Digital payments are now the global standard. With online transactions made easier, faster, safer, and increasingly accessible via digital wallets and mobile devices, the number of digital payment users worldwide is projected to reach 8.34 billion by 2030.

This is a significant number for businesses to keep up with. As new payment methods emerge, cross-border transactions increase, and access to new markets grows, the complexity of digital payments is increasing. Businesses must be equipped to navigate this landscape strategically. Along with the volume, it is the payment experience that directly impacts consumer satisfaction, encourages repeat purchases, and builds long-term trust. But for each customer to experience a successful, seamless transaction, a complex decision must be made - how a payment is routed.

This decision-making process is called payment routing with the goal to maximize the success rate of transactions, without friction or retries and minimal risk of fraud, failure, or a subpar customer experience. Businesses can work with payment orchestration platforms to employ the right type of routing depending on their consumer base and behaviour, transaction volume, and the geographies that they operate in. The complete range of routing options come with advantages leading to increased revenue, reduced failed payments and processing fees, and an overall enhanced customer experience.

What is payment routing?

Payment routing is the key optimizing aspect of a payment process - which uses automated decision-making to route payments through the best available path for a successful transaction, based either on predefined rules or real-time data. The potential for maximum successful transactions lies within this decision-making or logic that takes place behind the scenes within the seconds it takes to complete digital transactions. The routing process takes a payment from its initiation to completion - through layers of payment orchestration, routing engines, payment gateways, to bank networks and finally, the business.

How does payment routing work?

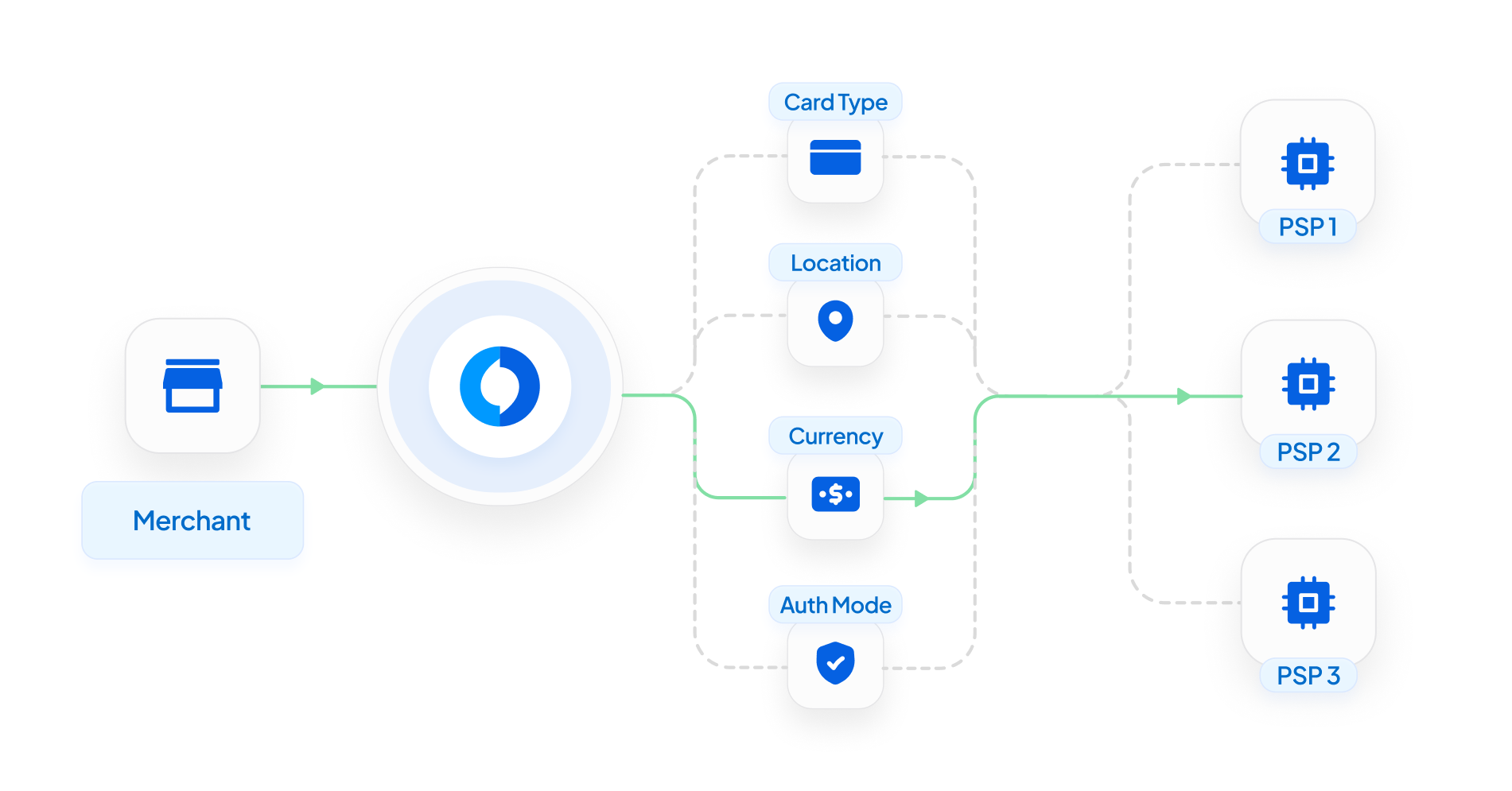

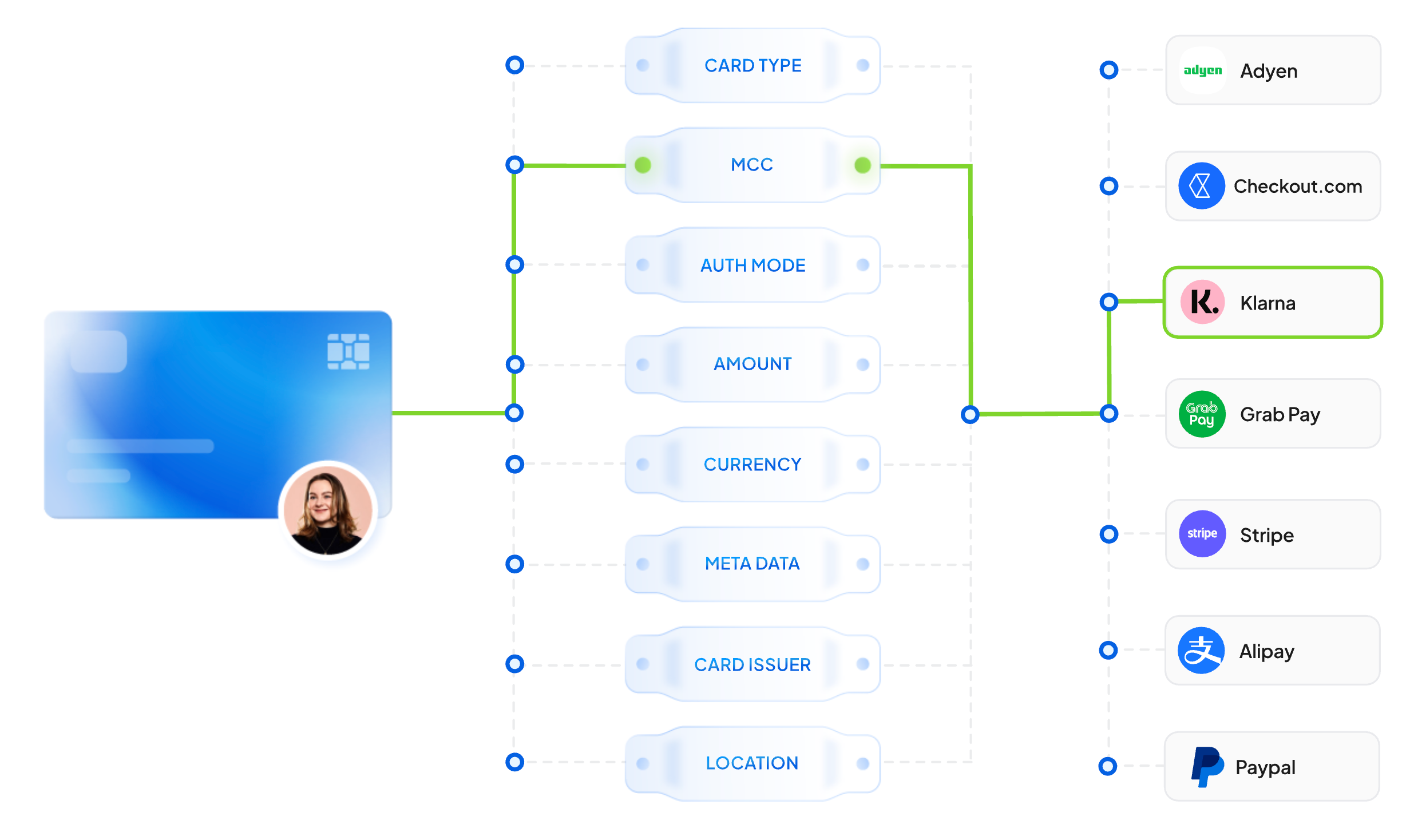

Once a payment is initiated, the routing engine triggers the decision-making process - starting with collecting payment details and other additional data like card type, BIN, currency and transaction amount, geography, or device type.

The engine then evaluates a combination of predefined rules and dynamic data to chart the best path for the transaction. These include approval rates and latency for best performance, processing fees for cost-effective routes, and evaluating risk signals for fraud prevention. Based on the evaluation at this stage, the engine routes the payment through the most suitable provider based on a set of rules that take into consideration geographic proximity (payments in a particular region routing through a regional provider for better rates and regulatory compliance), card brand performance, ie, routing payments through a processor with high success rates at Visa, whereas routing other payments through a process that works better with MasterCard, real-time data like latency, retry success rates, uptime and downtime, as well as cost efficiency based on transaction size.

Following these layers of analysis, the routing engine sends the transaction to the acquiring bank or payment processor most likely to approve the payment. If the transaction is approved, it is successful. However, in case of declined approvals, the routing engine may enable fallback routing by sending the payment to an alternate provider, cascading by attempting the payment again with adjusted parameters, or implementing a retry logic.

Customers have no visibility of this process, except the change from a transaction initiated screen to the screen that shows success or failure, which usually takes a few seconds. The speed, reliability, and success rate determine the payment experience, which is why a robust payment routing engine is a critical ability businesses can leverage to improve revenue, conversion, and consumer trust.

Successful, frictionless payments are at the core of payment routing, but businesses differ in volumes, goals, risks, and geography. Consequently, as does the routing that a business needs. Payment routing can be configured based on static rules, or dynamic logic and real-time data. In many cases, payment routing strategies may be combined for best results.

We’ll delve into the factors that businesses can take into account when exploring a payment routing strategy, but first let’s look at the strategies available for businesses to choose from.

Types of Payment Routing

Payment routing, with its substantial contribution to a business, both in revenue and customer relationships, is not a one size fits all solution. A payment routing strategy can be built and customized based on a business’s needs, whether that is market expansion across regions, payment methods, transaction volumes, minimizing processing costs, or fraud prevention.

Businesses can take into consideration how flexible, data-driven, and automated they want their payment routing strategy to be and build on the three foundational ways: static, smart, and dynamic routing.

Let’s take a closer look at each of these core routing strategies:

Static Routing

Static routing is typically the starting point for small or early-stage businesses with lower transaction volumes and complexity. It is the simplest form of payment routing as it requires minimal optimization and functions based on a set of predefined rules, without taking into account factors such as performance or real-time conditions. Once the rules are established, each transaction is routed based on them every time.

It is also implemented in regulated domestic markets. That is, if a business operates in a single region or transacts with one currency, static routing can efficiently handle payments without requiring currency conversion or similar complexities that arise in cases of cross-border transactions.

A critical limitation of static routing is that it offers no recourse for failed transactions if a provider performs poorly, causing friction for customers that must retry the transaction or choose a different payment method.

Smart routing

Smart routing is an advanced form of payment routing. It’s built on the same foundation of static routing and reviews the same aspects of a payment while leveraging real-time data, sophisticated algorithms, and machine learning to decide how to route payments without relying on a predefined rule or logic.

A crucial improvement with smart routing is that it reduces the chances of failed payments or false declines and routes to the provider with high authorization rates. This is achieved by a continuous analysis of variables like PSP health, consumer behaviour, geography, currency, and payment method, to use as context when identifying which payment provider or bank is most likely to authorize the payment for a successful transaction. It analyzes in real-time which PSPs are facing downtime or latency issues, and incorporates historical data to review fraud risks, processing costs, and approval rates, to improve the chances of a successful payment.

While the goal of routing is improved chances of successful, cost-effective, and secure transactions, static routing follows predefined rules, whereas smart routing is more fluid and adaptive to real-time, changing conditions to route payments.

Dynamic routing

Dynamic routing is a data-driven, adaptive form of routing that furthers the capabilities of smart routing. While smart routing optimizes transaction flows through intelligent decisioning across issuer-level preferences, cost-aware routing, and failover logic, dynamic routing evaluates real-time signals, to determine the path for a transaction for best possibility of a successful transaction.

Evaluating signals in real-time allows dynamic routing to no longer depend on the if-then logic, but adapt instantly to current conditions across a comprehensive range of data including uptime, performance, card brand, geography, processing costs, time of day or week patterns, or fraud risk scores. This helps transaction paths be optimized in real-time, instead of assumed logics, with improved approvals, reduced disruption, and better cost management.

Especially in the case of high-volume or cross-border transactions, dynamic routing acts as a live optimization engine, allowing businesses to respond to shifting conditions.

How does payment routing help businesses?

Regardless of the volume and complexity of payments, businesses employ payment routing to maximize revenue, reduce costs and friction, and enhance overall customer experience. Payment routing ensures best possible outcomes for both customers and businesses, regardless of the type of routing used. Whether the payment routing is static, smart, or dynamic, it enables businesses to:

- Maximize approvals to increase the likelihood of success, and ensure that no revenue is lost due to payment failures.

- Control costs by optimizing paths that select the lowest processing fees without affecting performance.

- Ensure uptime and resilience by adapting and rerouting during outages or processor issues.

- Support scalability and global growth by matching transactions to local providers for compliance, performance, and savings.

- Streamline operations by removing manual intervention through intelligent automation.

What factors should businesses consider when setting up a payment routing strategy?

The key to an impactful payment routing strategy is to ensure that businesses leverage the context payments provide and then align it with business objectives. Here are the factors that you should take into consideration:

- Geography and markets

Payment location and the markets your business operates significantly influence costs and local regulatory requirements. With local acquirers typically approving local payments faster and with lower fees, it is critical that businesses set up routing strategies that are tailored to each region, especially in cases of cross-border transactions. Businesses can avoid foreign exchange conversions and remain compliant with local regulations with a geographically strategic payment routing system.

- Transaction volume and complexity

Not all transactions are equally complex, nor do all businesses see the same transaction volumes. A static payment routing strategy can cater to low-volume businesses, requiring minimal optimization. However, businesses with higher transaction volumes across payment methods and higher risk potential need a sophisticated payment routing strategy that offers better risk assessment, authentication, and control.

- Performance data

Both real-time and historical data is a goldmine of insights that can help businesses determine their payment routing strategy. Visibility into this data is critical to inform and optimize your payment routing logics.

- Operational capability

Depending on the routing logic that suits your business, you can choose to employ a payment orchestration system, especially when implementing smart and dynamic routing, to manage and optimize your payments on a single platform.

How does Juspay help?

Juspay's routing engine comprises of several key components:

- Routing Rules Engine: Enables merchants to create and manage routing rules without code, facilitating quick adjustments to routing strategies as business needs evolve.

- Real-Time Monitoring: Provides visibility into transaction performance across different PSPs, allowing for data-driven decisions to optimize routing.

- Fallback Mechanisms: Automatically reroutes transactions to alternative PSPs in case of failures or downtimes, ensuring higher transaction success rates.

- Integration with Multiple PSPs: Supports seamless integration with a wide range of payment providers, offering merchants the flexibility to choose partners that best fit their requirements.

These components work together to provide a comprehensive routing solution that adapts to the dynamic nature of online payments. Juspay empowers businesses to tailor their payment flows with both rule-based and dynamic routing systems, designed to adapt to various transaction volumes, operational complexity, and strategic objectives.

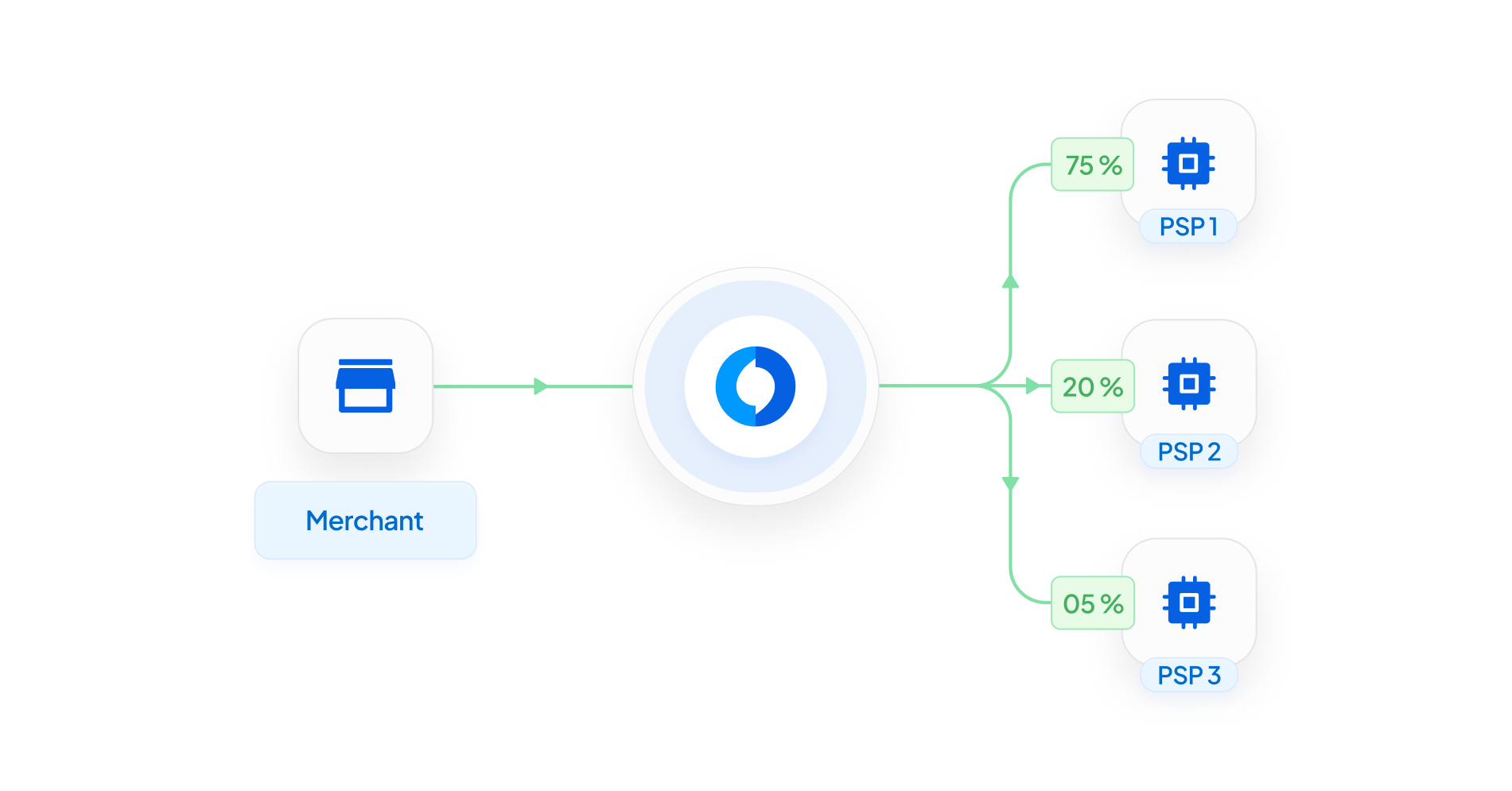

- Rule-based Ordering: The payment routing strategy relies on the predefined rules regarding payment method, card type, transaction amount, or geographic region, set by businesses to route payments to the preferred payment service providers.

- Dynamic Gateway Ordering: Instead of predefined rules, dynamic ordering leverages real-time data across factors like success rates, latency, and processing fees, to automatically select the most efficient payment service provider to ensure successful transactions.

Case Study - How Juspay helped a social commerce brand navigate PSP outages

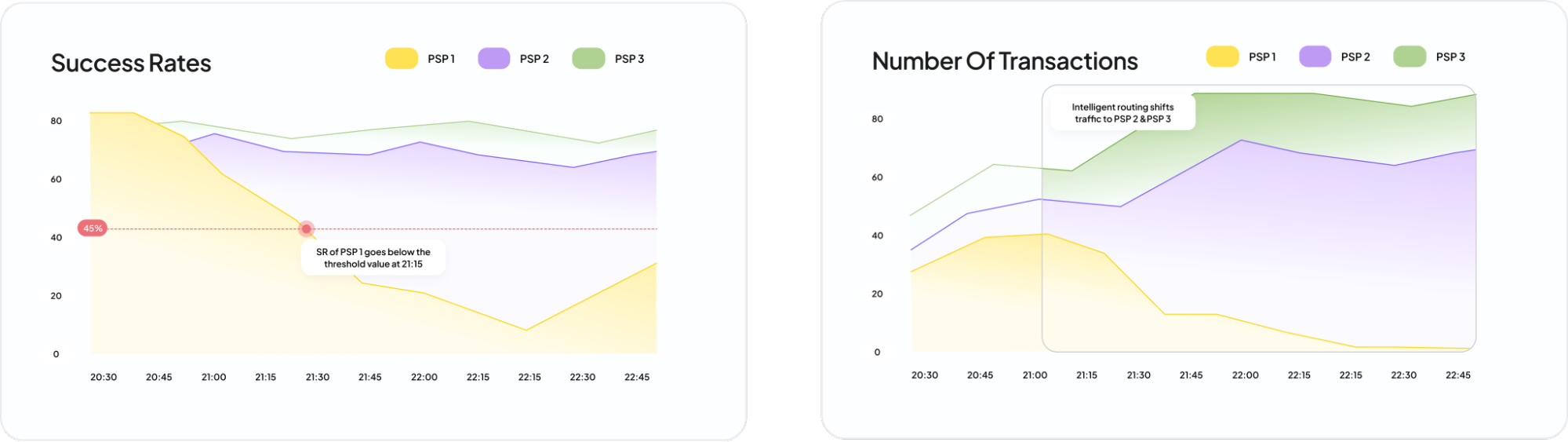

For digital businesses, every failed transaction translates to lost revenue and customer trust. To protect businesses from these losses, smart routing becomes a critical aspect of their payment infrastructure. Here’s how smart payment routing helped Juspay’s partner brand gain higher success rates, consequently improving customer experience by continuously monitoring payment service provider (PSP) performance in real time and dynamically steering traffic:

When PSP1’s authorization rates dropped below 45% and remained unstable for over 7 hours, Juspay’s smart routing system responded immediately with automated fallback routing to maintain business continuity. The system constantly monitors PSP performance in real time, using metrics like authorization success rates, latency, and decline codes. When PSP1’s performance fell below the configured threshold, it was dynamically deprioritized, and traffic was rerouted to PSP2 and PSP3, both of which were showing stable success rates above 70%.

Juspay’s fallback routing doesn’t rely on static backup logic; instead, it uses real-time signals, payment context, and success rate prediction models to determine the most optimal path for each transaction. Merchants also have the ability to configure weightage across PSPs based on performance, cost, or strategic preference, ensuring that fallback decisions align with their specific business goals. Over the course of the downtime, approximately 4,270 transactions were successfully redirected, resulting in a savings of around $18,000—without requiring any manual intervention or engineering effort.