Introduction: How Forward-Thinking Banks Can Lead in Merchant Acquiring

In an era of changing customer expectations, evolving competitor dynamics, and ever-more data for deriving strategic insights, merchant acquiring has re-emerged as a core growth and retention engine for tech-enabled banks. Banks hold natural advantages: deep customer relationships, regulatory strength, and the ability to offer integrated financial services. However, many still rely on legacy stacks built piecemeal over time, inhibited by siloed vendor contracts and brittle integrations. While functional, these systems lack the agility and visibility needed for omnichannel commerce, rapid integration, and programmable infrastructure.

To win enterprise clients and serve fast-growing digital businesses, banks must evolve beyond basic transaction processing. Forward-looking banks are now looking to deliver solution sets that are as modular and responsive as the fintechs they once considered niche. The goal is no longer just to support transactions, but use modern stacks to orchestrate payment flows, embed intelligence at every step, and unlock new monetization models through flexibility and scale.

This guide outlines the key components of a modern acquiring stack, reflecting capabilities proven at scale by leading global acquiring banks using Juspay’s Global Payment Acceptance Platform. The focus is on principles: what to build, why it matters, and how to do it right.

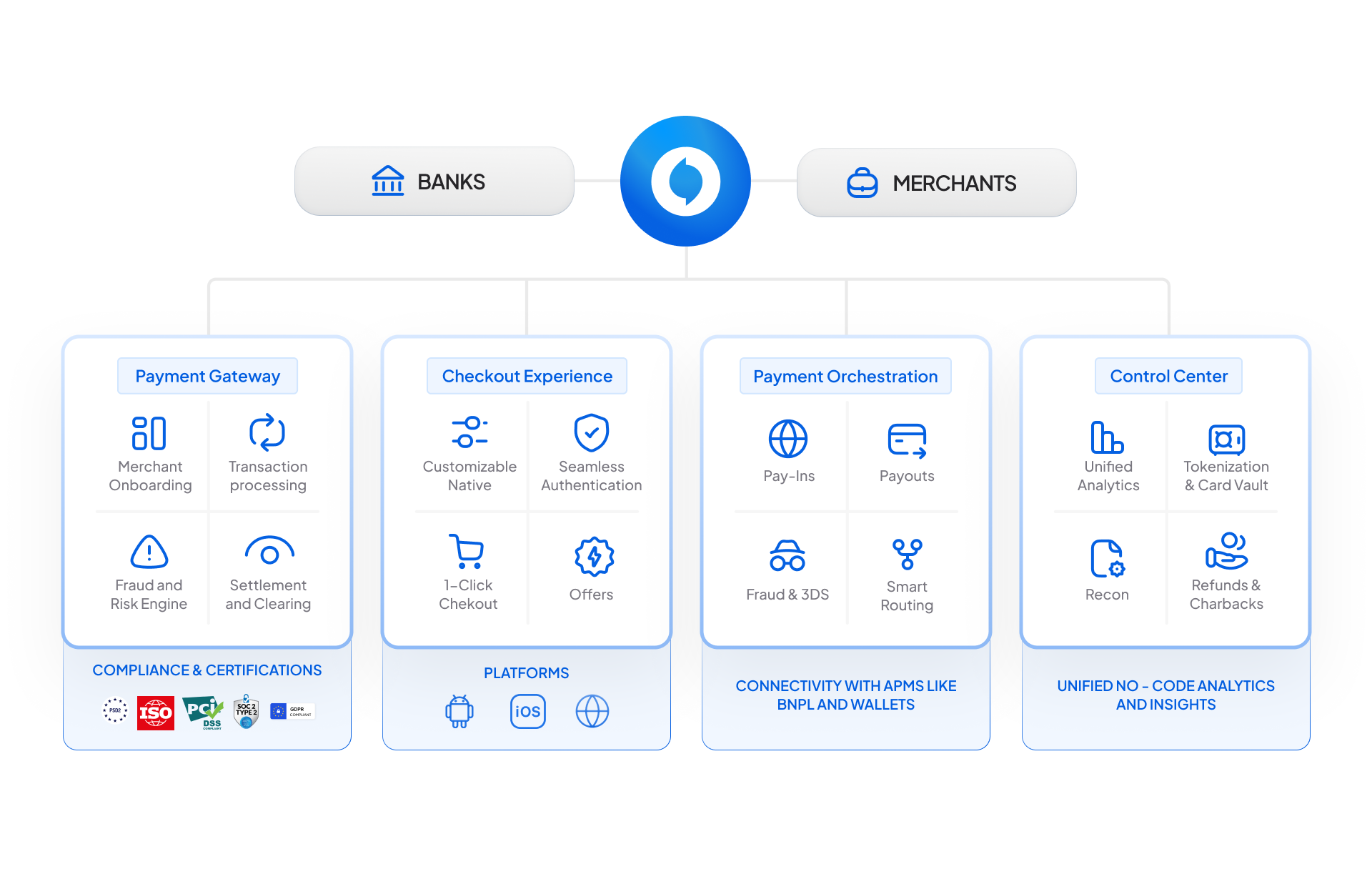

The Architecture Shift: From Gateways to Full Platforms

Modern acquiring requires a rethink of traditional architecture. Banks need to consolidate the value chain— from checkout, routing, authorization, fraud, and dispute to reconciliation—into a unified, interoperable platform. This means shifting from siloed gateways to programmable, API-first cores that enable rapid change without disrupting compliance or operations and remain consistent across interfaces, whether a transaction begins on a website, mobile app, or physical POS.

In practice, this enables banks using modern platforms to launch new capabilities such as cross-border payouts or token-based routing within weeks, not quarters.

Built for Scale: Why Cloud-Native Infrastructure Matters

Merchant acquiring has become a volume game. Successful platforms today must handle tens of thousands of transactions per second with near-zero latency. For instance, systems designed with stateless microservices and horizontal scalability have enabled some banks to sustain 20,000+ TPS during regional sales events without performance degradation or customer impact. Moreover, cloud-native monitoring frameworks now provide visibility not just into uptime, but into transaction-level latency, fraud patterns, and retry logic outcomes.

This depth of telemetry is foundational to optimizing success rates, controlling costs, and managing financial risk. Global banks powered by Juspay have been able to seamlessly manage transactions at scale and are better positioned to move into adjacent services like embedded finance or instant credit.

Omnichannel Enablement: One Stack, All Channels

Modern commerce is boundaryless and borderless. Consumers might start a transaction online and complete it in-store. Merchants expect their payment partner to accommodate this fluidity, with token continuity, uniform reconciliation, and cross-channel analytics.

Leading banks are responding by building unified orchestration layers that span both eCommerce and in-person payments - as well as emerging agent-assisted flows. A shared infrastructure is key to handling Card Present and Card Not Present transactions, authentication, tokenization, routing, and ledgering.

Juspay’s work with leading banks has shown how a single token vault and orchestration layer can drive use cases from 1-click checkouts to installments, from in person payments to invoice payments, across geographies. In effect, this allows banks to consolidate merchant relationships under one acquiring agreement, one reporting interface, and one source of truth—simplifying operations while improving merchant experience.

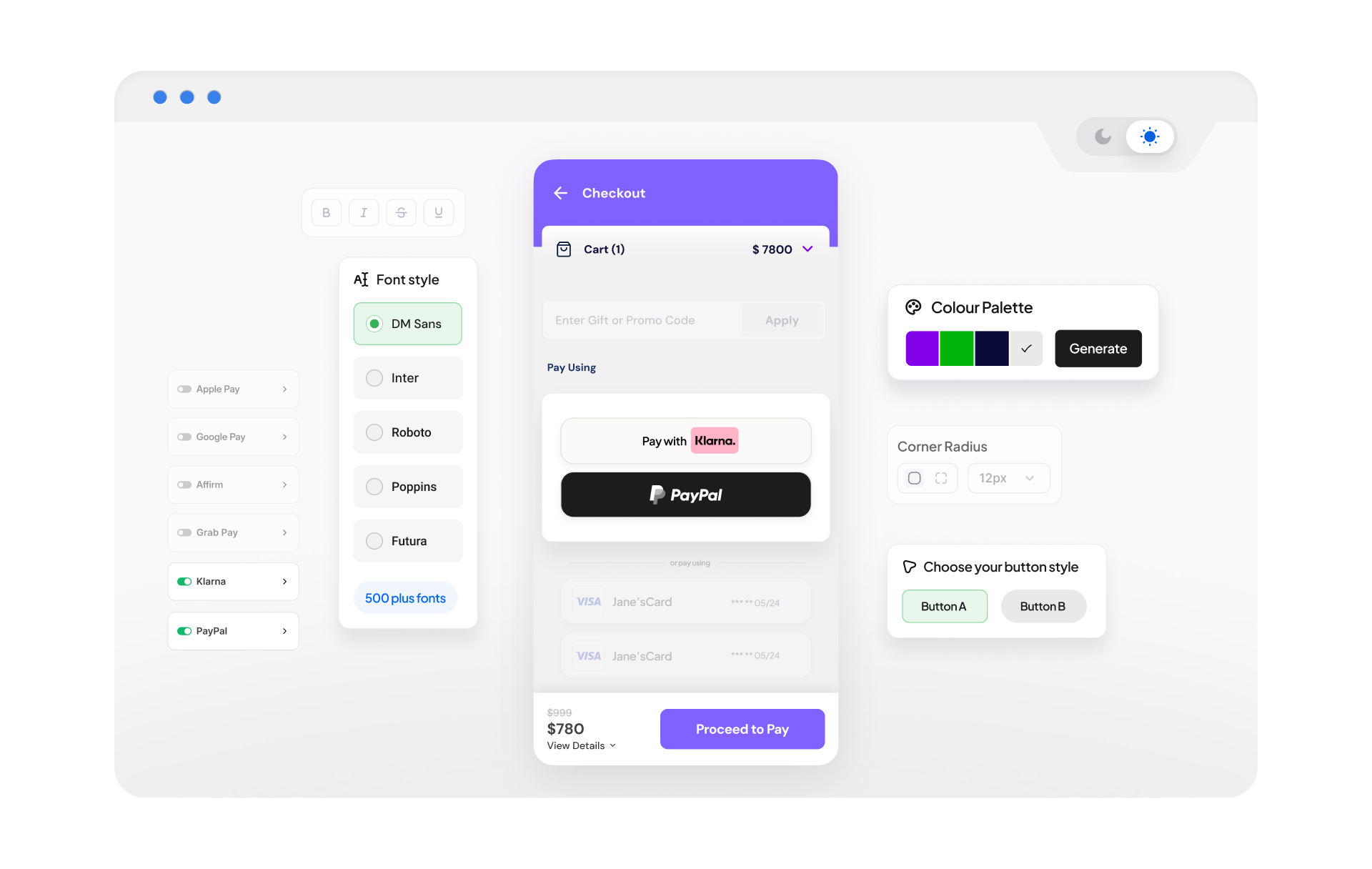

Merchant-Centric Design: Interfaces That Drive Adoption

In practice, this means enabling merchants to configure payment methods, view real-time settlements, initiate refunds, and track disputes from a single dashboard with no-code onboarding, developer-friendly APIs, and self-service tools. It also means offering SDKs for quick checkout integration, sandbox environments for QA, and uptime visibility.

For large banks, delivering this kind of user experience historically required up to a dozen vendors. Today, unified platforms allow banks to offer all of this out of the box—shortening onboarding from weeks to hours, and dramatically reducing the cost-to-serve.

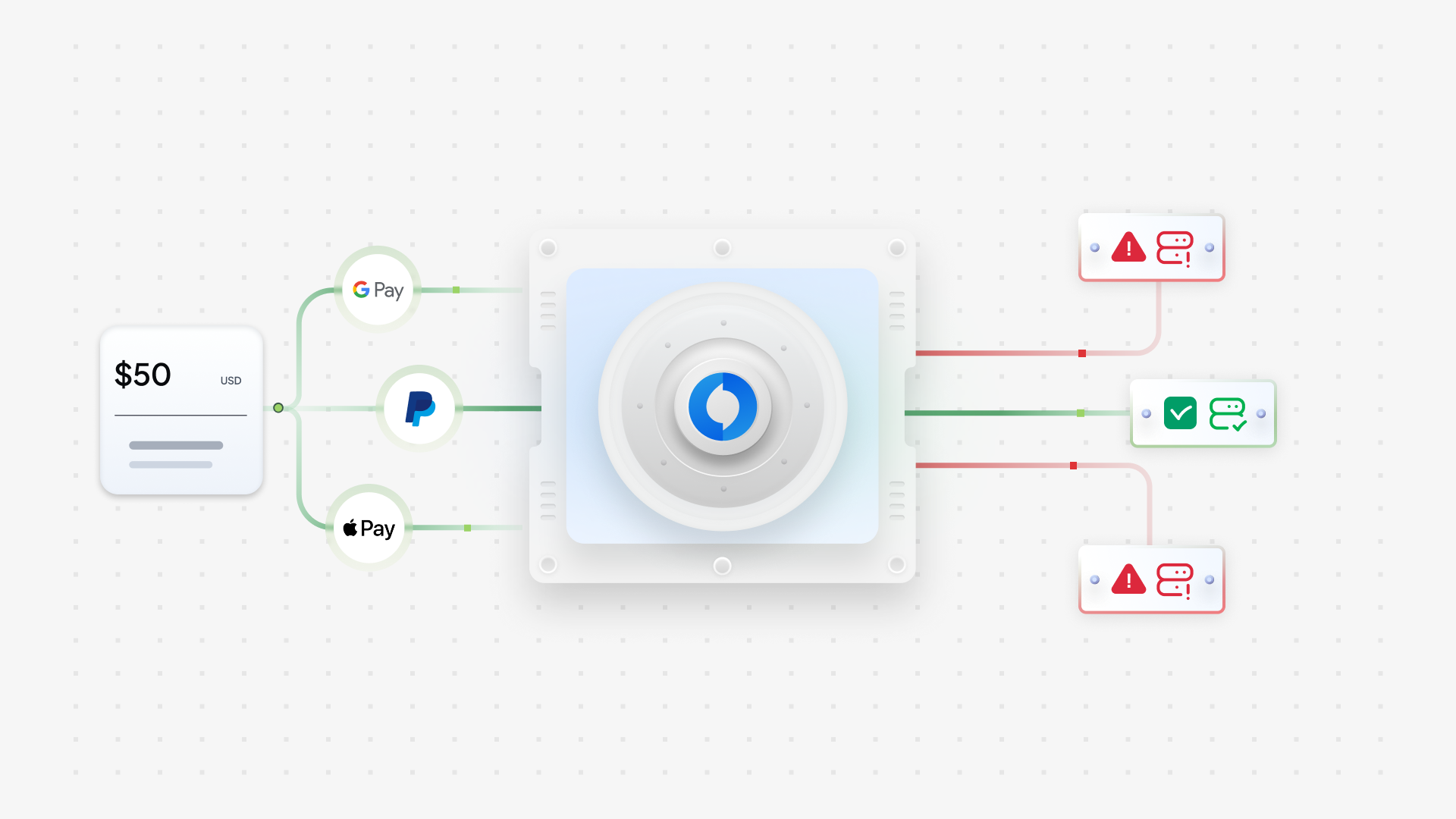

Success Rate Engineering: Optimization Is Not Optional

Acquiring revenue scales with transaction approval rates. However, approval is not a static metric, it varies by card type, geography, issuing bank, and even hour of day. High-performing platforms embed intelligence to route each transaction through the optimal path based on real-time signals.

This includes capabilities like issuer-aware routing, intelligent retries, and adaptive 3DS flows—all of which have helped banks collectively drive meaningful improvements in authorization rates, reduce friction for users, and recover lost revenue. One global bank, for instance, saw a 4%+ increase in card approval rates by enabling dynamic routing informed by real-time issuer latency and decline codes. Others have optimized modular authentication flows by dynamically toggling between SMS OTP, app-based prompts, and 3DS 2.0 based on user risk, resulting in both higher conversion and lower fraud.

Optimization like this is only possible with a decoupled architecture—where the decision engine operates independently of the processing layer, and where rules can be updated without release cycles.

Risk and Disputes: Intelligence from the Start

Too often, fraud and disputes are treated as back-office workflows. Modern platforms embed fraud prevention upstream in the payment journey with device fingerprinting, behavioral analytics, and velocity checks in real time—as well as dispute workflows beginning at transaction, not chargeback.

For example, rule-based FRM modules now allow banks to configure thresholds based on merchant profile, transaction type, geography, and customer history. Meanwhile, automated dispute engines pre-load evidence, assign liability using acquirer-issuer rules, and provide real-time tracking for merchants.

This integrated approach reduces chargeback ratios, improves recoveries, and gives merchants greater visibility into outcomes—helping banks retain high-volume clients.

Merchant Fee Infrastructure: Precision in Global Pricing

One of the most commercially impactful yet overlooked aspects of cross-border acquiring is fee configuration across domestic and international transactions. Without a transparent, programmable fee engine, banks risk inconsistent pricing and lost margins.

Modern acquiring stacks solve this with cost observability and optimization, as well as a dynamic fee logic that considers variables like the merchant pricing model (IC++, MDR, FX markups, discounts, surcharges), transaction currency, card issuer geography, interchange rates, and FX spreads. Fees are calculated per transaction, with real-time rules applied by card type, APM, or settlement preference.

This granularity ensures margin control, merchant transparency, and tailored pricing—such as loyalty-based incentives or differentiated local vs. cross-border rates. As local acquiring grows in strategic importance, fee simulation capabilities further help pricing and treasury teams test and refine models in real time.

FX Settlement: Managing Currency Complexity with Precision

Cross-border acquiring isn’t just about pricing—FX settlement is where operational complexity often turns into financial risk. Global merchants expect to accept payments in local currencies and settle in preferred denominations with minimal conversion loss. A modern acquiring platform enables this through a configurable FX engine that decouples transaction and settlement currencies. Banks can use it to offer same-currency settlement, auto-conversion with daily rates, or deferred conversion with scheduled pricing. FX markups can be tailored by merchant, corridor, or transaction type—balancing competitiveness and revenue.

What sets next-gen infrastructure apart is real-time transparency: merchants can preview net settlements (including FX spreads) pre-capture, while treasury teams get full exposure visibility for smarter hedging and liquidity planning. This requires a reconciliation framework that supports multi-currency ledgering, live rate ingestion, and automated FX gain/loss accounting. When executed well, banks reduce reconciliation time, avoid double conversions, and increase merchant trust. FX is no longer back-office—it’s a strategic product lever.

Reconciliation and Ledgering: The Financial Core

No matter how fast or elegant a payment experience is, it must close the loop with accurate, timely fund movement. This is where intelligent reconciliation engines and multi-party ledgering systems come in.

These systems ingest settlement files from networks, PSPs, and APMs; reconcile against authorization logs; and apply configurable fee rules to calculate merchant payouts. Leading implementations support granular fee types—including IC++, flat MDR, FX markups, and APM surcharges—applied at the transaction level.

In one implementation with a partner bank, Juspay’s real-time fee simulation and net settlement preview capabilities significantly boosted merchant trust, enabled advanced pricing tiers, and reduced manual reconciliation errors by over 80%.

Adaptability for Local Contexts: Compliance and Customization

It is critical for banks operating across multiple markets to support localization without hardcoding complexity.

To that end, banks are deploying rule engines to adapt flows based on geography like enforcing SCA in Europe, tax compliance in GCC, and privacy restrictions in APAC. Similarly, pre-built integrations to domestic APMs (Pix in Brazil, UPI in India, Mada in KSA, and so on) reduce time-to-market for new geographies.

This flexibility has allowed platforms to serve clients ranging from digital-native merchants to more traditionally in-person industries like logistics and healthcare within the same infrastructure. Since these rules are abstracted, compliance updates can be made rapidly, minimizing operational disruption.

Future Ready: Leveraging AI and ML for merchants’ success

Modern stacks must empower banks to leverage Artificial Intelligence and Machine Learning capabilities. Juspay is deeply invested in building AI ML capabilities and has observed benefits in success rate improvement, smart 3DS authentication and routing, managing risk, disputes, settlements.

Acquiring banks have a unique opportunity to leverage and lead the next wave of innovation in payment processing by embracing AI and ML. As merchants increasingly demand faster, safer, and more personalized payment experiences, AI and ML offer powerful tools to help banks meet and exceed these expectations.

By integrating AI and ML into core payment infrastructure, banks can not only streamline operations but also unlock new revenue opportunities for their merchants. Intelligent payment routing, adaptive pricing models, and tailored insights into customer behavior would allow merchants to optimize their performance and deliver better experiences to end consumers. AI ML can also support banks in calculating—and optimizing—the necessary reserves to cover higher-risk merchants.

Real-Time Visibility: The Control Center

Running a high-scale acquiring business without real-time telemetry is no longer viable. Leading banks now deploy centralized control centers that visualize transaction flows, approval patterns, risk alerts, and system uptime across both geographies and configurations

These dashboards are not just for operations, they also inform product strategy, client outreach, and regulatory reporting—while also supporting proactive resolution: e.g., identifying a sudden decline in Visa SR in a particular region and rerouting traffic until resolution.

One of Juspay’s partner banks used this flexibility to launch a new installment payment option across six markets—with differentiated pricing per geography—all within eight weeks. This kind of agility is essential as banks move toward personalized merchant services and intelligent pricing models.

Conclusion: From Utility to Differentiator

Merchant acquiring is no longer a cost center. With the right architecture, capabilities such as orchestration, tokenization, fraud control, and analytics aren’t just features—they deliver measurable ROI and build trust across merchants, regulators, and internal teams.

At less than the cost of building or maintaining legacy stacks, the blueprint for banks seeking to compete not just on price but capability is clear: adopt a platform mindset, design for modularity, align to merchant outcomes, and execute through cross-functional teams that blend product, compliance, and engineering.

With the right foundation, acquiring isn’t just revenue—it’s core infrastructure for next-gen banking.

Case Study: Juspay’s Partnership with a Top 10 Global Bank

Juspay partnered with one of the world’s top 10 banks by assets to enable their scale re-entry into global payment acceptance. Together, we co-created a next-generation platform leveraging Juspay’s proven strengths in high-scale orchestration, processing, tokenization, disputes, and payment experience optimization.

From engagement through delivery, we brought the platform to market in just six months, a major shift from traditional slower timelines. For the bank, this unlocks the ability to serve high-value enterprise and SME/SMB merchants and compete with modern, tech-enabled acquirers. Already live in APAC, the platform is powering payments for large enterprises across sectors like insurance, retail and travel.

Built for scale, flexibility, and innovation, the platform offers merchants a unified, future-ready payment experience—from seamless onboarding to access to a wide range of regional and alternative payment methods including wallets and real-time rails. It supports advanced use cases such as biometric authentication, on-us integration, subscription billing, delivers ~10% cost savings, and improves success rates by 5%+ with 99.999%+ uptime. Together, we’re enabling merchants to now power global payment experiences with the reliability and reach only a top-tier bank can offer.

Build the Future of Acquiring with Juspay

The evolution to a next-generation acquiring stack is not just a technical uplift—it’s a strategic shift in how banks design, deliver, and scale payments infrastructure. In this transformation, the role of a partner like Juspay is not to replace the bank’s core systems, but to complement and extend them. With over a decade’s experience building solutions for some of the most sophisticated global merchants, Juspay is leveraging that expertise to enable banks to modernize payment acceptance without sacrificing margins or control. Juspay’s Global Payment Acceptance Platform brings modular components—ranging from tokenized orchestration and intelligent routing to fee engines and real-time reconciliation—that integrate seamlessly with a bank’s existing environment.

By partnering with Juspay, banks retain full control over compliance, merchant relationships, and strategic direction, while accelerating their ability to serve modern commerce needs across markets and channels.