As enterprises scale, most transition from paying a blended fee for payment processing to adopting an interchange fee model with their payment processor or acquirer to reduce processing costs. However, in practice, 80% of growing enterprises report paying more than anticipated Payment Processing fees. Even after adopting interchange-plus pricing, businesses could still save 7-10% on their overall payment costs by optimizing their processing strategies with existing PSPs.

Let’s examine the problems that lead to increasing payment processing fees and how enterprises can solve these challenges

The core payment analytics problem

Guessing the payment processing fees & not knowing how to improve it

One of the biggest challenges in payment analytics that enterprises face is understanding their true payment processing costs and why those costs fluctuate month-to-month.

Large merchants typically address this complexity by employing in-house experts or building specialized tools to analyze and optimize their payment costs. Other enterprises often either accept the higher costs as a business expense, attend industry forums across the US and Europe for insights, or appoint a third-party specialist.

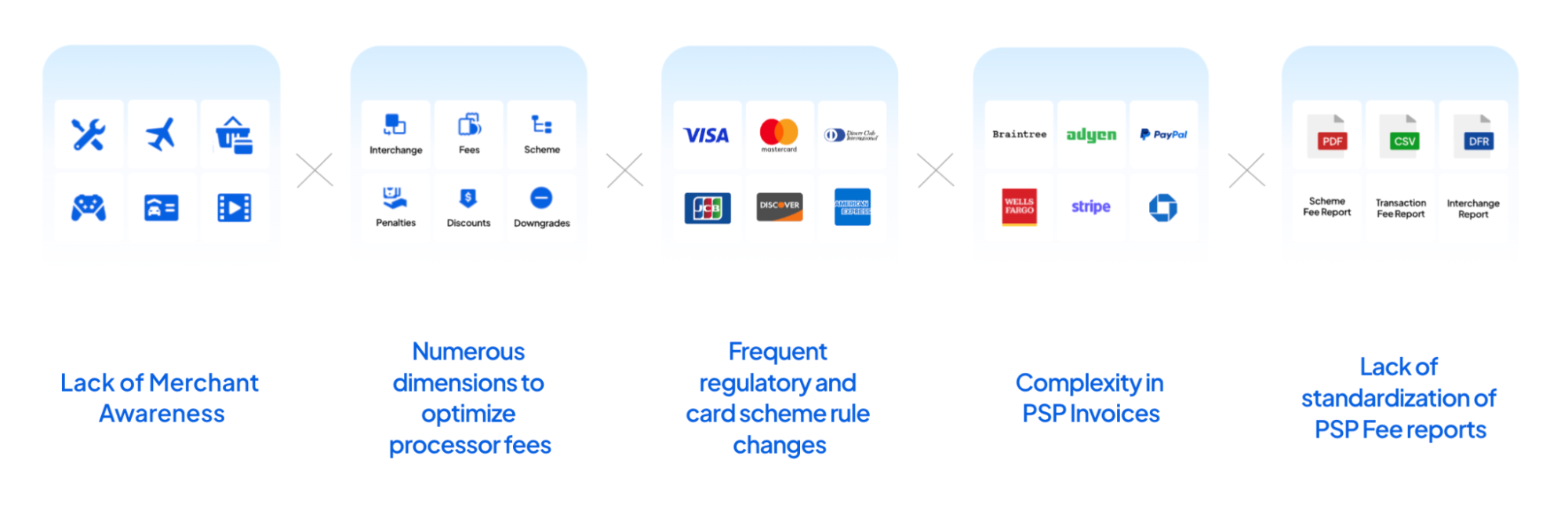

To grasp why interchange fees are so complex, it’s important to understand the key dimensions involved in payment analytics.

There are three primary components of interchange pricing: interchange fees (which account for 80-90% of total costs), scheme fees (10-15% of total costs), and acquirer fees (around 5% of total cost). Each of these cost components has its own subcategories, rules, and penalties—often detailed in the 900-page rulebooks provided by each card network (Visa, Mastercard, etc.). These rulebooks are regularly updated twice a year, with changes specific to different regions.

Interchange fees vary across 100+ programs, depending on the merchant’s business type (MCC), the card type used (consumer credit, signature, infinite, etc.), the payment scheme, and adherence to 7-10 qualifying criteria. Adherence to the qualifying criteria helps merchants qualify for a good interchange fee. Merchants that fail to meet these criteria risk higher fees (downgrades) and penalties, which vary in severity depending on the infraction.

Scheme fees are divided into 50+ categories, including mandatory, international, feature-driven, and bad behavior fees. A single transaction can incur anywhere from 3 to 10 of these fees (or more), depending on its nature.

When calculating monthly payment processing fees, acquirers and PSPs present the data through multiple reports, each with its own format and structure. Common cost reports include Interchange and Scheme Fee Reports, Settlement Fee Reports, and Payment Fee Reports. While some reports provide granular details on costs, others may require explicit requests for access. Now, if a merchant has more that one payment provider or acquirer the above complexities grow multi-fold since they would now need to not only analyze the costs individually, they’ll also need to bring them together using common semantics and be able to analyze and drill-down on them

Lastly, the merchants need to constantly navigate these complexities, refer to multiple sources, experts and teams to stay on top of these components and work with internal and external teams to streamline payments.

How to solve for cost observability using AIOps in payment analytics

Knowing the payment processing fees, auditing and optimizing it.

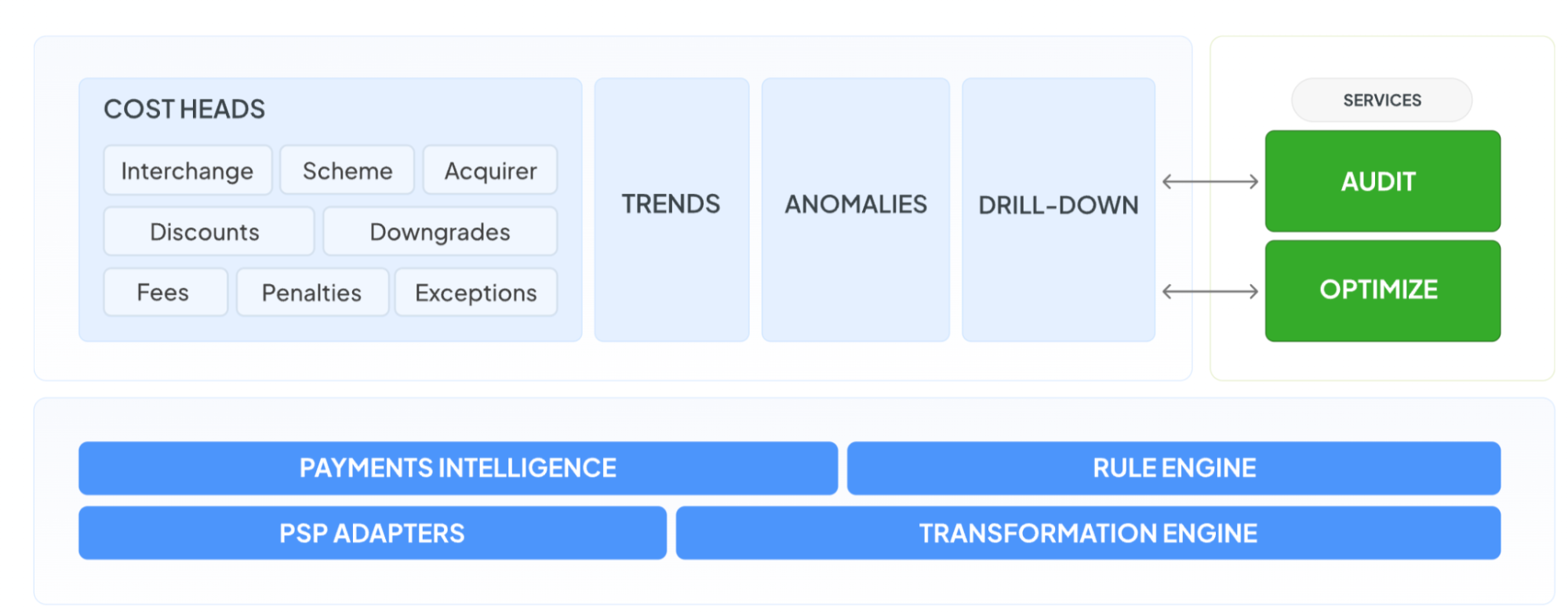

We envisioned an AI-driven payment analytics tool designed to help businesses streamline and optimize their payment processing costs. This powerful platform provides deep visibility into cost components, enabling organizations to identify trends, spot anomalies, and uncover savings opportunities. It features three core modules:

- Observability/Monitoring System: Tracks trends across cost categories such as interchange fees, downgrades, scheme fees, and acquirer fees over customizable time frames (1 to N months). This helps businesses detect anomalies and inconsistencies early.

- Auditing System: Identifies discrepancies like PSP errors, invoice mismatches, and other overcharges or missed savings. This system often yields savings without requiring additional engineering effort.

- Optimization Recommendations: Delivers actionable insights to maximize savings on interchange qualifications, reduce scheme fees, and minimize penalties.

Merchants can integrate their existing PSPs or acquirers, allowing the payment analytics tool to process payment reports in native formats without disrupting transaction flows. The platform standardizes and normalizes these inputs, leveraging advanced algorithms to generate actionable insights.

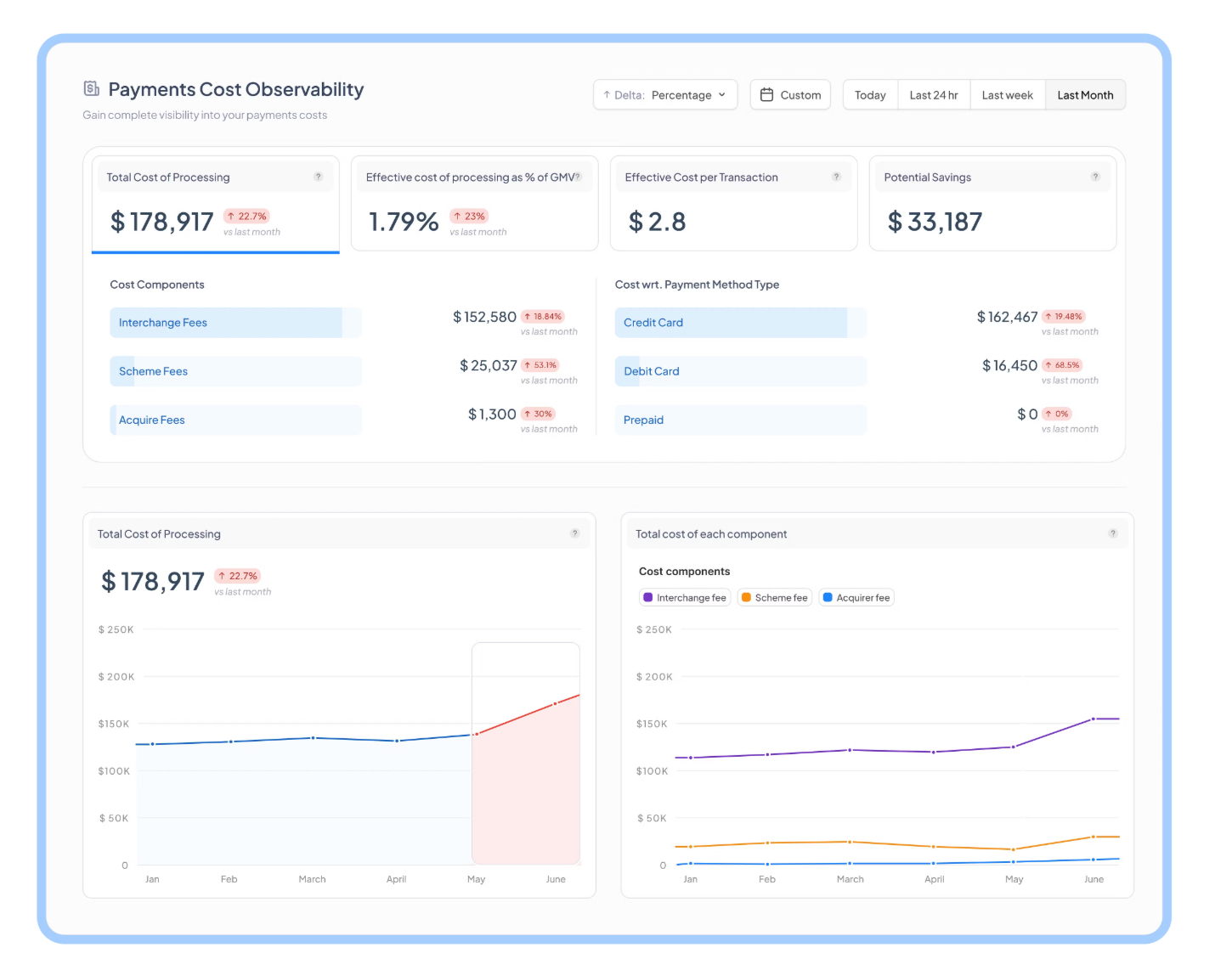

The payment analytics tool offers a comprehensive overview of processing costs, broken down across dimensions like cost categories and card types, while highlighting key trends. This enables merchants to pinpoint the components driving expenses and monitor cost changes over time.

Merchants will attach their existing PSPs or acquirers with the AI payment analytics tool, allowing the platform to process various payment reports in their native formats, without disturbing anything on the transaction flow. This tool will standardize the diverse data inputs, normalize them and apply its intelligence algorithms. It should also provide merchants with a comprehensive overview of their total processing costs, broken down across multiple dimensions.

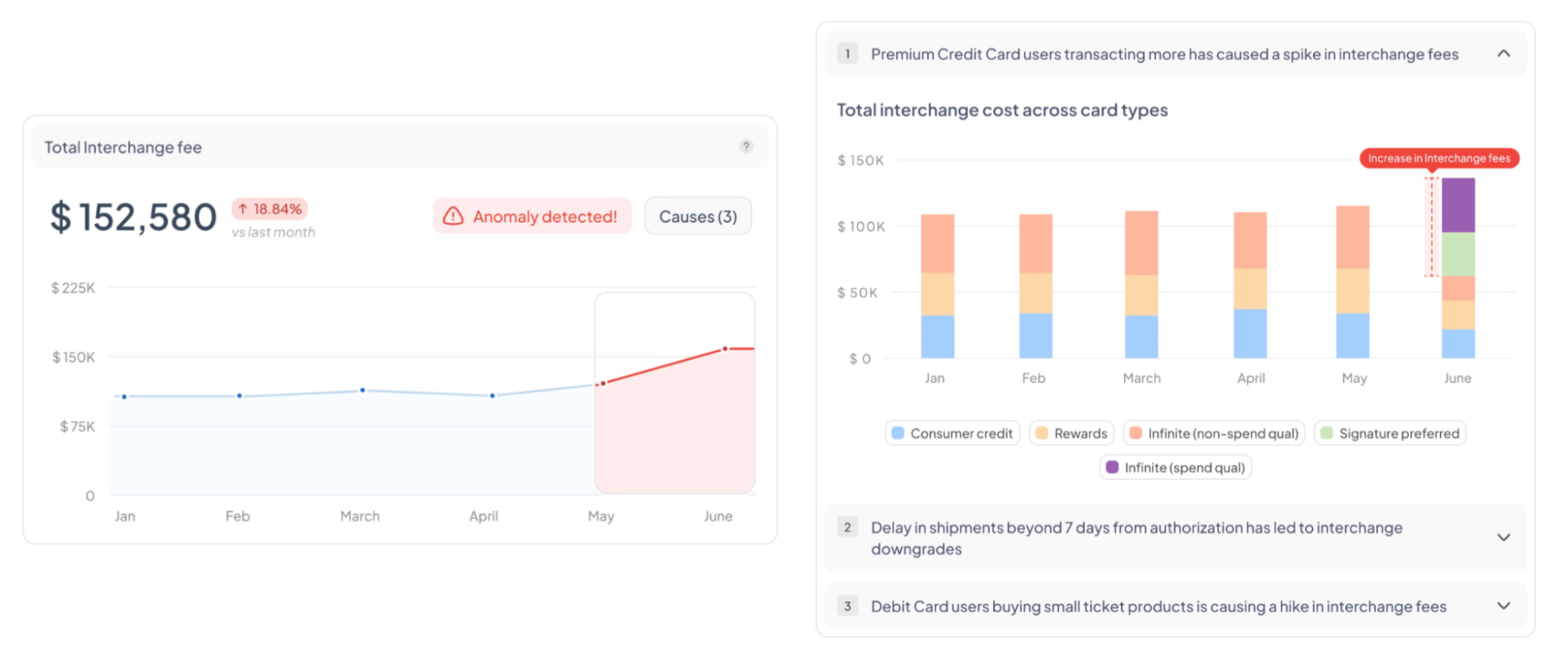

In the example shown, you can see an overview of the total processing costs, further dissected into different cost categories and card types, along with key trend insights. This enables merchants to gain visibility into the specific components driving their payment expenses and track cost changes over time.

* This graph is for illustrative purposes only and does not reflect any real merchant data.

Merchants can drill down into specific components, such as interchange fees, to identify anomalies. From there, they can either Audit to validate accuracy—ensuring correct charges and discounts—or Optimize to address underlying causes of increased costs. This payment analytics tool empowers merchants to address payment inconsistencies, uncover cost-saving opportunities, and enhance financial efficiency.

*This graph is for illustrative purposes only and does not reflect any real merchant data.

But developing such a complex AI powered payment analytics tool to track payments observability takes a lot of time and resources, especially for an enterprise merchant as it might lead them to deviate from their core functionalities.

That’s why we at Juspay have built HyperSense, an AI powered payment analytics tool to transform complex payment data into actionable insights, empowering businesses to make data-driven decisions. This intelligent platform ingests unstructured reports from diverse sources, converting them into structured outputs to provide full transparency and drive efficiency. With features like anomaly detection, automated root cause analysis (RCA), and a conversational interface, HyperSense simplifies the analysis of payment processing costs and trends.

The AI-driven payment analytics dashboard, HyperSense, caters to various user personas - from CTOs and CFOs to data analysts—allowing each to view data from their unique perspective. Merchants can analyze costs at a granular level, identify fluctuations, and take corrective actions. The Optimize feature offers tailored recommendations, leveraging Juspay’s 12 years of payment expertise and its capability to process 200 million+ transactions daily.

By combining AI with human expertise, HyperSense goes beyond insights, helping merchants implement optimization strategies in a controlled and reliable manner. Once live, the self-serve dashboard enables businesses to proactively manage their payment ecosystem, improving transparency, reducing costs, and driving performance.

HyperSense redefines payment analytics, making AI a cornerstone of smarter, more efficient financial management.

About Juspay

At the forefront of global payment innovation, JUSPAY is transforming the way the world transacts. We empower businesses to achieve superior conversion rates, reduce fraud, optimize costs, and deliver seamless customer experiences at scale. Trusted by leading enterprises, banks, and financial schemes worldwide, we are redefining global payment infrastructure.

Our cutting-edge payment experience, orchestration, and infrastructure solutions are engineered to meet the complex needs of enterprise businesses and financial institutions. Backed by top-tier investors such as SoftBank and Accel, we are committed to providing mission-critical payment services with unparalleled scalability, reliability, and efficiency. By integrating seamlessly into complex payment ecosystems, we enable faster go-to-market and drive stronger business outcomes across industries.

Founded in 2012 and headquartered in Bangalore, JUSPAY has been at the forefront of digital payment innovation. Today, we process over 200 million transactions daily, exceeding an annualized Gross Merchandise Value (GMV) of $900 billion while maintaining an exceptional reliability rate of 99.999%. With innovation hubs in Bangalore, Dublin, São Paulo, San Francisco, and Singapore, our team of over 1,200 professionals is shaping the future of digital payments worldwide.