Optimizing B2B Payments Drives Business Success: Here How

Optimizing business-to-business (B2B) payments is no longer a luxury but a necessity in the fast-paced business landscape. Inefficient B2B payment processes can lead to delayed payments, strained supplier relationships, and hindered growth. Embracing modern b2b payment solutions can transform the way businesses operate, driving efficiency, improving cash flow, and ultimately fueling success. Here is a detailed explainer.

It’s crucial for companies to make their business-to-business payments as efficient as possible today. When B2B payments take too long or are difficult to process, it can create problems like late payments, strained relationships with suppliers, and difficulties in growing the business. By using modern B2B payment solutions, businesses can work more smoothly, have better control over their money, and ultimately become more successful.

What Fuels the Need for Payment Modernization?

The traditional B2B payment processing methods, such as paper checks and manual invoicing, are inefficient, time-consuming, error-prone, and lack transparency. This leads to delayed payments and frustrated customers.

Additionally, the global nature of modern business necessitates seamless cross-border B2B payment solutions that can handle different currencies, varying regulatory requirements, and fluctuating exchange rates. This complexity further exacerbates the challenges associated with traditional payment methods.

The growing demand for faster, more secure, and cost-effective payment options is a key driver behind payment modernization. Businesses are increasingly recognizing that optimizing their B2B payment processes can unlock significant value, including reduced operational costs, improved cash flow visibility, and enhanced customer and supplier satisfaction.

Streamlining B2B payments can lead to stronger business relationships, increased efficiency, and, ultimately, a healthier bottom line. The shift towards digital transformation has further accelerated this need as companies seek to leverage technology to streamline operations and gain a competitive edge.

Upcoming innovations such as artificial intelligence (AI), machine learning (ML), and blockchain are transforming the B2B payment landscape, enabling faster, more secure, and transparent transactions. Businesses that embrace these innovative B2B payment solutions can position themselves for success in the digital age, while those that cling to outdated methods risk falling behind.

It’s important to have smooth ways to make B2B payments across borders. This means being able to deal with different currencies, follow various rules and laws, and adjust to changing exchange rates. Traditional payment methods can make this even more complicated.

Hence, businesses want payment processes that are quick, safe and don’t cost too much. They’re finding that improving their B2B payments can bring big benefits, like spending less on day-to-day operations, knowing more about their finances, and making their customers and suppliers happier.

Making B2B payments work better can create stronger business connections, make things run more smoothly, and, in the end, improve their finances. As companies turn more towards using technology, they’re looking for ways to make their work smoother and stay ahead of the competition.

Artificial intelligence (AI), machine learning (ML), and blockchain are changing how B2B payments happen. It’s making payments faster, safer, and easier to understand. Companies that use these new payment methods can set themselves up for success in the digital age, while those that stay with the old ways might fall behind.

How Digital Payments Accelerate Cash Receipt?

Digital B2B payment solutions offer a myriad of benefits that can significantly accelerate cash receipt and revolutionize the way businesses manage their finances. Automated invoicing and payment reminders eliminate the need for manual follow-ups, reducing delays and human error, ensuring timely payments, and improving overall efficiency in B2B payment processing. This simple method not only saves time and money but also helps strengthen relationships with customers and suppliers by ensuring quick and accurate payments.

Real-time payment tracking, a hallmark of digital B2B payment solutions, provides businesses with unprecedented visibility into their cash flow. This transparency enables businesses to make better financial decisions, forecast future cash flows, and optimize their working capital. By having access to up-to-the-minute payment data, businesses can proactively identify potential bottlenecks, address payment delays, and maintain a healthy financial position.

Moreover, digital payment platforms often offer integrated reconciliation features, simplifying accounting processes and reducing the risk of errors. This seamless integration of payment data with accounting systems takes manual data entry and reconciliation out of the equation, saving valuable time and resources. The accuracy and efficiency of digital reconciliation processes ensure that financial records are updated and reliable.

By embracing digital payments, businesses can streamline their accounts receivable processes, improve their cash flow management, and ultimately enhance their financial performance. The adoption of digital B2B payment solutions not only accelerates cash receipt but also strengthens relationships with stakeholders. This improves operational efficiency and helps businesses grow and succeed in the digital age.

What Enhances Liquidity Management with Company Cards?

Company cards are emerging as a powerful tool for enhancing liquidity management in the B2B landscape, providing businesses with a convenient and secure way to make payments, track expenses, and manage cash flow. They offer a modern alternative to traditional B2B payment methods, such as checks and wire transfers, both known to be slow and cumbersome.

With features like spending limits, real-time transaction monitoring, and customizable controls, company cards offer unparalleled flexibility and control over B2B payment processes, allowing businesses to tailor their payment strategies to their specific needs.

Furthermore, virtual cards can be issued instantly, enabling businesses to make timely B2B payments without the need for physical cards. This flexibility is especially useful nowadays, where being able to make fast decisions and carry out tasks efficiently is really important. Businesses can improve their finances, lower the chances of fraud, and get useful information about their spending habits by using company cards as part of their B2B payment plans. The data generated by company card transactions can be used to identify cost-saving opportunities, track spending trends, and make more informed financial decisions.

In addition to the benefits mentioned above, company cards also offer a range of other advantages for B2B payments. They can help businesses streamline their accounts payable processes, reduce the need for petty cash, and improve employee expense management. By consolidating B2B payments onto a single platform, businesses can gain a holistic view of their spending and identify areas for improvement. This enhanced visibility and control can lead to significant savings and healthier financial performance.

How Juspay Improves B2B Payment Performance?

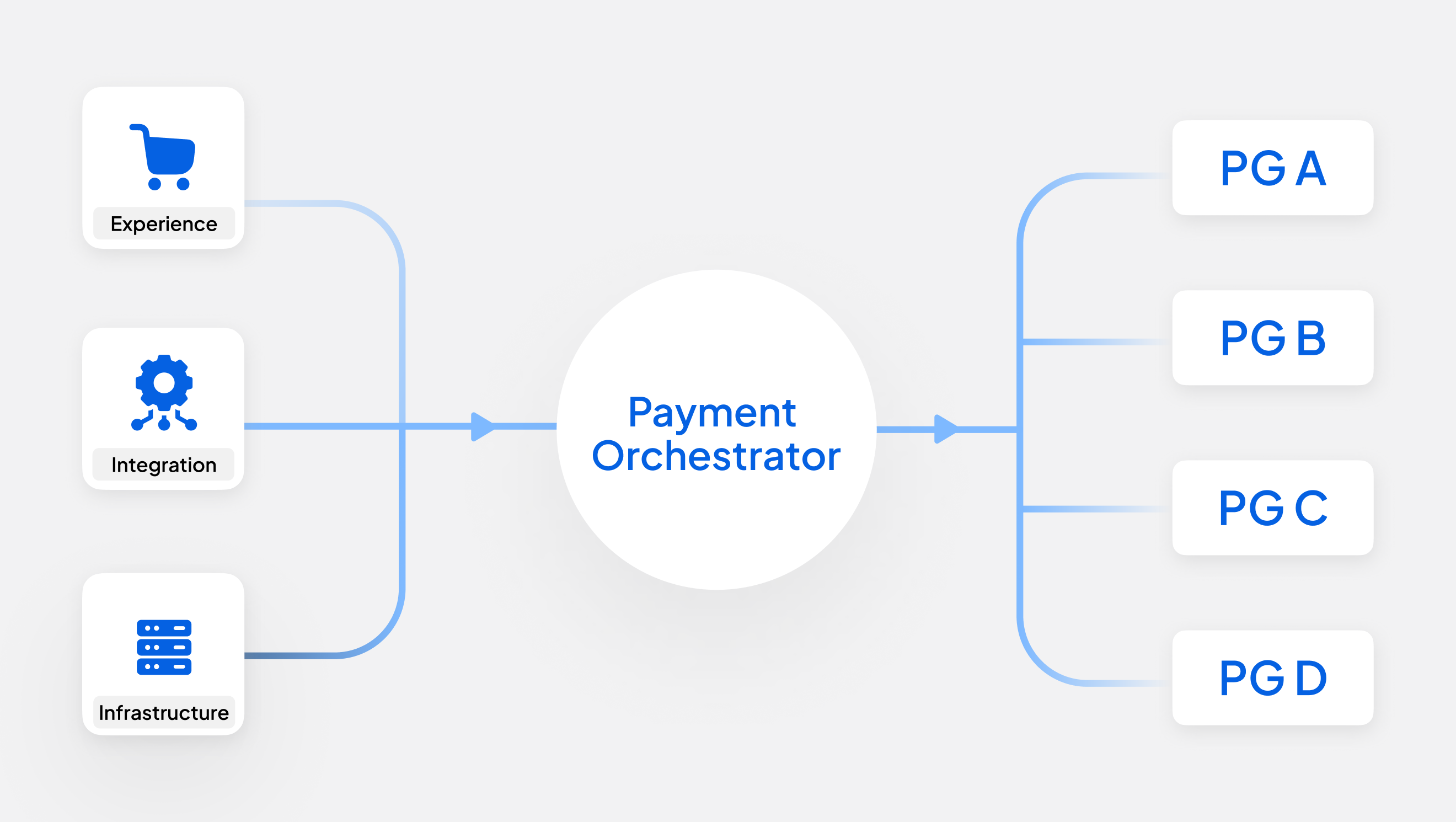

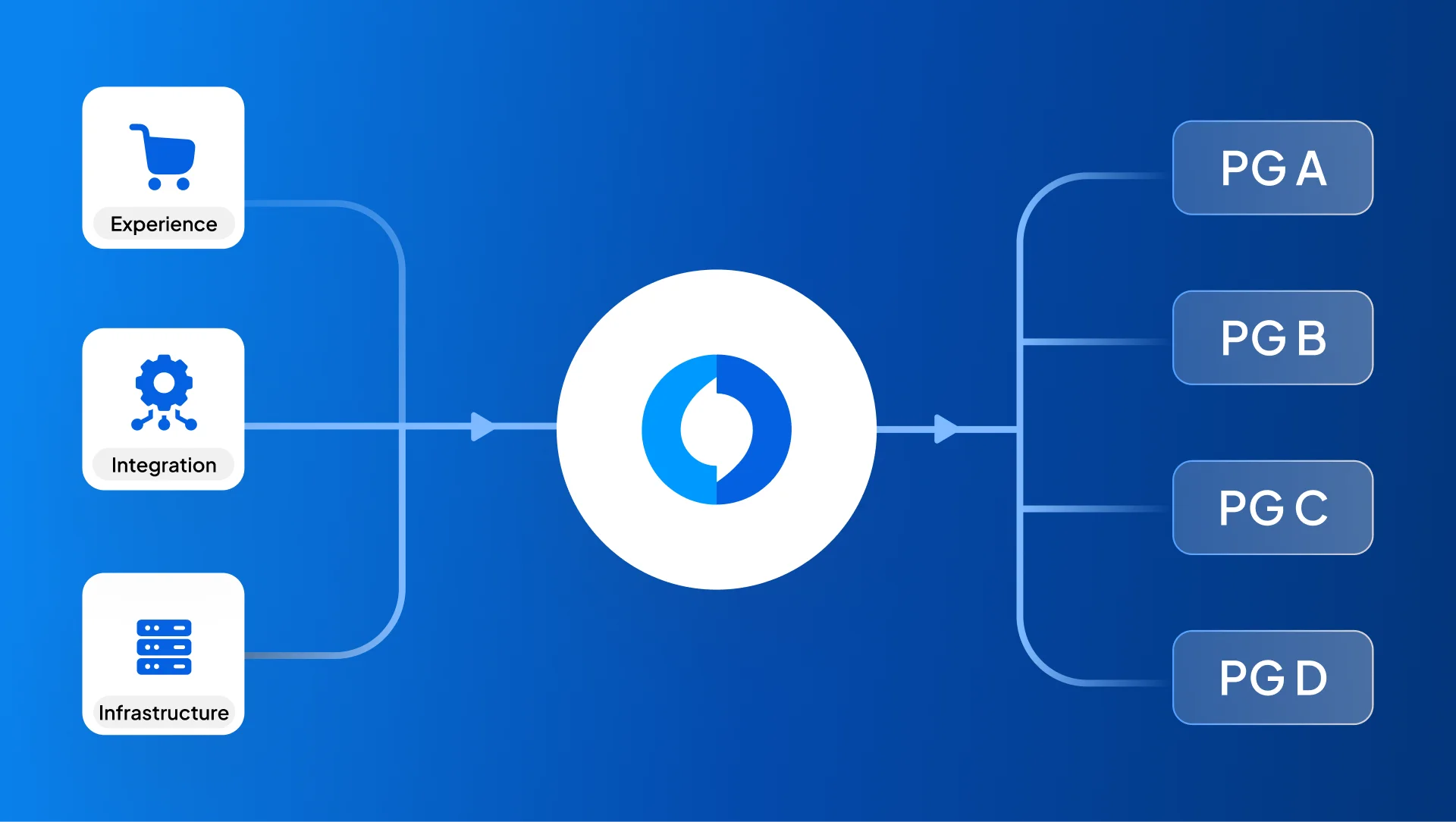

Juspay is a leading provider of B2B payment solutions that empower businesses to streamline their payment operations and achieve optimal performance.

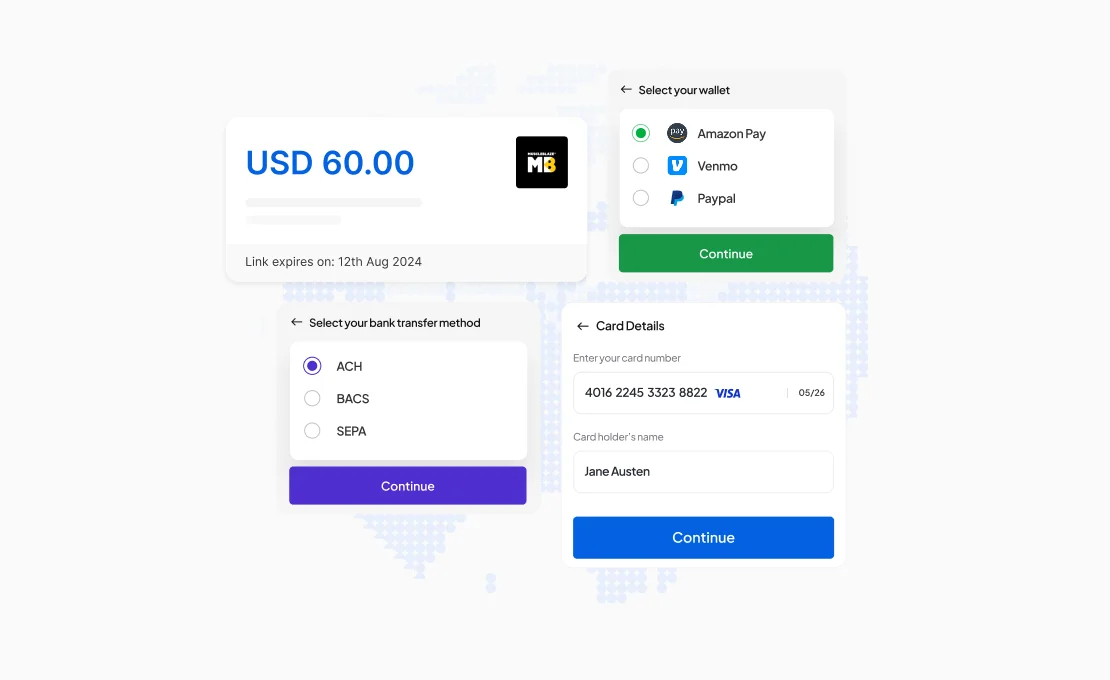

With its comprehensive suite of products and services, Juspay offers a seamless and secure platform for managing B2B payments across various channels and geographies, catering to the diverse needs of businesses operating in different industries and regions. This flexibility ensures that businesses can access the right payment solutions regardless of their size or location. Its innovative features, such as automated reconciliation, real-time payment tracking, and customizable reporting, enable businesses to gain full visibility and control over their B2B payment processes. This transparency allows businesses to identify bottlenecks, optimize cash flow, and make data-driven decisions to improve their financial performance.

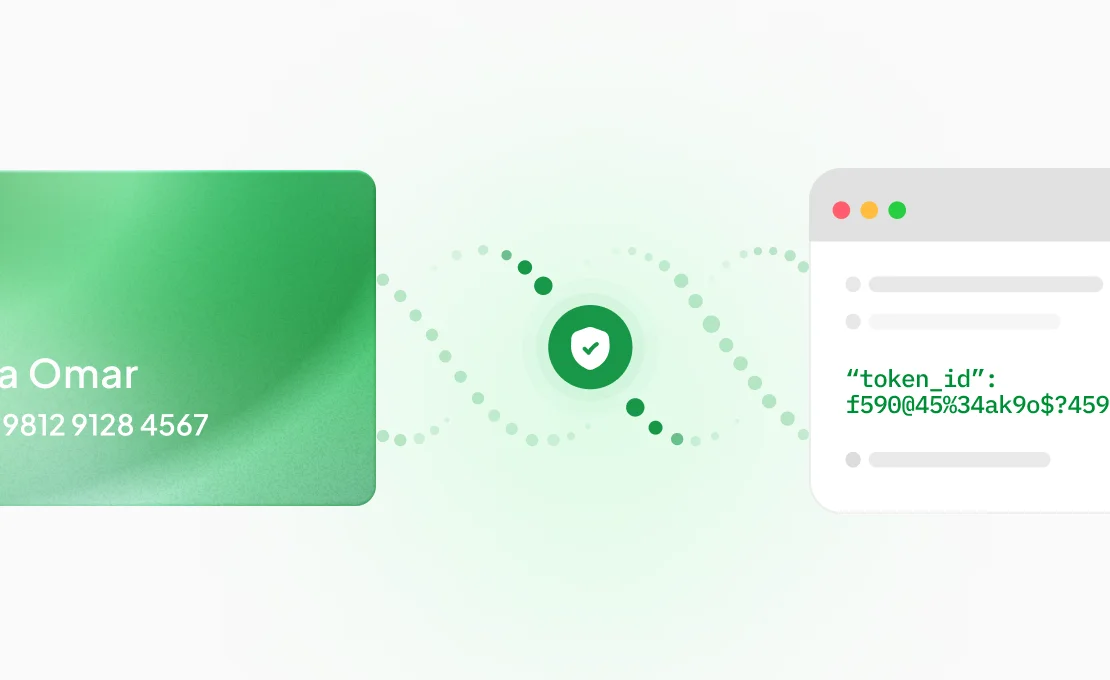

By automating repetitive tasks and providing real-time insights, Juspay frees up valuable resources that can be better utilized for strategic initiatives. Juspay’s robust security measures, including encryption, tokenization, and fraud detection, ensure that all transactions are protected from fraud and unauthorized access. This commitment to security provides businesses with peace of mind, knowing that their B2B payments are safe and compliant with industry standards.

Furthermore, Juspay is built to grow and change with businesses. The goal is to process payment as business needs change. By partnering with Juspay, businesses can unlock the full potential of their B2B payment operations, driving efficiency, reducing costs, and accelerating growth.