As enterprise merchants scale across markets, product lines, and payment partners, managing payment processing costs becomes increasingly complex. Payment infrastructures expand, integrations multiply, and with them, the visibility into fee structures often becomes challenging.

Without a unified and structured view, finance and payment teams face significant challenges in reviewing, reconciling, and analyzing their true costs. By the time discrepancies or inefficiencies are detected, the financial impact has already been absorbed into the bottom line.

This is no longer just a reporting issue, it is lack of complete transparency, traceability, and control on your payment costs. In this blog, we explore the critical challenges enterprise merchants face in managing their payment processing costs and how a structured and detailed cost observability can unlock margin opportunities and improve cost control at scale.

Why payment processing costs visibility is broken for enterprises?

With respect to payment processing fees, every market has its own challenges as regulated by card brands in respective regions. For example, in the U.S, merchants face intricate interchange frameworks, downgrades, penalties, and different interchange rates for each card type that vary by industry and transaction type. In Europe, network fees are applied inconsistently across different countries, varying for domestic and cross-border transactions, applicability of certain fees only for few countries and differing rules even within the EU.

With these complexities managing payments across business units, markets, and PSPs has been more operationally demanding and their payment processing fees are even more challenging to track and optimize.

Let’s break down the core challenges faced by most of the enterprise merchants across US and Europe today:

1. Disjoint and unclear fee reports

Enterprise merchants operating across geographies like the U.S. and Europe often work with multiple PSPs to support regional preferences, business unit needs, reliability, or to optimize for pricing. They also accept a variety of payment methods including cards, wallets, BNPL, and direct bank transfers, further adding to the complexity.Each provider shares fee data based on their own system logic, reporting structures, and interpretation of transaction attributes. While PSPs aim to present costs as accurately as possible according to how their systems are tuned, the resulting reports often vary in format, fee categorization, and level of detail. Some providers offer aggregated cost summaries, while others report at the transaction level but use differing logic to derive and structure the data.

As a result, merchants receive a fragmented and inconsistent view of their overall payment costs. Consolidating these diverse data streams into a single, unified view becomes a highly manual, error-prone process. Reconciliation of fees — especially across multiple PSPs, currencies, business units, and regions — is not only difficult, but often operationally overwhelming.

Without standardization or a consistent lens across providers, it becomes nearly impossible for merchants to break down fees accurately, let alone identify reasons for penalties, overcharges, or opportunities for optimization.

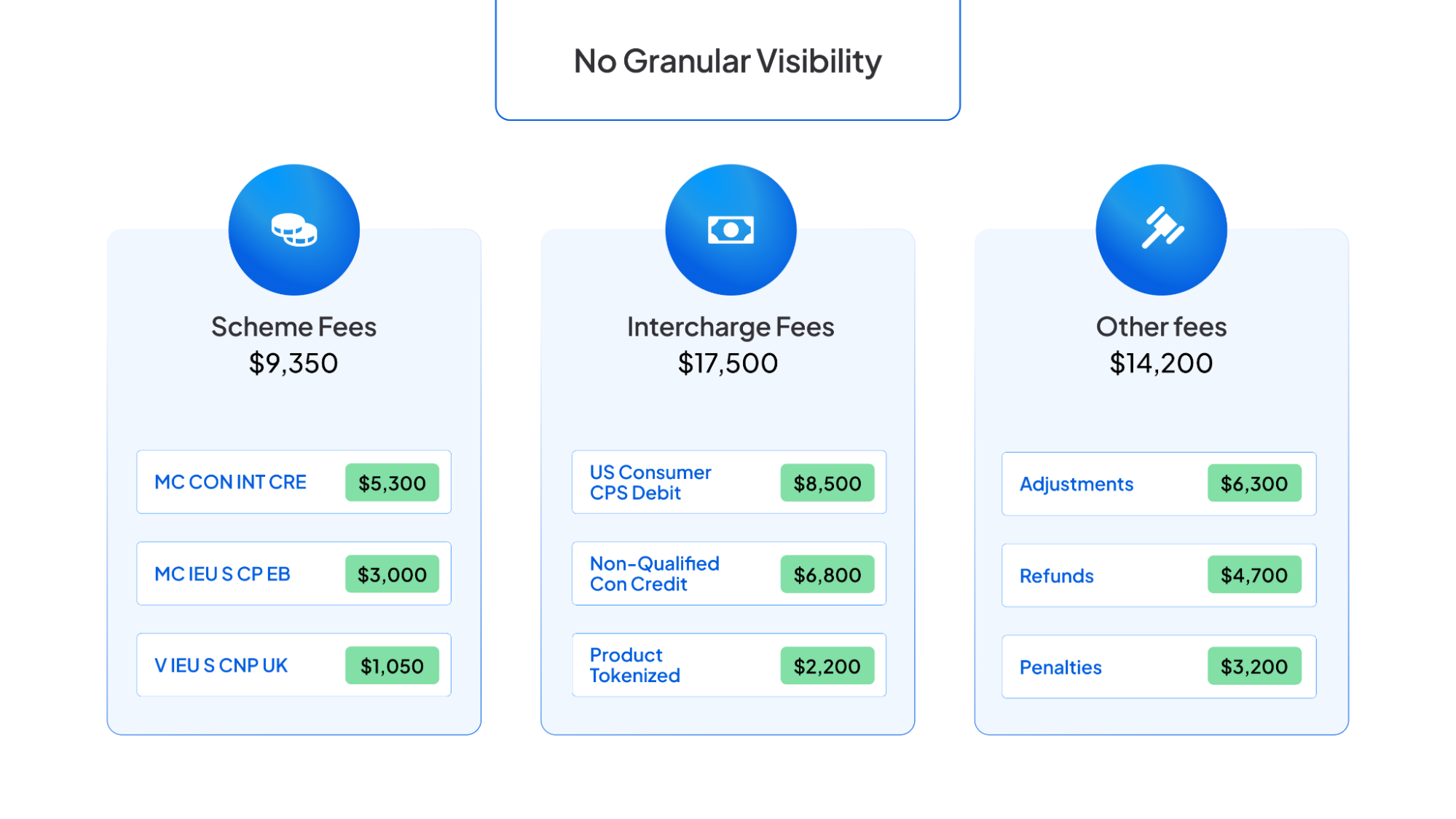

2. No Granular Visibility Into What You're Really Paying For!

Enterprise merchants deal with thousands to millions of transactions daily. While they may have summary-level visibility on total fees, the real challenge lies in understanding where those costs are coming from at a granular level.

For example, you might know your total payment processing fees last quarter were $3.6 million but not that 8% of that fee came from a specific card type under a card brand in a single region, where high authorization decline rates from that card type was causing additional retry fees.

In addition fee reports will be often incomprehensible with fee names combinations and short forms. For instance, fee descriptions often follow internal naming conventions optimized for system processing by providers. A line item like “MC IEU DB ICEC CON S CP EB” may technically represent a certain fee name from a provider perspective, but without access to detailed fee mapping or definitions, it becomes extremely difficult for merchants to decipher what exactly they are being charged for.

These insights aren’t easily surfaced, and in many cases, they require manual extraction, reconciliation, and in-depth analysis. Often, that means dedicating full-time finance or ops resources just to track fees down to the item or transaction level.

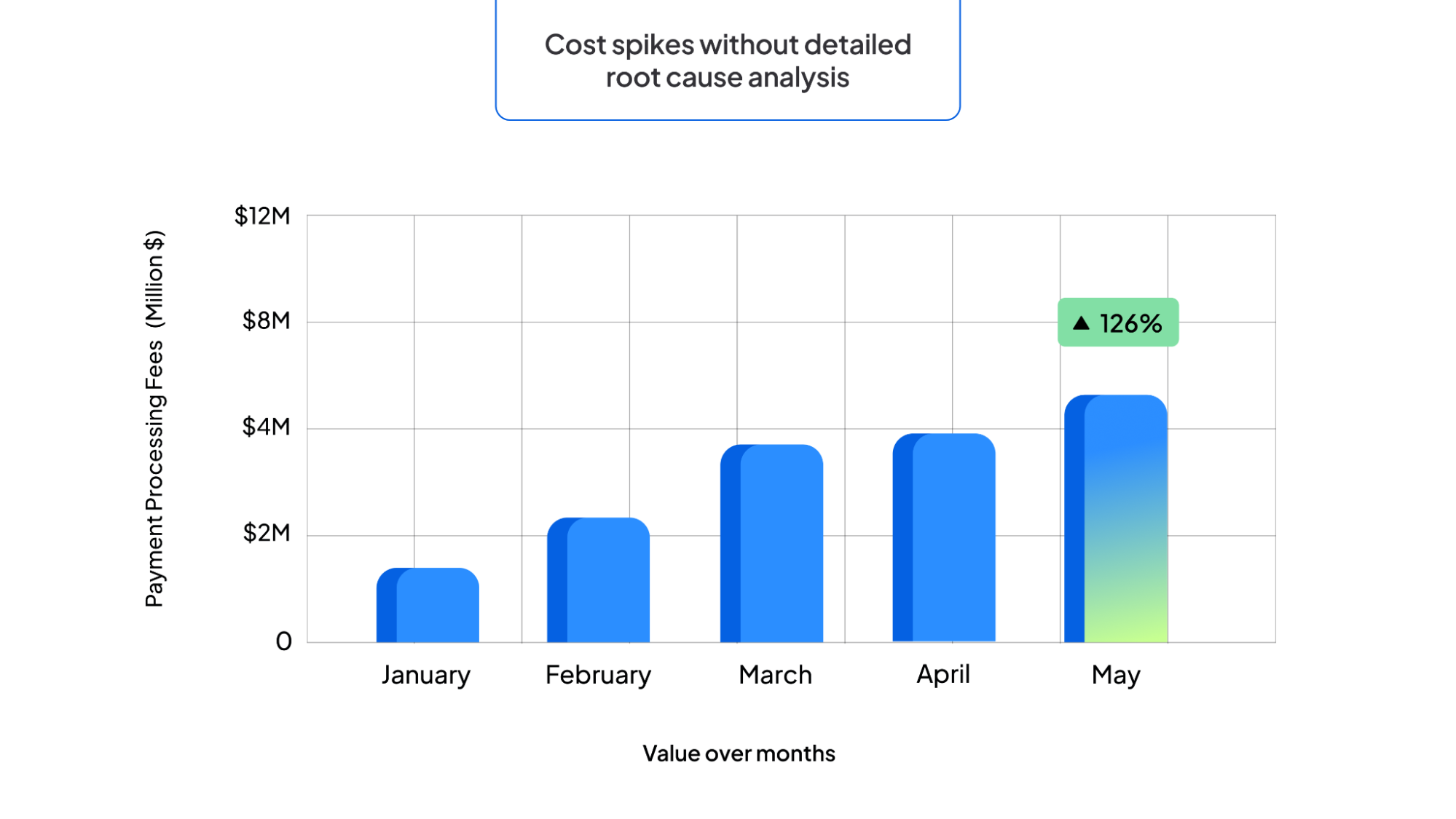

3. Cost Spikes without detailed root cause analysis

When payment costs rise unexpectedly, enterprise merchants are often left guessing the cause. Was it a change in card network pricing? A PSP fee adjustment? A configuration issue with the processor? Or perhaps a shift in consumer behavior triggering different transaction flows?

Without a centralized and structured way to analyze cost drivers, the root cause often remains unknown and by the time it’s discovered, it is already eaten into your margin.

To support innovation and create more seamless payment experiences for merchants and consumers, card networks regularly introduce updates adjusting fee structures, refining qualification criteria, and adding new transaction features. However, with frequent changes and highly detailed technical rules, it becomes difficult for merchants to fully interpret the downstream cost impact.

Take the Visa Digital Commerce Fee, for example.In the U.S., this fee applies to all card-not-present (CNP) settled transactions regardless of the type. This includes ecommerce checkouts, phone orders, mail orders, automatic billing, card-on-file transactions, and even manually keyed payments. For someone encountering this fee for the first time, there’s often no clear indication of why it was charged. And this is just one example of the payments ecosystem being filled with nuanced fee structures like this.

Without transparent mapping between fees, rules, and real transaction patterns, merchants are left without the insight they need to manage costs effectively.

4. Lack of Foresight into Card Network Pricing Shifts

In the same way, when card brands release their updates, these changes can significantly impact your payment costs, but merchants may or may not realize the impact of these changes on their payment processing fees.

There’s no centralized, consistent way to track and understand these updates. Information is often fragmented and released through multiple sources, in varying formats.These fee changes are tied to a wide range of attributes like card type, authentication method, transaction channel, and merchant category and all are defined differently across card schemes.Without a structured breakdown of how these attributes influence your fees, it will be a daunting manual task to understand the impact of these fees.

Cost observability layer for Payment processing fees

We believe enterprise merchants don’t just need reports, they need detailed visibility into their payment fees, control and right decisions to avoid unnecessary fees.

We have built a Cost Observability tool, a SaaS product of Hyperswitch designed specifically to solve the pain points mentioned above for mid-to-large enterprises operating across multiple regions, PSPs, and payment methods. It is not just about displaying your fees, it’s about helping you understand, audit, control and optimize your payment processing fees with complete visibility.

Here’s how our tool addresses the above challenges:

- Unified Cost Dashboard: No more fragmented views. It consolidates fee data from all your PSPs, card schemes, and payment methods across regions and business units into a single unified sleek dashboard giving you a full visibility of your payment costs.

- Deep Cost Analytics: Drill down into your payment fees by PSP, card brand, region, payment method, and business units. You have flexibility to view your costs at the most granular level.

- Identifying and analyzing cost spikes: Automatically detect cost spikes and anomalies across any dimension with alerts before they impact your margins. Uncover root causes, from behavioral shifts to penalties, with detailed analysis.

- Fee Audit Engine: Compare billed fees against expected rates to spot discrepancies. Our tool helps you validate if PSPs are charging in line with agreed pricing and flags potential overcharges down to the transaction level.

- Forecasting Network Fee Changes: Forecast and understand how upcoming card scheme rule changes (e.g., Visa/Mastercard) will impact your future costs.

- Intelligent Cost Prediction and Scenario Planning: It can leverage your transaction meta data to predict your payment processing costs and also can enable you to simulate scenarios such as adjusting your card brand mix, routing changes, or payment method adoption strategies to plan your payment processing costs.

What Makes our tool different?

Solving payment cost visibility at enterprise scale isn’t just about building a dashboard, it requires handling fragmented data, decoding opaque fee structures, and adapting to constantly evolving network rules. Hyperswitch cost observability tool is built with our foundation to solve that complexity.

Here’s how we make it work:

- Normalizing Data Across PSPs, Schemes, and Regions: We ingest fee data from multiple PSPs, networks, and geographies even when it comes in different formats, structures, or levels of detail. Our ingestion layer applies a normalization engine that maps and aligns fee names, transaction types, and reporting logic into a unified schema. This enables you to see your costs at a unified view, regardless of format.

- Decoding Fees With Intelligent Mappings: We maintain a dynamic fee intelligence model that understands fee structures across Visa, Mastercard, and major PSPs. Every fee is mapped back to its true source whether it’s interchange, scheme, or markup and is labeled with clear context: what it means, when it applies, and why you were charged.

- Built-In Rules Engine for Audits and Deviations: Our audit engine cross-checks billed rates with your contracted rates or publicly available benchmarks. We also flag unexpected patterns in your fees and list down possible root cause analysis for your cost spikes using AI engines and rule engines that analyse possible cause and effect relationships.

- Network Fee Forecasting Engine: We stay on top of card scheme updates and model the downstream impact of upcoming rule changes using your transaction history or meta data available from your fee reports. This allows you to see how future network changes might affect your costs, and plan your strategies to avoid unnecessary costs.

- Enterprise-Grade Architecture: Built to handle scale, this tool runs on a robust, secure architecture designed for high-volume data processing. We offer flexible data ingestion options, including SFTP, API-based integrations, and direct PSP connections. Your data stays safe, reliable, and always accessible.

In short, we don’t just display what’s happening, we show you why it’s happening, and how to take action. Hyperswitch cost observability tool transforms fragmented fee data into structured cost intelligence, so you can stay ahead of complexity, eliminate overcharges, unlock margins that were previously hidden and control your costs.

What Makes our tool different?

There are dashboards. There are reports. And then there’s real observability. Here’s what sets it apart:

- Not just a fee viewer — a cost intelligence platform: Other tools may show you summary costs or basic breakdowns. Hyperswitch Cost observability too gives you actionable intelligence, with the depth to trace costs down to each fee type, and the flexibility to slice data across any business or regional axis.

- Purpose-built for enterprise-scale complexity: We understand what $500M+ GMV merchants deal with: multiple PSPs, multiple currencies, and multiple reporting formats. This was designed for that scale and complexity involved in payment processing fees across regions.

- Always up to date, always evolving: We stay on top of network fee changes, regional nuances, and PSP logic so you don’t have to. Our platform evolves with your business and the payment landscape.

In a world where payment processing fees are one of the least understood in detail, we put control back into the hands of enterprise merchants with Hyperswitch Cost observability. Explore Hyperswitch Cost Observability today. Try the live demo