Running a business that accepts digital payments means that you'll face chargebacks at some point in time. The real problem occurs when these chargebacks turn fraudulent, they become a serious threat to a business’ profitability. Before moving on with chargeback fraud, let's first understand why chargebacks were introduced.

Chargebacks were introduced in the US in 1974 with the Fair Credit Billing Act. The aim was to protect consumers against fraud, technical errors, or non-delivery of the product/services whenever they were transacting through a credit card or a bank account. Chargebacks soon became a crucial tool for consumer protection, but a few consumers started abusing it by falsely claiming chargeback against a legitimate transaction.

Chargeback fraud, nowadays, has become a critical issue for the merchants as it is increasing rapidly. According to a Mastercard-sponsored study by Datos Insights, merchants identify 45% of their chargebacks as fraudulent. The study also states that the merchants will lose $15 billion to fraudulent chargebacks in 2025. This article will help merchants understand what chargeback fraud is, how it affects their business, and how they can prevent it.

What Is a Chargeback and How Does It Work?

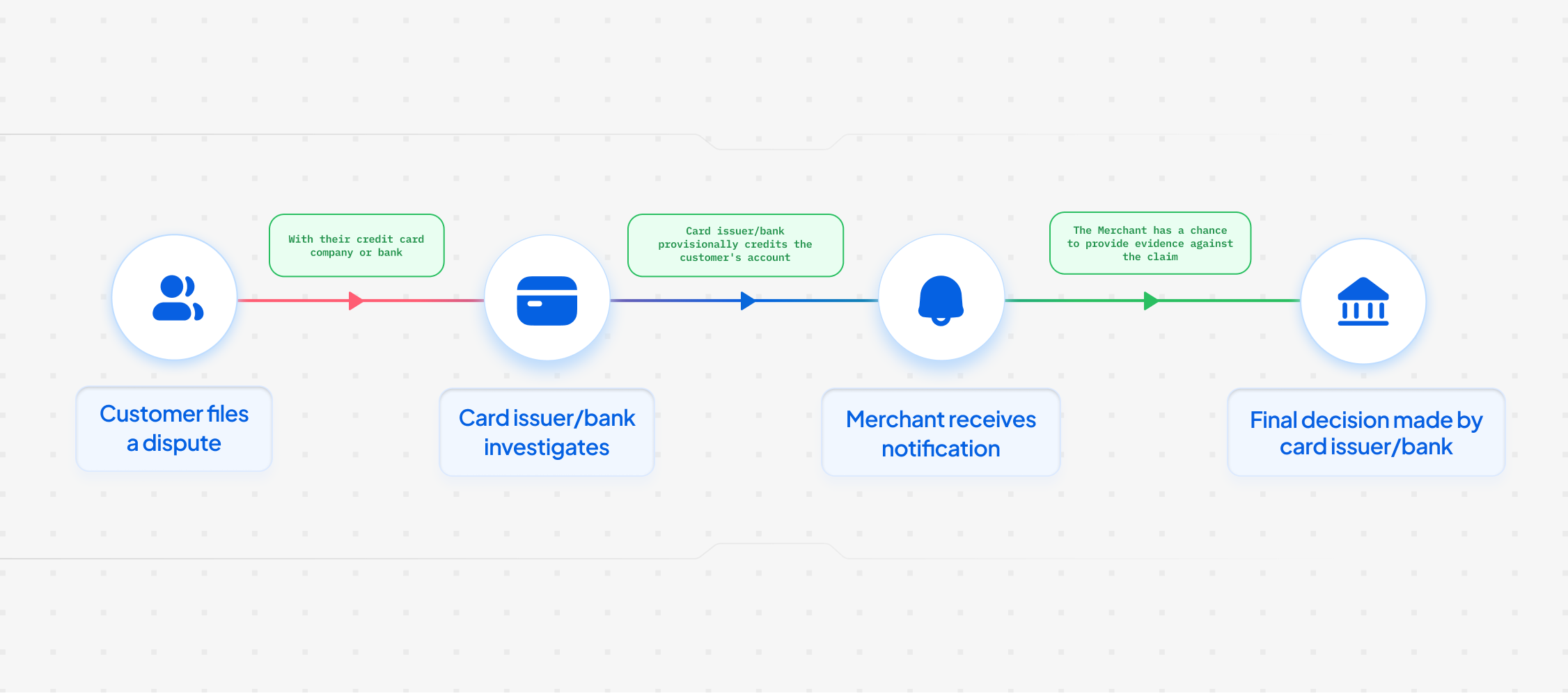

Before moving to chargeback fraud, let's first understand what chargeback is. Think of a chargeback as a financial safety net for consumers. When customers dispute a transaction with their bank/credit card provider, they're essentially asking for their money back while bypassing your business entirely. The process works like this:

- Customer files a dispute with their credit card company or bank

- Card issuer/bank investigates the claim and provisionally credits the customer's account

- Merchant receives notification and has a chance to provide evidence against the claim

- Final decision is made by the card issuer/bank based on available evidence

Chargebacks serve an important purpose in the payment ecosystem, they give customers confidence to make purchases, knowing they are protected in case something goes wrong. However, fraudsters exploit this by falsely filing a chargeback leading to what we now know as chargeback fraud.

What is Chargeback Fraud?

Chargeback fraud occurs when customers deliberately abuse the chargeback system to get their money back while keeping the product or service they purchased. It's essentially a form of theft that uses legitimate consumer protection processes as a weapon against merchants.

Here's how it works: A customer makes a purchase, receives the product or service, then contacts their bank claiming they never authenticated the transaction or never received what they ordered. The bank/credit card provider issues a chargeback, the customer keeps both their money and the product, and the amount gets deducted from the merchant’s account leading to lost revenue for the merchant.

This type of fraud is particularly damaging because it bypasses your normal customer service channels. Instead of contacting you directly to resolve issues, fraudulent customers go straight to their bank, making it nearly impossible for you to address their concerns before losing the sale.

Chargeback Fraud vs. Friendly Fraud: What's the Difference?

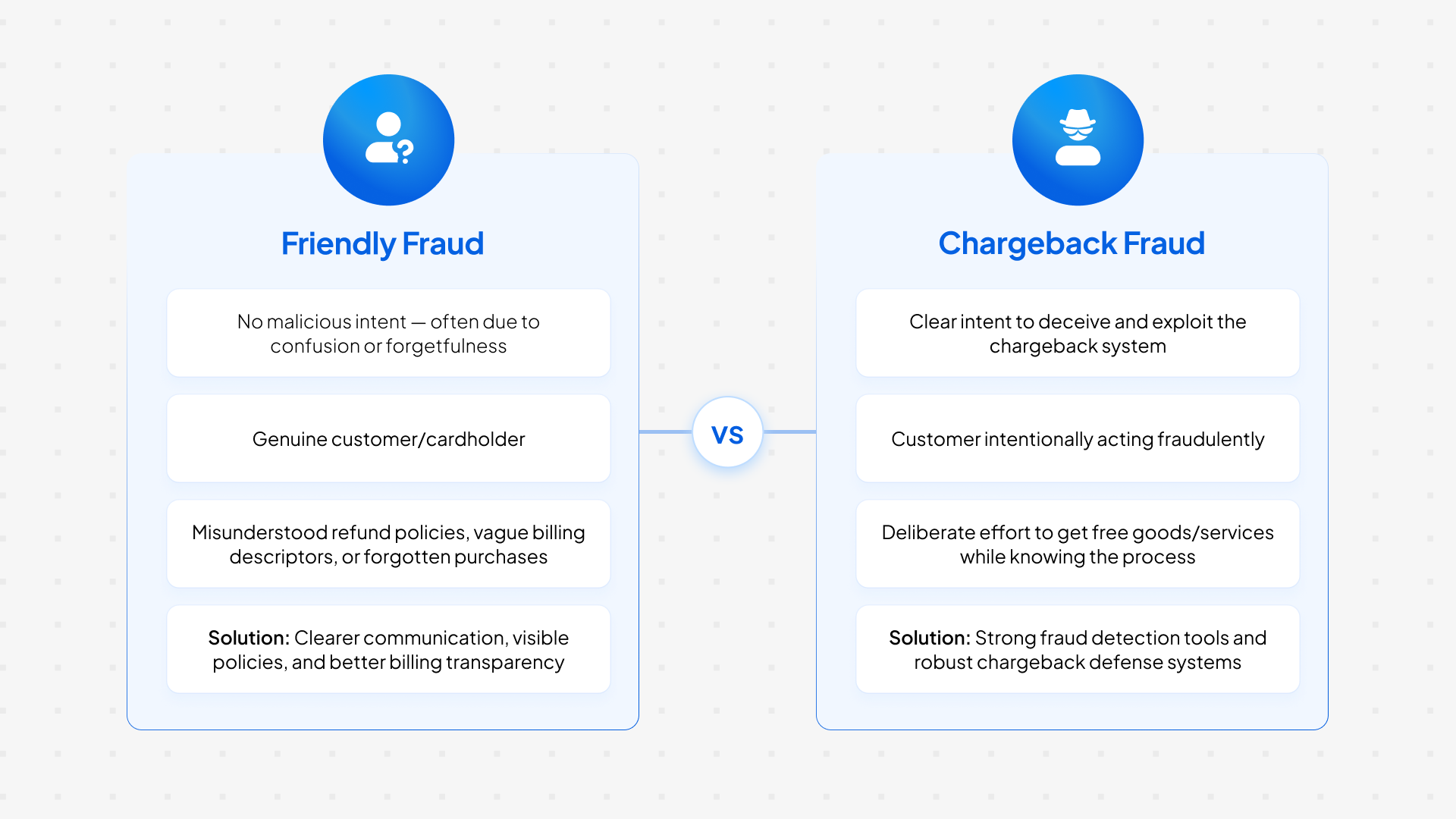

While often used interchangeably, chargeback fraud and friendly fraud have a few differences:

Friendly Fraud happens when customers file chargebacks without malicious intent. They might genuinely forget about a purchase, not recognize your business name on their statement, misunderstand your refund policy or the transaction was done by the customer’s family members. These customers are not trying to steal from the merchant - they're just confused or misinformed.

Chargeback Fraud involves deliberate deception. These customers intentionally abuse the chargeback system to get free products or services. They understand the process and exploit it for personal gain.

A merchant should handle both friendly fraud and chargeback fraud differently. Friendly fraud can often be prevented through better communication and clearer policies, while chargeback fraud requires more robust defense mechanisms and fraud detection tools.

Types of Chargeback Fraud

Let's take a look at the different types of chargeback fraud helps you recognize patterns and develop targeted prevention strategies:

True Fraud

This involves stolen credit card information used to make unauthorized purchases. While not technically chargeback fraud since the cardholder is legitimately disputing an unauthorized transaction, it still results in chargebacks that impacts your business.

Friendly Fraud (First-Party Fraud)

Customers file chargebacks without foul intent, this can be due to:

- Forgetting about recurring payments or subscriptions

- Not recognizing the merchant name on their statement

- Misunderstanding return or refund policies

- Family members making purchases without the customer’s knowledge

Intentional Chargeback Fraud

Deliberate abuse of the chargeback system where customers:

- Claim they never received products they actually received

- Dispute digital products after partially or fully consuming them

- File chargebacks on recurring payments they signed up for

- Use services then claim they were unauthorized

Return Fraud

Customers receive the physical products, use or consume them, then file chargebacks claiming defective or undelivered goods. This is particularly common with digital products, software, and online courses.

Subscription Fraud

Subscription fraud is a significant problem for businesses with recurring payment models. Customers sign up for services, use them for months, then dispute all charges claiming they never authorized the subscription.

How Chargeback Fraud Affects Your Business

The impact of chargeback fraud extends far beyond the immediate financial loss. Here's what you're really dealing with:

Direct Financial Losses

Every chargeback costs you the original transaction amount plus an additional chargeback fee. You also lose the product or service provided, leading to a two sided loss in the revenue.

Operational Overhead

Chargeback management consumes valuable time and resources. Merchants need to allocate staff to manage chargeback disputes, collect evidence, and communicate with financial institutions. This hidden cost impacts your overall productivity and profitability.

Risk to Payment Processing

Card networks monitor the chargeback ratio of merchants for the safety of the customers. If it exceeds a certain threshold (typically 1% for Visa and 1.5% for Mastercard), merchants can face penalties, higher processing fees, or even lose the ability to accept credit cards entirely.

Inventory and Cash Flow Issues

For physical products, chargebacks mean losing inventory without compensation. For service-based businesses, you've already invested time and resources that can't be recovered. This creates cash flow problems that can cripple growing businesses.

Damage to Customer Relationship

Fighting chargebacks can damage relationships with legitimate customers who may have filed disputes due to confusion rather than malicious intent.

The chargeback-to-transaction ratio has increased rapidly in the last few years, including merchant error, true fraud, and first-party fraud. Even merchants with strong fraud prevention measures are seeing more disputes.

Comprehensive Chargeback Protection and Prevention Strategies

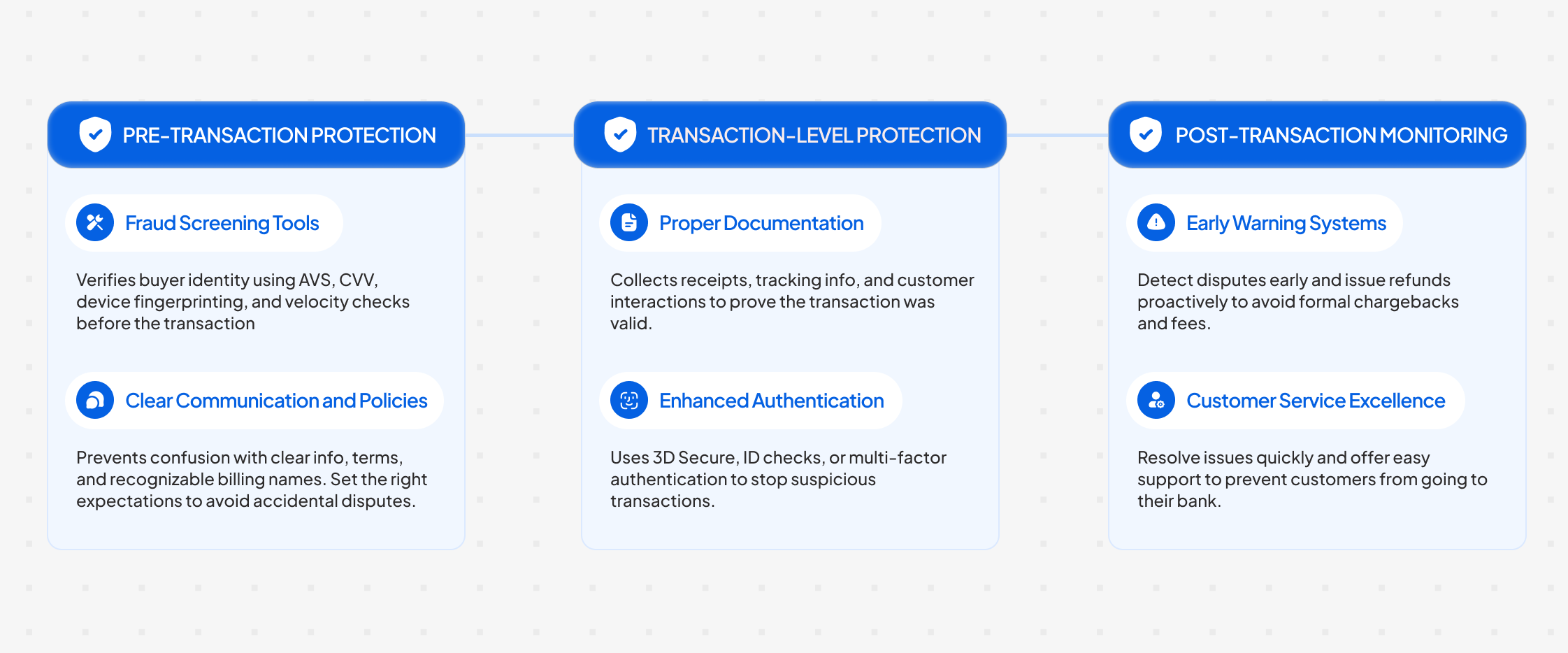

Protecting your business from chargeback fraud requires a multi-layered approach that addresses prevention, detection, and response:

Pre-Transaction Protection

- Fraud Screening Tools: These tools help verify buyer identities before completing transactions. Address Verification Service (AVS) compares billing addresses with card issuer records, while CVV verification confirms the customer has the physical card in their possession. Device recognition identifies suspicious devices or browsing patterns that might indicate fraudulent activity, and velocity checking flags unusual purchasing patterns or frequencies that could signal coordinated fraud attempts.

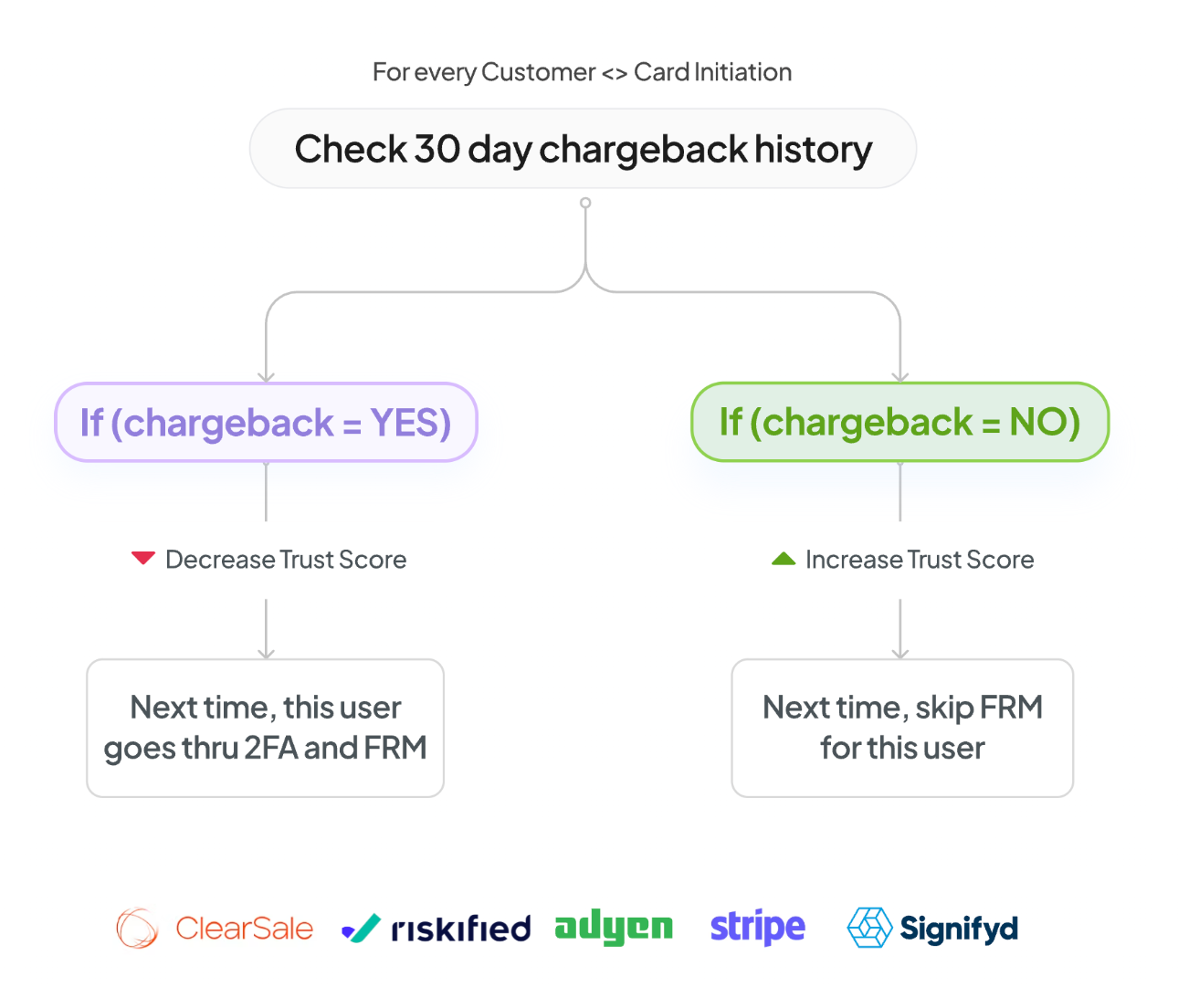

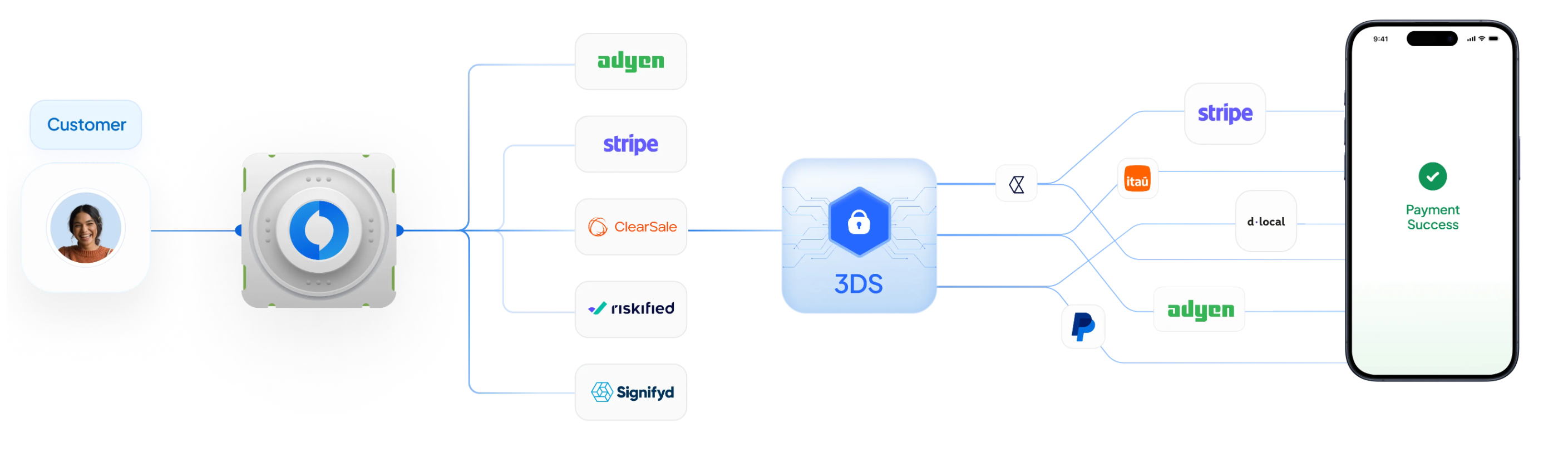

- Fraud scoring tools: These tools provide an additional security layer by grading a particular transaction based on the recent transaction history of the customer. Merchants can build a custom fraud & risk management engine with a global payment orchestrator like Juspay tailored to utilize insights from existing customers and payment method data. Juspay’s custom FRM engine enables merchants to build an in-house trust score to check a customer’s risk profile.

- Clear Communication and Policies: Many chargebacks occur due to confusion rather than malicious intent, making clear communication a merchant’s first line of defense. Using recognizable business names on credit card statements prevents customers from filing disputes simply because they don't remember making a purchase. Providing detailed product descriptions and comprehensive terms of service helps set proper expectations from the start. Sending confirmation emails with clear contact information gives customers a direct path to resolve issues with you instead of their bank. Making your refund and cancellation policies easily accessible on your website reduces confusion about how to get their money back legitimately.

Transaction-Level Protection

- Proper Documentation: To defend against a chargeback, gather and submit evidence that the transaction was legitimate, such as order confirmations, delivery tracking, and communication records with the customer. This documentation can help prove the validity of the sale and refute the chargeback claim. Essential documentation includes signed delivery receipts or tracking information that proves the customer received their purchase, customer communications like emails, chat logs, and support tickets that show ongoing interaction, and terms of service acceptance records that demonstrate the customer agreed to your policies.Merchants should also collect IP address and device information to establish the customer's digital footprint, and screenshots of account activity for digital services that show the customer actively used what they paid for. This comprehensive documentation becomes a merchant’s strongest defense against a dispute.

- Enhanced Authentication: For high-value transactions or orders that score high on fraud scoring, implementing additional verification steps can prevent illegitimate purchases from completing. Requiring additional verification steps for suspicious orders and using 3D Secure authentication for such transactions.Implementing multi-factor authentication for customer account access ensures that only authorized users can make purchases or changes to their accounts, significantly reducing the risk of unauthorized transactions that lead to legitimate chargebacks.

Post-Transaction Monitoring

- Customer Service: Many chargebacks can be prevented through excellent customer service that addresses issues before customers feel compelled to contact their bank. Responding quickly to customer inquiries and complaints shows that you're committed to resolving problems, while providing easy-to-find contact information gives frustrated customers a clear path to reach you directly. Offering hassle-free returns and refunds when appropriate demonstrates good faith and often costs less than fighting a chargeback, and following up with customers to ensure satisfaction can catch potential issues before they escalate. Remember that customers who have positive interactions with your support team are far less likely to dispute charges, making customer service one of your most effective chargeback prevention tools.

Chargeback Response Strategy

When chargebacks do occur despite your prevention efforts, having a systematic response strategy improves your chances of winning a dispute. A merchant’s response should include reviewing the chargeback reason code to understand exactly what the customer is claiming, gathering all relevant information that supports your case, and preparing a compelling rebuttal letter that explains why the chargeback should be reversed. Timely submission of a merchant’s response is important since late responses are automatically ruled in favor of the customer.

The quality of the evidence matters a lot in chargeback disputes. Providing clear, organized documentation that tells a compelling story, including timestamped delivery confirmations that prove the customer received their purchase, showing proof of customer engagement with your service through login records or usage data, and demonstrating compliance with card network requirements all strengthen your case substantially.

Building a Chargeback Protection Program

Creating an effective chargeback protection program requires ongoing attention and systematic refinement to stay ahead of evolving fraud tactics. Your monthly review process should analyze chargeback trends and patterns to identify common themes, examine the specific dispute reasons to understand what's driving customer complaints, review and update your fraud prevention rules based on new threats you're seeing, and train your staff on emerging fraud techniques and prevention strategies.

Tracking key performance indicators helps measure your program's effectiveness and identify areas for improvement. Monitor your overall chargeback ratio to ensure you stay below card network thresholds, calculate your win rate for disputed chargebacks to gauge the quality of your evidence and response process, measure the average time to resolve disputes since faster responses often lead to better outcomes, and track the total cost per chargeback

Apart from that a merchant should also monitor customer satisfaction scores, as happy customers are less likely to file chargebacks. The fraud landscape constantly evolves, so your protection strategies must evolve alongside new threats. Stay updated on emerging fraud trends and techniques, regularly test and update your fraud prevention rules to ensure they're catching new attack patterns, gather feedback from customers about their experience to identify friction points that might lead to disputes, and collaborate with other merchants to share threat intelligence and best practices.

Effectively Enhance Fraud Detection with Juspay’s Custom FRM engine

Juspay enables merchants to build a custom Fraud & Risk Management engine, seamlessly integrate FRM services into your Payments Stack, and leverage tailored insights from customer attributes & payment methods data. With Juspay’s custom FRM engine, merchants can build an in-house trust score to identify a customer's risk profile and push for 2FA accordingly.

Key Benefits:

Processor-Agnostic Integration: With a single API, merchants can seamlessly connect with an FRM solution of their choice.

Customized Fraud Strategies: Adjust fraud prevention measures by selecting between Pre-Auth and Post-Auth checks based on specific payment methods and connectors.

Unified Dashboard: A comprehensive dashboard that displays all flagged transactions, simplifying fraud review and decision-making.

Real-Time Alerts: Receive instant notifications the moment suspicious activity is detected—allowing for swift responses and reduced financial risk.

Insightful Analytics: Gain deep insights into fraud trends with detailed reporting, empowering smarter strategy updates and prevention tactics.

Conclusion

Chargeback fraud poses a serious threat to businesses of all sizes, but it's not insurmountable. By understanding the different types of fraud, implementing comprehensive prevention strategies, and maintaining excellent customer service, you can protect your business while providing the payment flexibility your customers expect.

Remember that chargeback prevention isn't a one-time setup - it requires ongoing attention and refinement. Stay informed about new fraud trends, regularly review your chargeback data, and don't hesitate to invest in tools and services that can help protect your business.

The key is to be proactive rather than reactive. Every chargeback you prevent is not just money saved, but also time and resources that can be invested in growing your business instead of fighting disputes.