Impact

- Significant Improvement in Payment Success Rates

- Faster Loan Approvals

- Reduced Manual Effort in Reconciliation

- Improved Student Satisfaction

Products Used

- Hyper Credit - Loan Marketplace

- Hyper Checkout

- Intelligent Payment Orchestration

- Unified Reconciliation

- Unified Analytics

Amity Online, India’s first UGC-approved online university, serves over 200,000 students with a wide range of courses accessible through its website. The enrollment process is designed to be simple: students enter their details, select a course, choose a fee structure, and complete the payment.

But here’s the catch—despite offering a variety of payment options, Amity was facing difficulties with fragmented user experience, operational inefficiencies, and slow loan approval rate. The platform needed a comprehensive solution to streamline payments, simplify reconciliation, and a seamless payment experience for the students.

Navigating a Fragmented Payment Ecosystem

Amity offered three primary payment methods:

- Online Payments via a third-party payment gateway, covering UPI, EMI, cards, and bank transfers.

- Demand Drafts (DDs), which required manual processing.

- Loans from multiple lenders, each with its own application process.

To make matters more complex, Amity was adding a new payment gateway to expand its options. However, the lack of a unified interface meant students often found themselves jumping between different systems, leading to confusion and frustration during the payment process.

Slow Loan Approvals

Applying for loans was a headache for students. They had to navigate multiple lender portals separately, which not only increased the time spent but also led to repeated rejections due to a lack of eligibility-based recommendations.

Operational Complexities and Reconciliation Woes

Amity’s Finance team struggled to manage multiple dashboards for payment confirmations, lender statuses, and reconciliation. Offer management was also disorganized, making it difficult to track discounts, bank promotions, and coupon redemptions efficiently.

Creating a Unified Payment Experience

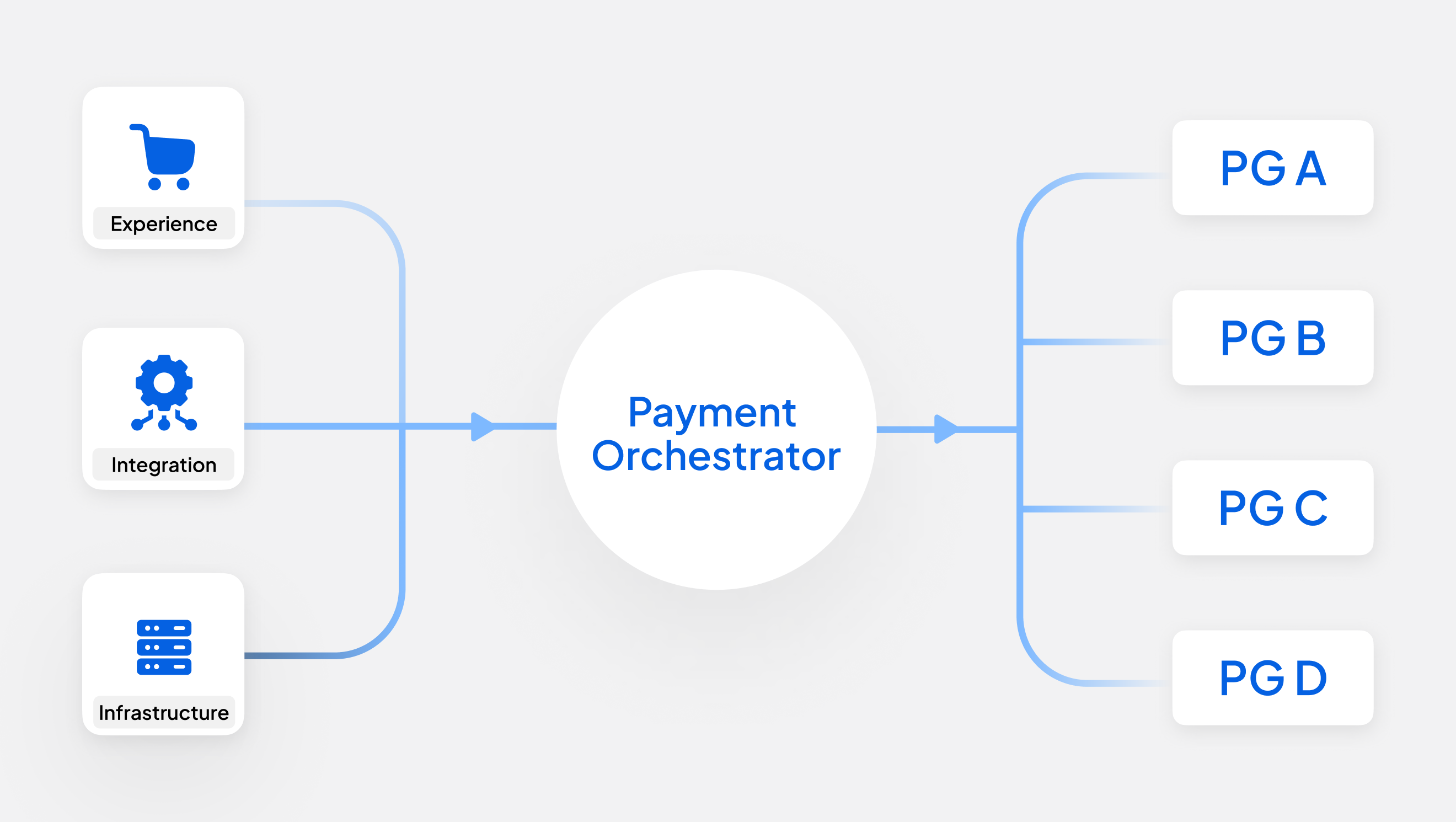

Juspay proposed a fully managed, native payment orchestration solution that didn’t just streamline payments but also optimized affordability options like EMIs and loans.

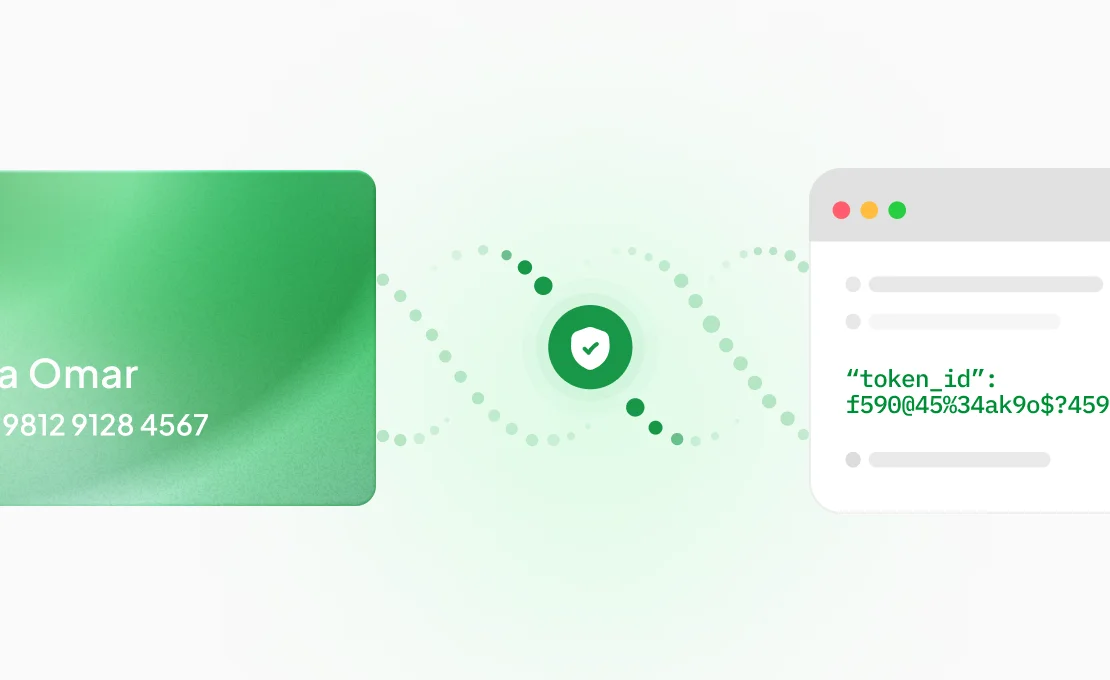

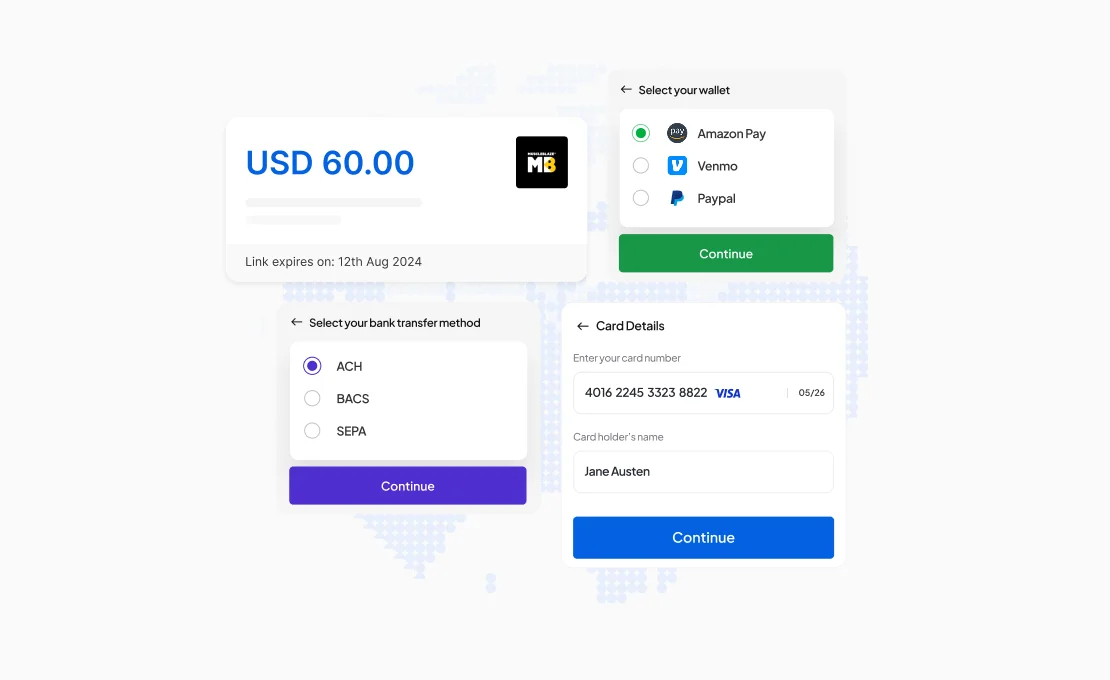

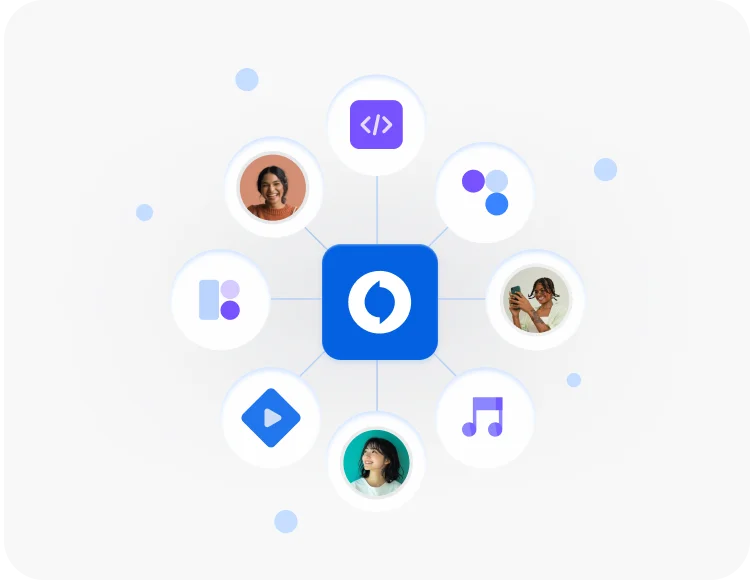

With Juspay’s Hyper SDK, Amity integrated a single payment page across its web and mobile platforms. This meant students could access all payment options—cards, UPI, net banking, EMI, and instant loans—within one consistent, user-friendly interface. No more redirects to different portals.

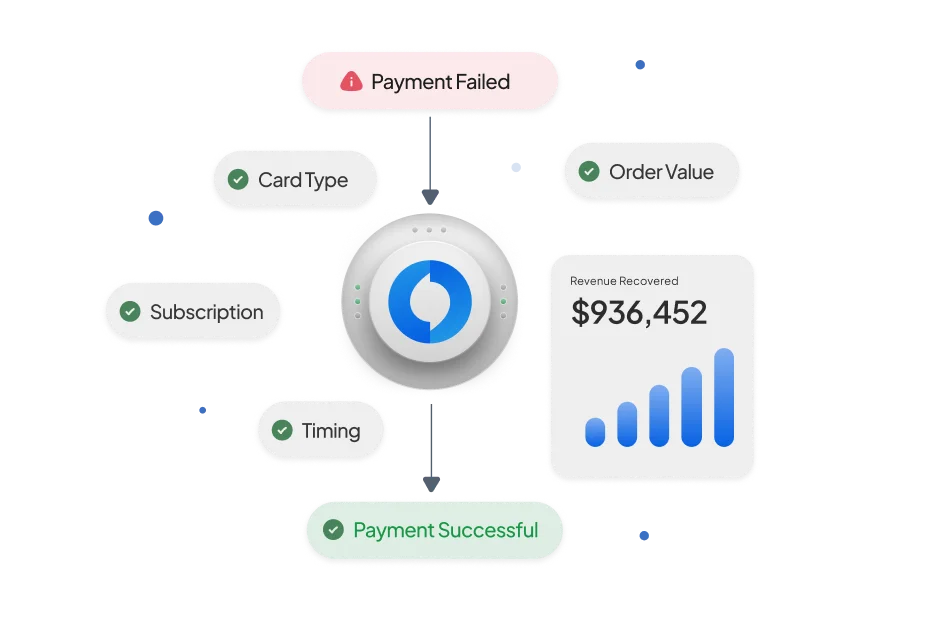

Juspay’s configurable payment page also allowed Amity to:

- Customize the order of payment options (e.g., prioritizing EMI for high-ticket purchases).

- Enable real-time alerts for payment methods with low success rates.

- Optimize retry logic for failed transactions, boosting completion rates.

Empowering Smarter Loan Approvals with HyperCredit

Juspay introduced HyperCredit, a dynamic lender recommendation engine that transformed the loan application process for Amity by:

- Aggregating all lenders under one common entry point.

- Matching students with lenders based on eligibility, reducing rejection rates.

- Enabling instant re-attempts with alternate lenders if the first attempt failed.

- Providing real-time visibility into loan statuses across all partners.

This approach slashed loan approval times and gave students a smoother, more reliable financing experience.

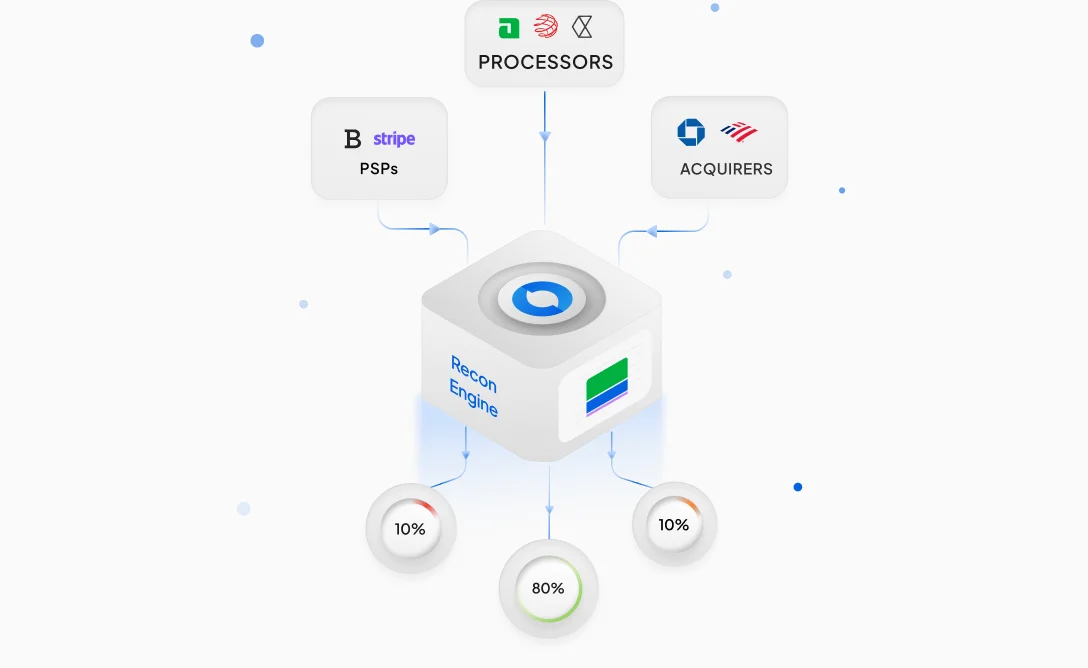

Automating Reconciliation and Optimizing Offer Management

Juspay’s reconciliation module automated the matching of settlement data from multiple payment partners, cutting down on manual effort significantly.

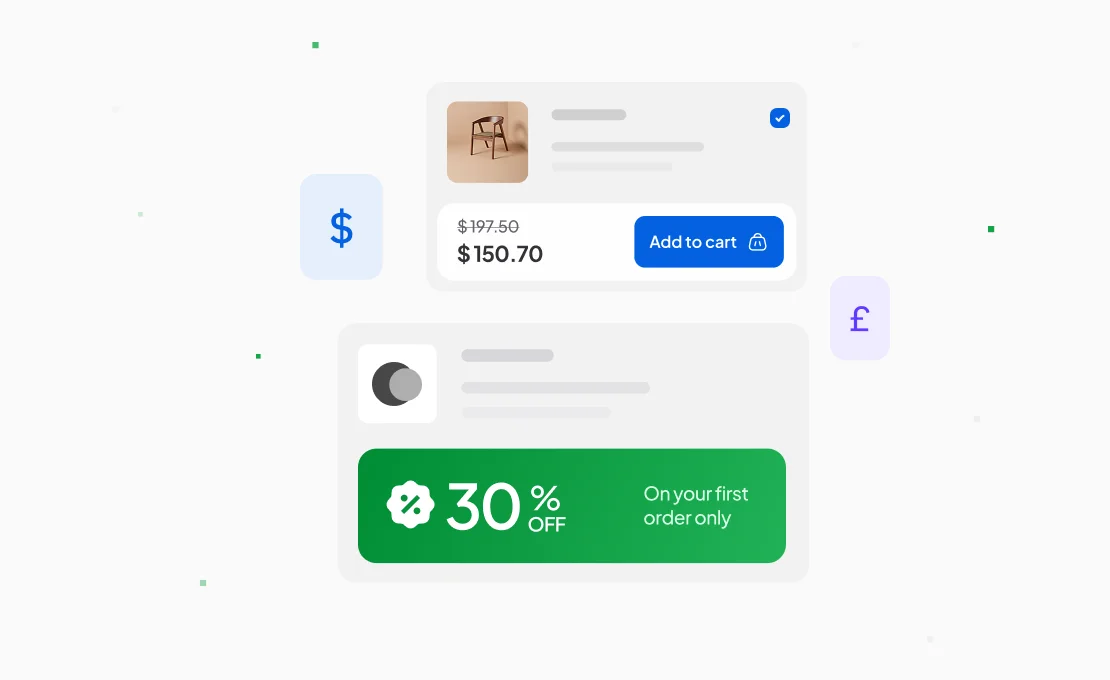

Additionally, Amity could now configure and track offers directly within Juspay’s platform, simplifying the management of:

- Custom discount codes for students.

- Bank and lender-specific promotions.

- Reporting and reconciliation of applied discounts.

Transforming Payment Operations and Student Experience

With Juspay, Amity transformed its payment process from a fragmented, cumbersome operation into a seamless, automated experience. By leveraging Juspay’s payments stack, Amity now offers students a frictionless payment journey while optimizing operations at scale.

For any online platform dealing with complex payment workflows, Juspay provides the perfect blend of technology, flexibility, and reliability to simplify payments and drive better business outcomes.