In mobile-first economies, where digital wallets, QR, and real-time payments are quickly becoming the norm, the shift in consumer expectations, regional regulatory frameworks, and relationships between issuers and acquirers is evolving quickly. To keep up with this evolution, it is imperative to businesses to offer exceptional payment solutions to retain and improve revenue, enhance customer experience, and manage costs, especially for cross-border markets. The effective means to respond to these goals lies in a robust payment routing strategy.

What is Payment Routing?

A successful payment experience is driven by the right decisions. It's about choosing the right acquirer or PSP (Payment Service Provider) for each transaction, based on region, currency, issuer preferences, and regulatory requirements.

Payment routing refers to the logic and infrastructure that determines how a payment is sent through an acquiring bank, PSP, or processor. This decision-making process evaluates multiple signals, such as card type, merchant location, customer geography, transaction currency, and network conditions, and chooses the most optimal path to ensure a successful transaction.

What Is Smart Routing?

Smart routing (also known as intelligent routing) is an advanced form of payment routing that uses real-time data, pre-configured rules, or, machine learning algorithms to dynamically choose the most optimal processing path for each transaction

A key advantage of smart routing is its ability to minimize failed transactions and false declines. It does this by intelligently routing payments to the best payment processors available and routes transactions accordingly to reduce drop-offs and boost payment success rate. This selection is informed by continuous analysis of variables such as PSP performance, consumer behavior, geography, currency, and payment method.

How Does Smart Routing Work?

Smart routing systems evaluate signals to determine the most optimal parh for each transaction. These include:

- Transaction metadata: Card type (credit/debit), issuer country, BIN, transaction amount, and currency.

- Historical performance data: Success/failure rates by acquirer, card type, or geography.

- Regulatory constraints: Compliance with regional mandates like SCA (Strong Customer Authentication) or LCR (Least-Cost Routing).

- Time-based patterns: Time-of-day or day-of-week performance metrics.

- Cost structures: Interchange rates and PSP processing fees.

- Fraud risk signals: Known high-risk behaviors or flagged geographies.

The smart routing workflow generally includes the following steps:

1. Transaction Evaluation

The system parses incoming payment requests to extract relevant metadata, such as card type (Visa, Mastercard, Amex), BIN (Bank Identification Number), currency, and customer location.

2. Rule Matching

Using a rule engine or machine learning model, the system determines whether a transaction meets the criteria for certain routing decisions. For instance, a rule might say that all transactions over $500 from Europe should use Acquirer A.

3. Acquirer Selection

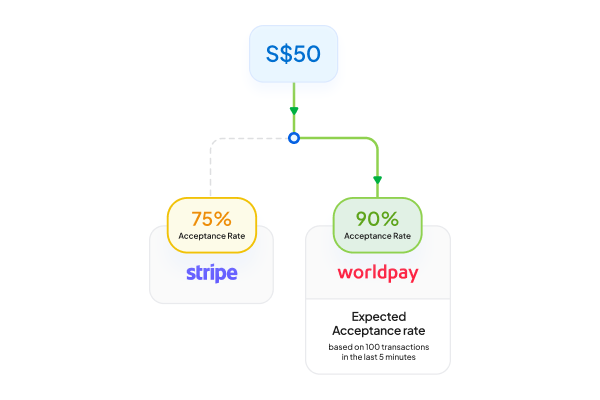

Based on the evaluation and rule matching, the system selects the most appropriate acquirer or PSP. In advanced implementations, this may involve scoring multiple options and selecting the one with the highest expected success probability.

4. Execution and Monitoring

The payment is sent to the selected acquirer. The system continuously monitors success rates, latency, and error codes from the PSPs to refine its future decisions.

Facets of Smart Routing

Smart routing combines several advanced techniques and operational strategies to ensure maximum efficiency and reliability. Below are the core facets:

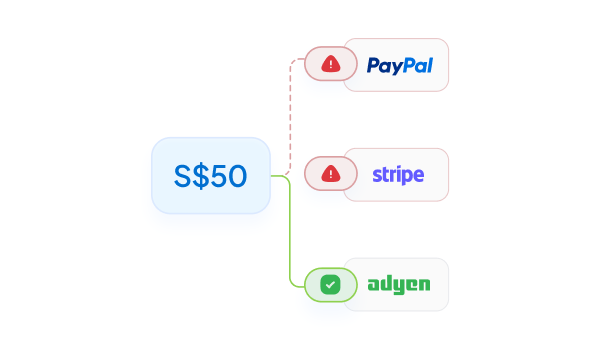

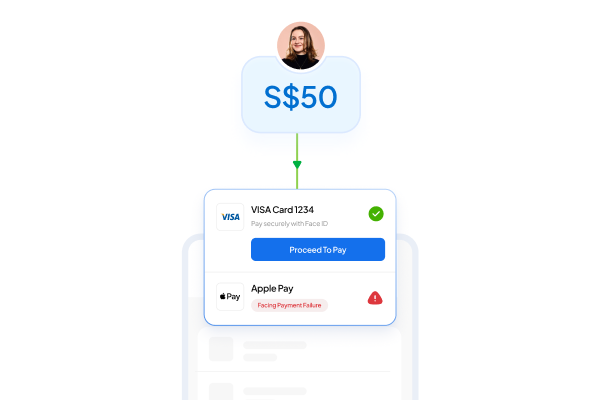

1. Fallback Routing

If the primary PSP or acquirer fails to authorize a transaction—due to an outage, timeout, or decline—fallback routing attempts the transaction with an alternative provider. This improves resilience and reduces customer friction.

2. Predictive Routing

This uses machine learning to predict which acquirer is most likely to succeed for a given transaction, based on patterns in historical data. For example, if Acquirer B has a 92% success rate for cards issued in Canada at 8 PM, the model will prefer that route.

3. Risk-Based Routing

Risk scoring is used to route high-risk transactions through PSPs with stronger fraud mitigation tools, additional authentication layers, or better chargeback management. Low-risk transactions may go through cost-efficient providers to save on fees.

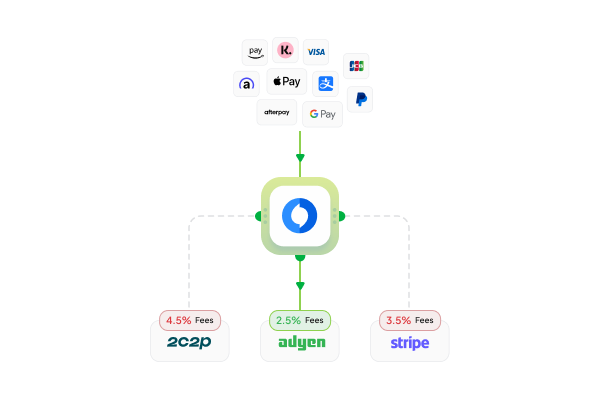

4. Least-Cost Routing (LCR)

LCR dynamically routes transactions through the cheapest available channel, particularly in markets like Australia and the EU where interchange fees are regulated. This involves choosing between debit schemes or selecting acquirers with favorable pricing.

5. Outage Alerts

Smart routing engines constantly monitor acquirer and PSP health. In the event of a service degradation or downtime (e.g., HTTP 500 errors, latency spikes), the system reroutes transactions to avoid impact.

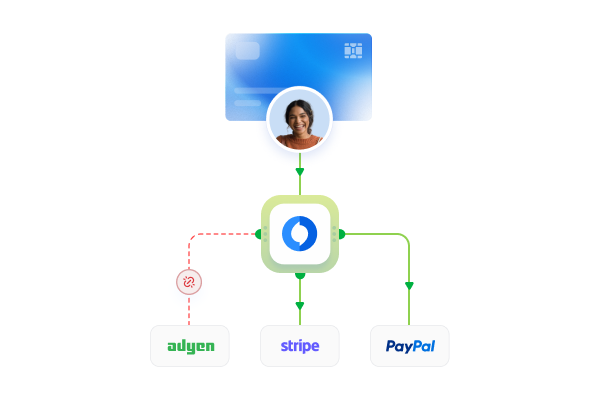

6. Cascading Routing

Smart routing engines automatically forward failed transactions to alternate PSPs. This requires setting up priority logics for payment processors. Cascading helps in eliminating the effect of technical issues on payments.

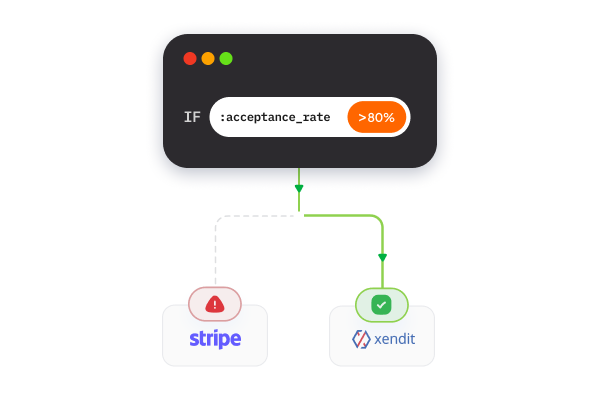

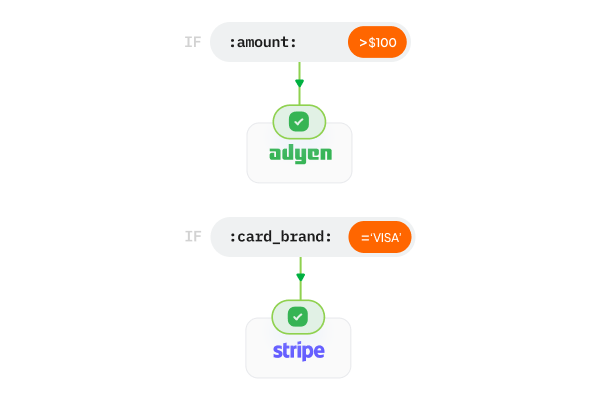

7. Custom Rule-Based Routing

Allows businesses to define routing rules based on specific business logic. For instance, routing all American Express transactions to PSP A or sending high-value transactions through an acquirer with better fraud tools.

Benefits of Smart Routing for Businesses?

Smart routing delivers measurable impact across multiple dimensions of business performance:

1. Increased Success Rates

By selecting the optimal acquirer for each transaction, businesses reduce false declines and boost revenue. This is especially important in industries like travel and e-commerce, where issuer behaviour can be highly variable.

2. Reduced Payment Costs

Least-cost routing helps businesses optimize processing fees by routing transactions through cheaper rails or regulated networks. Over time, this can significantly impact the bottom line.

3. Improved Resilience and Uptime

Routing around outages or degraded performance ensures customers aren’t affected by technical issues with a specific PSP. This is critical for businesses with high transaction volumes or global customer bases.

4. Greater Control and Flexibility

Customizable rules and real-time data empower product and payments teams to align routing strategies with business priorities, whether that’s cost optimization, risk reduction, or maximizing success rates.

5. Faster Market Expansion

Smart routing facilitates seamless geographic expansion by localizing payment experiences. For example, a business entering Brazil can route transactions through a local acquirer that supports PIX, improving success rates and compliance.

Which Businesses Should Employ Smart Routing?

While smart routing benefits a wide array of merchants, it’s particularly essential for:

- High-Volume Merchants: E-commerce platforms, travel aggregators, and subscription services processing large numbers of transactions daily.

- Global Businesses: Companies operating across multiple countries where acquirer performance and regulations vary widely.

- Multi-PSP Setups: Businesses integrated with several PSPs or looking to reduce reliance on a single provider.

- Fintechs & Payment Facilitators: Embedded finance companies and platforms offering payments as part of their product stack.

- High Decline-Rate Verticals: Sectors like gaming, digital media, and ticketing where issuer decline rates are high and vary by region.

How Can Juspay Help?

Juspay offers a powerful smart routing engine designed to meet the complex needs of modern businesses. Here’s how:

Routing Rules Engine

Juspay enables no-code configuration of sophisticated routing logic. Merchants can set up rules based on card type, BIN range, transaction amount, geography, payment method, or risk profile. This flexibility allows rapid iteration and optimization without engineering overhead.

Real-Time Monitoring and Insights

Juspay provides granular visibility into transaction performance across PSPs. This includes real-time dashboards, error tracking, success rates, and latency metrics, enabling continuous tuning of routing strategies.

Fallback and Cascading Mechanisms

Juspay's fallback logic ensures that failed transactions are retried automatically with alternate PSPs. This increases transaction reliability, especially during provider outages or peak traffic.

Multi-PSP Integrations

Juspay supports seamless integrations with a broad range of domestic and international PSPs and acquirers. This gives merchants the freedom to select the right partner for each market and routing strategy.

Rule-Based Ordering

Businesses can define a priority list for transaction routing based on their own logic, ensuring compliance with internal policies or regional mandates like LCR.

Advanced Features

- ML-Based Predictive Routing

- Geography-Specific Optimization Playbooks

- Regulatory-Adaptive Routing (e.g., SCA-aware routing in Europe)

- Risk Engine Integration for fraud-aware routing decisions

Conclusion

In a fragmented, fast-moving global payments environment, smart routing is more than a technical feature—it’s a strategic capability. By combining data, automation, and intelligent logic, smart routing empowers businesses to unlock revenue, control costs, and deliver frictionless payment experiences.

For companies looking to scale globally, adapt to local regulations, and stay resilient in the face of infrastructure failures, smart routing isn’t just valuable. It’s essential.

With Juspay’s robust routing engine, businesses gain the tools they need to navigate complexity and thrive in today’s payment ecosystem.