What is Global Payouts?

Payouts is the process of transferring funds from one entity to another, enabling businesses to disburse payments to customers, vendors, employees, or partners. They are a cornerstone of financial operations, facilitating everything from salary payments and loan disbursals to refunds and marketplace settlements. In today’s globalized economy, payouts are not just about moving money—they are about ensuring transactions are fast, secure, and compliant with regional regulations.

Key Stakeholders in the Global Payouts Infrastructure

The global payout ecosystem involves multiple stakeholders, each playing a critical role:

- Businesses: From e-commerce platforms to gig economy apps, businesses rely on payouts to fulfill financial obligations.

- Customers: End-users who receive payments, such as freelancers, sellers, or refund recipients.

- Banks and Payment Processors: Institutions that facilitate the actual transfer of funds.

- Regulators: Entities that enforce compliance with local and international financial laws.

Why Global Payouts Matter

Payouts are more than just a financial transaction; they are a reflection of a business’s reliability and efficiency. For instance, a gig worker receiving instant earnings or a customer getting a quick refund can significantly boost trust and satisfaction. On the operational side, efficient global payout systems reduce administrative overhead, minimize errors, and ensure compliance with tax and regulatory requirements. In industries like e-commerce, gaming, and financial services, global payouts are a critical differentiator, directly impacting customer retention and brand reputation.

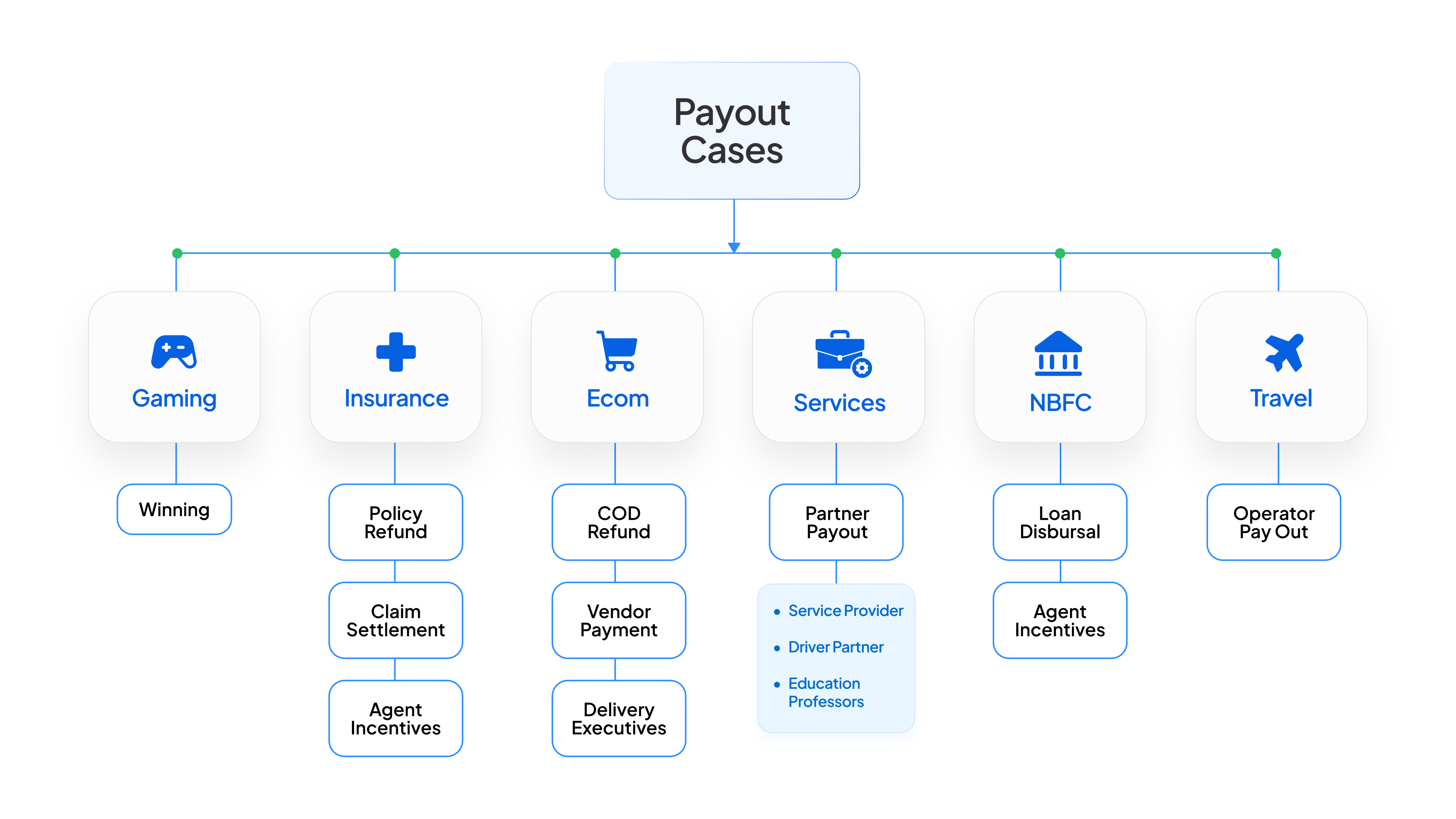

Use Cases of Global Payouts

Global payouts are ubiquitous across industries. For example:

- Gig Economy: Ride-hailing platforms disburse earnings to drivers in real-time.

- E-Commerce: Marketplaces process refunds and pay sellers their share of revenue.

- Financial Services: Digital lenders disburse loans directly to borrowers’ accounts.

- Gaming: Online gaming platforms pay out winnings to players.

Types of Payouts: Categorized by Key Dimensions

Payouts can be classified into three key dimensions: speed (instant vs. scheduled), complexity (single vs. bulk payouts), and geography (domestic vs. cross-border). Each type serves specific business needs and comes with its own set of advantages and challenges. Below, we explore these categories in detail.

| Category | Dimension | Pros | Cons | Use Cases |

| Speed | Instant Payouts | - Real-time or near real-time access to funds, enhancing user experience. - Ideal for industries like gig economy platforms or marketplaces. | - Higher processing fees due to real-time payment rails (e.g., UPI, Visa Direct). - Requires robust infrastructure for real-time processing. | - Gig economy platforms paying drivers instantly after each trip. - Marketplaces disbursing earnings to sellers in real-time. |

| Speed | Scheduled Payouts | - Cost-effective due to batch processing systems (e.g., ACH, SEPA). - Predictable and easier to manage for businesses with regular payout cycles. | - Delayed access to funds may not suit recipients needing immediate payments. - Less flexible for businesses requiring real-time disbursements. | - Payroll systems disbursing salaries on a fixed schedule. - E-commerce platforms paying sellers weekly or monthly. |

| Complexity | Single Payouts | - Simple and straightforward, suitable for individual transactions like refunds. - Easy to manage for businesses with low transaction volumes. | - Inefficient for businesses with high transaction volumes. - Can become cumbersome to manage at scale. | - E-commerce platforms processing refunds for individual customers. - Gig economy platforms paying freelancers for completed tasks. |

| Complexity | Bulk Payouts | - Highly efficient for processing large volumes of transactions in a single batch. - Cost-effective, reducing processing time and fees. | - Require robust systems to handle complex payout structures (e.g., split settlements). - Errors in bulk processing can impact multiple recipients simultaneously. | - Payroll systems disbursing salaries to employees. - Marketplaces paying thousands of sellers simultaneously. |

| Geography | Domestic Payouts | - Lower costs and faster processing times without currency conversion or international regulations. - Easier to manage due to familiarity with local banking systems and regulations. | - Limited to local transactions, restricting global operations. | - Local e-commerce platforms paying sellers within the same country. - Gig economy platforms disbursing earnings to workers in a single region. |

| Geography | Cross-Border Payouts | - Enable global operations, expanding market opportunities. - Essential for global freelancers, international marketplaces, and cross-border e-commerce. | - Higher costs due to intermediary banks, forex margins, and regulatory compliance. - Fluctuating exchange rates can impact the final amount received by recipients. | - Global freelancers receiving payments from international clients. - E-commerce platforms paying sellers in different countries. |

Regional Nuances in Global Payouts

Payout methods and regulatory requirements vary significantly across regions due to differences in banking infrastructure, consumer behavior, and local regulations. Below, we explore a few popular payout methods, regulatory considerations, and unique challenges in each region, ensuring comprehensive coverage of all major systems and guidelines.

Africa

Africa is a leader in mobile money adoption, driven by limited traditional banking infrastructure.

- Popular Methods:

- Mobile Money: M-Pesa (Kenya), Airtel Money, and MTN Mobile Money are widely used for global payouts.

- Bank Transfers: Used in more developed economies like South Africa.

- Cards: Debit and credit cards are gaining traction in urban areas.

- Regulatory Considerations:

- Compliance with local AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations.

- Licensing requirements for mobile money operators.

- Challenges:

- Region-Specific: Limited banking infrastructure in rural areas and low card penetration.

- Common: High transaction fees for cross-border payouts.

East Asia and Pacific

This region includes countries like China, Japan, Australia, and New Zealand, each with unique payment ecosystems.

- Popular Methods:

- China: Alipay, WeChat Pay, and UnionPay dominate the market. Cards are widely used, especially UnionPay.

- Japan: Bank transfers, Konbini (convenience store payments), and cards like JCB are popular.

- Australia: BPAY, PayID for real-time payments, and card payments (Visa, Mastercard).

- New Zealand: Bank transfers, POLi Payments, and card payments.

- Regulatory Considerations:

- China: Strict capital controls and data localization requirements.

- Japan: Compliance with local AML and KYC regulations.

- Australia: Compliance with AUSTRAC (anti-money laundering regulations).

- New Zealand: Compliance with local AML and KYC laws.

- Challenges:

- Region-Specific: Navigating strict regulations in China and adapting to Japan’s unique payment methods.

- Common: High card transaction fees in some countries.

Europe and Central Asia

Europe and Central Asia have a highly developed financial ecosystem with a strong emphasis on digital payments and data privacy.

- Popular Methods:

- SEPA (Single Euro Payments Area): Enables seamless euro-denominated transfers across 36 countries.

- Cards: Visa, Mastercard, and local schemes like Cartes Bancaires (France) are widely used.

- Digital Wallets: PayPal, Skrill, and other e-wallets are popular for consumer payouts.

- Regulatory Considerations:

- Compliance with GDPR (General Data Protection Regulation) for data privacy.

- Adherence to PSD2 (Payment Services Directive 2) for payment innovation.

- Challenges:

- Region-Specific: Complex compliance requirements for GDPR and PSD2.

- Common: Currency conversion fees for non-euro transactions.

Latin America and the Caribbean

Latin America and the Caribbean are diverse regions with varying levels of financial inclusion and unique payout methods.

- Popular Methods:

- Brazil: Pix for instant payouts, Boleto for cash-based payments, and cards like Elo and Hipercard.

- Mexico: SPEI (Sistema de Pagos Electrónicos Interbancarios) for real-time interbank transfers and card payments.

- Caribbean: Bank transfers, mobile money platforms like Digicel, and card payments.

- Regulatory Considerations:

- Strict tax reporting requirements (e.g., CPF in Brazil).

- Compliance with local AML and KYC regulations.

- Challenges:

- Region-Specific: High reliance on cash-based methods like Boleto in Brazil.

- Common: Fraud risks in card payments and limited banking infrastructure in rural areas.

Middle East and North Africa

The Middle East and North Africa have a mix of traditional and modern payment methods, with a growing focus on digital transformation.

- Popular Methods:

- Bank Transfers: Widely used for B2B and B2C payouts.

- Cards: Visa, Mastercard, and local schemes like Mada (Saudi Arabia) are popular.

- Digital Wallets: PayPal and local e-wallets are gaining popularity.

- Regulatory Considerations:

- Compliance with local AML and KYC regulations.

- Restrictions on cross-border payouts in some countries.

- Challenges:

- Region-Specific: Regulatory hurdles for cross-border transactions.

- Common: Limited adoption of real-time payment systems.

South-East Asia

South Asia is a rapidly growing region with high adoption of mobile payments and real-time payment systems.

- Popular Methods:

- India: UPI (Unified Payments Interface) for instant bank-to-bank transfers, IMPS for immediate payments, NEFT for batch transfers, and RTGS for high-value transactions. Cards (RuPay, Visa, Mastercard) are widely used.

- Bangladesh: Mobile wallets like bKash, real-time payment systems like RTGS, and cards.

- Pakistan: Bank transfers, mobile wallets like Easypaisa, and cards.

- Regulatory Considerations:

- Compliance with local AML and KYC regulations.

- Data localization requirements in some countries (e.g., India).

- Challenges:

- Region-Specific: Fragmented payment systems across countries.

- Common: Fraud risks in card payments and limited interoperability between mobile wallets.

Challenges in Global Payouts

Managing global payouts is a complex process that comes with its own set of challenges. Below, we explore critical challenges that businesses face.

Account Validation of the Receiver

Validating the recipient’s account is a critical step in ensuring successful payouts. However, this process is fraught with challenges:

- Incorrect Account Details: Typos or outdated information can result in failed transactions—or worse, funds being sent to the wrong recipient. In such cases, recovering the money can be extremely difficult, if not impossible. Both the user and the payout initiator are liable in such scenarios.

- Regional Variations: Different regions have unique validation requirements. For example:

- Brazil: CPF (Cadastro de Pessoas Físicas) checks are mandatory for financial transactions.

- India: UPI-based account validation requires real-time verification of bank accounts.

- Manual Processes: In many cases, account validation is still manual, leading to delays and errors.

- Fraud Risks: One of the key fraud risks in global payouts is account takeover or manipulation, where fraudsters may intercept the process and inject their own account details—diverting funds away from the intended recipient. This type of fraud is not only hard to detect in real time but can also result in significant financial damage. To mitigate such risks, it’s essential to implement robust Know Your Customer (KYC) checks before initiating any payouts.

Cross-Border Complexity

Cross-border payouts introduce a layer of complexity that domestic payouts do not face:

- Volatility of exchange rates: While some payout processors like Wise offer a time window during which exchange rates are locked—ensuring that the rate agreed upon at the time of payout creation is honored during disbursement—not all providers offer this safeguard. If funds are disbursed through platforms without rate protection, fluctuating exchange rates can impact the final amount received by the beneficiary.

- High Fees: Intermediary banks and forex margins often result in high transaction costs.

- Processing Delays: Cross-border transactions can take days to settle, especially in regions with limited banking infrastructure.

- Tax Implications: Businesses must navigate varying tax laws and reporting requirements in different countries.

Payout Failures

Payout failures are a significant pain point for businesses and recipients alike:

- Technical Glitches: System errors or downtime can disrupt payout processes.

- Bank Rejections: Transactions may fail due to insufficient funds, incorrect account details, downtimes, cut off hours or bank-specific restrictions.

- Network Issues: Real-time payment systems like UPI or Pix rely on stable networks, which may not always be available.

- Retry Mechanisms: While retries can resolve some failures, they add complexity and cost to the process.

- Recipient Experience: Frequent failures and delays can erode trust and can have a negative impact on the recipient’s experience.

Fraud and Compliance

Fraud and compliance are ongoing challenges in the payout ecosystem:

- Fraudulent Transactions: Fraudsters may exploit payout systems to steal funds or launder money.

- Regulatory Compliance: Businesses must adhere to a growing list of regulations, including:

- AML (Anti-Money Laundering): Preventing illegal activities through financial systems.

- KYC (Know Your Customer): Verifying the identity of recipients.

- GDPR (General Data Protection Regulation): Protecting customer data in Europe.

- Evolving Regulations: Compliance requirements are constantly changing, requiring businesses to stay updated and adapt quickly.

- Penalties for Non-Compliance: Failure to comply with regulations can result in hefty fines and reputational damage.

Scalability

As businesses grow, their payout systems must handle increasing transaction volumes without compromising speed or accuracy:

- High Transaction Volumes: Managing large-scale payouts can strain existing systems due to complex payouts lifecycle and its sensitive nature.

- Infrastructure Limitations: Legacy systems may not be equipped to handle rapid growth.

- Resource Allocation: Ensuring sufficient liquidity and operational resources for payouts during peak periods.

Recipient Preferences

Different regions and demographics prefer different payout methods, adding complexity to the process:

- Diverse Preferences: For example, mobile money is preferred in Africa, while UPI is dominant in India.

- Customization Needs: Businesses must tailor payout methods to meet local preferences, which can be resource-intensive.

Reconciliation

Matching payouts with invoices or orders can be complex, especially in high-volume environments:

- Manual Reconciliation: Time-consuming and prone to errors.

- Automation Challenges: Implementing automated reconciliation systems can be complex and costly

Liquidity Management

Businesses must ensure they have sufficient funds to cover payouts, especially during peak periods:

- Cash Flow Management: Balancing payouts with incoming revenue can be challenging.

- Forex Risks: For cross-border payouts, fluctuating exchange rates can impact liquidity.

Case study: How Juspay Simplified Global Payouts for Indonesia’s Leading Travel Platform

One of Indonesia’s top online travel agencies (OTAs), offering flight, hotel, train, car rental, and event ticket bookings, faced a critical challenge in managing global payouts and cross-border refunds. Since customers can make bookings six months or more in advance, the OTA needed a robust system to handle refunds that could arise long after the initial transaction. However, not all payment aggregators (PAs) supported refunds to the original payment method beyond certain time limits, creating operational and compliance hurdles.

The Challenge: Complex Refund Flows & Cross-Border Constraints

The primary issue was ensuring refunds were processed back to the original payment method, as mandated by card networks and financial regulations. Many PAs had strict time windows (e.g., 180 days for card refunds), beyond which "back-to-source" refunds would fail. Additionally, cross-border transactions added another layer of complexity, as global payout methods varied by region, currency and payment provider.

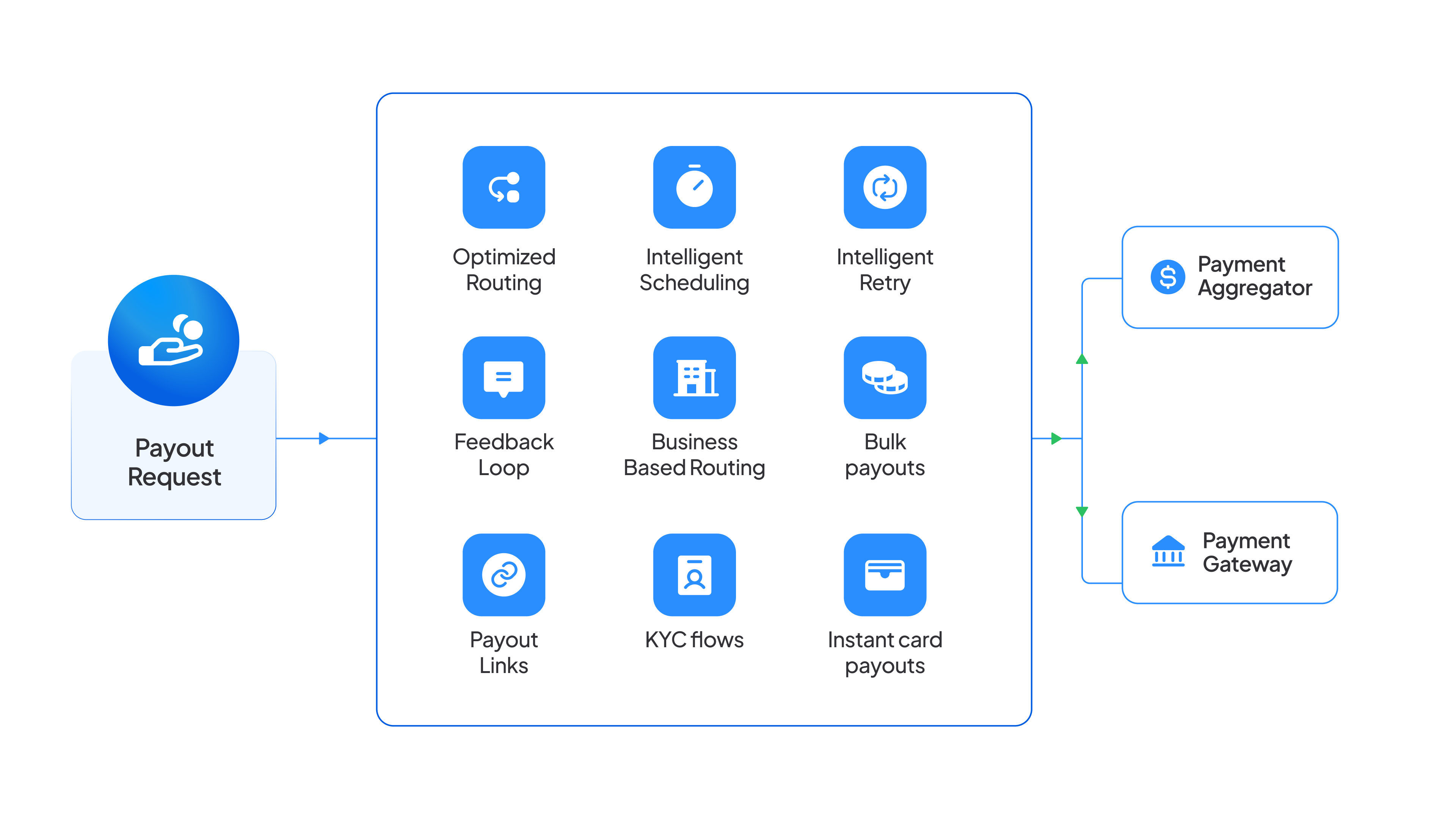

Juspay’s Solution: Smart Payout Routing & Fallback Mechanisms

Juspay implemented a dynamic payout routing system that automatically selected the best payment aggregator based on:

- Refund eligibility (checking PA time limits and payment method support).

- Fallback to alternate PAs or bank transfers if the original refund method failed.

To streamline the process, Juspay also enhanced the OTA’s merchant portal with:

- Automated user payment detail capture (storing card tokens, e-wallet IDs, or bank accounts at booking time).

- To manually initiate bank transfers by allowing for users to provide their details

- Real-time refund status tracking to ensure compliance with regulatory timelines.

The Result: Faster, Reliable Refunds & Improved Customer Trust. With Juspay’s solution, the travel platform could:

- Process refunds efficiently, even for bookings made months in advance.

- Maintain compliance with global payment regulations and card network rules.

- Enhance customer satisfaction with faster, hassle-free refunds.

Click here to know more about Juspay’s product suite and our open-source payments platform