Card payments are the most popular and widespread payment instrument across the globe for both online and offline transactions. Convenience and ease of usage provided by cards, especially in this fast-moving digital economy era, have helped gain widespread popularity for them. As the digital revolution keeps accelerating, there is an elevated need for innovative solutions to further simplify card payments, make them more frictionless, secure, and easier to use.

Offline transactions, that is payments made in physical stores using POS systems, are already streamlined for convenience and speed. Payment can be made instantly and securely with just a single tap of the card against the POS machine, thanks in part to the use of EMV chips, which improve security and minimize fraud risk in such transactions.

Online transactions, however, are more challenging. Remote purchase, often an e-commerce transaction, is a transaction in which a buyer and seller are not physically present in the same room and in this case the mode of payment can be anything. Card-not-present transactions are those remote purchases, wherein the cardholder provides the card details to the merchant at the time of payment, thus being more vulnerable to fraud.

While card payments have improved offline, online payments continue to encounter obstacles like cart abandonment and security issues. Although the use of card payments continues to increase, most online stores struggle with minimizing cart abandonment. Two major causes of abandonment include a lack of trust in merchant sites where card information is to be entered and a lengthy or complex checkout process. As per latest statistics, 25% of consumers leave their carts because they are worried about the security of their credit card details, and 22% leave because of a complicated or lengthy checkout process. Moreover, security issues are still a predominant concern in online shopping. As MasterCard has asserted, card-not-present fraud in the United States was four times greater than point-of-sale fraud in 2019.

To tackle these issues, payments have been enhanced with capabilities such as tokenization of card information for online transactions. The next generation of this development is Click to Pay, designed according to the EMVCo SRC guidelines. The intention of this enhancement is to simplify online payments as simple as tapping a card in a POS machine—allowing payments on digital platform with just a single click while ensuring enhanced security and ease of use for online consumers

In a Glance

What is click to pay

Click to Pay is an easy, secure digital payment solution that simplifies the online shopping process by enabling consumers to pay with a single click. By not having to repeatedly input payment information, Click to Pay accelerates the checkout process, making it more convenient and secure—particularly for repeat customers.

Built on the EMVCo Secure Remote Commerce (SRC) standard, Click to Pay was launched by large international card networks, such as Visa, Mastercard, American Express, and Discover. Its purpose is to enable a frictionless and unified payment experience for consumers shopping online, no matter what retailer or payment method they select.

With Click to Pay, consumers are able to safely store their payment information—like credit card numbers and billing addresses—in a single, centralized profile associated with their email address or phone number. This eliminates the need for shoppers to enter payment information manually every time a purchase is made, resulting in faster checkouts and fewer obstacles in the payment process. All they have to do is choose their desired payment option and make the purchase with one click.

The payment details in Click to Pay are stored and encrypted securely in a tokenized profile by the networks and not by the merchant. The tokenized data ensures that card details of consumers are never retained on merchant systems, keeping fraud risks low and subsequent transactions secure. At the time of online shopping by a consumer, the merchant reaches out to the network in getting the tokenised profile against which the cards are stored skipping the need of a user entering the card details manually.

Click to Pay makes it easier for consumers in completing their transaction successfully, thereby enhancing the payment experience. It also facilitates trust, as the system is supported by the security of the large card networks, which guarantees consumer data protection.

For consumers, Click to Pay enhances the overall payment experience through a consistent and frictionless checkout process, which results in greater conversion rates and lower cart abandonment. Because Click to Pay is backed by international card networks, it is interoperable globally, and thus can be used seamlessly across borders, making it more accessible to a wider number of customers globally.

Benefits of click to pay

- Quicker transactions: All payment data is safely held by the network (Visa, mastercard, Amex, Discover) in a single profile for speedy and secure transactions. In a world where consumers want to finish the online check out process in four minutes or less, click to pay shortens the number of steps a repeat user must take and moves on to payment authentication in one click.

- Decreased cart abandonments: Actions such as filling card information, recalling passwords are no longer required. Upon a single click, the payment proceeds to subsequent steps like authentication as the users are able to avoid sign-ins on familiar devices, assisting merchants with decreased cart abandonments and delivering users with a smooth experience.

- Increased security: Compliant with EMV Security standards and with stringent data protection guidelines like PCI DSS, Click to Pay secures consumer payment data behind multiple layers of security. It employs sophisticated features such as velocity checks, geolocation verification to ensure protection against fraud. It integrates with all EMVCo partners (Visa, Mastercard, American Express, and Discover) and leverages the most advanced level of security at each checkout to lower risk to merchants. Click to Pay even utilizes dynamic cryptograms to establish specific cryptographic signatures per transaction that can't be tampered with by fraud, such as replay attacks.

- By tokenizing guest checkout transactions, Click to Pay reduces card-not-present fraud. The familiar Click to Pay icon can also enhance consumer trust due to familiarity. Merchants have a universal, interoperable solution that simplifies the checkout experience and improves security. Customers can make payments with confidence at merchants with click to pay enabled.

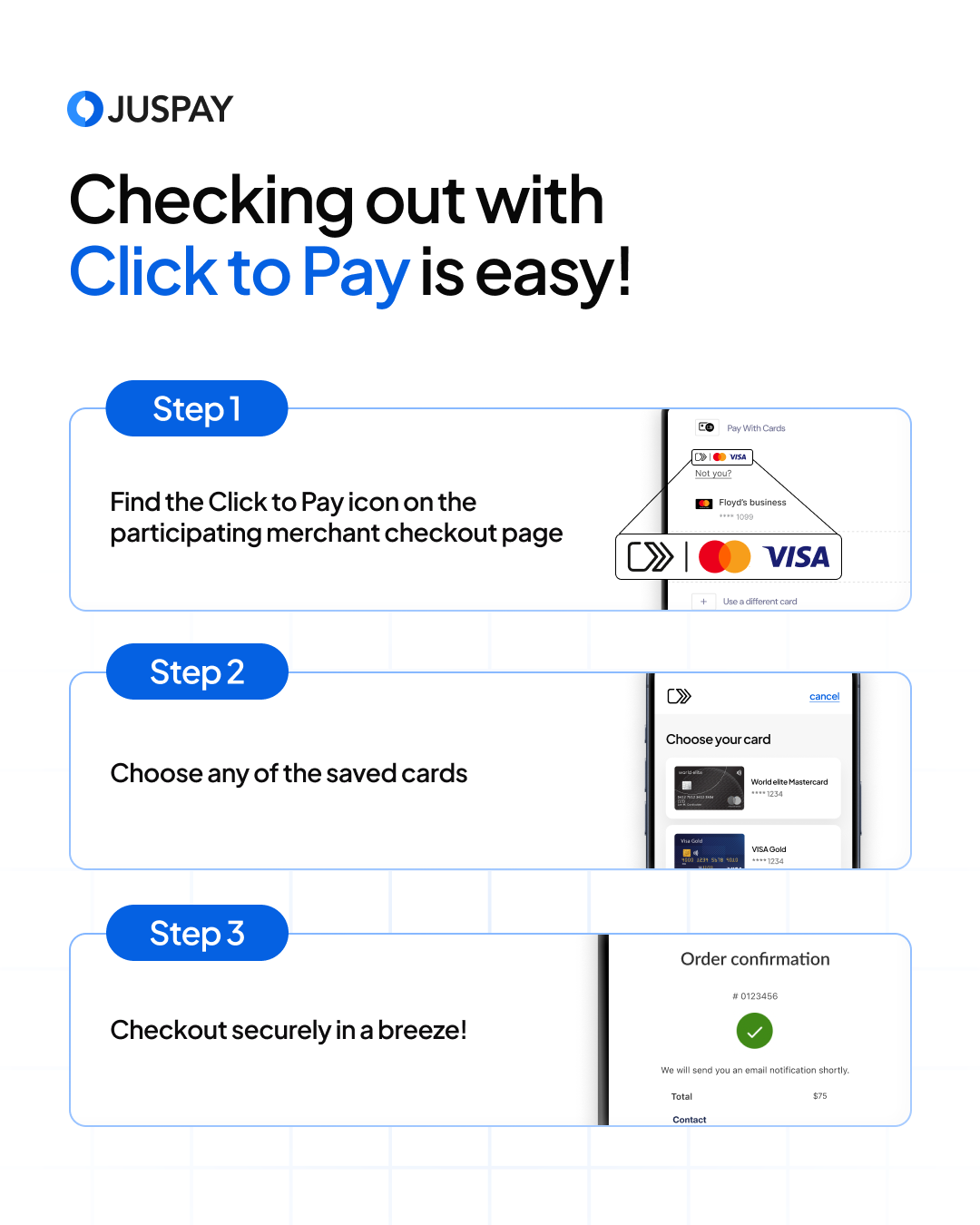

User flow click to pay

How does click to pay work: Click to pay mechanism can be divided into three key steps

- User registration

- User recognition

- Payment processing

SRC Profile Creation for New Users – User Registration

Setting up a Click to Pay profile allows users to securely store their payment details in one location so it is accessible on all participating merchant’s checkouts pages you see the Click to Pay icon. Users can create the profile either from click to pay participating merchants checkout page, network provided website or from their banking website. Users would be required to enter an email address and a mobile number to use Click to Pay. To authenticate the information provided, and to prevent fraud, networks can send authentication codes in the form of an email or an SMS. It is free to create a Click to Pay profile.

Adding cards to your click to pay profile

Through the Network Website:

Customers can access their Click to Pay profile through the card network's website (for example, Visa, Mastercard, American Express).

After login, they can choose the cards they wish to add to the profile.

Users click the "Add" button for each card to add it to the Click to Pay account.

Through Merchant Checkout:

In the case where users are making a purchase through a participating merchant, they can find the Click to Pay icon at checkout.

At payment time, users can click to add a card by tapping on the "+" (Add) icon from the Choose a Card field.

The user can also input their card information to link it to their Click to Pay profile for reuse in the future.

Through Online Banking:

It is possible for some users to add cards directly to Click to Pay through the online banking service or mobile banking app of their bank.

Users can search for the Click to Pay icon from within the banking platform and navigate through instructions to add their cards.

Remember that these methods might vary slightly depending on the specific Network and your bank's participation.

User Recognition and Payment Processing

For users who have already created a Click to Pay profile, making card payments becomes even easier when shopping at participating merchants:

- At the checkout of a participating merchant, users will notice the Click to Pay logo. This means that they can make payment using their Click to Pay profile.

- The system will confirm if the mobile number and email address used for registration match with what the merchant already has. If confirmed, the user’s card information is populated and the user is able to pay for the purchase in one click.

- If the verification process is not successful, users will be prompted to log in to their Click to Pay profile. Once logged in, users can choose the option to “Remember this device”, which allows for one-click payments during future transactions.

- “Remember this device” feature is particularly useful for making future purchases faster and more seamless.

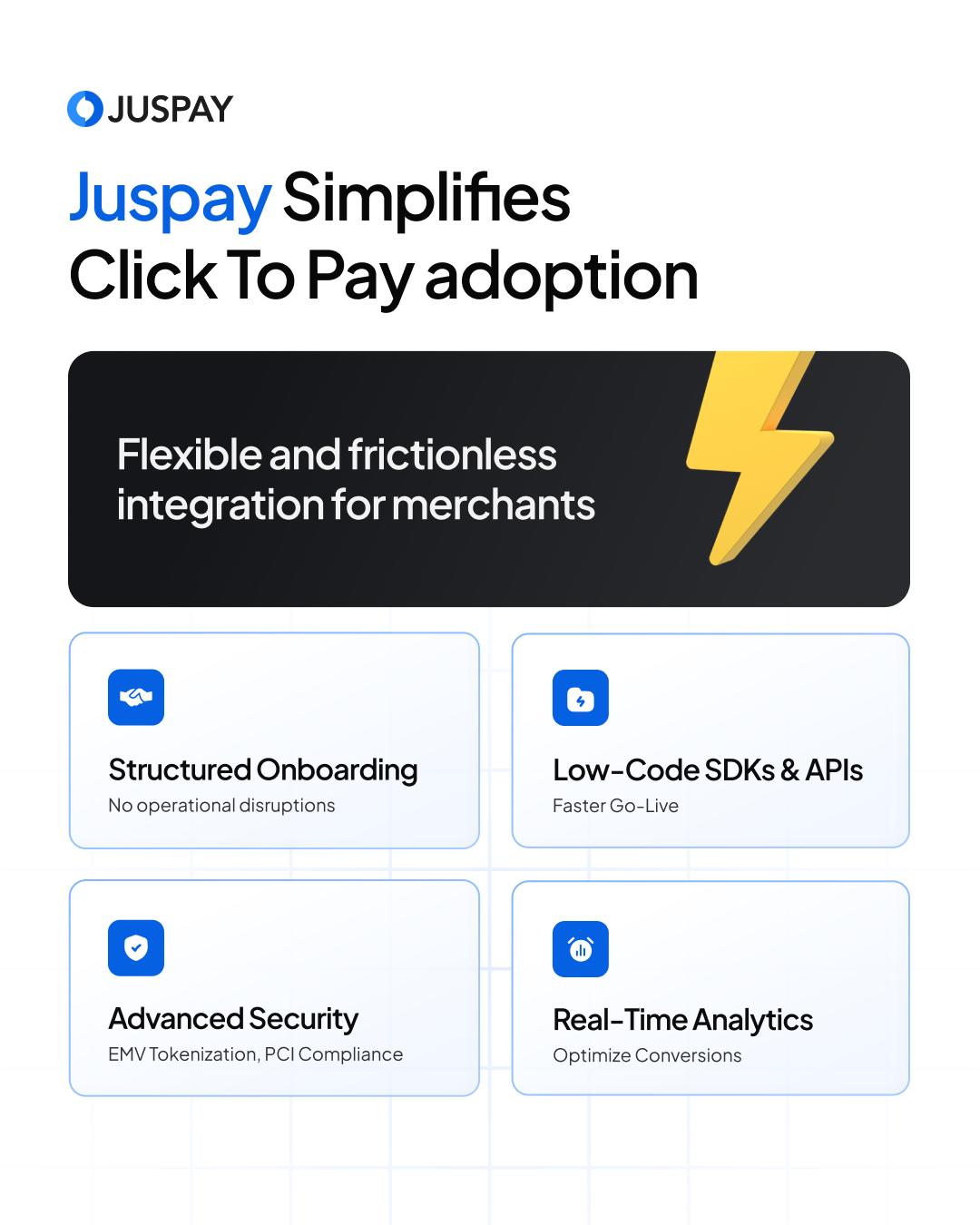

Benefits of implementing click to pay with a TSP like Juspay

As companies seek to implement Click to Pay solutions, they are confronted with an array of challenges, ranging from complex integrations with existing payment systems and ensuring compliance with evolving security standards, to managing fraud, chargebacks, and technical support.

These challenges are considerable, particularly for companies with legacy infrastructure, international customers, or constrained resources. This is where a technology service provider (TSP) such as Juspay comes into play. Juspay, known for its experience-focused approach, provides effortless integration with current infrastructure, guaranteeing compliance with international data security protocols such as PCI DSS and GDPR, along with strong fraud protection capabilities. TSPs that cater to all stakeholders (Merchants, Networks, users) have strategic advantage through deeper market insights and help with faster Go live through its Reliable, scalable, and affordable software offerings. Juspay's offerings make it the ideal partner for businesses seeking to navigate the complexities of Click to Pay and deliver a secure, hassle-free payment experience for both staff and customers.

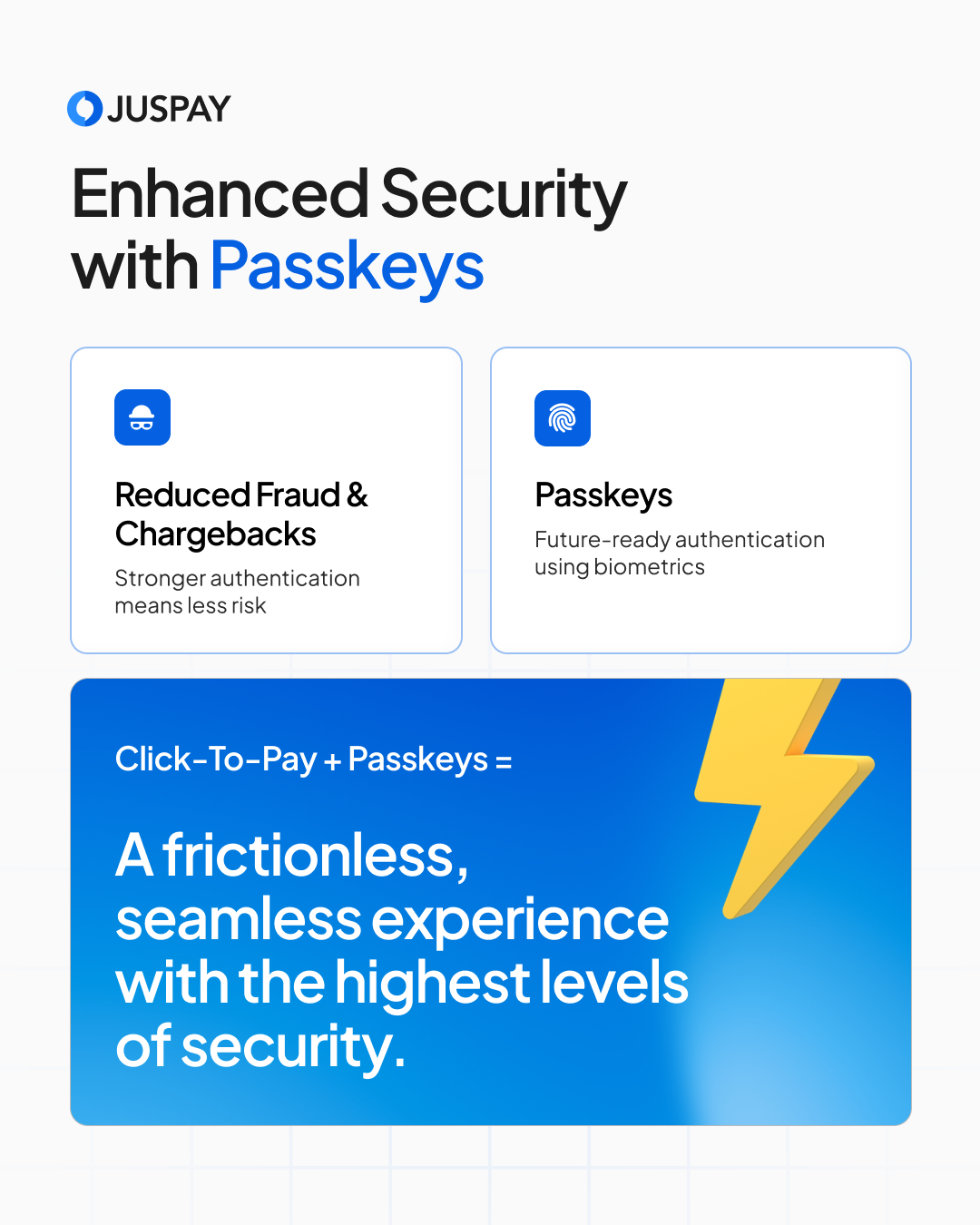

Future of Click to Pay: Click to Pay with Passkeys

Passkey: A passkey is a FIDO (Fast IDentity Online) authentication credential on the basis of FIDO (Fast Identity Online) standards, which enables an individual to log in to websites and apps with the same process with which they unlock their device (biometrics, PIN, or pattern).

With passkeys, users do not have to type in usernames and passwords or other factors. In comparison to passwords, logging in with a passkey significantly enhances security because a passkey is phishing-resistant and the credential is not reused in contexts.

In card payments through Click to Pay, two-factor authentication (2FA) is usually needed to add security, introducing some friction in the checkout process.

But passkeys can resolve this friction by providing a frictionless, secure, and password-free transaction experience. When retailers include passkeys as part of the Click to Pay flow, their consumers are able to authenticate the payment using the device's native security features—be it a fingerprint, facial recognition, or PIN—enhancing both security and convenience of e-commerce transactions. Juspay, together with networks such as Visa and Mastercard, has launched Click to Pay with Passkeys, to transform the online payment experience.

This new functionality simplifies the checkout process by utilizing on-device biometric verification like fingerprint scanning or facial recognition. It replicates the easy, intuitive process of unlocking smartphones, enabling consumers to finalize their purchases with a mere biometric verification—without passwords or PINs. This greatly minimizes the threat of data breaches and fraud, providing consumers and merchants with confidence. Consumers can make one-click secure payments across operating systems, browsers, and devices with Click to Pay with Passkeys, making the overall payment experience seamless. Juspay's implementation of Click to Pay with Passkeys also enables seamless guest checkout, enabling customers to make transactions easily and quickly without inputting payment information manually.

This not only increases convenience but also minimizes friction in the checkout process, directly tackling one of the primary causes of cart abandonment—time-consuming and complicated payment processes. By removing the necessity for static passwords or one-time passwords (OTPs), this innovation speeds up payments, makes them more secure, and more user-friendly. This is in line with the increasing worldwide trend of doing away with password-based security systems in favor of more secure, user-friendly alternatives. The marriage of passkey technology and tokenization is the future of secure payments, providing customers with both increased security and a seamless experience. With Click to Pay with Passkeys, Juspay and Mastercard are not only solving today's payment issues but are also setting the stage for the future of digital payments—a future where security, ease, and speed come first, enabling consumers and businesses to take part in secure and seamless online transactions.

Benefits of using Click to pay with Passkeys:

- Reduced friction – By eliminating the need for passwords and manual card entry, Click to Pay combined with passkeys provides a seamless and hassle-free checkout experience. Users can authenticate their transactions effortlessly using biometrics, such as fingerprint or facial recognition, or a simple device PIN.

- Faster Checkout – With one-tap authentication, customers can complete their purchases in seconds, dramatically reducing friction in the checkout process. This speed leads to enhanced customer satisfaction and faster transaction completion.

- Better Security – The use of passkeys ensures robust, phishing-resistant authentication, making it virtually impossible for malicious actors to steal login credentials. With the elimination of passwords, businesses and customers benefit from enhanced security, reducing the risk of password leaks and fraud during the payment process.

- Liability shift –Issuer takes complete liability under Token Authentication Service (TAS) program. The merchant gets the benefit of chargeback liability shift to the issuer when the transactions are authenticated through Click to Pay with Passkeys service.

Click to pay + Passkeys = A frictionless, seamless experience with highest levels of security

Innovations with Passkeys in Payments

Juspay, in partnership with networks such as Mastercard, has launched Click to Pay with Passkeys, to transform the online payment process. This feature streamlines the checkout experience by taking advantage of on-device biometric authentication like fingerprint recognition or facial scanning. It mimics the simple, intuitive action of unlocking smartphones, enabling consumers to finalize their transactions with an easy biometric verification—no passwords or PINs required. This greatly reduces the danger of data breach and fraud, providing consumers and merchants with an added sense of security. Using Click to Pay with Passkeys, consumers are able to conduct secure, single-click payments, regardless of the device, browser, or operating system, for a seamless overall payment experience.

Juspay's implementation of Click to Pay with Passkeys also enables guest checkout to become streamlined, so customers can complete purchases easily and efficiently without inputting payment information manually. This not only adds convenience but also minimizes friction in the checkout process, which directly targets one of the major reasons for cart abandonment—slow and cumbersome payment processes. By removing the requirement for static passwords or one-time passwords (OTPs), this innovation accelerates payments, secures them, and makes them easier to use. This is in line with the emerging worldwide movement towards doing away with password-based security measures in favor of safer, user-friendly solutions. The union of passkey and tokenization technology is the future of payment security, providing consumers with a seamless experience along with greater security. With Click to Pay with Passkeys, Juspay and Mastercard are not just addressing current payment challenges but are also paving the way for the future of digital payments—one that prioritizes security, convenience, and speed, making it easier for consumers and businesses to engage in safe and efficient online transactions.

User flow: Click to pay and Passkeys Registration

User flow: Click to pay and Passkeys Repeat user’s experience