Consider this scenario: A consumer, prepared to finalize a purchase on your website, lands on the checkout page. The necessity to repeatedly add payment details ranging from re-entering credit/debit card details, bank credentials, apm/wallet login credentials etc. creates friction in completing the transaction, potentially giving them an opportunity to abandon their purchase . Many shoppers abandon their carts when faced with the tedious process of adding payment details creating additional friction in the checkout process. Payment tokenization simplifies this entire process and provides a seamless and secure checkout experience with just a few clicks to your customers.

What is Payment Tokenisation?

Payment Tokenization is a process to convert your customer’s sensitive payment data like card numbers, digital wallet credentials, bank account numbers, ACH details, etc. to a unique, irreversible, set of characters, called tokens. Tokenization is an alternative and compliant way of saving the details of your customer’s payment method. These tokens are stored in a token vault which are then passed to the respective parties in the payments ecosystem (card networks in case of card payments, wallet providers for digital wallet payments, etc) to identify and decode the tokens. Let’s take a look at one of the card payment tokenization flows known as network tokenization flow.

- The flow begins when a customer selects a saved card on the checkout page to complete the purchase.

- Post that, the merchant fetches the token as well as the Token Authentication Verification Value (TAVV) from the token requestor. TAVV is a one-time cryptogram which acts as a CVV/CVC equivalent enabling customers to complete the transaction without entering CVV/CVC

- These details are then sent to the acquirer/PSP (Payment Service Provider), and it passes the information to the network.

- The card network, then converts the token to clear PAN and passes the payment details to the issuer bank

- The issuer bank authenticates/authorizes/declines the transaction and sends the response back to the network

- The same response gets forwarded by the network to the acquirer/PSP (Payment Service Provider) and then to the merchant. The merchant displays the response (transaction successful, transaction declined) to the customer

The Benefits of Payment Tokenization

The implementation of payment tokenization delivers numerous advantages for businesses across various sectors, particularly those handling high volumes of digital transactions. These benefits extend beyond simple security enhancements to include operational efficiencies, compliance simplification, and improved customer experiences.

Enhanced Customer Experience and Trust

In the competitive digital marketplace, customer experience significantly influences purchasing decisions and brand loyalty. Tokenization enables businesses to offer streamlined checkout experiences, one-click purchasing, and seamless payment across multiple channels without compromising security. Customers benefit from faster transactions and the convenience of saved payment methods without the anxiety associated with providing sensitive information repeatedly.

Enhanced Security and Fraud Prevention

Payment tokenization significantly strengthens transaction security by removing sensitive data from business environments entirely. Since tokens have no intrinsic value and cannot be mathematically reversed to reveal the original payment information, hence, there is little to no threat of fraud even if the tokens are compromised. This fundamental security approach dramatically reduces the risk of payment fraud and data breaches that could expose customers’ financial information.

This represents a fundamental shift from traditional security models that focused on protecting sensitive data to an approach that removes the valuable data entirely, rendering potential breaches far less damaging.

Simplified Regulatory Compliance

For businesses handling payment card information, compliance with industry standards like the Payment Card Industry Data Security Standard (PCI DSS) represents a significant operational and financial burden. Tokenization reduces this compliance scope by removing actual card data from the merchant's environment. When sensitive information is replaced with tokens, fewer systems fall under strict PCI DSS requirements, resulting in simpler audits, reduced documentation needs, and lower compliance-related costs.

This compliance simplification proves particularly valuable for growing businesses that may lack extensive security resources. By implementing tokenization, organizations can effectively outsource much of their payment security burden to specialized providers while maintaining high security standards. The reduction in PCI DSS scope translates directly to resource savings that can be redirected toward business growth and development initiatives.

Improved Operational Efficiency

Beyond security benefits, tokenization streamlines numerous business operations related to payment processing. For recurring billing scenarios, subscription services, and loyalty programs, tokenization enables secure payment reference without requiring customers to repeatedly provide their payment details. This creates a frictionless experience for customers while reducing the administrative burden associated with payment management.

The operational advantages extend to analytics and reporting functions, where tokenized data can safely be used across business systems without exposing sensitive information. This allows organizations to maintain comprehensive transaction records and perform detailed analysis while preserving customer privacy and security. The result is a more efficient operation that balances security requirements with business intelligence needs.

Furthermore, as data privacy concerns continue to grow among consumers, businesses that demonstrably prioritize payment security build stronger trust relationships with their customers. The implementation of advanced security measures like tokenization signals a commitment to protecting customer data, potentially differentiating businesses in crowded markets where trust has become a competitive advantage.

Types of Payment Tokens

There are different types of tokens and not all tokens function in the same way. The effectiveness of a token depends on its type and how it is applied within the payment ecosystem.

Network Tokens

Network tokens are issued and managed by major payment networks such as Visa, Mastercard, and American Express. Unlike device tokens, network tokens are designed for broader interoperability, meaning they can be used across multiple merchants, platforms, and payment service providers (PSPs). These tokens dynamically update when a card is replaced or renewed, ensuring payment continuity without the need for customers to manually update their card details.

Network tokens help businesses reduce transaction declines but also enable secure card-on-file transactions, which are essential for subscription services, digital marketplaces, and recurring payments.

Device Tokens

Device tokens are linked to specific physical devices, such as smartphones, tablets, and smartwatches. These tokens ensure that payments can only be initiated from the authorised device, significantly reducing the risk of unauthorised transactions. They are widely used in mobile payment solutions such as Apple Pay and Google Pay, where each transaction generates a unique, device-specific token instead of transmitting the actual card number. This is particularly effective in reducing fraud for contactless payments, in-app transactions, and digital wallets.

PSP Tokens

PSP tokens are generated and managed by payment service providers such as Stripe, Adyen, and PayPal. These tokens allow merchants to securely store customer payment details within their PSP’s infrastructure, removing the need to handle raw payment data directly. PSP tokens are particularly beneficial for businesses operating across multiple payment gateways, as they provide flexibility in transaction routing.

A key advantage of PSP tokens, beyond simplifying compliance with regulatory requirements, is their ability to support seamless multi-platform payments. They enable businesses to manage transactions across multiple payment processors while maintaining high security standards.

Single-use & Multi-use Tokens

Single-use tokens are generated for and intended to be valid for only one specific transaction. Once that transaction is attempted (successfully or unsuccessfully), the token/data becomes invalid for any subsequent authorization attempts.

The main purpose of single-use tokens is to provide the highest level of security for individual transactions. If transaction data containing this single-use element is intercepted, it cannot be reused for another purchase which prevents replay attacks.

Multi-use tokens are designed to be used for multiple transactions over time. They remain valid until the underlying payment data expires, the token itself expires, or it is explicitly deactivated/revoked by the customer.

The main purpose of multi-use tokens is to enhance the user experience of repeat customers by making the payment experience frictionless and hassle-free.

Payment Tokenisation Process Flow

Payment Tokenization isn’t just about replacing payment details, it’s a fundamental process that keeps transactions secure while improving authorisation rates, reducing fraud, and ensuring seamless customer experiences. The way tokens are generated, maintained, and mapped plays a direct role in payment acceptance, customer retention, and operational efficiency. But what happens once a token is created -

- Generation – When a customer enters their payment details at checkout, the payment provider generates a unique, random token that replaces the payment details. This means businesses never store sensitive payment information, reducing compliance burdens and security risks.

- Maintenance – In case of multi-use tokens, the tokens must remain valid for ongoing transactions, such as subscriptions and card-on-file payments. If a customer’s card expires or is replaced, the token needs to be updated to ensure uninterrupted payments without requiring manual intervention.

- Mapping – Even though merchants don’t have direct access to raw payment details, tokens must still be securely linked back to the original PAN for payment authorisation and processing. This ensures smooth transaction routing, fraud detection, and chargeback management within a protected environment.

PCI Compliance and Clear PAN

Contrary to popular opinion, tokenisation hasn’t made clear PANs obsolete. While tokenisation enhances security and streamlines transactions, there are still essential use cases where access to the original PAN remains critical. The reality is that many core functions of payment processing, risk management, and customer experience depend on the access to clear PAN.

1. Fraud Detection & Risk Analysis

Fraud prevention systems depend on the clear PAN to identify transaction patterns, detect anomalies, and flag suspicious activity. Many advanced fraud detection models use PAN data across different merchants, banks, and geographic locations to identify potential threats. Without access to PANs, fraud prevention tools would have limited visibility, making it harder to detect coordinated fraud attempts or repeat offenders.

Additionally, risk models often leverage historical transaction data tied to a PAN to assess the likelihood of fraud. If businesses and fraud detection platforms only worked with tokenised data, it could disrupt their ability to effectively assess risk and prevent chargebacks.

2. Chargebacks & Dispute Resolution

When customers dispute transactions, merchants, banks, and payment processors must refer back to the original card details to investigate claims and resolve disputes. While tokens help with transaction security, they don’t replace the need for clear PANs in chargeback handling and dispute resolution.

For example, if a cardholder disputes a transaction from a recurring service or suspects unauthorized activity, their issuing bank needs to verify and trace the transaction back to the original PAN to determine its legitimacy. Without access to the PAN, businesses may struggle to provide sufficient evidence during dispute resolution, leading to higher losses from chargebacks.

3. Payment Continuity & Retries

A failed payment can lead to lost revenue and customer frustration, but clear PANs help prevent unnecessary payment drop-offs by enabling smart retries and payment continuity.

- If a transaction is declined due to insufficient funds, the merchant can retry the payment at a later time without requiring the customer to re-enter their card details.

- If a cardholder updates or replaces their card, the merchant can use the PAN to maintain payment continuity across different transactions, subscriptions, and services.

- When a fallback method is needed, having access to the PAN allows merchants to use alternative routing or acquirers to complete the transaction.

Ultimately, clear PANs and tokenisation are not mutually exclusive. Instead, they complement each other, creating a secure yet efficient payments ecosystem where merchants can maximise security, improve authorisation rates, and enhance customer experiences, all while remaining PCI-compliant.

Impact of Payment Tokenisation

Impact on Merchants

For most e-commerce merchants, over 75% of returning customers save their payment details for a seamless checkout experience wherein they only need to authenticate their transactions. This not only serves as a seamless checkout experience but also improves the conversion and success rates for merchants by 7–8%.

A merchant today enables such experiences by saving their customers’ payment details, either on their own platform(if PCI L1 compliant) or on PCI L1 certified partner platforms who can store these payment details on their behalf. Let’s take a look at the payment tokenization transaction flow using a card from a customer’s point of view.

Impact on Customers

The first transaction for a user on a Merchant who has enabled tokenization is largely the same, except that the user will have to give explicit consent to the Merchant to tokenize their cards before proceeding with payment authentication. Merchants generally take consent on the checkout page, but sometimes merchants may take consent during the time of new user account creation by adding a tokenization clause to their terms & conditions.

First Transaction (Converting the Card to a Token)

Repeat Transaction (Token-based transaction)

The following transactions after a card tokenization, again, largely remain unchanged. The only difference is that the user need not fill in the card details, he can just select the saved cards and proceed with the transaction.

Blending Token Management with Orchestration

Modern payment systems are built on a complex network of gateways, acquirers, and token service providers. An orchestration platform that seamlessly integrates token management services acts as a central control layer, ensuring that all these components work together efficiently while optimising payment routing. This provides several key advantages:

- Centralised Token Management – Instead of managing tokens across different providers separately, orchestration allows businesses to consolidate and control all token-related activities within a single platform. For example, a merchant handling global payments may use network tokens from Visa/Mastercard, PSP tokens from their acquirer, and device tokens from digital wallets. A TSP Orchestrator automatically retrieves and maps these for seamless processing.

- Seamless Integration – Tokens should work across multiple payment service providers (PSPs), gateways, and networks. A well-orchestrated system ensures that businesses can leverage tokenisation without being locked into a single provider. For example, if a PSP-issued token fails due to issuer restrictions, the system automatically retries the transaction using a network token or securely retrieves the PAN to process via another acquirer.

- Dynamic Routing for Better Performance – Smart orchestration automatically determines the most efficient payment route, selecting the best gateway or acquirer based on factors like cost, speed, and authorisation success rates. For example, if an acquirer is experiencing downtime, instead of failing the transaction, a smart orchestration reroutes the payment through another provider, retrieving a valid token from its central vault in real time.

The Bigger Picture: Where Payment Tokenisation is Headed

Payment tokenization has shifted from being purely a security measure to a fundamental pillar of modern payment infrastructure. As the industry evolves, payment tokenisation will continue to enhance transaction efficiency, fortify security, and enable greater interoperability across global payment networks.

AI-driven security will leverage machine learning to predict and prevent fraud before it happens.

Universal payment tokenisation standards will promote global adoption, improving interoperability between payment systems worldwide.

Blockchain & decentralisation could integrate with tokenisation to enhance transparency, security, and transaction integrity.

The Juspay Payment Tokenisation

Juspay is a certified Token requestor and a token service provider that is integrated with all major networks (Visa, Mastercard, Amex, etc.) to enable tokenization for merchants. Juspay’s tokenization suite is capable of handling the complete token lifecycle management. We’ve issued more than 150 million network tokens globally.

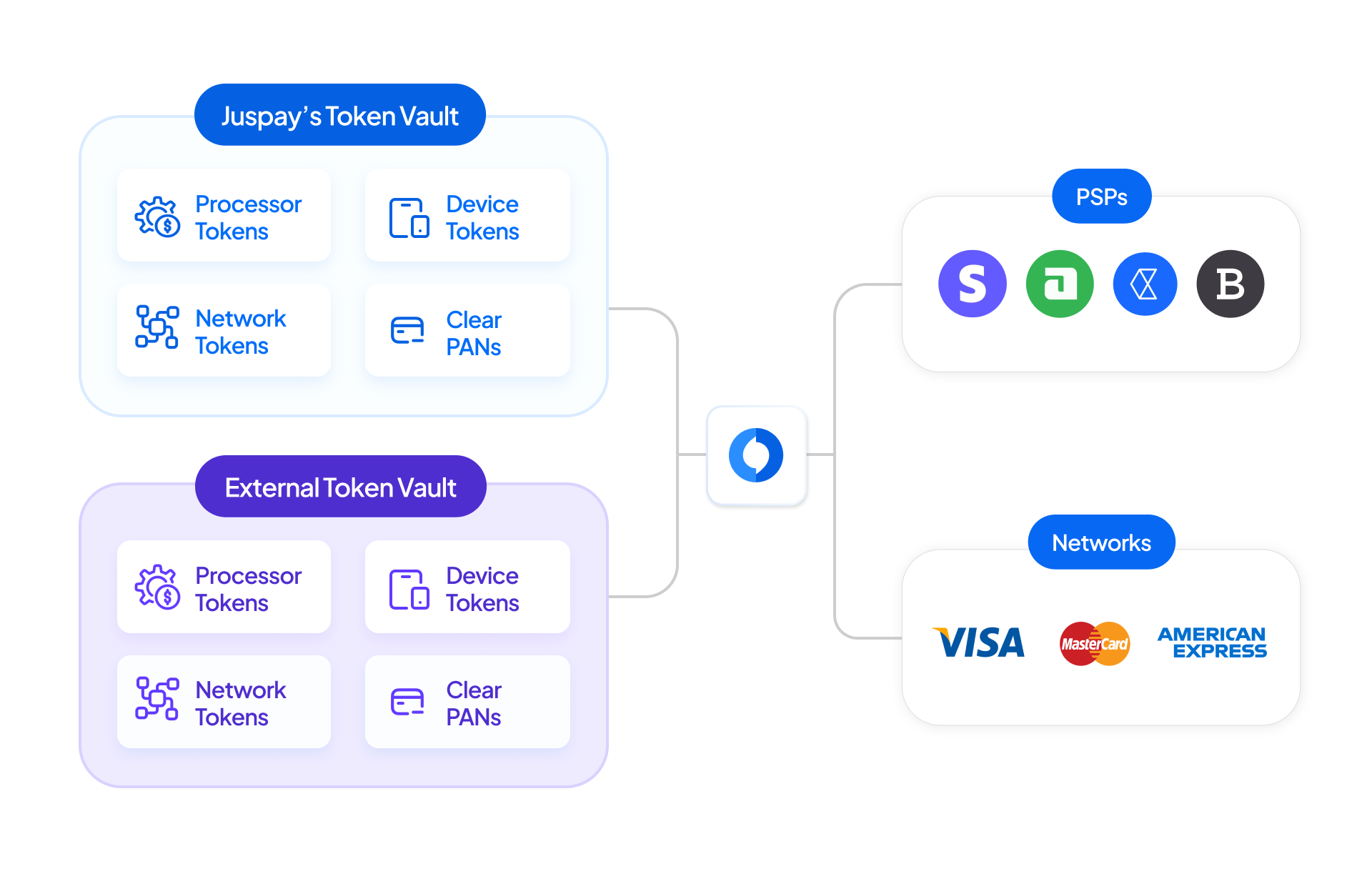

Juspay also offers a unified, scalable and versatile token vault solutions offering-

- Flexibility in token storage and management by enabling merchants to bring their own token requestor credentials and configure it within Juspay’s vault.

- Ability to orchestrate between multiple token vaults by maintaining sync between vaults to support migration.

- Capability to store clear PANs of the end customer and use them judiciously to switch credentials and improve transaction success rates.