In today’s digital economy, accepting card payments is essential for large and small businesses. Every swipe, tap, or click involves multiple parties: the merchant, the acquiring bank, the card network, and the issuing bank. Behind that seamless transaction lies a trio of separate fee streams each serving a distinct purpose and stakeholder. Understanding these fees empowers you to take control of your payment costs and safeguard profitability.

Among these costs, interchange fees stand out as the most significant in value and scheme fee is often considered as the least transparent. Let's understand each fee in detail.

Interchange Fees: The Issuing Bank’s Share

Interchange fee is the largest component of card processing costs. These are set by card networks such as Visa, Mastercard, and American Express, typically reviewed biannually (April and October). Interchange fee comprises a percentage of the sale plus a fixed component and is paid by the acquiring bank on behalf of the merchant to the issuing bank. These fees compensate for underwriting risk, fraud prevention, and credit handling services. In the U.S., interchange often ranges from 1.3% to 2.9%, varying by card type and region and Europe interchange fee is regulated and capped at 0.3% for consumer cards.

What influences interchange rates?

Several factors influence how interchange fees are calculated:

- Card Type: Premium rewards cards, business or corporate cards generally carry higher interchange fees due to the added benefits and risk exposure.

- Transaction Method: Card-not-present (CNP) transactions such as online or mobile payments often attract higher rates compared to card-present transactions, as they involve more fraud risk.

- Merchant Category Code (MCC): Different industries are assigned specific MCCs, which affect the baseline interchange rate. For example, utility services may benefit from lower rates than luxury retail.

- Transaction Risk Data: Providing additional authentication data, like the Address Verification System (AVS) or Card Verification Value (CVV), can reduce perceived risk and qualify the transaction for a lower interchange rate.

- Geographic Region: Cross-border or international transactions usually incur higher interchange fees due to additional risk and compliance costs.

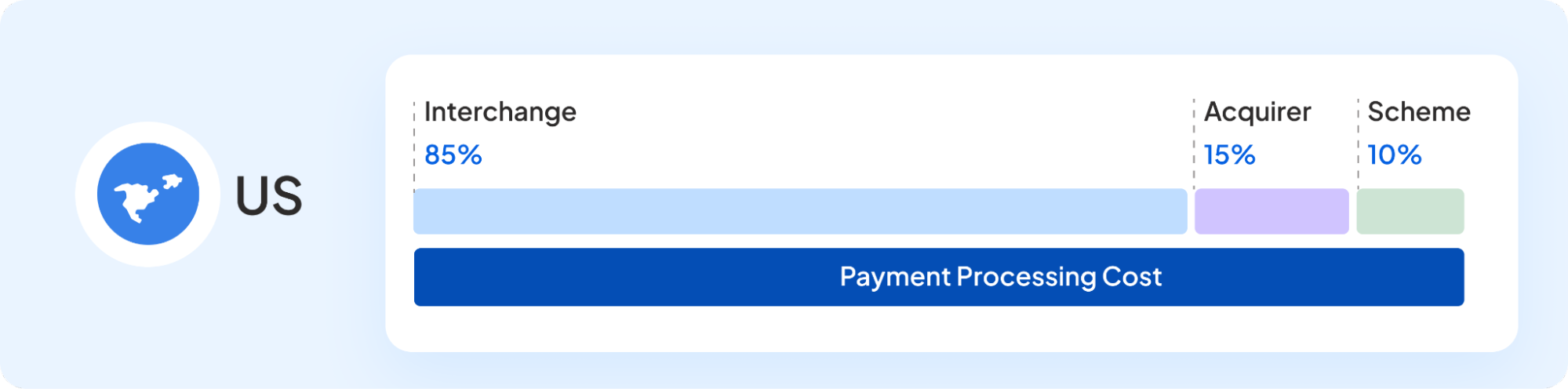

Note: Interchange fees constitute a significant portion (70–90%) of card processing costs in the U.S. Conversely, in the EU, these fees are capped at 0.2% for debit and 0.3% for credit, resulting in network fees accounting for a larger share of overall costs.

Scheme Fees: The Card Network’s Charge

Scheme fees are levied directly by the card networks such as Visa, Mastercard, and American Express to fund the operation of their global infrastructure. These fees support network maintenance, fraud prevention tools, authorization services, and settlement systems. While they typically represent around 0.11 % to 0.15 % of transaction volume, they also include per‑transaction charges and surcharges for cross‑border usage or specialized network services.

Though smaller than interchange fees, scheme fees apply to every card transaction and can quickly accumulate at scale. These fees set by networks like Visa, Mastercard, and American Express are calculated based on multiple factors such as card type, transaction channel, merchant category, region, and processing route.

Why Scheme Fees Are Complex

- Multiple Fee Layers: A single transaction may incur several scheme fees (e.g., authorization, clearing, cross‑border assessment), each triggered by different attributes.

- Cross‑Border Complexity: International transactions often add extra layers, including currency conversion and inter‑regional clearing fees, which vary by corridor and network.

Acquirer Fees: Your Processor’s Markup

Acquirer fee, also known as your processor’s markup, is charged by the acquiring bank or payment processor. These fees cover services such as authorization routing, settlement, risk management, compliance tools, reporting, and merchant support, and is the fee component that is negotiable.While interchange and scheme fees are fixed by networks, the acquirer markup typically falls between 0.20% and 0.50% of the transaction amount.

Why It Matters

- The only negotiable lever: Since you cannot alter interchange and scheme fees, the acquirer markup is the primary control point for reducing your card acceptance costs.

- Significant savings potential: For high-volume or high-ticket merchants, negotiating a modest decrease even from 0.40% to 0.30% can translate into substantial annual savings.

Example: Standard Breakdown for all three fee components

Under a transparent interchange-plus model, a typical $100 transaction might be allocated as follows:

| Fee Component | Typical Rate | Amount |

| Interchange Fee (issuing bank + network) | ~1.80% | $1.80 |

| Scheme Fee (card network assessment) | ~0.14% | $0.14 |

| Acquirer Markup (processor services) | ~0.40% | $0.40 |

| Total Processing Cost | ~2.34% | $2.34 |

This structure aligns with published industry averages, where interchange (~1.8%), scheme (~0.14%), and acquirer markup (~0.40%) combine for a total fee of approximately 2.34%.

Globally, merchants often pay a combined fee total of 2.0% to 3.5% per transaction including all three fee components, depending on region and merchant profile.

While each fee component interchange, scheme, and acquirer markup serves a distinct purpose, they often interact in opaque and inconsistent ways across providers, regions, and transaction types. The lack of standardization, combined with constantly shifting network rules, makes it nearly impossible for merchants to intuitively understand what they are actually paying, let alone pinpoint optimization opportunities. Without a unified view, even experienced teams struggle to make sense of what is negotiable, what is fixed, and what is simply misapplied.

How do you solve this complexity?

Payment fees are inherently complex, shaped by constantly evolving regulatory frameworks, cross-border considerations, and layered security and network requirements. Fee structures vary by card type, geography, transaction context, and processor relationships making them difficult to interpret and even harder to predict.

To stay ahead of this complexity, merchants must ensure clear visibility into all fee components to avoid unnecessary or sudden cost surprises. This requires the ability to break down costs at a transaction level, perform regular audits, and continuously monitor how network rule changes or provider pricing adjustments impact overall spend.

To simplify this process, Juspay offers a Cost Observability tool that ingests merchant statements and processor invoices, automatically unifies payment fee components across providers and regions into a single, intelligent cost dashboard. It performs transaction-level audits on your fee reports and delivers actionable insights on cost inefficiencies and optimization opportunities. Experience Juspay Cost Observability tool demo here.

Frequently Asked Questions

1. How will I know if interchange or scheme fees are updated by the networks?

Card networks typically update fee schedules biannually (April and October). These updates are published on their official websites and communicated to acquiring banks and processors, who then pass the information to merchants often via monthly statements or email notifications.

2. Are cross-border transactions charged differently?

Yes. Cross-border transactions often incur additional scheme fees (e.g., cross-border assessments, currency conversion surcharges) and may face higher interchange rates due to increased fraud and operational risk. These charges can significantly increase total processing costs for international sales.

3. Can I reduce costs by switching card types or encouraging specific payment methods?

Yes, Debit transactions usually carry lower interchange rates than credit cards, and domestic cards may cost less than international ones. Encouraging lower-cost payment types can reduce overall processing expenses without changing processors.

4. Are there hidden or bundled fees I should watch out for?

Yes. Some processors bundle multiple scheme fee components into a single charge, making it difficult to identify individual costs. Reviewing detailed statements or requesting an interchange-plus pricing model can improve transparency.

5. How can I benchmark my total processing cost?

Compare your effective rate (total fees ÷ total sales) to published averages in your region or industry. Effective rates of 2.0–3.0% are typical for many merchants; higher rates may signal room for negotiation or pricing structure changes.