Introduction

In the dynamic era where consumer tastes are changing quickly in contemporary business, adopting omnichannel payments is now essential for long-term success. Recent statistics emphasise how important omnichannel payments are becoming. Industry surveys state that companies that implement omnichannel strategies see a significant boost in overall revenue along with a considerable increase in consumer engagement. In the Omnisend Report 2021, for instance, marketers who used three or more payment channels saw a 494% increase in order rate compared to those who only used one.

In the current times, omnichannel payments blur the lines between the physical and digital worlds, reinventing the consumer journey. Customer happiness and brand loyalty are both increased by the smooth integration of omnichannel payment processing. This article covers the meaning of omnichannel payments, examines the nuances of these payments via several channels, and presents ideas that, in the digital era, will help propel one’s company to new heights.

Defining the Concept of Omnichannel Payment

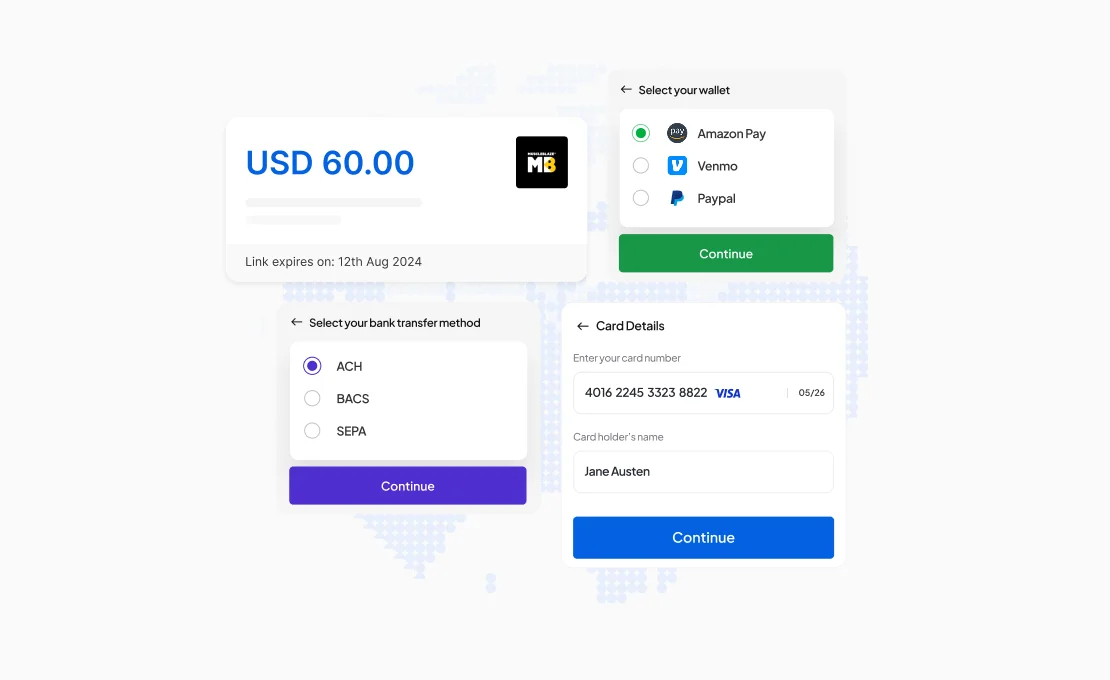

The meaning of omnichannel payments is nothing but a process that ensures a consistent consumer experience across multiple touchpoints that represents a company’s ability to incorporate a variety of payment methods easily. It is crucial to take payments from customers in accordance with their preferences, whether they are interacting with you in person, online, on the go, receiving regular bills, or using other channels. This includes a variety of options, such as the ease of Buy Now Pay Later (BNPL) plans, quick bank transfers, and contemporary digital wallets in addition to conventional credit cards.

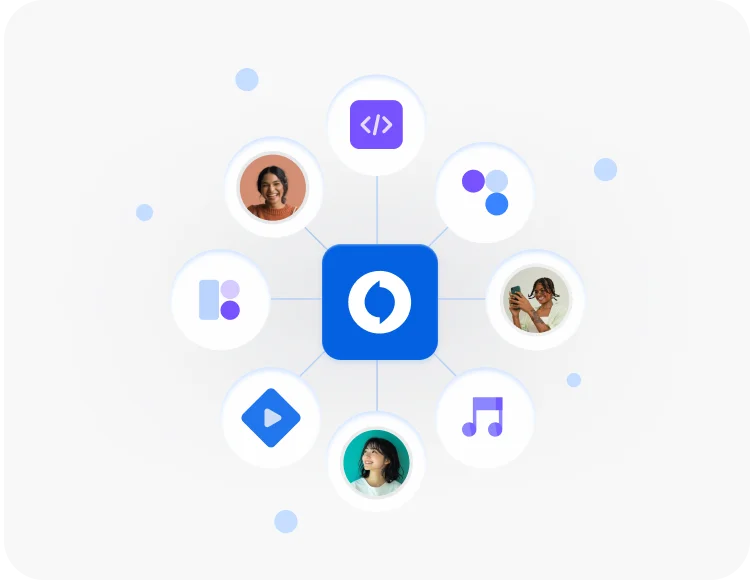

By combining in-store, social media, mobile, email, web, phone, and live chat experiences, omnichannel payments dismantle conventional barriers and give customers a seamless, cohesive experience. A solid omnichannel platform does more than just integrate; it enables real-time synchronisation of data and supports a variety of banking methods. The contemporary customer demands the freedom to start procedures via one channel and move smoothly to another, doing away with the need to provide the same data continually. As the meaning of omnichannel payment is understood, the following section will talk about how it works.

Unveiling the Seamless Process on How Omnichannel Payment Works

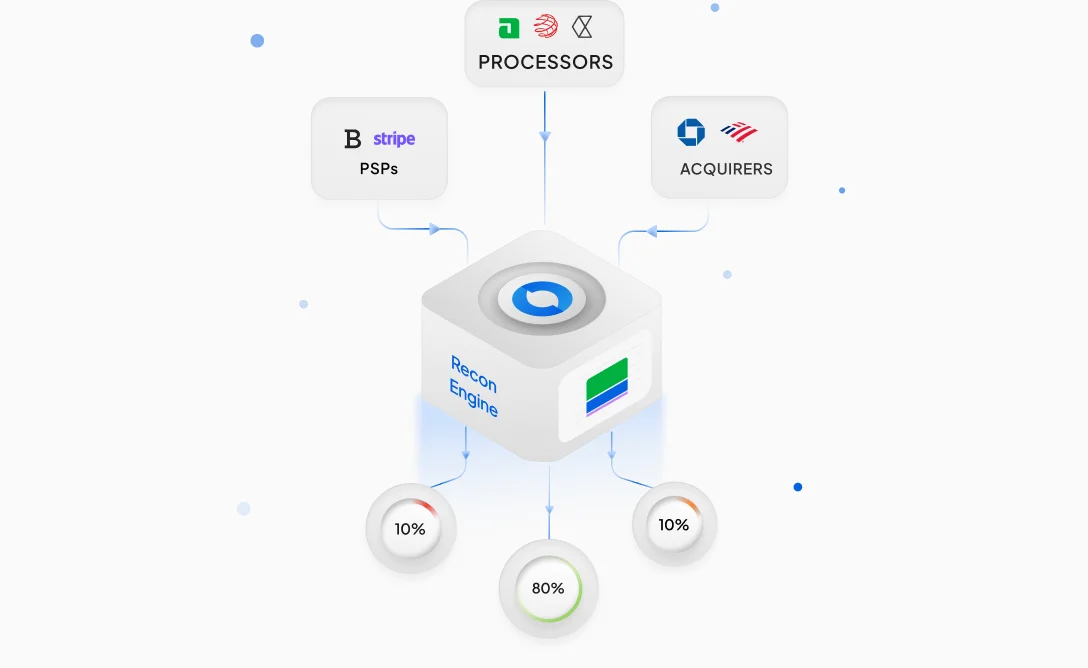

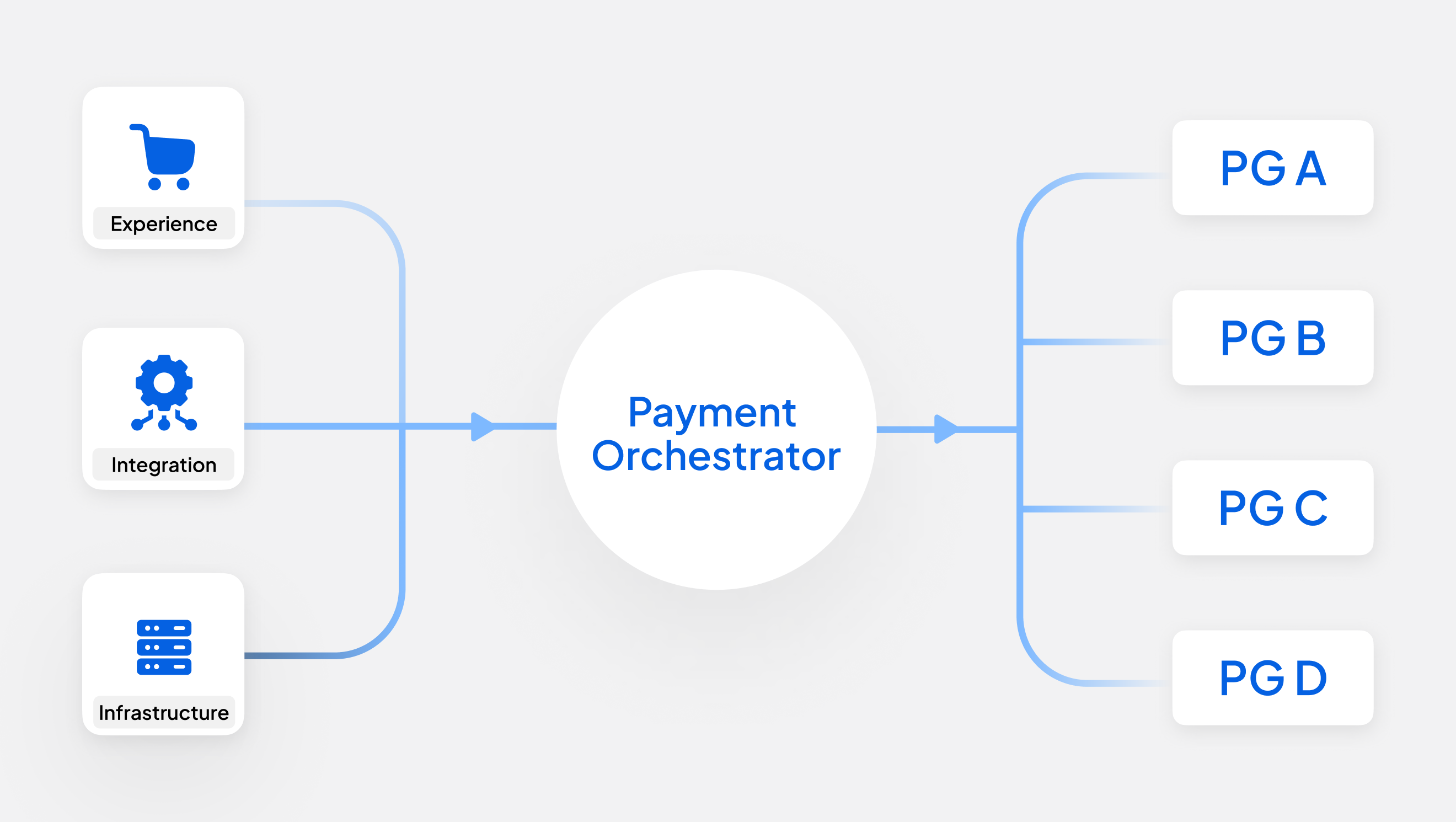

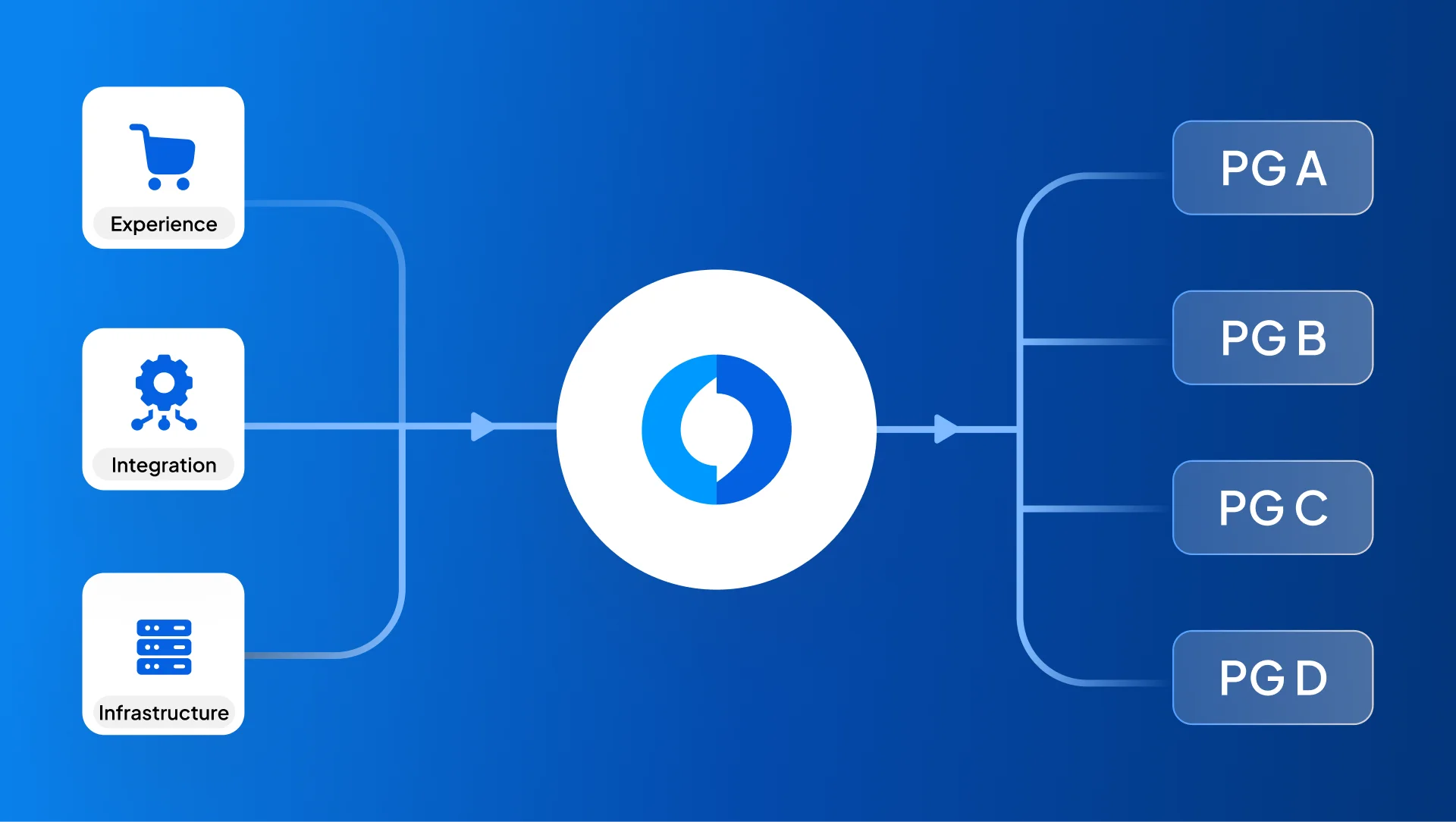

Retailers primarily use omnichannel payment processing in conjunction with outside fintech firms. These specialised fintech companies are excellent at creating fintech software, also known as “white label” software, because it is easily rebranded for any customer. Rather than the fintech company they have contracted with the help of this strategic alliance, customers will always communicate with retailers or merchants. The following primary guarantees are established in a client context by these retail-focused omnichannel payment processing platforms:

- Security of Sensitive Consumer Information:

In building a rapport of trust between the company and its clients, the fintech specialises in robust security protocols to protect financial and personal data. - Unique Buyer Experience:

The smooth and uniform shopping experience that the omnichannel payment processing system guarantees benefits the business, whether customers interact through mobile apps, in-store, or the internet, to give a unique and customised shopping experience. - Quickly Auditable Data Points:

The technology produces readily auditable data points, making transaction tracking and analysis more effective. This helps the company generate informed business data insights and helps monitor financial activity. - Brand Consistency Throughout Online Presence:

Regardless of the medium by which they communicate with the business at hand, platforms for omnichannel payment processing make sure that the brand image is consistent and recognisable. Building brand identity requires maintaining brand consistency across several online channels.

Steering the Seamless Landscape with Types of Omnichannel Payments

Omnichannel payments offer businesses and customers a consistent experience across several platforms, showcasing a flexible and adaptable approach to contemporary transactions. Comprehending the various forms of omnichannel payments is essential for companies seeking to establish a smooth and cohesive payment network. The following section will explore the various directions that omnichannel payment processing can take:

- E-commerce Omnichannel Payments:

E-commerce sites that offer a suitable user experience on desktop, mobile, and app platforms welcome omnichannel payments. This entails utilising an assortment of payment methods, including digital wallets, credit cards, and other online payment gateways. - Buy Now Pay Later (BNPL) Solutions:

The rise of BNPL solutions is evidence of how omnichannel payments are changing. With this kind of buyer, you can make purchases and pay for them later or in instalments. This solution provides a practical and adaptable payment option. - Contactless Omnichannel Payments:

The use of contactless payments has grown significantly, particularly in the context of omnichannel transactions. This technique makes use of NFC and QR code technology to facilitate quick and safe payments. Contactless payments emphasise convenience and speed by streamlining the checkout procedure. - Voice-Activated Omnichannel Payments:

Voice-command transactions are increasingly included in omnichannel payments due to the development of voice-activated technologies. With virtual assistants, users may initiate payments, check balances, and finish transactions with voice commands. This kind of omnichannel payment offers a futuristic, hands-free payment experience. - Social Media Omnichannel Payments:

Companies can use social commerce tools to facilitate transactions, with a focus on media applications directly. These platforms’ seamless integration of payment choices improves consumer involvement and offers a comprehensive shopping experience. - Recurring Billing Omnichannel Payments:

Additionally, recurring billing situations involving users authorising repeating payments for memberships, subscription services, or utility bills fall under the category of omnichannel payments. This guarantees that the payment procedure stays the same regardless of the customer’s interaction with the website or other channels.

Elevating Your Business Experience with Benefits of Omnichannel Payments

Omnichannel payments provide companies with a complete approach to improve customer satisfaction and promote operational excellence. The following list of points will focus on how adopting omnichannel payment methods can advance your company:

- Enhanced Customer Experience:

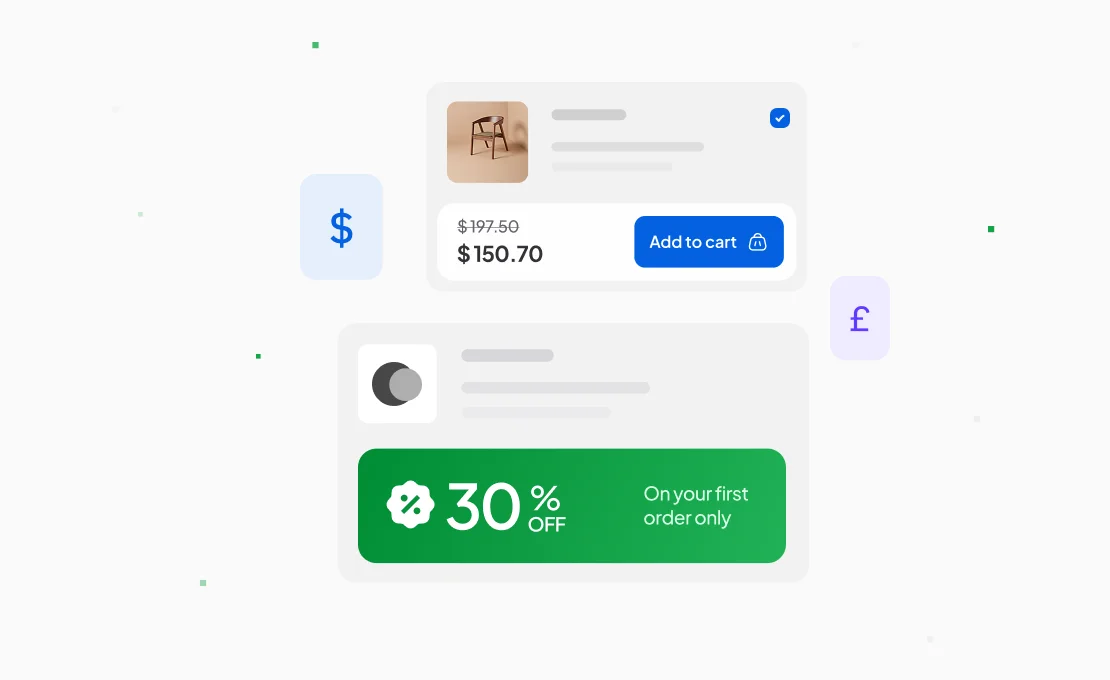

The customer journey is redefined by omnichannel payments, which offer a smooth and uniform experience across several touchpoints. The unified payment process reduces friction and boosts customer happiness and loyalty whether customers interact through in-store purchases, online transactions, or mobile apps. - Increased Sales and Revenue:

This variety helps to boost sales and revenue in addition to drawing in more clients. There is a higher chance of transactions being successful when clients can choose between digital wallets, credit cards, or innovative methods like Buy Now Pay Later (BNPL). - Improved Operational Efficiency:

The complexity of administering several systems is decreased when payment channels are integrated into a single system. Accuracy and efficiency are guaranteed by real-time data synchronisation, freeing up organisations to concentrate on their core competencies rather than managing disjointed payment processes. - Flexibility and Convenience:

This adaptability enhances a simple and tailored payment experience as customers are given a free choice to make while they opt for preferred payment methods. Customers can use standard credit cards, contactless payments, or mobile wallets; the flexibility of omnichannel payment solutions accommodates their evolving needs.

The Complete Guide on How to Activate Omnichannel Payments for Your Company

For your business’s customised move, enabling omnichannel payments calls for a careful and thorough approach. Cautious planning and implementation are necessary for the integration of omnichannel payment solutions both on and off your website. The specific actions one needs to do to integrate omnichannel payments into one’s company easily are as follows:

1. On-Website Omnichannel Payment Integration:

- Conduct a Payment Systems Audit:

Perform a comprehensive evaluation of your current website payment systems before implementing omnichannel payments. Determine which payment methods are in use at the moment, comprehend client preferences, and determine whether your systems are compatible with omnichannel integration. - Implement a Unified Payment Gateway:

Combine different payment methods into a single, integrated payment gateway. Customers should be able to make payments with ease and consistency using this gateway, which should connect in-store, online, and mobile transactions smoothly. - Optimise for Mobile Payments:

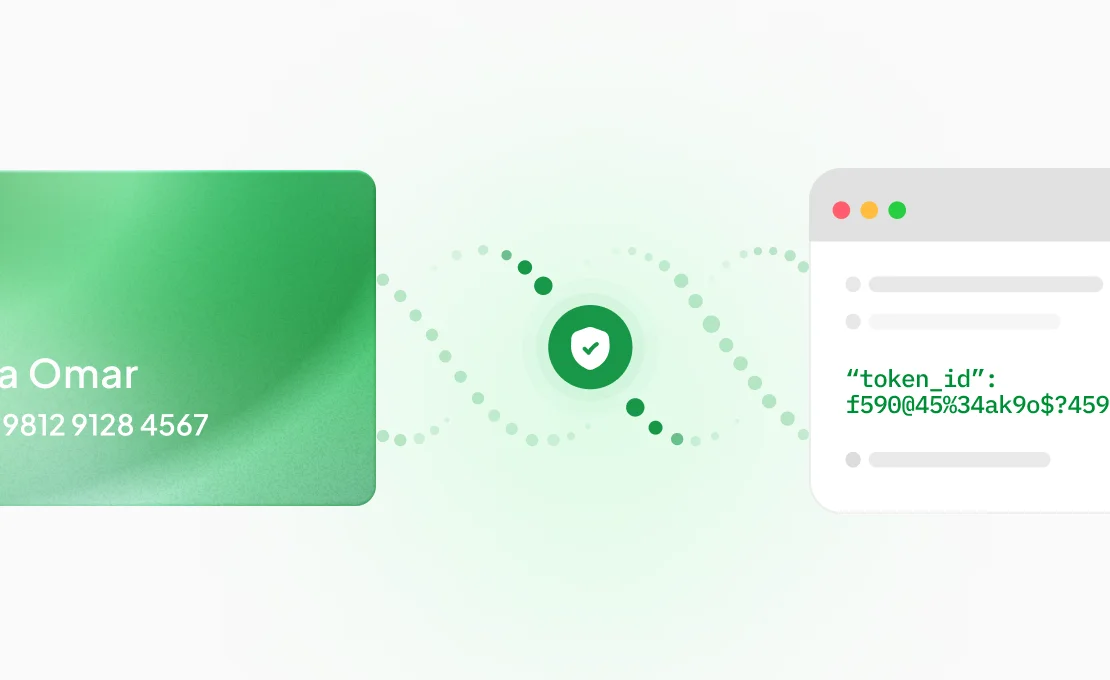

Optimise your website for mobile payments, considering how everyday mobile purchases are. Make sure that the checkout procedure offers a seamless transition between desynchronisation transactions and is responsive and user-friendly on a variety of devices. - Incorporate Security Measures:

Security with omnichannel payments is crucial. Put in place robust security mechanisms, such as tokenisation, encryption, and conformity to industry norms. Customers should be informed about the security elements to foster their faith in the payment procedure. - Enable Customer Authentication Options:

Give clients options for authentication based on what works best for them. This could involve biometrics, two-factor authentication, or other safe techniques. A good customer experience depends on striking a balance between security and consumer convenience.

2. Off-Website Omnichannel Payment Integration:

- Sync In-Store and Online Systems:

Sync your in-store and online payment systems if your company has small stores. Inventory, client information, and transaction specifics are guaranteed to be constant across all channels thanks to this synchronisation. - Implement a Centralised Customer Database:

Create a centralised customer database that combines information from every channel. Customers’ preferences and purchases are captured via this data, which also synchronises relevant details to enable customised interactions across channels. - Collaborate with Payment Partners:

Work together with financial institutions, technology companies, and payment partners to guarantee smooth omnichannel integration. Collaboration and regular contact are necessary to resolve any new issues and maximise the customised payment experience. - Adapt to Emerging Technologies:

Keep up with new developments in technology that can improve your ability to process payments across channels. This could entail implementing new omnichannel payment solutions, utilising AI to provide more individualised interactions, and optimising cutting-edge features that meet user demands.

Decoding the Selection Process: The Best Omnichannel PSP for Your Business

When it comes to the selection process of the right Omnichannel Payment Service Provider (PSP) for one’s business, one should make sure that it complies with the particular requirements of your business model, guaranteeing a unified and practical omnichannel payment experience. The following section will examine the things that should be prioritised while selecting the best Omnichannel PSP for your company, which can be customised to suit various business needs:

- Understand Your Business Needs:

Comprehend every detail of your business requirements prior to exploring Omnichannel PSP choices. Various industries have unique requirements. Identify the specific features and functions that are necessary for your business to succeed regardless of the market your business is in-retail, e-commerce, hotels, etc. - Compatibility with Your Business Model:

The PSP should seamlessly integrate into your existing workflows. Take into account the solution’s scalability to support the future expansion of the business. - Mobile Optimisation:

Optimise Omnichannel PSPs for mobile if mobile consumers are a major component of your organisation. Customers should be able to switch between devices with ease thanks to the solution’s smooth and simple mobile payment experience. - Compliance with Industry Regulations:

Make sure the Omnichannel PSP abides by industry rules and guidelines, particularly those pertaining to privacy and data security. Compliance with regulations preserves usefulness and inspires trust in your clients. - Scalability and Future-Proofing:

Take into account the Omnichannel PSP’s scalability to support the expansion of your company. Select a system that will grow with your business and be able to keep up with new developments in payment technologies. - Cost and Optimisation Structure:

Recognise the omnichannel’s price structure, set priorities, and assess the expenses of optimised transactions, monthly fees, and any extra services. Examine the pricing in relation to the projected return on investment and your budget.

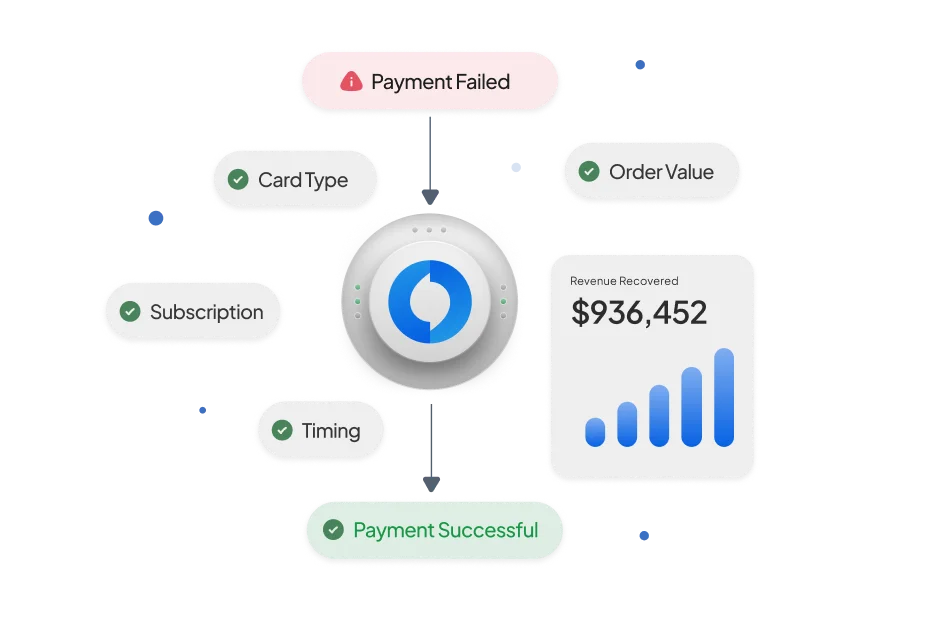

Omnichannel Payments with Juspay

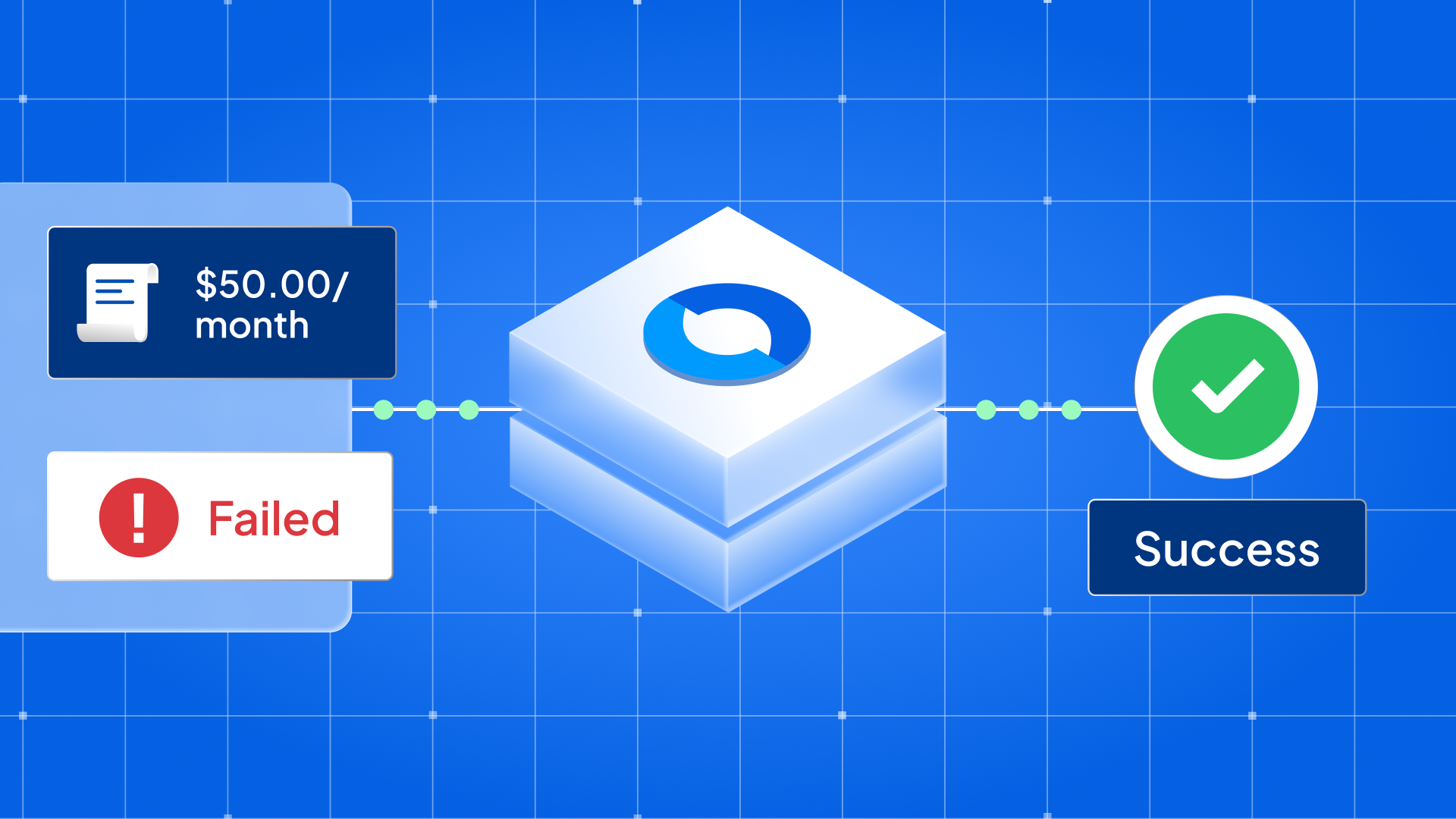

In the realm of omnichannel payments, Juspay has become a pathfinder when it comes to supplying companies with cutting-edge technologies that transform transaction processing. Juspay’s dedication to seamlessly streamlining payment experiences across several channels is at the heart of its solutions. Juspay guarantees a cohesive environment, promoting operational effectiveness and providing clients with a seamless shopping experience through mobile, in-store, and web platform integration.

The platform supports a wide range of payment methods, including digital wallets and credit cards, demonstrating a dedication to meeting the various demands of technologically literate customers. Furthermore, Juspay’s emphasis on security-which includes the use of cutting-edge authentication and encryption protocols, instils confidence in clients and fosters loyalty.

Conclusion

Thus, the power to integrate and optimise transaction processes, improve consumer experiences, and equip companies for the digital age is the core of omnichannel payments. Businesses should first assess how they presently manage payments to identify areas for improvement in order to get the most out of omnichannel payments. Watch out for security, make quick decisions using real-time updates, and ensure that your brand seems consistent and reliable across all platforms. Businesses may enter the world of omnichannel payments with confidence by following five easy steps, which will benefit both them and their clients.

FAQs

-

What is an omnichannel example?

One such example of omnichannel is a retail location that enables customers to transition quickly between online in-store and mobile app shopping channels. The individual can go through the products available on the website, buy them at the store, and then use a mobile app to track the status of their delivery. -

Why is omnichannel better than multichannel?

Since it provides a more seamless and integrated customer experience than multichannel, omnichannel is frequently regarded as being better than multichannel. While multichannel management entails handling several channels separately, an omnichannel strategy concentrates on giving clients a consistent and easy experience overall at touchpoints. Better brand consistency, more customer happiness, and a deeper understanding of consumer behaviour result from this. -

What is another word for omnichannel?

Another word for omnichannel that is frequently used interchangeably is cross-channel. Companies who want to offer a unified experience across online, offline, and mobile platforms can call this approach cross-channel marketing. The integration of several channels for a cohesive consumer experience is emphasised in both approaches. -

Why is omnichannel the future of business?

Omnichannel is the future of business because it conforms to the changing inclinations of contemporary consumers. Companies with a stronger chance of success are those who can combine these experiences with ease as people are making purchases through a range of channels, including mobile, in-store, and internet buying.