The concept of instalment payments has long been viewed as a win-win for both consumers and merchants. Merchants benefit from increased sales, while customers enjoy the flexibility of spreading payments over time, improving cash flow. The market size of instalment payment solutions is projected to exceed $3 billion by 2030, with a CAGR of 5.4% from 2023 through 2030. So, what is instalment payment, and how can it benefit your business? Let’s explore further.

Meaning of Instalment Payment

Definition and Key Concepts

Instalment payment is a method where consumers pay merchants’ invoices over time in smaller amounts spread over a set period. This enables businesses and individuals alike to make larger purchases or increase their spending capacity by breaking down the total cost into manageable instalments. This payment method introduces a unique element of convenience and flexibility that other payment methods do not provide to consumers.

Why instalment Payments are Important for Businesses and Consumers

For a business, having instalment payment as a payment option offers its customers the opportunity to make purchases even though they might not have immediate funds This can drive more sales. Moreover, even if the customer has enough to pay for the goods or services in one go, they may prefer to have the choice to pay for it in instalments to avoid a massive financial hit at once.

On the other hand, having the option to spread out the cost of purchases over time is also a huge attraction for customers. It allows them to not only make more purchases, but also larger purchases that they would not have if they did not have the option to pay in instalments. Overall, instalment payments are beneficial to the economy, with significant advantages for both businesses and consumers. Before delving into these benefits, let us first understand how the process works.

How Do Instalment Payments Work?

The Mechanics of an Instalment Plan

In an instalment plan, the total cost of a purchase is divided into smaller and more manageable payments by the merchant. These scheduled payments allow customers to pay the total amount over time, often with a fixed interest rate. Some merchants or credit card companies even provide offers of zero interest rates for certain payment brackets. Here is a breakdown of how an instalment plan works.

Step-by-Step Process of Making Instalment Payments

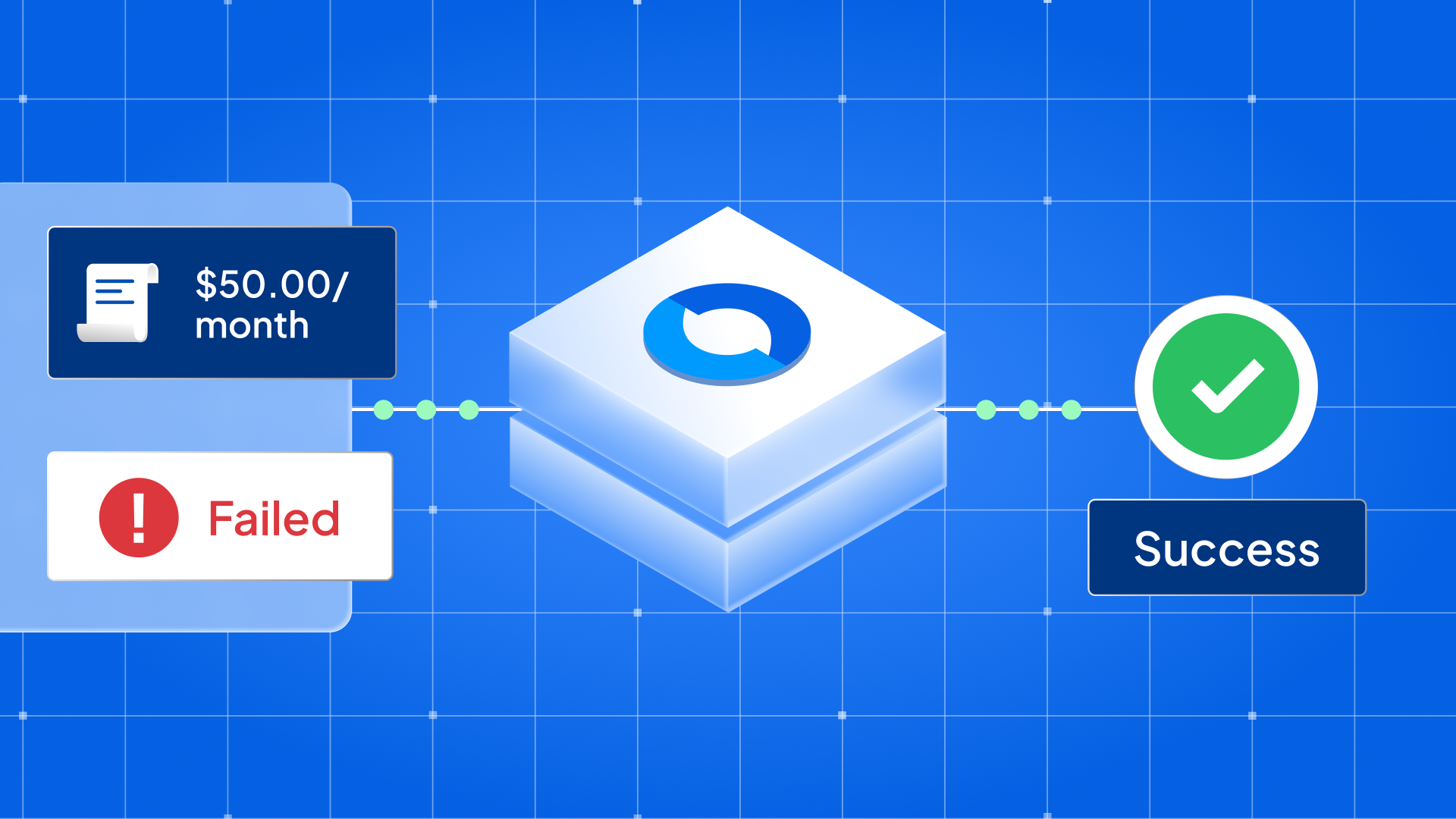

- Agreement - The foundation of an instalment plan is the agreement between the seller and the buyer. This agreement includes the scheduled payments, total payments, interest or fees, and the time frame for complete payment

- Deposit - The buyer pays an initial deposit to confirm their commitment to the purchase. This deposit is deducted from the overall payment, reducing the balance and instalment amounts.

- Scheduled Payments & Interest - After the initiation of the plan, the buyer must follow the payment schedule and pay their instalments on time. The applied interest or fees are divided across all instalments to ensure full cost coverage when the instalment plan ends. The interest on instalments is there to compensate the seller. Any additional fees, such as penalty fees for delayed payments on scheduled payments, incentivise the buyer to adhere to the instalment plan in a timely manner.

- Completion - This payment cycle concludes with all the final instalment payments by the customer, which fulfils the total payment agreement from the seller. It is at this point that the complete ownership of the good or service is transferred to the buyer.

Types of Instalment Payments

Fixed Instalment Payments

The buyer makes regular, fixed instalment payments over a period of time, with interest or additional fees included.

Flexible Instalment Plans

The buyer pays varying amounts on regular intervals. The varying instalment amount is often predetermined by the buyer, or in some cases, by the banks, on a fixed schedule.

Buy Now, Pay Later (BNPL)

BNPL acts more like a short-term loan, in which the buyer purchases the item under specific terms and conditions from the service provider, and pays over time in fixed instalments. Businesses can also offer BNPL as an instalment option, making them the service provider with the power to set their own terms and conditions.

Benefits of Offering Instalment Payments

Increased Sales and Customer Satisfaction

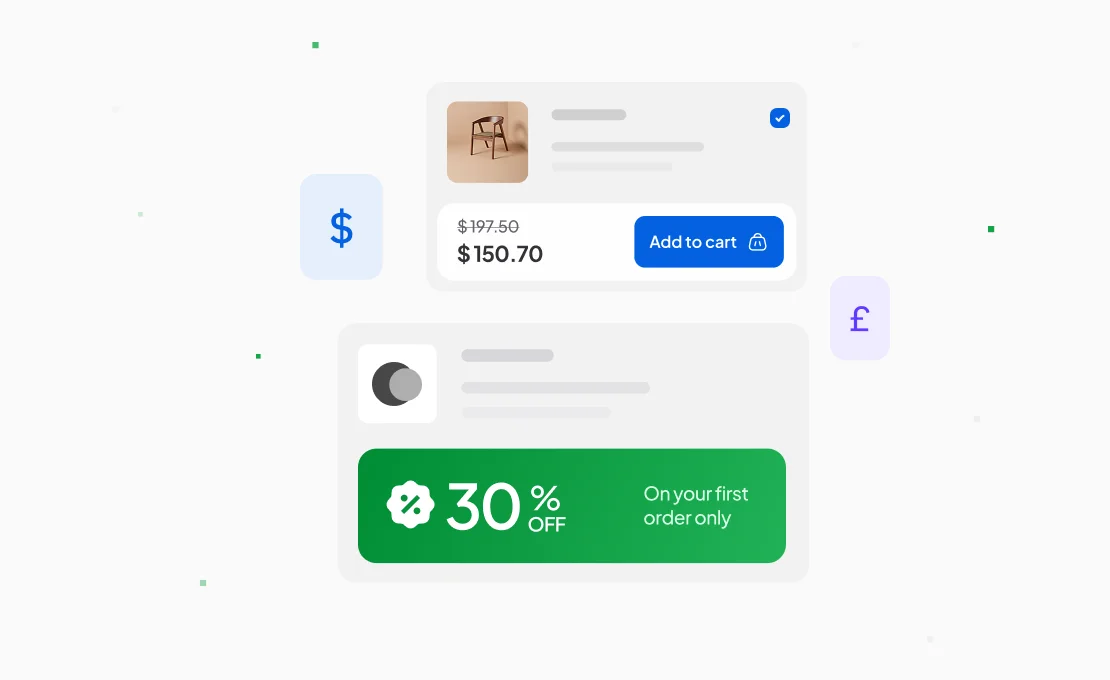

Offering instalment plans can significantly increase sales by allowing customers to make purchases they otherwise might not. This can lead to higher average order values and customer retention. The simple option for customers to spread their payments out not only increases the incentive to buy but also their overall satisfaction with the whole process.

Better Cash Flow Management for Businesses

How can businesses make high-value goods or services on their website more accessible? By enabling customers to match their payment outflows and their income inflows. Not only does it improve the cash flow management for businesses, but it also encourages stronger customer loyalty for the business.

How to Implement Instalment Payments for Your Business

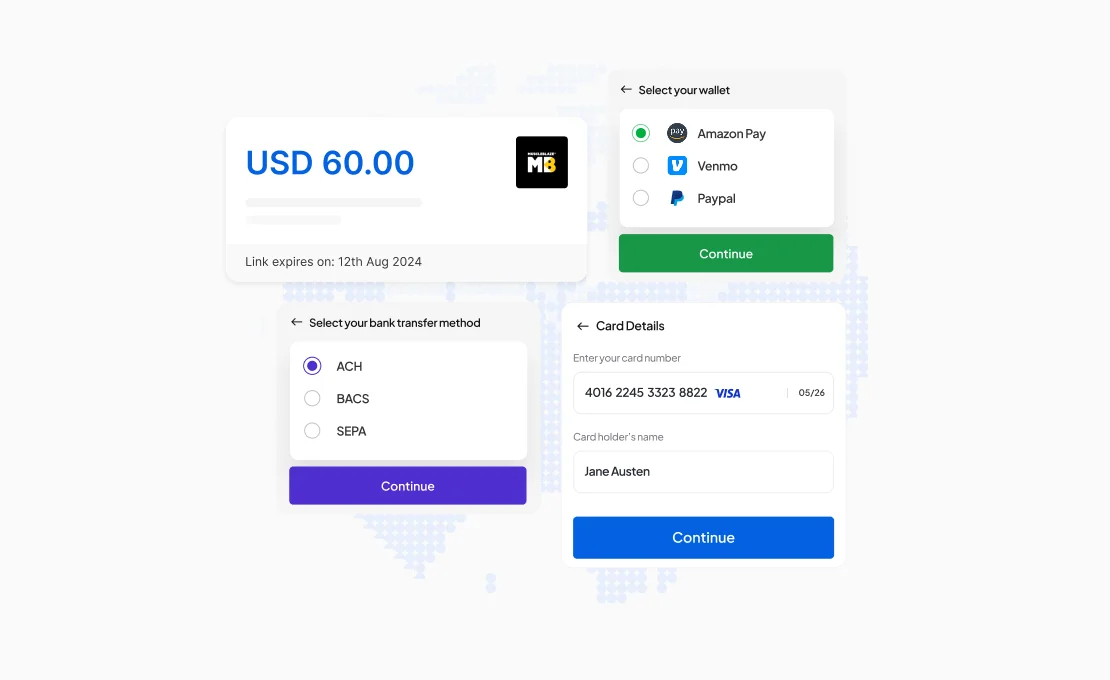

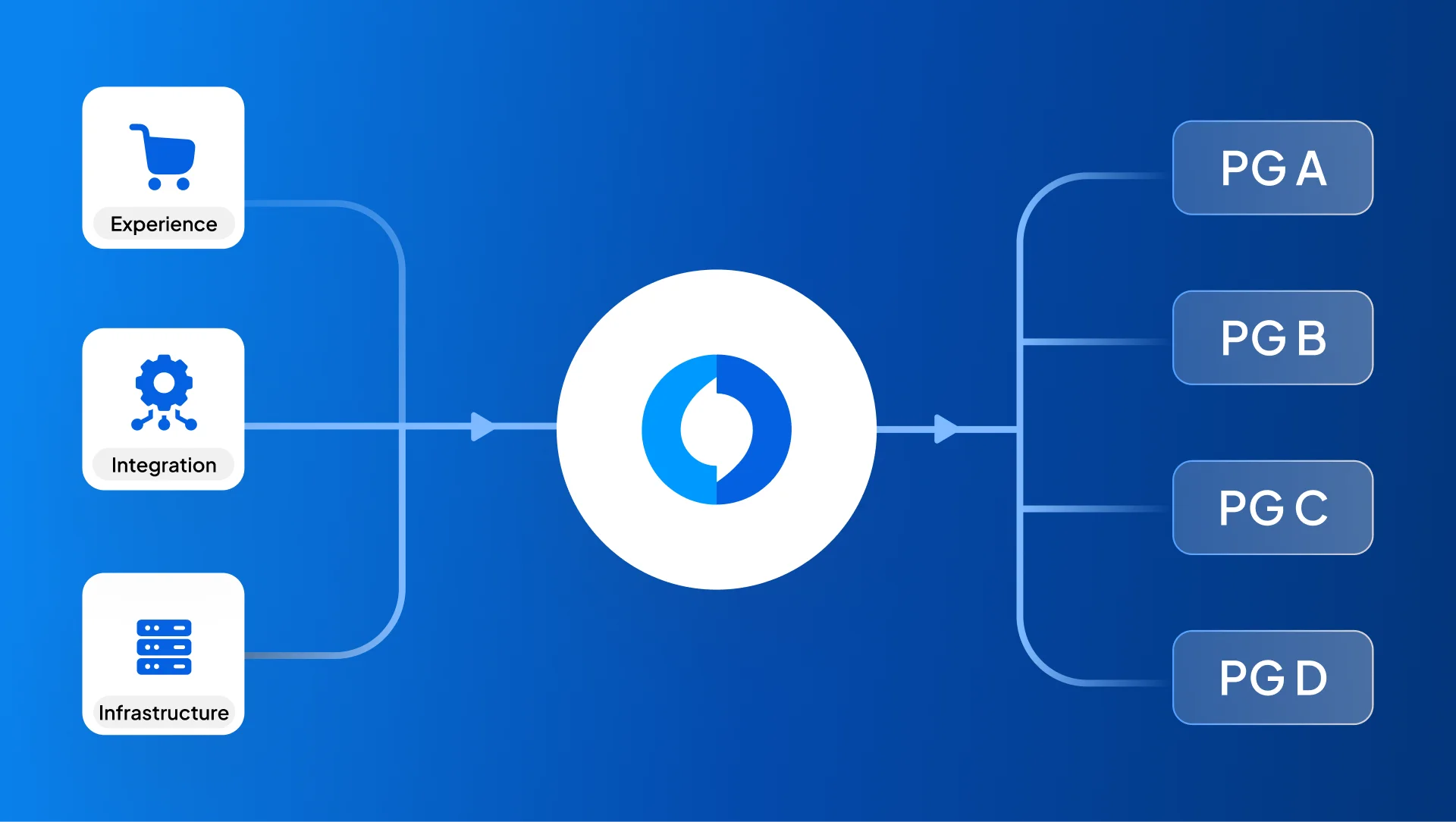

Choosing the Right Payment Solution

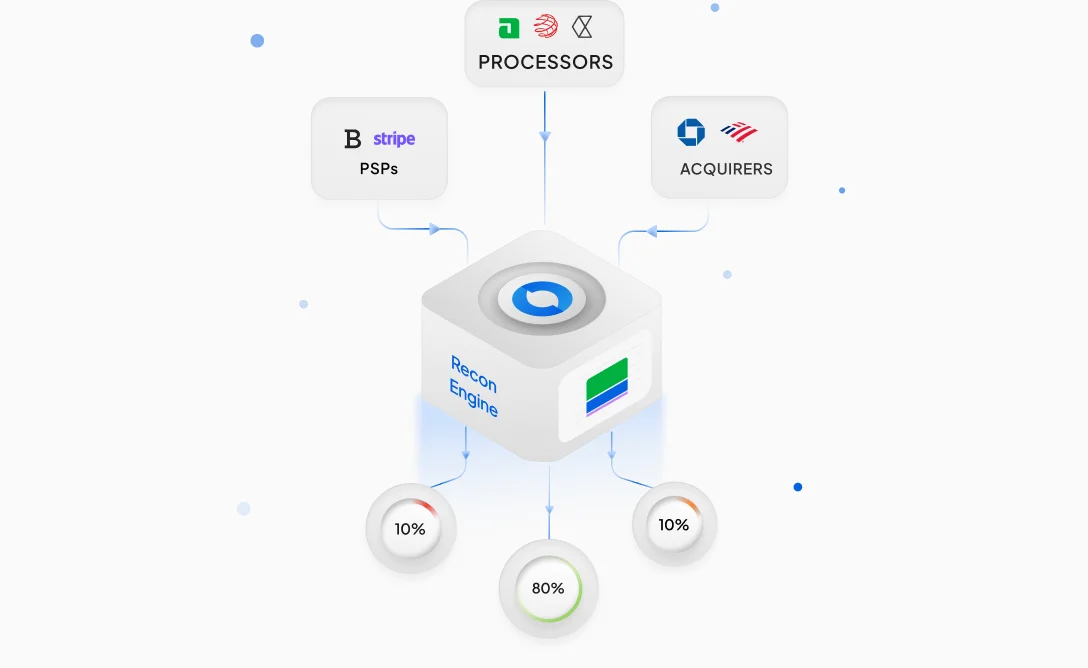

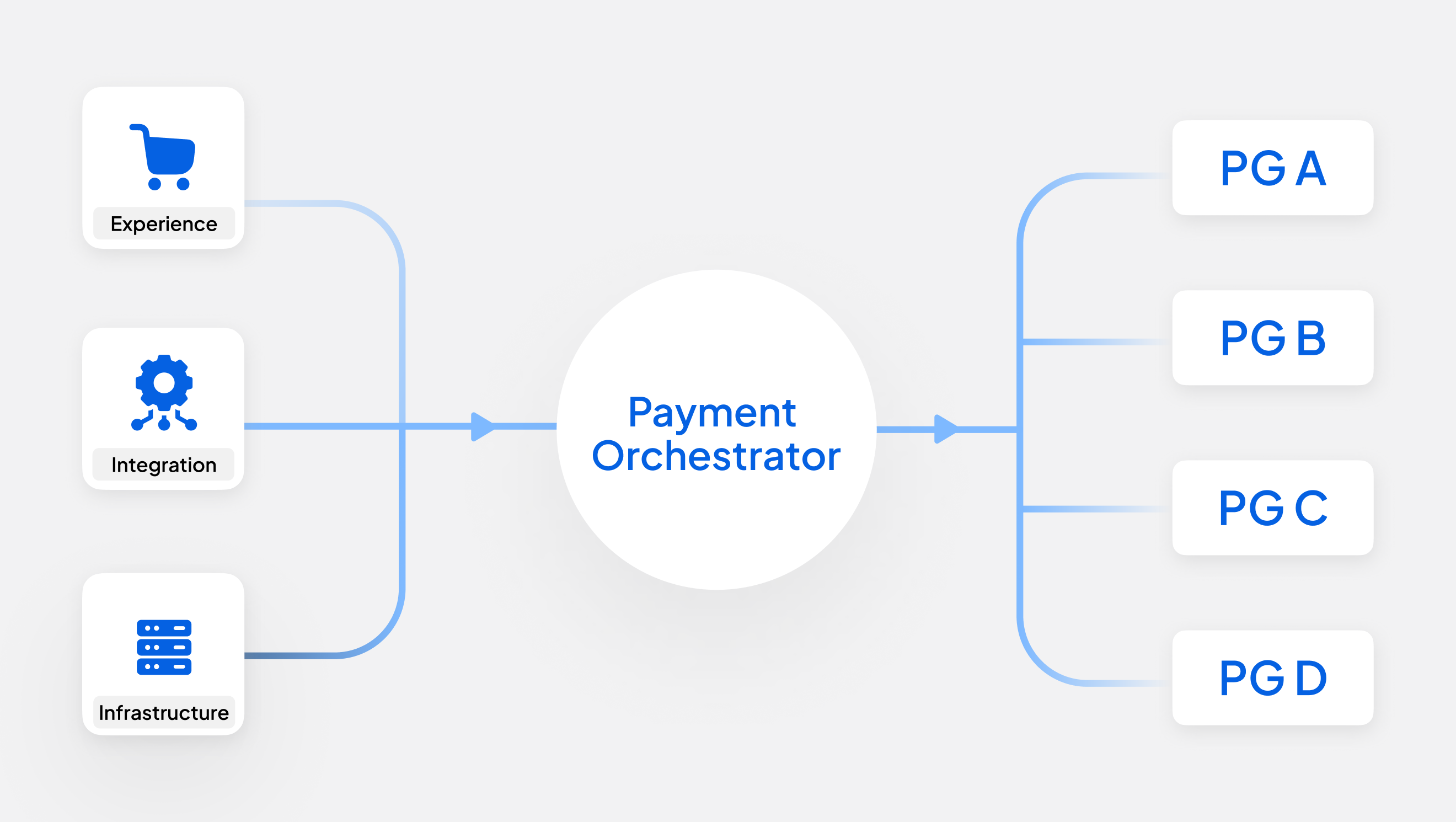

Choose a payment solution based on the product catalogue of your inventory, the financial strategy of your business, and long-term financial goals. Analyse customer behaviour, metrics like cart abandonment rates, and preferred payment methods. Trusted and secure payment solutions, offer a comprehensive payment infrastructure.

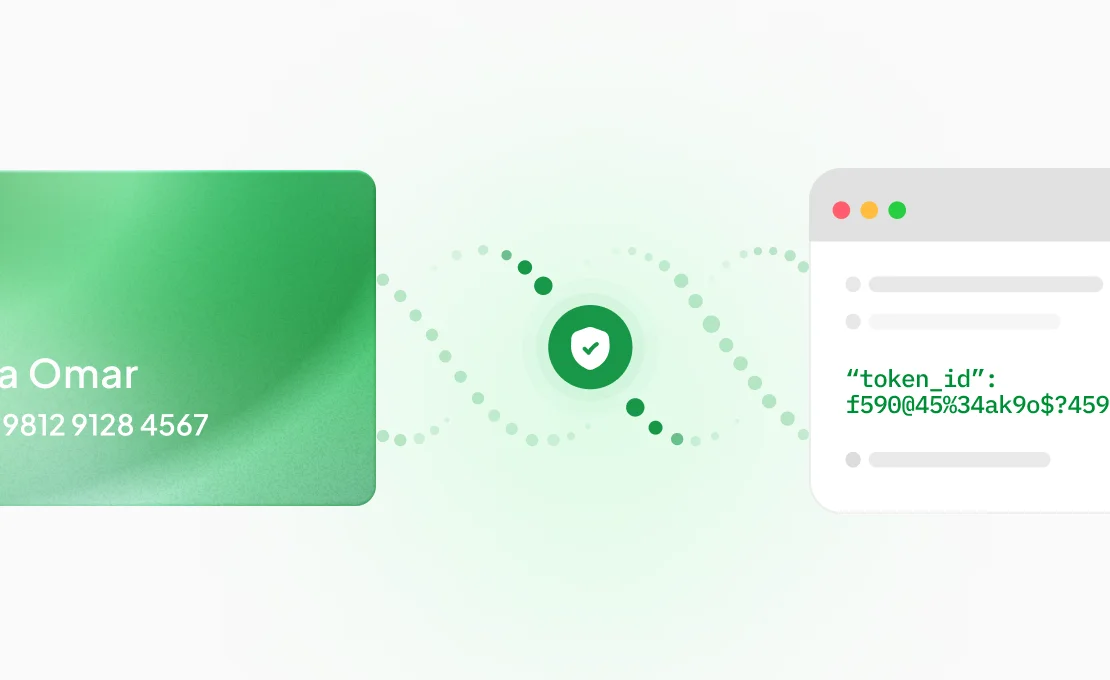

Compliance and Legal Considerations

It is also critical for businesses to comply with all global and regional compliances and financial regulations in order to maintain their brand image. Failure to do so can lead to legal issues or penalties. Hence, choosing a trusted payment solution can help you steer clear of any compliance or legal troubles concerning privacy, data, and financial laws.

Challenges of Instalment Payment Plans

Interest and Fees for Customers

The costs associated with maintaining a payment infrastructure to manage instalment plans are covered for businesses through interest rates or additional fees for the customers. It is imperative to strike the right balance of affordability and transparency to maintain customer trust.

Potential Risks for Businesses

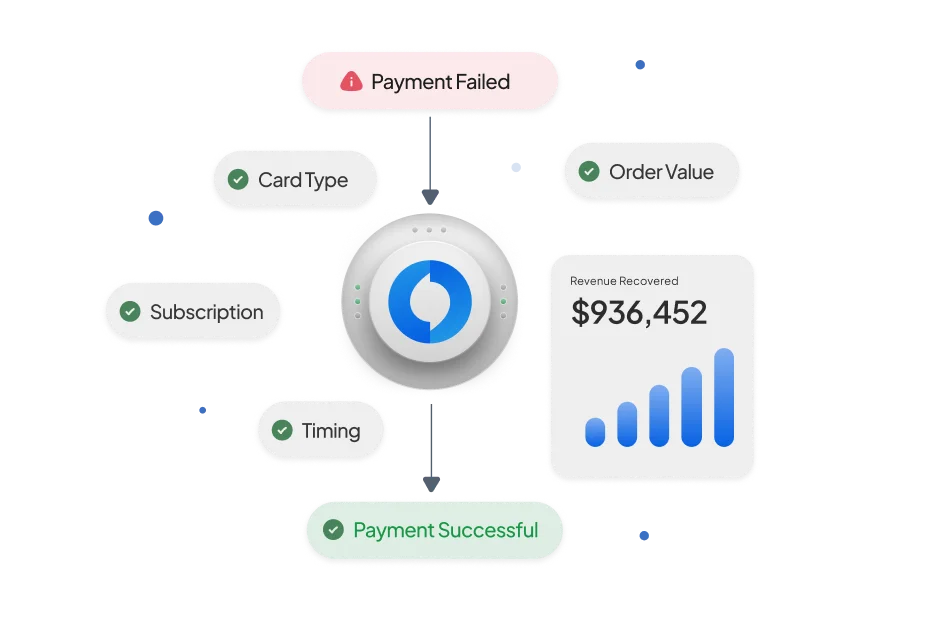

The financial forecasting and reporting of businesses are significantly impacted by the default payments of their customers. It is possible that not every customer goes through with the entire process of an instalment plan and completes their payment or pays it late. These incomplete or late payments hit the business’s expected revenue directly, and be a potential risk. Hence, having a rigid agreement and financial strategy around instalment payments is a must for businesses.

It’s the Right Time to Utilise Instalment Payment

Instalment payments have become almost a necessity for businesses, particularly eCommerce, to increase sales and make high-value items more accessible to the target audience. Choose a solution, which offers a seamless payment infrastructure with rigid terms and conditions. Analyse your business requirements, and start offering flexible instalment payment options to your customers with a world-class payment infrastructure.