One Card Shines with Higher Success Rates

catagory

About

OneCard, a 2019-founded fintech startup in India, stands out for its innovative approach to credit cards and financial management. It offers a single credit card with multiple virtual cards, each having unique details. Users can create up to 5 virtual cards with customizable features for added security. The associated mobile app provides real-time notifications, categorizes expenses, and offers insights to enhance financial management. OneCard’s reward system includes instant cashback and discounts, and it has garnered support from Sequoia Capital. The app boasts high ratings on both Google Play Store and Apple App Store. With partnerships with popular brands and unique features like instant card activation, OneCard is reshaping the financial landscape in India.

Challenges

Payments experience is customer experience. And as OneCard has redefined the Credit Card Landscape, the Payments experience for its customers also had to be something that rings true to One Card brand and delights customers in the process.

- How do you improve Success Rates across different Payment Methods?

- How do you build a native checkout experience that delights?

- How do you turn Payments Data into actionable insights?

Improving Payment Success Rates

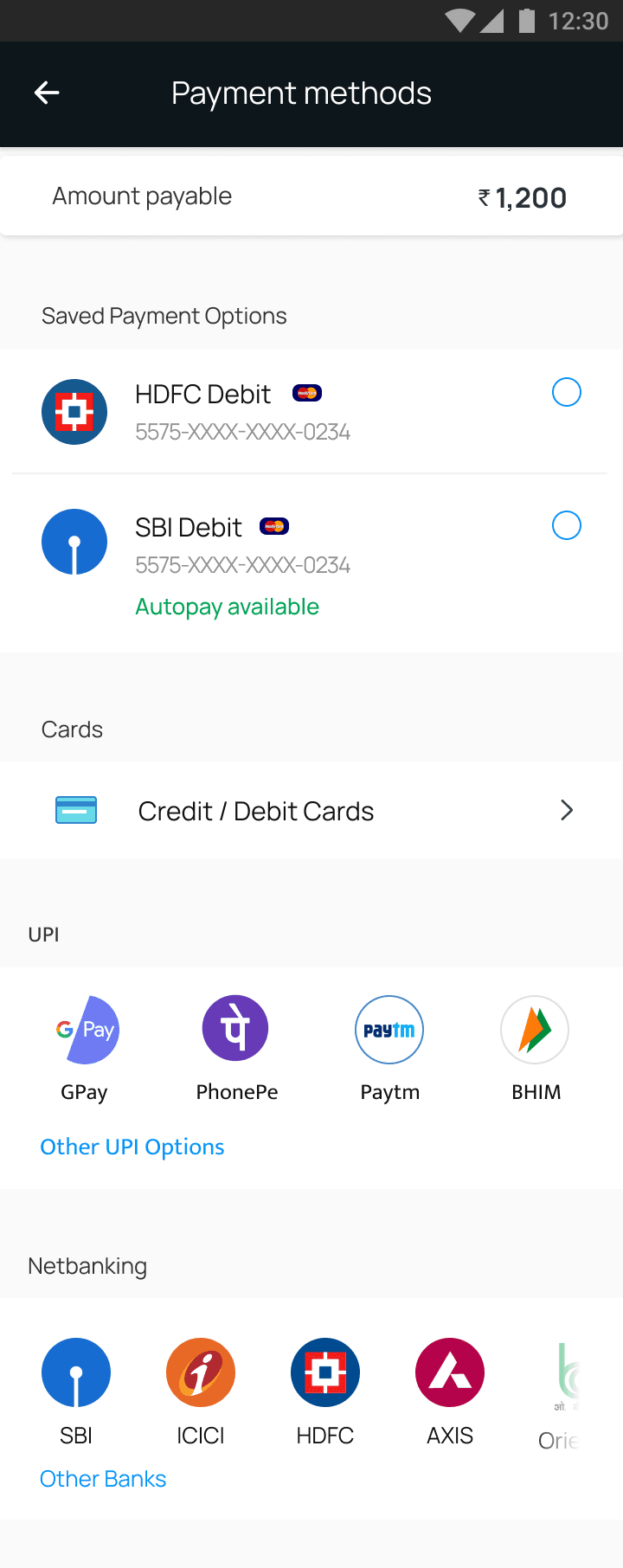

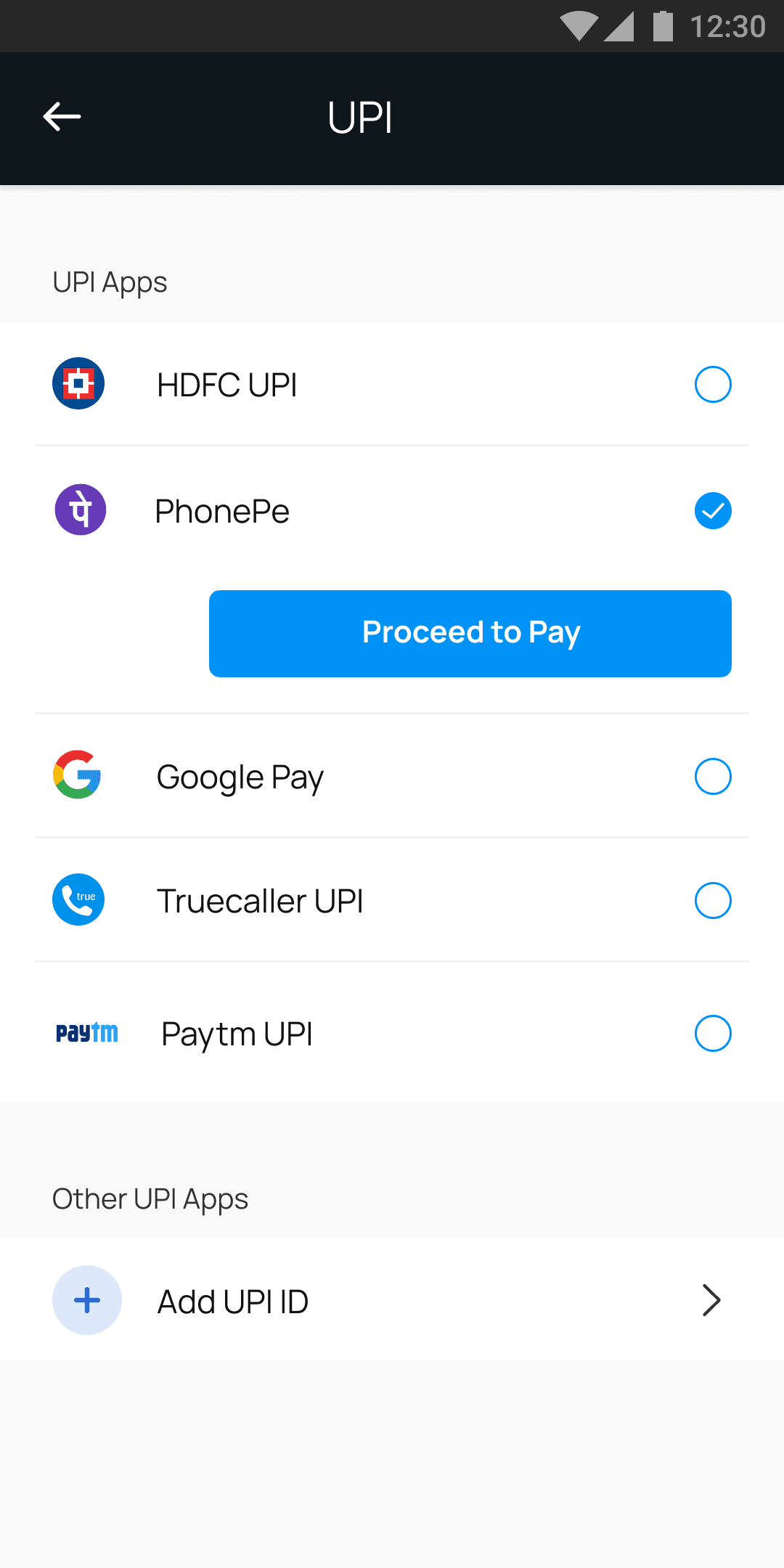

UPI as a payment method provides a seamless payments experience for customers and accounts for majority of Payments volume for OneCard. OneCard chose Yes Bank’s YesBiz Payment Gateway, developed in partnership with Juspay to process UPI transactions leading to a 6% increase in Success Rates. Additionally, Juspay’s verify VPA API reduced customer errors in UPI collect flow, by verifying the VPA address before proceeding to pay.

OneCard also implemented Juspay’s Native OTP read & submit to minimise user errors and enable a seamless card payment flow. Implementing Native OTP read & submit led to an increase Debit Card Success rates by 5.8%

Building a Native Checkout Experience

OneCard wanted to unify their multiple PA/PGs on their backend and present users with a seamless and branded checkout experience which speaks true to their brand language. OneCard was able to achieve a completely native checkout experience via Juspay Studio, which allowed them to build a custom branded checkout experience without writing any code.

Distilling actionable insights from Payments Data

Juspay’s Analytics Dashboard unifies disparate Payments Data from multiple Payment Gateways giving OneCard a complete and aerial overview of their Payment Systems health and key metrics on a granular level. The data pointed out several enhancements such as disabling underperforming and non-popular banks for Net Banking, which led to a 5.6% increase in Success rate for Net Banking. Furthermore, Juspay goes one step further and suggests features which can better the Payments experience for customers and reducing the time to transaction. OneCard implemented QuickPay, which reduced transaction time for customers.

Better Payments for a Better Credit Card Experience

Payments have evolved to more than just a transactional utility. For OneCard, building a payments experience that increased revenue was the key focus, with a seamless checkout experience. With an overall 6.58% increase in success rates, OneCard can provide a superior and conversion optimised checkout users, driving customer delight akin to the metal card in their wallets.