There are multiple reasons why consumers generally resist tedious checkout processes and choose to abandon carts over continuing with their purchase. According to research by the Baymard Institute, consumers are likely to abandon their carts if they don’t trust the platform with their credit card information (19%) or if their preferred payment methods are unavailable (10%). Convenience and security are critical factors consumers consider when making a transaction.

For businesses, having your customer’s payment information readily available can help reduce friction during checkout. However, storing this information securely while remaining compliant with legal regulations is a considerable task. A reliable, compliant payment vault that can enable you to offer exceptional payment experiences to your customers is the solution for you.

What is a Payment Vault?

A payment vault, also known as a token vault, is a digital database that stores sensitive information like credit card, bank account details, etc. However, instead of storing raw information, it takes security measures using tokenization to protect the data in the vault. In a credit card vault, card information is saved in the form of a unique token that is used in place of sensitive details to process payments. These tokens can also be used across platforms as network or multi-merchant tokens, allowing tokens to be recognized by multiple merchants, making transactions easier and more seamless.

The most common implications of a credit card vault can be seen in the following use cases:

- Recurring payments and subscriptions

- One-click checkouts

- Repeat transactions

How does a payment vault work?

A payment vault stores, secures, retrieves, and manages tokenized payment data. Once the payment data flows in, it is converted into a token and stored in an encrypted database. When a request to use this payment data arrives, the vault retrieves it to make a transaction.

Additionally, a payment vault also manages the lifecycle of the token by deleting expired or unused tokens, reissuing a new token if card details change, and maintaining compliance with PCI DSS and other regulatory requirements.

Who maintains a payment vault?

An in-house payment vault can allow businesses greater control over their storage, architecture, and custom integration workflows. The costs and compliance requirements associated with maintaining a payment vault can be laborious and require greater engineering and regulatory effort. This can be successfully accomplished by businesses with robust technical, security, and compliance capabilities. It demands a significant investment of effort into creating a payment vault, which could instead be used to focus on the core objectives of the business.

In such cases, they may outsource the effort to a third-party payment vault, offered by payment ops. businesses like Juspay. A third-party payment vault comes with built-in compliance and security measures, readily available APIs, tokenization, and are maintained and updated without requiring business overheads. This can help businesses take advantage of already established, compliant infrastructure, requires less technical expertise to integrate, and saves a significant amount of time.

Benefits of a payment vault

1. Improved security

Payment or credit card vaults are by definition a critical resource for businesses requiring secure storage for their payment data. Tokenization does the heavy lifting when it comes to protecting consumer credit card data, minimizing the risk of breach and fraud by preventing access to it, keeping both consumers and businesses safe.

2. Simplified compliance

With industry regulations evolving and growing each year, it is increasingly difficult for businesses to keep up without dedicating a significant amount of time and resources to complying with them. A payment vault takes up the burden of regulatory compliance, and associated audits and costs, as businesses don’t store payment data directly.

3. Centralized data management

A payment vault becomes the singular point of storing, tracking, and maintaining payment data which can be retrieved as required. Storing tokens in multiple places can lead to extra costs and hamper consumer experience if their details are repeatedly requested. This centralized payment or credit card vault can help businesses update card details, retry failed transactions, and keep consumer data secure in one infrastructure.

4. Enhanced customer experience

Checkout experiences can often make or break the relationship between businesses and their consumers. Credit card vault helps eliminate the factors that consumers generally avoid engaging with during checkout, like distrust in the platform or having to enter credit card details multiple times. An efficient checkout process can result in repeat custom and strengthen customer trust.

Challenges Faced by Merchants While Using Payment Vault

Traditional Payment Vaults Are Slowing Merchants Down. If you're a merchant trying to scale payments, you've probably felt boxed in by the systems that are supposed to support you. One of the biggest culprits? Traditional payment vaults.

Storing and managing sensitive customer payment data is critical — but most payment vaults were built for a very different era. They’re often tied to a Payment Service Provider (PSP), inflexible, and come with a laundry list of compliance and integration headaches.

Here’s what we keep hearing from merchants:

- “I’m locked into a PSP’s vault and can’t switch easily.”

- “PCI compliance is draining time and resources.”

- “Adding new payment methods takes forever.”

- “We want to experiment with routing but can’t touch the vault.”

And this friction doesn’t just slow your team down — it directly impacts your bottom line. Lower success rates, higher fraud risk, and limited innovation are the downstream effects of outdated vaulting infrastructure.

Solution: A Modular Payment Vault by Juspay Hyperswitch

At Juspay, we’ve taken a different path — one that puts merchants first.

Modular payment vault is our answer to the legacy vaulting problem. It’s a flexible, interoperable system that gives you full control over how and where you store customer payment data — with zero vendor lock-in.

With Juspay Hyperswitch, you can:

- Start with a built-in PCI-compliant vault

- Use Juspay’s hosted vault even in your self-hosted setup

- Or connect to third-party vaults like VGS, HashiCorp, or Voltage

This flexibility means you're never stuck. You can optimize your payment stack over time without rebuilding it from scratch.

Why it matters For The Merchants?

Let’s break down how a modular payment vault makes merchant's lives easier and payments smarter.

1. Escape Vendor Lock-In

Switching PSPs shouldn’t require a data migration project. Juspay Hyperswitch lets you tokenize once and use those tokens across multiple processors.

2. Simplify PCI Compliance

Want to keep your infrastructure light? Use Juspay’s hosted payment vault and shift PCI responsibility out of your core team.

3. Boost Authorization Rates with Smart Token Logic

Store multiple token formats (PANs, network tokens, PSP tokens), and let Juspay Hyperswitch pick the best one for each transaction. Built-in enrichment and retry logic improves success rates.

4. Add Wallets, BNPL & Bank Transfers — Not Just Cards

Juspay Hyperswitch supports tokenization for alternate payment methods like UPI, wallets, and BNPL — crucial for reaching customers in regions where cards aren’t dominant.

Your Vault, Your Rules: Deployment Options

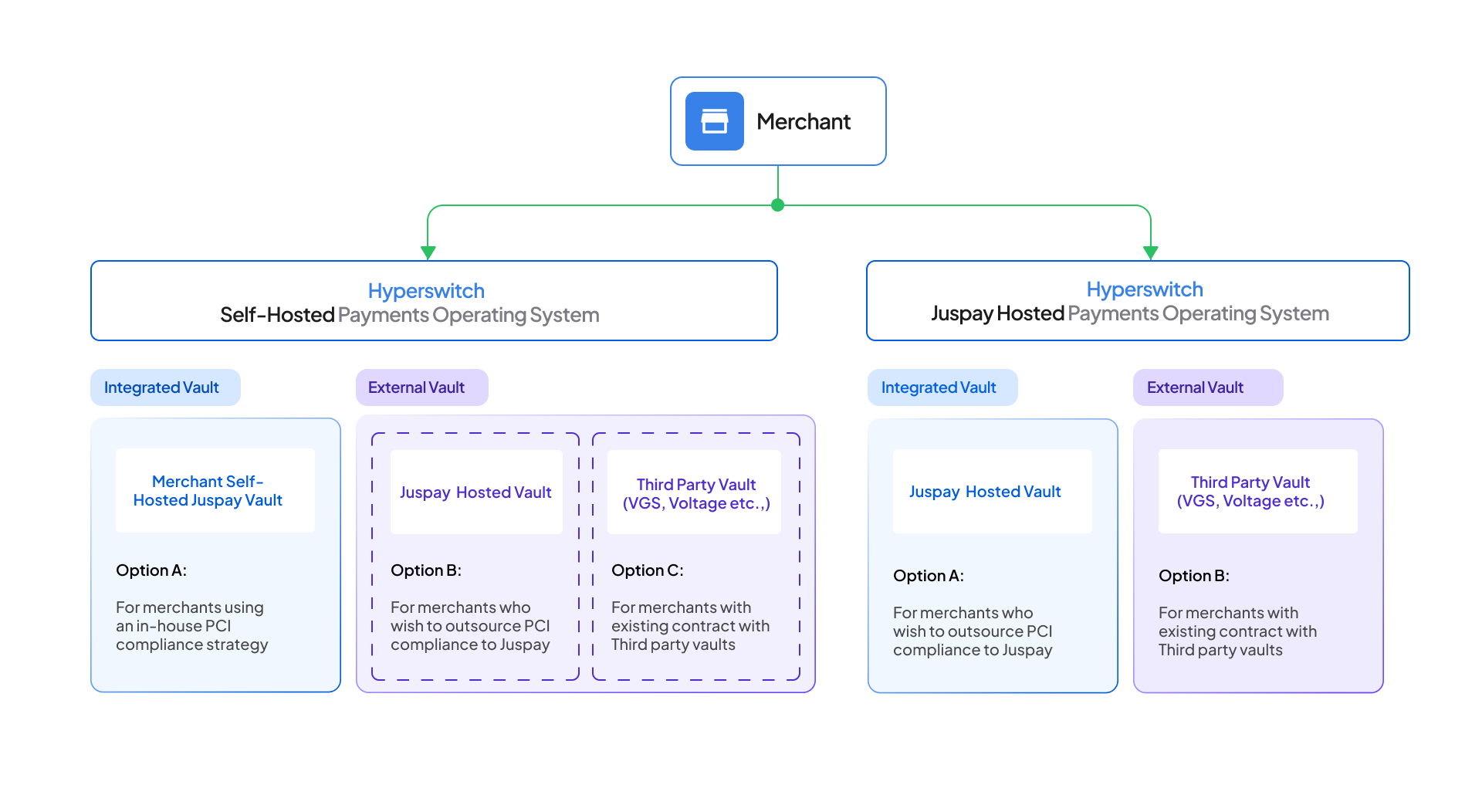

Juspay Hyperswitch supports vaulting across different configurations, so you can start simple and evolve as you need:

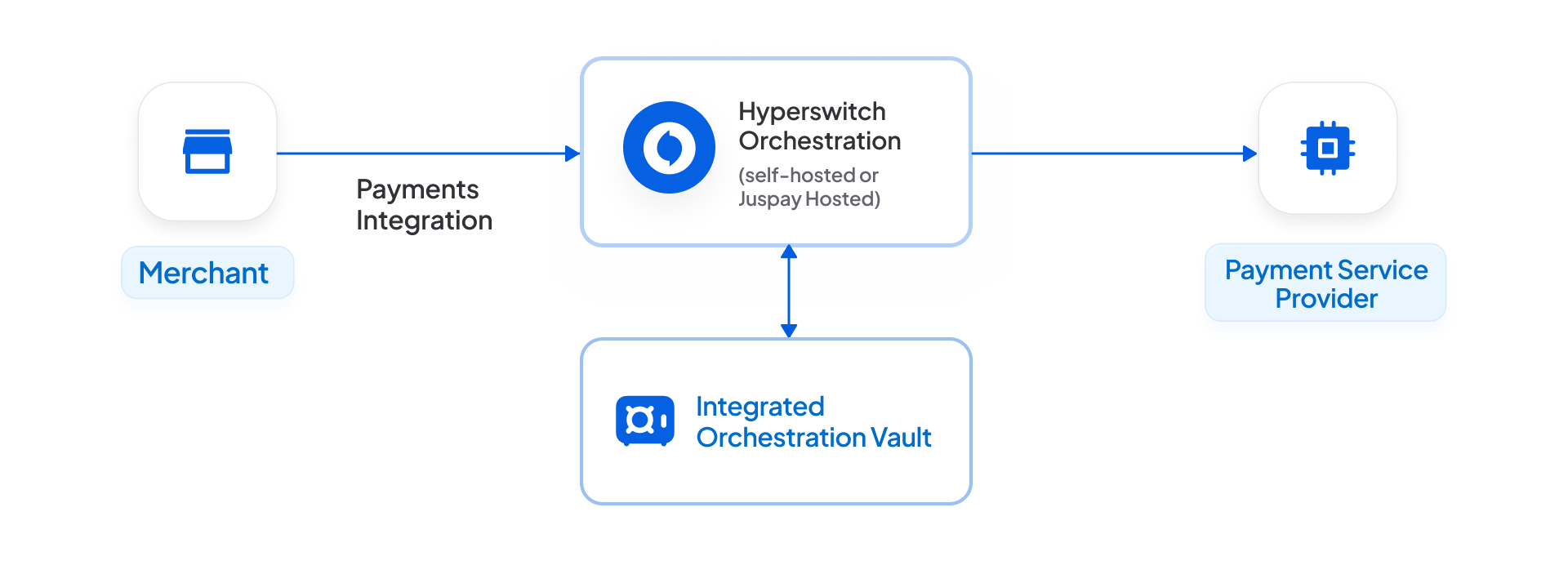

Integrated Vault (Built-In)

Great for merchants who want everything out-of-the-box. Comes with Hyperswitch and works in both self-hosted and Juspay-hosted modes.

- No additional setup

- Native card and APM support

- Ideal for fast onboarding

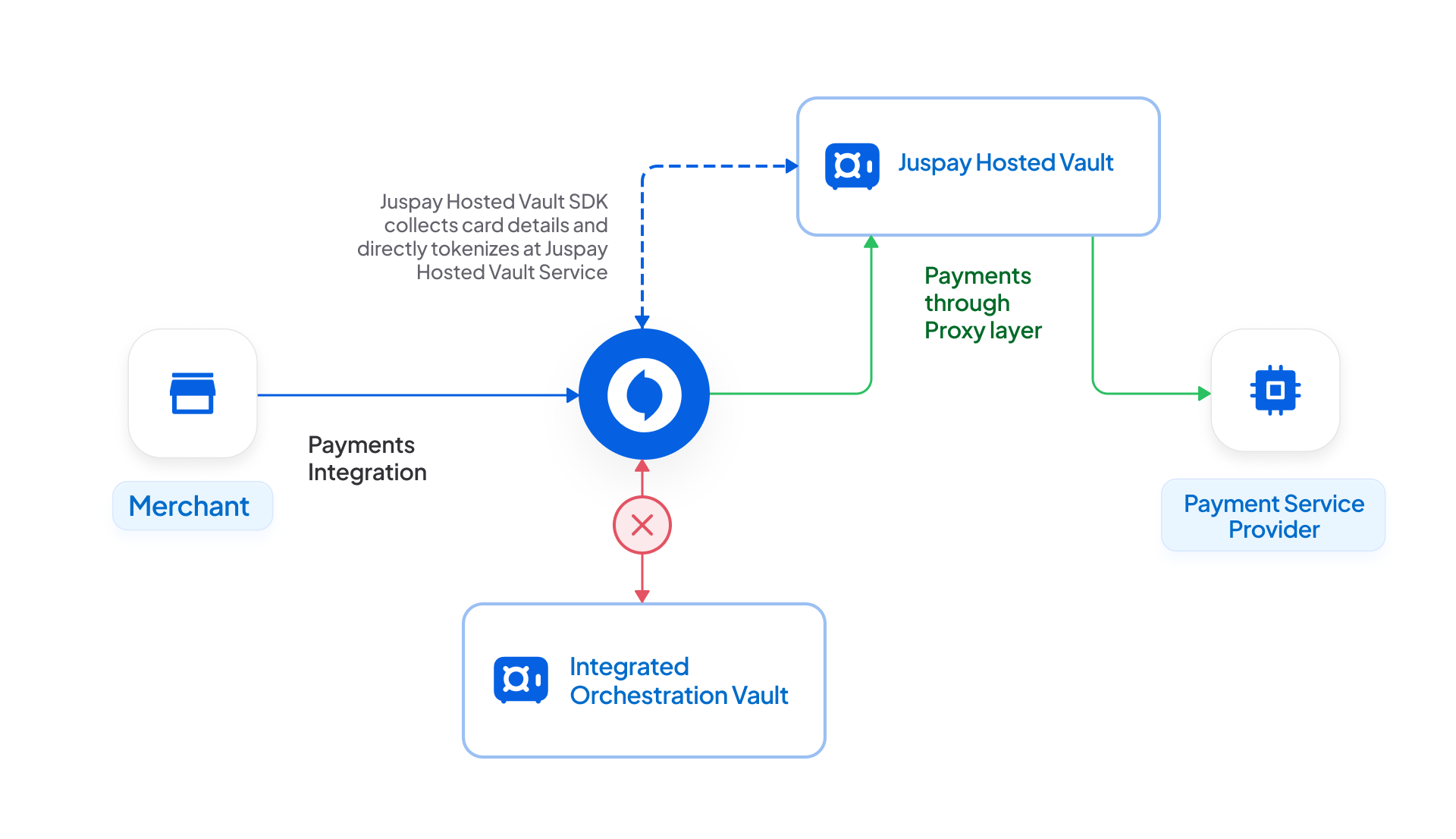

Juspay Hosted Vault (as an External Vault)

Running Juspay Hyperswitch yourself but don’t want PCI headaches? No problem, just plug in Juspay’s hosted vault.

- Shift PCI burden without leaving your setup

- Supports proxy payment flows

- API-based token management

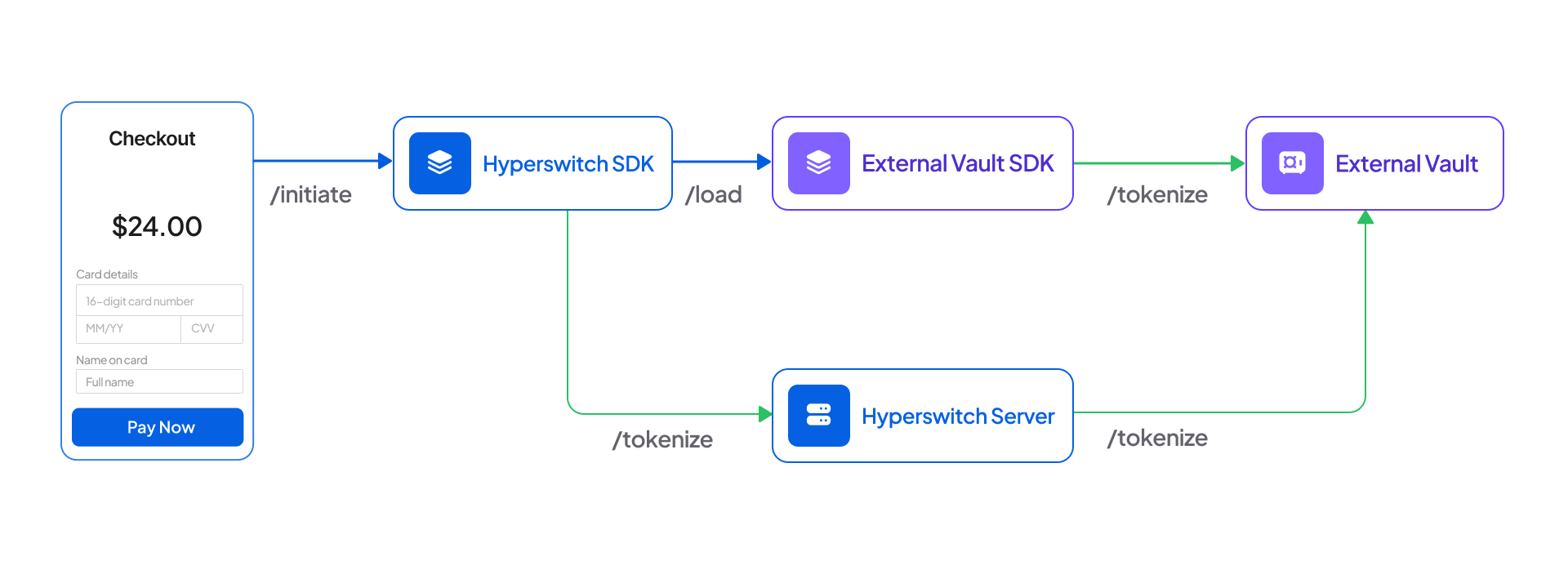

Third-Party Vaults (VGS, HashiCorp, Voltage, etc)

Already using a vault provider? You can integrate them directly into Hyperswitch using no-code connectors and SDK options.

- Use your vault’s SDK or use Hyperswitch Unified Checkout SDK to collect cards:

- Supports direct or proxy payments:

- Flexible Network Tokenization: Network Tokenization Support with your Own or Juspay as TSP

- Enables card forwarding and receiving between vaults

Features That Actually Move the Needle

Here’s a quick snapshot of what you unlock with Modular Vaulting:

- Smart Routing: One token, multiple processors, optimized routing

- Universal Tokenization: PANs, network tokens, PSP tokens — we support it all

Network Tokenization Support (With Your Own or Juspay's TSP)

Boost authorization rates and lower costs via:

- Juspay as your TSP (or)

- Build your own TSP credentials for full control

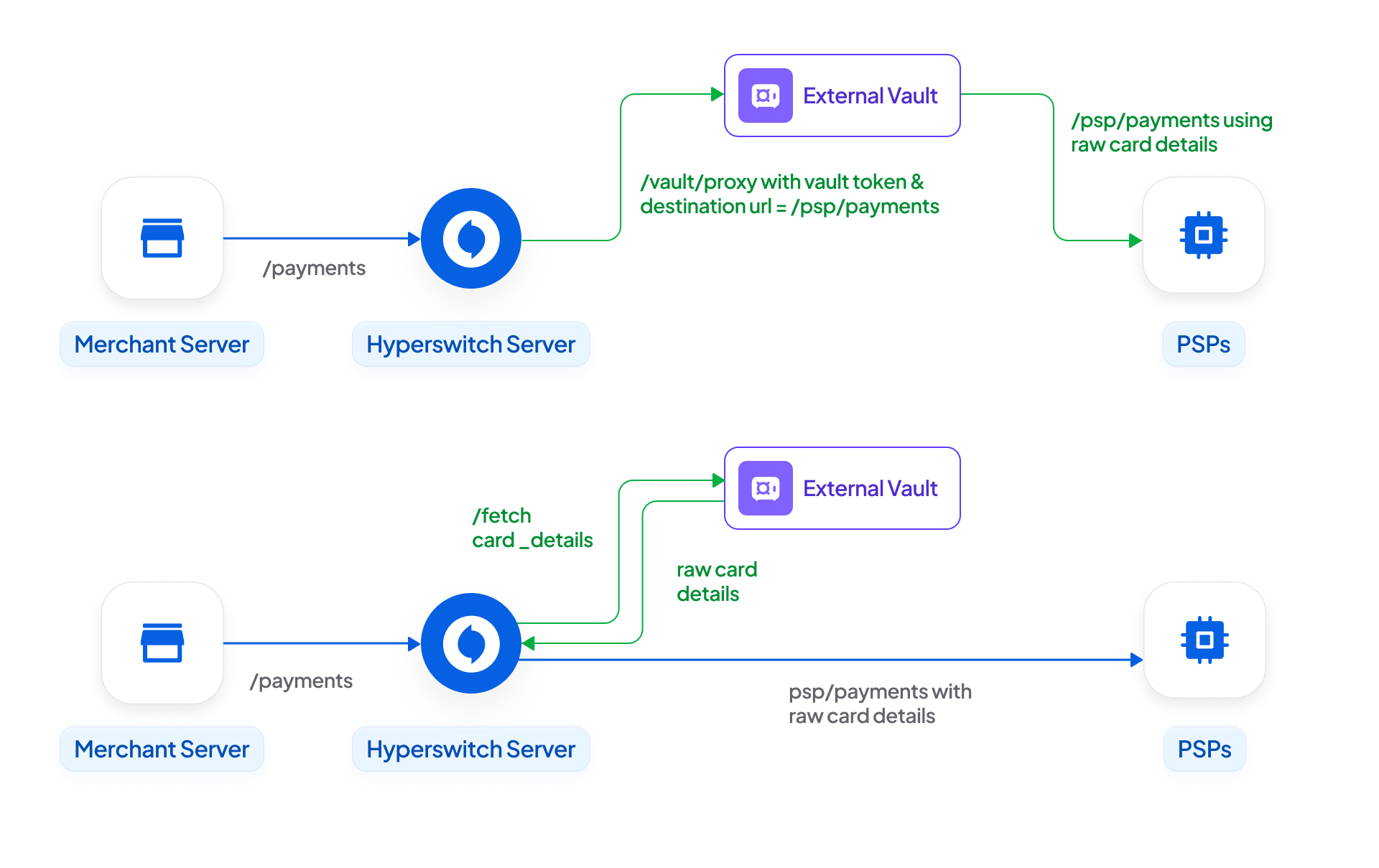

Direct and Proxy Payment Flows

Whether you need to send raw card data or go through a proxy for PCI compliance, Hyperswitch handles both flows with ease.

Card Forwarding and Receiving for Easy PSP Migrations

Push/pull tokenized cards across endpoints to migrate between PSPs without disruption.

Tokenization Beyond Cards

Hyperswitch tokenizes:

- Cards (PANs, PSP tokens, Network tokens)

- Wallets (like Paytm, PhonePe, etc.)

- BNPL methods (like Simpl, LazyPay)

- Bank accounts (for UPI and netbanking)

Conclusion: The Payment Vault Should Work for You, Not Against You

Vaulting isn’t just a backend detail, it’s the foundation of your payment strategy. It impacts your compliance workload, your ability to test and grow, and your customer experience at checkout.

Juspay Hyperswitch’s Modular Payment Vault gives you:

- Flexibility to evolve over time

- Control over your infrastructure

- Freedom from lock-in

- And a much easier path to compliance and performance optimization

Want to Dive Deeper?

If you're rethinking your payment stack or planning a payment vault migration, we’d love to show you what Juspay Hyperswitch can do, learn more.