If you are a business collecting payments online from your customers, you might be aware of the term payment routing.

Online payments have come a long way! The availability of a wide range of payment options has made it harder for merchants to keep up with customers’ preferences. Today, 100+ Payment Aggregators (PAs) & Payment Gateways (PGs) enable merchants to accept payment through different payment modes. However, integrating with multiple PAs & PGs incur a lot of operational costs. This is where a payment router/orchestrator comes into the picture. Let’s explore payment routing: its purpose, evolution, and how it aids online businesses in optimising payments.

Understanding Payment Routing

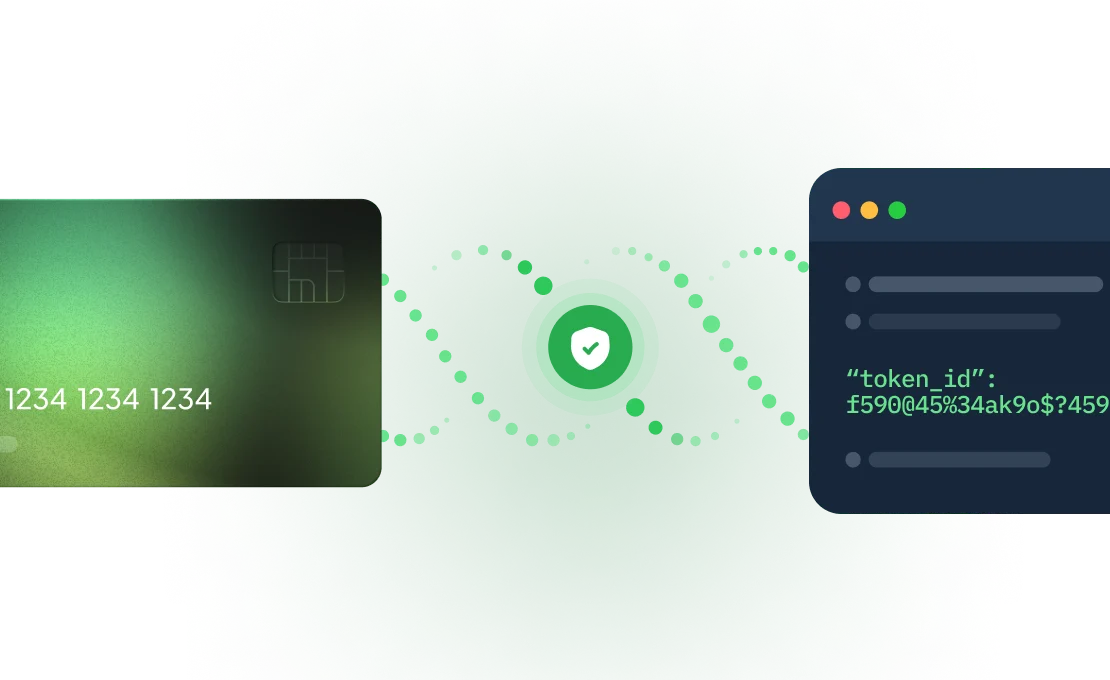

As the name suggests, payment routing defines the path/route of every transaction initiated on the merchant’s website or mobile application. A payment router connects a merchant’s website/app with different payment service providers (PSPs), acquirers, and banks on a single, unified software layer. This involves integrating and managing the entire payment process, including payment authorisation and transaction routing.

A payment router enables merchants to manage their payments efficiently within one platform rather than handle a multitude of integrations with different PSPs, helping them scale efficiently. With payment routing, businesses have the flexibility to enter new markets, integrate various payment providers, and accept payments through a wide range of payment modes, all without the burden of compliance with relevant regulations.

How Does Payment Routing/Orchestration Work?

Whenever a customer initiates a payment on a merchant website or an app, it goes through a set flow. These complex payment flows involve multiple steps, sometimes leading to payment failure. Payment routing identifies the best available route for a transaction and guides the payment through that route to minimise payment failure.

A payment router uses intelligent/dynamic payment routing to identify the best payment service providers available and routes transactions accordingly to reduce drop-offs and boost payment success rate.

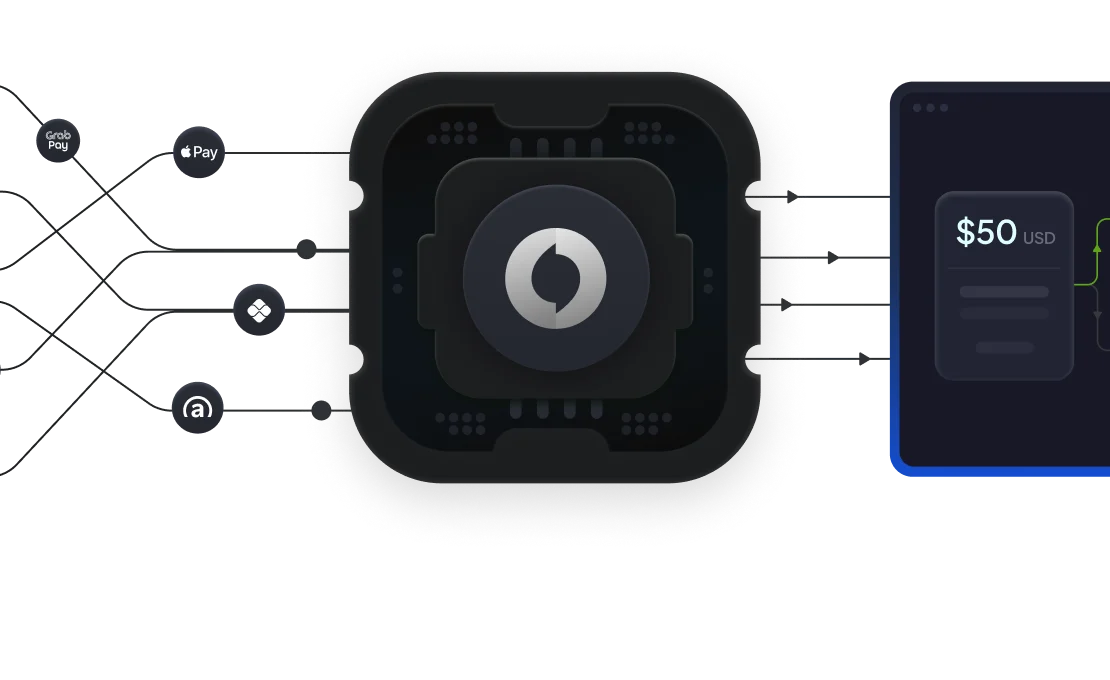

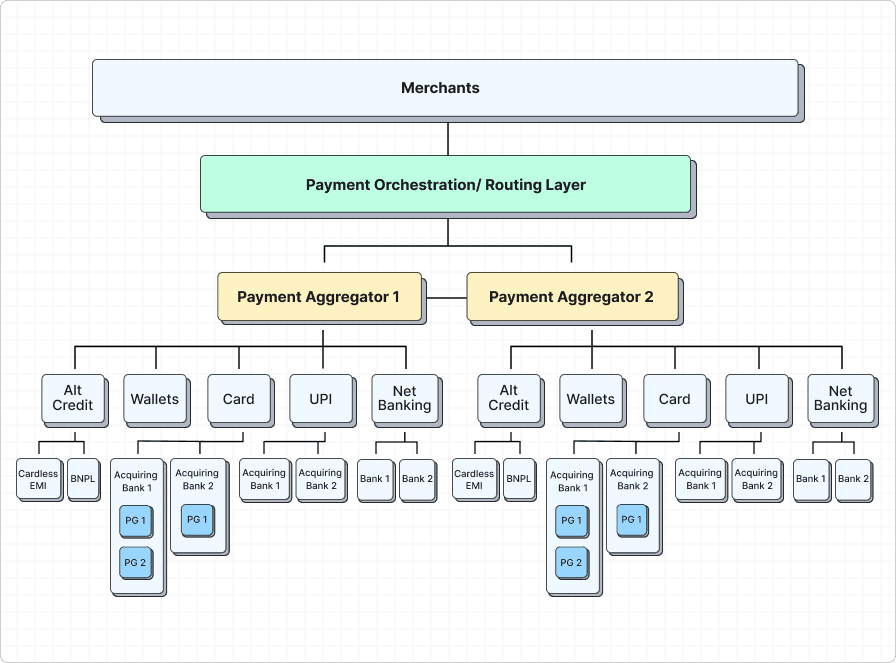

Here’s an illustration of the payment integration flow for a merchant -

In this scenario, a merchant is connected to two payment aggregators. Suppose the success rate of card transactions drops with the first payment aggregator due to an outage. In that case, the payment router/orchestrator will detect the issue and reroute all card transactions through the second payment aggregator.

Exploring the Types of Payment Routing

There are two types of payment routing that businesses can adopt. Businesses can also choose to adopt a hybrid payment routing model combining both types of payment routing:

- Intelligent Payment Routing

Intelligent payment routing uses advanced algorithms and real-time data analytics to route payments through multiple payment service providers (PSPs). Intelligent payment routing dynamically selects the most optimal path for each transaction. This method considers various factors such as network conditions, transaction volume, outage, etc., allowing businesses to maximise efficiency and payment success rate.

Intelligent payment routing analyses the performance of various PSPs to offer businesses a flexible and responsive solution. It plays a vital role in today’s fast-paced digital economy, where transactions demand speed, cost-effectiveness, and security. By understanding and implementing intelligent payment routing, businesses can optimise their payments for better success rates and scale efficiently.

- Static Routing

Static routing involves the use of pre-configured, fixed paths for processing transactions. Static routing is useful in business decisions based payment routing. However, static routing doesn’t have the capability to adapt to dynamic changes in transaction patterns or network conditions.

Businesses employing static routing should carefully assess their needs and implement a hybrid payment routing model that involves static routing for business decisions based routing and dynamic/intelligent payment routing to optimise payment success rates.

Payment Routing During the Transaction Flow

Product / service information collection

A payment router can route a transaction based on the product/service-related details selected by the customer. For instance, an e-commerce business may choose to route electronics category transactions and fashion category transactions through different PSPs due to the difference in ticket size.Transaction Information Collection

Payments can also be routed during the payment information collection phase. This includes details such as the amount being transferred, the identities of the payer and payee, or any additional transaction-specific data. For example - If a customer is paying his health insurance premium on an insurer’s portal and the amount exceeds 1 lac, the payment router will guide that transaction to a particular payment service provider.Transaction Initiation

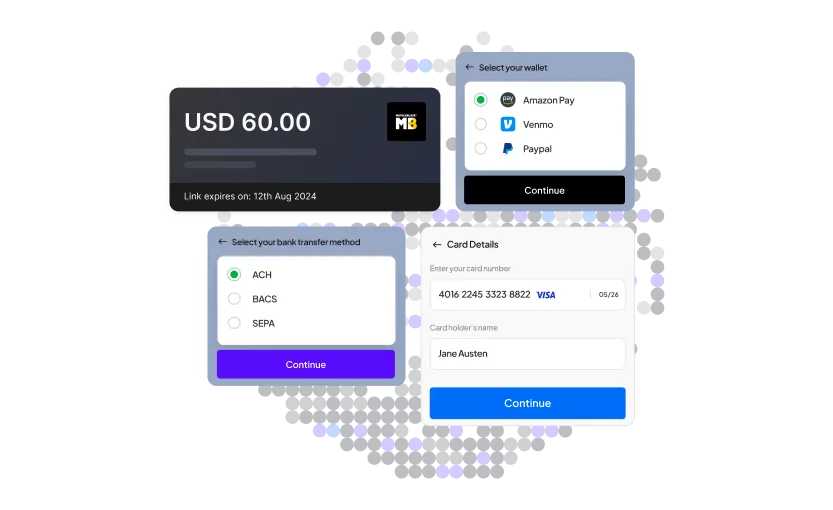

This is the most important step during a transaction flow where the payment needs to be routed. Once a customer is on the payment page, the transaction can be routed based on the payment mode selected by the customer. This is where intelligent payment routing plays a vital role, as it finds the best route for a specific payment method like debit/credit cards and directs the transaction accordingly.

Advantages of Payment Routing

Increased revenue

Payment routing platforms streamline end-to-end payments and improve customer experience, boosting sales, which leads to increased revenue. With increased success rates, more transactions cross the finish line, giving customers a superior payment experience and leading to higher NPS for businesses.Seamless Payment Integrations

A payment routing layer enables merchants to work with multiple PSPs with a single integration, drastically reducing the integration time and effort. For example, if a merchant wants to enable a specific wallet for its customers. He doesn’t need to integrate with the wallet separately, as the payment router is already integrated with the wallet.Diverse Payment Methods

One of the significant advantages of payment routing platforms is that they enable merchants to accept payments through a wide range of payment methods. Businesses can easily add new payment methods as a plug-and-play with a payment router. This is ideal for companies with customers who have diverse payment preferences, such as credit or debit cards, mobile wallets, or “Buy Now, Pay Later.”Superior Customer Experience

A complicated or lengthy checkout process often leads customers to abandon their carts. Payment routing platforms can help reduce cart abandonment by simplifying the checkout with features like automated OTP entry, saved cards, intelligent retries, and various payment options.Lower Payment Processing Costs

As organisations grow, they often need to connect with multiple providers, which can be costly to set up and maintain. However, a payment orchestration platform can help reduce these costs by directing transactions to processors with the lowest fees.

Route Your Transactions Hassle-Freely with Juspay

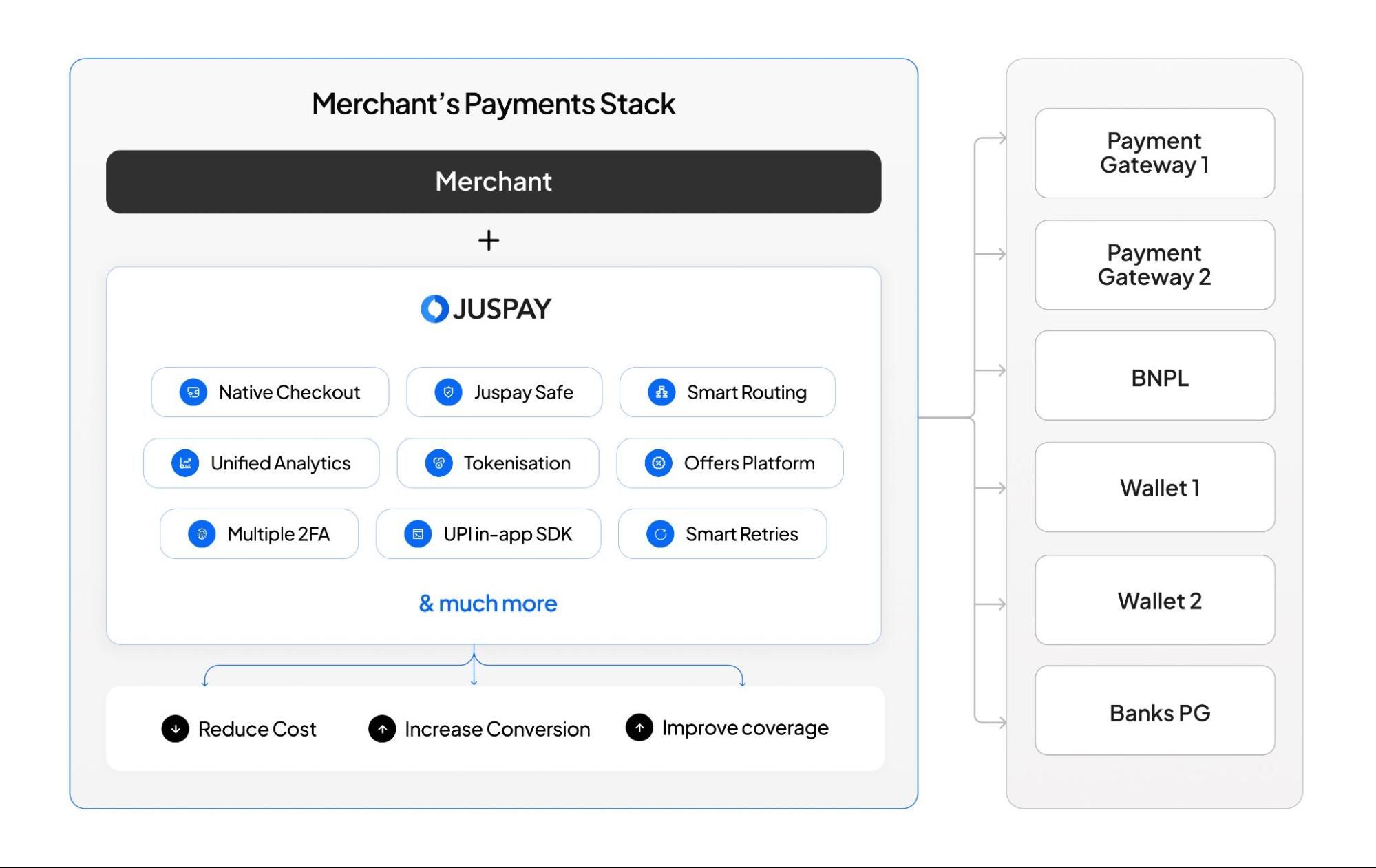

As you build, refine, and grow your business, having a payments partner who understands the challenges is crucial.

Juspay offers a future-proof infrastructure connecting directly to 100+ Payment Gateways, Visa, Mastercard, NPCI, and more. Our innovative products enhance the payment experience, driving growth for your business.

Juspay’s HyperCheckout is an all-in-one payment routing and experience suite that elevates payment experience, boosts conversions, and drives business growth.

Juspay HyperCheckout offers -

- Custom-branded native UI for your App and website

- Seamless 1-click checkout experiences

- Single No-Code Integration with 100+ payment gateways

- Robust orchestration and Smart Routing to boost conversions

- Compliance-in-a-box and

- Actionable Payment Analytics

Click here to learn more about Juspay HyperCheckout

FAQs About Payment Routing

1. What Is the Payment Routing Method?

The payment routing method is a strategic process that determines the optimal path for a financial transaction, ensuring seamless and efficient fund transfer. This process involves evaluating various factors to select the most suitable route for each transaction. The goal is to streamline the payment process and enhance overall operational efficiency for businesses.

2. What Is a Payment Gateway Router?

A payment gateway router serves as a technology solution that directs transactions through the most efficient and secure path within a payment network. It plays a crucial role in optimising the payment routing process, ensuring that transactions are processed seamlessly and securely. By leveraging advanced algorithms and real-time data analysis, payment gateway routers contribute to intelligent payment routing, offering businesses a comprehensive and efficient solution for their payment processing needs.

3. What Is the Principle of Routing?

The routing principle involves selecting the most optimal path for a transaction based on various factors. In the context of payment routing, these factors include cost-effectiveness, transaction speed, and security. The principle is fundamental to ensuring that financial transactions are processed efficiently and securely, aligning with the broader goals of businesses to achieve operational excellence in their payment processes.

4. What is the Significance of Payment Gateway Routing in Streamlining Transactions?

Payment Gateway Routing is crucial for efficient and secure financial transactions. It optimises paths to minimise payment failures and accelerate processing speed, enhancing overall operational efficiency.

5. Why is the Integration of a Payment Router Essential for Seamless Payment Flows?

The integration of a payment router is essential for ensuring seamless payment flows due to its ability to select optimal transaction pathways dynamically. By leveraging real-time data and advanced algorithms, a payment router streamlines the payment process, reducing friction and delays.