Payments Are No Longer a Back-Office Function

Payments, once buried under finance operations, are now strategic levers in aviation. In an industry defined by complex itineraries, multi-currency transactions, and exacting customer expectations, payments have taken center stage. Each year, over 2.9 billion airline booking transactions, valued at nearly $1 trillion, move through global payment systems. But at a steep cost—airlines spend over $20 billion annually on payments, nearly 3% of total revenue, and a staggering 78% of the industry’s net profit.

A fragmented payment ecosystem—built on outdated tech and patchy integrations—can’t keep pace. The ability to scale internationally hinges not only on fleet size or route networks, but requires a reliable payment infrastructure that can keep pace with the geographic and regulatory sprawl. Airlines need a global, unified payment stack, powered by orchestration, to transform payments from a cost center into a growth engine.

The Payment Turbulence: Challenges Airlines Face

For airlines, each market comes with its own layers of complexity. These challenges need to be addressed through a unified strategy to prevent them from transforming into friction.

1. Cross-Border Costs That Erode Margins

Operating across a mosaic of currencies and markets, airlines are burdened with hidden fees—cross-border interchange, FX conversion charges, and slow settlement cycles. Each ticket, loyalty redemption, or ancillary upsell compounds these inefficiencies, directly affecting profitability.

2. Disjointed systems that delays go-live

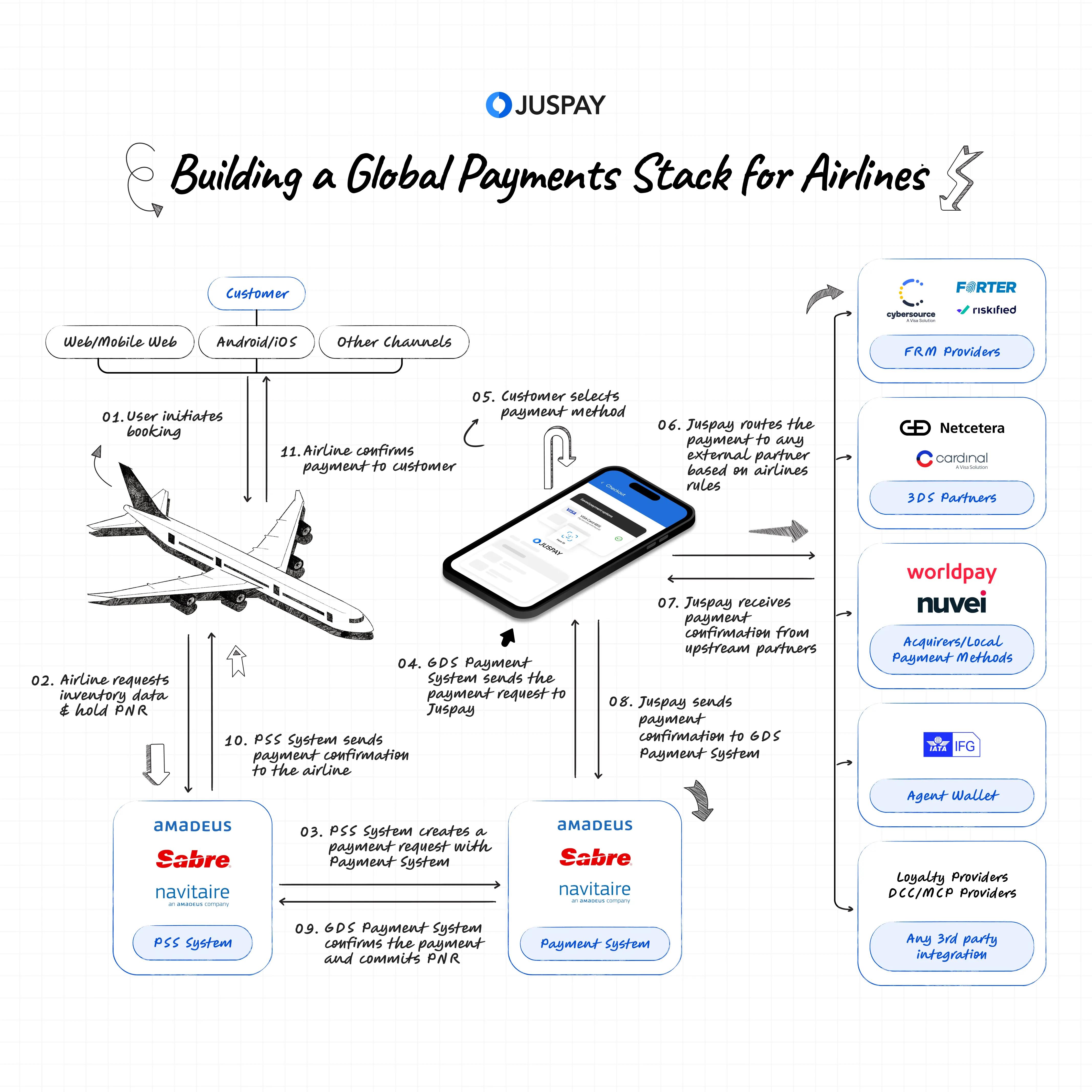

From GDS players to PMS to IATA to POS to Schemes to Acquirers, airlines need to efficiently work with myriad partners in the payment journey. A single change required for any new feature ask would require changes across the spectrum, which increases the time to market and make the payment experience poor.

3. Inconsistent Authorization Rates

The same card transaction may be approved in one region and rejected in another due to issuer behavior, local routing logic, or fraud checks. Every failed authorization isn’t just lost revenue—it’s a lost seat, a missed opportunity, and a degraded customer experience.

4. Operational Overhead from Fragmented Systems

Managing dozens of PSPs, acquirers, and fraud tools across currencies and channels creates an operational maze. Reconciliation becomes manual, error-prone, and expensive.

5. Local Payment Methods (LPMs) Are Table Stakes

Customers increasingly expect to see their preferred local methods—like UPI in India or Pix in Brazil. Ignoring LPMs means low conversion, regardless of strong route economics.

6. Payment Experience Shape Brand Perception

A declined transaction, a clunky checkout, or a delayed refund—these aren’t UX bugs; they erode trust. In a competitive market with low switching costs, payment friction turns loyal flyers into lost customers.

Start with the Control Tower - Orchestrate, Don’t Just Integrate

Airline payment ecosystems span hundreds of PSPs, acquirers, fraud vendors, GDS, IATA and indirect sales channels. Traditional gateways or point-to-point setups struggle under this complexity. One change for the end customer would require cascading changes across all the players that will result in the change going live in months that should have taken days.

Like a control tower, orchestration sits atop your payment stack—deeply integrated with all partners -- dynamically routing transactions, retrying failures, adapting presentment based on device, currency, or issuer response in real-time. A travel orchestration layer like Juspay can help airlines convert high-latency, high-failure cross-border payments into successful local transactions—e.g., routing a Singapore passenger booking from Paris via a domestic acquirer to improve success rates and cut fees.

With B2B flows, travel orchestration strengthens the airline’s B2B infrastructure within the IATA BSP. By issuing virtual cards at booking and routing payments locally, airlines enable secure, real-time ticketing while converting interregional flows into on-us transactions—cutting FX costs and boosting margins. With credit-backed settlement and compliance-ready processing, orchestration transforms complex, multi-party B2B payments into a streamlined, cost-efficient engine that scales with global distribution.

Reduce Friction with Local Acquiring & Currency Intelligence

Routing international cards through foreign acquirers causes higher MDR, lower success rates, and false fraud flags. When a card issued in Brazil is processed through a US-based acquiring setup, the merchant often pays higher fees, experiences lower approval rates, and may be flagged for fraud. Multiply this by millions of transactions per month, and the cost delta becomes material. Local acquiring solves this—by processing payments through in-market PSPs, airlines improve success rates and reduce costs.

Juspay’s partnership with one of the global airlines is a benchmark to show travel orchestration’s critical role here. As the airline expanded into 20+ countries, Juspay reconfigured its existing acquirer connections and added eight new region-specific acquirers. The result was a marked reduction in cross-border transaction costs and significant improvement in authorization rates, particularly for bookings made in emerging markets where global card penetration is low.

Beyond acquiring, Multi-Currency Pricing (MCP) and Dynamic Currency Conversion (DCC) offer price transparency and reduce FX risk, improving trust and conversions to immediately convert currencies at checkout—reducing forex risk for airlines, offering transparent pricing to customers, and unlocking incremental revenue opportunities.

Embrace Local Payment Methods

By 2028, local payment methods (LPMs) are expected to account for 60% of all e-commerce transactions globally. It is critical that airlines adapt to this shift. Cards are no longer the standard of global payments, with wallets and bank transfers dominating payments in Southeast Asia, similarly with Pix in Brazil and UPI in India.

But, offering LPMs through direct integrations is a significant demand on both time and resources. Orchestration platforms with pre-integrated LPM connectors simplify this to allow airlines to test and scale these methods in a controlled environment.

Juspay’s approach: transferring a generic payment stack to make it truly global. It offers A/B testing for new payment methods, turned on or off via a dashboard, and routed intelligently depending on success rate, cost, or even promotions. An airline launching routes in a new country can go live with the top three domestic methods in days, not quarters, without hardcoding changes into their core systems.

Turn Checkout into a Revenue Channel

Modern consumers demand speed, simplicity, and security. However airline checkout experiences are often designed to serve multiple markets with a single template, and tend to fall short in delivering the frictionless, fast, and familiar flow that modern consumers expect.

Juspay’s Checkout Experience Suite delivers a mobile-first, passkey-enabled, intelligently adaptive checkout. It supports:

- One-click payments

- Smart retries without re-entering details

- Real-time fraud detection

- Adaptive UI for device and locale

With increasing booking volumes coming from mobile browsers and apps, optimizing for latency, seamless authentication, and SDK-based checkout flows can yield conversion uplifts in the range of 5-10%. For a carrier with high transaction volumes, the bottom-line impact of even a 2% increase in checkout success can translate into millions in recovered revenue.

Real-Time Risk Management without Killing Conversion

Long booking horizons, high-ticket values, international card usage, and third-party bookings make aviation a prime target for both opportunistic and organized fraud. Legacy fraud tools often force a tradeoff between security and success.

Modern travel orchestration blends third-party tools (like Forter, Riskified or Cybersource) with in-house behavioral scoring and geo-specific rules—triggering 3DS, soft declines, or manual review intelligently.

This layered model improves fraud catch rates while reducing false positives. Airlines benefit from fraud orchestration scenarios that adjust based on route, fare class, device, or user history—maximizing safety without hurting conversions.

Make Payments Data a Strategic Asset

Payments are one of the richest sources of behavioral and operational data an airline possesses, but very often, data is trapped within acquirer dashboards, scattered across teams, or not collected at all. Without visibility into approval rates by issuer, 3DS drop-off points, or retry success rates, optimization becomes guesswork and airlines fly blind.

Travel Orchestration platforms unify and visualize data across regions, enabling:

- Acquirer re-negotiations

- Checkout optimizations

- Root-cause identification of revenue leakage

Juspay’s dashboard allows granular tracking of decline reasons by region or issuing bank, enabling proactive resolution before they snowball into revenue leakage. The ability to drill down from a macro view into specific PSP or bank behaviors allows airlines to treat payments not as plumbing but as a strategic lever.

Airlines can take analytics a step further with Juspay’s Payment Scorecard which acts as a decision-making engine and surfaces actionable insights to improve Payment Metrics. It actively analyses payment metrics across the entire lifecycle to suggest targeted actions that can improve payment performance. Whether it's boosting approval rates, reducing drop-offs, or identifying suboptimal routing paths, the Scorecard translates raw data into intelligent, pre-configured recommendations. For airlines managing sprawling global payment stacks, this feature offers a systematic way to cut through complexity and drive continuous optimisation without the guesswork.

Improve Authorization Rates with Richer Data

For airlines, high approval rates are non-negotiable—but achieving them requires more than just clean payment rails. Travel orchestration platforms fix this by intelligently leveraging 3DS 2.0 to pass crucial data like AVS (ZIP codes, street addresses), device info, and real-time authentication metadata. This comprehensive data gives issuers more confidence, directly leading to higher authorization rates and fewer frustrating false declines, significantly improving the customer's booking experience.

Additionally, providing Level 2 and Level 3 data such as itemized invoices, freight and duty amounts, shipping details, and PO numbers—unlocks lower interchange rates for cards. More data means greater issuer confidence, translating directly to better authorization rates, fewer false declines, and higher conversion—especially vital for complex, high-value airline transactions.

Automate Reconciliation, Empower Finance

Behind every successful transaction are settlement files, processor reports, and back-office accounting systems trying to reconcile what was authorized, settled, refunded, or charged back. For multinational airlines, this can mean thousands of files per week, in different formats, currencies, and tax treatments.

The result? Finance teams drowning in spreadsheets, manual matching, and missed revenue recovery opportunities. Automation here is a compliance necessity. Juspay’s Reconciliation Engine normalizes transaction data across PSPs and acquiring banks, flags exceptions in real time, and enables a single-view dashboard for ops, finance, and treasury teams.

Beyond speed, the value lies in visibility. Airlines can understand settlement lags, refund discrepancies, and fee deductions by geography or channel. This insight can then be fed back into the orchestration engine to further optimize routing, cost, and even customer support workflows.

Conclusion: Build for Scale, Optimize for Precision

Airlines don’t need just another payment vendor. They need a smart, resilient architecture that can scale globally, power new business models, and transform payments from a cost line into a revenue stream. One that adapts across markets and turns complexity into competitive edge.

Today’s leading carriers aren’t reacting to payment challenges—they’re re-architecting their stacks around orchestration. From local acquiring and LPMs to dynamic routing, data enrichment, and automated reconciliation, orchestration provides a unified control layer that simplifies operations, improves success rates, and enhances the end-to-end customer journey.

This shift is already underway. In an industry where every transaction counts and every market behaves differently, some of the world’s most forward-thinking airlines have moved away from fragmented, legacy systems in favor of orchestration-first strategies—allowing them to launch faster, operate leaner, and convert better.

The sky isn’t the limit. But only if your payment stack can keep up.