Payment acceptance rate is a critical metric for merchants as it directly affects their business operations and financial performance. Payment acceptance rate measures the percentage of successful transactions completed by a merchant without any failures.

A high payment acceptance rate is crucial for merchants as it directly impacts customer satisfaction, revenue generation, operational efficiency, reputation, and relationships with payment providers. Monitoring and striving for a high SR is essential for merchants to thrive in the competitive marketplace and build a successful and sustainable business.

This guide will walk you through everything you need to know about payment acceptance rates, why they matter for your bottom line, and practical steps to improve them.

Understanding Payment Acceptance

Before diving into payment acceptance rate, let's clarify what payment acceptance actually means and what are the processes affecting it . Payment acceptance is simply your business's ability to successfully process customer payments through various methods - credit cards, debit cards, digital wallets, bank transfers, and more.

When a customer tries to pay, several processes happen behind the scenes:

- Authentication: Verification of the customer's identity to ensure they are authorized to use the payment method

- Authorization: Approval or denial of the transaction based on authentication and availability of funds

- Payment Processing: The flow of payment information through various parties in the payment flow

Each step can potentially fail, affecting your overall payment acceptance rate. Understanding this process helps you identify where problems might occur and how to fix them.

Modern payment acceptance isn't just about having a card reader anymore. Your customers \

What is the Payment Acceptance Rate?

Payment acceptance rate is the percentage of payment attempts that successfully complete. It's calculated using this simple formula:

Payment Acceptance Rate = (Successful Transactions ÷ Total Transaction Attempts) × 100

Let's say your online store processed 1,000 payment attempts last month. Of those, 920 went through successfully, while 80 failed for various reasons. Your payment acceptance rate would be:

Most successful businesses aim for a payment acceptance rate above 95%. However, this can vary by industry - subscription services might see higher rates due to stored payment methods, while high-risk industries might struggle to reach 90%.

Payment acceptance rate is an important metric for businesses as it provides insights into the effectiveness of their transactional processes and the overall customer experience. A high payment acceptance rate indicates that the majority of transactions are completed successfully, leading to customer satisfaction, revenue generation, and a positive reputation. On the other hand, a low payment acceptance rate may indicate issues such as failed transactions, payment errors, or order fulfillment problems that can result in dissatisfied customers and potential revenue loss.

Monitoring and improving payment success rate can help businesses identify and address bottlenecks, technical glitches, or operational inefficiencies that may hinder successful transactions. By striving for a high SR, businesses can enhance customer satisfaction, optimize their processes, and ultimately drive growth and profitability.

Why Payment Acceptance Rate is Critical for Your Business Success

Your payment acceptance rate directly impacts three crucial areas of your business: revenue, customer satisfaction, and operational efficiency.

Revenue Impact

Every failed payment is lost revenue. If a merchant is processing $100,000 in monthly transactions with an 85% acceptance rate, you're losing $15,000 every month. Scale that up for growing businesses, and the numbers become staggering

Successful transactions directly contribute to revenue generation. A high payment acceptance rate means a higher percentage of completed transactions, resulting in increased sales and revenue for the business.

Customer Experience

Failed payments create frustrated customers. A research by the Baymard Institute shows that 70% of customers abandon their purchase after a single payment failure. Even worse, many won't return to try again later.

A high payment acceptance rate indicates that a significant proportion of transactions are successfully completed without any issues or failures. This translates to a positive customer experience, as customers can trust that their transactions will be processed smoothly.

Customer satisfaction is crucial for businesses as it leads to customer loyalty, repeat purchases, and positive word-of-mouth referrals.

Operational Costs

Low acceptance rates create hidden costs. Even if the final outcome of a transaction is a decline, the payment processor and the card network have already expended resources and completed the technical steps of authentication and communication.

A nominal amount is charged to the merchant to cover the costs of this technical "labor" and the use of the payment infrastructure. High payment acceptance rates reduce these operational headaches.

Monitoring and improving payment success rate can help businesses identify inefficiencies in their transactional processes. By analyzing failed transactions and addressing underlying issues, businesses can optimize their operations, streamline workflows, and improve overall efficiency.

Competitive Advantage

Businesses with smooth payment processes gain competitive advantages. Customers notice when transactions work seamlessly, and they're more likely to become repeat buyers. In competitive markets, payment reliability can be the difference between winning and losing customers.

Insights on upgrading the payment stack

Monitoring payment acceptance rate provides valuable insights into transaction patterns, potential issues, and customer preferences. By analyzing transaction data, businesses can identify areas for improvement, such as optimizing checkout processes, enhancing security measures, or addressing common customer pain points. Continuous improvement based on payment acceptance rate leads to a better overall customer experience and business performance.

Key Factors That Influence Your Payment Acceptance Rate

Multiple factors affect whether customer payments succeed or fail. Understanding these helps merchants identify improvement opportunities.

Payment Processor/Payment Service Provider (PSP) Quality

The efficiency and accuracy of payment processing systems play a critical role in transaction success. Issues such as declined payments, PSP downtime, or PSP failures can result in failed transactions and negatively impact payment acceptance rates.

Payment Method Diversity

As new payment methods like digital wallets, Buy Now, Pay Later (BNPL), and Real-Time Payments (RTP) become more popular, customers are increasingly choosing them due to the convenience they provide. Offering multiple payment options significantly improves acceptance rates. Here's why:

The absence of local or alternative payment options can act as an obstacle, negatively affecting payment acceptance rates. To make the checkout process easier for a diverse range of customers, businesses should offer local and alternative payment methods, as these options often vary by region.

Technical Infrastructure

The performance and usability of a website or an app can influence payment acceptance rates.

- Page load speed: Slow checkout pages lead to abandoned transactions

- Mobile optimization: Over 50% of payments happen on mobile devices

- Security certificates: Outdated SSL certificates can block payments

- Integration quality: Poor PSP integration can cause failures

Geographic and Regulatory Factors

Several factors related to a customer's location can affect payment acceptance rates, including higher failure rates for cross-border transactions, specific payment requirements due to local regulations and complications from multi-currency processing.

Fraud Prevention Systems

Strong security measures are essential to protect customer data and ensure secure transactions. However, overly strict security measures or complex authentication processes can create barriers for customers and potentially increase the likelihood of failed transactions.

Customer Behavior Patterns

Understanding customer behavior is key to optimizing payment acceptance rates. Merchants need to consider factors like peak transaction times, which can strain processing systems; unusual transaction amounts, which might trigger fraud alerts; customer demographics and even purchase patterns, since subscriptions have different requirements than one-time buys.

Proven Strategies to Improve Your Payment Success Rate

Now let's explore practical steps you can take to boost your payment acceptance rate and recover lost revenue.

Analyze your PSP performance

Evaluate the decline reason reports to understand why payments fail. Common decline reasons include:

- Insufficient funds

- Invalid card details

- Transaction flagged as fraud

- Technical timeouts (infrastructure problems)

If a large chunk of the transactions are getting declined due to PSP technical timeouts, merchants can consider integrating with a fallback PSP which will automatically retry transactions in case of errors such as failures, false declines, and system errors.

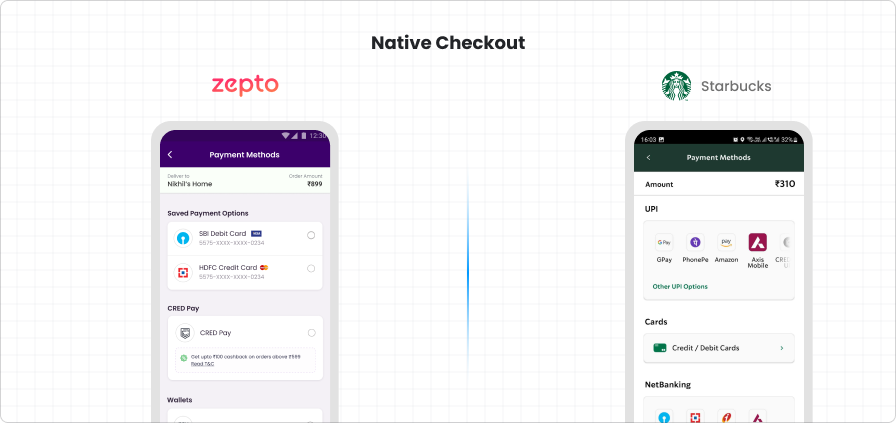

Integrate with local/alternative payment methods

Enabling customers to pay via local/alternative payment methods is favourable for businesses as well as their customers. For businesses, these payment methods ensure that the customers won’t leave their cart just because their preferred mode of payment is unavailable leading to higher payment acceptance rates.

For customers, the availability of familiar and preferred local or alternative payment methods enhances convenience and builds trust. This increased convenience encourages customers to complete their transactions, leading to higher payment acceptance rates and reduced cart abandonment.

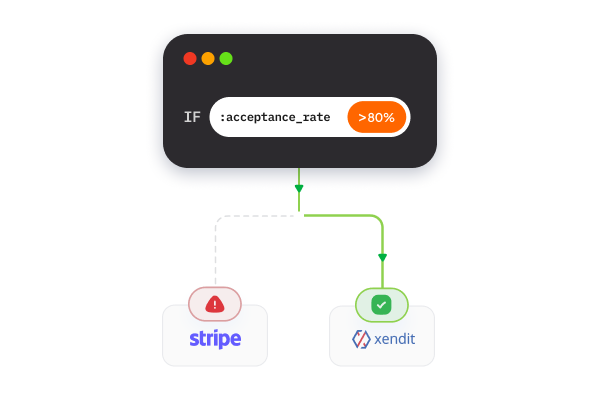

Implement Smart Payment Routing

An important factor that affects payment acceptance rates is the health of the payment service provider. Payment acceptance is severely affected by PSP downtime. To tackle this, businesses can implement dynamic routing which enables businesses to route transactions to the best performing PSP, mitigating the risk of failed payments due to PSP downtime.

Businesses can also set rule based routing which enables them to optimize their payment costs. A global payment orchestrator like Juspay can enable businesses to set custom routing logic to boost their payment acceptance rates.

Optimize Checkout Experience

The checkout page is a critical component of a customer journey, it plays a significant role in determining whether a customer completes their purchase or abandons their cart. The checkout design, including the payment options, is crucial for providing a smooth and seamless experience that encourages customers to complete their transactions, leading to higher payment acceptance rates.

Offering a nave and blended checkout experience, where the payment page design is consistent with the brand guidelines of the website/app builds trust and encourages the customers to complete their transactions.

Businesses can also display customers’ preferred payment method at the top of the checkout page, making it convenient for the customer to complete their transactions. Understanding the nature of payment is also important, for example:if the merchant offers high-ticket items and customers frequently use EMI to make the purchase, it is beneficial to display credit/debit cards as the topmost option along with any available EMI offers.

Juspay Hypercheckout provides a no-code design studio that allows businesses to create custom, branded checkout experiences. Merchants can easily customize the look and feel of their payment page and optimize it according to their use-case.

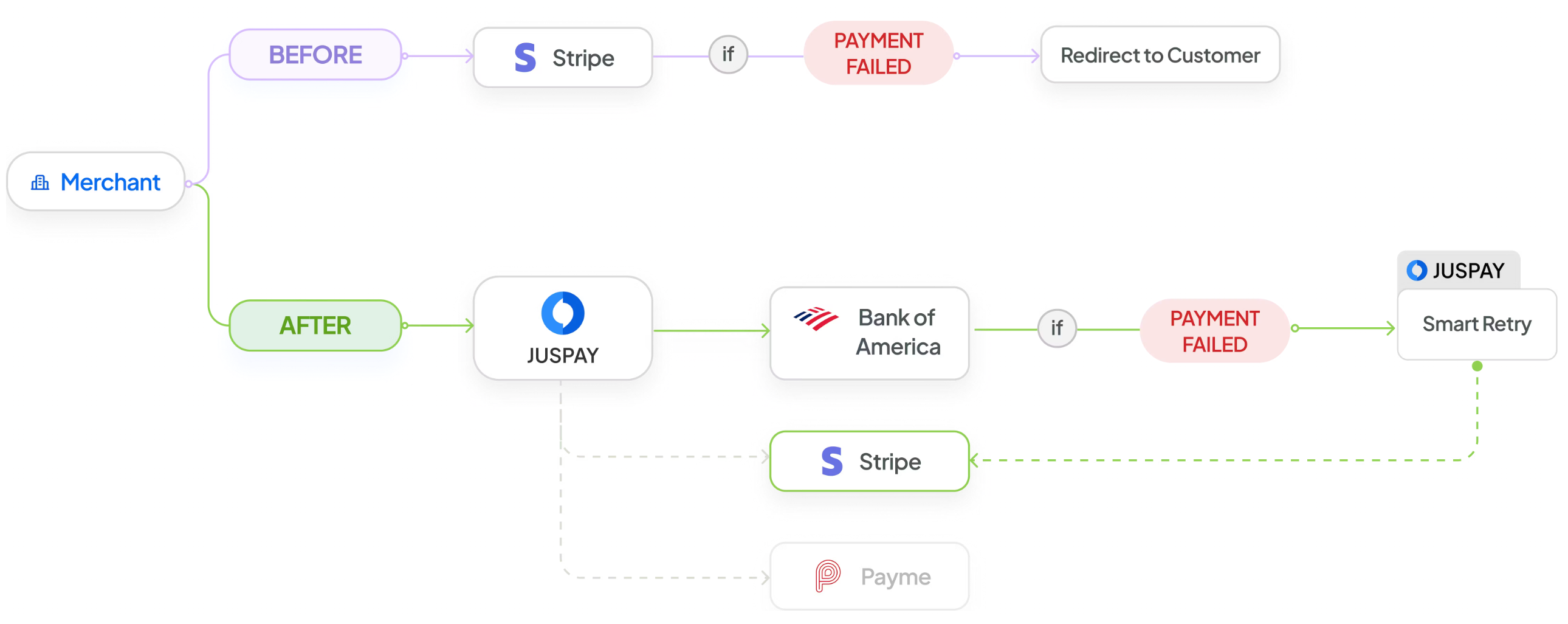

Implement Smart Retry Logic

Smart retries automatically re-routes transactions to an alternative payment service provider. This process happens instantly and in the background, without any action needed from the customer. Smart retry logic significantly boosts payment acceptance rates and helps businesses recover lost revenue.

Juspay’s payment orchestration platform enables businesses to set-up smart retry logic to automatically send transactions to a secondary PSP, if the primary PSP is unavailable.

Enhance Fraud Detection Balance

Payment acceptance rate is also affected by false declines. Let’s first understand what false declines are.

False declines occur when a genuine transaction initiated by a customer is declined by either the bank or the PSP as it is considered as a fraudulent transaction. False declines can lead to customer frustration, demotivating them to complete their transaction.

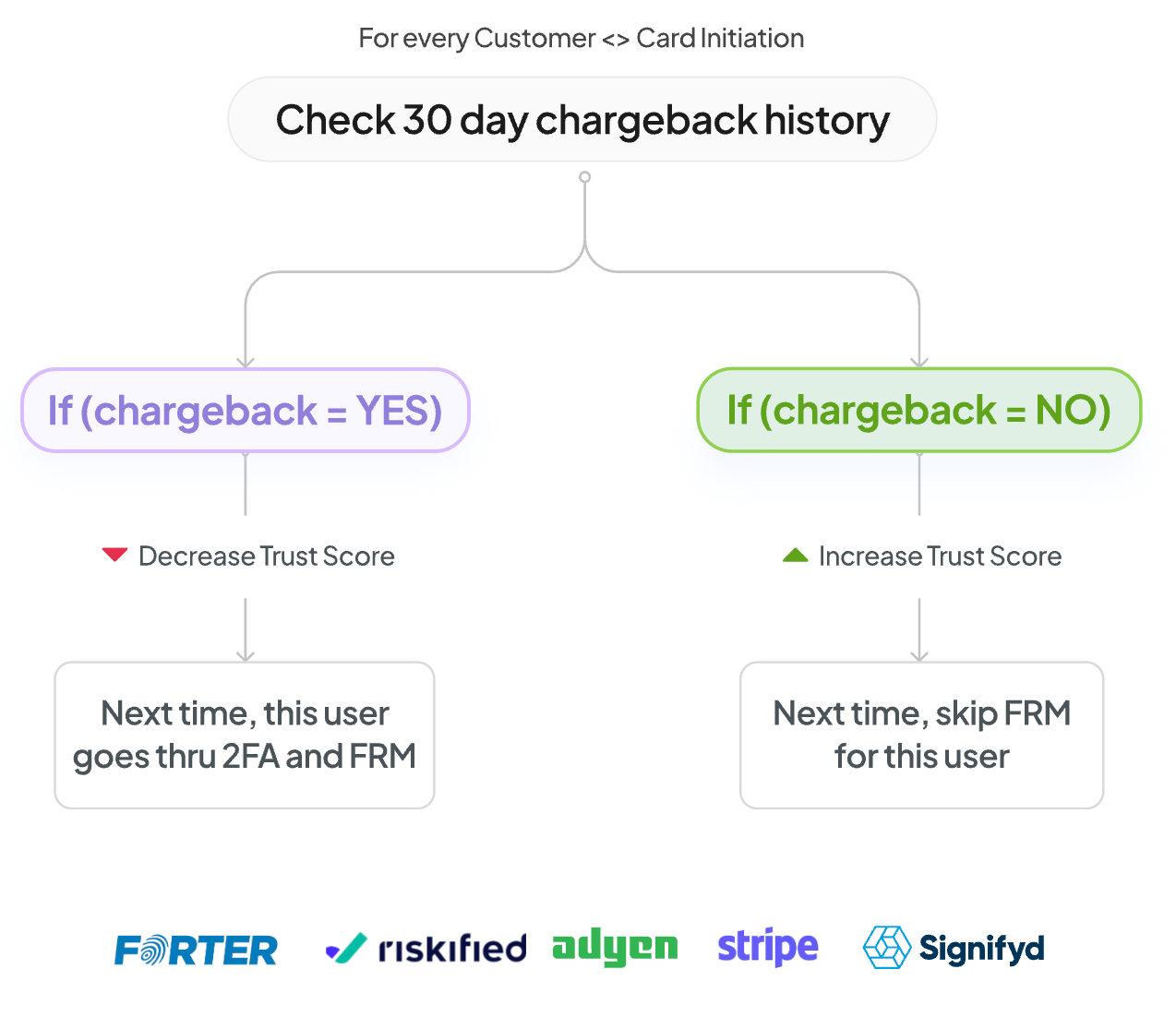

Effective risk rule optimization is essential for minimizing false declines, which can significantly impact customer experience and revenue.Juspay's Fraud Orchestration platform addresses this challenge by integrating with leading fraud detection providers such as Riskified and Signifyd. These integration enables businesses to implement fraud detection algorithms that distinguish between fraudulent and legitimate customer transactions, reducing the incidence of false declines.

Optimize Payment Acceptance rates with Juspay

Juspay is a global leader in enterprise payment solutions, powering payments for merchants and banks worldwide.

Building upon our foundational expertise in Payment Experience optimization and Payment Orchestration, we develop robust and scalable payment infra that support global enterprises in optimizing their payment stack.

Juspay processes over 200 million daily transactions globally, with 99.999% reliability and managing an annualized GMV exceeding $670 billion, we empower organizations to:

- Achieve market leading payment acceptance rates

- Enhance security and fraud mitigation strategies

- Reduce payment processing costs

- Provide superior customer experiences at scale

Trusted by industry leaders such as Amazon, Google, Microsoft, Visa, Mastercard, American Express, Juspay simplifies payment orchestration and global coverage, boosts conversions, reduces fraud, and delivers seamless customer experiences.

Conclusion: Building a Robust Payment Acceptance Strategy

Improving your payment acceptance rate is an ongoing optimization process that directly impacts your business growth. Every percentage point improvement in payment acceptance rates translates to recovered revenue and satisfied customers.

Start with the basics: analyze your current payment stack performance, identify the biggest sources of payment failures, and implement targeted solutions. Whether that's adding multiple processors, payment methods, or optimizing checkout flow, merchants should focus on changes that will have the biggest impact first.

Remember that payment success rate optimization is about creating a smooth experience for your customers while protecting your business from fraud and technical issues. The best approach balances security, functionality, and user experience.

Payment acceptance rate reflects how well your business serves customers at the most critical moment - when they're ready to buy. By following the strategies outlined in this guide, you'll be well-equipped to maximize successful transactions and drive sustainable business growth.