In the ever-evolving landscape of global finance, mastering the intricacies of SEPA transfers has become imperative for Indian businesses exploring international trade. This article serves as a strategic guide for companies aiming to navigate the complexities of SEPA transfers from India, offering insights tailored to the unique needs of the Indian market.

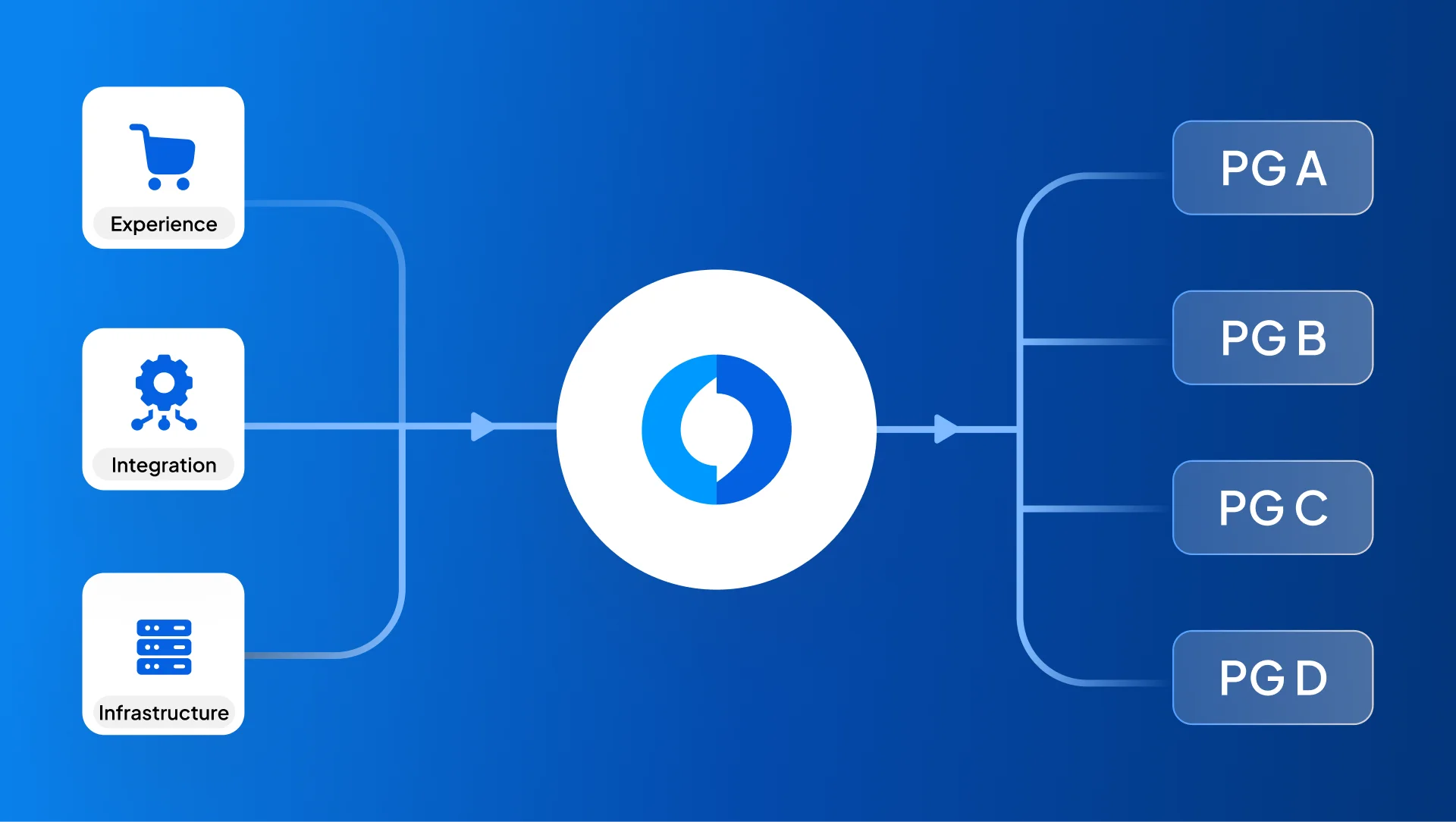

SEPA, or the Single Euro Payments Area, is not merely a financial framework; it’s a pivotal instrument empowering Indian businesses to streamline their international financial transactions efficiently. As companies increasingly expand their horizons, understanding the nuances of SEPA becomes a crucial competitive advantage. This article delves deep into the core of SEPA, elucidating its multifaceted nature and providing actionable insights. From decoding the various types of SEPA payments to understanding their seamless integration into Indian banking systems, readers will gain comprehensive knowledge to harness the full potential of SEPA transfers in their global financial endeavours.

Understanding SEPA : Unveiling the Secrets of Single Euro Payments Area

Navigating the global financial landscape, businesses encounter the Single Euro Payments Area (SEPA) as a pivotal player in facilitating seamless cross-border transactions. This section unravels the intricacies of SEPA, shedding light on its fundamental concepts and underscoring its relevance for Indian businesses engaging in international trade.

- Definition and Purpose

The full form of SEPA is the Single Euro Payments Area, which represents a harmonised framework designed to simplify and standardise euro transactions across 36 countries. The primary purpose of SEPA is to create a unified payments market, eliminating barriers for businesses and consumers conducting transactions within the SEPA zone. This initiative not only streamlines cross-border payments but also fosters a more interconnected and efficient financial ecosystem.

- SEPA Countries and Its Global Impact

The scope of SEPA extends beyond the 27 member states of the European Union, encompassing additional SEPA countries such as Norway, Iceland, Liechtenstein, Switzerland, Monaco, and San Marino. This broader inclusion positions SEPA as a global influencer, impacting international trade and financial transactions worldwide. For Indian businesses eyeing global expansion, understanding the reach of SEPA is integral to leveraging its benefits.

SEPA transforms the landscape of cross-border transactions, offering a standardised platform that transcends geographical boundaries.

SEPA Payment Spectrum: Breaking Boundaries Beyond Euro Transactions

As businesses in India explore avenues for global financial transactions, a crucial question arises: Is the Single Euro Payments Area (SEPA) exclusively designed for euro transactions? In this section, we dissect the geographical scope of SEPA, offering insights into where and how businesses outside Europe can harness the potential of SEPA payments.

- Geographical Scope of SEPA

While the name emphasises the euro, SEPA’s geographical scope extends beyond the borders of Europe. The SEPA zone includes 36 countries, encompassing not only the 27 European Union member states but also additional nations such as Norway, Iceland, Liechtenstein, Switzerland, Monaco, and San Marino. This expansive reach positions SEPA as a global player in the realm of cross-border transactions.

- Where Can SEPA Payments be Utilised Outside Europe?

SEPA payments are not confined to the European continent. Many countries outside the SEPA zone, including India, recognise and accept SEPA transactions. This recognition extends SEPA’s influence and makes it a valuable tool for businesses engaged in international trade beyond the geographical confines of Europe.

For Indian businesses seeking to expand globally, understanding that SEPA is not exclusive to euro transactions but has a global footprint is pivotal. It opens doors to a versatile and widely accepted payment solution that can streamline transactions and enhance the efficiency of financial operations on an international scale.

By grasping the broader reach of SEPA, businesses can confidently integrate it into their financial strategies, knowing that it transcends borders and offers a reliable means of conducting transactions globally.

Seamless SEPA Transactions: Navigating Money Transfers in India

For Indian businesses navigating the complexities of international finance, understanding how to transfer money using the Single Euro Payments Area (SEPA) is a strategic imperative. This section unfolds the steps involved in SEPA transfers from India, elucidating the benefits for Indian businesses and highlighting how SEPA seamlessly integrates into the fabric of the Indian banking system.

- Steps Involved in SEPA Transfers from India

1. Initiating the Transfer: The SEPA transfer process commences with the initiation by the sending party. This can be a business sending funds to a supplier or a company disbursing payments to international partners.

2. Authentication: Both the sending and receiving banks authenticate the transaction to ensure its security and legitimacy. This step adds an extra layer of protection, safeguarding the interests of all parties involved.

3. Processing: Once authenticated, the transfer moves into the processing phase. During this stage, the funds are debited from the sender’s account, marking the beginning of the transaction’s journey.

4. Credit to Receiver: The culmination of the SEPA transfer involves crediting the funds to the recipient’s account. This final step ensures that the transaction is completed and the funds are available to the intended recipient.

- Benefits for Indian Businesses

1. Efficiency: SEPA transfers are renowned for their efficiency, providing a swift and reliable means of transferring funds globally. This efficiency is crucial for businesses with time-sensitive transactions.

2. Cost-Effectiveness: Compared to traditional methods, SEPA transfers from India often come with lower transaction costs. This cost-effectiveness contributes to overall savings for businesses engaged in international trade.

3. Global Recognition: SEPA payments are globally recognised, facilitating seamless international transactions for Indian businesses. This global acceptance enhances the flexibility and reach of companies operating on an international scale.

- Integration with Indian Banking Systems

SEPA transfers can be seamlessly integrated into the existing banking systems in India. The compatibility ensures that businesses can incorporate SEPA into their financial operations without significant disruptions or complications. The standardised procedures of SEPA align with the robust infrastructure of Indian banks, making it a convenient and accessible option for businesses across the country.

Now, after understanding how to navigate the SEPA transfer process. By embracing the efficiency, cost-effectiveness, and global recognition of SEPA, businesses can elevate their financial operations to meet the demands of the international marketplace.

SEPA Schemes Decoded: Diving into Diverse Transaction Horizons

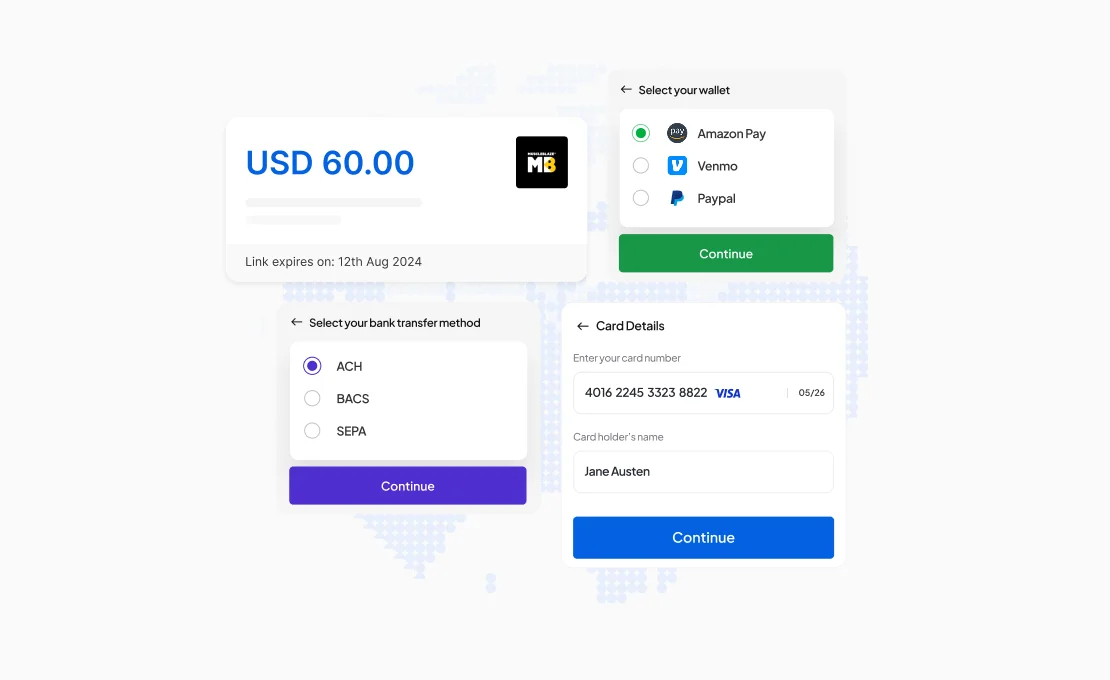

In the intricate world of international finance, understanding the diverse types of Single Euro Payments Area (SEPA) transactions is paramount for businesses seeking optimal solutions. To truly harness the potential of Single Euro Payments Area (SEPA) transfers, companies must familiarise themselves with the various schemes offered within the SEPA framework. This section provides a detailed exploration of four key SEPA schemes, shedding light on how each scheme caters to specific transactional needs and offering insights to help businesses choose the most suitable approach.

The SEPA Credit Transfer Scheme

At the core of SEPA’s offerings is the SEPA Credit Transfer Scheme. This scheme is tailored to facilitate seamless and efficient credit transfers within the SEPA zone. By adhering to standardised formats and procedures, the SEPA Credit Transfer Scheme ensures that payments are executed with precision, providing businesses with a reliable mechanism for electronic credit transfers.

The SEPA Instant Credit Transfer Scheme

For businesses requiring real-time transaction processing, the SEPA Instant Credit Transfer Scheme emerges as a pivotal solution. This scheme goes beyond traditional timelines, enabling companies to access funds immediately. In a fast-paced global business environment, the ability to execute transactions in real time can be a game-changer, offering businesses a competitive edge in responding to market dynamics swiftly.

The SEPA Direct Credit Core Scheme

Stepping into the realm of direct debits, the SEPA Direct Credit Core Scheme is designed to streamline the process of collecting payments. This scheme caters to a broad spectrum of transaction types, from regular subscription payments to one-time transactions. With standardised procedures and a secure framework, businesses can establish a reliable system for receiving payments, contributing to overall financial stability.

The SEPA Direct Debit Business-to-Business Scheme

Tailored specifically for business-to-business transactions, the SEPA Direct Debit Business-to-Business Scheme addresses the unique needs of enterprises engaged in trade and commerce. By facilitating direct debits between businesses, this scheme fosters a smooth flow of funds within the B2B landscape. It streamlines financial interactions between enterprises, supporting the seamless operation of supply chains and business partnerships.

Through a thorough exploration of these SEPA payment schemes, businesses can make informed decisions about which approach aligns best with their transactional requirements. The key lies in understanding the specific advantages each scheme offers and strategically incorporating them into the broader financial strategy.

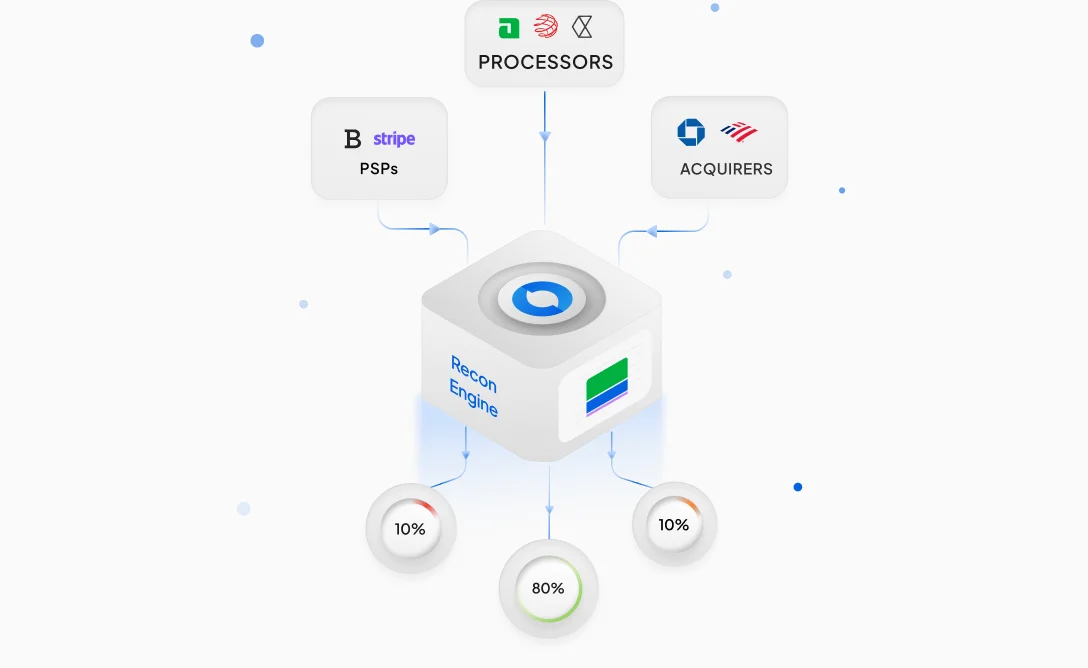

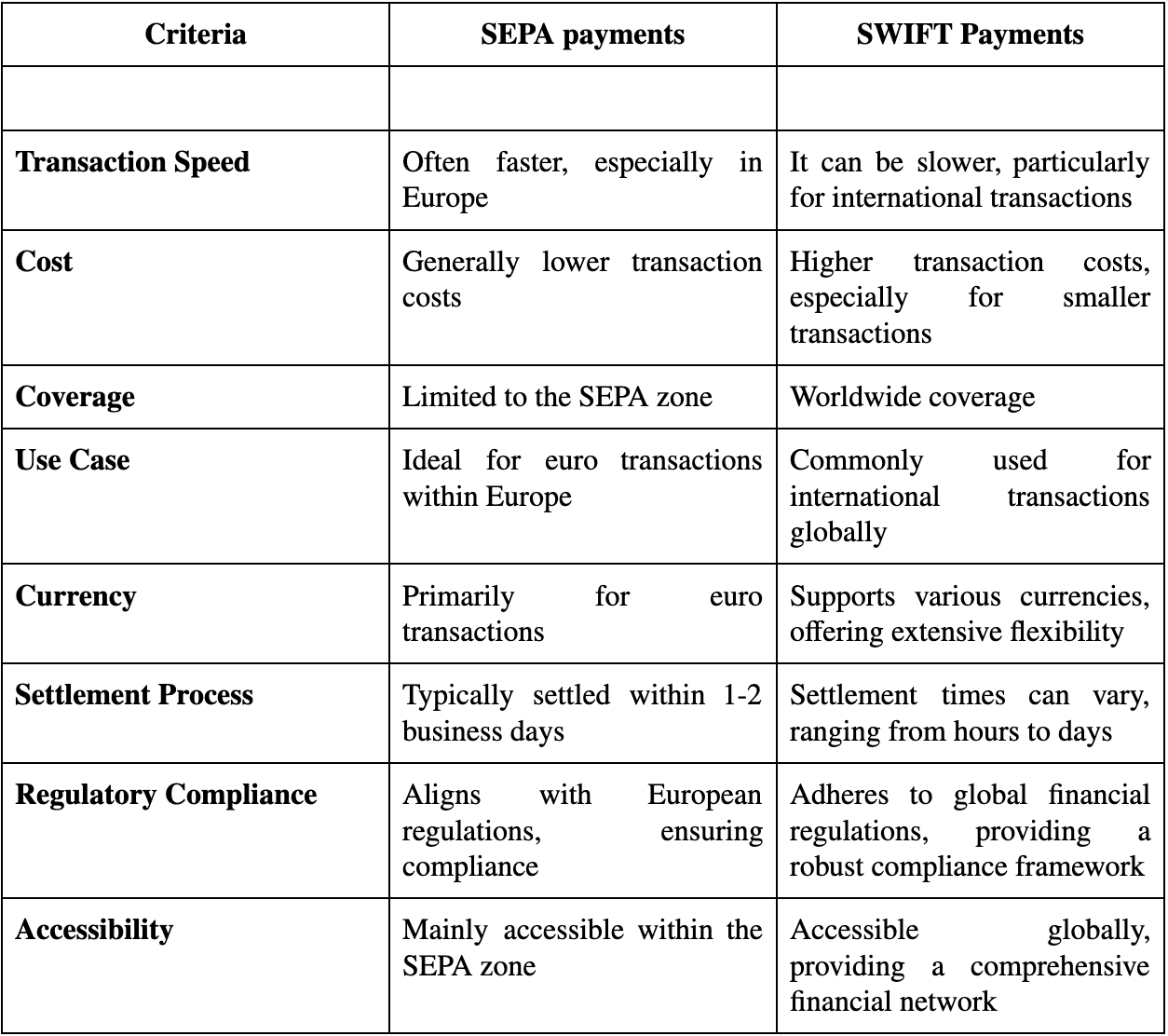

SEPA vs SWIFT Payments: Deciphering International Transaction Dynamics

In the dynamic landscape of international transactions, businesses often encounter the choice between Single Euro Payments Area (SEPA) and SWIFT payments. This segment strives to unveil the distinctions between these two systems, providing a comprehensive analysis to assist businesses in making informed decisions tailored to their particular transactional demands.

Grasping these variances empowers businesses to select between SEPA and SWIFT payments according to their unique transactional prerequisites, guaranteeing utmost efficiency and cost-effectiveness.

SEPA Payments Unveiled: Concluding the Global Payment Puzzle

In the ever-evolving landscape of international finance, embracing the nuances of Single Euro Payments Area (SEPA) transfers emerges as a strategic imperative for Indian businesses. From the efficient SEPA Credit Transfer Scheme to the real-time transactions enabled by the SEPA Instant Credit Transfer Scheme, enterprises gain a versatile toolkit for global financial operations. The SEPA Direct Debit Business-to-Business Scheme further streamlines transactions, fostering a conducive environment for seamless cross-border trade.

As businesses in India look beyond their borders, the understanding that SEPA payments are not exclusive to euro transactions but hold global recognition becomes a pivotal insight. SEPA seamlessly integrates into the robust Indian banking systems, offering efficiency, cost-effectiveness, and global reach. The comparative analysis of SEPA vs SWIFT payments equips businesses with the knowledge to make informed choices, ensuring transactions align with specific needs.

In essence, SEPA empowers Indian businesses with a strategic advantage in the global marketplace. By comprehending the intricacies of SEPA transfers from India, companies can navigate the complexities of international finance, fostering a path of efficiency, reliability, and global connectivity.

FAQs About SEPA Transfer from India

1. What is the meaning of SEPA?

SEPA, which stands for the Single Euro Payments Area, is a standardised framework designed to simplify and streamline euro transactions across 36 countries. Its primary goal is to create a unified payments market, promoting efficiency in cross-border transactions and cultivating a seamless financial ecosystem.

2. What is the purpose of SEPA payment?

The purpose of SEPA payments is to create a unified and standardised platform for euro transactions, streamlining cross-border payments and fostering an interconnected and efficient financial ecosystem.

3. How does SEPA transfer benefit Indian businesses?

SEPA transfers benefit Indian businesses by providing a cost-effective, efficient, and globally recognised solution for international transactions. This enhances the flexibility and reach of Indian companies operating on a global scale.

4. How secure are SEPA transfers for Indian businesses?

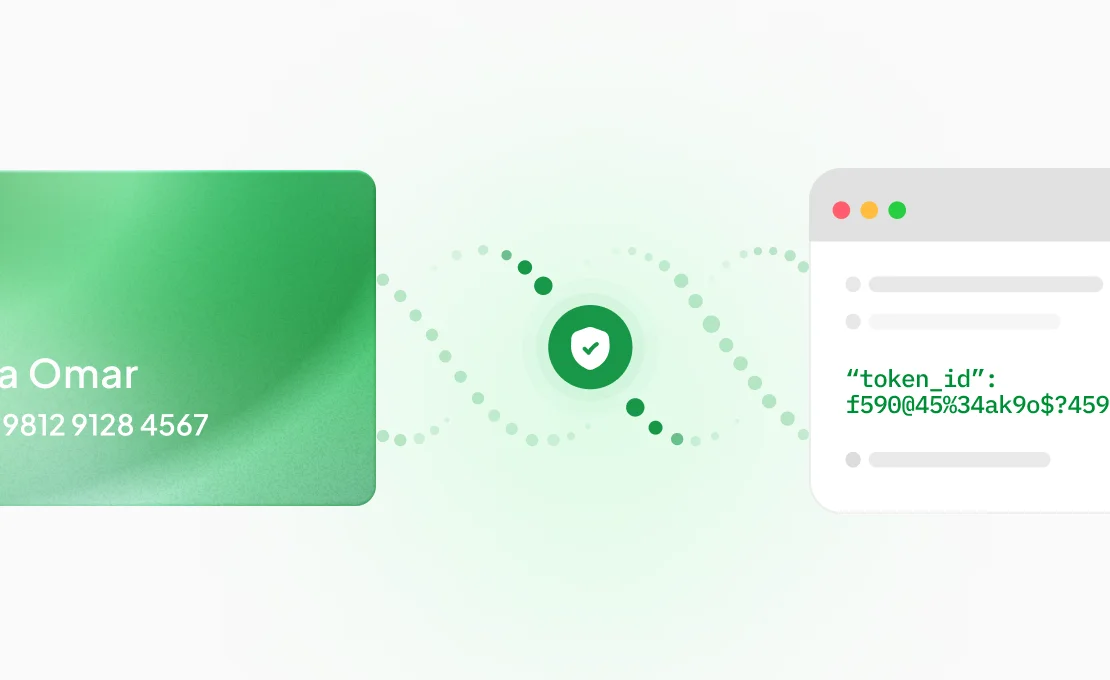

SEPA transfers prioritise security with robust authentication processes at both ends. This ensures a secure environment for transactions, safeguarding the interests of Indian businesses against cyber threats.

5. Are there any specific requirements for Indian businesses to initiate SEPA transfers?

Indian businesses must adhere to SEPA regulations, including the necessity of a valid International Bank Account Number (IBAN) for the recipient. Ensuring compliance with these requirements facilitates smooth and compliant transactions.