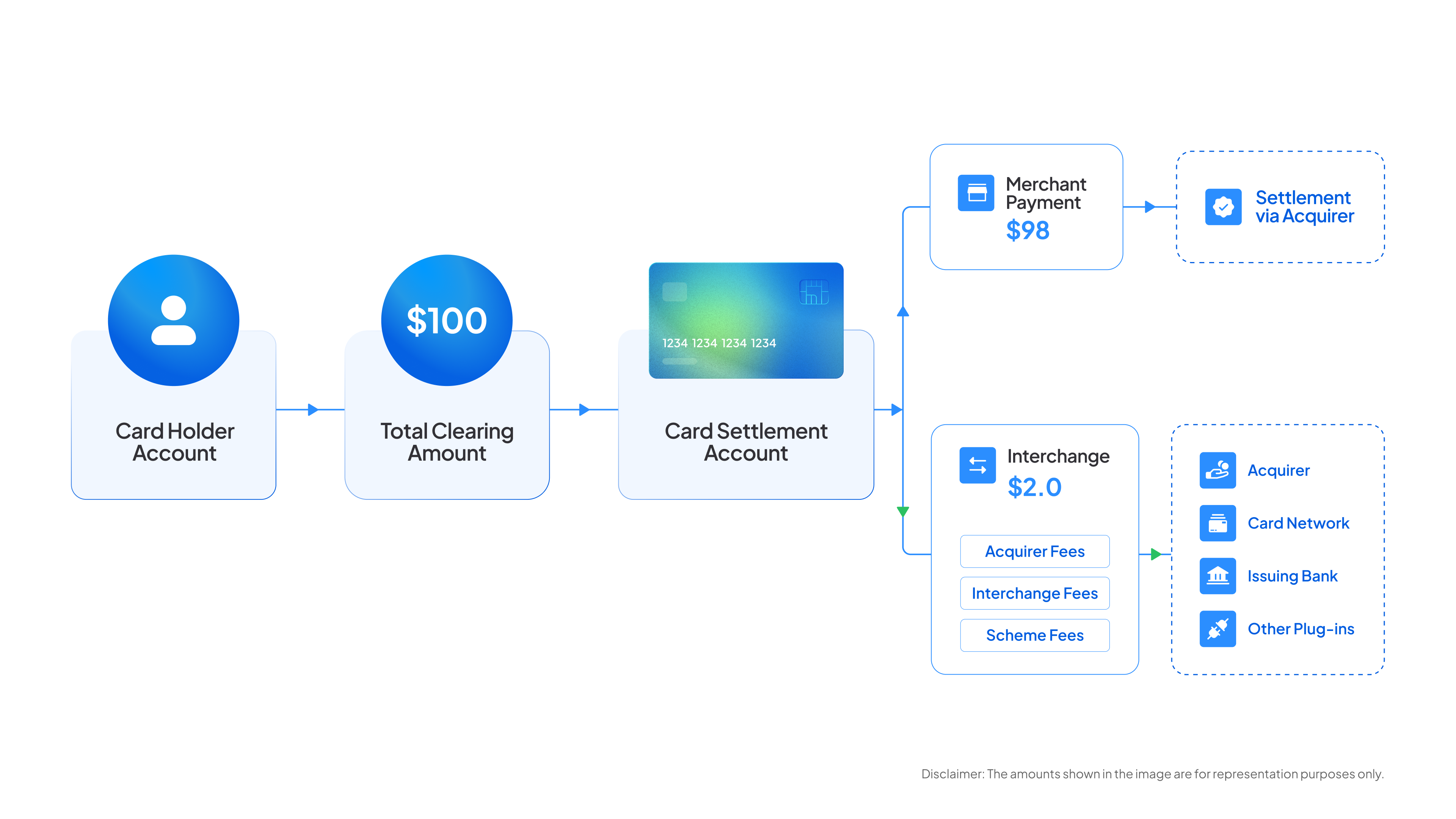

Merchants face significant challenges in managing the complex and often opaque fees associated with payment processing. Each card transaction is subject to multiple cost layers:

- The interchange fees (paid to the customer’s bank)

- The scheme fees (charged by card networks for infrastructure and fraud prevention),

- And the acquirer fees (imposed by payment processors).

Interchange fees, which constitute the largest portion of payment processing costs, vary significantly across regions due to local regulations and market conditions. These fees often dominate conversations about card-acceptance costs. However, unlike processing fees, which are more variable and, in some cases, rising faster than interchange, these rates are non-negotiable for merchants. The complexity of payment cost structures frequently leaves merchants struggling to fully understand their total expenses. This confusion largely stems from the different pricing models used in the industry, especially:

- The Blended Model, which combines all fees (interchange, scheme, and acquirer fees) into a single rate, makes costs predictable but less transparent. Smaller merchants typically use the blended model, as the model appears more straightforward, however, it hides the specific breakdown of each cost, making it hard to know exactly where cost fees could be optimized.

- The Interchange++ (IC++) Model, in contrast, offers a clearer picture by separating costs into three parts: interchange fees, scheme fees, and processor markups. Although this model provides more transparency, it adds complexity and requires merchants to analyze multiple fee components to identify their cost drivers.

Without a clear understanding of these pricing structures, merchants risk overpaying for payment processing, missing critical cost-saving opportunities, and, most importantly, failing to detect overcharges from service providers.

Regulation: Catalyst or Constraint?

The approach to interchange fees varies widely across regions and is shaped by local regulations, market dynamics, and economic priorities. In some markets, the regulatory frameworks act as a driver for cost reduction and transparency, while in others, they may inadvertently limit innovation or create disparities.

For instance, in the United States, the Durbin Amendment, introduced as part of the Dodd-Frank Act in 2010, mandates that interchange fees for debit card transactions be "reasonable and proportional" to the processing costs. This regulation has two key components:

- Fee Caps: Imposing limits on the interchange fees that can be charged on debit card transactions. The debit card interchange fees are restricted to 21 cents plus 0.05% of the transaction amount. An additional 1 cent charge is allowed for fraud prevention costs.

- Routing Choice: Ensuring merchants have the ability to route debit transactions over at least two unaffiliated networks, fostering competition.

In contrast, the European Union’s Interchange Fee Regulation (IFR) caps interchange fees for both credit and debit cards, aiming to reduce merchant costs and promote cross-border competition. Unlike the Durbin Amendment, however, the IFR does not mandate routing choice, which limits merchants' flexibility in optimizing network costs.

These regional differences significantly influence how merchants manage payment expenses and navigate interchange structures, highlighting the varied priorities and outcomes of regulatory approaches worldwide.

High Cost of Acceptance: The Need for Unified Insights

In 2023, merchants in the United States paid an unprecedented $224 billion in card-acceptance costs, the highest globally, according to the CMSPI State of the Industry Report. Of this, the interchange fees, paid to card-issuing banks for processing transactions, accounted for $143 billion.

When fees become unsustainable, merchants often seek to renegotiate rates or switch providers. In the U.S., interchange fees can vary widely, from 0.05% to 2.45% of the transaction value. Managing these costs effectively is a complex challenge without a unified view of the payment operations and a clear understanding of total expenses, inefficiencies, and opportunities for optimization.

Fragmented Cost Visibility

To control costs, merchants must evaluate critical factors such as interchange qualifications, scheme categories, and transaction routing. However, the data provided separately by PSP platforms, acquirers, and card networks is often fragmented and inconsistent, leading to an aggregation and alignment process that is both time-consuming and error-prone. This is because each provider may use different formats, structures, or levels of granularity, requiring merchants to manually consolidate and compare datasets. Inconsistencies with mismatched transaction details, missing fee components, hidden charges or discrepancies in calculations, are fairly common.

Fragmented data makes it challenging for merchants to effectively manage payment costs. A unified view of payment cost structures is essential to consolidate fragmented data, uncover inefficiencies, and take proactive steps to reduce expenses. By leveraging advanced analytics and integrated platforms, merchants can simplify this process, optimize costs, and focus on achieving sustainable savings.

3 Strategies to Optimize Costs

1. Consultancy-Led Approach and Insights

Taking a strategic, data-driven approach is key to managing payment processing costs effectively. By thoroughly reviewing payment systems, merchants can uncover hidden fees and pinpoint areas where they are overpaying. For example:

- Exploring options like using alternative payment networks to reduce debit card fees.

- Adopting cost-effective technologies to secure transactions

- And meeting compliance requirements without overspending.

This not only saves money but also improves reliability and enhances the customer payment experience, keeping merchants competitive in an evolving market.

2. Dynamic Debit Routing

Dynamic Debit Routing, or Least Cost Routing (LCR), offers merchants a significant opportunity to save on debit card transaction fees. This strategy allows merchants to route payments through the network offering the lowest fees based on transaction amount, card type, and applicable network charges. Advanced payment processors use AI algorithms to determine the most cost-effective path, balancing savings with transaction success rates.

The competitive landscape has further shifted with the rise of PINless debit transactions on single-message networks like STAR, Pulse, and Accel, which offer significant cost advantages over dual-message networks like Visa and Mastercard. According to CMSPI, merchants implementing PINless routing strategies could save up to 25% on interchange fees for card-not-present (CNP) debit transactions.

3. Data-Driven Tools

Advanced analytics platforms consolidate fragmented data from multiple channels, providing clear visualizations of cost structures and enabling merchants to identify inefficiencies. With the help of machine learning algorithms, merchants can uncover trends such as high decline rates, suboptimal routing paths, or hidden fee structures, and take corrective actions.

These insights enable merchants to align their payment offerings with customer preferences at checkout, leading to higher conversion rates and improved customer satisfaction.

Industry Trends: AI-Driven Cost Optimization & Authorization

Managing payment costs is a critical challenge for merchants. Gaining a clear view of these costs requires robust tools to detect anomalies, identify discrepancies, and ensure accurate billing. Common issues like PSP errors, invoice mismatches, and overcharges can easily go unnoticed without a system to consolidate and analyze fragmented payment data.

AI-driven solutions are increasingly being used to transform this complexity into actionable insights. These platforms monitor trends, detect cost deviations, and offer domain-specific context to explain anomalies, empowering merchants to make informed decisions. By optimizing interchange qualifications, reducing scheme fees, and minimizing penalties, merchants can uncover significant savings while improving the overall efficiency of their payment operations.

- Machine learning algorithms assess transaction data to identify the most economical routing paths.

- These algorithms also facilitate predictive analytics- allowing companies to forecast expenses and adjust operations proactively.

- AI models analyze factors such as transaction history, user behavior, and contextual data to assess fraud risk.

For instance, J.P Morgan has been using AI-based large language models for payment validation screening, which helps them make more informed authorization decisions by enabling better queue management and reduced false declines. The account validation rejection rates have been cut by 15-20 per cent in 2023.

Leverating the right tool is the start a well-executed orchestration strategy yet a proactive approach is key. Advanced tools that adapt to changes in card network policies can help merchants stay compliant, avoid penalties, and respond swiftly to evolving rules. By consolidating fragmented cost visibility into a unified view, merchants can not only reduce expenses but also position themselves to navigate future challenges with agility and confidence. HyperSense, an AI-driven layer integrated within Juspay, is designed to address these complexities, offering merchants the tools they need to take control of their payment costs effectively.