In recent years, payment orchestration has become a hot topic, capturing the attention of a growing number of merchants. What lies behind this growing popularity, however, has been shifting significantly. While conventional definitions focus narrowly on the technical integration of multiple payment service providers (PSPs), it has become apparent that a more holistic approach was needed to address regional nuances and broader business needs.

In a Glance

What is payment orchestration?

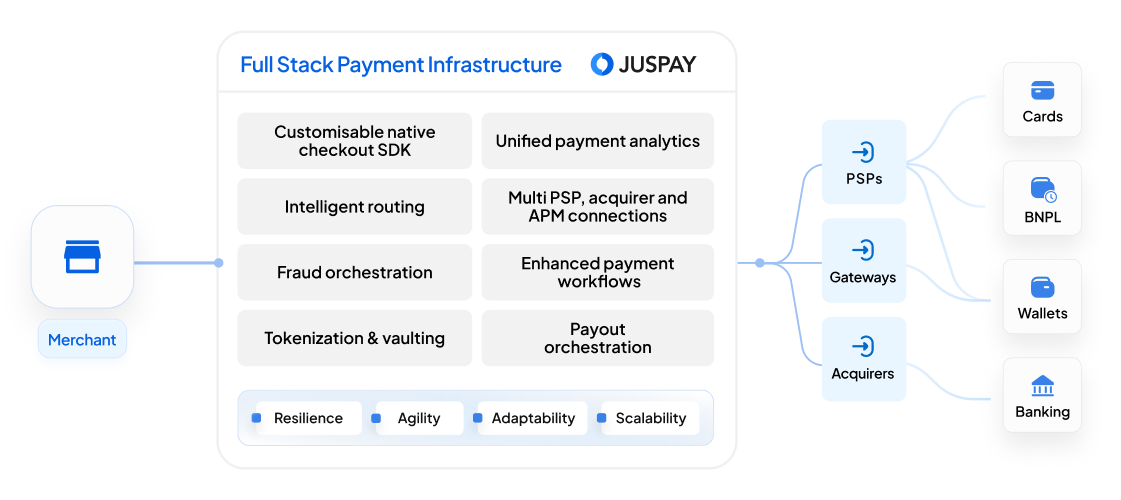

Payment Orchestration is a sophisticated payments operating system that connects with the merchant’s tech infrastructure, providing a unified layer that intelligently manages the entire payment lifecycle, from checkout to reconciliation. Payment Orchestration Platforms (POP) provide a unified integration layer which can power multiple components of the merchant’s payment ecosystem. This layer includes:

- Native Checkout Experience: Seamless, native checkout experience, personalized for each market & its customers

- Integration Engine: This allows merchants to integrate and manage various payment service providers (PSPs), acquirers, payment gateways, and other financial service providers through a single, unified, no-code platform. It is like a universal adapter that can connect to different types of electrical outlets.

- Routing Logic: Think of the routing logic as a traffic controller for payments. It determines the optimal path for processing transactions based on predefined rules and real-time data, such as cost, success rates, auth rates, performance, fraud, chargeback rates, contract commitments and regional regulations. This ensures that each transaction is processed through the most efficient and cost-effective channel.

- Unified Analytics and Reporting: This component provides businesses with a dashboard to monitor their payment stack performance across various dimensions like PSPs, Payment methods, FRM providers etc. It offers valuable insights and data on transaction trends, success rates, auth/acceptance rates, and other key metrics, enabling businesses to identify areas for improvement and optimize their payment strategies. Furthermore, it makes payment operations seamless with automated reconciliations, chargeback & refunds management and much more.

- Security Measures: Security is paramount in payment processing. The POP incorporates robust security measures, like tokenization and encryption to ensure compliance with industry standards, such as PCI DSS, and protect sensitive customer information. This acts as a safeguard against fraud and data breaches.

All these aspects of payment orchestration come together to enhance and optimize payments to meet their business objectives of improving conversions, optimizing payment fees & operational costs, and serving diverse customer preferences.

Payment Orchestration landscape

The underlying mechanisms of payment orchestration trace back to the early days of digital payments. As e-commerce grew, digital merchants were among the first ones to seek ways to streamline payment processes, leading to the development of various technologies and solutions for integrating multiple payment gateways. The evolution of APIs in the early 2000s further propelled payment orchestration, allowing merchants to connect seamlessly with different payment service providers.

Yet, many of the early implementations introduced a challenge, they lacked agility and scalability. They were initially shaped for large businesses, designed to meet their specific needs, and relied heavily on a limited selection of global payment service providers, focusing primarily on card transactions. As new PSPs entered the scene and the payments ecosystem became more diversified, these solutions needed to adapt to support a wider range of payment methods, providers, and related value-added services to meet the evolving merchant requirements.

The conventional approaches to orchestration often overlooked regional payment differences, consumer behavior, along with the varied fraud patterns and local regulations. Ultimately, this gap hampered merchants' effectiveness in addressing unique market challenges, limiting their ability to optimize costs, improve operational efficiency, and capitalize on opportunities for business growth.

As the market for payment orchestration grows, the payment orchestration platforms have built the capabilities to solve these issues by integrating with the local PSPs to offer a wider range of payment methods, they have also started offering related value-added services like hosted checkout, subscription module, card vault, etc.

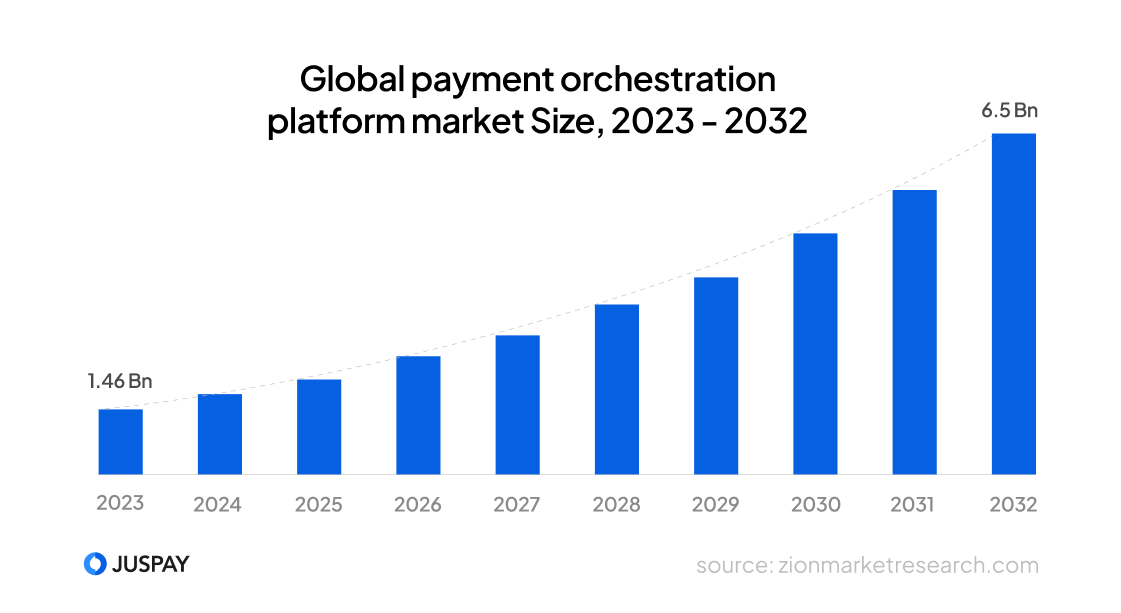

Today, the global payment orchestration market generates an yearly revenue of 1.46 Billion $ and is expected to grow at a CAGR of approximately 19.5% and reach 6.5 billion $ in 2032.

Market Nuances and Pain Points

Regional dynamics strongly shape country-specific trends. It is increasingly clear today that an effective payment orchestration strategy must be tailored to meet the unique needs of each market, rather than relying on a one-size-fits-all approach. A major challenge for merchants across regions is balancing payment process friction with customer preferences. Inefficiencies and unmet expectations often lead to passive churn—a widely recognized industry challenge where an estimated 30% of transactions fail due to declines—resulting in revenue loss and reduced customer loyalty.

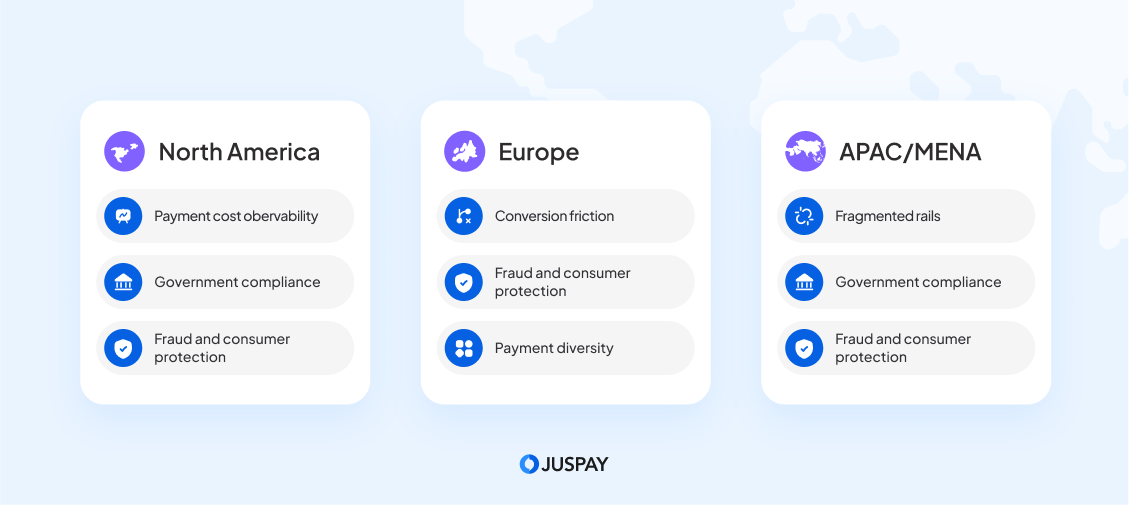

At Juspay, we also see distinct regional factors shaping market dynamics and highlighting unique regional pain points.

United States

The US is a market that continues to be driven by legacy payment infrastructure and very much dominated by credit and debit card payments in terms of consumer-to-business transactions. Along with high card usage, we are seeing a rise in the popularity of ACH transfers, particularly due to the adoption of real-time payments and the emergence of mobile payment apps. All forms of credit payments are more prevalent in this market, along with the growing interest in Buy Now, Pay Later (BNPL) options. Consequently, merchants face several key challenges:

- Transaction costs. US merchants have to navigate higher transaction costs associated with cards (and indeed ACH) compared to other developed economies. In fact, according to a 2023 report, U.S. merchants face the highest card acceptance costs globally, with a 34% increase since 2009, driven largely by the growth of e-commerce. These higher costs stem from elevated interchange rates and the lack of regulatory caps on credit card fees, unlike in Europe.

- Regulatory complexity. Integrating modern payment solutions with legacy systems is a challenge in itself, especially when navigating complex federal and international regulations, such as AML and PCI DSS, all while staying aligned with the card network mandates.

- High fraud rates. The fraud landscape in the US market mirrors the global trend of rising e-commerce payment fraud rates, but it also faces challenges unique to the region. The US accounts for 42% of fraud by value, significantly higher than Europe’s 26%. This disparity emphasizes the need for both merchants and payment providers to prioritize security measures in light of rising cyber threats.

Europe

The European payments market is one that has been traditionally better served by payment orchestrators since it has been highly developed both in terms of infrastructure and regulatory frameworks, particularly around card payments. The regulatory initiatives aimed at boosting competition like the PSD2 directive and Interchange regulation have fueled a strong shift toward local payment methods. This shift, along with the diversity of currencies and customer preferences, has contributed to the further fragmentation of payment rails.

Merchants operating in European markets face the challenge of meeting heightened consumer expectations while managing complex regional regulations and the necessity for cross-country and cross-currency processing.

Typical challenges for European merchants are:

- Local and alternative payment methods. Cards and standard bank transfers can no longer be assumed as default payment options, with the rising adoption of digital wallets and other alternative instruments. Yet, amid this diversity, consumers expect seamless cross-border payment experiences, perhaps now more than ever.

- Reducing friction. Merchants must also balance security with user experience, particularly given stringent authentication requirements. In particular, with 3DS implementation causing friction for merchants, the ongoing challenge of fraud prevention versus user convenience has led to innovations like Click-To-Pay and PassKeys to enhance merchant and customer experiences.

- Chargebacks. Reducing chargeback rates is another core challenge for merchants, due to increased protections for both payees and buyers. This involves finding effective ways to address both customer protection and fraud prevention, especially as account-to-account (A2A) transactions through Open Banking and other payment channels with fewer built-in consumer protections become more prevalent.

APAC & MENA

While otherwise heterogeneous, APAC and MENA markets share some key characteristics that often trip global players off - particularly those originating from Europe or the US. Driven by rising mobile adoption and targeted government initiatives, some countries across APAC and MENA are embracing fast, innovative local payment methods, often bypassing traditional banking systems. This shift is creating an increasingly digital-first payment landscape, steering market participants toward localized solutions rather than conventional payment infrastructures.

As a result, we see several key challenges in these markets, including:

- Fragmentation of payment methods and rails. Merchants face a fragmented payment ecosystem with numerous local providers. The dominance of mobile payments, domestic A2A schemes and other unique payment methods (including cash-on-delivery) implies that relying solely on local card acquiring is insufficient for maximizing acceptance and conversion.

- Cultural and behavioural diversity. Merchants' payment teams must account not only for these technological complexities but also for the diversity within local populations, including the varying levels of digital literacy, as well as the regulatory landscape.

- Significant government presence in the ecosystem. Stringent compliance requirements driven by national policy agendas are common across both regions, which in a country like India for example include data localisation laws and strong customer authentication mandates. This reflects the substantial government investments in digital and payment infrastructure.

Why do businesses need payment orchestration?

A Payment Orchestration Platform is a service provider offering an additional layer to the merchant's payment stack. It essentially works as an extension to the merchant’s payments team. A payment orchestration provider offers multiple tech services, allowing merchants to optimize their payments as per the needs of their ever evolving customer needs..

In today's fast-paced world, payments are constantly changing. To excel in this environment, merchants must enhance their payment operations and deliver the best possible payment experience to their customers. This is where payment orchestration comes in and here's why merchants need it:

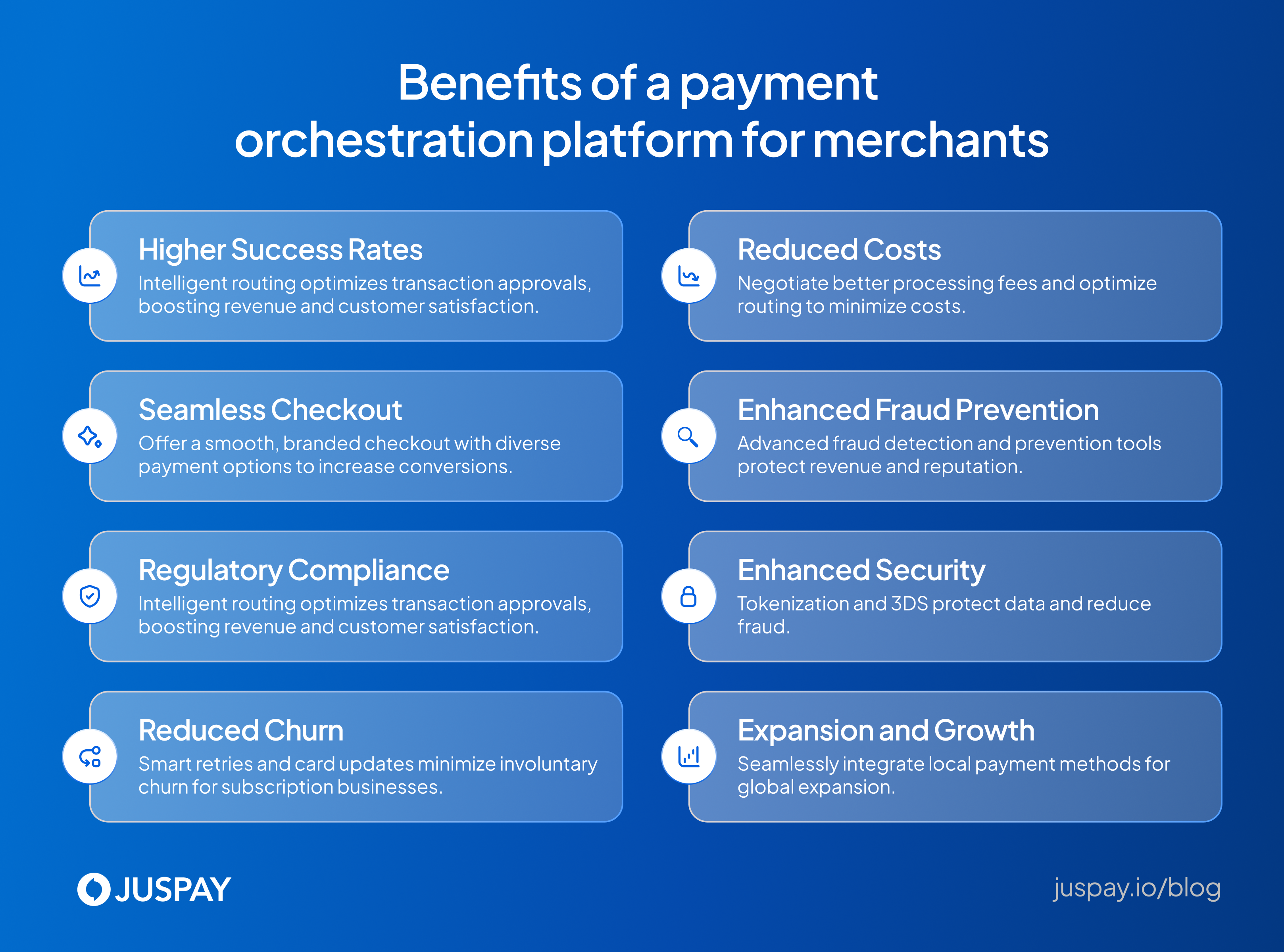

- Higher Success Rates: Payment orchestration platforms intelligently route transactions through the most reliable payment gateways and acquirers, based on factors like the cost, authentication rates, performance, fraud, chargeback rates, contract commitments etc. This dynamic routing boosts revenue for the merchants and enhances customer experience by minimising transaction failures.

- Reduced Payment Processing Costs: Payment orchestration enables merchants to minimize transaction fees by intelligently routing transactions. This leads to significant cost savings, especially for high-volume merchants.By using multiple payment providers through a unified platform, merchants can also negotiate for lower payment processing fees.

- Seamless Checkout Experience: Payment orchestration helps merchants boost conversion by offering a custom-branded checkout that feels native. Merchants can cut down on abandoned carts and increase sales by providing customers with multiple payment options (including local payment methods from different regions) and ensuring transactions are quick and safe. An advanced payment orchestration provides other value-added services, such as a 360-degree offers engine system that lets merchants show targeted promotions at checkout, leading to more sales conversions and customer satisfaction.

- Enhanced Fraud Prevention: Payment orchestration platforms provide advanced fraud detection and prevention mechanisms to the merchants. This helps merchants lower their risk of fraud and chargebacks protecting their money and reputation.

- Meeting Regulatory Compliance:Payment orchestration platforms help merchants comply with various industry standards and rules, like PCI DSS. This ensures safe payment processing and lowers the risk of penalties and fines.

- Enhanced Security: Payment orchestration providers also offer tokenization and secure card vaults to protect sensitive card info, while smart 3DS and decoupled authentication/authorization lowers fraud risk. Seamless authentication options like out-of-band and payment passkeys streamline the checkout process.

- Flexibility and Scalability: Payment orchestration provides merchants the ability to adapt to changing market conditions and what customers demand. They can add or remove payment options when they need to and grow their payment operations as their business grows.

- Expansion and Growth: Payment orchestration enables merchants to integrate with local payment methods, gateways, acquirers seamlessly, with minimal dev efforts which enables merchants to expand into new markets.

- Reduced Churn: For subscription businesses, payment orchestration platforms reduce involuntary churn with smart retry logic that reduces payment failures by considering factors like decline codes, payment methods, and regional patterns, and automatic card-on-file updates to prevent churn from expired cards.

How does payment orchestration work?

Payment orchestration streamlines the often complex process of managing various payment providers and optimizing payment flows. Here's a breakdown of how it works:

1. Centralized Platform: At its core, payment orchestration involves a centralized platform that integrates with multiple payment gateways, processors, acquirers, and other payment-related services. This platform acts as a single point of contact for managing all payment operations.

2. Transaction Initiation: When a customer initiates a payment, the orchestration platform intelligently determines the optimal route for the transaction . This decision is based on predefined rules and real-time data, such as cost, success rates, customer preferences, and regional regulations .

3. Dynamic Routing: The platform's routing logic analyzes various factors, including the customer's location, transaction amount, currency, and payment method, to select the most efficient and cost-effective payment gateway and acquirer for processing the transaction .

4. Payment Processing: Once the optimal route is determined, the platform securely transmits the payment information to the selected payment processor . The processor then communicates with the issuing bank to verify and authorize the payment .

5. Fallback and Retries: If the initial payment attempt fails, the orchestration platform can automatically retry the transaction through a different gateway or acquirer . This fallback mechanism helps improve authorization rates and minimize failed transactions.

6. Reconciliation and Reporting: The platform automatically reconciles transactions and provides merchants with comprehensive reports on their payment performance . This data helps merchants identify areas for improvement and optimize their payment strategies.

7. Security and Compliance: Payment orchestration platforms incorporate robust security measures, such as tokenization and encryption, to protect sensitive customer data and ensure compliance with industry standards like PCI DSS ..

To build or to buy a payment orchestration platform

As a merchant, choosing between a Payment Orchestration Provider (POP) and building an in-house payment orchestration platform is a crucial decision with significant implications for your business. Here's a detailed analysis of both approaches:

Opting for a payment orchestration provider is quicker to set up, requires less technical expertise, and can provide specialized knowledge and experience in payment orchestration. A full-stack payment orchestration solution like Juspay can also provide merchants with value added services like an offers suite, card vault, token orchestration, adaptive 3DS, decoupled authentication & authorization, etc.

While in-house payment orchestration platforms can provide more control over the systems and security, they require a significant investment of time, money, and technical expertise. This can pull focus away from your core business activities. However, it's worth noting that modern payment orchestration platform providers like Juspay Hyperswitch, offer robust security and compliance, making them a strong alternative. Juspay Hyperswitch is an independent, open-source and composable solution that is built to offer utmost control to the merchants.

The best choice depends on your specific needs and resources. If you need a fast and cost-effective solution with expert support, a payment orchestration provider is the ideal option. If you have the time & resources and need a highly customized solution with complete control over the systems, building in-house might be better.

The Future? An Infrastructure-Led Approach to Payment Orchestration

The complexity of the global markets demands a nuanced approach to payment orchestration, one that goes beyond technical integration to address regional nuances and unique challenges.

As mentioned, from the outset, orchestration platforms commonly tackled different barriers, primarily revolving around integration to gateways. The increasing complexity of global markets calls for a more sophisticated approach to payment orchestration—one that transcends technical integration to address regional nuances, regulatory compliance, customer preferences, and align with broader business objectives.

These regional nuances, regulatory compliance and customer preferences demand a system where the merchants have utmost control over their payments infrastructure to provide a seamless experience to their end users, this is where an open source payment orchestration platform thrives.

An open source payment orchestration solution like Juspay Hyperswitch enables merchants to build their own payments stack and only rely on the service provider for support and enhancements or outsource PCI compliance to them.

These systems enable merchants to partner with a payment orchestration provider now and seamlessly transition to an in-house system later. Along with this, these payment orchestration provider enables merchants to use modern ways like code evaluation and self-deployment to evaluate the product end-to-end in hours rather than month long RFPs

Juspay, Redefining the Paradigm in Payment Orchestration

Merchants are increasingly turning to payment orchestrators as strategic partners. Rather than focusing solely on gateway integration, a modern orchestration platform today must prioritize capabilities that improve success rates, optimize local payment setups, and enable merchants to scale efficiently in a globally diverse marketplace.

This shift is redefining the role of orchestration in commerce, moving it from a technical layer for payment gateway and PSP integrations to a full-stack payment infrastructure that encompasses elements such as:

- Powering the Checkout Experience

- Intelligent Routing to Uplift Authorization Rates and Optimise Costs

- Fraud Orchestration & Token Vault

- Adaptive 3DS & Retry Payment Workflows

- Unified Payment Analytics and Operations

- Reliable, Scalable and Performant Payments Infrastructure

And more…

This is precisely the foundation of how we approach the orchestration infrastructure at Juspay. Our platform emulates the transformative role AWS plays in cloud computing, while our vision is to deliver seamless, secure, and adaptable payment solutions that blend global reach with a deep understanding of local market needs. We are supporting merchants in building payment frameworks that are both globally scalable and regionally sensitive—ushering in a new paradigm shift in payment architecture.