QR code payments are changing the way businesses and customers pay. Offering convenience, security, and efficiency, QR code payments are rapidly becoming a preferred method for both. However, it is important to understand what goes behind QR code payments, their advantages, security considerations, and how Juspay can help businesses seamlessly integrate this innovative technology.

Boosting Open Banking Payments Adoption

QR code payments are making it easier for people to use open banking services. They allow you to securely and conveniently make transactions directly from your bank account, cutting out the middleman and reducing fees. It’s a simple and safe way to pay for things.

As open banking becomes more popular, businesses are starting to use QR code payments for their transactions. This makes it easier for people to use this new technology, and more businesses are expected to start using it, too.

QR Code Payment Mechanics

The mechanics of QR code payments are remarkably simple yet effective. A QR code, short for “Quick Response” code, is a two-dimensional barcode that stores information as a series of pixels.

When scanned by a smartphone camera, the QR code can initiate a payment transaction, direct users to a payment page, or initiate various other actions. This versatility makes QR codes a great tool for businesses to engage with customers and improve payment processes.

For customers, making QR code payments is as easy as opening their smartphone camera or payment app and scanning the code. The payment details are then automatically populated, and the transaction can be authorized with a simple tap or confirmation. This seamless process eliminates the need for manual data entry, reducing errors and enhancing the overall customer experience.

Advantages of QR Codes for Secure Payments

QR codes have two main benefits for secure payments, which make them a great choice for both businesses and customers.

Firstly, QR codes are really convenient. Customers can make payments quickly and easily using their smartphones without needing their physical credit/debit cards or cash. This is especially helpful for fast transactions, like buying things in a store or making payments on a smartphone.

QR code payments for businesses are incredibly versatile. They can be used for a wide range of transactions, including in-store purchases, online payments, peer-to-peer transfers, and even donations. This versatility makes them adaptable to various business models and use cases.

QR codes are easy to create and can be shown on things like signs, screens, and even receipts, so many people can use them.

Ensuring Security in QR Code Payments

Security is a top concern when it comes to digital payments, and QR code payments for businesses are no exception. However, several measures can be taken to ensure the security of QR code transactions.

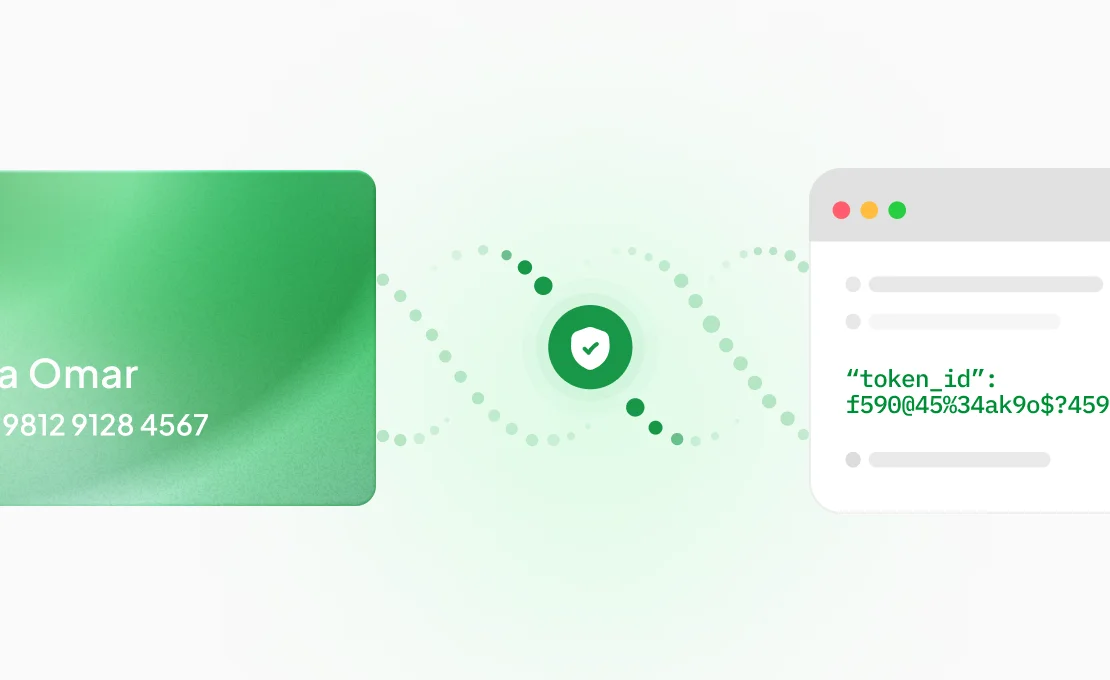

One crucial step is to ensure that the QR code itself is generated securely and protected from tampering. This can be achieved through encryption and the use of dynamic QR codes that change with each transaction.

Another important aspect is to educate customers about the potential risks associated with QR code payments, such as phishing scams or malicious QR codes. By promoting awareness and providing clear instructions on how to safely use QR codes, businesses can empower their customers to make informed decisions and avoid falling victim to fraud.

To make QR code payments even more secure, you can add extra layers of protection like using your phone and a password to confirm your payment and setting limits on how much money can be sent at one time.

How to Integrate Open Banking Payments with Juspay?

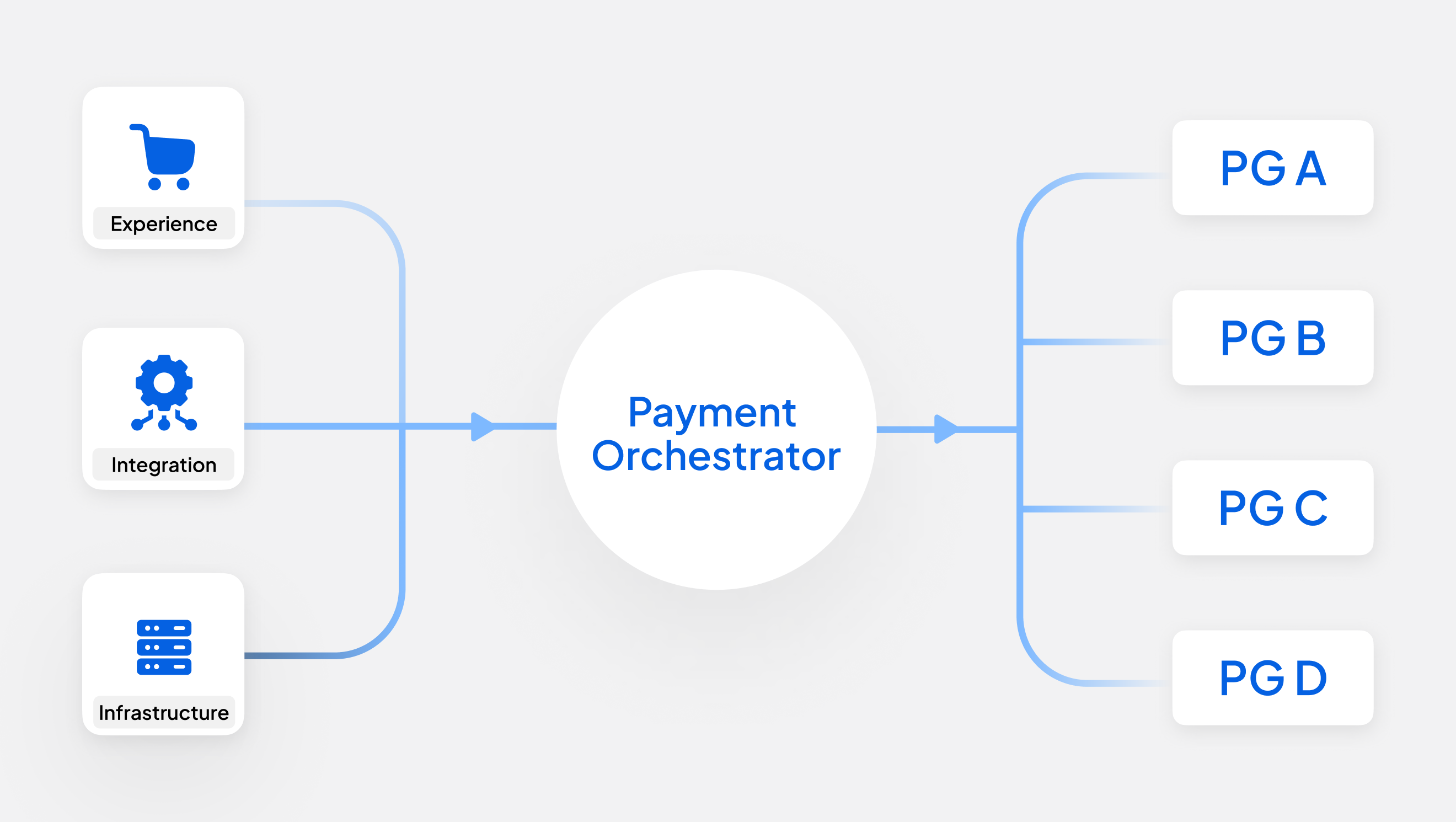

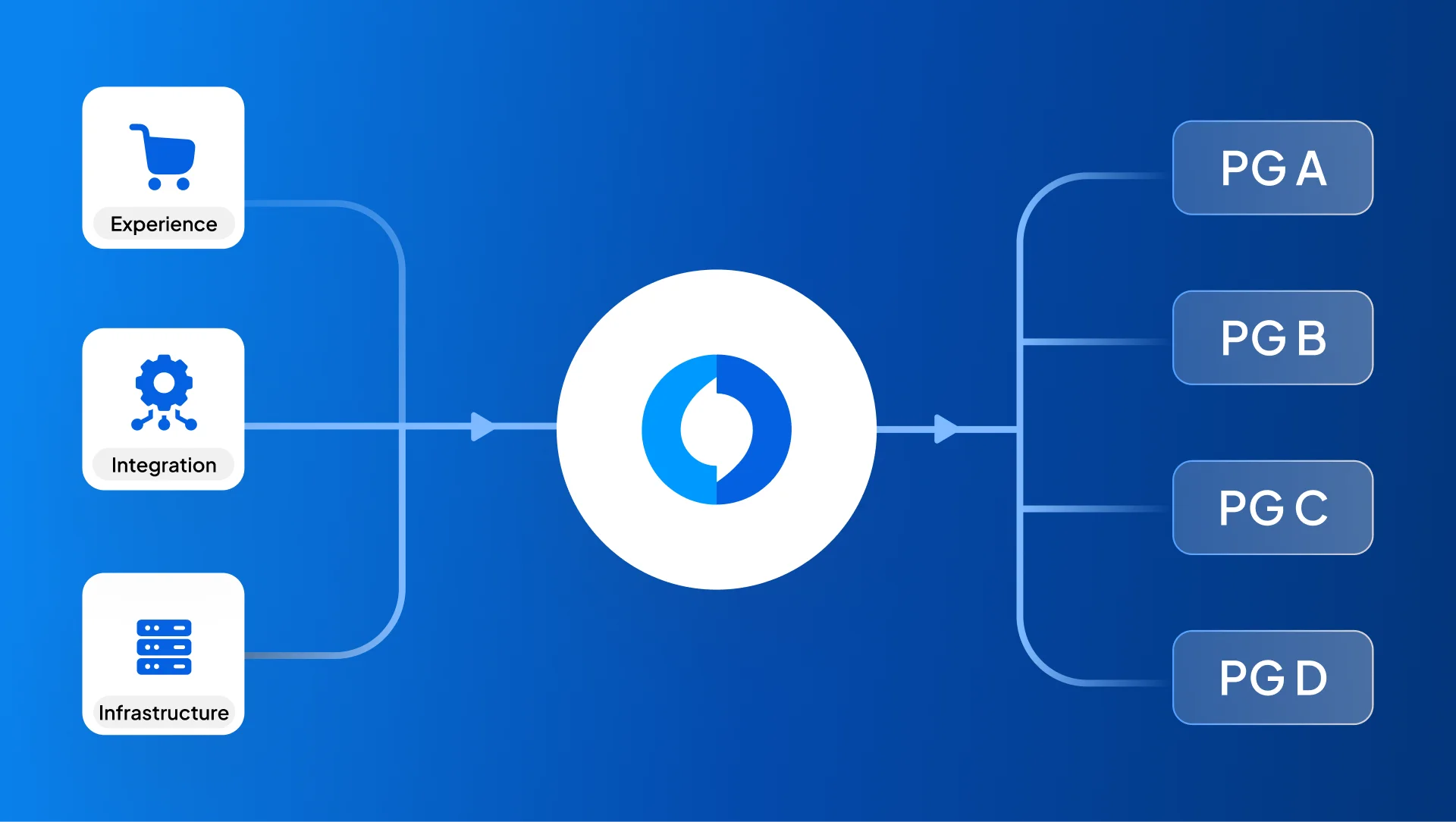

Integrating open banking payments with QR codes through Juspay is a seamless process that opens up new avenues for businesses to accept payments directly from customers’ bank accounts. Juspay’s robust platform provides the necessary tools and infrastructure to facilitate secure and efficient open banking transactions using QR codes.

By partnering with Juspay, businesses can leverage the power of open banking to reduce transaction costs, and offer their customers a wider range of payment options. The integration process typically involves setting up API connections between the business’s systems and Juspay’s platform, configuring payment flows, and implementing QR code generation and scanning mechanisms.

Utilizing Payment Links with QR Codes for Merchants

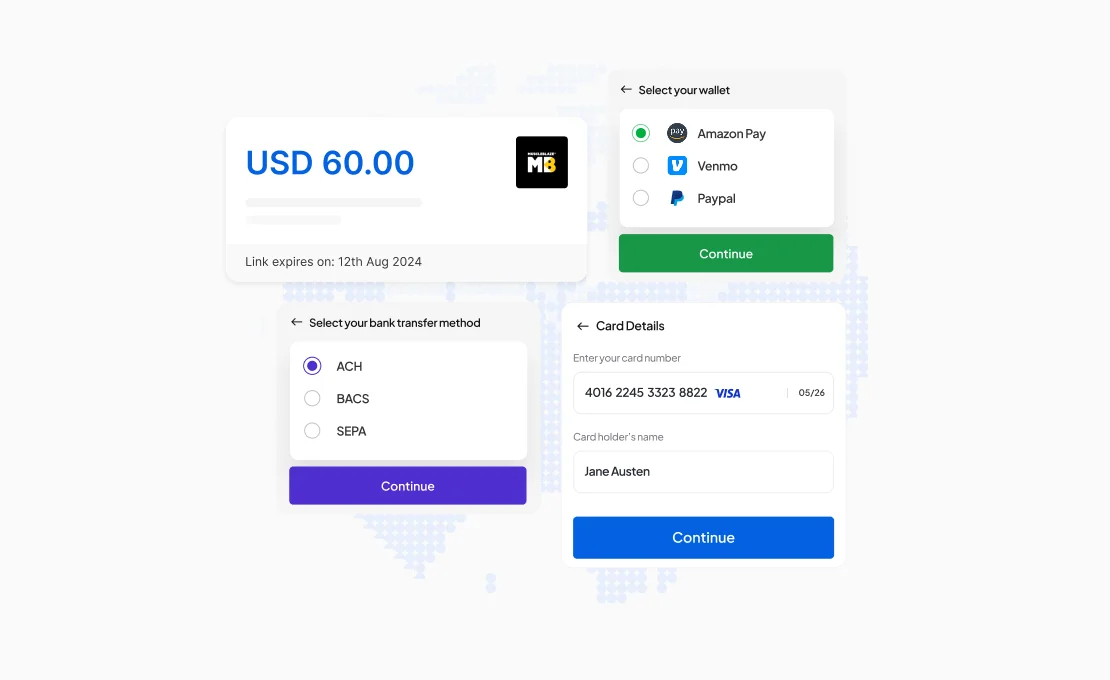

Payment links with QR codes are powerful tools for merchants to simplify and improve their customers’ payment processes. A payment link is a unique URL that, when clicked or scanned, directs customers to a secure payment page where they can complete their transactions.

By incorporating QR codes into payment links, merchants can enable customers to initiate payments effortlessly by simply scanning the code with their smartphones. This eliminates the need for manual data entry, reduces errors, and enhances the overall customer experience.

Payment links with QR codes can be used in various scenarios, including invoices, online stores, and even physical point-of-sale terminals. This versatility makes them a valuable asset for businesses seeking to optimize their payment processes and enhance customer satisfaction.

Exploring QR Codes and Superapps

QR codes have become a cornerstone of mobile payment solutions, particularly in superapps that have gained immense popularity in East Asian countries. Superapps like WeChat Pay and Alipay in China, Kakao Pay in South Korea, LINE Pay in Japan, and GrabPay in Malaysia have added QR code payments to their platforms, offering users a seamless and convenient way to make payments for a wide range of goods and services. These superapps often incorporate multiple payment types and offer various ways to pay using QR codes, catering to diverse user preferences and transaction scenarios.

For example, LINE Pay in Japan allows merchants to charge a fixed amount that is paid upon scanning the QR code, or alternatively, customers can enter a custom amount after scanning the code. This flexibility makes QR code payments suitable for a wide range of business models, from small vendors to large enterprises.

The integration of QR code payments into superapps has significantly contributed to the widespread adoption of this technology in these regions, making it an integral part of daily life for millions of users.

Embrace Mobile Payments with Juspay

As businesses seek to optimize their payment processes and enhance the customer experience, embracing mobile payment methods like QR codes is becoming increasingly important.

Juspay, with its expertise in payment orchestration and innovative solutions, can help businesses seamlessly integrate QR code payments into their existing systems. By partnering with Juspay, businesses can leverage the power of QR codes to streamline transactions, reduce costs, and enhance customer satisfaction.

Juspay’s platform offers a massive suite of features to support QR code payments, including QR code generation, scanning, and secure payment processing. With its robust infrastructure and intelligent routing capabilities, Juspay ensures that QR code payments are processed efficiently and reliably, even during peak periods.

Furthermore, Juspay is committed to protecting all QR code transactions from fraud and unauthorized access. This gives both businesses and customers peace of mind.