Accelerate your

lending growth

Enable instant credit access for customers with seamless lender integrations

Reduction in

underwriting costs

Faster TAT for

approvals

Higher approval rates/

higher conversion rate

Pre-integrated

merchants

Power the Future of

Lending

Get direct access to high-intent customers, smarter distribution, and cutting-edge technology to scale business at a lower cost.

Grow your Portfolio

Tap into pre-integrated merchant networks across high-intent verticals, and expand reach with omni-channel distribution

Minimize Costs

Cut customer acquisition, underwriting, and integration costs with our intelligent rule engine and seamless one-click merchant integrations.

Boost Conversions

Improve approval rates with real-time eligibility checks and embedded credit journeys

Fully Compliant

Our platform is designed to meet the highest standards of data handling, user consent, and secure transaction flows—ensuring full compliance with applicable regulations.

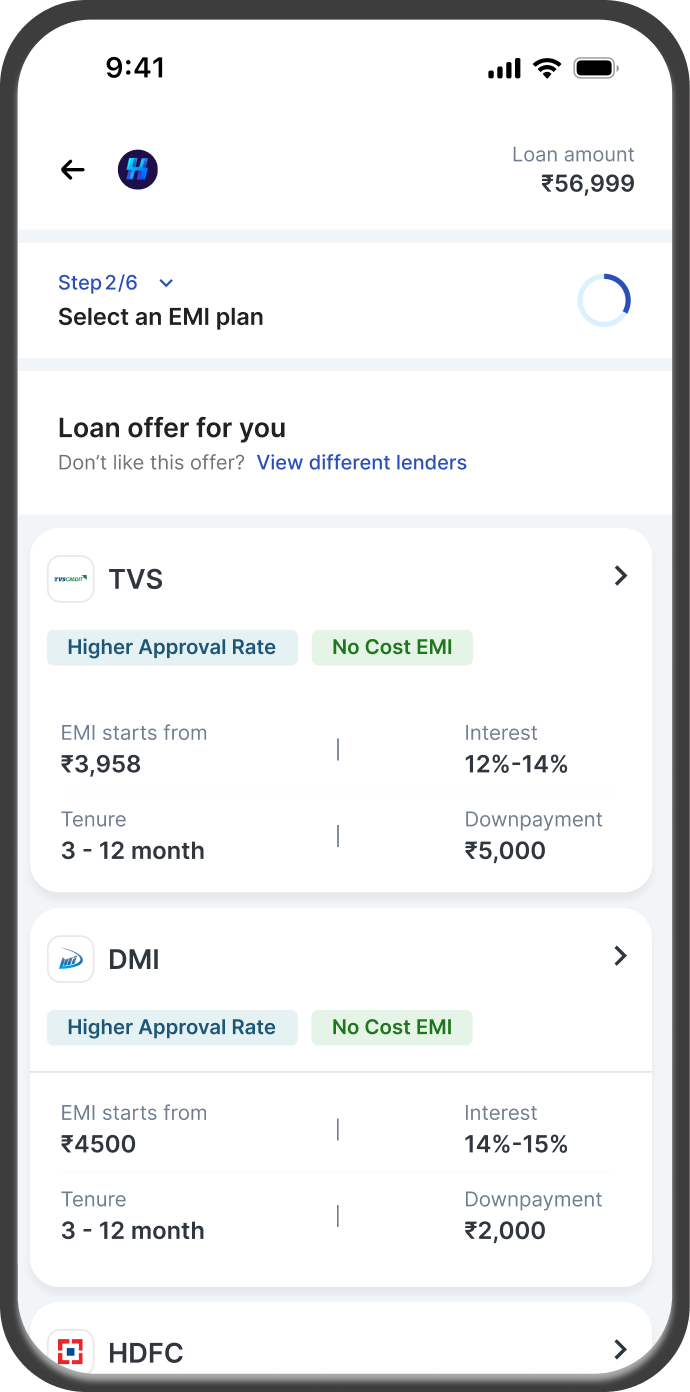

Checkout Financing

Offer credit right at the point of purchase and convert customers instantly with easy EMIs or loans

Unlock High-Intent Leads

Get intent-driven customers at the point of purchase across high-value verticals.

Instant Access to Merchants

Tap into a pre-integrated network of top merchants, with zero integration effort.

Higher Conversions, Lower Costs

Boost ROI with real-time checks that cut drop-offs, trim costs by 25%, and lower CAC.

Compliance Built In

Secure, responsible, and ready for today's regulatory landscape

Pre-approved, card-free

EMIs

Expand your reach with pre-approved, card-free EMIs across online and offline channels

Smarter Offer Discoverability

Engage buyers early by displaying installment options right from product discovery to checkout

Omni-Channel Distribution

Enable smooth, cardless EMI experiences across mobile, web, and in-store channels, to tap into Tier 2/3 markets.

Risk-controlled

funnel

Leverage our data-backed orchestration engine to manage exposure & optimize performance across SKUs & geographies.

Higher Approvals at Lower Costs

Improve approval efficiency by up to 20% with real-time eligibility checks, & reduce integration overhead with standardized APIs.

Contextual Personal Loans

Offer contextual, pre-approved personal loans across high-intent moments like checkout, product description pages, loan links, and offline touchpoints

High-Intent, Contextual Leads

Access pre-qualified customers across high-intent categories — engaged with offers at the right moment.

Faster Disbursals

Move customers from application to disbursal in minutes with integrated, instant-ready loan flows.

Tailored Journeys for Higher Conversions

Improve user experience and reduce drop-offs by configuring the journey as per your requirements.

Data-driven Business Loans

Expand into high-value SME lending with contextual, data-driven business loans embedded directly into merchant workflows.

Access Pre-Qualified Leads

Tap into a growing base of digitally verified SMEs already engaging in commercial purchases.

Enable Data-Driven Underwriting

Leverage rich transactional and invoice data from merchants to improve credit decisioning and reduce NPAs.

Built into Buyer Journeys

Integrate directly into merchant CRMs, ERPs, and B2B checkouts to offer contextual loans and boost conversions.

Expand your SME Reach

Tap into SME demand across diverse sectors like logistics, pharma, manufacturing, and education.

A pre-integrated merchant network at your fingertips. Talk to our team to partner with us!