the most crucial step in the transaction journey where the actual revenue realization happens (in most of the cases), a streamlined checkout experience is essential for ensuring customer satisfaction and driving sales.A study conducted by Baymard Institute shows that too long/complicated checkout process is the reason for cart abandonment for 22% of US customers.Solution - Try to reduce the number of clicks taken by the user to complete the transaction. Implement one-click checkout flows for your customer. Eliminate the need to switch between the web pages/apps. Enable customers to link their wallet account to the merchant app and pay by simply authenticating the transaction (through PIN, biometric, etc) within the checkout page itself.Another great way to reduce friction on the checkout page is to enable QuickPay. QuickPay displays a customer's preferred payment methods as a widget on the checkout page. Juspay Hypercheckout enables merchants to streamline their checkout process. From providing rich one-click checkout experiences to offering QuickPay, Juspay Hypercheckout ensures the most seamless checkout experience for your customers.

Businesses can store customer payment information (card, bank, or wallet details) securely in a PCI-compliant tokenization vault. This allows repeat customers to check out without re-entering their payment details, significantly reducing friction in the checkout process. Juspay’s token vault provides a flexible token storage and management solution to the businesses by enabling them to bring their own token requestor credentials and configure it with Juspay’s vault. Juspay is also a token requestor/token service provider with over 150 million network tokens issued globally.

Businesses can store customer payment information (card, bank, or wallet details) securely in a PCI-compliant tokenization vault. This allows repeat customers to check out without re-entering their payment details, significantly reducing friction in the checkout process. Juspay’s token vault provides a flexible token storage and management solution to the businesses by enabling them to bring their own token requestor credentials and configure it with Juspay’s vault. Juspay is also a token requestor/token service provider with over 150 million network tokens issued globally.

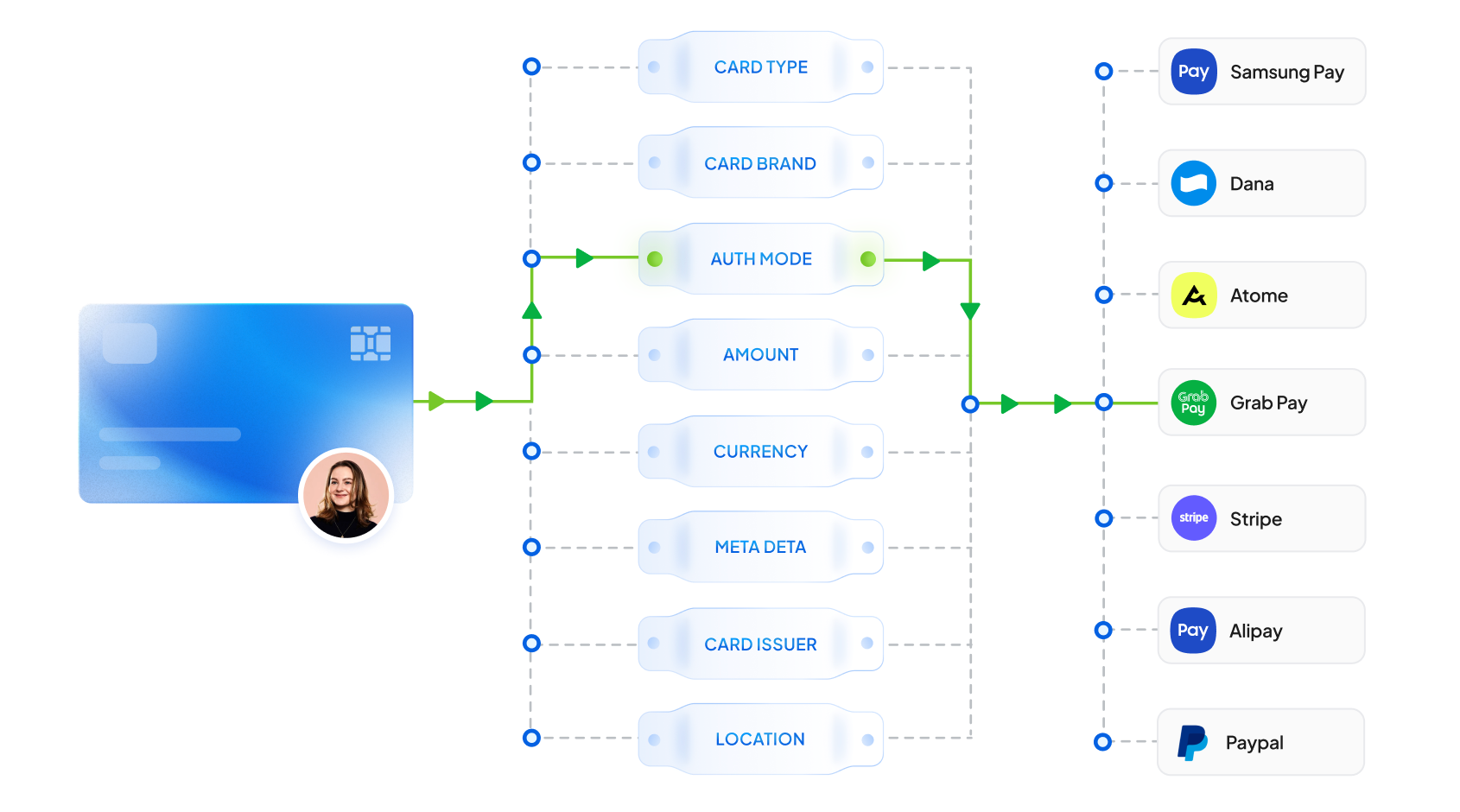

- Preferred payment method unavailable - With the advent of modern payment methods like digital wallets, Buy Now Pay Later (BNPL) And Real Time (RTP) Bank Transfers, customers’ preferred mode of payment is also shifting. According to The Federal Reserve Payments Study (FRPS) , Alternative payment methods like mobile wallet payments have shown a strong growth in the US market, reaching 14.4 billion transactions in 2022, up from 2.9 billion in 2018.Unavailability of Local/Alternative payment methods can be a limiting factor and can lead to cart abandonment. Almost 13% of the US customers abandon their carts due to lack of payment methods.Solution - Provide your customers with widely accepted local/alternative payment methods. These payment methods vary region to region. Offering local/alternative payment methods to your customers can significantly reduce drop-offs at the checkout page. Juspay's orchestration engine empowers businesses to integrate 300+ PSPs and local/alternative payment methods globally with no-code integrations.

- Security concerns - As online fraud becomes more prevalent, customers are growing more aware and cautious about safeguarding their financial details. Almost 25% of the US customers abandon their carts because they don’t feel secure providing their card information.Solution - Business should ensure that they have an active SSL certificate and their website is PCI compliant. They should also adhere to regional data protection regulations, such as GDPR for businesses operating in Europe.To instill customer confidence, businesses should prominently display proof of all regulatory compliance on the checkout page.

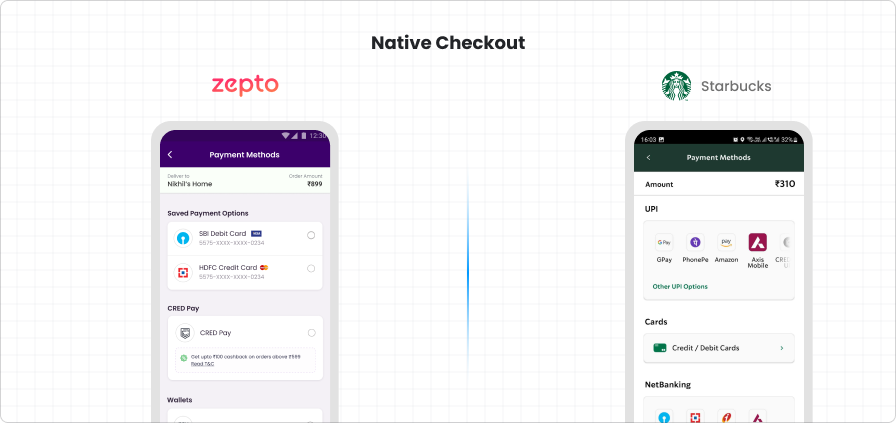

- Inconsistent checkout experience - A disjointed checkout experience, where the checkout page's design and style are inconsistent with the rest of the website or app, can raise red flags for customers. This mismatch may lead them to question the legitimacy of the business, creating doubt about the security of their transaction and ultimately causing them to abandon their carts.Solution - Offer a native and blended checkout experience to your customers where the design of the payment page matches the brand guidelines of your website/app. This consistent look and feel reassures customers that they are still within a secure and familiar environment, fostering confidence and reducing any hesitation they might have about finalizing their purchase.Juspay Hypercheckout offers a no-code design studio where businesses can design custom branded native experiences across Android, iOS and Web. Customise elements to the look and feel of your brand.

Phase 3 - Post checkout phase

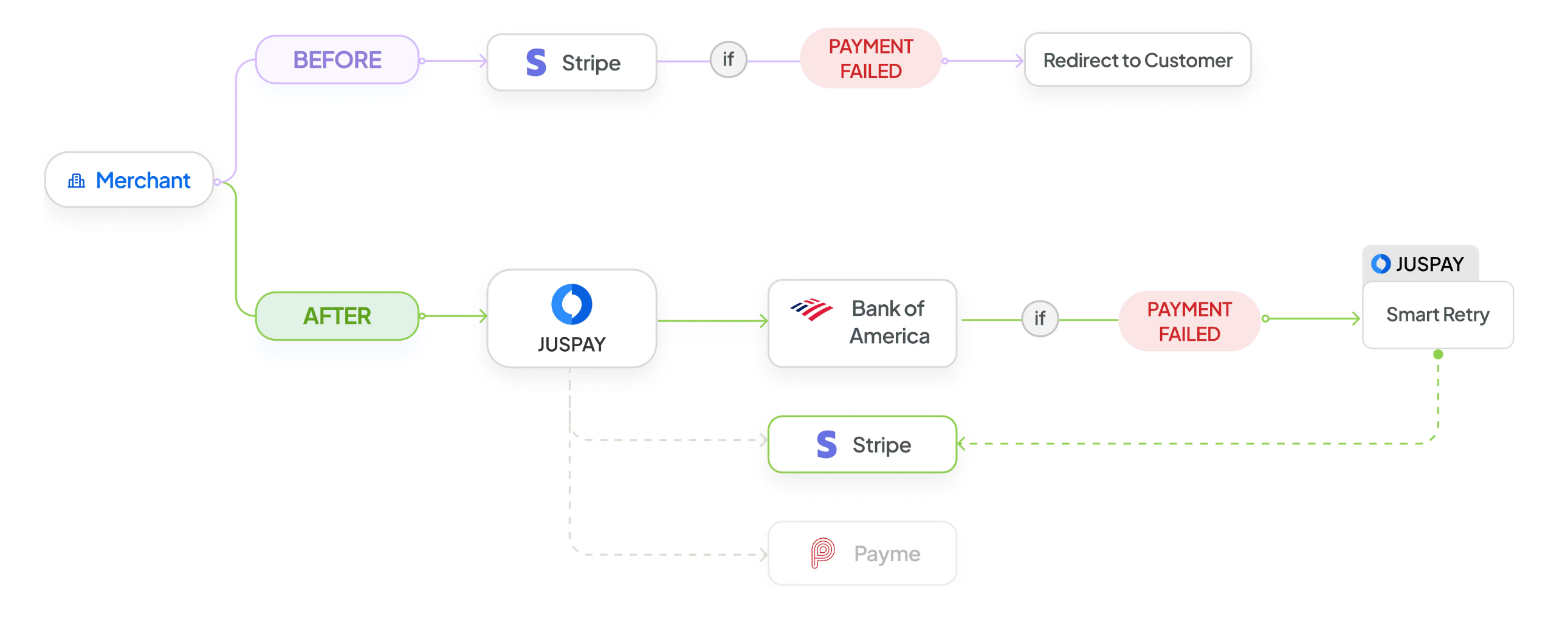

- False declines - False decline refers to a situation where a legitimate transaction is mistakenly declined by the acquiring bank or the payment service provider as it is wrongly identified as a fraud or declined by the system. False declines might frustrate a customer leading them to abandon their cart.Solution - Implement a fallback retry mechanism that automatically routes transitions to an alternate processor after a payment fails. Juspay’s smart retry workflow silently retries a transaction with an alternate processor if the primary processor fails. This process happens behind the scenes, without requiring any action or input from the customer, thus preventing frustration and maintaining a positive user journey.Optimizing risk rules is also crucial to avoid false declines. Juspay’s Fraud Orchestration helps businesses connect to fraud solution providers such as Riskified, Signifyd to clearly bifurcate fraud and genuine transactions and thus reduce false declines.Businesses can set up 3D Secure (3DS) triggers for transactions that have a higher probability of being flagged as fraudulent. By implementing a 3DS authentication flow for these specific transactions, businesses can substantially improve the payment authorization rates. With Juspay’s intelligent authentication system , businesses can build a unified authentication experience across all PSPs, present a 3D Secure challenge when needed, and ensure an optimal & secure payment journey every time.

- Transaction failure due to PSP downtime - Payment Service Provider (PSP) downtime refers to a period when the PSP's systems are unavailable, preventing them from processing transactions and resulting in failed payments. Failed transactions are a leading cause of cart abandonment among the US customers.Solution - Businesses can address this problem by implementing the following strategies.Proactive approach (dynamic routing) - Businesses should dynamically route payments to the best performing PSP to avoid PSP downtimes. A payment orchestrator like Juspay can enable merchants to set up dynamic routing rules and increase their conversion rates.Reactive approach (fallback routing) - Fallback routing automatically retries transactions in case of errors such as failures, false positive declines, and system errors. With Juspay’s orchestration platform, businesses can set up rules or automatically send the transaction to a secondary payment service provider if the primary one is unavailable.

Impact of Cart Abandonment on Businesses

Cart abandonment has significant implications for businesses, impacting their revenue, customer relationships, and operational efficiency. Some key impacts include:

- Loss of revenue: Abandoned carts are a source of direct revenue loss on the surface but if we look at a bigger picture, cart abandonment is much more than that. Let’s look at it at a customer level instead of a transaction level.When a customer abandons their cart, the chances of them returning to complete the purchase are significantly diminished. This lost sale represents not just the immediate revenue opportunity, but also the potential future revenue that a customer could have generated over time—their Customer Lifetime Value (CLV). Consequently, cart abandonment has a substantial negative impact on a business's overall profitability, as it leads to the loss of both current and future revenue streams.

- Skewed marketing cost: Lets circle back to where we started this article. When a customer abandons their cart, the investment made to acquire that customer through marketing and advertising efforts fails to generate any revenue. This directly increases the CAC, as the acquisition cost is spread across a smaller number of successful conversions.Furthermore, businesses often attempt to recover these lost sales by investing additional marketing spend in retargeting campaigns, designed to re-engage the customer and encourage them to complete their purchase. This additional spend on the marketing and retargeting further inflates the CAC, compounding the initial loss.

- Inventory management challenges: Businesses frequently use the number of items added to shopping carts as an indicator of anticipated demand for a particular Stock Keeping Unit (SKU).However, a high cart abandonment rate can significantly skew these projections. If a large proportion of customers abandon their carts, the business may overestimate demand and consequently overstock that SKU. This excess inventory then leads to increased inventory management costs, including storage, handling, and potential losses due to obsolescence or spoilage.

- Deterring brand image - In today’s highly competitive market, creating a unique brand identity and distinguishing your business from your competition has become ever so difficult. It takes a lot of time to create a brand image that resonates with your customer and makes them your loyal customers.Cart abandonment can severely undermine these efforts by creating a negative customer experience. Customers who abandon their carts may perceive your brand as inattentive to their needs and focused solely on sales, thereby damaging your hard-earned brand image and eroding customer trust. This negative perception can not only lead to lost sales but also harm your long-term brand reputation.

How can businesses prevent cart abandonment?

Till now we have covered in-depth all the measures businesses can apply to prevent cart abandonment. Let’s take a quick overview of all the measures -

- Reduce friction - An essential element for minimizing cart abandonment is to eliminate as much friction as possible from the checkout process. This involves streamlining the customer journey by removing extra steps, such as mandatory account creation, which adds an extra step and delays the purchase.Also, streamlining the checkout process by removing multi page checkout flow can significantly improve the user experience. Offering seamless one-click checkout flows also reduces the friction, allowing customers to complete their purchases swiftly and effortlessly, thereby reducing cart abandonment.

- Build trust - This involves making sure that the customer feels secure throughout the checkout process. Businesses should offer a native and blended checkout experience that matches the look and feel of their website.Businesses should also be compliant with governing guidelines like GDPR, PCI, etc. and should display all the proofs of compliance during the checkout process.

- Offer diverse payment options - Offering local/alternative payment methods is beneficial for both businesses and their customers. For businesses, these payment methods often come with a lower Merchant Discount Rate (MDR), meaning they can process transactions at a reduced cost.For customers, the availability of familiar and preferred local or alternative payment methods enhances convenience and builds trust. This increased convenience encourages customers to complete their transactions, leading to higher conversion rates and reduced cart abandonment.

- Improve functionality of payment stack - Once the customer has initiated the transaction, the payment engine should be capable of processing the payment. This involves building a reliable, scalable and seamless payment stack.Reducing payment failures is directly proportional to cart abandonment rate. A decrease in the number of failed payment transactions directly results in a reduction in the cart abandonment rate.

How can Juspay help in reducing cart abandonment?

Juspay is a global leader in enterprise payment solutions, powering payments for merchants and banks worldwide.

Leveraging our core strengths in Payment Experience, Payment Orchestration, and Payment Infrastructure, we engineer highly reliable and scalable payment solutions that power global brands in their digital commerce journey.

Juspay processes over 200 million daily transactions globally, with 99.999% reliability and managing an annualized GMV exceeding $670 billion, we empower organizations to:

- Achieve industry-leading conversion rates

- Strengthen fraud prevention capabilities

- Optimize Payments Processing Costs

- Deliver exceptional customer experiences at scale

Trusted by global leaders including Amazon, Google, Microsoft, Visa, Mastercard, American Express, Juspay unifies the payments worldwide to accelerate go-to-market and drive global business outcomes

Conclusion

Cart abandonment is a severe business challenge that directly impacts revenue, customer relationships, and brand reputation. However businesses can efficiently minimize cart abandonment and recover lost revenue by understanding the various causes of cart abandonment and utilizing effective strategies to address them,

This involves making the checkout process frictionless and seamless, establishing trust with the customer, providing a wider range of payment methods, and having a secure and reliable payment infrastructure.

Cart abandonment is not just an operational issue but a necessity for businesses to scale up. Businesses can convert abandoned carts into successful transactions and develop long-term customer loyalty by providing a superior customer experience and by building effective payment solutions.