Payment technology for

for subscription business

business

Optimise recurring revenue for every business model

From SaaS to streaming, Juspay's payments technology optimises recurring revenue, reduces churn, and powers seamless recurring revenue management.

Streaming services

Seamlessly power recurring payments for streaming platforms.

Membership

Power recurring payments for memberships seamlessly.

Subscription boxes

Seamless recurring deliveries without any payment interruptions.

Pay as you go!

Allow customers to top-up their subscription plans seamlessly.

SaaS technology

Streamline recurring revenue with better retention & seamless renewals for SaaS platforms.

Seamless subscription management

management from sign-up to renewal

sign-up to renewal

Frictionless user journeys, seamless recurring revenue management, and payment flows that streamline recurring revenue operations.

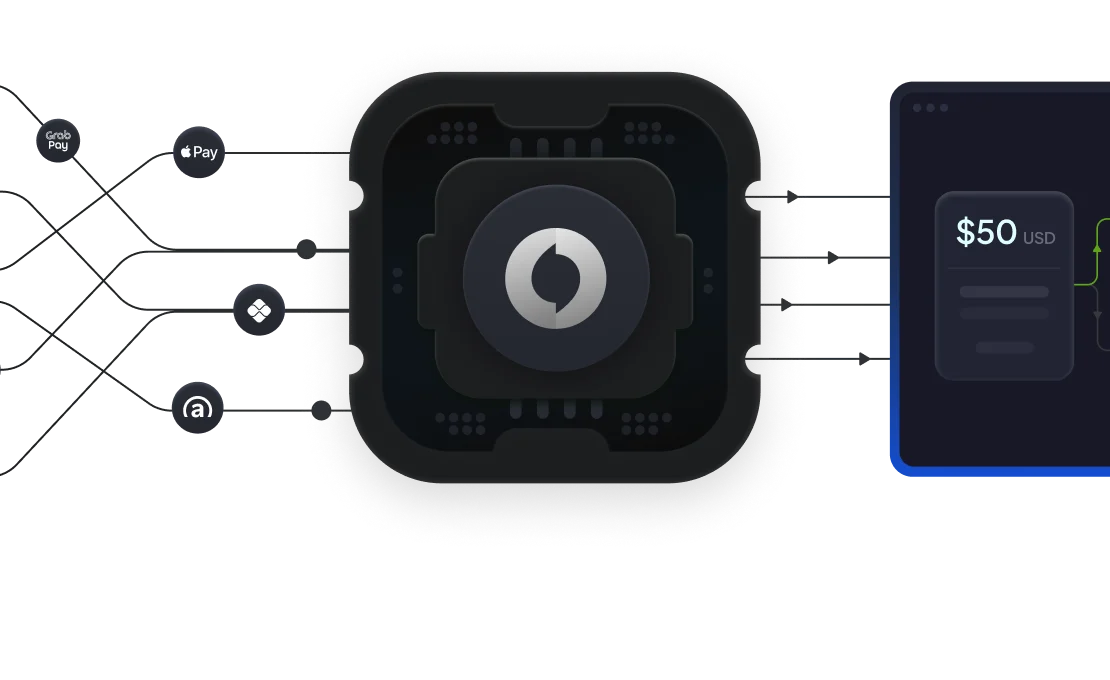

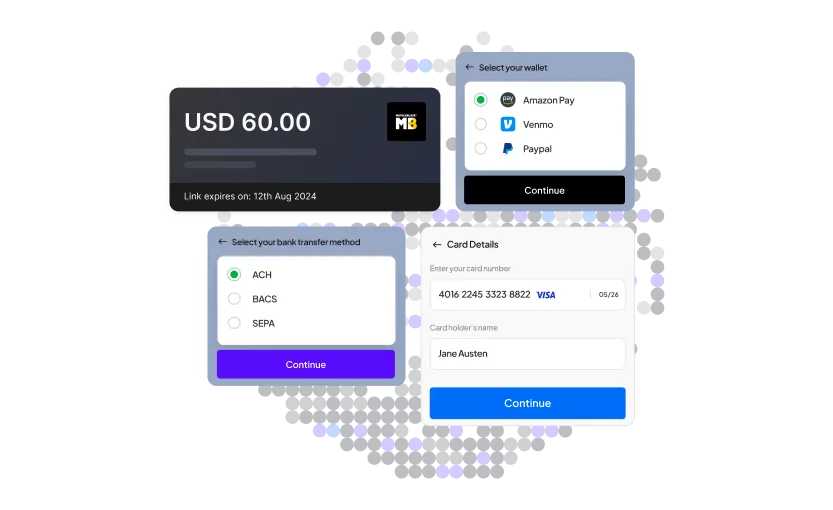

Frictionless sign-ups

with cards or alternate payment methods

Make signing up a breeze with frictionless

checkout experiences. Support local & alternative

payment methods along with cards.

Optimise renewals with retries, real-time card updater and more

Improve customer retention with auto-retries. Prevent

false declines due to expired card information and power seamless recurring payments.

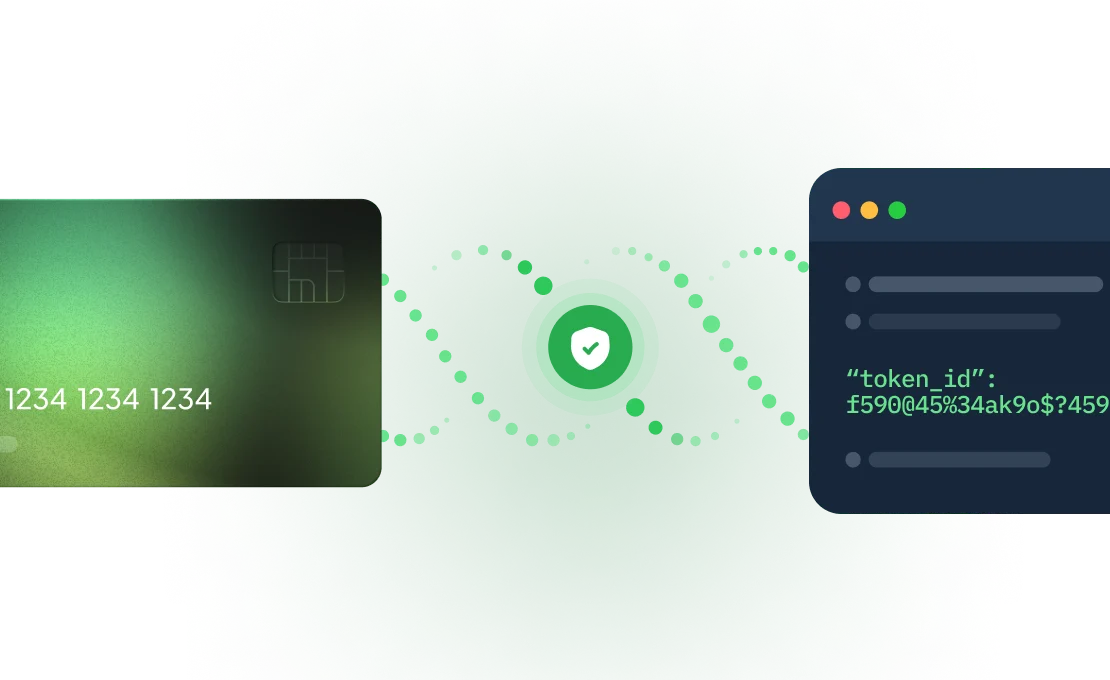

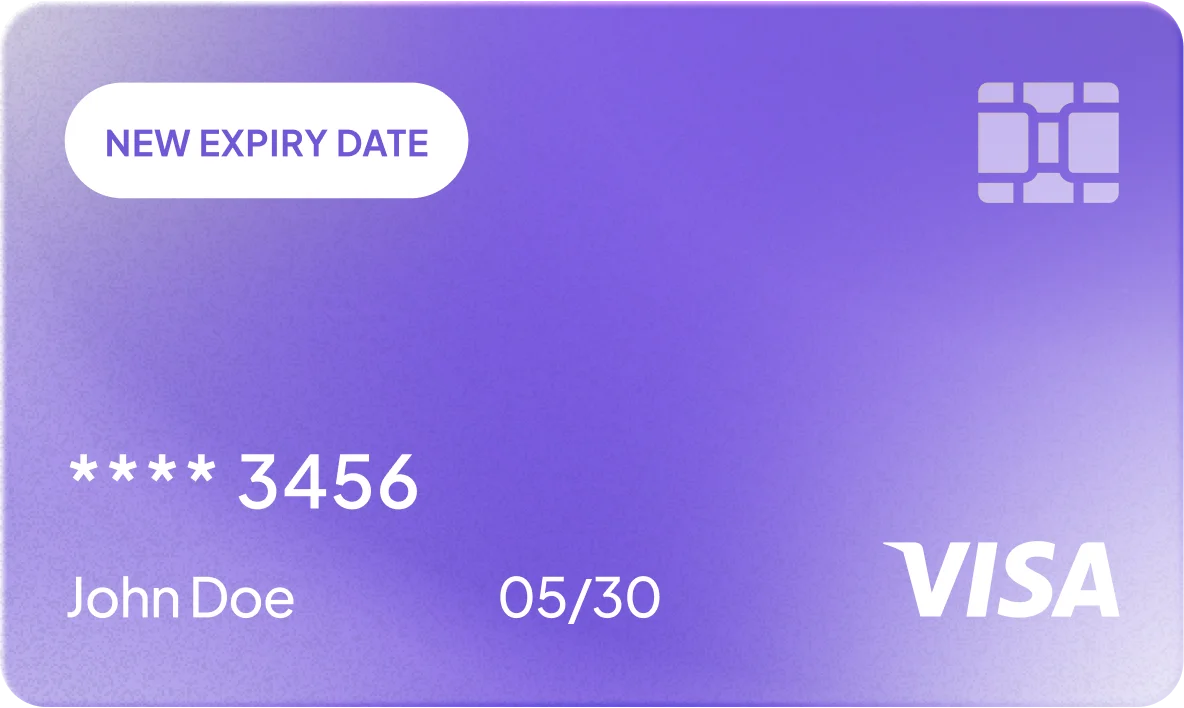

Improve retention

with account updater

Automatically update card details to minimize declined transactions and optimize recurring payments. Reduce payment interruptions by seamlessly refreshing payment information when cards expire, are replaced, lost, or stolen.

Seamless recurring payments

Prevent payment failures caused by outdated card details. Reduce the fees associated with declined transactions & ensure uninterrupted recurring payments.

Uninterrupted customer experience

Automatic updates of card information ensures seamless renewals and minimises involuntary customer churn.

Automatic & on-demand updates via API

Cards in your vault will

be updated every month.

Monitor card expirations

proactively

Automatically update card details to reduce declined transactions and optimize recurring payments.

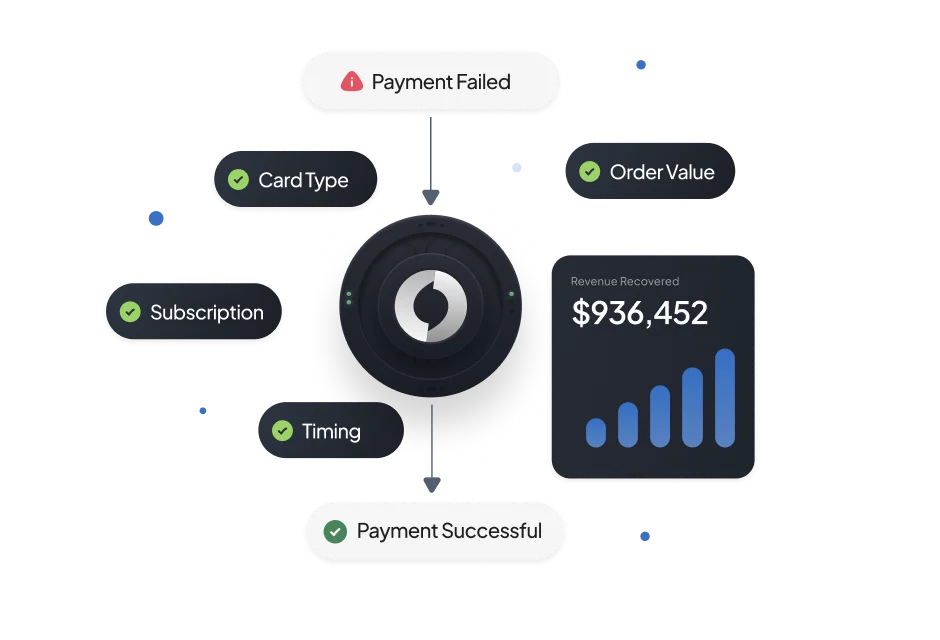

Improve authorisation

authorisation rates with smart retries

with smart retries

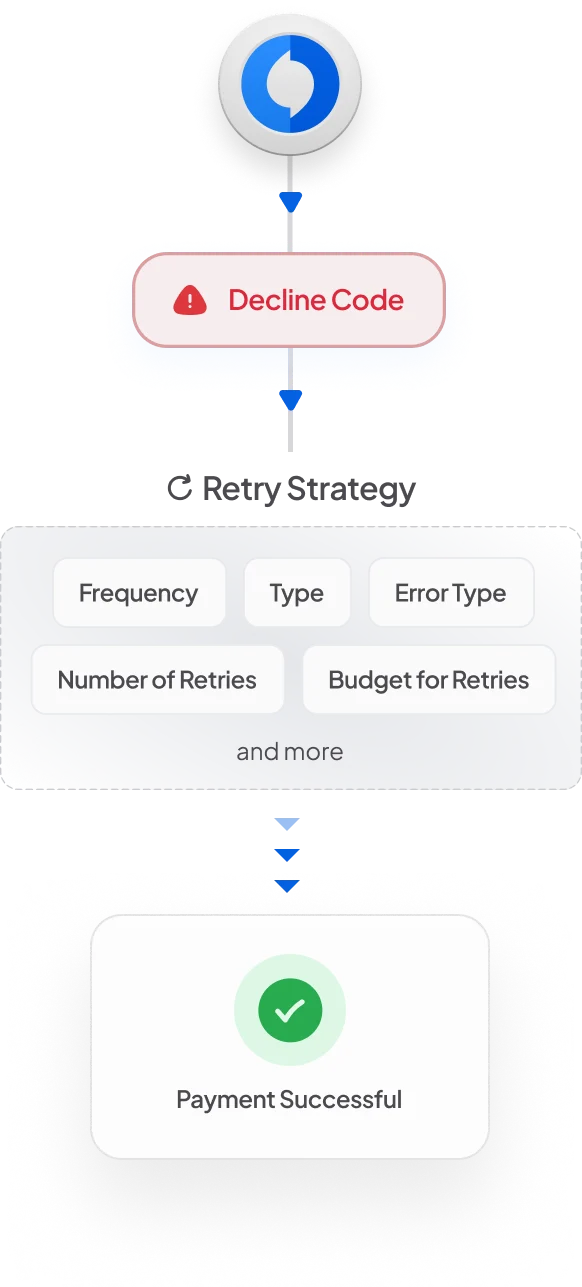

Retry failed transactions intelligently based on error codes, custom rules,and more.

Save costs with

dynamic retry rules

Multi-modal intelligent retry strategy based on decline code, error type, payment method, region, user behaviour, issuer, and more.