Card declines are a pervasive issue in the world of digital payments. They occur when a customer’s credit or debit card is rejected during a transaction. Understanding the reasons behind card declines and the associated decline codes is vital for businesses seeking to provide a seamless payment experience for their customers. In the ever-evolving world of digital payments, businesses encounter a myriad of challenges, and one of the most prevalent and perplexing hurdles they face is card declines. These declines can disrupt transactions, lead to revenue loss, and affect customer satisfaction. To navigate this intricate terrain, it’s crucial for businesses to not only understand why card declines happen but also be intimately familiar with the diverse card decline codes that provide insights into these issues.

In this comprehensive guide, we will delve deep into the world of card decline codes, their profound impact on businesses, and how to effectively manage and prevent them.

Unraveling the Mystery Behind Card Decline Code

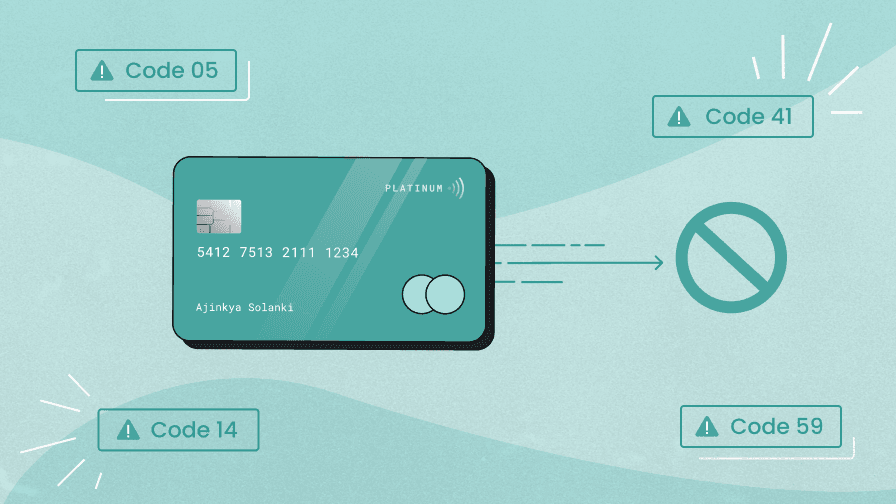

A card decline code, also known as a decline reason code, is a numeric or alphanumeric code provided by the card issuer or payment processor to indicate why a transaction was declined. Each code corresponds to a specific reason, helping businesses promptly identify and address the issue.

Let’s understand this with an Example – A customer’s card is refused with the code “05.” According to this code, the transaction was often rejected because there wasn’t enough money in the customer’s account.

Understanding Card Declines’ Impact on Business

Card declines can significantly impact businesses, affecting their revenue, customer satisfaction, and overall reputation. Here’s how card declines can affect a business:

1. Revenue Loss

When a card is declined, the immediate consequence for a business is revenue loss. The sale is forfeited, resulting in a direct hit to the bottom line. This is especially detrimental during peak sales periods or for high-value transactions.

2. Customer Frustration

Card declines can lead to customer frustration and dissatisfaction. Customers expect smooth and hassle-free payment experiences. When they repeatedly encounter payment issues, they may abandon their shopping carts or make their purchases elsewhere.

3. Reputation Damage

A high rate of card declines can harm a business’s reputation. Customers may perceive the business as unreliable or insecure, eroding trust and loyalty. In an age where online reviews and word-of-mouth recommendations hold significant sway, reputation damage can have far-reaching consequences.

4. Operational Costs

Managing card declines, processing refunds, and addressing customer inquiries can incur additional operational costs for businesses. These costs can quickly add up and impact overall profitability.

Different Card Decline Code Types

Depending on the card network (such as Visa, Mastercard, or American Express) and the particular cause for the decline, card decline codes can change. The following list of typical card decline codes includes explanations for each type in great detail:

- Insufficient Funds (Code 05): This decline code is generated when insufficient funds are in the customer’s account to pay the transaction amount. One of the most frequent causes of card declines is this.

- Card Expiration (Code 54): Any attempt to use a card after it has expired.

- Invalid Card Number (Code 14): This code is generated when the card number provided is incorrect or invalid. It could be due to a typographical error or outdated card information.

- Card Not Activated (Code 78): Some cards require activation before they can be used for transactions. This decline code may appear if a customer’s card has not been activated.

- Suspected Fraud (Code 59): To safeguard the cardholder, the card issuer may reject a transaction if it involves fraud or other suspicious circumstances.

- Cardholder’s Request (Code 41): This decline code indicates that the cardholder has requested the card issuer to block or decline specific types of transactions, such as online purchases.

- Exceeds Withdrawal Limit (Code 51): Some cards have withdrawal or spending limits. If the transaction amount exceeds these limits, it will result in this decline code.

- System Error (Code 96): This decline code is related to technical issues within the payment system or network. It’s usually temporary and not a result of the customer’s actions.

List of Card Decline Codes

Here is a more extensive list of card decline codes to provide businesses with a deeper understanding:

- Code 01: Refer to Card Issuer

- Code 02: Refer to Card Issuer, Special Condition

- Code 03: Invalid Merchant

- Code 04: Pickup Card

- Code 05: Insufficient Funds

- Code 06: Error

- Code 07: Pick Up Card, Special Condition

- Code 08: Honor with Identification

- Code 09: Request in Progress

- Code 10: Partial Approval

- Code 11: VIP Approval

- Code 12: Invalid Transaction

- Code 13: Invalid Amount

- Code 14: Invalid Card Number

- Code 15: No Such Issuer

- Code 19: Re-enter Transaction

- Code 21: No Action Taken

- Code 22: Suspected Malfunction

- Code 25: Unable to Locate Record

- Code 30: Format Error

- Code 41: Lost Card, Pickup

- Code 43: Stolen Card, Pickup

- Code 51: Exceeds Withdrawal Limit

- Code 52: No Checking Account

- Code 53: No Savings Account

- Code 54: Expired Card

- Code 55: Incorrect PIN

- Code 57: Transaction Not Permitted to Cardholder

- Code 58: Transaction Not Permitted on Terminal

- Code 59: Suspected Fraud

- Code 61: Activity Amount Limit Exceeded

- Code 62: Restricted Card

- Code 63: Security Violation

- Code 65: Exceeds Withdrawal Frequency

- Code 75: Allowable Number of PIN Tries Exceeded

- Code 76: Unable to Locate Previous Message

- Code 77: Repeat of a Previous Message

- Code 78: Card Not Activated

- Code 80: Date of Birth Error

- Code 85: No Reasons to Decline

- Code 91: Issuer Unavailable

- Code 92: Payment Gateway Authentication Error

- Code 93: Violation of Law

- Code 94: Duplicate Transaction

- Code 96: System Error

- Code 98: Cryptographic Failure

- Code 99: Duplicate Reversal

Please note that this is a comprehensive list of card decline codes, and numerous other decline codes can occur during transactions.

How to Prevent Card Decline?

The impact of card declines on businesses cannot be overstated. To mitigate the adverse effects, businesses can take proactive steps to prevent card declines:

1. Regular Card Updates

Encourage customers to keep their card information up to date, especially the expiration date. Remind them to replace expired cards promptly.

2. Verify Card Information

Implement mechanisms to verify the accuracy of card numbers and other payment details during the checkout process to reduce errors.

3. Address Fraud Concerns

Collaborate with payment processors to implement robust fraud detection systems that can identify and block potentially fraudulent transactions.

4. Customer Communication

Establish clear communication channels with customers to address any concerns or issues related to their payments. Provide guidance on resolving card decline issues.

5. Payment Gateway Optimization

Choose a reliable payment gateway that offers real-time authorisation and fraud prevention features.

6. Customer Education

Educate customers on the importance of maintaining sufficient funds, activating their cards, and monitoring their accounts for suspicious activity.

Conclusion

In summary, card decline codes are a crucial component of the e-payment landscape, and organisations need to be prepared to manage them. Businesses may improve their payment processes, lower revenue loss, and offer a better customer experience by being aware of the many sorts of refuse codes, their effects, and how to avoid them. Managing card declines effectively requires being proactive and educated in the digital world.

FAQs About Card Declined Codes

1. What is code 14 card declined?

Code 14, “Invalid Card Number,” is a card decline code that occurs when the card number provided is incorrect or invalid. It could be due to a typographical error or outdated card information.

2. What is code 12 card declined?

Code 12, “Invalid Transaction,” is a generic card decline code indicating an unspecified transaction issue. It does not provide specific details about the reason for the decline.

3. What is card decline code 15?

Code 15, “No Such Issuer,” often indicates that the card issuer (such as a bank or financial institution) is unaware of the specified card number. It can be because a card is invalid or wasn’t issued by that specific institution.

4. What should a business do if they consistently experiences a high rate of card declines?

If a business consistently experiences high card decline rates, it should:

- Review and optimise payment processes.

- Communicate with the payment processor.

- Implement advanced fraud prevention measures.

- Reach out to affected customers.

- Monitor decline trends.

- Conduct A/B testing on checkout pages.

5. How can businesses strike a balance between security and convenience when addressing card decline issues?

Businesses can balance security and convenience when addressing card declined issue by:

- Implementing 3D Secure authentication.

- Using tokenisation for secure data handling.

- Offering multiple payment options.

- Optimising payment pages for usability.

- Communicating transparently about security measures.

- Providing responsive customer support.