In the retail world, keeping financial records accurate is a constant challenge. With so many transactions happening across different channels, ensuring that every payment, refund, and charge lines up correctly is no small task. Retailers today have to deal with multiple payment systems, high return rates, and the complexity of selling through various platforms—all of which make payment reconciliation more complicated than ever.

High Returns Volume: Retailers are constantly processing returns, be it online or in-store. It is estimated that returns alone will reach $890 billion in 2024. To keep their books accurate, every return must be precisely matched to its original transaction.

Multi-PSP Setup: Supporting multiple payment methods introduces additional channels and partnerships, often spanning multiple regions. Merchants have to navigate a complex network of payment processors and gateways, each operating with different systems and formats. This fragmentation makes it challenging to seamlessly reconcile and consolidate increasing transaction volumes.

Omnichannel Operations: Today's retailers sell through multiple different channels, like physical stores, online shops, and mobile apps. This requires synchronization across various systems, such as accounting software, payment service provider reports, and bank statements, to ensure data accuracy and consistency.

Diverse Payment Methods: Accepting diverse payment methods, such as credit cards, debit cards, digital wallets, and bank transfers, makes payment reconciliation trickier. Each type has its own processing time and fees, which adds another layer of complexity.

Given these complexities, many retailers are now using automated payment reconciliation tools. These tools help streamline the process, reduce error rates, and improve financial accuracy. Implementing such payment reconciliation tools can lead to significant improvements in operational efficiency and financial control.

Payment Reconciliation: Understand the Challenge

In today's retail environment, complexity is unavoidable. Consider a specific landscape: A customer shops online and later returns it to the store. It appears that simple transactions generate a complicated web of data in many systems. The online payment processor records sales in one format, while the in-store system handles the return in another. These transactions need to be accurately reconciled across all systems.

According to the latest research by Ernst and Young, the finance departments spend nearly 60% of their resources managing these transaction-intensive processes.

The Real Cost of Manual Payment Reconciliation

Manual payment reconciliation has its inefficiencies:

Financial Impact:

- Lost Revenue: Banks reported a loss of $2.1 million per incident due to payment reconciliation errors.

- Resource Allocation: Manually reconciling transactions consumes 30% of the finance team's time.

- Processing Time: Manually reconciling each transaction can take anywhere from 45 to 60 minutes.

Operational Inefficiencies:

- The conventional manual methods for matching transactions could only handle 5 to 10 per hour, and even then, mistakes were common.

- Retailers spent weeks reconciling their monthly general ledger balances, which caused delays and missed opportunities.

A retail operations director summed up the struggle: "Payment reconciliation was a real headache before we adopted automation—it felt like trying to solve an enormous jigsaw puzzle every single day. There were times when we'd waste entire hours just to pinpoint one transaction that didn't match up."

Why Is Payment Reconciliation So Difficult?

Payment reconciliation is particularly difficult in today's retail environment because a single purchase can affect so many different systems. This is due to the decentralized nature of retail payment systems. Imagine trying to complete a puzzle with pieces that don't fit!

- Data Format Differences: Different systems record financial data in different formats, which makes payment reconciliation challenging.

- Timing Differences: Different payment processors have different settlement cycles.

- Card payments: T+2 to T+3

- Digital wallets: Typically settle on the same day

- Bank transfers: T+1 to T+3

- Cross-Channel Transactions: Omnichannel retail operations render payment reconciliation even more difficult.

- Online returns are endemic, happening some 17.6% of the time.

- In-store returns occur somewhat less frequently, yet still some 10.02%.

A single return must flow through:

- The original online payment processor

- The in-store point-of-sale (POS) system

- The inventory management system

- The general ledger

Each system logs transactions in a different manner, creating a knotted mass of information that has to be unwound very carefully and matched up to absolute perfection.

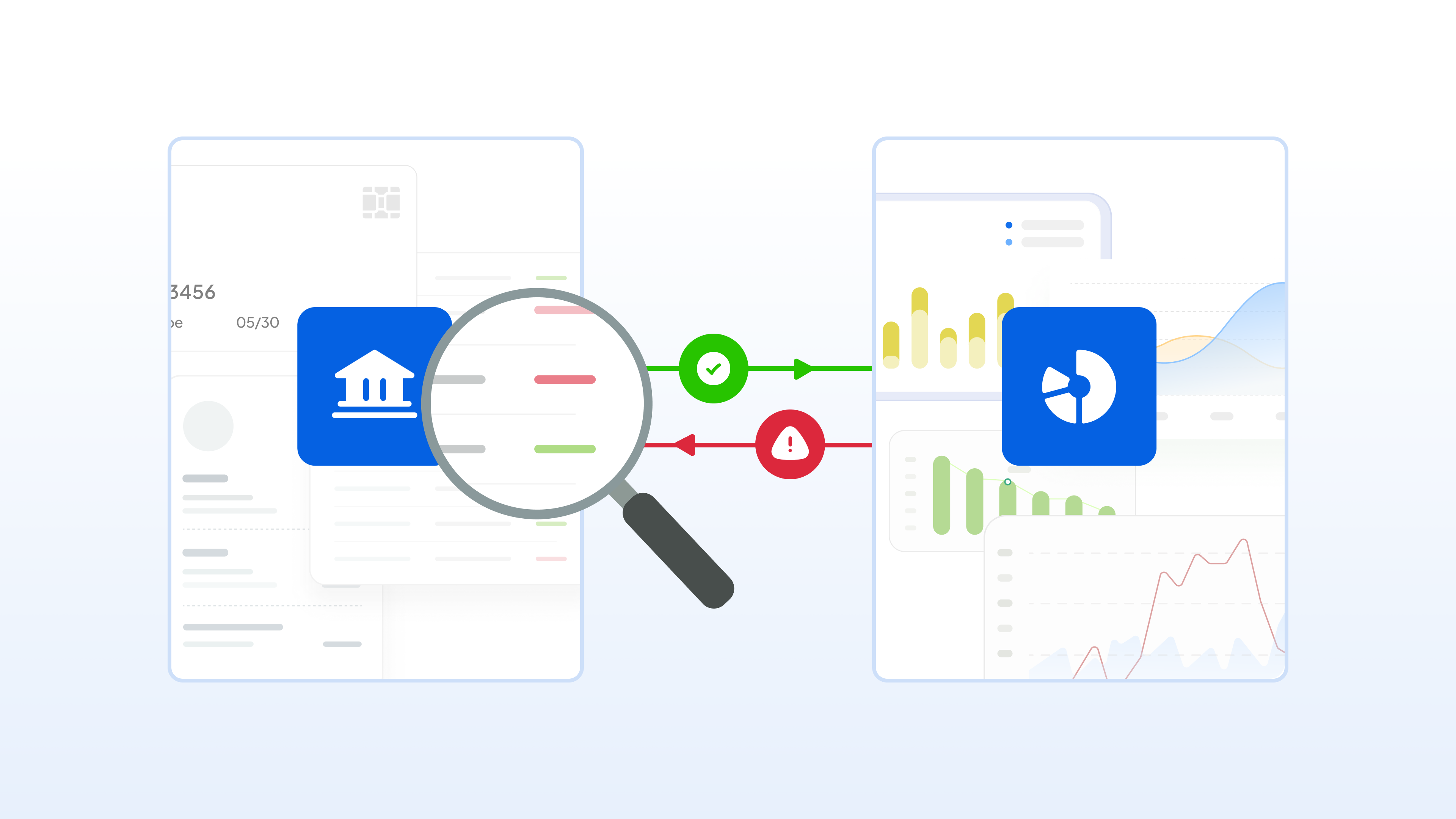

Hyperswitch: Revolutionizing Payment Reconciliation

Juspay's Hyperswitch is simplifying payment reconciliation for today's complexities by optimizing payment processing. Handling over 200 million+ transactions daily, Hyperswitch is a hyper-intelligent payments bridge, always matching and cross-verifying information.

How Hyperswitch operates:

Imagine an online consumer who wants to return a purchase at a brick-and-mortar store. Hyperswitch:

1. Identifies the original transaction

2. Matches it with the return, regardless of what payment systems were initially utilized

3. Updates all accounts in real-time

4. Highlights any discrepancies for instant validation

Measurable Results

Companies using automated payment reconciliation are experiencing phenomenal improvement:

- Faster payment reconciliation cycles: reconciliation cycles reduced from hours to minutes

- Fewer Errors: Error rates enhanced to less than 0.5%

- Time Saving: Finance teams reclaiming 75% of their payment reconciliation time

- Faster Processing: Processing time per payment reconciliation reduced from 45-60 minutes to 5-10 minutes (Source: PWC Payment Operations Study, 2024)

Case Study: Online Travel Agency Success Story

A prominent online travel agency (OTA) grappled with complex payment reconciliation challenges due to managing diverse settlement files across multiple currencies, taxes, and conversion rates. After implementing a unified reconciliation framework by Hyperswitch:

- Operational efficiency boosted by 60%

- Financial accuracy hit 99.5%

- Payment data across multiple regions was seamlessly integrated, significantly reducing processing time and errors

- A customized single settlement file was introduced, streamlining accounting and finance operations

- The initial pilot project covered two areas and is now being rolled out further to include other areas

Implementation Guide: Transitioning to Modern Payment Reconciliation

For businesses considering automating payment reconciliation, follow this step-by-step guide:

1. Begin with Assessment:

- Chart out current payment flows

- Identify key pain areas and bottlenecks

- Establish concrete KPI improvement goals

2. Plan the Transition:

- Transition gradually by starting with one payment processor or channel to minimize risks

- Phase by phase expand to other channels

- Include training and support for finance teams to enable smooth adoption

3. Measure Success:

- Track payment reconciliation accuracy, processing times, error levels, and other key KPIs

- Measure cost savings

- Use KPIs to recalibrate and fine-tune the system

Preparing for the Future

Since retail returns are projected to reach $890 billion in 2024 (NRF Report), reliable payment reconciliation is not just necessary for processing current volumes—it's an important investment in future growth and operational efficiency. Businesses that utilize modern, automated software such as Hyperswitch are ready to process higher volumes of transactions without compromising accuracy or efficiency.

In today's environment, payment reconciliation is a differentiator. By freeing up time and resources, businesses can focus on what counts most: delivering value to customers and driving growth.