Unlocking the Power of Payment Networks: Your Ultimate Guide to Seamless Transactions!

In the dynamic landscape of the financial world, staying abreast of trends in payment networks is integral for businesses navigating the realms of electronic funds transfer and credit card transactions. The digital era has ushered in a paradigm shift in how funds move across individuals, businesses, and institutions. Payment networks, the conduits through which financial transactions flow, have witnessed a transformative evolution. From the rise of electronic funds transfer networks to the prominence of credit card networks, understanding the nuances of these systems is crucial for businesses seeking efficient and secure financial transactions. In this comprehensive guide, we will unravel the layers of payment networks, exploring their definitions, significant players, and, most importantly, their operational dynamics.

Before delving into the mechanics of payment networks, it’s imperative to recognise the major trends shaping their trajectory. The surge in digital transactions, the advent of innovative peer-to-peer payment networks, and the ever-expanding global reach of credit card networks are vital trends that underscore the transformative nature of payment systems. By grasping these trends, businesses can strategically position themselves within the intricate web of payment networks to optimise financial processes. As we embark on this journey through the world of Payment Networks, the goal is to equip businesses and individuals with a comprehensive understanding of these systems, empowering them to make informed decisions in an era defined by digital financial interactions.

Decoding Payment Networks: Unraveling the Tapestry of Modern Transactions

In the intricate web of financial transactions, a payment network serves as the connective tissue, facilitating the seamless flow of funds between individuals, businesses, and institutions. Payment Networks, as the term suggests, are organisational structures that enable and govern financial transactions. These networks encompass a diverse array of entities, including card associations and electronic funds transfer (EFT) networks, forming an interconnected framework within which funds are transferred securely and efficiently.

To grasp the essence of payment networks, it’s vital to understand the fundamental components that constitute these intricate systems. Payment networks comprise various participating entities such as credit card companies, banks, credit unions, and other financial institutions. These entities are interlinked through electronic networks, creating a channel through which funds can be transferred under a shared set of regulations and guidelines.

Key Characteristics of Payment Networks:

- Diversity of Participants: Payment networks bring together a myriad of financial entities, each playing a specific role in the transactional process. This diversity ensures a robust and inclusive framework for economic interactions.

- Electronic Connectivity: The backbone of payment networks lies in electronic connectivity. Transactions are not carried out through physical means but are orchestrated through digital channels, enhancing speed and efficiency.

- Regulatory Guidance: A shared set of regulations and guidelines govern the operations of payment networks. These standards ensure the security and integrity of financial transactions, instilling confidence in users.

Types of Payment Networks

Payment networks are not monolithic; they are categorised into distinct types, each serving specific purposes in the realm of financial transactions. The major categories include:

- Credit Card Networks: Dominated by industry giants such as Visa, Mastercard, Discover, and American Express, credit card networks facilitate the issuance and usage of credit cards, enabling consumers to make purchases with a deferred payment mechanism.

- Electronic Funds Transfer (EFT) Systems: These encompass a broad spectrum of networks, including Automated Clearing House (ACH) and wire transfers. EFT networks enable the electronic movement of funds between different financial institutions, bank accounts, or individuals.

- Peer-to-Peer (P2P) Payment Networks: Emerging as a disruptive force, P2P networks allow individuals to transfer funds directly without the intermediaries of traditional financial institutions.

- Automated Teller Machine (ATM) Networks: Familiar to all, ATM networks enable users to access their bank accounts for various transactions, from cash withdrawals to balance inquiries.

Demystifying the Major Payment Networks

In the ever-evolving landscape of financial transactions, major payment networks play a pivotal role in shaping how individuals and businesses exchange value. To navigate this complex ecosystem, it’s essential to demystify the workings of these influential networks. Let’s delve into the intricacies of the key players that dominate the payment network arena, shedding light on the processes that underpin their functionality.

1. Visa: Empowering Global Transactions

Visa, a household name in the realm of payment networks, stands out as a global leader. Facilitating a staggering 242 billion transactions in 2022, Visa has firmly established itself as a cornerstone of the payment infrastructure. Functioning as an open network, Visa collaborates with a multitude of financial institutions, allowing them to issue credit cards within its expansive network.

How Visa Works:

- Transaction Authorisation: When a customer initiates a purchase, the merchant’s point-of-sale system captures the relevant information and sends it to the acquirer.

- Issuer Authorisation: The merchant’s acquirer, in turn, requests authorisation from Visa, which then forwards the transaction to the customer’s issuing bank.

- Approval and Payment: Upon receiving authorisation, the issuing bank approves the transaction, and the payment is routed back to the merchant through the acquirer.

2. Mastercard: Orchestrating Secure Transactions

With a substantial 150 billion transactions in 2022, Mastercard stands shoulder to shoulder with Visa in the global payment network landscape. Similar to Visa, Mastercard operates as an open network, fostering collaboration with various financial institutions for the issuance of credit cards.

Mastercard Transaction Flow:

- Customer Purchase: The customer initiates a purchase from a merchant using a Mastercard.

- Authentication: The merchant’s point-of-sale system captures and securely transmits the customer’s account information to the acquirer.

- Authorisation Request: The acquirer requests authorisation from Mastercard by submitting the transaction details to the customer’s issuing bank.

- Transaction Approval: The issuing bank authorises the transaction, and the approval is relayed back to the merchant for payment processing.

3. American Express: A Closed-Loop Network

In contrast to Visa and Mastercard, American Express (AmEx) operates as a closed-loop network. This means that AmEx functions both as the payment network and the card issuer. While this model offers a more exclusive operating structure, it limits the network’s adoption compared to open networks.

Unique AmEx Operation:

- Transaction Lifecycle: AmEx handles the entire transaction process, from issuance to authorisation and payment. This closed-loop model provides a more centralised control mechanism.

4. Discover: Navigating Financial Horizons

Discover is another significant player in the payment network arena. Like American Express, Discover operates as a closed-loop network, managing the end-to-end transaction process. Discover’s prominence in the U.S. market positions it as a notable choice for consumers and businesses.

Discover’s Closed-Loop Operation:

- Transaction Initiation: Customers utilising Discover cards initiate transactions for goods or services.

- In-House Processing: Discover, as a closed-loop network, manages the entire transaction process internally, from authorisation to settlement.

5. UnionPay: A Global Force in Chinese Payments

While often overshadowed by its Western counterparts, UnionPay has emerged as a powerhouse in the Chinese payment landscape. With 213 billion transactions in 2022, it commands a significant share of the global payment network scene.

UnionPay’s Influence:

- Global Presence: UnionPay’s reach extends beyond China, making it a global player. It collaborates with international partners, facilitating transactions across borders.

Understanding the dynamics of these significant payment networks provides businesses and individuals with a roadmap for selecting the most suitable network for their financial interactions. The choice between open and closed-loop networks, as well as the global reach of networks like UnionPay, significantly impacts the efficacy and accessibility of transactions.

Know How Payment Networks Work

The seamless experience of swiping a credit card or conducting an online transaction often conceals the intricate web of processes orchestrated by payment networks. To unravel the complexity, let’s embark on a journey to understand the inner workings of these financial conduits, exploring the mechanisms that drive transactions and empower businesses and consumers alike.

1. In-Person Vs. Digital Transactions

In-Person (Card-Present) Transactions:

- Physical Point-of-Sale (POS): In a traditional in-person transaction, a customer engages with a physical point-of-sale system. This could involve swiping, inserting, or tapping their card on a payment terminal.

- Transaction Authorisation: The POS captures the customer’s account information and securely transmits it to the acquiring bank.

Digital Transactions (Card-Not-Present):

- Digital Tools and Payment Gateways: In the realm of e-commerce and digital transactions, customers utilise digital tools and payment gateways. These gateways serve as the digital counterparts to physical POS systems, facilitating secure communication between the customer, merchant, and payment network.

- Role of Payment Processors: Payment processors act as intermediaries, connecting merchants to payment networks. Payment gateways, a subset of payment processors, play a crucial role in communicating transaction details to both the cardholder and the merchant.

2. Transaction Approval Process

Key Players in Transaction Approval:

- Customer: Initiates a purchase, setting in motion a request to their card issuer for payment.

- Card Issuer (Issuing Bank): The financial institution providing the cardholder’s account sets security standards and verification measures. It is responsible for authorising transactions.

- Acquiring Bank: The bank maintaining the merchant’s account receives funds from the issuing bank after a transaction is authorised.

Transaction Flow in an Open-Loop System (Using Mastercard as an Example):

- Step 1: Customer Pays with Mastercard: The customer purchases from a merchant.

- Step 2: Payment Authentication: The merchant’s POS captures the customer’s account information and sends it to the acquirer.

- Step 3: Transaction Submission: The acquirer requests authorisation from Mastercard, forwarding the transaction to the customer’s issuing bank.

- Step 4: Authorisation Request: Mastercard submits the transaction to the issuer for authorisation.

- Step 5: Authorisation Response: The issuing bank approves the transaction, sending the response back to the merchant.

- Step 6: Merchant Payment: The issuing bank transfers the payment to the merchant’s acquirer, which deposits it into the merchant’s account.

3. Open vs. Closed Networks

Open Networks (e.g., Visa and Mastercard):

- Collaboration with Financial Institutions: Open networks allow various financial institutions to issue credit cards within their network. They operate as facilitators, relying on third-party institutions like banks for card issuance.

- Inclusive Model: Due to their open nature, these networks are more inclusive, engaging with a broad range of financial entities.

Closed Networks (e.g., American Express):

- Integrated Model: Closed networks act as both the payment network and the card issuer. This closed-loop structure means that the network manages all aspects of a transaction internally.

- Exclusivity: While offering a more centralised model, closed networks can be less inclusive due to their self-contained operation.

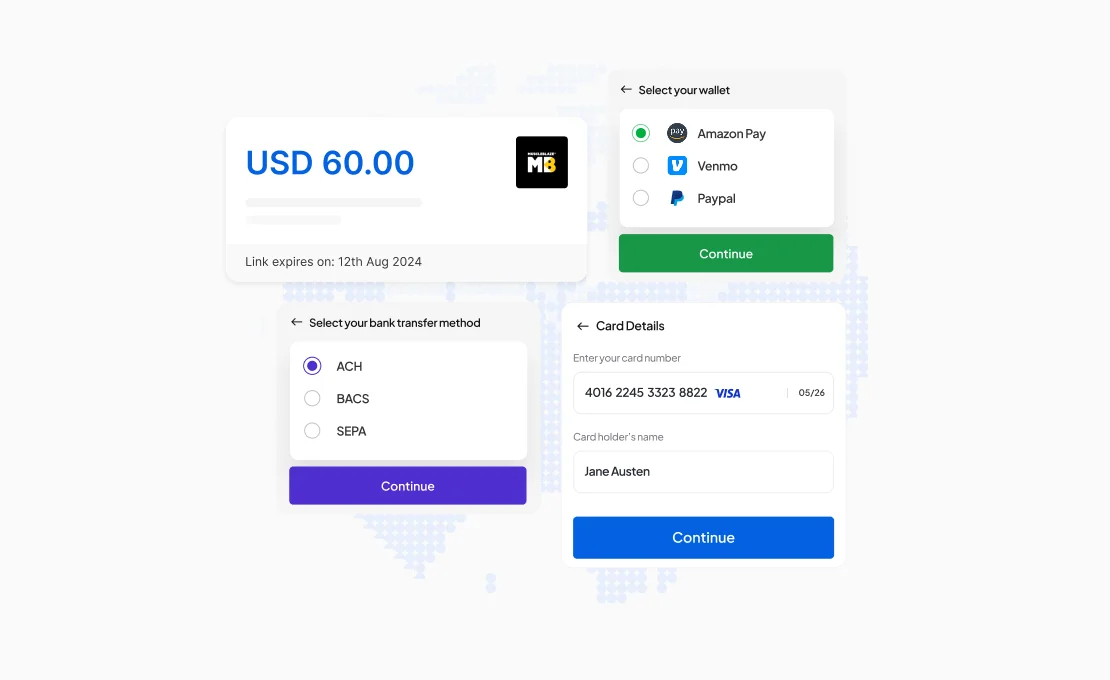

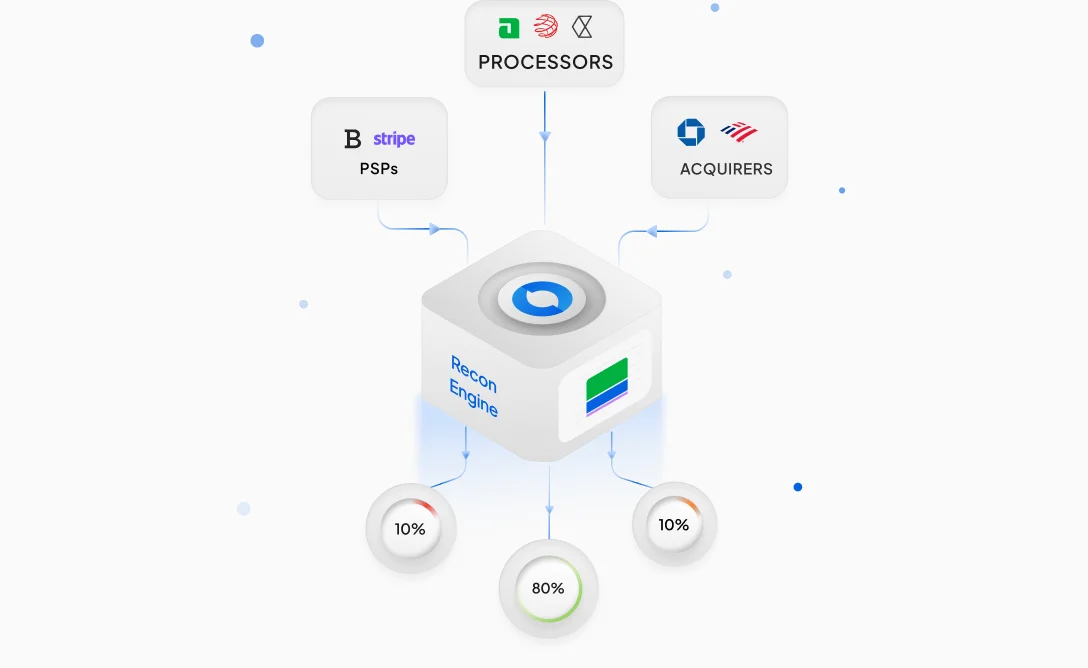

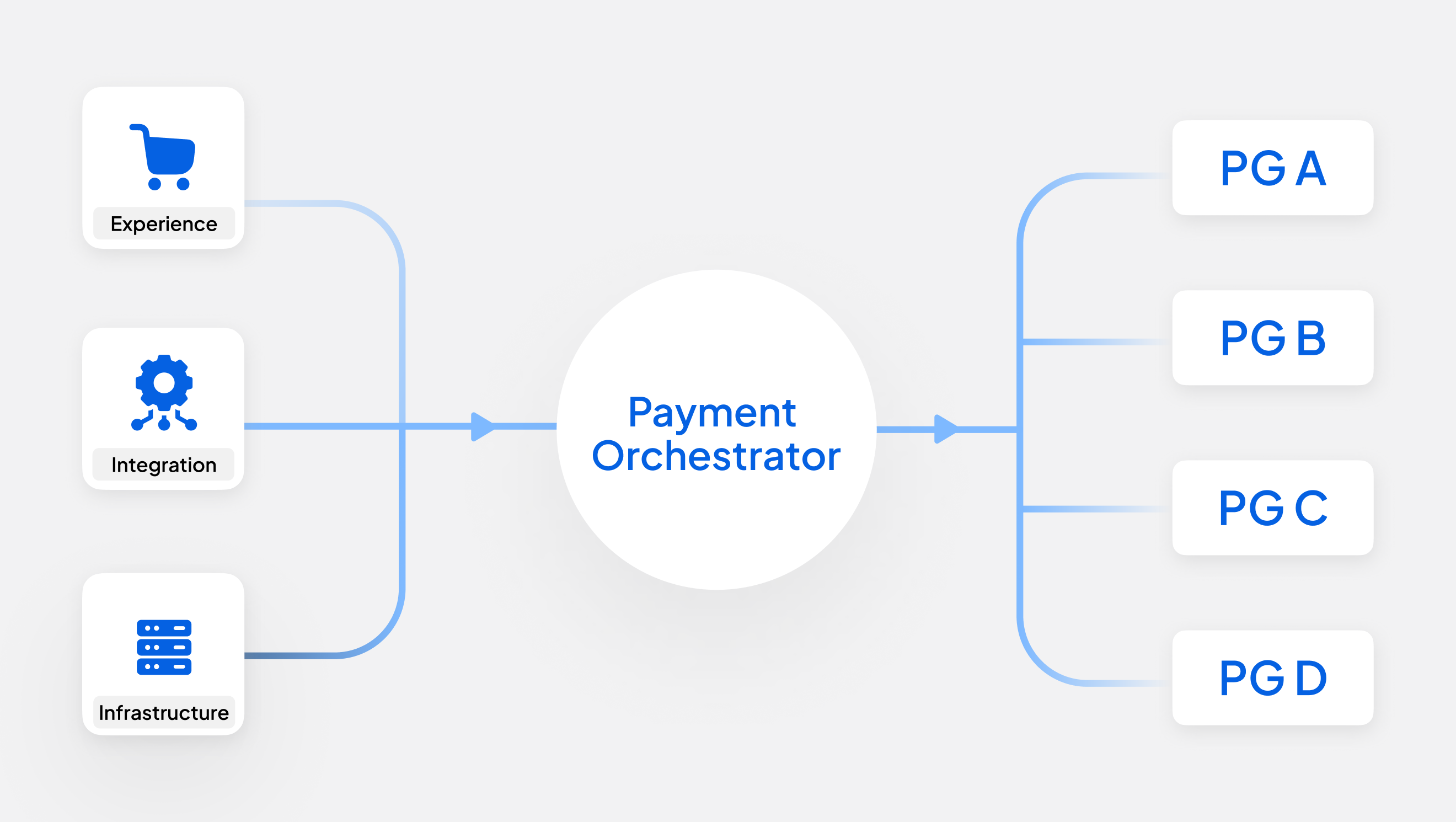

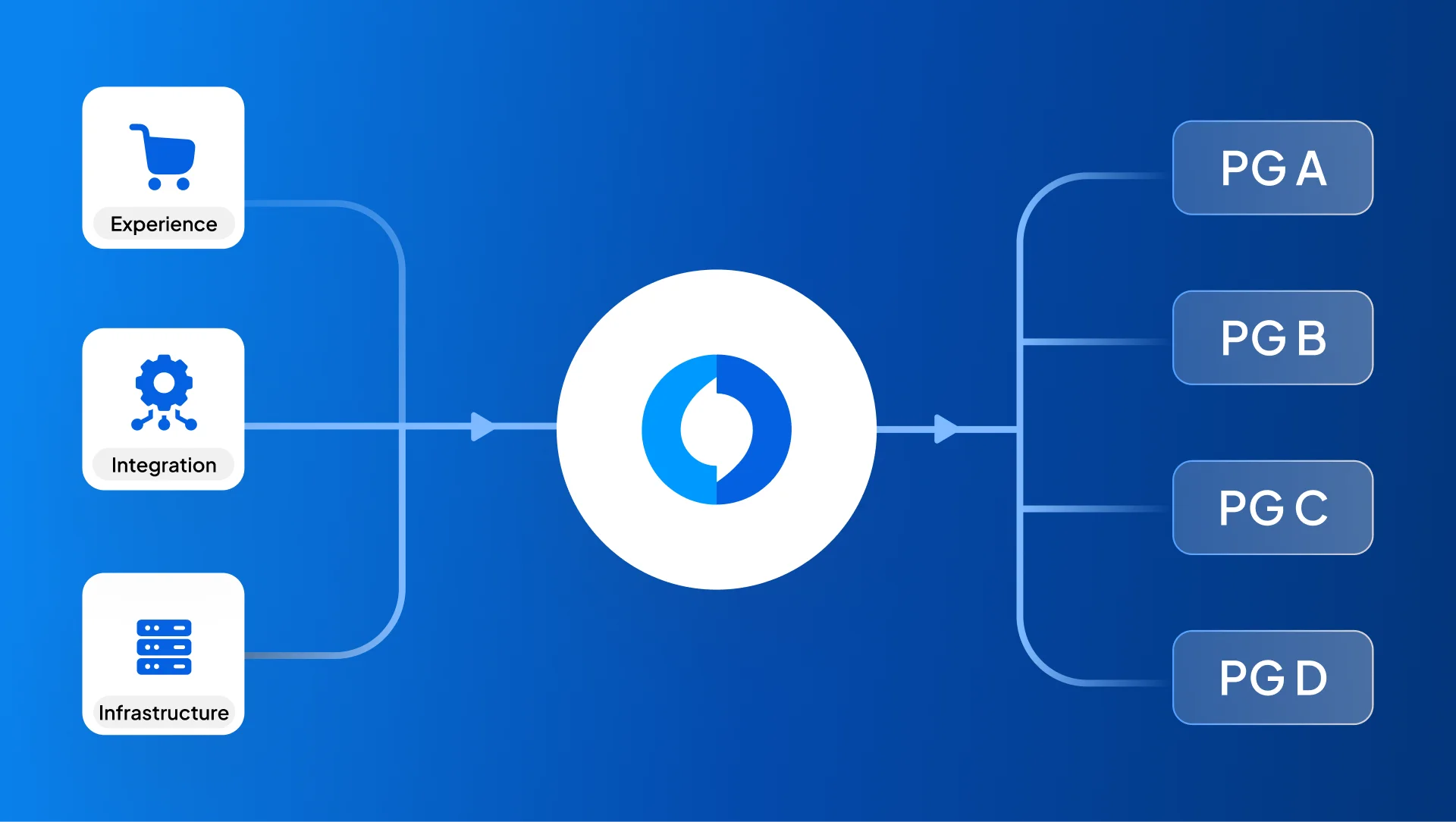

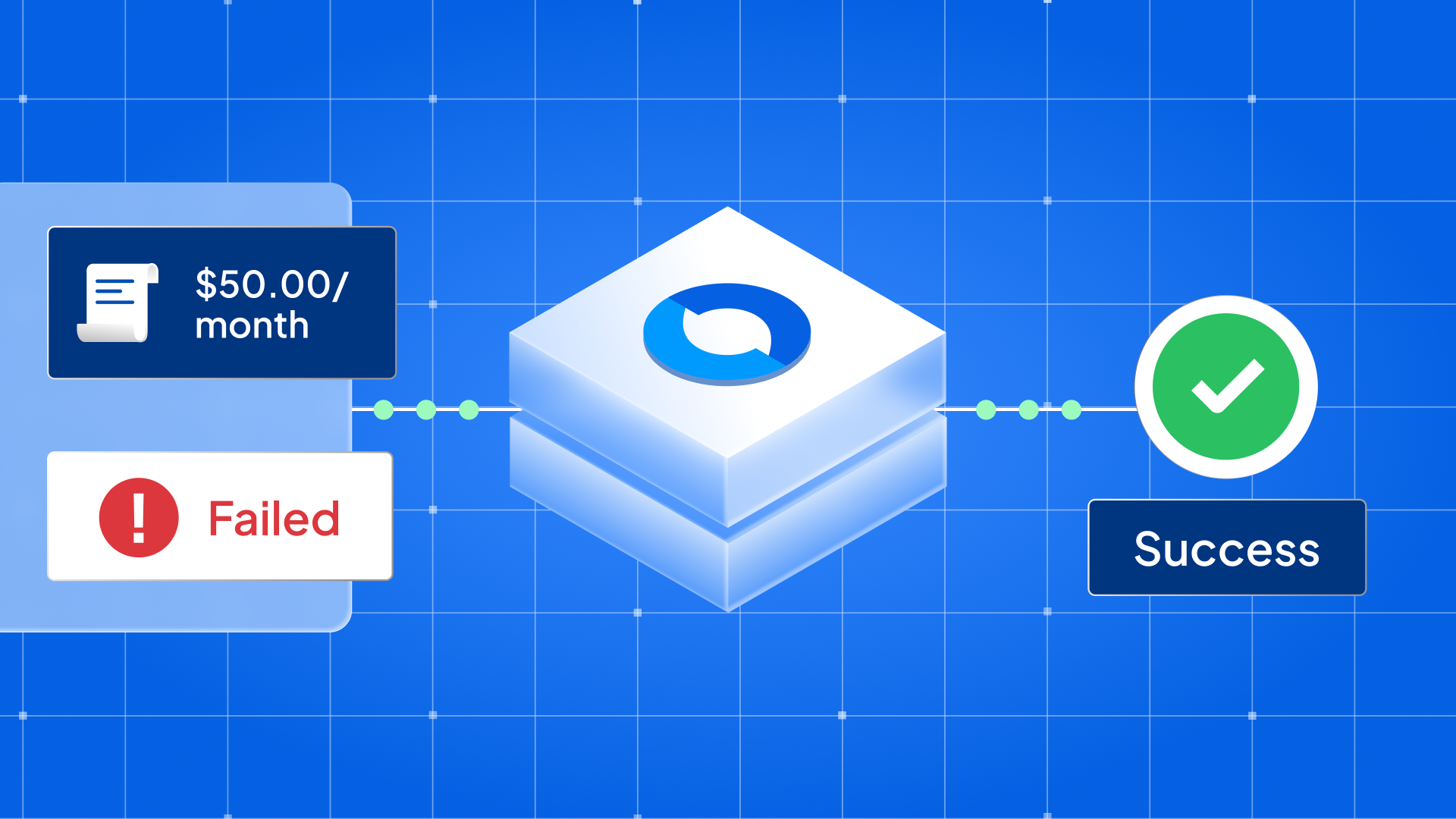

4. Role of Payment Orchestration Platforms

In the digital age, payment orchestration platforms play a vital role in simplifying the integration of card processing for merchants. These platforms not only streamline connections to card processing networks but also extend support for various payment methods, ensuring a comprehensive and secure payment solution.

Critical Aspects of Payment Orchestration Platforms:

- Integration with POS Systems: Merchants connect to card processing networks through acquiring banks, and payment orchestration platforms facilitate these connections.

- Support for Card and Non-Card Payments: Payment orchestration platforms go beyond card payments, offering integrations for a diverse range of payment methods.

- Enhanced Security and Compliance: These platforms provide robust support and security measures, keeping merchants’ payment systems compliant with the latest industry standards.

Understanding the intricacies of transaction processes, the distinction between open and closed networks, and the role of payment orchestration platforms sets the stage for businesses to navigate the dynamic landscape of payment networks effectively.

How does Juspay Harness the power of Payment Networks?

As we navigate the intricacies of payment networks, it’s essential to spotlight how Juspay are shaping the landscape of digital transactions. Juspay doesn’t merely participate in the realm of payments; it orchestrates a symphony of payment gateways to deliver a unified, seamless, and enterprise-grade payment experience. Let’s delve into how Juspay, operating as a Payments Operating System, leverages various payment networks to redefine the norms of transaction processing.

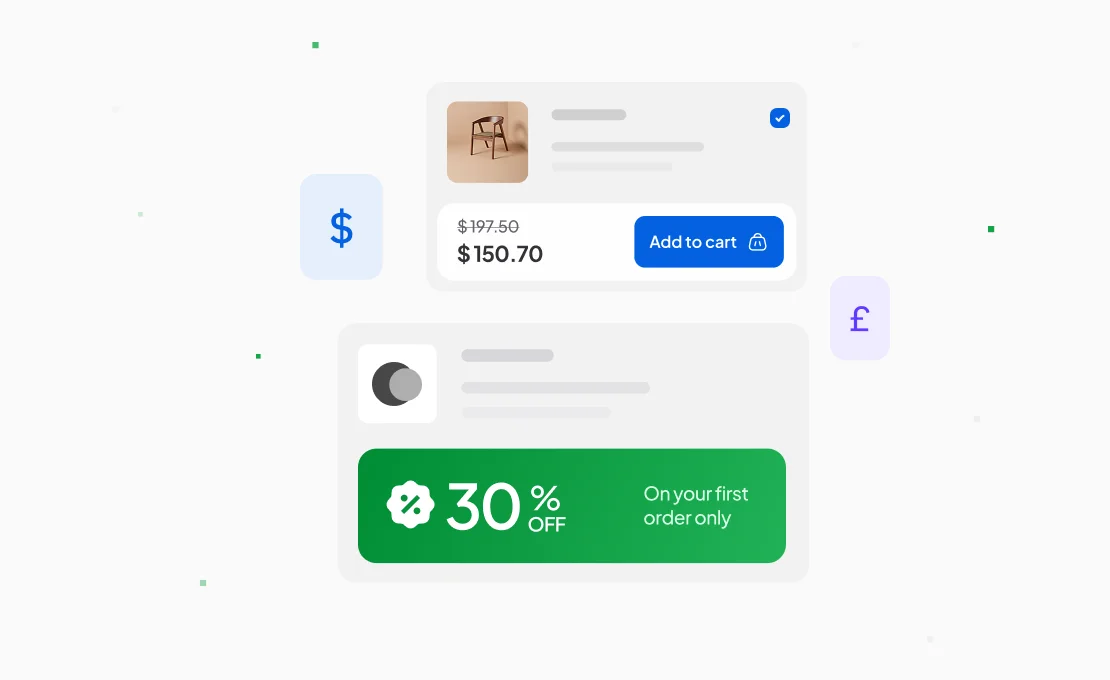

1.Unifying Payment Gateways for Seamlessness

In the multifaceted world of digital payments, the integration and compatibility of payment gateways play a pivotal role. Juspay’s approach revolves around unifying these gateways, creating a cohesive ecosystem that ensures a seamless experience for both merchants and consumers.

Key Features of Juspay’s Unified Payment Stack:

- Seamless Integration: Juspay streamlines the integration of diverse payment gateways, providing a consolidated platform that simplifies the complexities of managing multiple systems.

- End-to-End Solution: From the initiation of transactions to their completion, Juspay’s payment stack offers an end-to-end solution. This end-to-end approach enhances reliability and minimises potential points of failure.

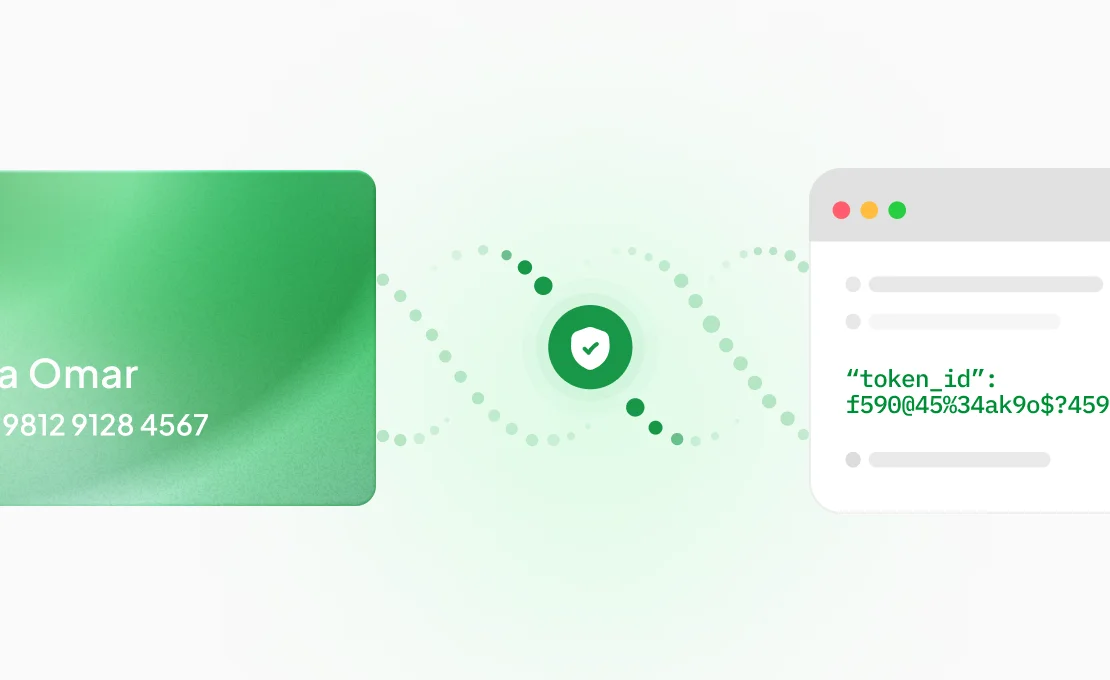

2. Prioritising Security and Reliability

The digital payment landscape demands stringent security measures to safeguard sensitive information and maintain consumer trust. Juspay, as a Payments Operating System, places a premium on security and reliability.

Security Measures Implemented by Juspay:

- Data Encryption: Juspay employs advanced encryption protocols to secure the transmission of payment data, ensuring that sensitive information remains confidential.

- Transaction Monitoring: Real-time monitoring is a cornerstone of Juspay’s strategy. By actively tracking transactions, the system can promptly identify and respond to any anomalies or potential threats.

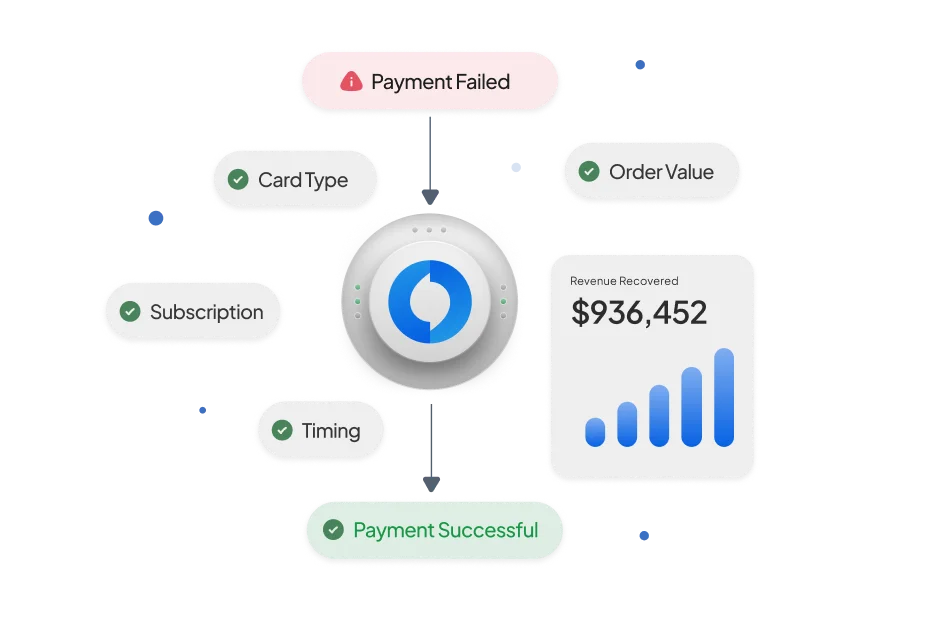

3. Enterprise-Grade Performance for Higher Revenue

For businesses, the efficiency and performance of payment systems directly impact revenue. Juspay positions itself as an enterprise-grade solution, aiming to elevate revenue streams while minimising costs.

How Juspay Enhances Revenue Streams:

- Reliability: An enterprise-grade system implies reliability. Juspay’s focus on reliability minimises transaction failures, reducing revenue loss attributed to technical glitches.

- Cost Optimisation: By unifying payment gateways and streamlining processes, Juspay contributes to cost optimisation. The result is a higher revenue-to-cost ratio for businesses.

Juspay’s unique positioning as a Payments Operating System brings a transformative dimension to the way businesses approach digital transactions. By understanding the nuances of various payment networks and the intricacies of transaction processes, Juspay optimises the payment journey for merchants and provides a secure and efficient experience for consumers. Juspay’s role in unifying payment gateways is not just a technical feat; it’s a brand commitment to delivering a superior payment experience. Through its seamless payment stack, Juspay enhances the relationship between merchants and customers, fostering trust and loyalty.

Conclusion

In the ever-evolving landscape of digital transactions, payment networks stand as the backbone of seamless and secure financial interactions. As we demystified the significant players-Visa, Mastercard, Discover, and American Express-it becomes apparent that these networks are not just conduits for transactions; they are architects of trust, reliability, and innovation. The intricate dance between issuing banks, acquiring banks, and payment processors is choreographed by these networks, ensuring that every swipe, tap, or click results in a harmonious financial transaction. The Payment Card Industry Security Standards Council, led by major networks like Visa and Mastercard, further fortifies the ecosystem, setting standards that prioritise the safety of cardholder information.

In this symphony of financial connectivity, emerging champions like Juspay redefine the narrative. Operating as a Payments Operating System, Juspay unifies payment gateways, bringing forth a seamless, secure, and enterprise-grade payment stack. As businesses strive for higher revenue and lower costs, the role of payment networks, exemplified by both industry giants and innovative disruptors, becomes increasingly pivotal. In this dynamic landscape, embracing the power of payment networks is not just a necessity; it’s a strategic imperative to thrive in the digital economy.

FAQs About Payment Networks

1. What is the Meaning of Payment Networks?

In finance, Payment Networks are the digital frameworks connecting entities for secure fund transfers. They dictate rules and pathways, ensuring smooth electronic transactions. These networks underpin modern payments, orchestrating processes for swift, safe fund movement between payers and payees. From credit card transactions to online purchases, payment networks play a pivotal role in shaping secure, efficient financial interactions.

2. Can you provide examples of Payment Networks?

Certainly! Prominent Payment Networks include Visa, Mastercard, American Express, Discover, and UnionPay. Visa, with its global reach, facilitates a vast number of transactions, while Mastercard and American Express offer extensive payment solutions. Discover is known for its U.S. presence, and UnionPay dominates in China. These networks create the infrastructure enabling electronic transactions and connecting financial institutions, merchants, and consumers worldwide.

3. Is UPI a Payment Network?

The Unified Payments Interface (UPI) has become a cornerstone of digital transactions, especially in the context of the burgeoning fintech landscape. However, UPI, or Unified Payments Interface, differs from traditional payment networks. While it facilitates electronic funds transfer, it operates within a specific national context, primarily in India. UPI serves as a platform that enables seamless fund routing and merchant payments but doesn’t fit the broader global scope of payment networks like Visa or Mastercard. UPI is more aptly described as a domestic real-time interbank electronic funds transfer system.

4. What is the Role of Networks in Payments?

Payment networks play a multifaceted role in the complex ecosystem of financial transactions. At their core, these networks act as facilitators, providing the infrastructure that enables the smooth flow of digital payments. They create and enforce the rules and pathways for authorising, verifying, and approving card transactions. Beyond this foundational function, payment networks, through entities like the PCI Security Standards Council, also set and enforce industry-wide security standards. By doing so, they ensure a secure environment for both in-person and digital transactions, protecting the sensitive information of cardholders.

5. What is the Largest Payment Network?

Determining the most prominent payment network involves considering various metrics, including transaction volume, global reach, and the number of cards issued. As of recent data, Visa has consistently held the position as the most extensive and widely used payment network globally. With a staggering 242 billion total card transactions in 2022, Visa outpaces its counterparts like Mastercard, American Express, and Discover. Visa’s expansive network, coupled with its acceptance in numerous countries and by countless merchants, solidifies its status as the largest payment network, facilitating a substantial portion of the world’s digital transactions.