Supercharge Sales

with Embedded Credit

Access pre-qualified leads, reduce cost & grow your loan portfolio exponentially.

Seamless Experience &

streamlined operations

Powerful credit experience for customers, driven by intelligent orchestration, and streamlined operations for merchants with no-code lender integrations.

Checkout Financing

Unlock working capital for SMEs, channel partners, and enterprise buyers with tailored credit solutions

Frictionless Onboarding

Auto fill forms with existing data to reduce loan journey time.

Smarter Pre-Qualification

20+ deep profile checks to get eligible lenders.

Real - Time Lender Decisioning

Get offers within seconds and complete the flow digitally.

Resume Anytime, Anywhere

Allow your customer to resume from where they left off.

Customer Retargeting

Re-engage dropped off customers with contextual nudges.

Seamless Attribution

Effortlessly sync all internal systems. CRM, CMS, ERP. All check.

EMI Explorer

Unlock EMI options at the point of discovery to ensure higher conversions

Plug it anywhere

Easily integrates with landing page, product description or payment page.

All-in-one Widget

Supercharge your offers & promotions with credit discovery

Designed to convert

Explore different EMI options to find the best match.

Smart Convert

Empower your sales heroes to drive revenue through assisted financing.

Credit Console for Assisted Sales

Check eligibility across all lenders for your customers

Collect Payment without Restrictions

Enable every option - one-shot, split/partial payments, subscriptions, EMIs, and loans

Zero Time to Market

Roll out HyperCredit to sales units across geographies instantly

360-Degree Control

All-in-One Control: Manage lenders, applications, and data reconciliation

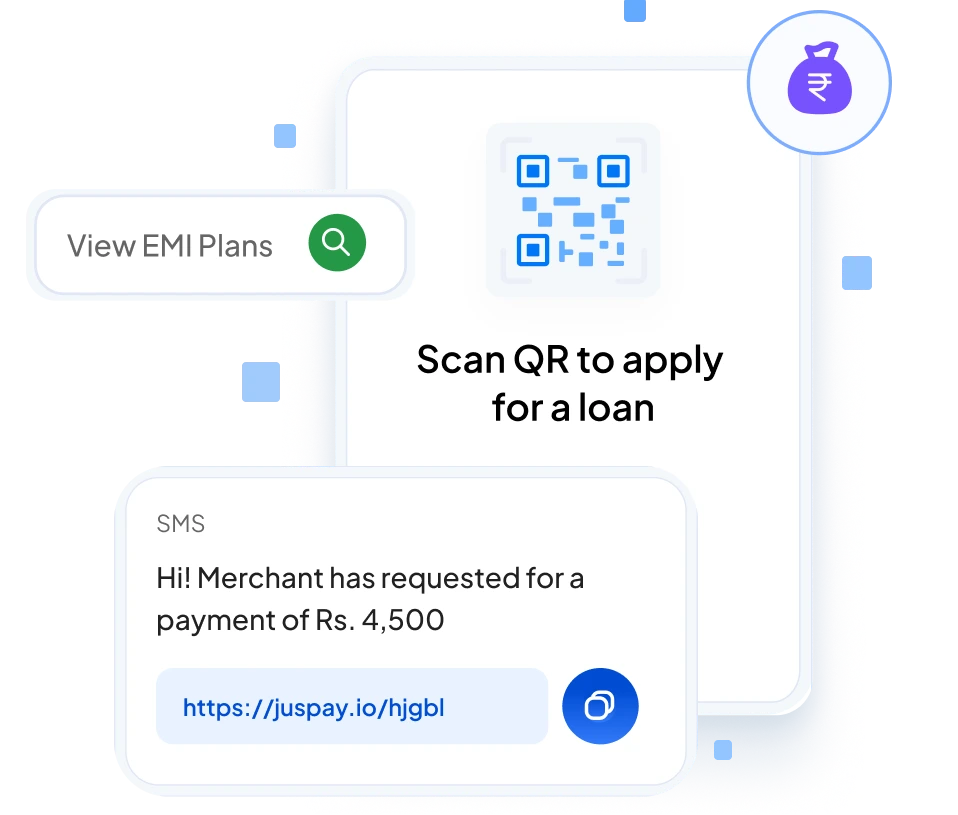

HyperCredit on QR

Bolster your in-store sales through HyperCredit on QR

Omnichannel Payment Experience

Standardize EMI offerings across all sales channels.

Dynamic SKU based QRs

Enable product specific offers, EMIs and promotions.

Self Eligibility Check

Let customers Scan and Discover their perfect EMI fit.

Contextual Personal Loans

Drive customer conversion, affordability, and higher ticket purchases by delivering real-time, personalized loans across high-intent touch points

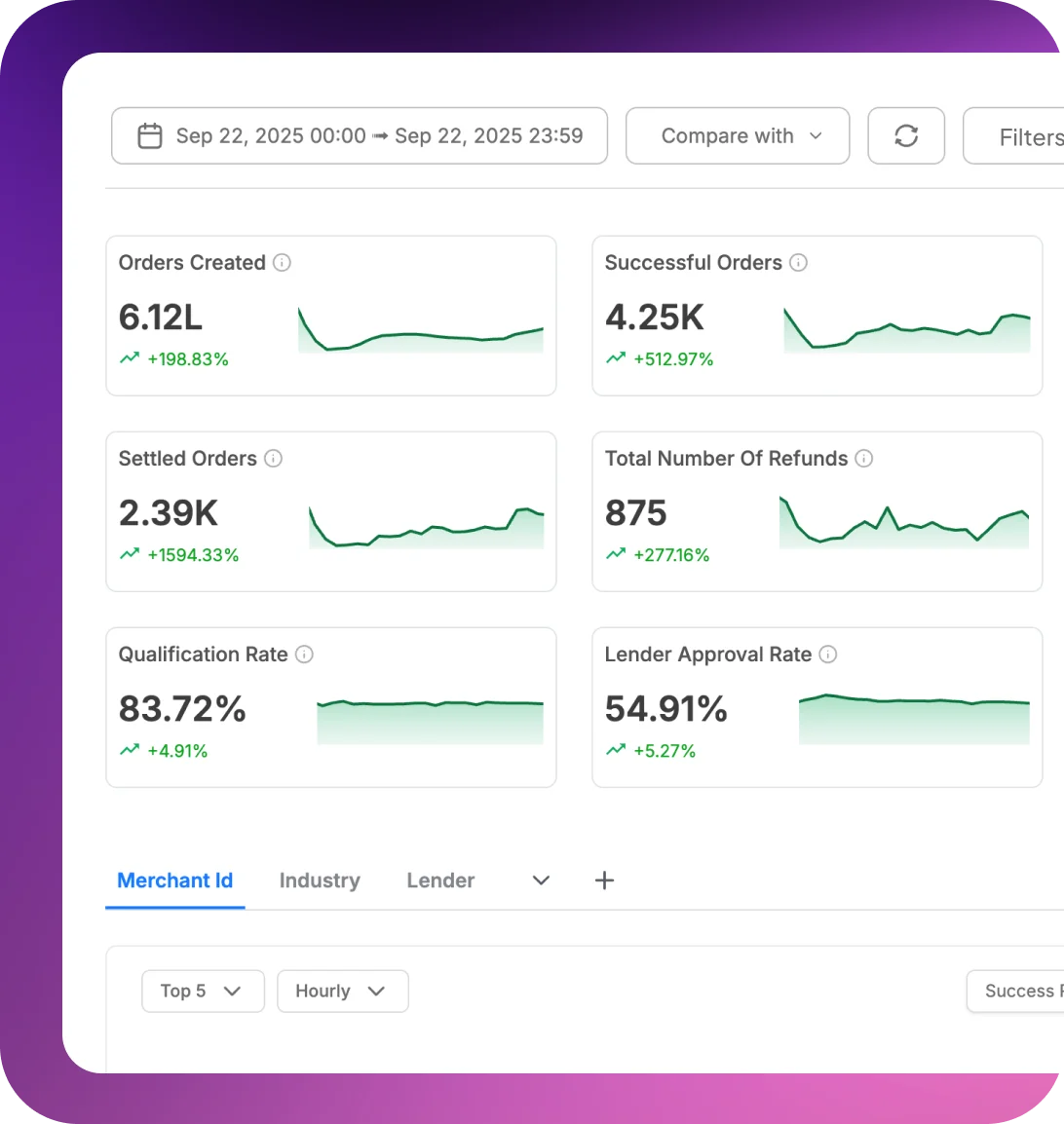

Maximize Conversions

Offer your customers a completely digital, seamless loan journey from discovery to disbursal with intelligent routing based on eligibility, success rate, TAT, or your own preferences.

Integrate Once, Increase Earnings

Plug into a wide lender network with no-code integration to boost earnings and cut overhead.

Boost Customer Engagement

Utilize eligibility checks across all lenders and effectively retarget customers via WhatsApp, SMS or email.

Empower Sales Teams

Guide customers through fast-track loan journeys and increase high-value conversions by up to 35% with SmartConvert Dashboard.

Data-driven Business Loans

Expand into high-value SME lending with contextual, data-driven business loans embedded directly into merchant workflows.

Finance High-Value Transactions

Offer credit for large-ticket, recurring purchases like inventory, equipment, and working capital with strong utilization potential.

Expand Customer & Partner Base

Onboard SMEs and channel partners who struggle with large upfront payments, and improve customer & partner loyalty

Enable Recurring Sales

Extend term loans to commercial buyers with dynamic repayment options.

Integrated into Workflows

Integrate within CRM, invoicing, or B2B checkout for higher engagement and pull-through.

India's biggest businesses streamline Credit Operations with HyperCredit.