Merchant QR Code: Meaning, How It Works, and Benefits

In an era where speed, convenience, and security are paramount, the digital payment ecosystem has been continually innovating to meet these demands. Among these innovations, merchant QR codes have emerged as a pivotal tool, revolutionising how transactions are conducted in both physical and digital marketplaces. This technology allows merchants to accept payments swiftly and securely, facilitating seamless exchange of funds with a simple scan.

Initially designed for automotive part tracking, QR code technology is now a digital payment game-changer. Bridging cash systems and the digital era, its simplicity and security make merchant QR codes pivotal in digital commerce. Global QR stats for 2024: 26.95 million scans worldwide, with an average of 8 QR codes generated per minute. Dynamic QR codes saw a 433% increase, accumulating 6,825,842 scans globally. India’s adoption rate stands at an impressive 9.33%, transforming transactions and driving financial inclusivity in regions with limited banking access, forging a more connected and efficient digital economy.

Demystifying the Merchant QR Code

A merchant QR code serves as a digital gateway, seamlessly connecting a customer’s intent to make a payment with a merchant’s ability to receive it. It encodes vital transaction details, such as the merchant’s unique identifier linked to their bank account or digital wallet. Essentially, the merchant QR code encapsulates payment information in a scannable format, facilitating direct transactions when scanned by customers through smartphones or QR-capable devices. In India, the Unified Payments Interface (UPI) standardises QR code payments nationwide, ensuring universal acceptance.

The introduction of merchant QR codes marks a revolutionary departure from traditional payment methods. Unlike cash transactions requiring physical handling or card payments with POS machines, QR codes provide a contactless, device-agnostic solution. This not only expedites transactions but also boosts security, mitigating fraud and theft risks associated with cash and card handling. By consolidating payment details into a single, scannable image, merchant QR codes simplify the payment process, fostering accessibility and convenience for a broader user base. In today’s fast-paced commerce, where efficiency and safety are paramount, this innovation proves indispensable.

How Do Merchant QR Codes Work?

Understanding the workflow of merchant QR codes illuminates their efficiency and simplicity in facilitating transactions. The process encompasses several steps from the moment a customer decides to make a payment to the completion of the transaction.

Step-by-Step Workflow:

Generation of the QR Code

The merchant generates a QR code, which is a visual representation of their payment information, including their merchant UPI ID or other relevant payment details. This can be a static QR code, which remains the same for all transactions, or a dynamic QR code, which is generated uniquely for each transaction and can include specific transaction details like the amount.

Displaying the QR Code

The merchant displays this QR code at the point of sale or shares it digitally with the customer. In physical stores, it is often printed and placed near the cashier. For online transactions, it might be displayed on the checkout page or sent through an email or messaging service.

Scanning by the Customer

The customer uses their smartphone to scan the QR code through a UPI-enabled payment app. Upon scanning, the app deciphers the encoded payment details embedded within the QR code.

Transaction Review and Authorisation

Once the QR code is scanned, the payment app displays the merchant’s details and the transaction amount (if it is a dynamic QR code). The customer reviews this information and authorises the payment by entering their UPI PIN, confirming their intent to transfer the funds.

Payment Processing

The payment request is then processed through the UPI network, facilitating the secure transfer of funds from the customer’s bank account to the merchant’s bank account.

Transaction Completion

Both the merchant and the customer receive instant notification confirming the transaction’s completion. This real-time confirmation ensures transparency and trust in the payment process.

The Role of UPI in QR Code Transactions:

The Unified Payments Interface (UPI) plays a pivotal role in the functioning of merchant QR codes in India. It standardises the payment process across different banks and payment apps, ensuring that any UPI-compliant app can be used to scan any merchant QR code, making transactions universally accessible and seamless.

This streamlined process not only enhances the transaction experience for customers but also simplifies the payment acceptance mechanism for merchants, eliminating the need for multiple payment processing setups. The integration of UPI with QR codes represents a significant advancement in digital payments, offering a quick, secure, and hassle-free method for conducting transactions.

What Are the Benefits of Merchant QR Codes?

Merchant QR codes bring a multitude of benefits to the table, enhancing the transaction process for both merchants and customers. Here is a detailed look at the key advantages:

1. Increased Efficiency

-Quick Transactions: Transactions via QR codes are completed within seconds, significantly reducing the time spent on each payment, leading to faster checkout times and higher customer throughput for businesses.

-Ease of Use: For both parties, the process is straightforward-scan, review, and confirm-eliminating the need for manual entry of payment details and thereby reducing the scope for errors.

2. Enhanced Security

-Reduced Fraud Risk: Since the transaction is fully digital and requires authentication (such as a UPI PIN), the risk of fraud is minimised compared to cash transactions or card swiping.

-Privacy Protection: Customers do not need to share sensitive banking information directly with the merchant, as the transaction is processed through secure UPI channels.

3. Cost-Effectiveness

-Lower Transaction Costs: Merchants can save on the cost of purchasing and maintaining card reading equipment since QR codes can be generated for free and displayed simply by printing or on a digital screen.

-No Additional Fees: For most transactions, there are no additional fees for using merchant UPI QR codes, making it an economical choice for businesses.

4. Universal Compatibility

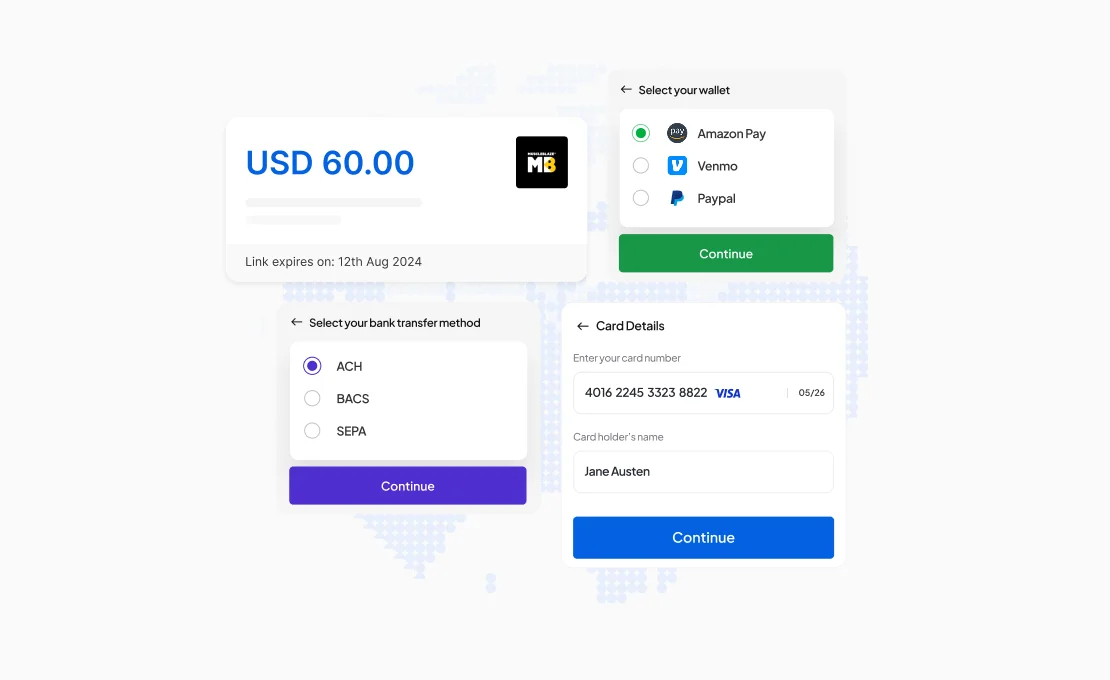

-Wide Acceptance: Since QR codes adhere to UPI standards, they can be scanned using any UPI-compliant app, offering flexibility to customers to use their preferred payment app.

-Cross-Platform Use: Merchant QR codes can be displayed in various formats-printed, on websites, or through digital communication-ensuring they can be used in all sales environments, from physical stores to online platforms.

5. Real-Time Payment Confirmation

-Instant Notifications: Both merchants and customers receive instant confirmation of the transaction, facilitating immediate reconciliation and enhancing trust in the payment process.

6. Accessibility

-No Need for Sophisticated Hardware: Merchants do not require sophisticated hardware; a printed QR code or a digital display is sufficient, making it accessible even for small vendors.

-Supports Small Transactions: Ideal for small-value transactions, encouraging digital payment adoption across all transaction sizes.

These benefits highlight why merchant QR codes have rapidly become a favoured mechanism for transactions in the digital age, offering a blend of convenience, security, and efficiency that traditional payment methods struggle to match. As businesses continue to seek solutions that streamline operations and enhance customer experience, the adoption of merchant QR codes is poised to grow further.

How to Generate Merchant QR Codes?

Generating a merchant QR code is a straightforward process that can significantly enhance the payment experience for your customers. This is how you can create one for your business:

Through a Payment Gateway or Bank:

- Select a Provider: Choose a payment gateway or bank that offers merchant UPI QR code generation services. Most major banks and payment gateways in India support UPI QR codes for merchants.

- Sign Up or Log In: If you’re new to the service, sign up by providing your business details and completing any required verification processes. Existing users can simply log in to their accounts.

- Navigate to QR Code Generation: Look for an option to generate a UPI QR code. This could be labelled differently depending on the provider but is usually found under the merchant services or payment tools section.

- Enter Business Details: You may need to enter specific details about your business, including the name, UPI ID (if already assigned), and transaction limits. Some platforms allow you to customise the look of your QR code with your business logo.

- Generate and Download: Once all necessary details are filled in, generate the QR code. You can then download it for printing or use it on digital platforms.

Directly Through UPI Apps:

- Open Your UPI App: Launch the UPI app you use for business transactions, such as BHIM, Google Pay for Business, or Paytm for Business.

- Find the Merchant Services Section: Look for an option within the app to create a QR code for receiving payments. This might be under a ‘Business Tools’ or ‘Merchant Services’ section.

- Input Transaction Details: Some apps allow you to set a fixed amount for the QR code, which is useful for specific services or products. For a general-use QR code, you can skip this step.

- Customise and Generate: If the app offers customisation options, you can add your business name or logo to the QR code. Then, generate the QR code.

- Display or Share: Print out the QR code for physical transactions or embed it in your online checkout system. You can also share the QR code link through messaging apps or emails for remote payments.

Tips for Effective Use:

- Visibility: Ensure the QR code is prominently displayed at your point of sale or on your website to encourage use.

- Education: Educate your staff and customers about using QR codes for payments to ensure a smooth transaction process.

- Security: Regularly monitor transactions through your merchant account to detect any unusual activity promptly.

By following these steps, you can easily generate a merchant QR code, opening up a convenient and secure payment channel for your customers. As digital payments continue to evolve, leveraging technologies like merchant QR codes can provide a competitive edge, enhancing customer satisfaction and operational efficiency.

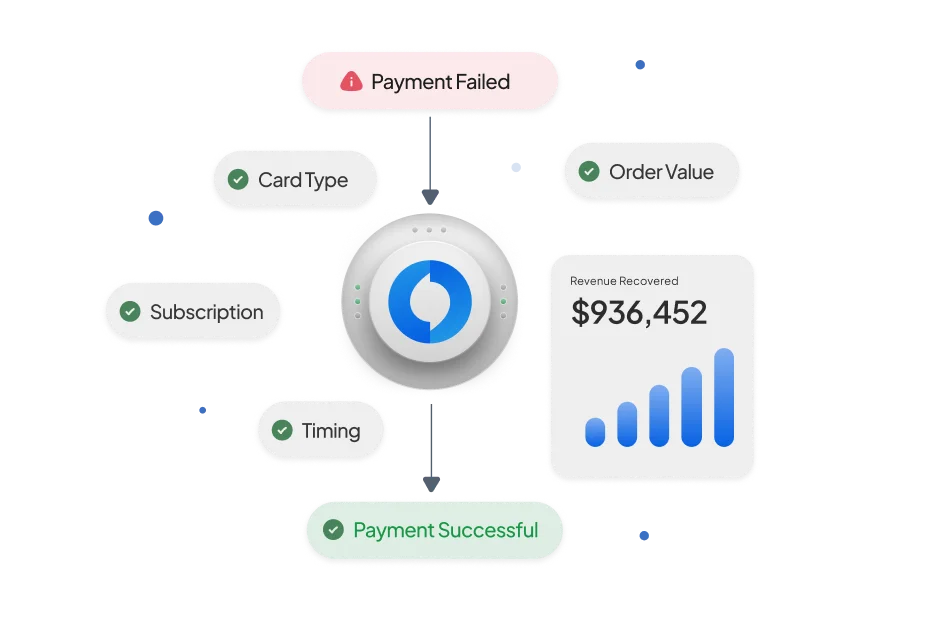

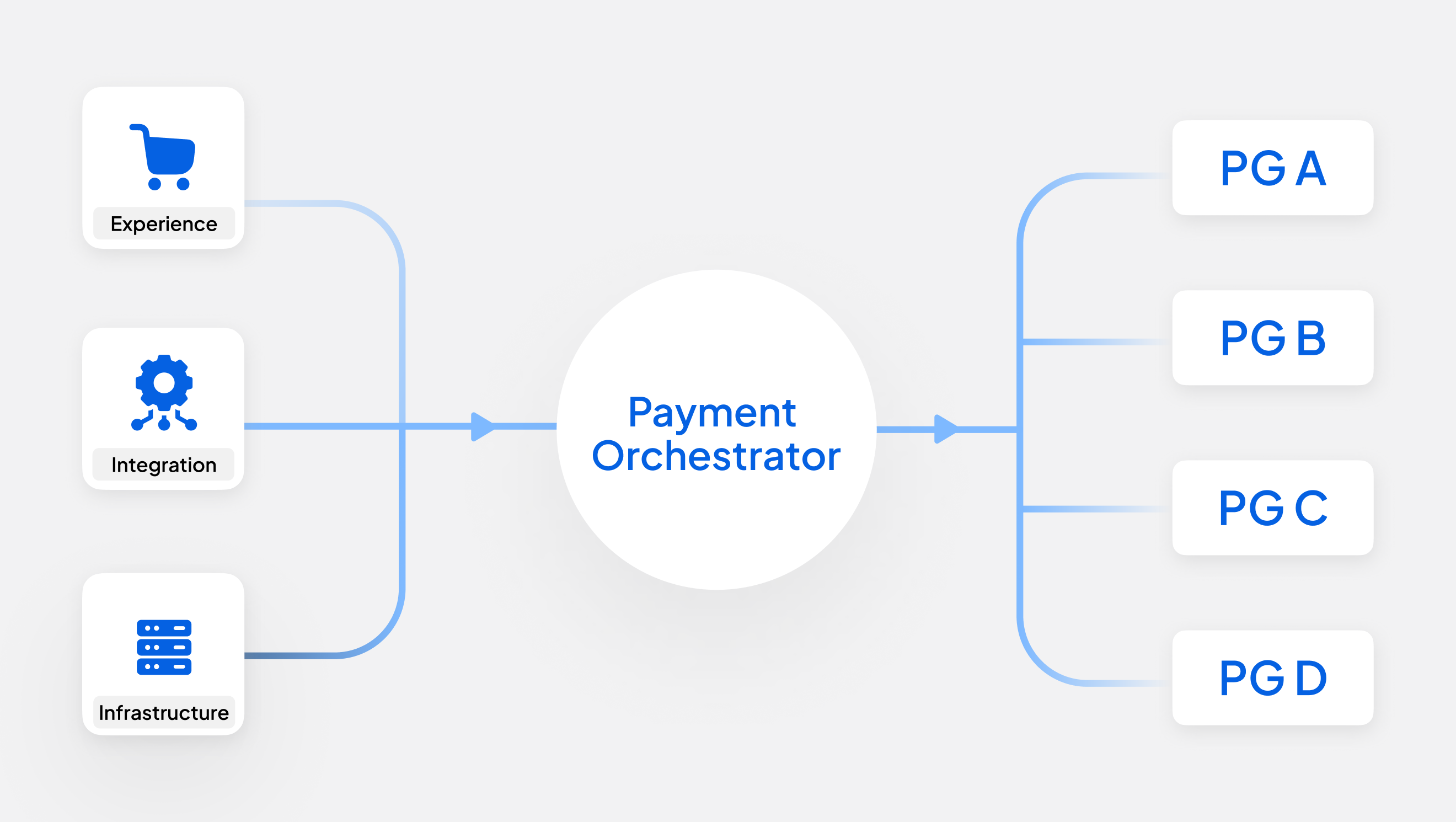

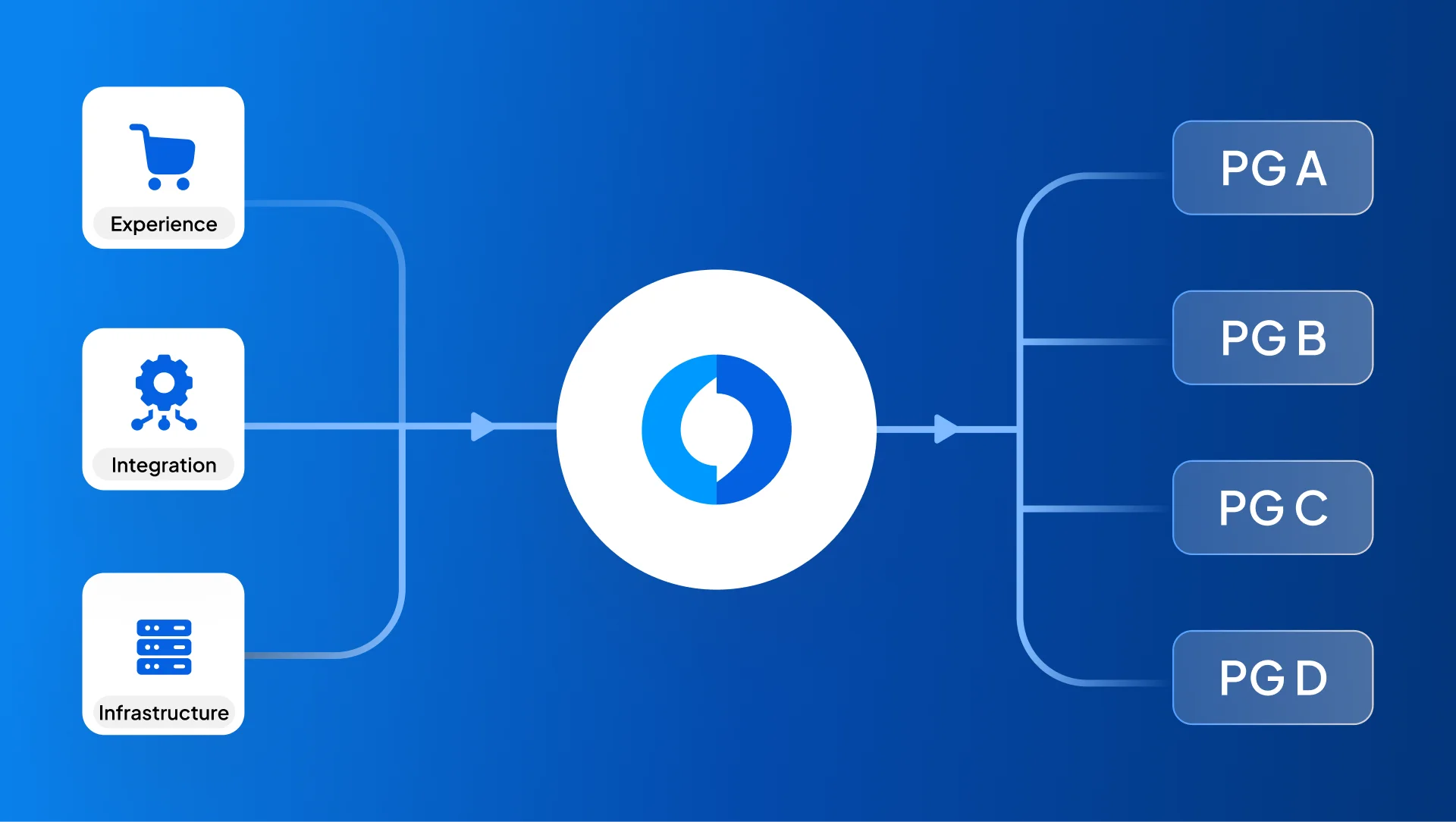

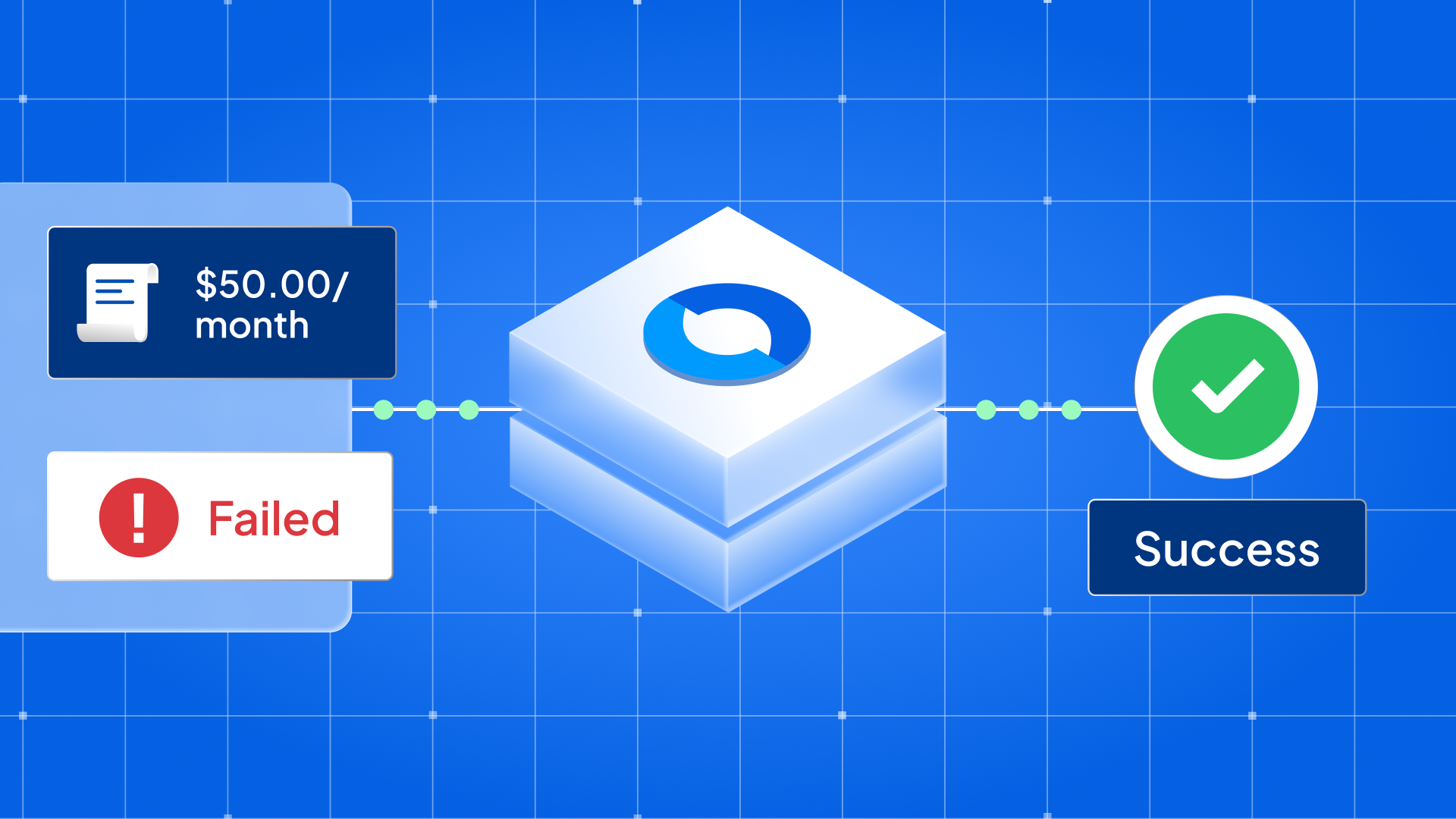

Merchant QR Code Integration with Digital Payment Solutions Like Juspay

Integrating merchant QR codes with digital payment solutions like Juspay can significantly enhance the efficiency and security of transactions for businesses. Here is how such an integration can benefit your operations:

- Seamless Payment Process

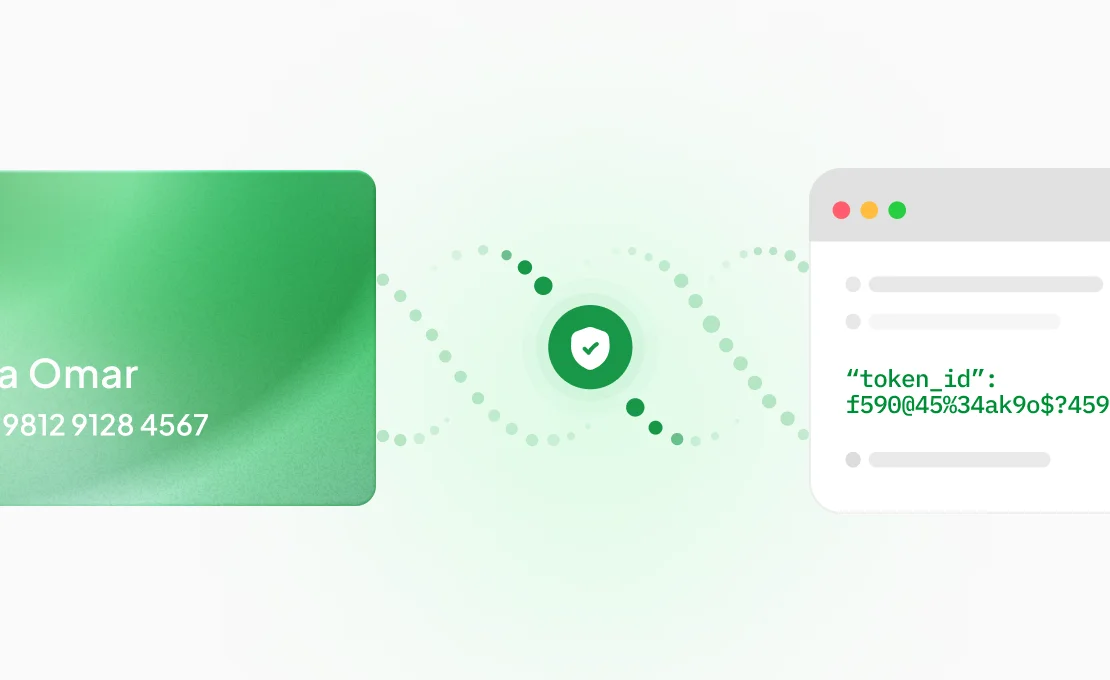

Juspay offers a streamlined process for generating and managing merchant QR codes. By integrating these QR codes, businesses can ensure a frictionless transaction experience, allowing customers to make payments effortlessly. - Enhanced Security Features

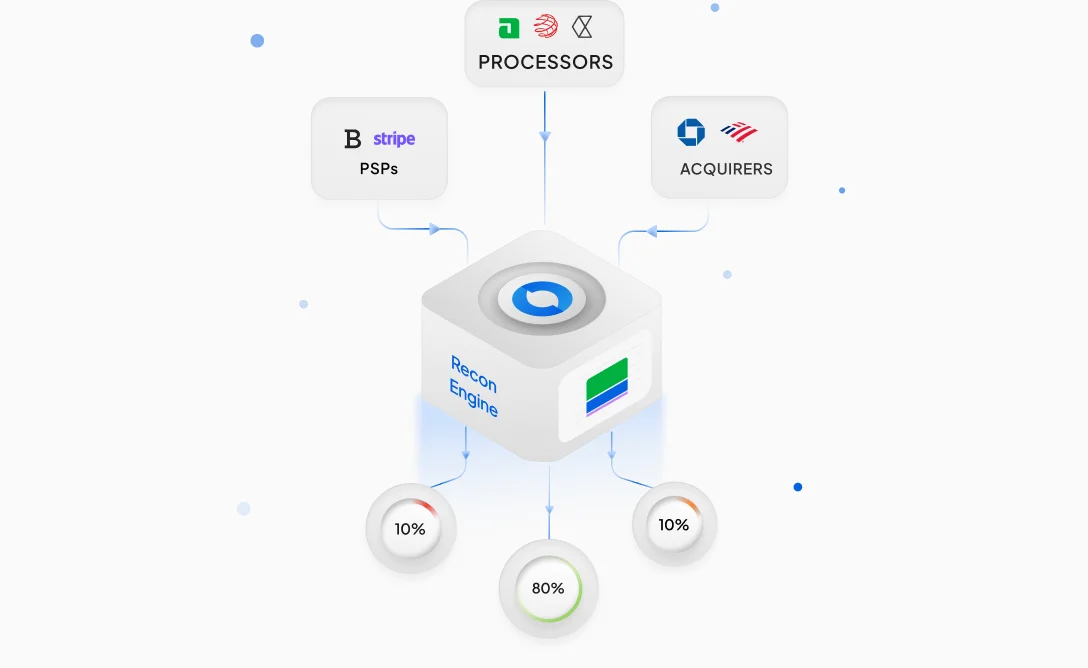

Platforms specialising in digital payments often come with advanced security features. Integrating merchant QR codes through these services ensures that each transaction is encrypted and securely processed, safeguarding both the merchants’ and the customers’ financial information. - Comprehensive Transaction Management

Such integrations allow businesses to access detailed transaction reports and analytics, enabling them to track sales, monitor payment trends, and make informed decisions based on comprehensive data analysis.

Steps for Integration with Juspay:

- Choose a Reputable Digital Payment Provider: Research and select a digital payment solution like Juspay that offers robust support for merchant QR codes and aligns with your business needs.

- Set Up a Merchant Account: Follow the provider’s process to set up a merchant account, which typically involves submitting business details and completing a verification process.

- Generate Merchant QR Codes: Utilise the platform’s tools to generate QR codes specific to your business. These can often be customised with your business logo or other identifiers.

- Implement QR Codes in Your Payment Process: Display the QR codes at your point of sale or integrate them into your online checkout system. Ensure they are clearly visible and accessible to customers.

- Train Your Team: Educate your staff about the new payment system to ensure they can assist customers and manage transactions smoothly.

- Monitor and Analyse Transactions: Use the platform’s dashboard to monitor transactions, check for any issues, and analyse payment data for better financial planning.

Integrating merchant QR codes with a digital payment solution not only simplifies the payment process but also brings technological advancements to your doorstep, ensuring your business stays ahead in the competitive digital landscape. It offers a balance of user-friendliness, security, and data insights that can propel your business growth.

Conclusion

Merchant QR codes represent a leap forward in simplifying digital transactions, offering businesses a secure, efficient, and cost-effective way to accept payments. Their integration with digital payment solutions amplifies these benefits, providing a seamless payment experience bolstered by advanced security and comprehensive transaction management. As the digital economy continues to evolve, leveraging technologies like merchant QR codes will be instrumental in navigating the complexities of digital payments, ensuring businesses remain agile, customer-focused, and secure.

The adoption of merchant QR codes is more than a trend; it is a strategic move towards future-proofing your business in the digital age, ensuring you can meet customer expectations for simplicity and security in transactions.

FAQs About Merchant QR Codes

1. How to Identify Merchant QR Codes?

Merchant QR codes can typically be identified by the distinct logo or name of the payment service displayed on the code itself. They may also include specific merchant information, such as the business name or ID, to ensure the payment is directed to the correct account.

2. How to Make a Merchant QR Code?

To create a merchant QR code:

- Sign up with a UPI payment provider or your bank’s merchant services.

- Navigate to the QR code generation section within their service portal.

- Enter your merchant details as required, including your UPI ID.

- Customise your QR code if the option is available.

- Generate and download the QR code for display at your point of sale or online platform.

3. What is a Merchant ID in UPI?

A merchant ID in UPI is a unique identifier assigned to a business when it registers for UPI payments. This ID helps process payments, track transactions, and ensure that payments are correctly attributed to the merchant’s account.

4. Is There a Fee for Using Merchant QR Codes?

Most UPI transactions, including those via merchant QR codes, do not incur fees for the consumer. However, merchants should check with their payment service provider or bank as certain B2B transactions or high-volume processing may involve nominal charges.