If you ask businesses about top rising threats to them, it’s unlikely that you will get chargeback fraud as one of the answers. Yet, this threat leads to hefty monetary losses annually for businesses. Chargeback frauds result in substantial revenue drops and unnecessary business spending, adding a double whammy to their finances. Hence, understanding the mechanism behind chargeback fraud and implementing specific prevention strategies is crucial for the survival of businesses.

What is a Chargeback Fraud?

Fraud is the intentional ploy to gain an unjust or illegal profit, which often results in monetary loss for individuals or companies.

Chargeback fraud occurs when a consumer deliberately disputes a legitimate transaction with an unsuspecting merchant to receive a refund while keeping the product or service. Such consumers typically ask the bank to reverse the charge on that transaction.

Usually, chargeback fraud occurs in 3 different ways. First, a customer alleges they didn’t authorise the payment, so the chargeback should be initiated. Second, a customer claims they didn’t get the goods or services as promised, so they want a chargeback. Third, customers say they are unhappy with the goods or services and want a chargeback.

In fraud cases, such claims are misleading. Merchants ordinarily cannot understand they are being scammed. So, they honor such claims which means a direct financial hit for the merchant. Simply, chargeback fraud is a harmful practice that can be quite hard to identify. It is damaging as it robs businesses of valuable time, money and resources.

Types of Chargeback Fraud

Apart from knowing the chargeback fraud meaning, you will also need to know the various types through which chargeback frauds are effected. All of them damage businesses, making it important to understand them.

Friendly Fraud

The name of this chargeback fraud type contains ‘friendly’, but there is nothing amicable about it. Friendly fraud happens when a consumer makes a legitimate purchase but later disputes the charge either due to forgetfulness, a misunderstanding, or with the intent to receive a refund while keeping the goods.

In this type of fraud, customers may claim they forgot about the transaction, didn’t understand the billing properly, or willingly questioned the transaction to get a refund—all while having no intention of returning the goods. Unfortunately, it's one of the most common forms of chargeback fraud and is hard for businesses to fight off due to its harmless appearance.

Return Fraud

Let’s now turn to return fraud. This happens when unscrupulous customers abuse the return policy by asserting a false claim about the product or service. They might return something else, a less valuable item, or even a vacant box.

Return frauds lead to chargebacks if the business denies the refund, as customers can contest the charge through their bank.

Digital goods

Digital goods, due to their intangible forms, are misused for chargeback fraud.

This is particularly frequent in industries dealing in intangible products such as software, music, and online subscriptions.

Since these goods or services have no physical form and are often delivered instantly, they're hard to track. And recovering them is harder. Fraudsters can contest these purchases without much difficulty, leading to chargebacks that are difficult to refute.

Which types of businesses are impacted by chargeback fraud?

Chargeback fraud doesn’t favour any one industry or sector. But, there is evidence that points to startling facts. One, some industries are more susceptible to chargeback fraud than others. Two, these firms come from industries including e-commerce, subscription-based services, digital goods sellers, online travel services, and even gaming. Naturally, they have been hit by financial losses.

These sectors depend on card-not-present transactions, which essentially means they lack the physical verification that in-person buys can provide.

Retailers, typically those with ‘generous’ return policies, also face chargeback frauds more regularly than those that don’t have such policies. So, for these businesses, chargeback fraud protection is a must, or else they risk substantial financial losses.

Why is Chargeback Fraud Hard to Identify?

Chargeback frauds are infamously hard to spot. The main reason appears to be that chargeback frauds look and feel legitimate on the surface until you realise they aren’t.

The time elapsed between the purchase and the dispute can also make it difficult for a merchant to get the evidence to contest the chargeback. Banks usually go with their customer. This stance places merchants at a major disadvantage.

Hence, without the best chargeback protection tools, you as a business may find it quite hard to differentiate between a legitimate dispute and a fraud.

How to Prevent Chargeback Fraud

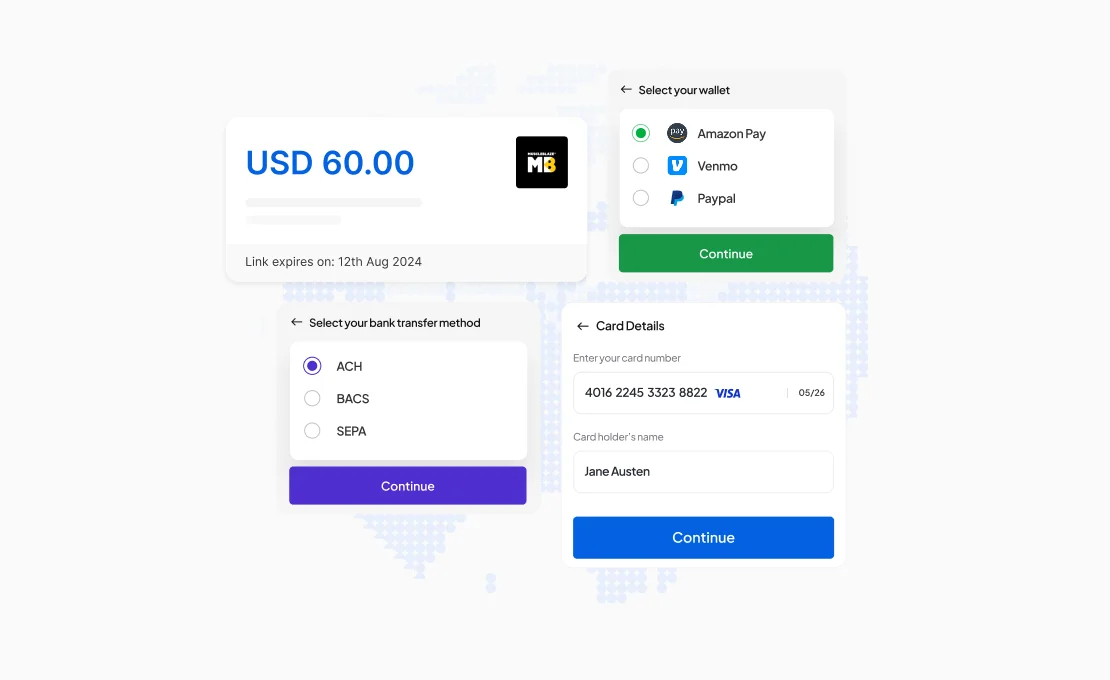

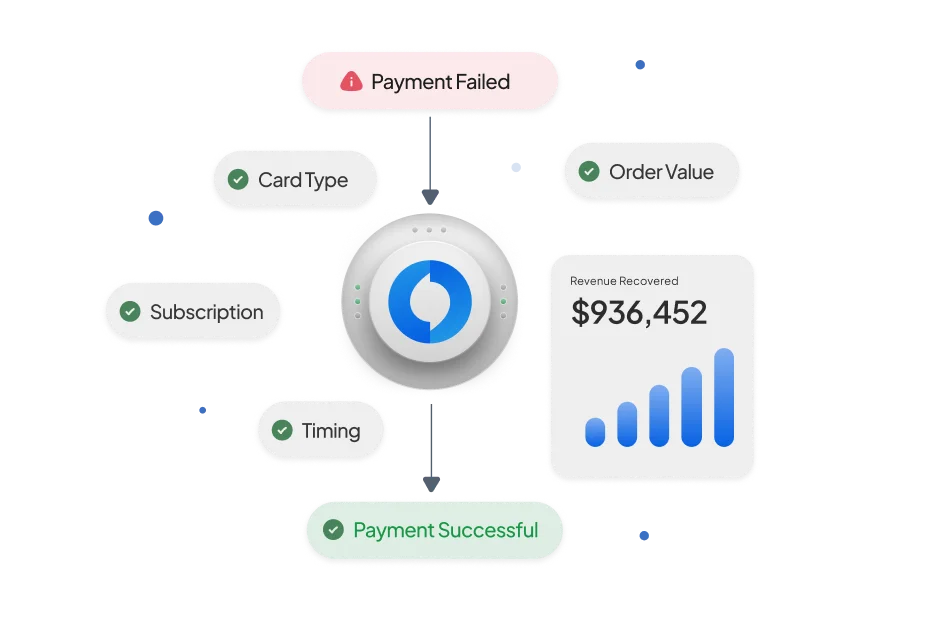

Preventing chargeback fraud requires a proactive approach. Clear communication with customers is a good first step. Make sure your return and refund policies are easy to understand. Offering detailed receipts or proof of delivery can also help. Using chargeback fraud prevention tools, such as multi-factor authentication and fraud detection software, is another key tactic. These solutions can flag suspicious transactions before they turn into a problem. Finally, merchants should work with banks to build a strong case against fraudulent chargebacks by keeping thorough records and documenting every transaction.

Conclusion

Chargeback fraud is a serious issue that can harm businesses financially. Understanding how chargeback fraud works and taking measures to prevent it is essential. Businesses can protect themselves from unnecessary losses by educating themselves about the different types of fraud and utilising chargeback prevention tools.

Explore Juspay’s Chargeback Protection Solutions

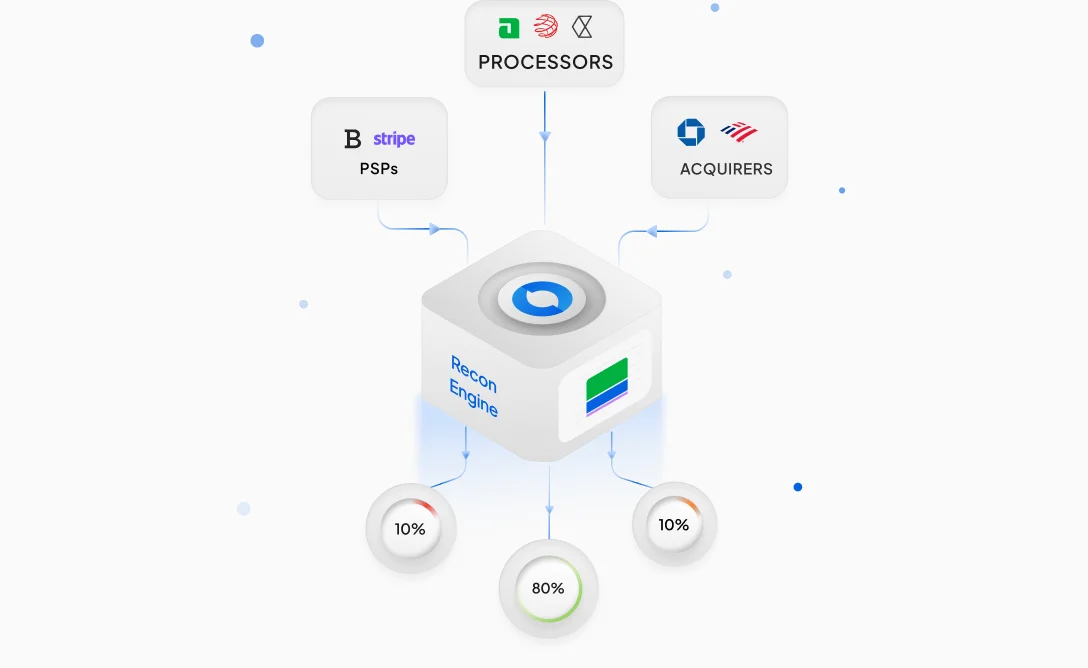

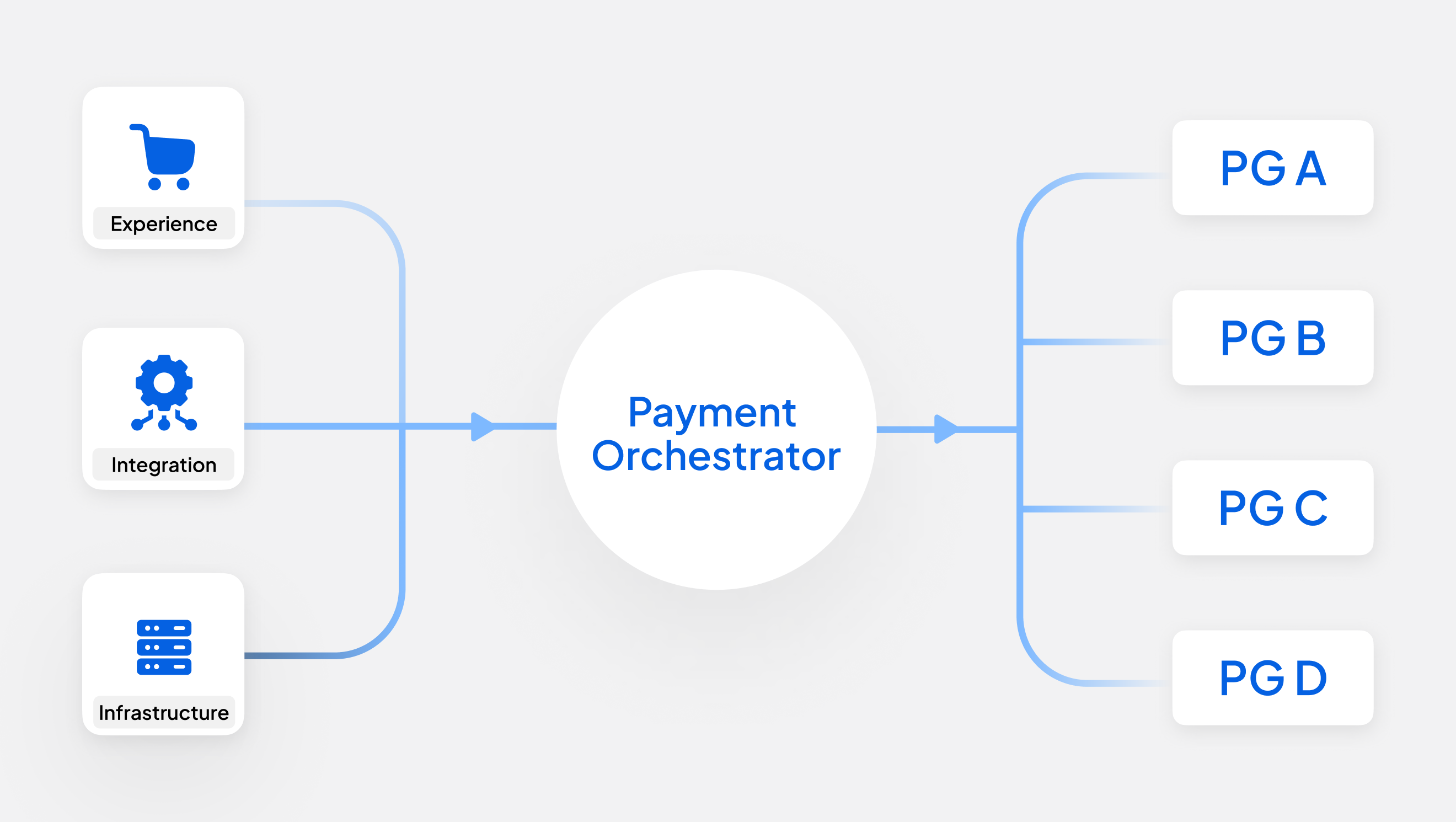

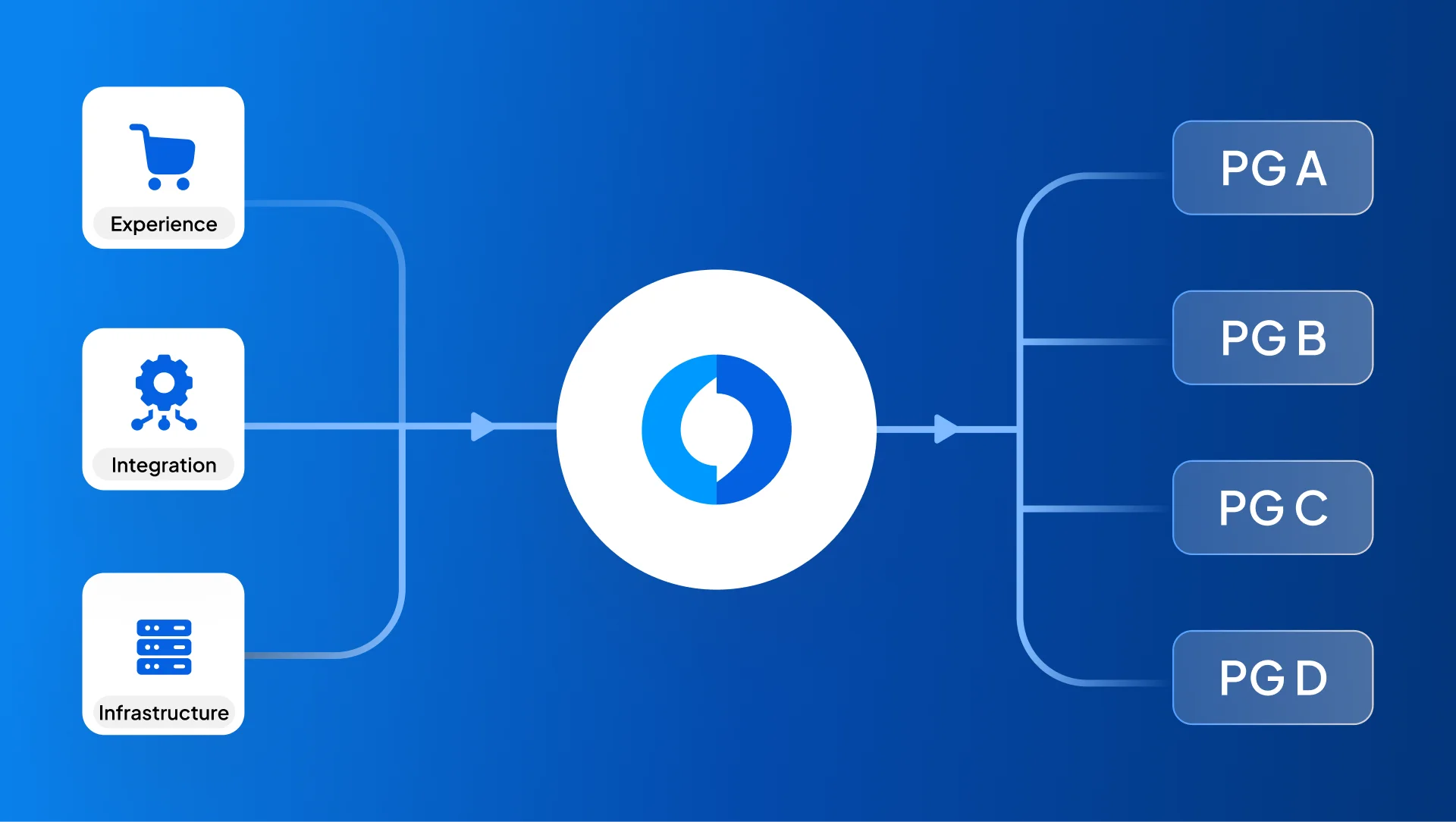

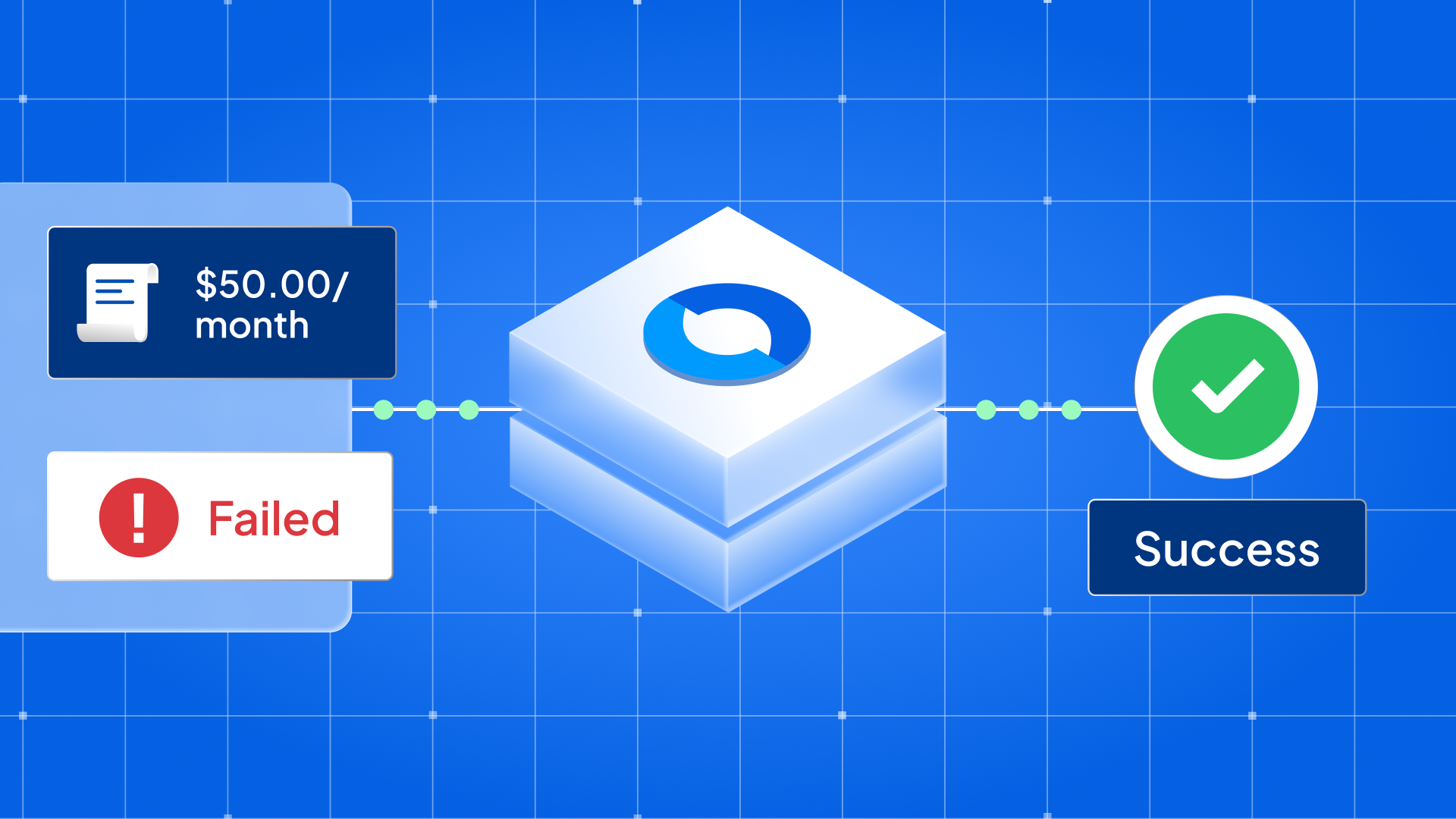

Juspay helps businesses reduce chargebacks by managing disputes across multiple processors through a unified dashboard. With comprehensive tools designed to prevent and resolve chargebacks, Juspay ensures merchants have the best resources at their disposal to protect their revenue.