Scaling internationally has become a fundamental necessity for most eCommerce and SaaS companies looking to thrive, capture new markets and diversify revenue streams. The globalized nature of commerce itself, along with the increasing competitiveness of certain home markets, pushes businesses to expand beyond borders.

However, global growth introduces new layers of complexity in payments. The complexities stem not only from shifting regulatory requirements but also from the diverse consumer expectations at each stage of the transaction journey. Meeting these expectations hinges on offering payment experiences that are familiar, fast, and reliable and that reflect the ever-rising standards shaping user expectations throughout the checkout process. Merchants who fail to offer these localized payment approaches risk losing out on significant customer bases.

Expanding Payment Method Coverage

Merchants today face significant challenges in offering comprehensive payment method coverage. A decade ago, a card-only payment strategy through a global PSP might have been sufficient, providing simplicity and broad coverage. However, the landscape has changed dramatically and today’s global markets demand far more flexibility. With local payment methods projected to represent 58% of global eCommerce transactions by 2028 (vs. 47% in 2023), relying solely on cards is no longer a sustainable growth strategy.

Particularly since the increase is largely driven by the rise of account-to-account payments (such as instant bank payment rails, or Open Banking) which are estimated to account for 18% of all transactions by 2028 and payment wallets.

It is then not surprising that those merchants who get coverage right see a significant upside, given that the same study found that 77% of consumers were ready to abandon their shopping carts when their desired payment method was not available.

PSP Diversification

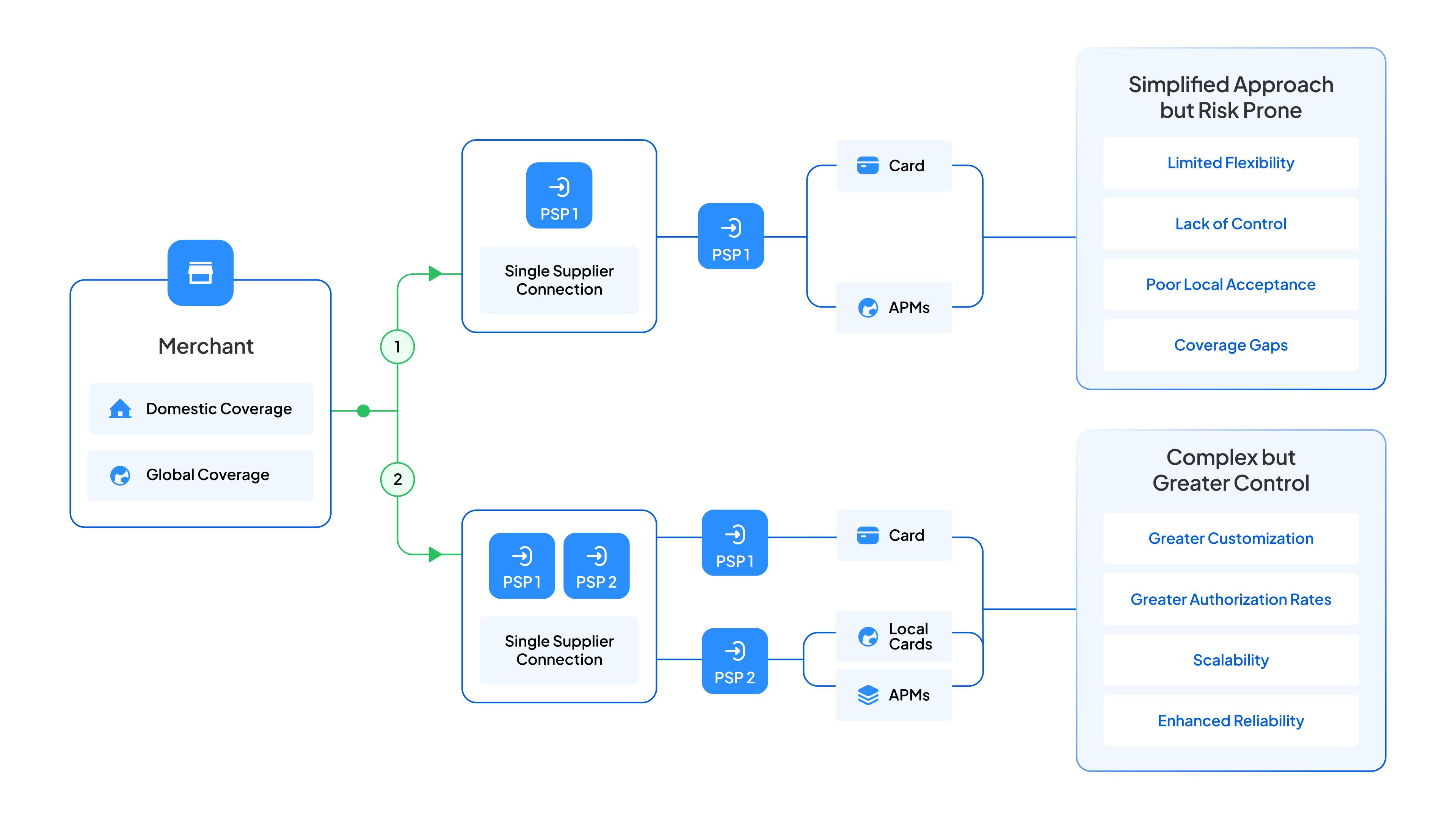

So how do merchants, eCommerce platforms, and SaaS companies ensure comprehensive payment coverage today? At the most fundamental level, gaps in supporting specific countries and local payment methods are typically ‘plugged in’ using one of two approaches:

1. Single Supplier Connection: Simplified but Risk-Prone

A single supplier connection relies on one Payment Service Provider (PSP) to handle all payment methods. This approach simplifies operations because merchants only need to manage one integration. However, it comes with notable risks:

- Reliability Issues: If the PSP experiences downtime or technical issues, the merchant’s entire payment system can be compromised, leading to lost sales and frustrated customers.

- Limited Flexibility: Merchants are constrained by the PSP’s capabilities and roadmap, which may hinder their ability to quickly adapt to changing business needs or market demands.

- Coverage Gaps: Relying on a single PSP may result in limited support for certain regions or local payment methods. To bridge these gaps, merchants might need to migrate to a PSP with broader global reach or integrate additional PSPs (whether global, regional, or local).

2. Multiple PSP Connections: More Reliable but Complex

The second strategy involves integrating with several PSPs to expand payment coverage. This approach is typically more future-proof, as relying on a single PSP can lead to reliability issues when service outages occur. This approach offers several benefits:

- Enhanced Reliability: Diversifying across multiple PSPs protects merchants from service disruptions. If one PSP experiences issues, transactions can be rerouted to an alternative provider.

- Increased Flexibility: Merchants can offer a wider range of payment methods, including local and regional options, meeting customer preferences in different markets.

- Future-Proofing: This strategy better supports long-term growth, as it allows businesses to adapt quickly to new payment trends and technologies.

While this approach enhances reliability and flexibility, it also increases operational complexity and costs. This dependency can also be particularly challenging for platforms and SaaS companies since attempting to migrate to another provider often means having to re-onboard all the users.

Balancing Cost and Scalability

Adding new payment methods and PSPs can raise operational costs significantly. Merchants need to strike a balance between offering diverse payment options and achieving cost efficiencies. Bulk discounts from PSPs can help mitigate costs, but only if the merchants can maintain high transaction volumes. The diversification of PSPs can reduce dependency but may also dilute transaction volume, making it harder to achieve those volume-based discounts. So these considerations have to be balanced against the benefits that increased coverage and payment service availability can bring in terms of incremental spending, new customers, and a decrease in basket abandonment.

Ensuring Reliability

Integrating with multiple PSPs clearly has its own challenges. Bringing these capabilities fully in-house is a great task in terms of transaction routing, risk management, and reconciliation, as well as making it potentially harder to innovate and keep up with the increasingly fast-changing market. Increasing provider diversification also does little to address service reliability unless it is accompanied by a resilient orchestration infrastructure.

Interruptions in payment availability can frustrate customers and damage a brand’s reputation. Therefore, merchants need to ensure that their payment infrastructure can handle high transaction volumes without breaking down.

For instance, Juspay supports up to 20,000 transactions per second (TPS) while offering industry-leading agility. This allows merchants to handle peak loads seamlessly, ensuring reliable and consistent payment processing.

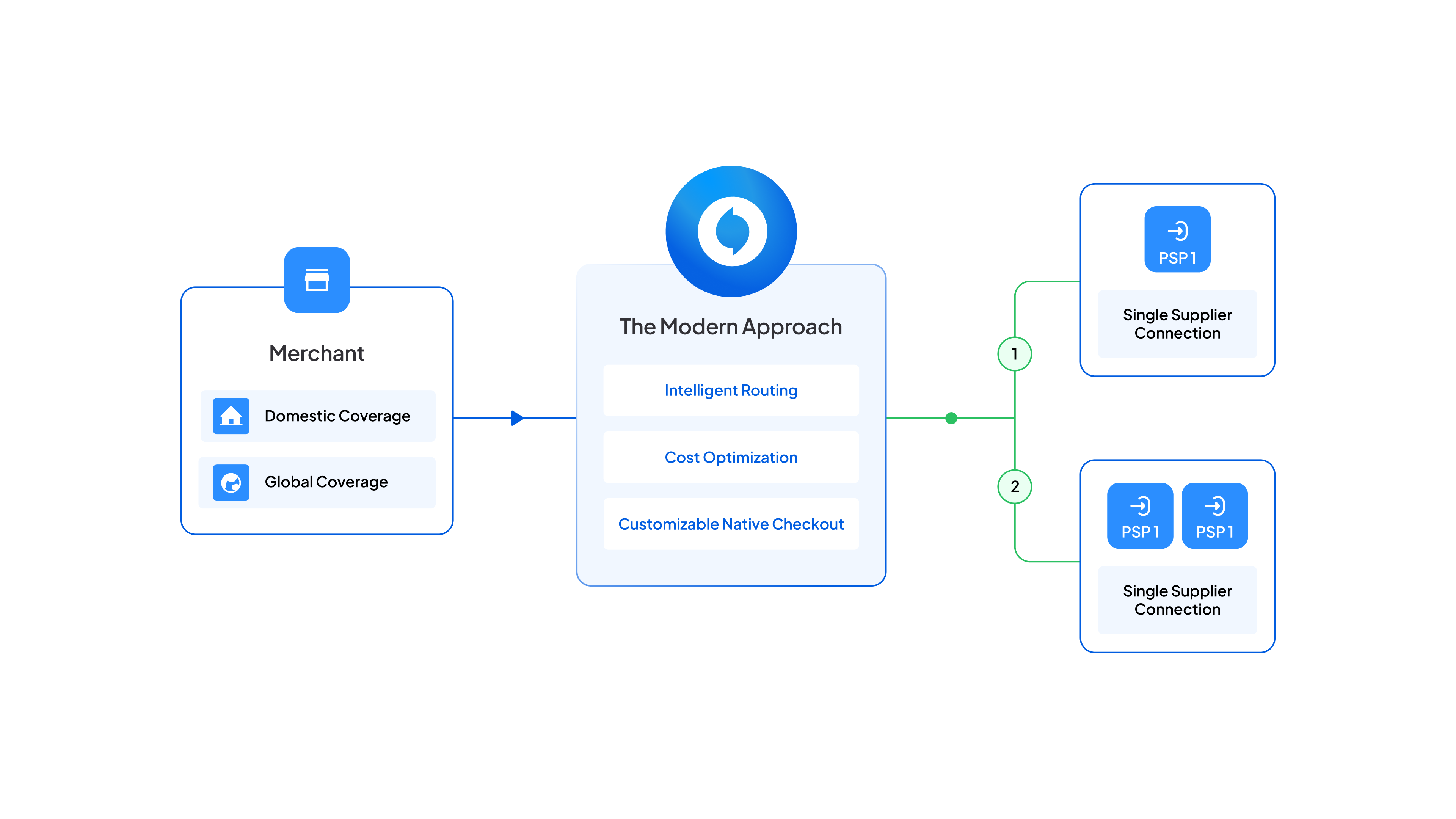

Routing Nuances in Modern Orchestration

In reality, most global coverage solutions fall short of expectations. Many of these solutions rely on a single provider or 'core' PSP, which achieves global reach through a limited number of supplier relationships. This often means limited customizability as well as contractual reliance on a ‘main’ provider in terms of both commercials and the product roadmap. Many lack an extensive local acceptance strategy, leaving out regions with some of the highest acceptance costs or decline rates.

This is where modern payment orchestration can add significant value. At Juspay, we believe that an orchestration layer should allow a merchant or a platform to work with any PSP (ideally through no-code integrations). The solution should also be technically flexible to allow customization or both payment routing and user experience.

The key ways in which orchestration can improve payment coverage are:

- Intelligent routing. The purpose of increasing coverage is to reduce basket abandonment and improve conversions. Orchestration platforms can help merchants with this by optimizing transactions for authorization rates. One example is Juspay intelligent routing solution that allows to automate transaction routing rules so that they can be driven by success rates.

- Cost optimization Higher success rates ultimately also drive down costs and intelligent routing also allows the merchant to achieve payment volume quotas to further optimize per transaction cost. This helps to balance the trade-off between payment method availability and margins.

- Customizable native checkout. It's important to note that merely adding more payment methods doesn’t always boost conversion rates or attract new customers. If the checkout process becomes too complex, it can overwhelm consumers, leading to frustration and abandoned transactions.Changing the checkout UX can also risk a rise in basket abandonment with consumers taken aback by unfamiliar payment journeys.

This is why the checkout experience should contextualise payment method availability based on relevance, consumer preference and transaction type. Many global PSPs do not currently offer this, leaving many merchant or platform business models unsupported.

In essence, the role of payment orchestration should be to maximise payment method and geographical coverage while minimizing transaction costs and ensuring a simple yet flexible user experience that can respond to end-users needs and preferences. When executed effectively, such a proposition can unlock new business models, such as tailoring different payment methods to specific transaction types, while providing the commercial flexibility to reduce transaction costs, monetize payment acceptance or even rethink the approach to pricing risk.

This is why, at Juspay we built our business to support your growth roadmap in a way that best suits your needs. As partners on your global expansion journey we offer.