Navigating the complexities of payment processing costs is a critical challenge for any merchant aiming to optimize their bottom line. With different processors offering varying pricing structures, merchants often face the dilemma of choosing a model that aligns best with their business needs. A deep understanding of various pricing models, particularly the nuances between Interchange++ and blended pricing, is paramount. These models significantly impact your overall payment processing expenses, and choosing the right one can lead to substantial savings.

Interchange++ and Blended Models

Interchange++ (or Interchange Plus Plus) and Blended are the most widely used pricing models for card transactions.

Blended pricing represents a straightforward method for calculating transaction fees, characterized by a single, flat rate applied uniformly across all card types involved in a transaction. For example, Stripe charges 2.7% of the total transaction value plus a fixed $0.05 for an in-person payment, irrespective of whether the customer uses a debit card, a standard credit card, or a premium rewards card.[a]

The Interchange++ pricing model offers a clear explanation of transaction fees, providing full transparency into the costs involved, by separating the total fee into three distinct components: actual interchange fee (paid to the card-issuing bank), scheme/network fee (paid to card networks like Visa or Mastercard), and acquirer markup (fee charged by the acquirer).

There is also a third, less transparent model known as tiered pricing that exists. Under this model, the provider classifies your transactions based on type of transaction and card used and determines the tier (Qualified, Mid, Non-Qualified) after the transaction, and classification is non-standardized across acquirers. Some transactions might end up in the highest-fee "Non-Qualified" tier, even if they are low-cost.

Which Model Should You Choose?

Choosing the right payment processing model hinges on understanding the core trade-offs between simplicity, transparency, and your specific business needs. Let's understand each of these in case of both Interchange++ and blended models.

1. Ease of Use and Predictability

Blended pricing offers a simple and predictable fee structure, which is its main benefit. This approach simplifies financial overhead by reducing the number of invoices and reports to manage. It provides consistent monthly fees for low-value payments, eliminating the need for frequent invoice reconciliation. For example, a straightforward 2.7% + $0.05 blended rate ensures a consistent cost, regardless of the card used.

2. Cost Clarity and Room for Optimization

In contrast to Blended pricing, Interchange++ offers complete clarity by detailing every fee as it was charged, namely the - interchange, network, and processing/acquirer fees. This clarity is crucial for businesses as it leaves the room open for them to optimize on their payments and save more.

Understanding the varying interchange rates, especially the difference between consumer and commercial transactions, becomes crucial in optimizing your fees. Interchange++ makes these rates transparent, empowering you to make an informed decision.

- Consumer interchange programs, involving cards used for personal spending, can offer rates as low as 0.05%, particularly for regulated debit or prepaid transactions.

- Commercial transactions, involving cards used for commercial use such as business or government purchases, typically incur significantly higher interchange fees, starting at a substantial 1.8% per transaction.

This clarity is crucial because interchange rates vary significantly, a fact influenced by regulations like the Durbin Amendment in the US which also defines the distinction for regulated debit cards. Merchants can even reduce their commercial interchange costs by providing additional transaction data known as Level 2 and Level 3 data. Its superiority lies in its direct pass-through of costs i.e., the merchant pays the exact interchange and scheme fees charged by the card networks, plus a fixed processor markup thus enabling savings opportunities that are impossible under a blended model.

3. Based on your Business Profile

If you want to look beyond ease and even optimization to choose a model then you need to spend time and analyze your unique business profile, considering factors like your average transaction value and typical card types. Let's explore how these elements guide your optimal choice.

When is Blended Pricing the Better Choice?

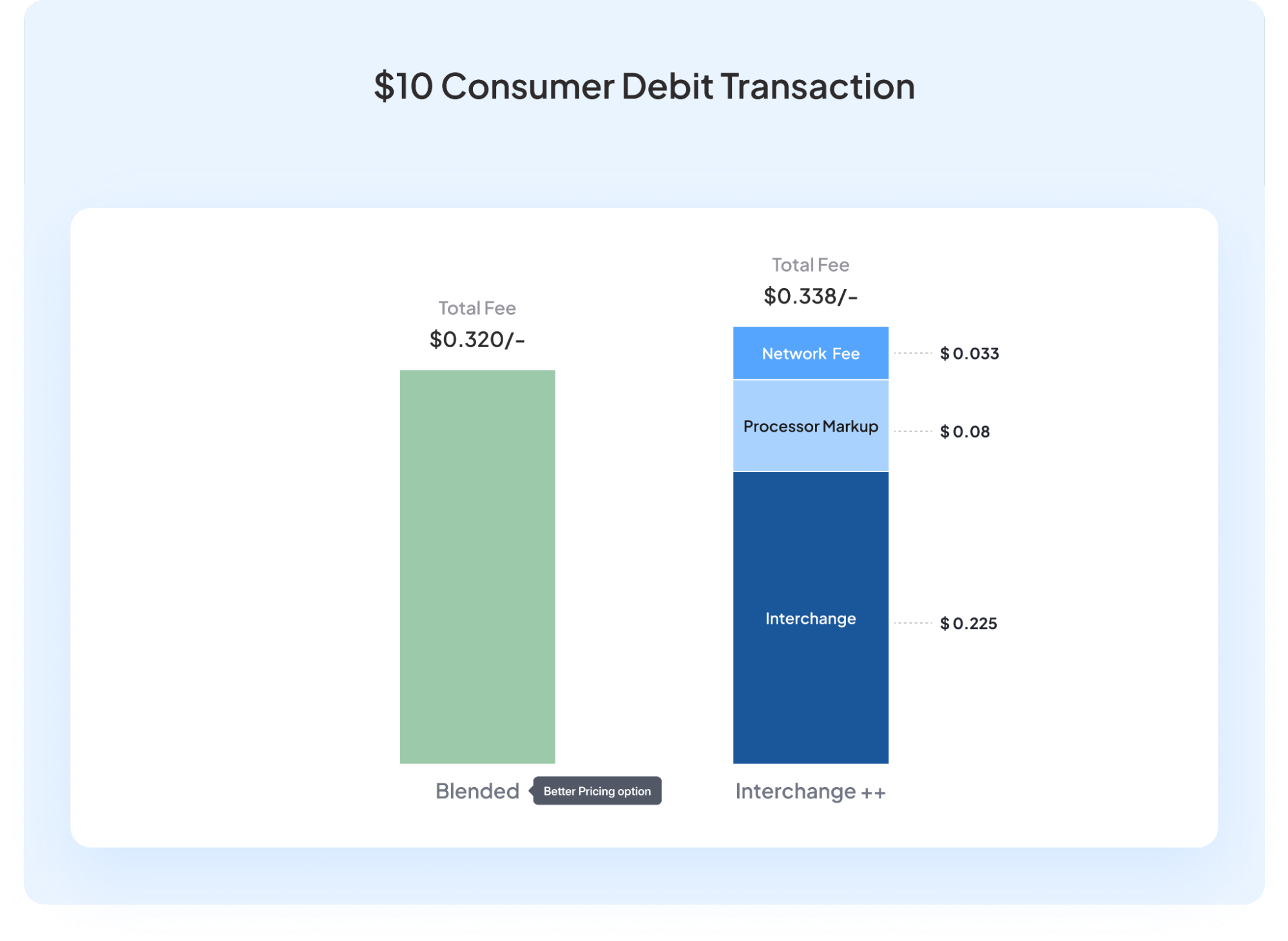

Blended pricing is most effective for businesses with small ticket sizes, typically under $20, and a high concentration (over 90%) of consumer debit and credit card transactions. Although the percentage rate of an IC++ plan may appear low, the fixed fee component of interchange plus plus pricing can significantly inflate the cost of small sales, leading to increased overall fees as transaction volume rises. The examples below further illustrate this point.

- For instance, consider a $10 transaction on a consumer debit card. Under a 2.7% + $0.05 blended rate, the cost is $0.32. In contrast, a typical IC++ cost combining the Interchange fee (0.05% + $0.22), Network fee (0.13% + $0.02), and Processor markup (0.30% + $0.05) totals $0.338, making the blended option cheaper.

- Similarly, a $15 transaction on a consumer credit card, the blended cost at the same rate is $0.455, whereas the detailed IC++ cost would be higher at approximately $0.461, again making blended pricing the more economical choice.

When do you need to consider IC++ pricing?

The IC++ model offers advantages for businesses handling large average transaction amounts or numerous payments from corporate or government cards, in addition to standard consumer transactions. While blended pricing applies the same fee for any type of commercial cards with a single higher fee, IC++ allows opportunities for cost savings when merchants pass additional information (L2 & L3 data) for the transaction, thereby avoiding downgrades or penalties. The following examples illustrate how providing correct information can lead to lower overall costs with IC++ compared to blended:

- On a $200 transaction with a majority of commercial cards, a 2.7% + $0.05 blended rate would cost $5.45. However, the weighted cost under an IC++ model would be closer to $4.65, saving the merchant $0.80.

- Similarly for a $500 payment made with a commercial card where Level 3 data is provided, the blended cost is $13.55. With IC++, submitting this data qualifies for a lower Interchange rate, and the total cost drops to $11.37. This represents a significant saving of over $2, an optimization completely obscured by a blended plan.

Conclusion

When choosing between Interchange++ and blended pricing models, there's no one-size-fits-all solution. Your decision should be guided by your overhead costs, business profile, transaction volume, and card mix. Consumer-heavy or small businesses might benefit from the simplicity of blended pricing, while commercial businesses stand to gain significant savings with Interchange++.

Ultimately, transparency in payment processing costs enables better financial decision-making. We recommend regularly reviewing your card mix and processing fees to ensure your chosen model continues to align with your business needs as you scale.

If you are already on IC++ , explore your card mix and fee breakdown with the Juspay Cost Observability tool to assess if you can optimize your payment processing costs. Check our demo here.

Frequently Asked Questions

1. What is Level 2 and Level 3 data?

Level 2 and Level 3 data refer to additional transaction information that can be provided during commercial card processing:

- Level 2 data includes tax amount, customer code, and merchant postal code

- Level 3 data includes line-item details like product codes, quantities, unit prices, shipping information, and more Providing this data can qualify transactions for lower interchange rates on business and government cards.

2. What is the Durbin Amendment?

The Durbin Amendment is a provision of the Dodd-Frank Wall Street Reform and Consumer Protection Act that limits interchange fees charged on debit card transactions. It applies to financial institutions with over $10 billion in assets, creating what's known as "regulated debit" with significantly lower interchange rates.

3. What causes interchange downgrades?

Interchange downgrades occur when transactions don't qualify for the best available interchange rates, resulting in higher fees. Common causes include:

- Not processing transactions within 24 hours

- Missing or incorrect data (especially for commercial cards)

- Not using Address Verification Service (AVS)

- Not meeting security requirements

- Manual entry instead of card present transactions