In the past decade, there has been a substantial rise in the number of merchants accepting digital payments. One trend that is common across all geographies is that cards are the most prominent payment method used by the customers to make digital payments. Since card payments have a high adoption rate, every player in the payments ecosystem is focused on making them as seamless and secure as possible.

Network Tokenization was introduced with the same mindset, to make the flow of card information more secure while reducing the friction of entering the card details for repeat purchases. Let’s take a look at what network tokenization is, and how it works.

What is Tokenization?

Before diving into network tokenization, let's first understand the concept of tokenization. Tokenization refers to converting a 15/16 digit card number also known as the Primary Account Number (PAN) to an alphanumeric string of random characters which form a token. These tokens prevent sensitive card information from flowing into the hands of fraudsters safeguarding the customers. These tokens help businesses to stay PCI compliant and reduce the risk of data breaches as these tokens cannot be used by fraudsters to make a transaction.

How Tokenization Works

When a customer enters their credit card number (let's say 4111-1111-1111-1111), the Payment Service Provider (PSP) or the network replaces it with a random string like "TKN_8X9Y2Z5A3B7C". This token:

- Has no mathematical relationship to the original card number

- Can't be reverse-engineered to reveal the actual card data

- Is useless to hackers even if they steal it

- Can be safely stored in token vaults

The token is then shared during the entire transaction flow and gets decoded & replaced by PAN at a specific endpoint.

What is Network Tokenization?

Network tokenization adds an additional layer of security to traditional tokenization. Instead of a business or a payment processor creating tokens, the card networks themselves (Visa, Mastercard, American Express, Discover) generate and manage these tokens.

Network tokens are merchant specific but can be used across multiple platforms, and payment service providers (PSPs), providing broader interoperability. Network tokens have the capability to update card PAN when a card is replaced or renewed, ensuring payment continuity without the need for customers to manually update their card details.

Network tokenization is an advanced security system that constantly adapts. The card networks create tokens that can:

- Update automatically when cards are reissued

- Include cryptographic validation for each transaction

- Work seamlessly across different payment channels

How Does Network Tokenization Work?

Understanding how network tokenization works is crucial for merchants who are working with multiple payment service providers. Let's take a look at the network tokenization flow -

Step 1: Token Request

When a customer provides their card information, the merchant’s system (or their payment processor) sends a tokenization request to the card network.

Step 2: Card Validation

The card network validates the card information in real-time. They check:

- If the card is valid and active

- If the cardholder has authorized tokenization

- If there are any fraud concerns

Step 3: Token Generation

Once validated, the network generates a unique token. This isn't just a random number – it's a specially formatted string that contains metadata about the tokenization request

Step 4: Token Provisioning

The network sends the token back to the merchant’s system (token service provider or payment processor) along with:

- The token itself

- Token expiration date

- Cryptographic information for validation

- Any restrictions on token usage

Step 5: Transaction Processing

When a customer initiates a transaction using a tokenized card, the merchant sends the token instead of the actual card number to the PSP and the PSP forwards the token to the network. The network:

- Validates the token

- Checks transaction permissions

- Passes the underlying card data to the issuing bank

- Returns the transaction result

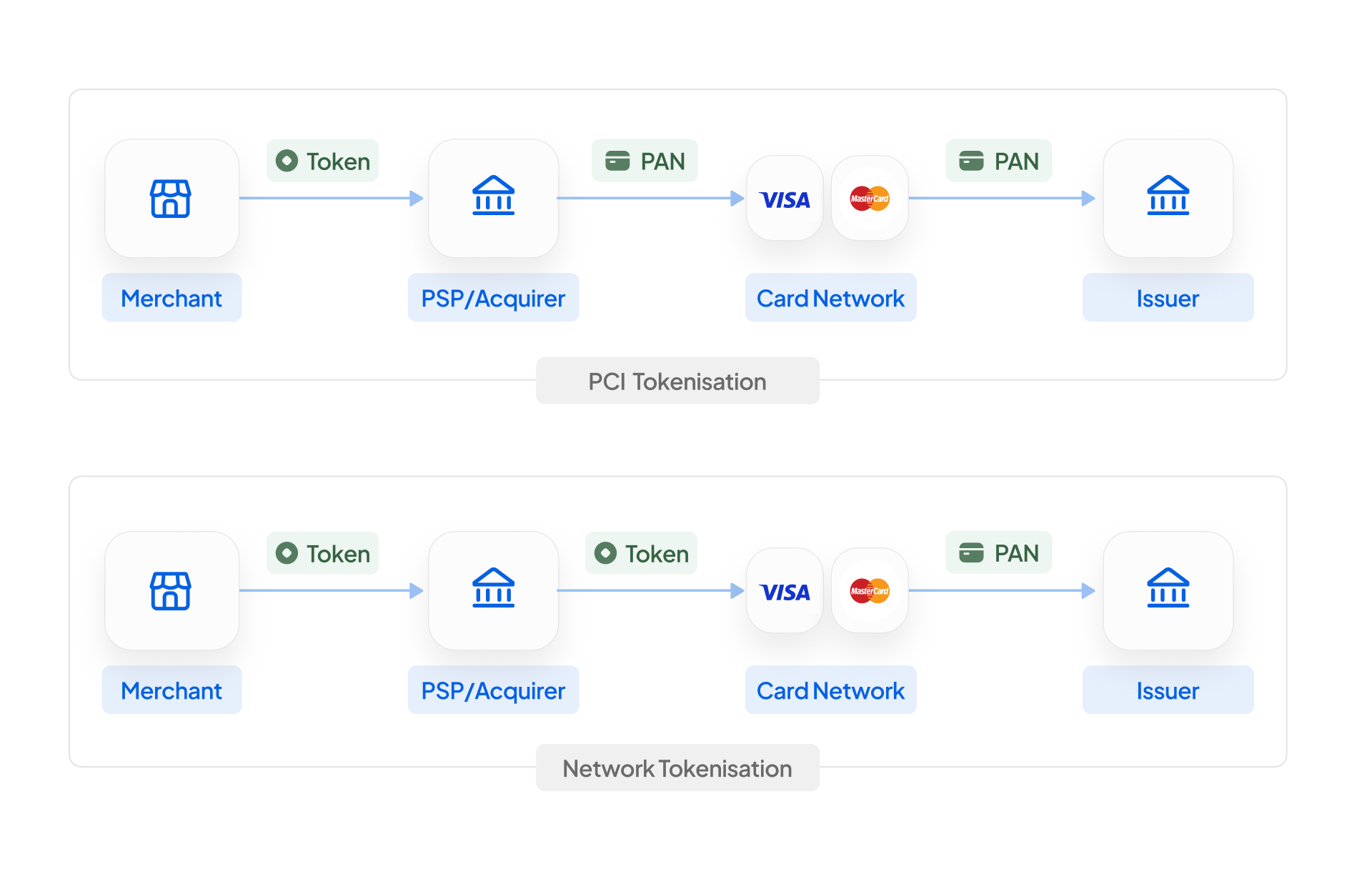

Difference Between PCI Tokenization and Network Tokenization

Let's take a look at some of the key differences between network tokenization and PCI tokenization-

PCI Tokenization

PCI tokenization, also called merchant tokenization or gateway tokenization, involves a Payment Service Provider (PSP) who generates a token against a customer’s card details. When a customer makes a purchase, the merchant passes the token to the PSP, who decodes the token and sends the card PAN to the network to further process the transaction.

Network Tokenization:

Network tokenization represents a more advanced approach. The card networks themselves create and manage tokens using their global infrastructure. Network tokens can potentially work across multiple platforms and processors. Since network tokens are directly connected to the customer’s account, they can automatically update the card details, in case a new card is issued.

Benefits of Network Tokenization

Enhanced Security and Fraud Prevention

Network tokenization provides multiple layers of security that traditional payment methods simply can't match:

Dynamic Cryptographic Validation: Each transaction includes cryptographic data that validates the token's authenticity. Even if hackers intercept this information, they can't reuse it for fraudulent transactions.

Real-Time Fraud Monitoring: Card networks analyze every tokenized transaction using their fraud detection systems. They can spot suspicious patterns across millions of transactions and block fraud before it happens.

Domain Restrictions: Network tokens can be restricted to specific merchants, channels, or transaction types. A token created for your e-commerce site can't be used for in-store purchases, adding another security layer.

Reduced Data Breach Impact: If your systems are compromised, stolen tokens are worthless to attackers. They can't convert tokens back to card numbers or use them outside your authorized environment.

Improved Customer Experience

Your customers will notice the difference immediately:

Seamless Recurring Payments: Network tokens automatically update when customers receive new cards, keeping your revenue flowing uninterrupted.

Faster Checkout: Customers can complete purchases quickly without re-entering payment information. Network tokens enable seamless transactions across all channels.

Cross-Channel Consistency: A customer can save their payment method on the website and use it in their mobile app without any additional setup.

Reduced Cart Abandonment: Reduced friction in card payments result in reduced number of customers abandoning their purchase

Operational Efficiency

Network tokenization streamlines your payment operations:

Automated Card Updates: Merchants don’t need to spend time and money managing failed payments due to expired cards reducing involuntary churn. Network tokens handle updates automatically.

Simplified PCI Compliance: Network tokenization helps businesses stay PCI compliant, saving time and audit costs.

Better Authorization Rates: Network tokens often achieve higher authorization rates because card networks can provide additional context about the transaction.

Cost Savings

The financial benefits add up quickly:

Reduced Chargebacks: Better fraud prevention means fewer chargebacks and associated fees. Some merchants see chargeback reductions of 30-50% after implementing network tokenization.

Decreased Customer Service Costs: Fewer failed payments mean fewer support tickets and customer service interactions.

Improved Cash Flow: Automatic card updates ensure recurring revenue continues without interruption.

Business Use Cases for Network Tokenization

Different types of businesses can leverage it in unique ways to solve specific challenges. Let's explore how various business models can benefit from this technology.

Subscription and Recurring Payment Businesses

If you run a subscription service, network tokenization solves involuntary churn from failed payments.

The Problem: Traditional recurring billing systems fail when customers receive new cards. Studies show that 15-20% of recurring payments fail monthly due to expired or replaced cards.

The Solution: Network tokenization automatically updates payment credentials when banks issue new cards. Your billing system continues working without customer intervention.

Real-World Applications:

- Streaming Services: Netflix, Spotify, and similar platforms use network tokenization to ensure uninterrupted service

- SaaS Companies: Software subscriptions remain active even when customers change banks

- Membership Sites: Gym memberships, professional associations, and clubs benefit from continuous payment processing

E-commerce and Online Retail

Online merchants face unique challenges with payment security and customer convenience. Network tokenization addresses both concerns simultaneously.

Key Benefits for E-commerce:

- Guest Checkout Optimization: Customers can save payment methods securely for future purchases

- Mobile Commerce: Seamless payments across mobile apps and responsive websites

- Cross-Border Transactions: Network tokens work globally with consistent security standards

Multi-Channel Businesses

If businesses sell through multiple channels – online, in-store, mobile app, phone orders – network tokenization creates a unified payment experience.

The Challenge: Traditional tokenization systems work within single channels. Customers need to re-enter payment information for each channel.

The Solution: Network tokens work across all payment channels, providing consistent customer experience.

B2B and Enterprise Payments

Business-to-business payments often involve large amounts and complex approval processes. Network tokenization adds security without complicating workflows.

Enterprise Applications:

- Procurement Systems: Integrate tokenized payments with purchasing workflows

- Vendor Payments: Automate recurring vendor payments with token-based systems

Key Advantages:

- Approval Workflows: Tokens can be restricted to specific transaction types or amounts

- Multi-Currency Support: Network tokens work across global payment networks

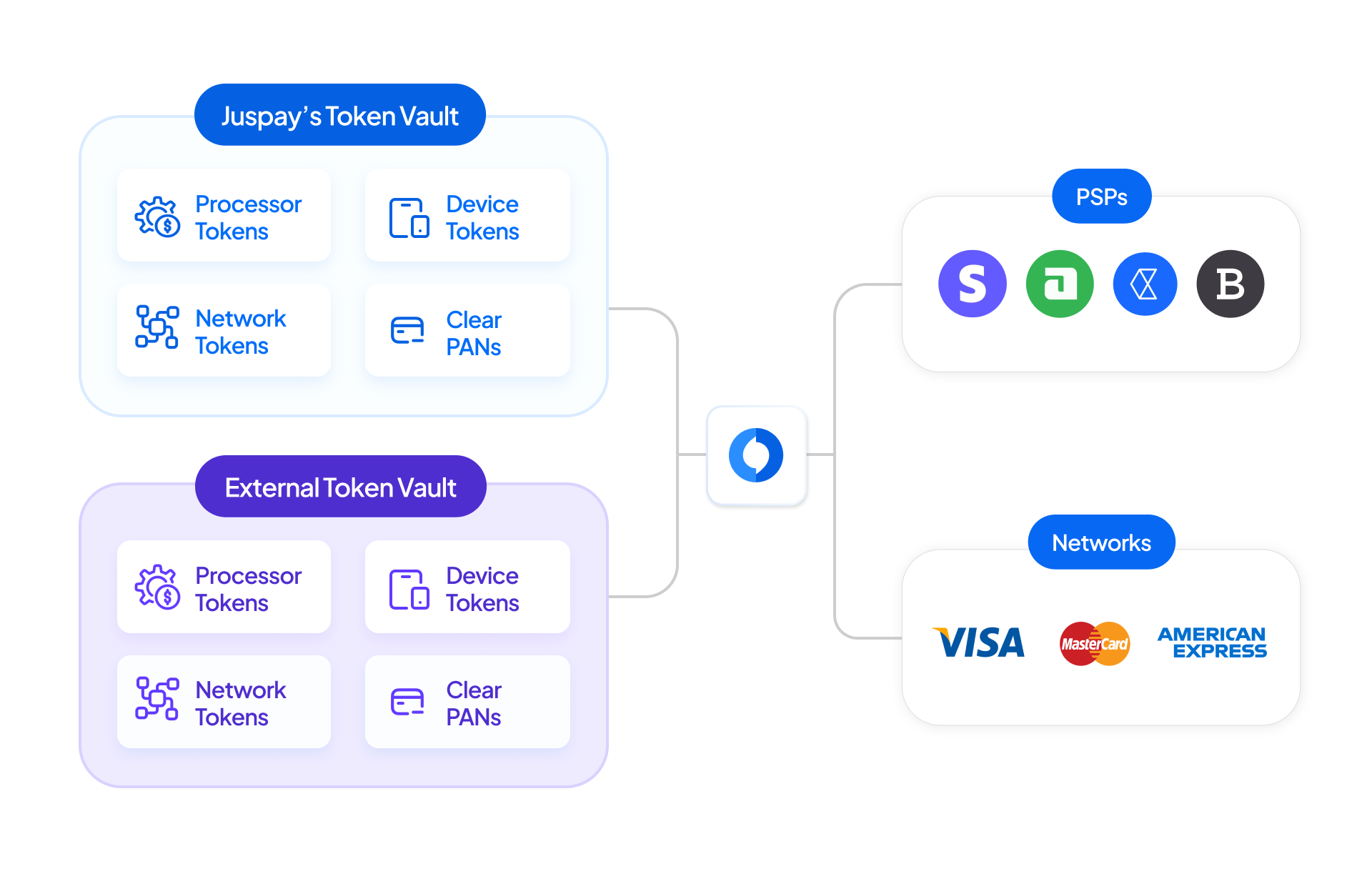

How Can Juspay Help?

Juspay is a certified Token requestor and a token service provider that is integrated with all major networks (Visa, Mastercard, Amex, etc.) to enable tokenization for merchants. Juspay’s tokenization suite is capable of handling the complete token lifecycle management. We’ve issued more than 150 million network tokens globally.

Juspay also offers a unified, scalable and versatile token vault solutions offering-

- Flexibility in token storage and management by enabling merchants to bring their own token requestor credentials and configure it within Juspay’s vault.

- Ability to orchestrate between multiple token vaults by maintaining sync between vaults to support migration.

- Capability to store clear PANs of the end customer and use them judiciously to switch credentials and improve transaction success rates.

Conclusion: The Future of Secure Payments

Network tokenization represents more than just another security measure – it's a fundamental shift in how businesses handle payment data. As cyber threats continue to evolve and customer expectations rise, implementing network tokenization isn't just smart business; it's essential for survival.

The benefits are clear and measurable. Businesses that implement network tokenization see immediate improvements in security, customer experience, and operational efficiency. More importantly, they position themselves for future growth in an increasingly digital economy.

The technology landscape is moving toward tokenization as the standard for payment security. Early adopters gain competitive advantages, while businesses that wait risk falling behind. The question isn't whether to implement network tokenization, but when and how to do it most effectively.

As you consider your next steps, remember that network tokenization is an investment in your business's future. The upfront costs and implementation effort pay dividends through reduced fraud, improved customer satisfaction, and streamlined operations. Most importantly, it gives you the foundation to build innovative payment experiences that keep customers coming back.

The future of payments is tokenized, secure, and seamless. By implementing network tokenization today, you're not just protecting your business – you're positioning it to thrive in tomorrow's digital economy.