Undeterred by physical access to a bank, slow transfers, or unavailability of card details, payments have taken the shape of secure, instant, and convenient experiences with digital wallets. So much so, that nearly half the global transactions in 2024 were made using digital wallets, making it the most popular payment method, with credit card transactions coming in second. The rise of UPI in India, Pix in Brazil, along with the popularity of Google Pay and Apple Pay, all point in the same direction, that digital wallets are the key to payment experiences that are quick, accessible, and secure for everyone.

What is a digital wallet?

A digital wallet is a software that stores payment information like credit and debit cards or bank account details on mobile phones, laptops, tablets, or wearable devices and are used to make payments online and offline without requiring access to a physical card or entering payment details each time. However, convenience isn’t the only reason why digital wallets are a majorly preferred payment method. It is ultimately the security of digital wallet payments that make them so widely accepted.

How are digital wallets made secure?

Digital wallets protect data with multiple levels of security. These include tokenization, encryption, and biometric authentication to enable the convenience of payments that make digital wallets so popular. With credit and debit cards enabling digital wallets, keeping sensitive information secure during transactions is a necessity. Digital wallet tokenization is the foundation on which digital payments are made remarkably safer.

How does digital wallet tokenization work?

A stolen credit card contains all information - including the user's name, PAN, security code, and expiration date - that a fraudster can misuse. When saved online, digital threats like malware and phishing can have the same effect if the card information is vulnerable. To prevent any exploitation of the sensitive information that can be mishandled and used to defraud users, digital wallet tokenization eliminates the access to the actual wallet details and replaces it with a token.

A token is a unique, randomly generated, device-specific code that becomes representative of the card details, and ensures that card information is never exposed throughout the transaction. This token replaces the actual card number (PAN) with a code when it is added to a digital wallet. The wallet then sends a request to the card network to generate the token that becomes the new identity of your card, and is saved to your device for any transactions that will be made through the wallet.

During data transfer, the communication between the wallet and card network, along with the token is encrypted to prevent any data exposure. In the final leg of the transaction, biometric authentication allows for the payment to be made only by the user of the device, adding another layer of security to a tokenized digital wallet.

What is the difference between card tokenization and digital wallet tokenization?

While payment tokenization is the common factor, and it works toward the same goal of enhancing the security and convenience of digital payments, it functions differently when it comes to cards and digital wallets.

| Card Tokenization | Digital Wallet Tokenization | |

| Type | Merchant or network level token | Device-specific token |

| Usage | Recurring transactions, subscriptions, e-commerce platforms. | Contactless transactions on a particular device. |

| Storage | Token stored by the payment processor | Token stored on the device |

| Benefits | Eliminates vulnerable data from merchant systems | Includes an encryption and biometric layer |

Benefits of digital wallet tokenization

1. Enhanced security

Digital wallet tokenization reduces the exploitation of any sensitive data by replacing it with a token as it passes through merchant systems. This means even if a data breach is attempted, the fraudster will find the token that cannot be associated with any actual card details. While the card data is not accessible to a fraudulent party, it also remains invisible to the merchant. So another avenue of potential risk is also mitigated by the token replacing the actual data. This can help reduce losses and fraudulent chargebacks, protecting both banks and businesses.

2. Device-specific protection

With digital wallets, the token is only generated for one device like a phone or smartwatch. This prevents the token, if accessed, to be used on any device other than the one it's intended to be used on. In case the device is lost or compromised, the token can be cancelled remotely, without requiring the card to be cancelled. Keeping the digital wallet token restricted to a device minimizes the impact of risk on a user’s payment system, including their bank accounts or other payment methods.

3. Contactless, faster payments

A digital wallet eliminates the need for card details for each transaction. Once the details are saved securely through tokenization, the user can use biometric authentication to complete a transaction, making payments faster than ever. Even in case of changes in card details, a new token is re-issued on the backend without requiring the user to update the card details manually.

4. Inclusive payment experience

For unbanked populations, access to secure payment systems can become limited or restrictive. Digital wallet tokenization enables them to use alternative payment options by allowing device-based payments without the need for a physical card. The tokenization principle remains the same without a card, where any sensitive information like a prepaid account or mobile money details are replaced and safeguarded by a token. This helps include a larger number of people into the secure payment landscape.

5. Global acceptance

Digital wallet tokenization is supported by major card networks like Visa, Mastercard, American Express and others. This makes it easier for consumers to make payments anywhere in the world, as well as helping businesses utilize it to offer consistent payment experiences to their consumers when expanding across geographies.

6. Enhanced consumer experience

Consumers get a range of benefits in one place, seamlessly, with digital wallet tokenization. With one click payments combined with easy authentication, automatic card updates, and the security of tokens, trust is safe digital payments is likely to be strengthened with consumers leaning toward using them more and more in the near future.

Juspay’s Tokenization Suite

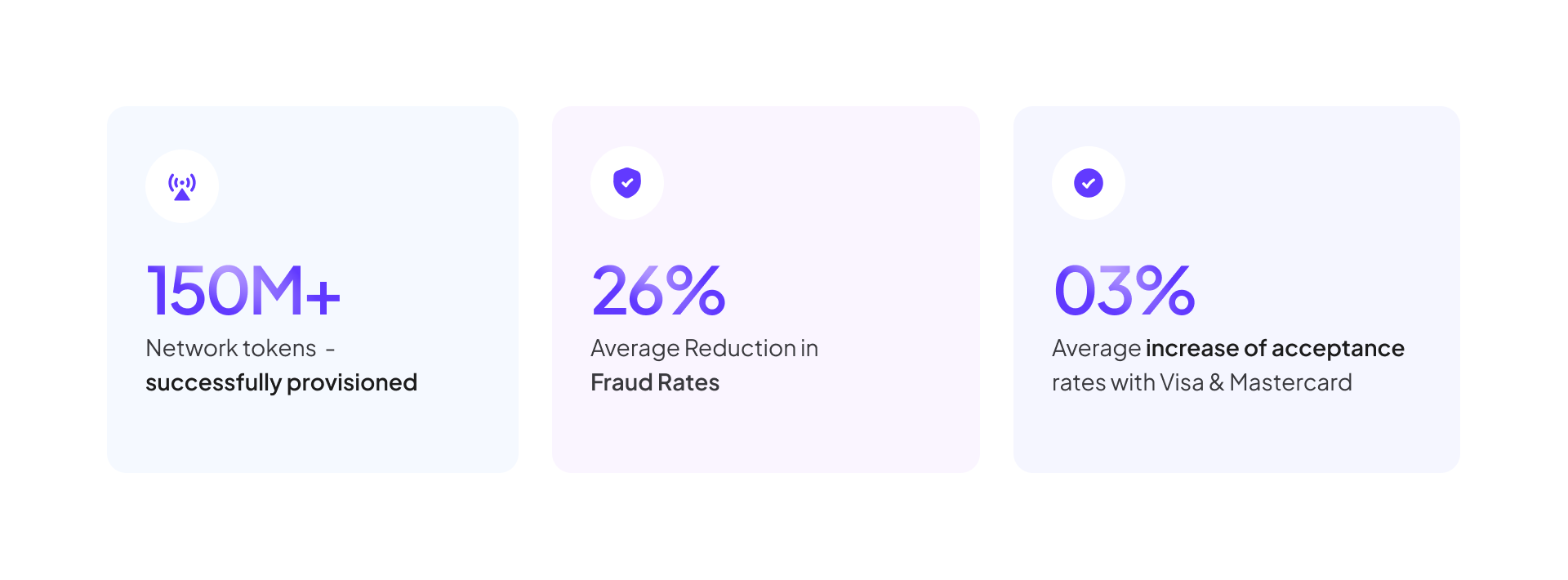

Juspay is a certified token requestor and service provider, integrated with all major card networks—including Visa, Mastercard, and Amex—to offer seamless tokenization for merchants. Our tokenization suite manages the entire token lifecycle, and to date, we’ve issued over 150 million network tokens worldwide.

Conclusion

The use of digital wallet payments is expected to grow at an 18.1% CAGR between 2024 to 2030 worldwide. At this rate, security is at the forefront of enabling digital wallets to protect users and businesses against fraud, making payments seamless and accessible across regions and currencies. While it is increasingly apparent that digital wallet tokenization is the benchmark of digital payment security, it is expected to play a greater role in emerging markets to make inclusive financial services. With its many benefits and implications, digital wallet tokenization is an enabler of secure, accessible payments across the globe.