In an increasingly interconnected global economy, understanding the various payment methods and choosing the right one has become critical. Different types of payment methods affect the economy in distinct ways. They affect the cash flow between financial institutions, financial reporting of businesses, customer satisfaction for eCommerce businesses, and much more. In this guide, we will explore the significance of these payment methods and how they can benefit your business.

What Are Payment Methods?

Understanding Payment Methods

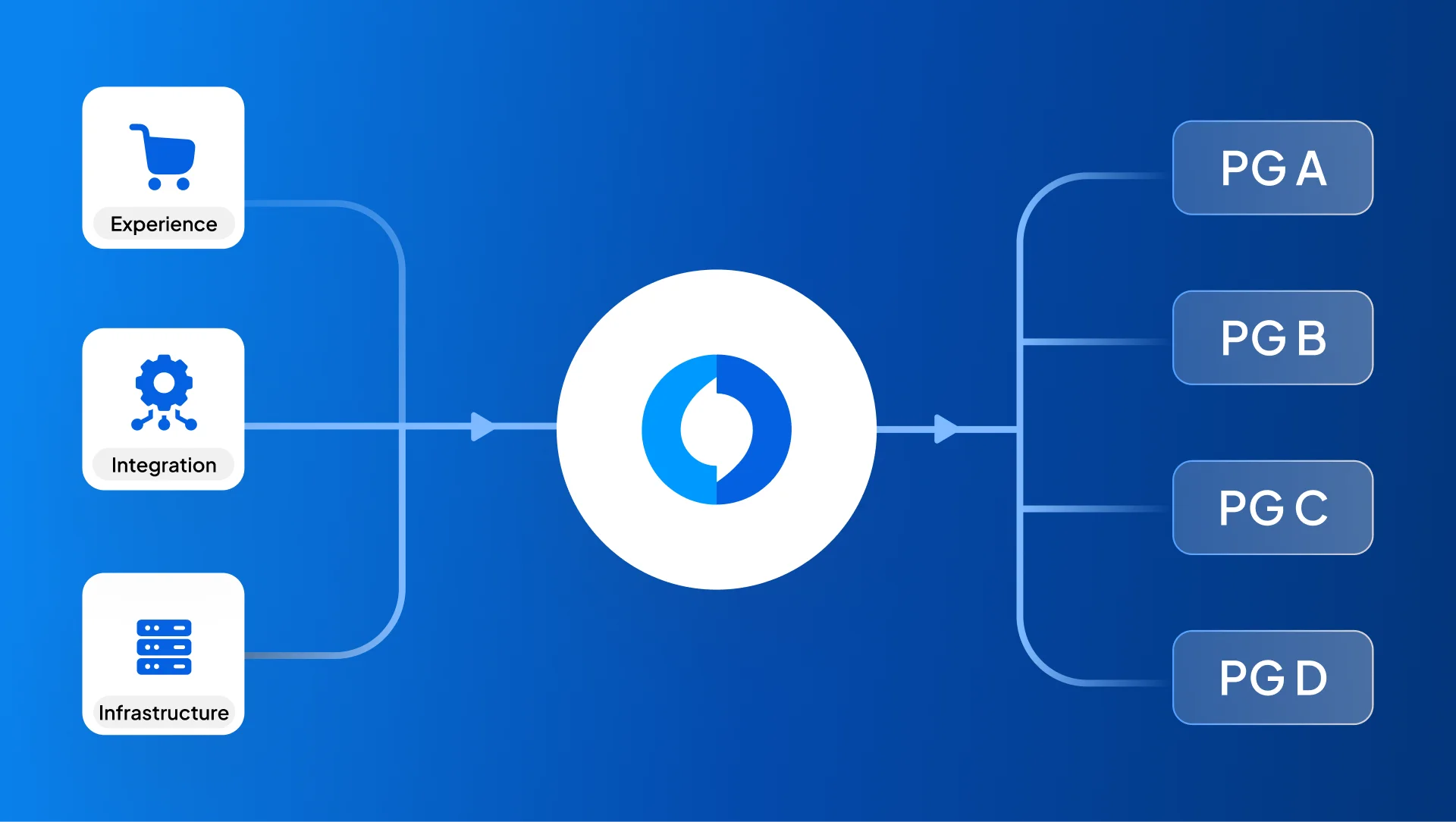

In essence, payment methods are the transaction options provided by merchants to their customers while conducting a sale of any kind, whether in a physical establishment or online. They serve as a bridge through which two or more entities can interact via financial transactions.

Why Payment Methods Matter for Businesses

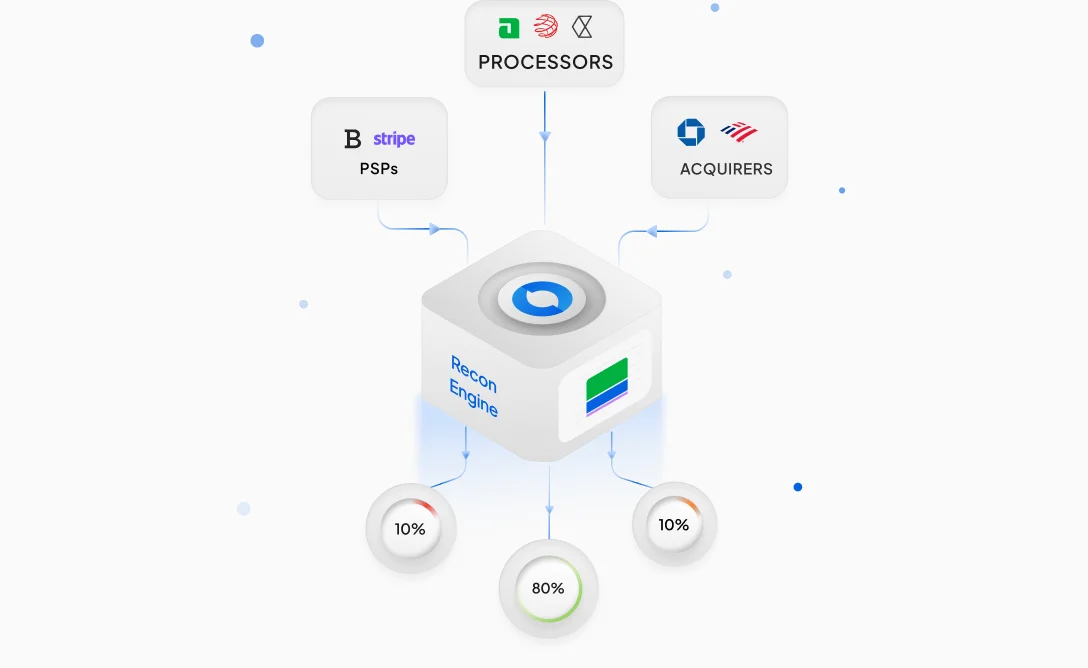

Payment methods act as a channel for businesses to conduct transactions with customers. They play a crucial role in the overall functioning of a business, influencing critical operations like financial reporting, cash flow management, and financial strategies.

Each type of payment method exhibits a unique process and impacts business operations in its own way. Gaining a proper understanding of payment methods and how their processes function is a key element for businesses to make informed decisions that align with their financial goals.

Types of Payment Methods

1. Cash Payments

Physical currency is exchanged between customers and businesses to conduct a purchase of goods or services.

2. Credit and Debit Cards

Cards that are linked to a bank account or a credit account at a bank are used by a customer to conduct a purchase or transfer funds.

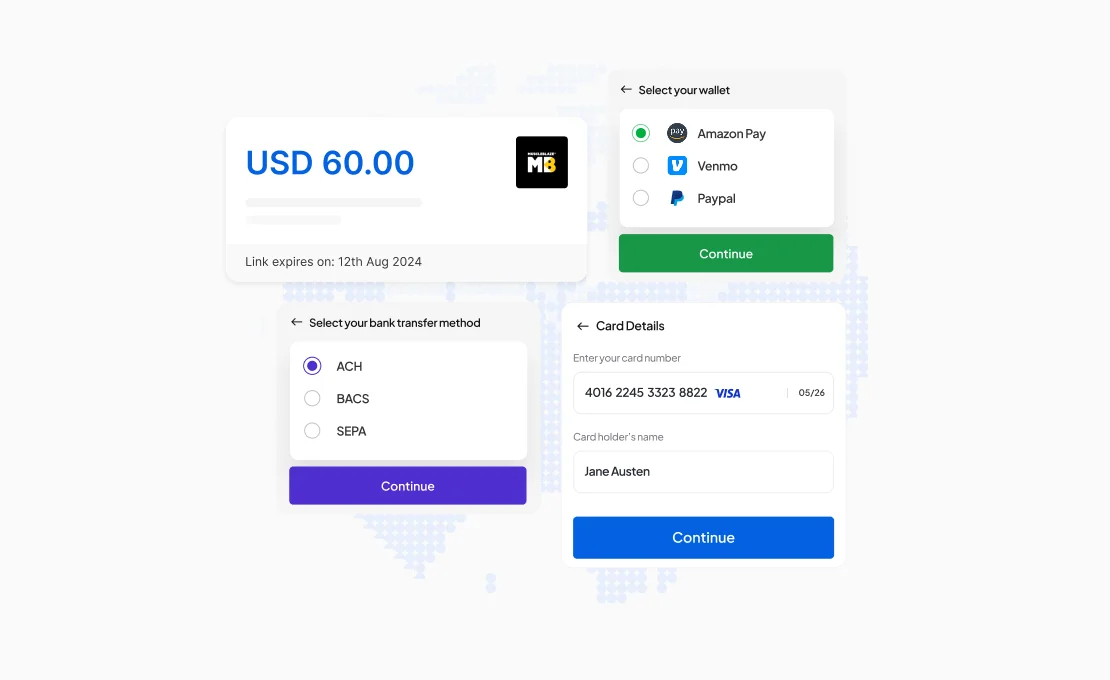

3. Online Payment Methods

- Bank Transfers - An electronic transfer between two bank accounts.

- Mobile Wallets - Mobile applications that facilitate direct fund transfer by storing payment information of the user for electronic transactions.

- UPI - Unified Payments Interface (UPI) is a real-time payment system that connects the bank accounts of a user to a UPI-enabled payments app, enabling secure digital transactions.

- Buy Now, Pay Later (BNPL) - Issuing banks enable customers to make purchases by deferring payments and paying them back through an instalment plan.

4. Contactless Payment Methods

- NFC Payments - Near Field Communication (NFC) payments use short-range secure wireless technology machines to allow secure transactions.

- QR Code Payments - A QR code generates payment information that is scanned by the customer from their payments app to initiate a transaction.

Choosing the Right Payment Method for Your Business

Understanding Your Target Audience

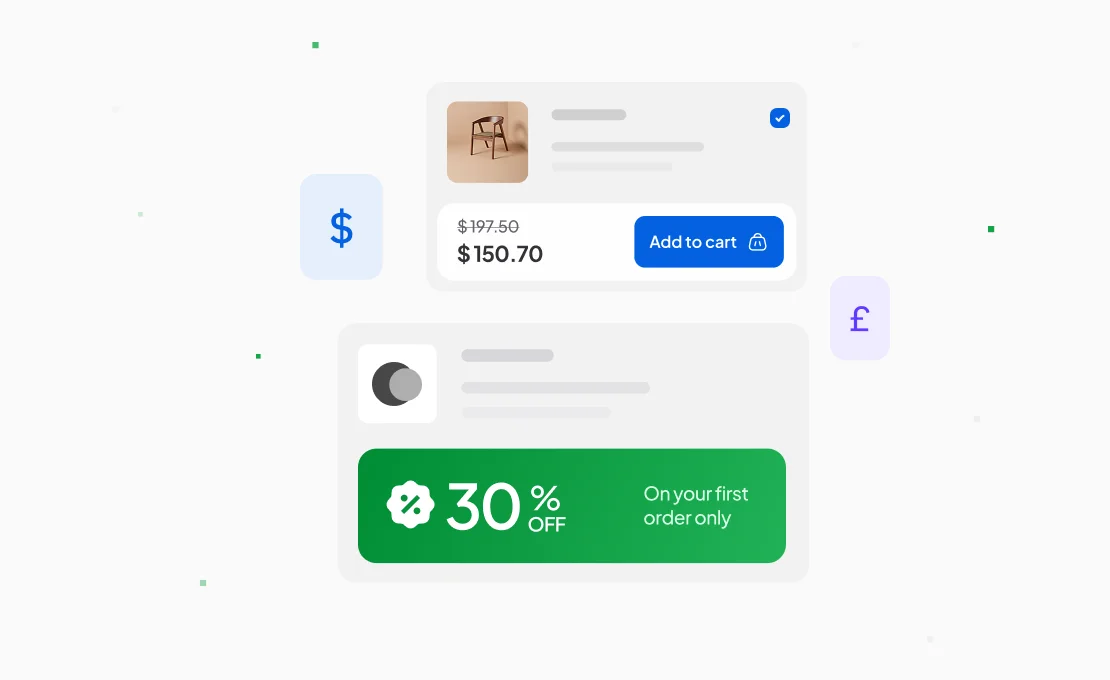

It is critical for businesses to understand their customers’ preferences, especially regarding payment methods. This can significantly help increase sales for businesses, as it enables customers to access convenient payment and reduces their efforts for a seamless customer experience.

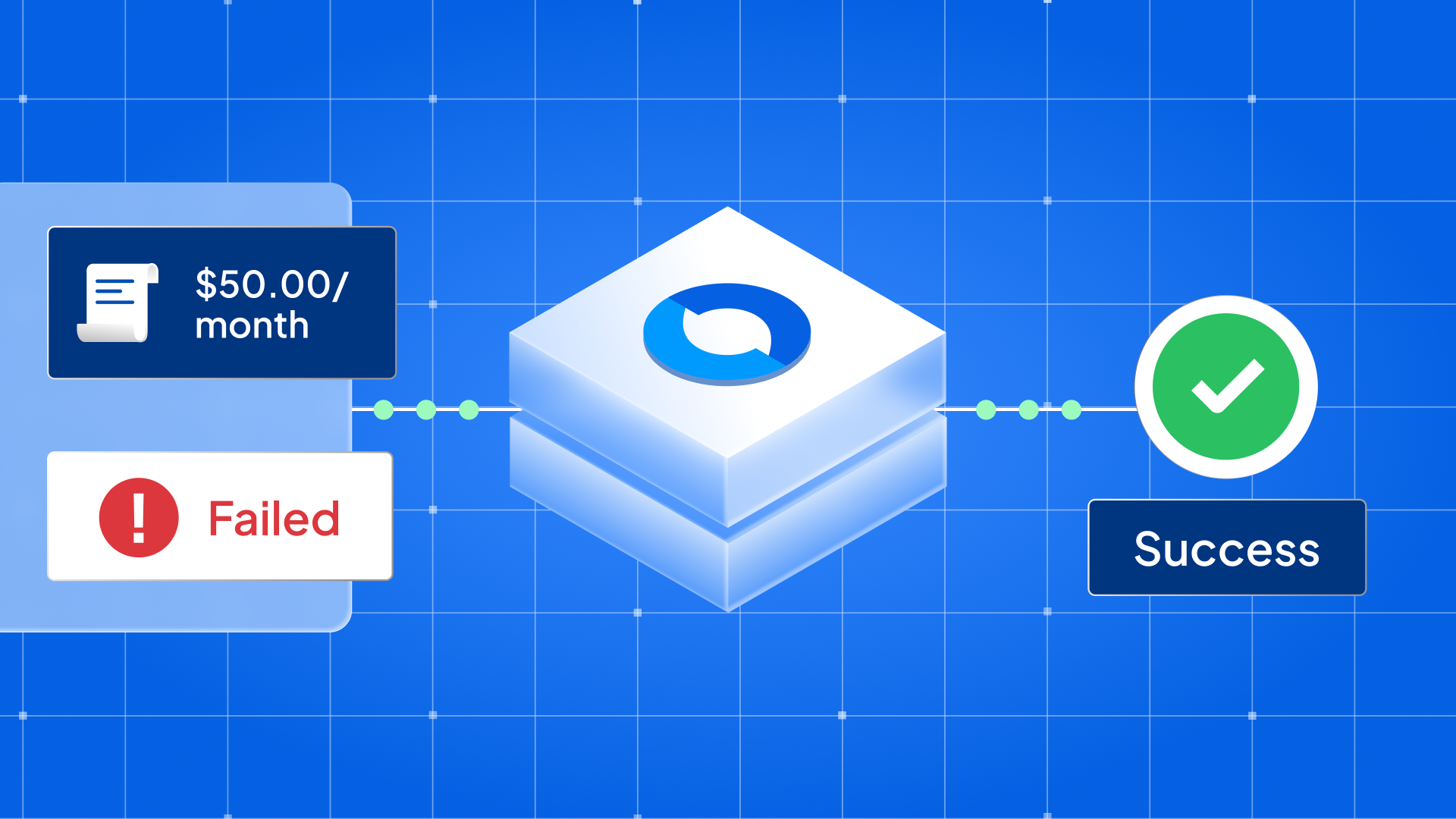

Evaluating Transaction Fees

For each type of payment method, you must determine its purpose for your business. This means examining the typical volume or size of transactions that your business conducts or receives. This will help you evaluate the costs incurred for these transactions and help you optimise your financial strategy. Transaction fees, VATs, processing fees, or any additional charges will help you align your financial goals with your budget dedicated to payment processing.

Security Considerations

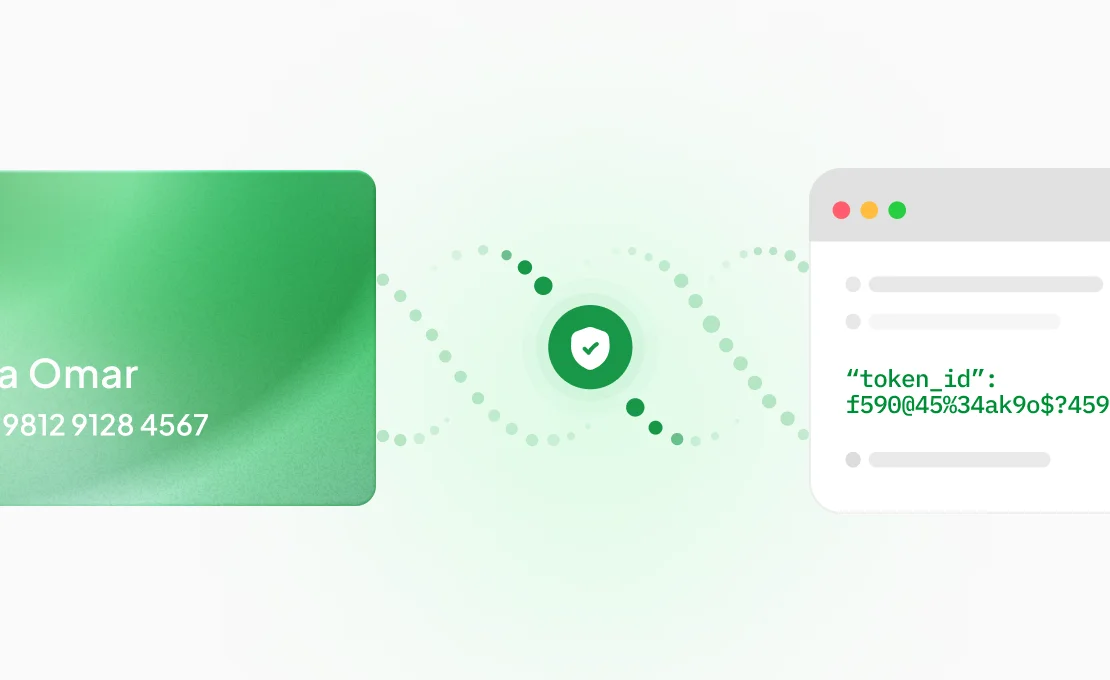

The most important consideration for any business is protecting their own and their customers’ data. Choose payment methods and processing solutions that offer high-end security infrastructure and features. This can include multi-factor authentication, data encryption, etc. Protecting your business and its customers against any potential threats is necessary to build and maintain customer trust.

Advantages of Offering Multiple Payment Methods

Increased Customer Satisfaction

Enabling convenience for customers by giving them the freedom to pick their preferred payment mode improves customer satisfaction. Even if it took a while for the customer to find the product or service they were looking for on your website, the overall satisfaction is highly dependent on how fast and convenient the checkout process is.

Better Conversion and Reduced Abandonment Rates

A recent research on cart abandonment rates has highlighted some interesting insights. For instance, almost 18% of users do not trust eCommerce stores with their personal credit card information. Additionally, a complicated payment process during the checkout deters 17% of customers. And 9% of customers abandon their cart if their preferred payment method is unavailable. Offering multiple payment methods can help reduce these rates and boost conversion.

The Future of Payment Methods

The world has shifted significantly towards digital payments since the last decade, and it now accounts for a big chunk of overall global payments. With newer technologies and innovations, these payment methods will further evolve and improve to offer consumers more convenience and security.

Already, newcomers like cryptocurrency and blockchain technologies have gained traction as payment methods. Virtual currencies like Bitcoin and Ethereum implement cryptography for anonymity and are becoming quite a popular mode of payment. However, with newer governmental regulations and the volatility of the market, these payment methods still have some way to go before becoming mainstream.

Listen to Your Customers

Gaining a comprehensive understanding of different payment methods, how they function, and what kind of fees they cost your business is crucial in building a rigid financial strategy for your business. Analyse your customers’ needs and preferences, and choose a trusted payment solution that incorporates multiple payment methods and high-level security for improving your sales.