Evolution of payment orchestrators

The term "orchestrator" has become ubiquitous in the payments industry. What used to be a separate category now overlaps with the offerings of many PSPs and even subscription engines that also perform orchestration. A decade ago, orchestration emerged as a solution to allow merchants to work seamlessly with multiple PSPs, acquirers, and banks, reducing the engineering effort required for each integration while maintaining a smooth payment experience for customers.Today, [payment orchestrators](https://juspay.io/payment-orchestration) have evolved significantly, touching on a wider range of offerings and feature sets. In this blog, we’ll explore what a modern payment orchestrator, such as Juspay, can offer.

Why do business need a payment orchestrator?

1. Expansion:

As businesses expand across different geographies, they encounter local requirements ranging from local payment methods and acquiring solutions to region-specific fraud protections. Additionally, businesses expanding across multiple channels (offline to online or vice versa), each with unique payment flows, require a payment orchestrator that offers both scalability and flexibility. Payment orchestrators allow businesses to manage this complexity with ease.

2. Unification:

As enterprises grow, they tend to become more complex, especially when new business units are added or when they grow through acquisitions and mergers. While the business aspects are often addressed promptly, unifying the tech stack, especially payments, takes longer. This is where a payment orchestrator steps in, resolving technical complexity and enabling seamless payment operations across the business.

3. Diversity:

The payments ecosystem is rapidly diversifying, with new payment innovations emerging regularly. These innovations quickly become customer favorites, and constantly updating checkout experiences to reflect this can be cumbersome for any business. Payment orchestrators make it easier for businesses to adopt new payment methods and experiences without overwhelming their existing systems. Additionally, they help build redundancy by offering multiple routes for the same payment method, ensuring a smoother checkout experience.

What do payment orchestrators engineer?

1. Core orchestration platform

At the core of orchestration lies integration—connecting merchants to different players within the payments ecosystem. However, modern payment orchestrators go beyond just connecting to PSPs. The goal is to get as close to the source as possible, minimizing intermediaries, lowering costs, and improving transparency by receiving more granular error codes.

A well-engineered payment orchestrator should integrate with not only PSPs and acquirers but also directly with banks, networks, and other payment methods. This level of unification should apply to both pay-ins and payouts as well as other key elements of the payment stack:

- Payment Methods: Klarna, Affirm, PayPal

- Payouts: ACH, Visa Direct, MasterSend, SEPA

- Risk and Fraud: Signifyd, Riskified, Kount, Forter

- Authentication Providers: Netcetera

- Taxation Engines: Avalara, TaxJar

Crucially, payment orchestrators should also provide a centralized vault for merchants to store customer payment information, allowing merchants to remain independent of any specific provider.

It's not just about the number of integrations, but the quality of these integrations that matters. This means offering the full range of payment flows available through a PSP (in-app vs. redirection flows, for example) and ensuring transparency when it comes to error responses and codes. A modern payment orchestrator should include an architecture where error responses from a PSP are categorized and delivered in a way that provides both granular raw error codes and user-friendly messages. For instance, one set of fields could deliver the raw error response and code directly to the merchant, while another provides a more unified, customer-facing error message. This ensures a consistent experience, even when multiple PSPs are involved.

A modern payment orchestrator delivers a seamless and unified checkout experience across all platforms, whether on Android, iOS, or web. The aim is to provide a native, blended experience that adapts to the user’s behavior, while still giving merchants full control and customization over the design, payment method prioritization, and overall flow. For returning users, it surfaces their preferred payment options directly within the interface, allowing them to complete the payment as well as manage saved payment methods with ease. This combination of flexibility and personalization helps ensure both a streamlined experience for customers and operational efficiency for businesses.

Cards still dominate in most major markets globally, and any global payment orchestrator should offer comprehensive support for card features: PSP Tokens, Network Tokenization, Account Updater Services, Digital Credential Updater. These features are essential in ensuring that merchants can process card payments efficiently, minimize involuntary churn due to outdated card details, and maintain flexibility in their payment processing strategies. Lastly, there are a few key aspects that set a modern payment orchestrator like Juspay apart:

- Optionality : Large enterprises often want their own branding on the solutions their teams use, but without the burden of hosting or managing PCI compliance. Modern payment orchestrators offer white-labeling flexibility across the entire spectrum, from UI-only changes to API end-points. Juspay, for instance, provides this optionality, allowing enterprises to maintain their branding. Moreover, companies looking to build their in-house solutions can leverage Juspay’s source-available stack, empowering their engineering teams to customize and own the solution without starting from scratch.

- Modularity – A modern payment orchestrator should allow businesses to pick and choose the features they need, whether it’s adding alternative payment methods (APMs), buy now, pay later (BNPL) options, or optimizing costs and reducing recurring churn. By offering modularity, payment orchestrators enable merchants to implement only the components that align with their unique business needs, driving both efficiency and flexibility in their payments strategy.

2. Transaction routing

Fully Transparent and Impartial Routing to Acquirers, PSPs, or Banks

Modern payment orchestration systems enable merchants to route transactions based on their specific goals, with full transparency and neutrality, offering flexibility across several paradigms:

- Volume-Based Routing: Merchants can set volume commitments with PSPs, defining the percentage of transactions routed to each provider. This allows businesses to not only meet volume agreements with their payment partners but also A/B test new PSPs and payment methods without fully committing from the start.

- Success-Based Routing: By monitoring the real-time health of each PSP for different payment methods within a defined time window, this setup intelligently routes transactions to the provider with the best success rates, optimizing for successful authorizations.

- Cost-Based Routing: Merchants can leverage a deep understanding of transaction costs, including interchange, scheme, and network fees, specific to card issuer bins, card types, and other variables. This enables the system to identify the most cost-effective route for transactions, ensuring a balance between minimizing costs and maintaining stable authorization rates.

- Parameter-Based Routing: Transactions can be routed based on various parameters, such as the issuer’s country, the merchant’s country, the payment method (card, wallet, bank transfer, etc.), card characteristics (BIN, type, network), transaction amount, currency, authentication method, capture process, business label, and even user-defined fields. This granular control ensures the routing strategy aligns with the merchant’s unique business needs.

- Debit Routing: Dual-message exempt transactions present significant cost-saving opportunities. Over the last few years, the cost of dual-message exempt transactions has risen by around 11 cents, and their mix in overall debit card transactions is increasing (with ~40% of debit card spends now coming from exempt issuance). The average interchange for single-message exempt transactions is ~0.68%, much lower than the ~1.40% average for exempt dual-message transactions. However, challenges arise when international networks refuse to de-tokenize PANs or validate transactions, impacting transaction processing. A modern payment orchestrator is able to offer merchants a way to leverage debit-routing by having smart mechanisms in place to handle the edge cases of failure.

- Payouts routing: Payouts are an essential part of many online businesses, particularly in sectors like insurance and marketplaces. Offering payee choice through payout links—where users can select their preferred payout method based on speed and cost—plays a significant role in enhancing customer satisfaction and driving NPS. Additionally, businesses can optimize costs by routing payouts through multiple providers, ensuring the most cost-effective transaction routes, and maintaining control over operational expenses. This flexibility not only improves the customer experience but also helps streamline financial operations.

3. Transaction retry

A modern payment orchestrator like Juspay is equipped with advanced retry capabilities that automatically reattempt eligible failed transactions, either through the same PSP or by dynamically selecting another eligible provider. These retries are informed by a thorough analysis of error categories, error messages, and various parameters to balance the cost of retry (potential penalties) with the expected benefits of a successful transaction.

This retry mechanism is designed to handle both customer-initiated and merchant-initiated transactions (MIT). While customer-initiated retries typically happen within a short window, MIT retries can span several days before reaching a final status. For MIT transactions, the payment orchestrator takes into account several parameters during retries, including clear PAN vs tokenized transaction, historical success rates, the type of transaction, payment method, card bin and region, credentials, customer history, transaction amount, network rules, retry count and frequency, day and time of retry, as well as potential penalties and trade-offs. This approach ensures an optimized retry strategy while adhering to network rules and minimizing risks.

4. Operations & Analytics

Once an enterprise begins working with multiple PSPs, one of the key challenges is managing reporting across them. Tracking all pay-ins, payouts, refunds, and disputes from different PSPs within a unified dashboard becomes essential for seamless operations. A modern payment orchestrator addresses this by consolidating these data points, offering businesses a single platform to oversee the full spectrum of their payments.

In addition to basic reporting, advanced payment orchestrators provide robust analytics across multiple payment dimensions, allowing businesses to dissect and understand their payment data at a granular level. From a customer support perspective, they also offer comprehensive logs that trace the entire journey of a payment, making it easier to debug issues and view transactions from the customer’s perspective rather than as isolated events.

Furthermore, reconciling transactions across business units, multiple PSPs, and banks, as well as unifying payment processing costs across varied PSP reports, involves ingesting data from diverse, unstructured reports with different formats and fields. A modern payment orchestrator transforms this complexity into structured, actionable insights, automating the processes of reconciliation, auditing, trend analysis, and reporting. By doing so, it not only simplifies the operations but also identifies opportunities to optimize payment flows for the business.

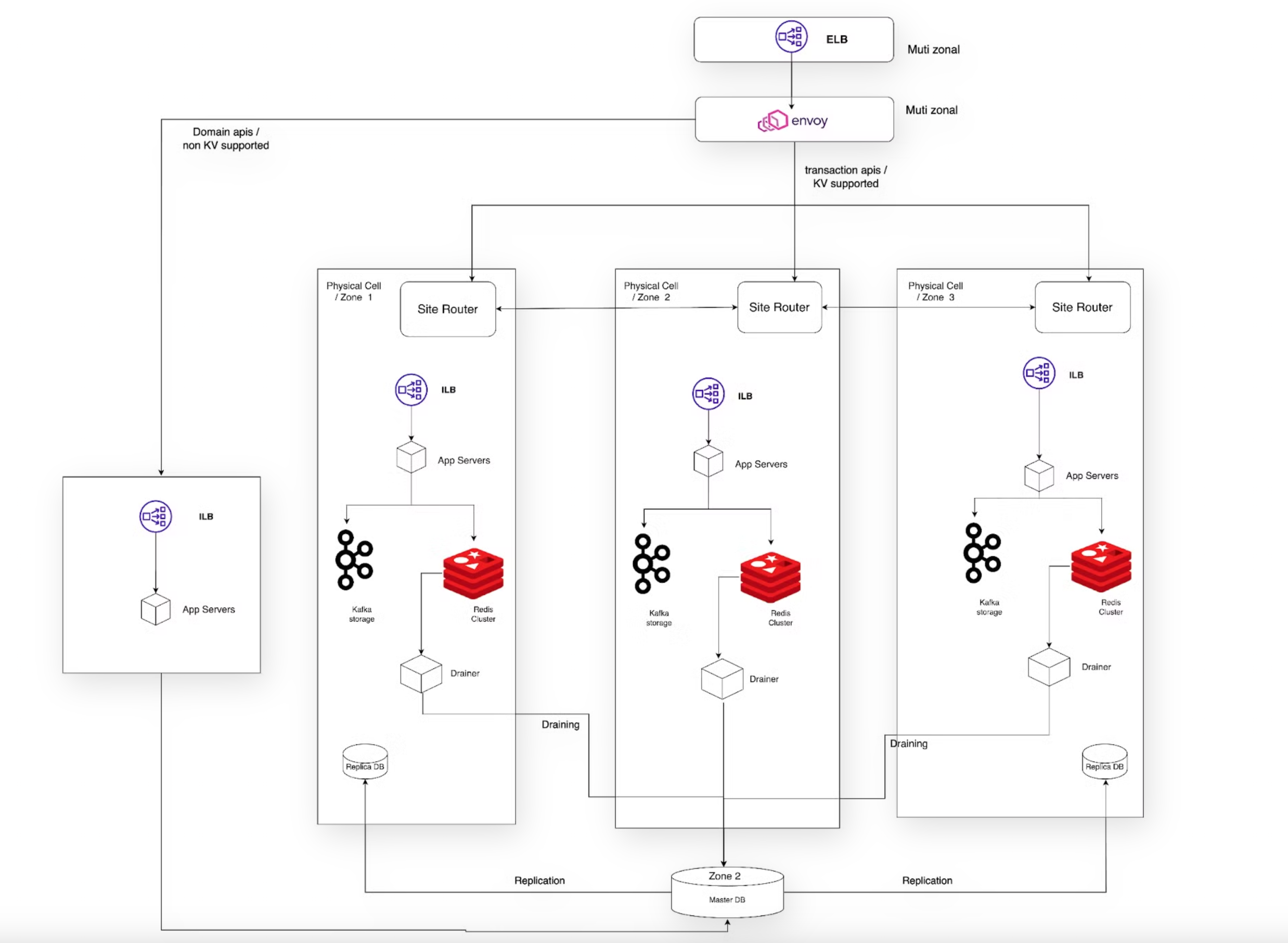

5. Infrastructure

Juspay’s solution is designed as infrastructure, built with the robustness of systems software—reliable, scalable, and high-performing. It operates in a horizontally scalable manner, utilizing cache-based shock absorbers to handle traffic surges and eliminate database bottlenecks, achieving a throughput of 20,000 TPS. Leveraging functional programming languages reduces transaction processing times to under 100 milliseconds. The system’s fully automated, end-to-end deployment process ensures risk-free, rapid releases, with features like staggered rollouts, A/B testing, and seamless scaling.

By maintaining a laser focus on reliability, modern systems like Juspay deliver 99.9999% uptime alongside fast and efficient transaction processing, making it a cornerstone of enterprise-grade infrastructure.

About Us

Juspay, founded in 2012, is a leading checkout platform and global payments orchestrator powering 200Mn+ transactions every day. Installed on over 1.5 Bn devices, Juspay serves 400+ enterprises and large brands like Amazon, Google, Microsoft, Flipkart/Walmart, Agoda, Zurich insurance and Flowbird. We are a venture backed company with 1200 employees, with presence in Bangalore, Singapore, San Francisco and Dublin Ireland. Our investors include SoftBank, Accel Partners, Vostok Emerging Finance and Wellington Management.