Introduction

Infrastructure/ Platform providers, SaaS, and Fintech (ISFs) grow their business by expanding the base of clients served, integrating with a range of payment processors, offering diverse payment methods, advanced flows and complex operational modes. This creates significant challenges namely, managing multiple PSP integrations/ coordinating complex messaging/ settlement flows, handling client-level isolation, enabling secure onboarding for their clients, offering configurable payment experiences, and supporting rich payment flows across industries.

This blog explores the common challenges faced by the Infrastructure, SaaS organizations or Platforms, and Fintech enterprises (ISFs) and how a composable open-source and modular payment orchestration platform simplifies these complexities. The blog will look at the 9 critical challenges faced by SaaS, Platforms and Fintech enterprises and discuss in brief the right ways to address them with a payments platform.

Key challenges and careabouts of ISFs

Challenge 1

The ISFs allow their clients to bring their own PSP connections or MIDs or wish to offer a wide range of pre-existing PSP and PM connections right out-of-box to enable swifter onboarding and go-lives for their clients. They have a need to integrate/offer to their clients regular PSPs as well as Platform / Connect accounts.

Juspay offering for ISFs

- Wide range of pre-existing direct connections to PSPs, Platform/ Connect accounts, Acquirers, Payment methods and non payment connectors (Fraud, 3DS, Tax and more)

- Agility to build a new PSP connection in 2-weeks or enhance an existing connection in 1-week

- Flexibility to leverage the connector integration product stack in different forms

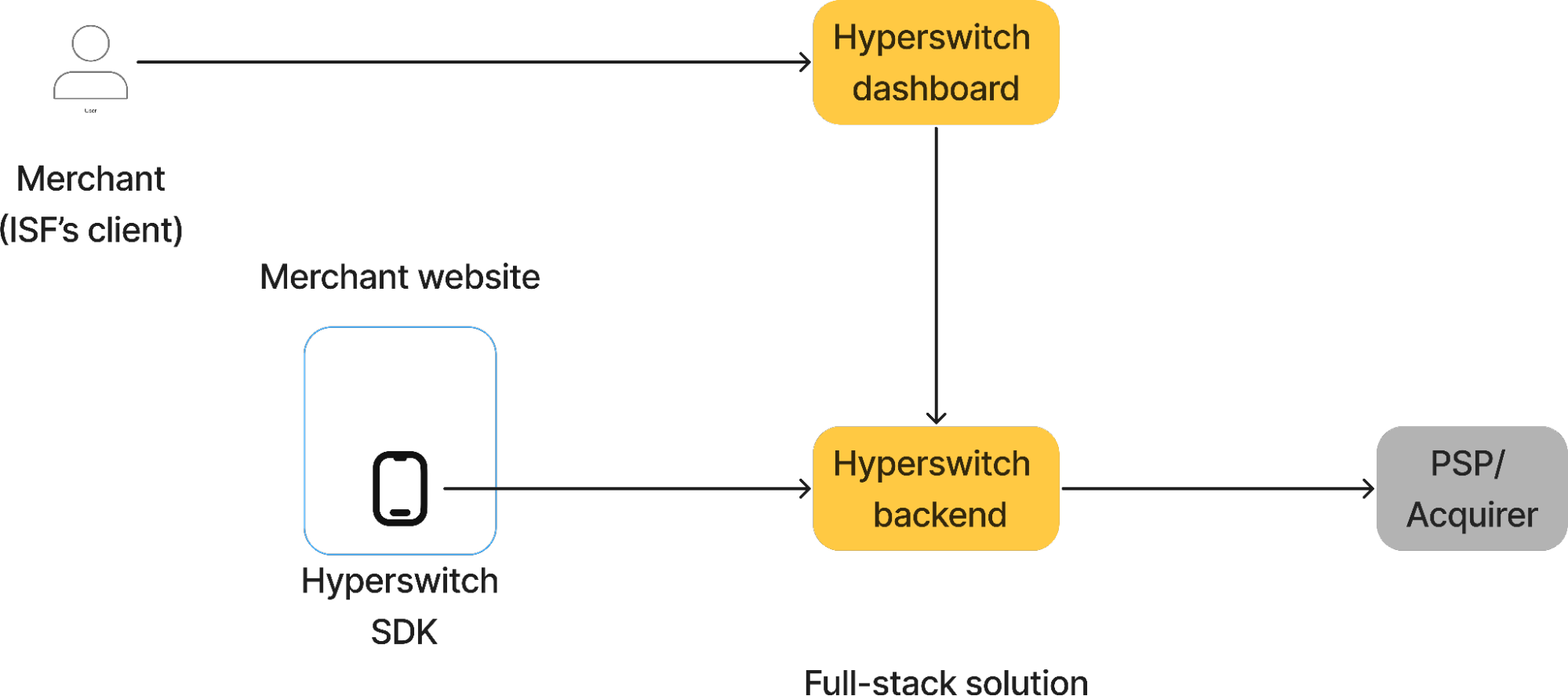

- Full stack payment product - It gives them access to front-end SDK, Dashboard, Flexible routing and retry workflows integrations along with integrations and core flows

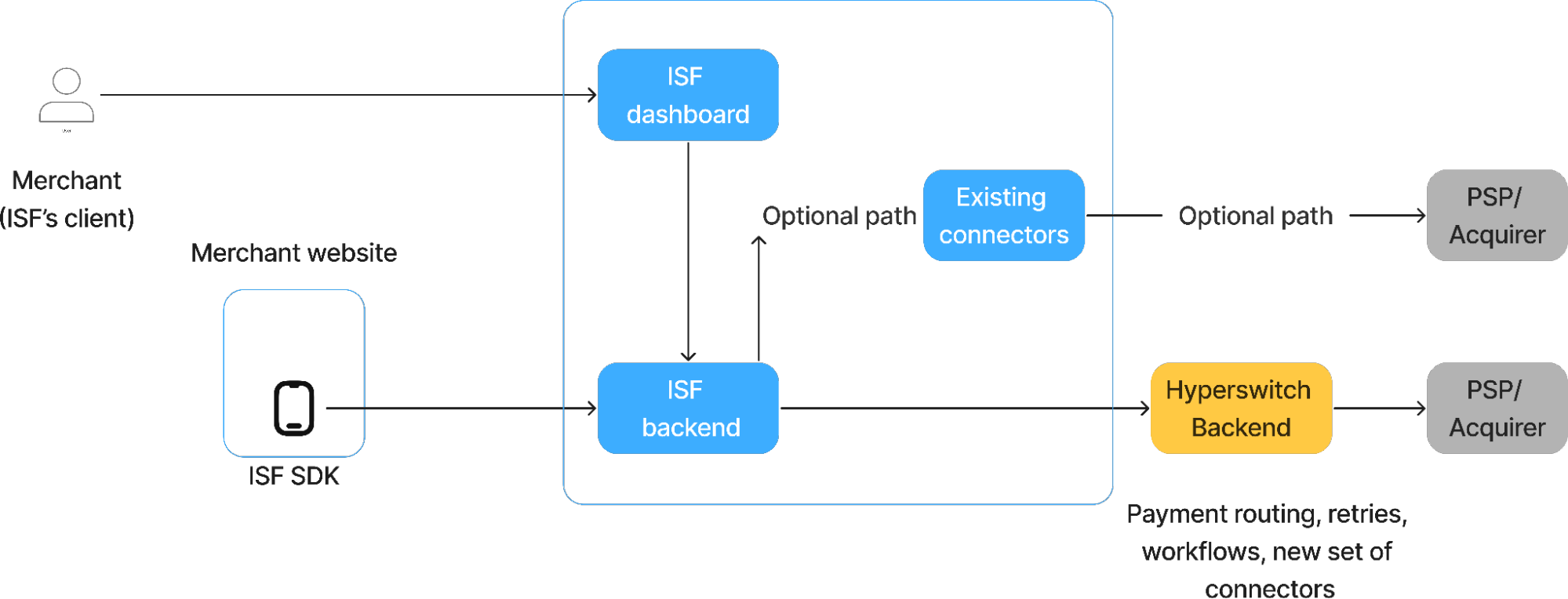

- Backend-only payment product - It allows them to continue with their front-end and dashboard while leveraging account management, Intelligent routing and retry workflows integrations and core flows via APIs

- Stateless connector payment product - It allows them to utilize Hyperswitch as a passthrough that translates their requests to any PSP request and gives a uniform response back without any storage involved.

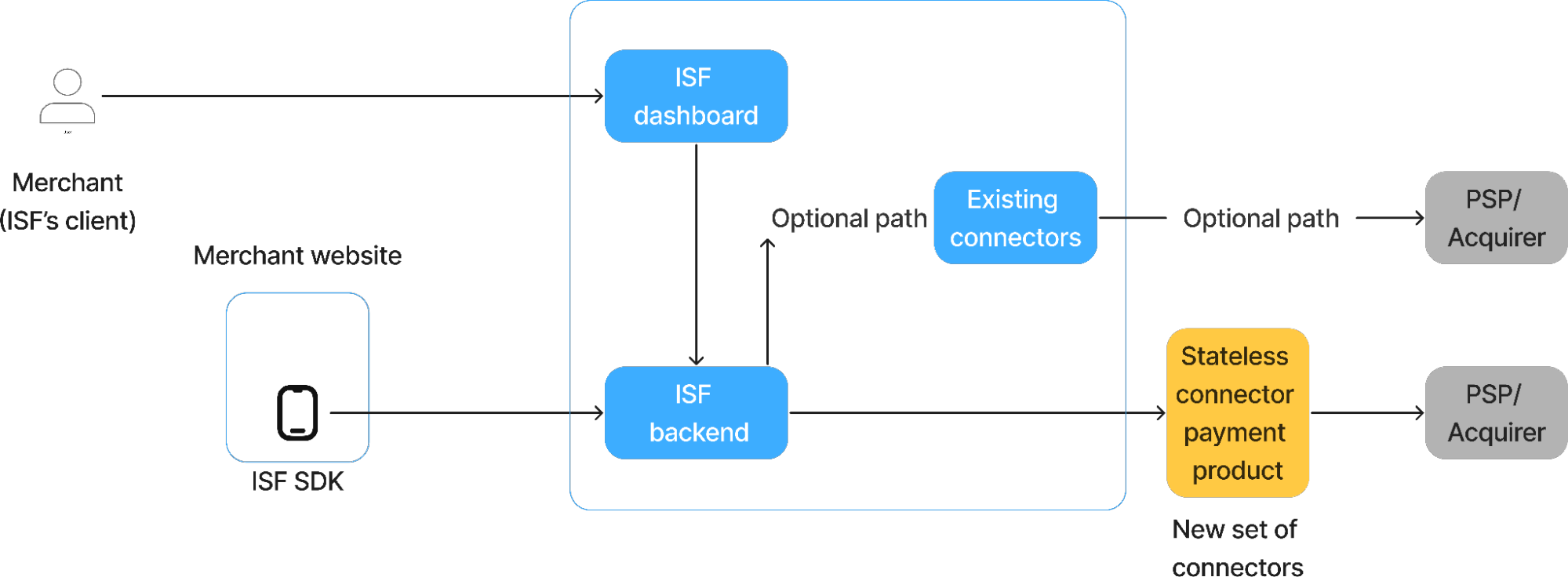

Full stack payment product integration

Backend-only payment product integration

Stateless connector payment product integration

Challenge 2

The ISFs require capabilities to logically isolate, structure and manage their clients in terms of their - PSPs, payment methods, end-user data, payment experience, routing and retry workflows, user access, operations and analytics.

Juspay offering for ISFs

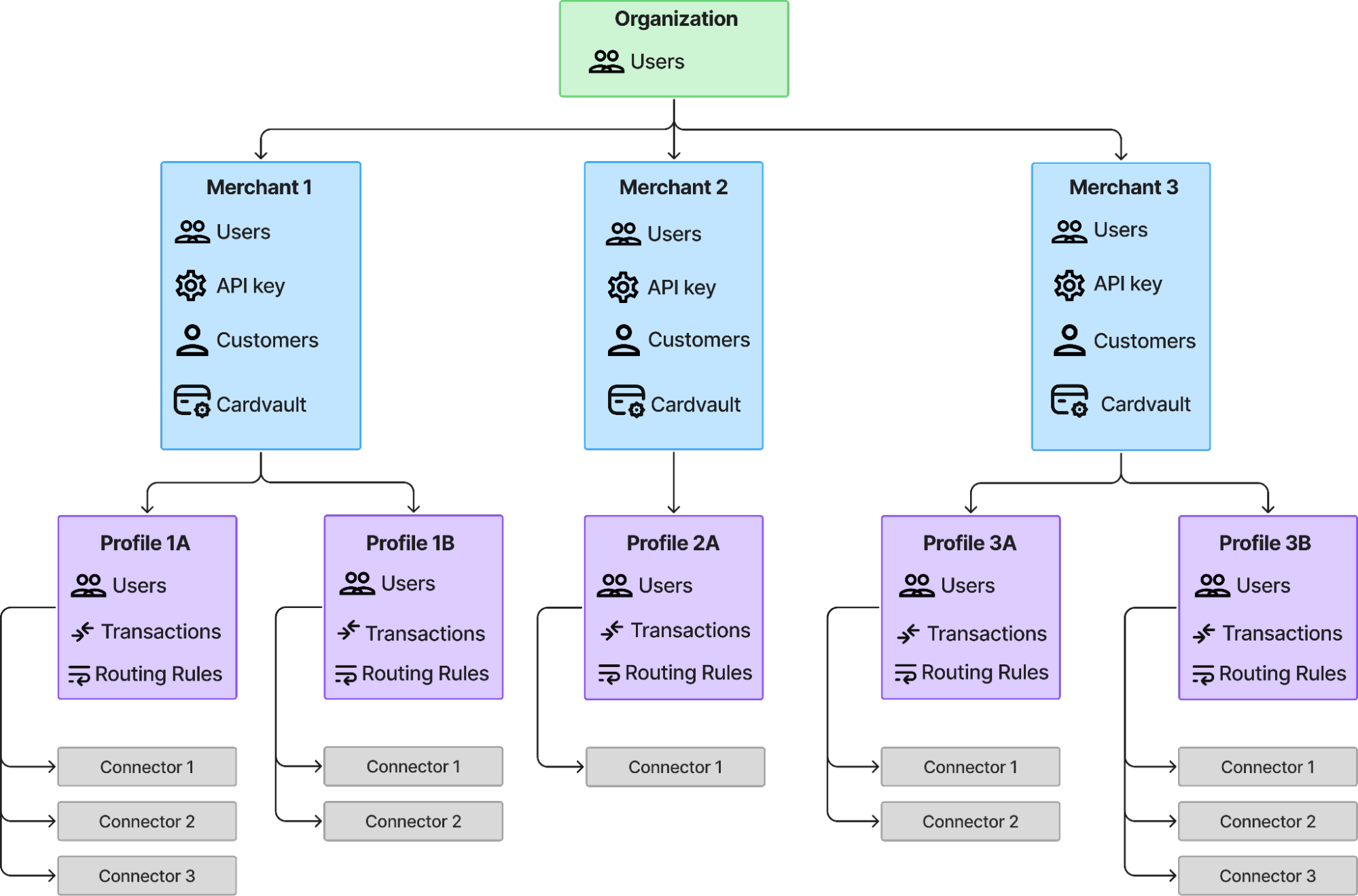

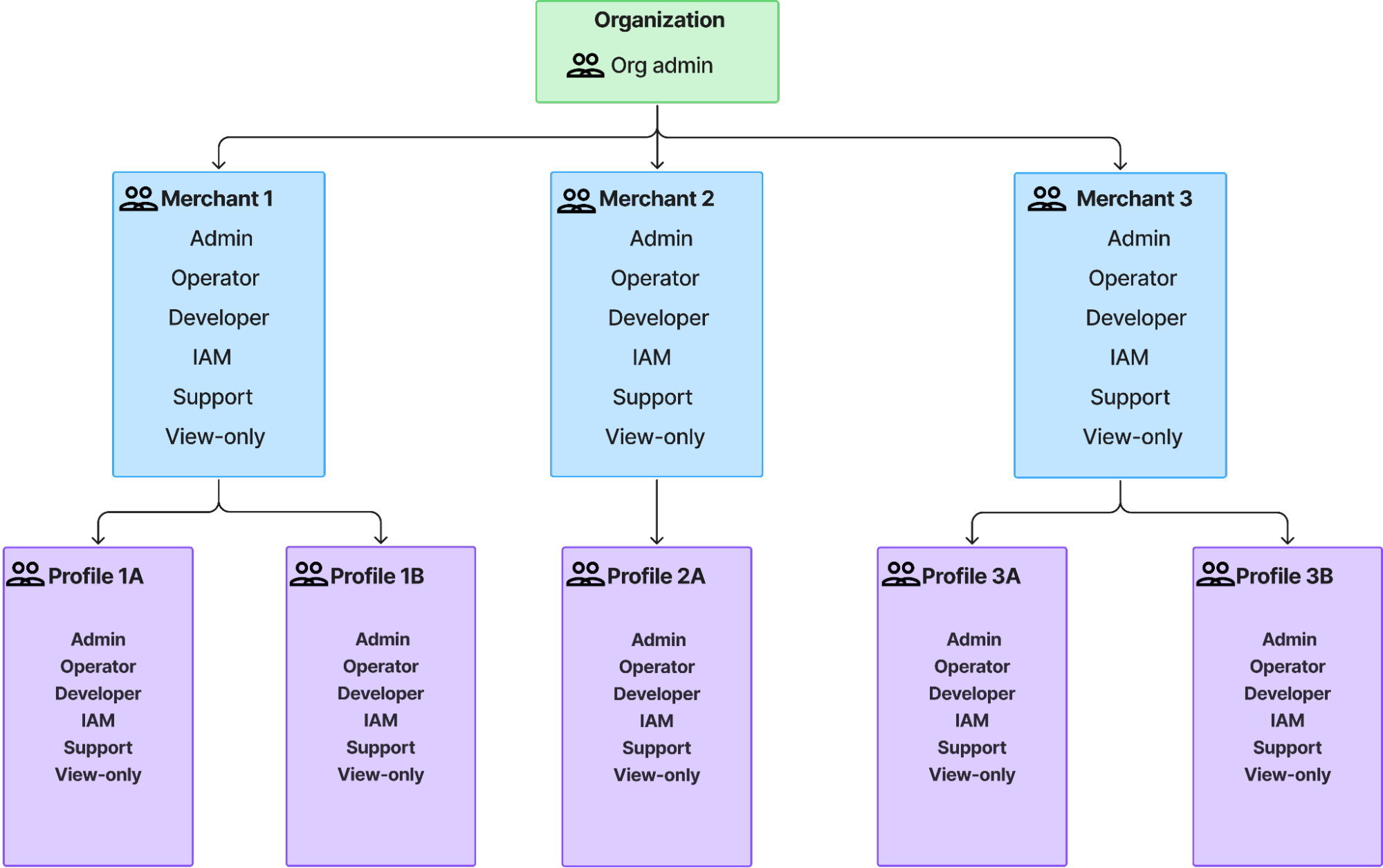

- Juspay offers a 3-level hierarchy called Organization, Merchant and Profile with a 1:many:many relationship between them. The single Organization oversees everything, while a Merchant is the logical isolation that an ISF can offer to its clients, and profiles are the leaf nodes where the PSPs, payment methods, workflows are added. The Organization (ISF) decides the end-user data sharing semantics across different Merchants (clients). Each level of hierarchy has different user access controls at each level.

- Juspay also offers payment, refund and chargebacks details unified across PSP and segregated at a Merchant and Profile level. ISF can allow their merchant to login to the HS dashboard to review these unified operations/analytics or extract them out into their own analytics pipeline

Organization-Merchant-Profile hierarchy

Organization-Merchant-Profile user roles

Challenge 3

The ISFs require programmatic client onboarding capabilities while operating as a merchant-of-record (MoR) or non MoR or both

Juspay offering for ISFs

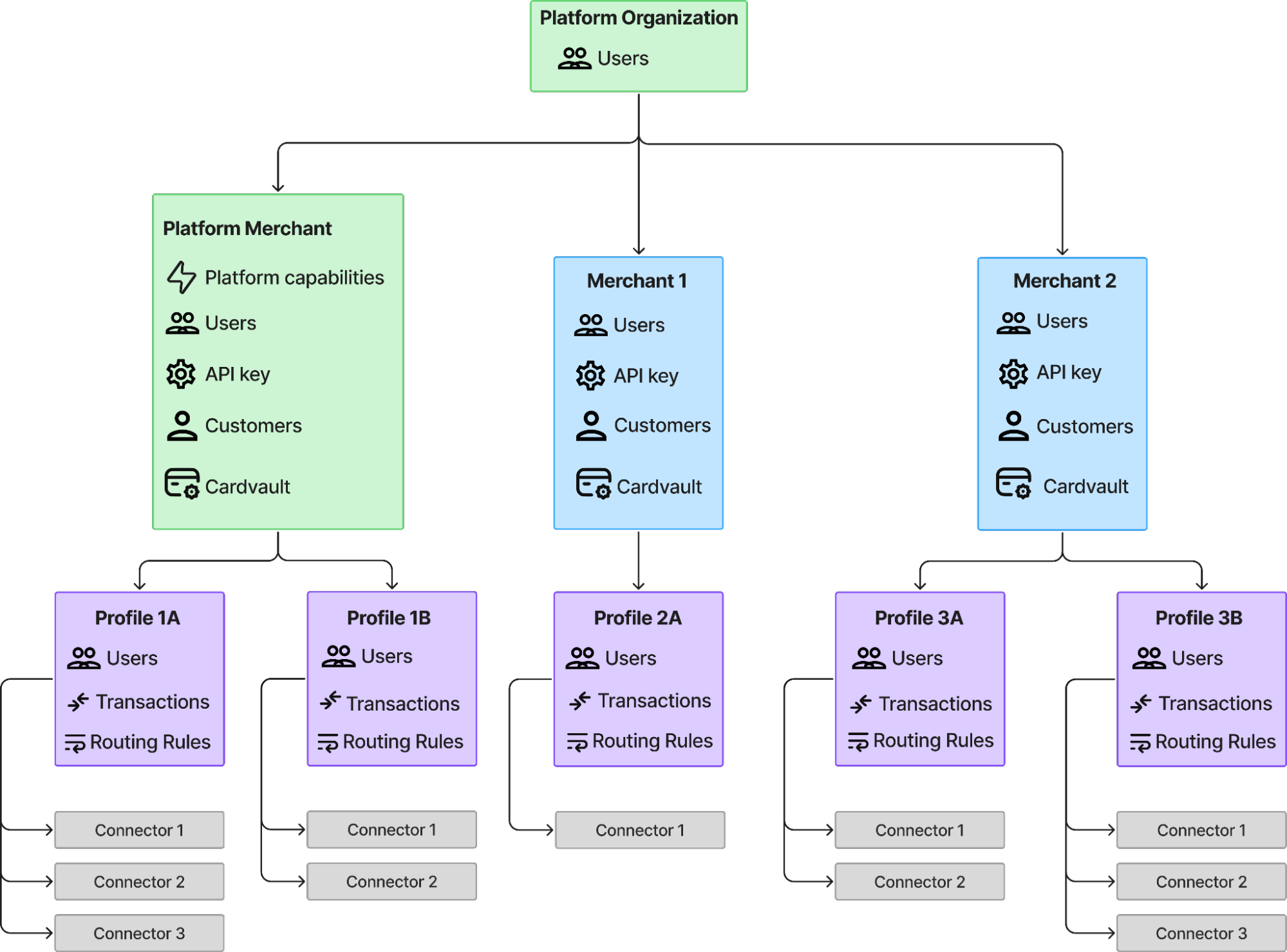

- Juspay offers a Platform account that allows ISFs to programmatically create a merchant and configure PSPs for them. In case the ISF acts as an MoR then they control the PSP API keys provided to the merchant, in case their client is the MoR then the client would need to to add their PSP keys.

- Juspay offers embedded dashboard components that can be leveraged by ISF for onboarding their client and obtaining their PSP keys in a secure manner on their own dashboard.

Organization-Merchant-Profile with platform capabilities

Challenge 4

The ISFs have traditionally built in-house a lot of key features and flows that are required for their clients, as payments is core to their business and scale. There are apprehensions about

i) Not owing these capabilities

ii) Depending on a vendor without knowing their tech prowess

iii) Not having a simple non-disruptive path of augmenting and transition

Juspay offering for ISFs

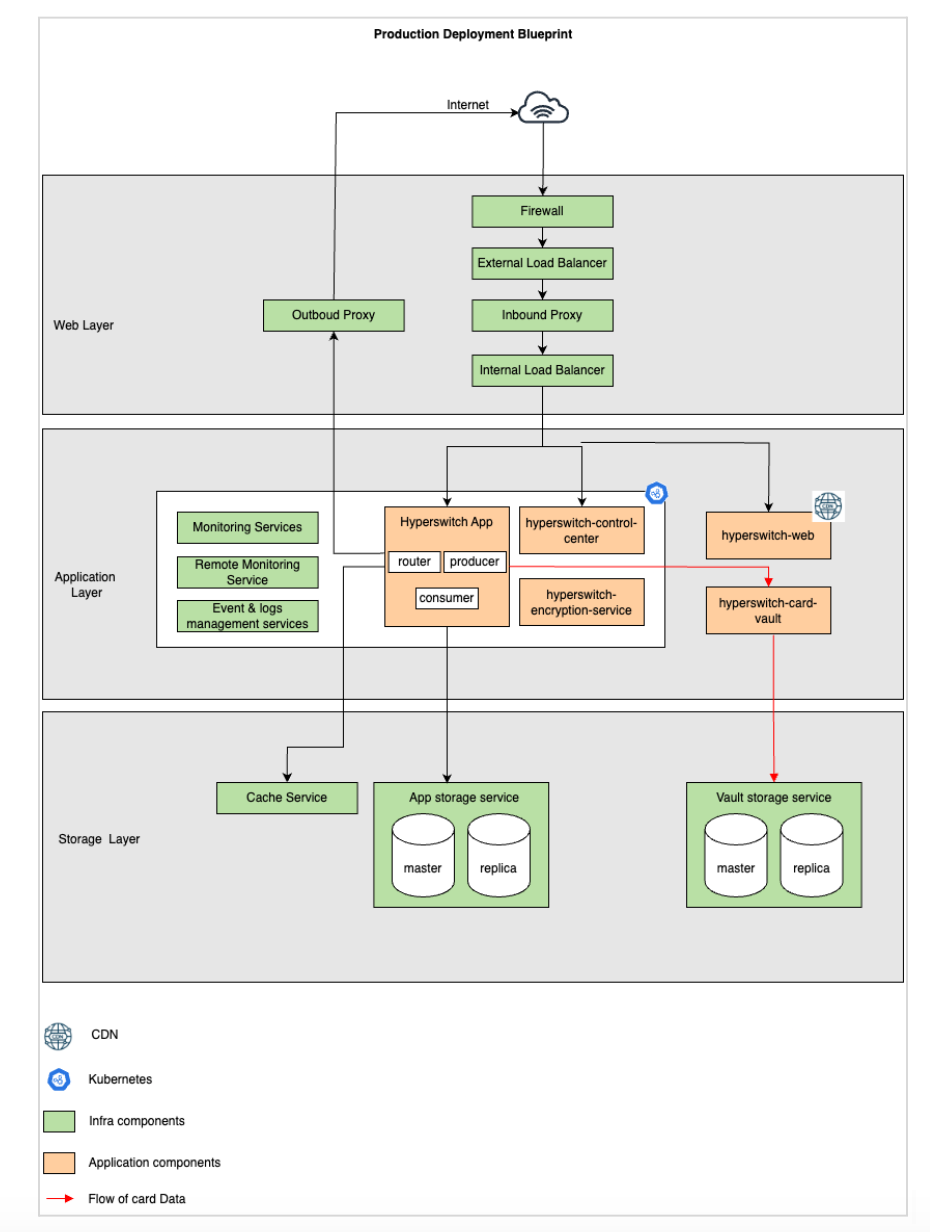

- Juspay offers a path to self-host the product, entire stack or specific capabilities even when they start with SaaS for quicker go-to market and proof of concept

- Juspay allows them to try the product using our hosted sandbox or by running the stack in their local or in cloud infrastructure. We also support the use of AI for exploring the product capabilities with tools like Deepwiki that scan the Hyperswitch Github code base to answer queries around features, implementation and other product capabilities.

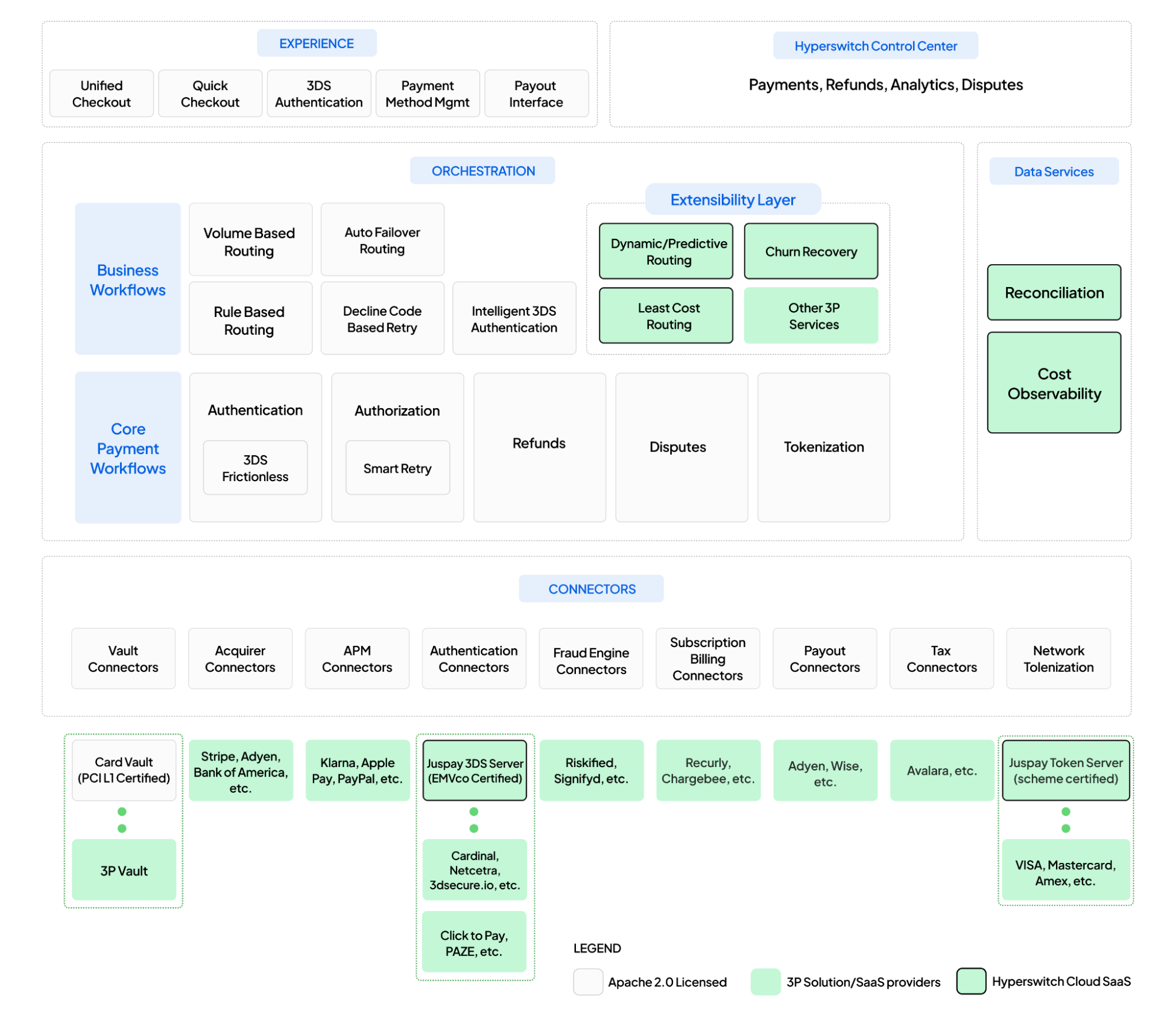

Juspay follows a modular architecture and is capable of allowing them to leverage point solutions like - Intelligent routing, Connector service, Vault, Cost observability, Revenue Recovery and 9 more to augment their existing capabilities. It is also capable of working with an existing vault, 3DS provider and front-end SDK allowing a simple non-disruptive way to transition

Modular block forming the Juspay Hyperswitch product stack

Juspay Hyperswitch self-deployment blueprint

Challenge 5

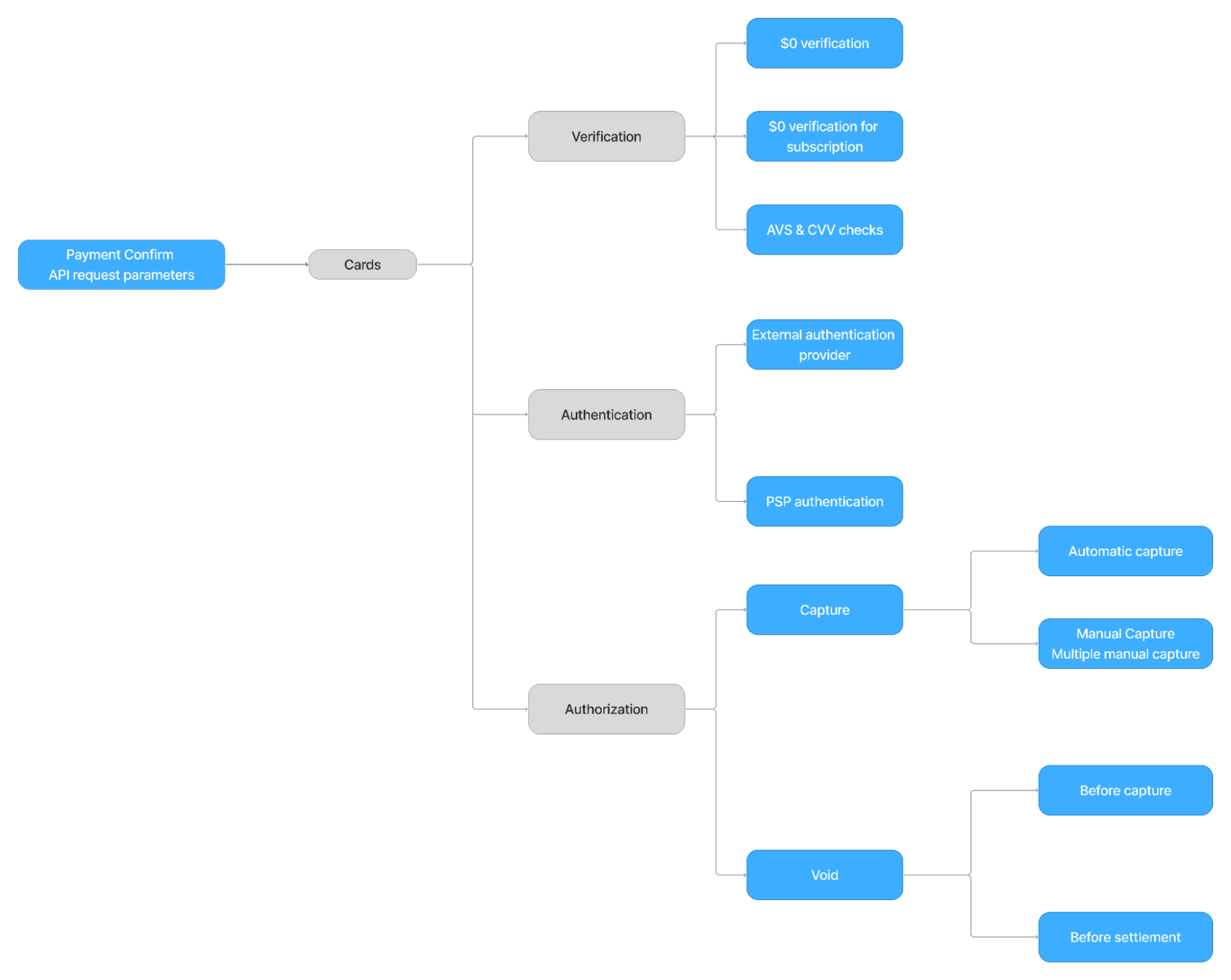

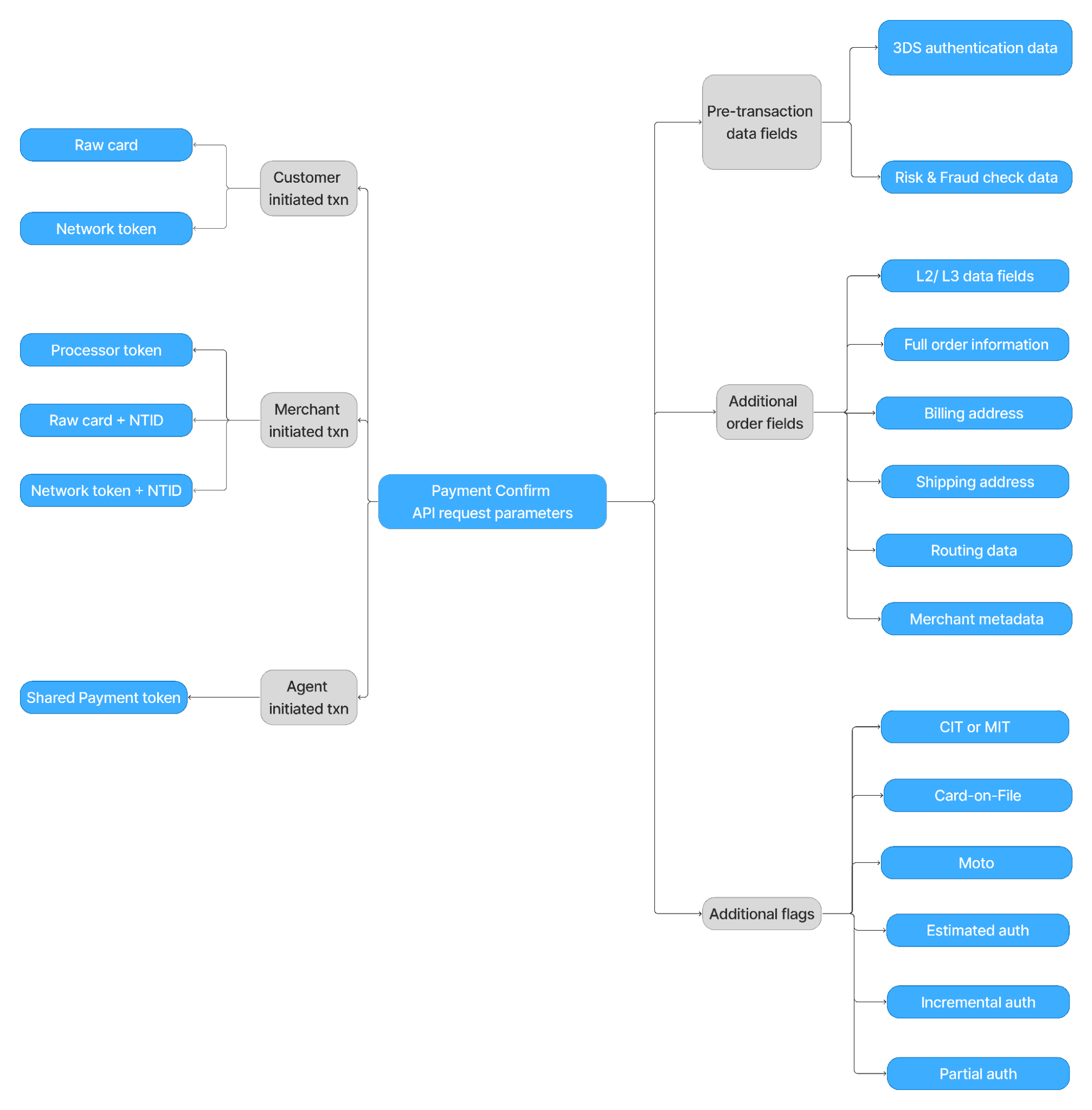

The ISFs have rich requirements of payment flows and payments request data across different legs of payments such as - Verification, Authentication, Authorization, Capture and Recurring payments depending on their client industry and requirements

Juspay offering for ISFs

- Juspay supported payment flexibilities include

- Verification payments or $0 auth

- Authenticating the end user with PSP or external 3DS solution (optional)

- Authorizing the transaction and applying different auth semantics

- Authorizing the transaction and generating PCI token

- Automatically capturing the payment or capturing it manually in single or multiple attempts

- Juspay supported payment fields in each PSP integrations including L2/L3 data, raw connector response, order data and more

Supported payment flows for cards

Supported parameters for cards

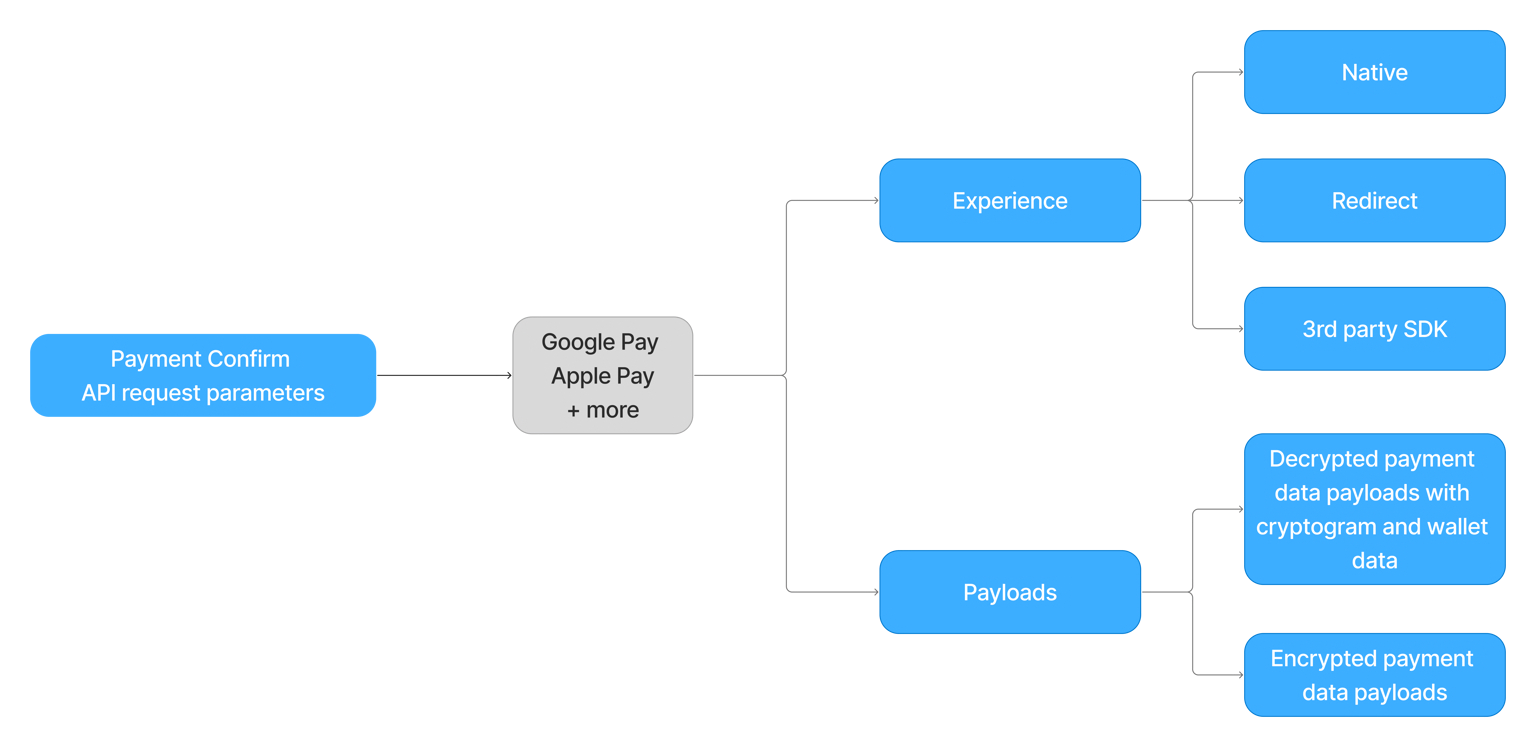

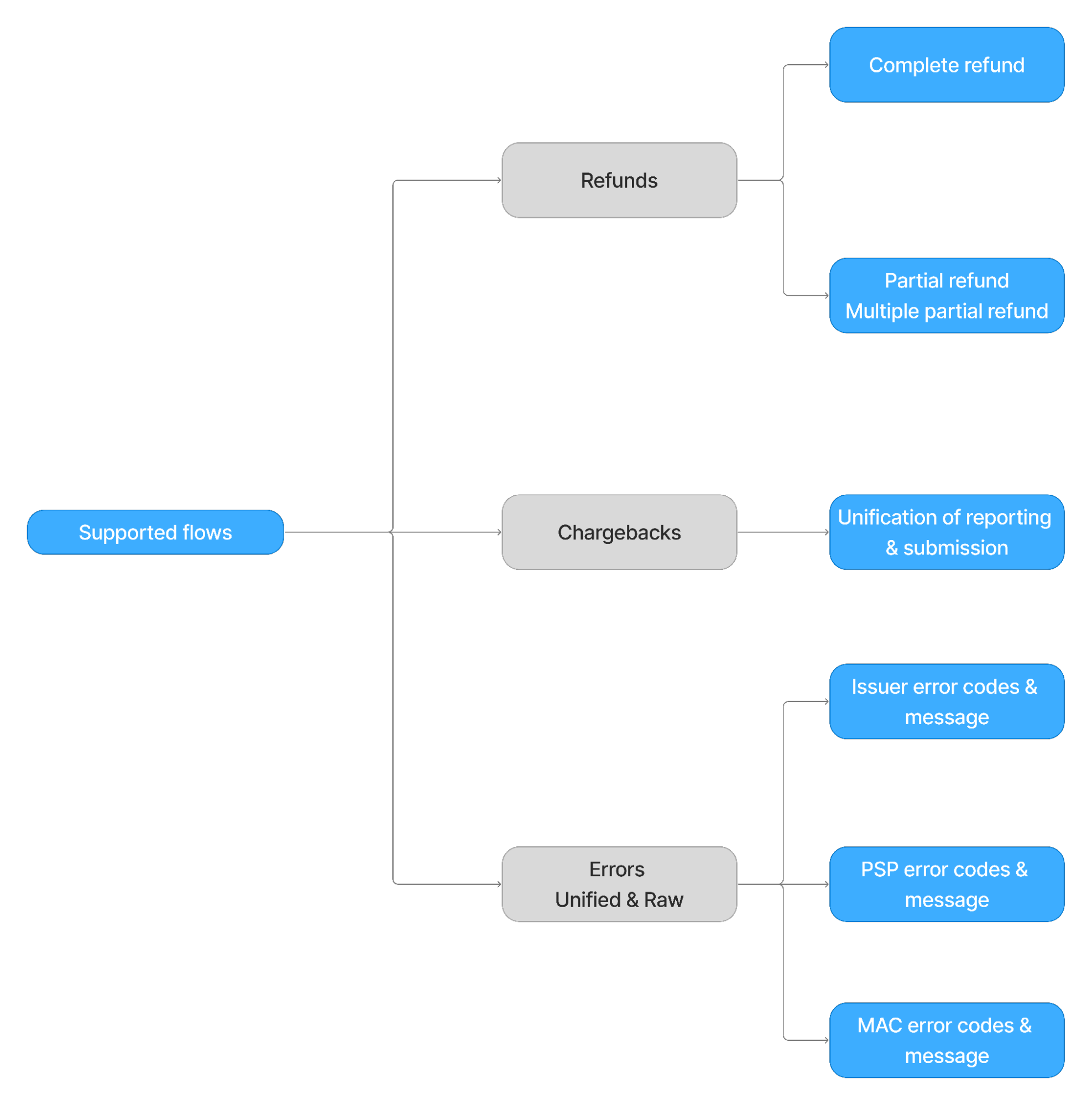

Supported parameters for wallets

Supported parameters for refunds, disputes & errors

Challenge 6

The ISFs have rich requirements of payment vaulting depending on their client industry and requirements

Juspay offering for ISFs

- Juspay offers different vaulting capabilities such as

- Connect an external vault - Orchestration stack works with any external card vault allowing a smoother adoption without migration

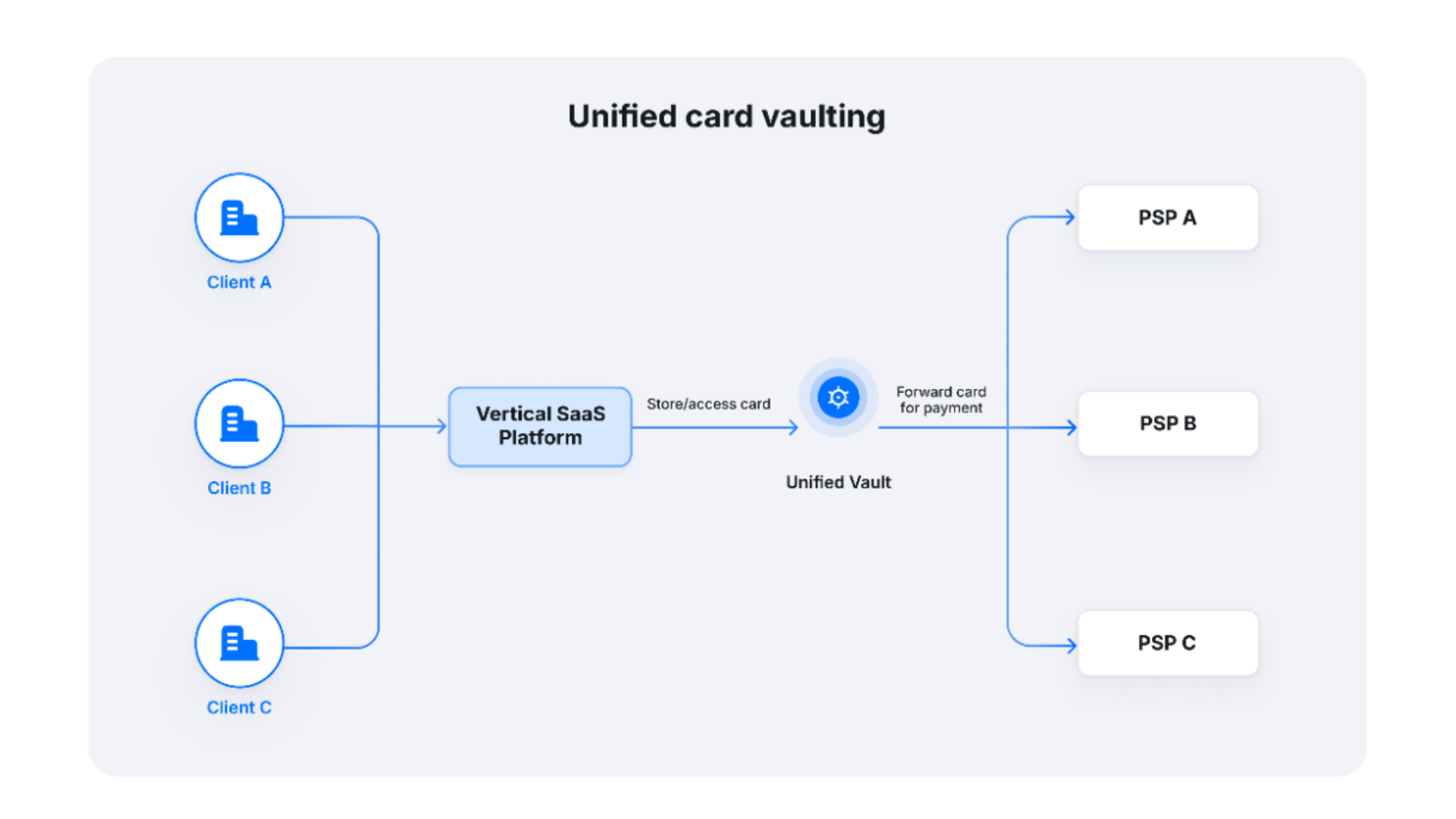

- Unified storage vault with Juspay - Cards across end customers’ of all the clients are stored in a unified vault for easier discovery and one-click payments

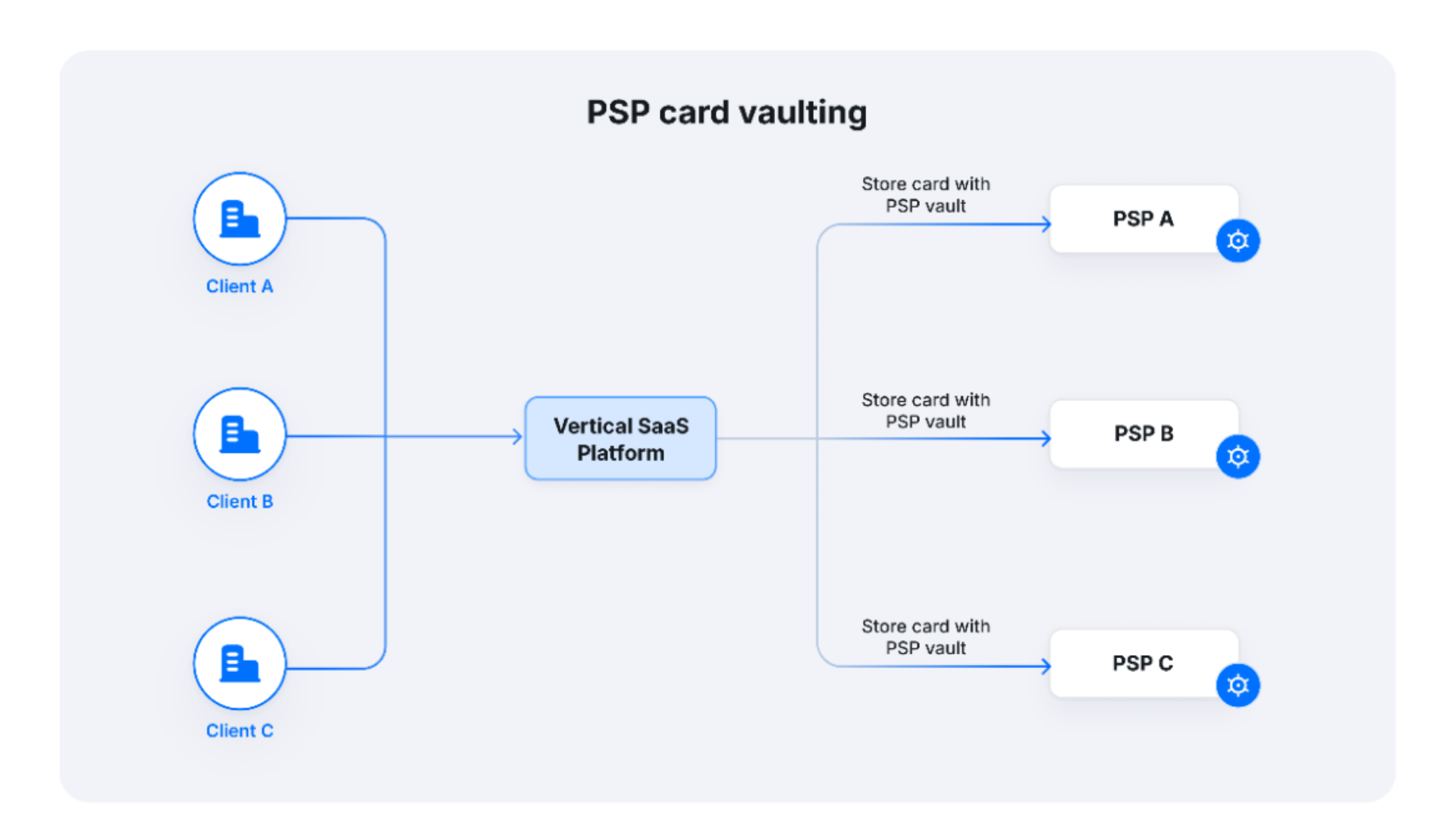

- PSP card vaulting - Cards across end customers’ of all the clients are stored in the vault of the PSP with whom the clients already have a contractual relationship.

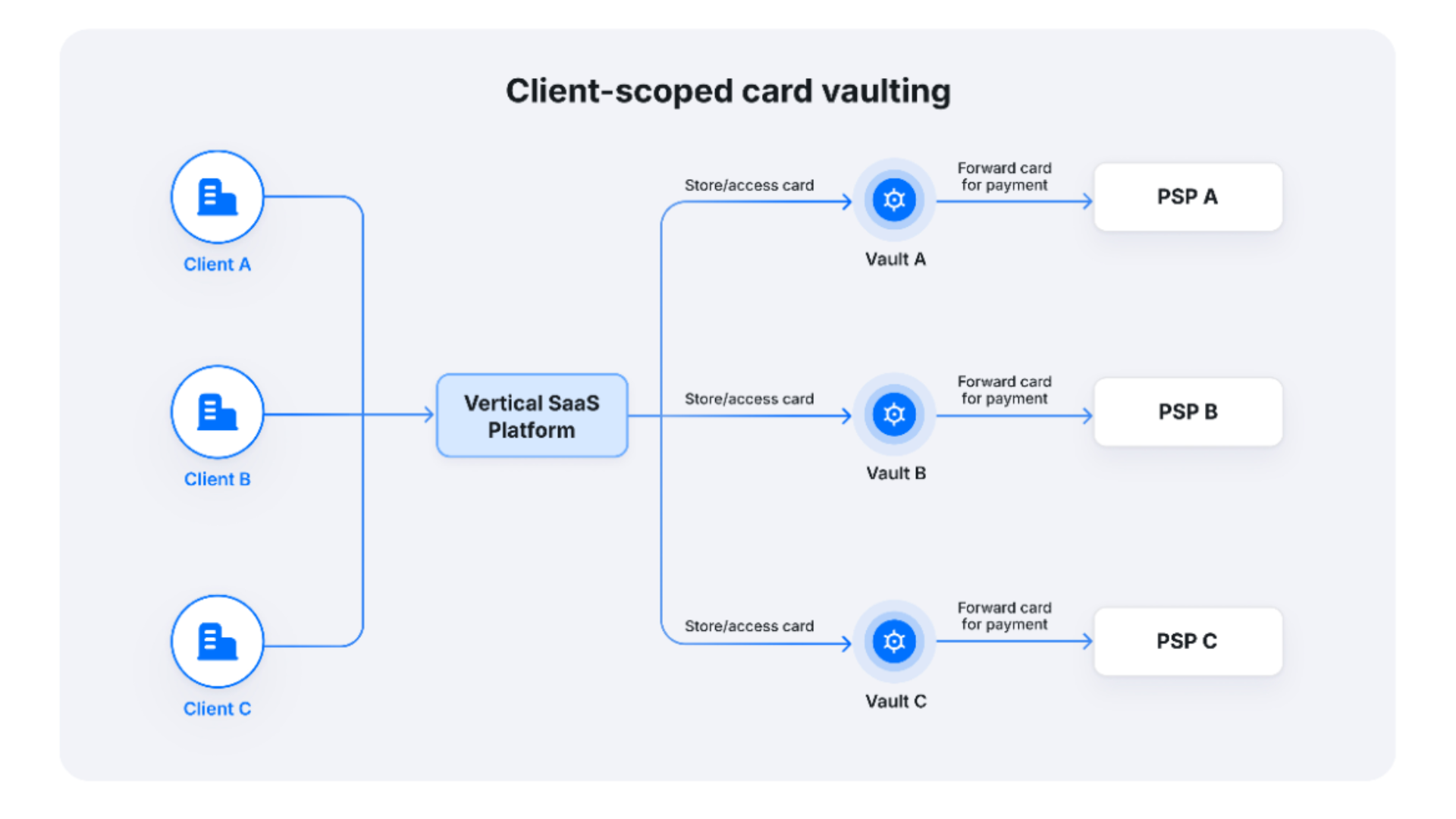

- Client-scoped card vaulting - The customer cards of each client are scoped and vaulted for dedicated use by a particular client

Unified card vaulting

PSP card vaulting

Client-scoped card vaulting

Challenge 7

The ISFs often facilitate incremental payment actions even if they were not in the original payment transaction to begin with. This is heavily driven by where they sit in the commerce flow. For instance an ISF supporting product refunds or uneven refunds (e.g. a WMS) or an ISF that triggers card capture on product-delivery (e.g. a OMS) could be facilitating these payment "actions" (refund, capture, etc.) even if they were not involved in the original authorization flow.

Juspay offering for ISFs

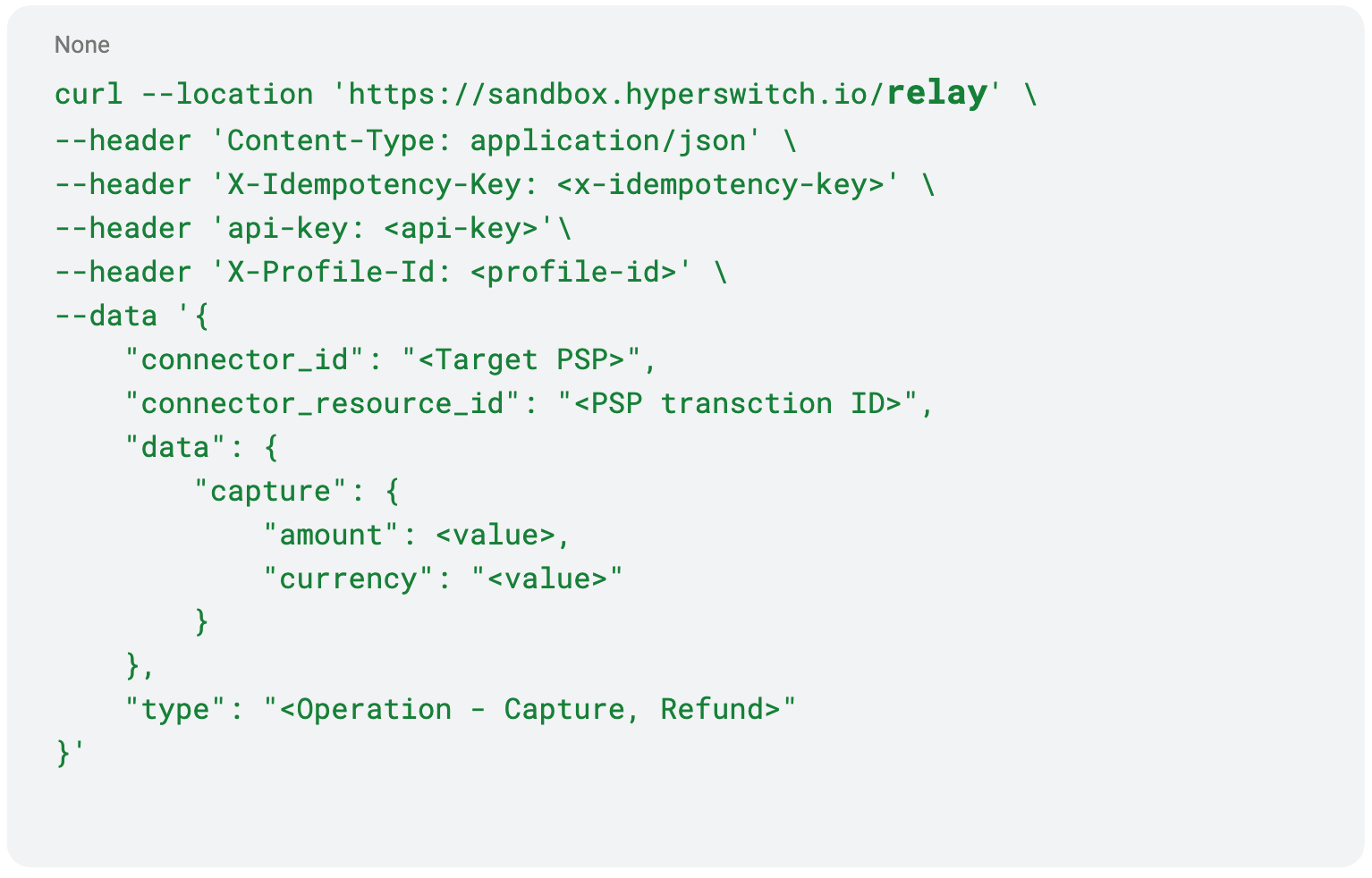

- Juspay’s Relay suite of APIs allows ISFs to make direct requests to PSPs to perform operations on an existing resource. Examples are -

- Refund a transaction which was captured outside the system or

Capture a transaction which was authorized outside the system. See sample request below:

Capture a transaction where authorization was external to system

Challenge 8

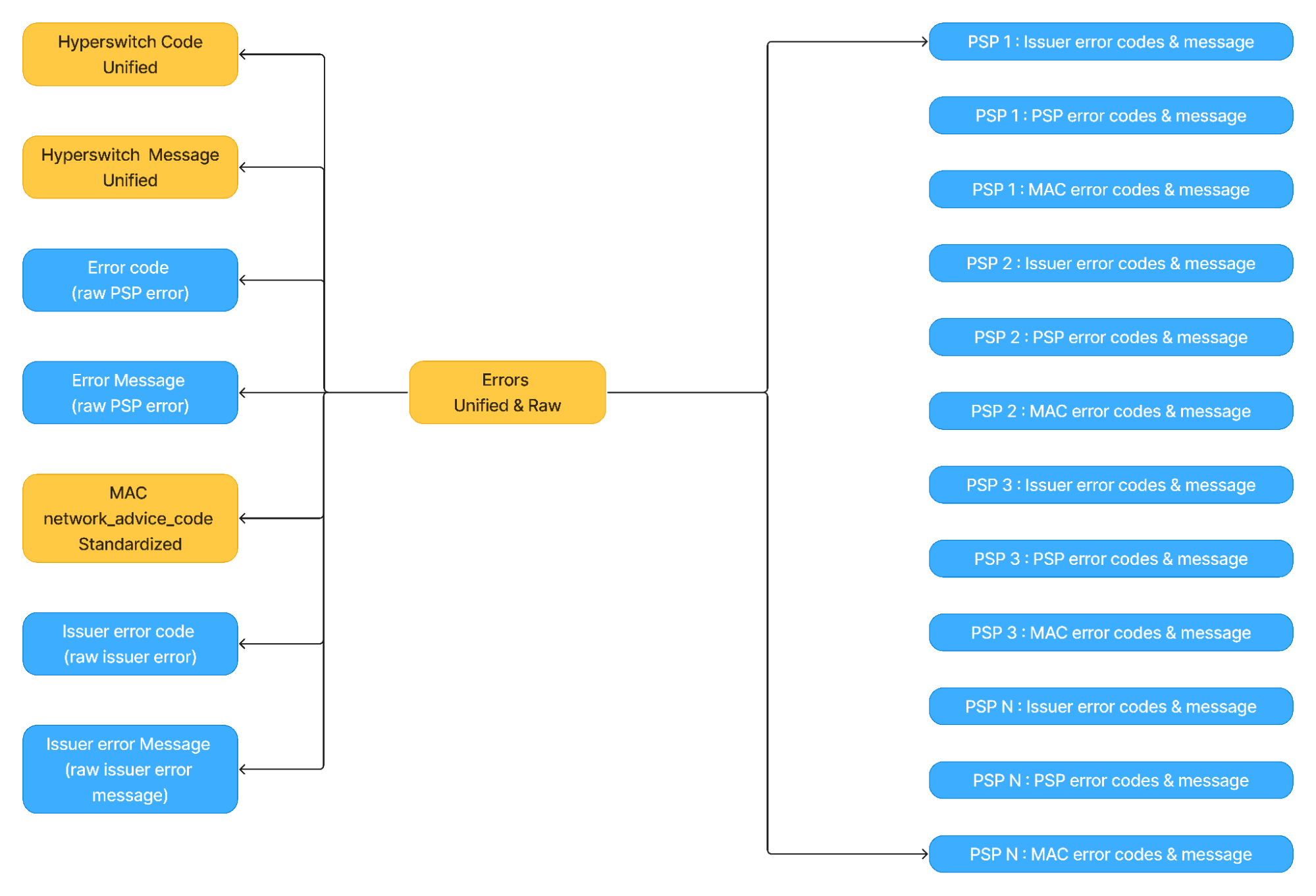

The ISFs requires reliable ways to handle PSP response data: (a) Unification, normalization, fidelity and granularity of status and response codes, e.g. mac response codes; (b) Homogeneity in webhook mechanisms employed (c) Raw PSP response

Juspay offering for ISFs

- Juspay unifies the PSP error code and error message and offers intelligible and standard error codes and messages across all PSPs. We also standardize the MAC codes and messages across the PSPs. This allows ISFs to present standard errors to their merchants and have internal processes work based on those standard codes. In addition to unification and standardization, we also pass through the raw error codes and messages for direct reference and usage. For example

- PSP 1 - 101 - Invalid card number

- PSP 2 - 1314 - Invalid card

- Juspay - US_1000 - Issue with payment method

Error code unification & standardization

Challenge 9

ISFs face challenges on delivering on service level SLAs they have with their clients especially when working with external vendors for delivering critical services like payments.

Juspay offering for ISFs

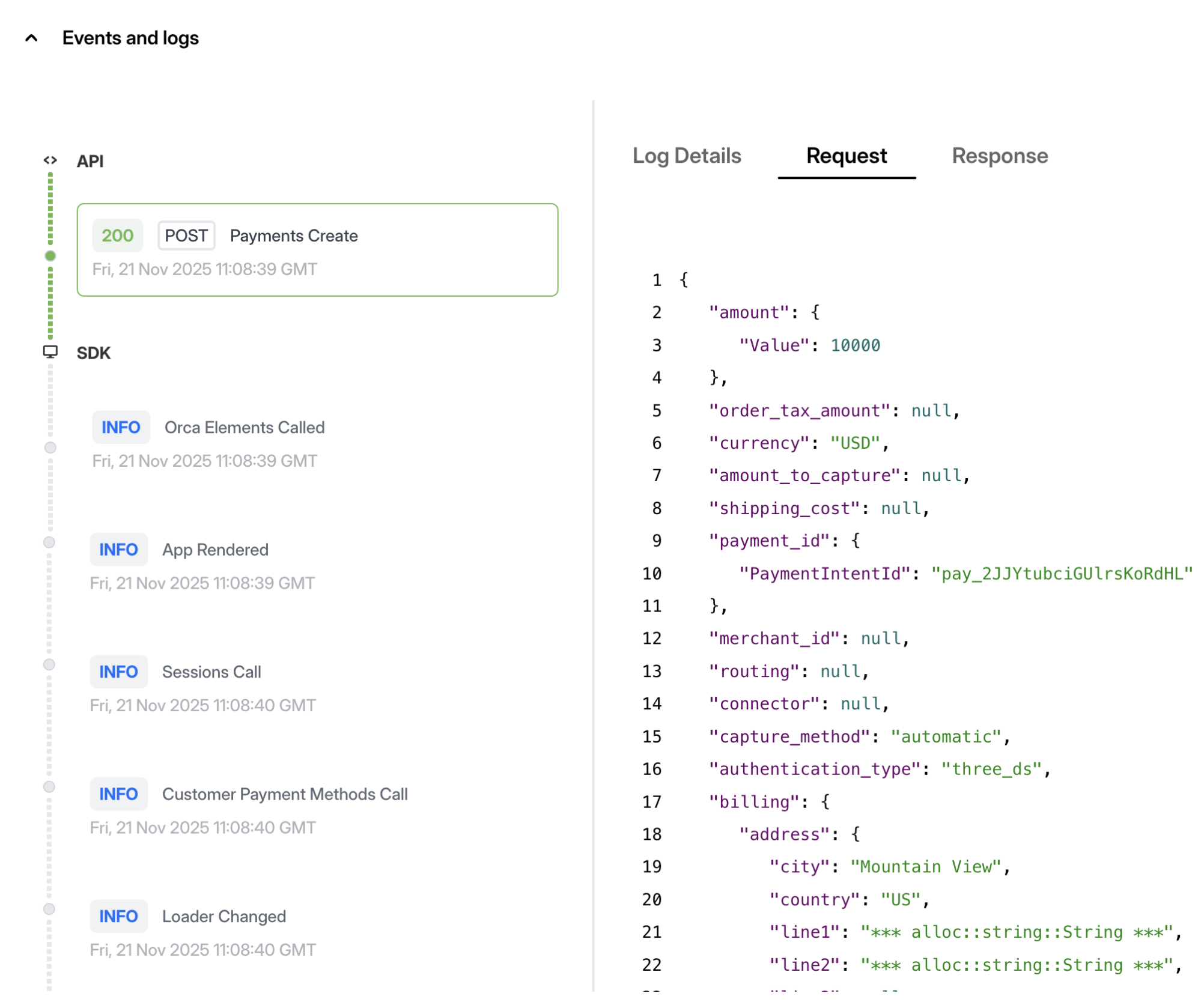

- Juspay offers an entire audit trail and detailed transaction logs of each transaction on the dashboard for ISFs to be able to do the first level debugging themselves without an external dependency. We are also enhancing the audit trail framework and coverage to open up the access to technical metrics & developer observability for the ISFs to get full visibility into the system.

- Additionally, we have a multi-sub merchant alerting system to detect PSP downtimes, error rate increase, new payment errors for ISFs to be able to send the feedback to their sub-merchants (clients) suggesting improvements and fallbacks. Such systems will enable ISFs to self-serve sub-merchant queries.

All payment event and logs on dashboard