The modern hospitality ecosystem has mastered the visible guest experiences, with great amenities, personalization, or frictionless service at the front desk. However, a common hurdle in the financial infrastructure has the potential to entirely diminish this experience.

It is a costly paradox, guest-facing teams relentlessly innovate to create seamless, intuitive journeys, the payment infrastructure that powers those journeys remains fragmented due to a patchwork of legacy systems, regional PSPs, and manual workarounds.

Payments are the final mile of the guest experience for a hotel, moving beyond mere transactions. When a payment fails, is declined due to rigid fraud controls, or forces the guest into a manual resolution loop, it devalues the entire investment made in the rest of the guest journey.

The Growing Complexity of Hospitality Payments

Unlike traditional retail, payments in hospitality aren’t just transactional, they’re contextual. Hotels must support not only advance bookings but also delayed capture, partial charges, loyalty redemption, local wallets, and even “no-show” fees.

Online Travel Agencies (OTAs) have become the dominant gateway to hotel discovery and bookings, especially for cross-border travelers. Each OTA enforces its own payment logic, tokenization rules, and fraud controls, which must coexist with the hotel’s PMS, POS systems, and direct booking infrastructure. And because the guest often expects to pay at the hotel (even when booking through an OTA), hotels inherit the risk of invalid cards and no-shows without early authentication. As OTAs continue to scale globally, they amplify the operational burden on hotels: fragmented data, inconsistent authorization performance, and complex reconciliation.

Key challenges include:

- Cross-Border Friction: Merchants often face rising costs due to cross-border fees and the complexities of accepting local currencies. Guests increasingly prefer local payment methods like GCash (Philippines), PayNow (Singapore), or Konbini (Japan), which their existing Payment Service Providers (PSPs) might not support. This leads to merchants working with multiple PSPs to cover different regions, which results in a reconciliation nightmare, requiring merchants to manually consolidate data across different platforms and regions back into their internal systems.

- Fragmented collection flows: Bookings are made online but often paid at check-in, over the phone, via OTA, or through corporate accounts. This disconnection between booking and payment channels makes tracking revenue difficult.

- High failure rates: Lost bookings are often a result of a lack of expertise in risk and fraud detection. Merchants frequently struggle with understanding local fraud trends, fail to accept the right localized payment methods, or lack the necessary prevention tools. This leads to authentication failures, 3DS friction, and an inability to effectively distinguish between legitimate customers and fraudsters.

- Operational overhead: Merchants often operate with multiple systems that suffer from broken flows. This disconnect forces them to rely on manual processes for refunds, chargebacks, and settlements.

- Pay-at-hotel workflows: When a booking is made online but payment occurs at the property, it introduces significant collection risks. Beyond simple logistics, these workflows are highly susceptible to fraud and chargebacks, as the cardholder verification often happens too late in the guest journey.The booking is made online, but the payment happens at the property. This introduces collection risks and complex workflows.

- No-show scenarios: Merchants must charge cancellation fees selectively depending on terms agreed upon at booking, which can be technically difficult to execute without card-on-file capabilities.

- Split payouts and loyalty programs: Payments often need to be distributed across multiple stakeholders, such as franchisee hotels, marketplaces, and service providers. These split payments are often triggered manually on the merchant's bank platform. This dependency on manual execution is prone to human error, which can lead to settlement mistakes.

The impact is clear and damaging: frustrated guests, lower conversion rates, and completely avoidable operational costs.

The Solution: A Programmable, Unified Layer of Payment Infrastructure

Orchestration: The Digital Concierge for Every Guest Payment

Managing payments across multiple geographies, providers, and risk profiles is complex. Especially for enterprises like hotel groups relying on a single PSP or manually stitching together multiple vendors often leads to fragmented experiences, failed transactions, and operational overhead.

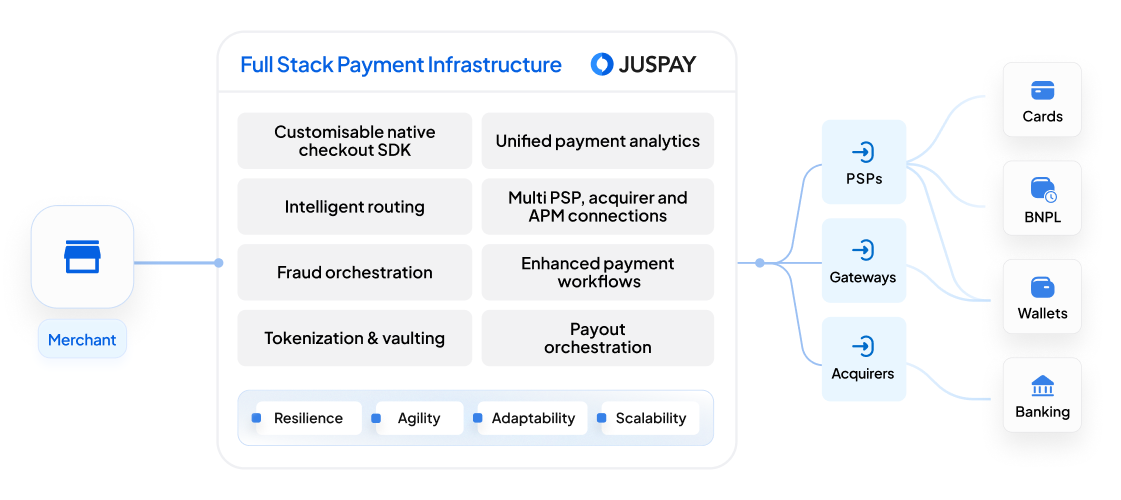

A Payment Orchestration Layer acts as the central nervous system of the payment stack. It sits above all PSPs, acquirers, PMS and fraud tools, enabling businesses to route transactions intelligently, unify data flows, and manage the entire payment lifecycle from one hub. With a single integration, a hotel group can connect to a local gateway in Thailand, a global acquirer for US cards, and a specialized fraud tool for high-risk regions, all while maintaining full control.

This orchestration unlocks seamless, reliable payments regardless of geography or risk. Failed transactions are retried automatically through alternative providers, preserving the guest booking experience. Operational complexity is dramatically reduced, cross-border challenges are abstracted away, and the business delivers a smooth, localized payment journey at global scale.

APMs & Multi-Currency: Speaking the Guest's Language

Today’s travelers expect to pay using familiar, trusted methods. With Alternative Payment Methods (APMs) like digital wallets, bank transfers, and BNPL services projected to account for nearly half of global e-commerce transactions, offering only card-based options is no longer enough. For hospitality businesses, failing to support region-specific methods like GrabPay in Southeast Asia, iDEAL in the Netherlands, or UPI in India, creates friction and leads to lost bookings.

A modern payment infrastructure enables dynamic, intelligent structure of APMs, detecting the guest’s location, device, and currency to surface the most relevant options in the local language. Multi-currency support ensures guests can view prices in their native currency while the hotel receives settlements on its own, removing foreign exchange ambiguity and operational burden.

This level of payment localization builds instant trust with guests and reduces friction at checkout. It not only drives higher conversion rates in existing markets but also accelerates growth in new and emerging geographies.

Pay at Hotel and OTA workflows: Capture Revenue Beyond the Booking

In many OTA and “Pay at Hotel” journeys, cards aren’t charged upfront but stored and used later. This creates gaps: expired cards, failed charges, and lost revenue from no-show or cancellation fees.

A modern orchestration layer solves this by securely storing cards, validating them in real time, and automating fee collection based on smart rules. With reliable auto-capture in place, hotels can seamlessly execute delayed charges, no-show fees, and other post-booking settlements without manual effort.

This reduces leakage, cuts operational overhead, and ensures hotels do not miss out on revenue.

Smart Payouts: Seamlessly Settling With Global Properties & Partners

While payments come in centrally, settling funds with individual properties and partners is often messy due to different currencies, varied fees, and manual reconciliation.

An orchestration layer fixes this by collecting payments, auto-reconciling every booking, and triggering payouts to each property after deducting MDR, FX, and commissions.

With support for multiple payout rails - bank transfers, cards, and local payment methods, funds reach properties quickly and at the lowest cost.

This creates clean reconciliation, faster settlements, and a far smoother financial experience for hotels and their partners.

Intelligent Routing: The Revenue Maximizer

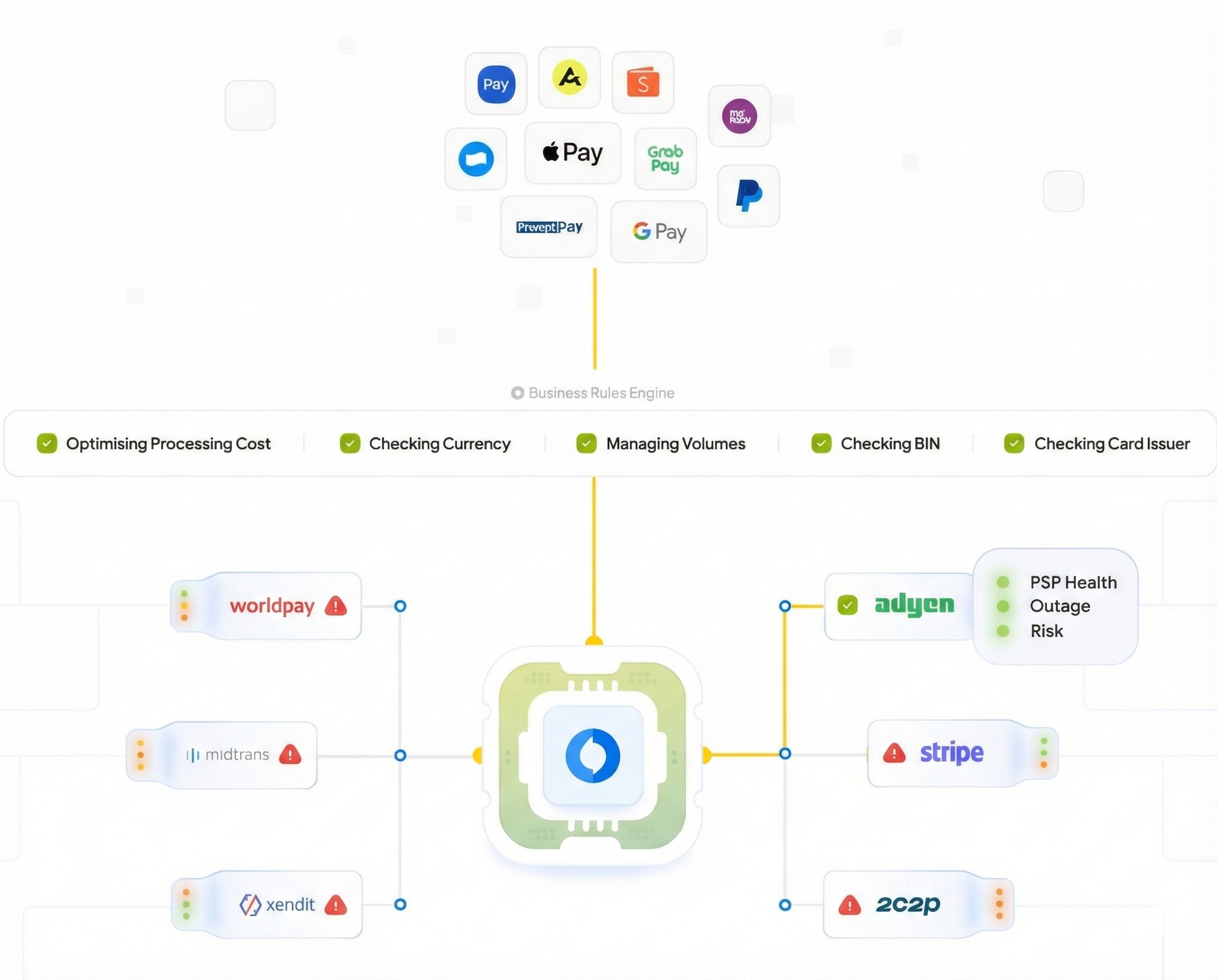

Relying on a single payment gateway for all transactions often leads to higher costs, lower success rates, and vulnerability to provider outages. For global hospitality businesses, this results in failed bookings, unnecessary cross-border fees, and lost revenue especially when guests use diverse cards and currencies.

Intelligent Routing, enabled by a payment orchestration layer, automatically directs each transaction to the most optimal payment processor in real-time. Based on configurable rules like cost efficiency, historical success rates, currency, location, and processor performance, it dynamically selects the best path for every payment and can also reroute traffic instantly in case of downtime or latency issues.

This precision routing boosts authorization rates by up to 10% and reduces processing costs by 5–8%. For hotels, that means more confirmed bookings, lower payment overhead, and a resilient infrastructure that maximizes revenue while adapting to market conditions in real time.

Checkout: The Frictionless Front Door

The checkout page is the final step in converting guest intent into revenue. But even small UX flaws like form fatigue, redirects to third-party payment pages, or poor mobile responsiveness can derail bookings at the last moment. As guest expectations rise, especially around convenience and speed, legacy checkouts become a liability.

A modern payment infrastructure empowers hotels to design a high-converting, branded checkout experience. Additionally, secure tokenization enables one-click payments for returning users, while smart retry logic handles soft declines. With smart recovery features, users can correct a typo without re-filling the entire form and a fully responsive design ensures the experience is consistent across desktop, mobile, and tablet.

Together, these enhancements reduce friction at the point of conversion and significantly boost success rates. Guests complete bookings faster and with greater confidence, whether from an office desktop or an airport lounge. The result is more revenue, fewer abandoned carts, and a payment experience that reflects the brand’s hospitality promise.

Risk Management: Smart, Dynamic Defense

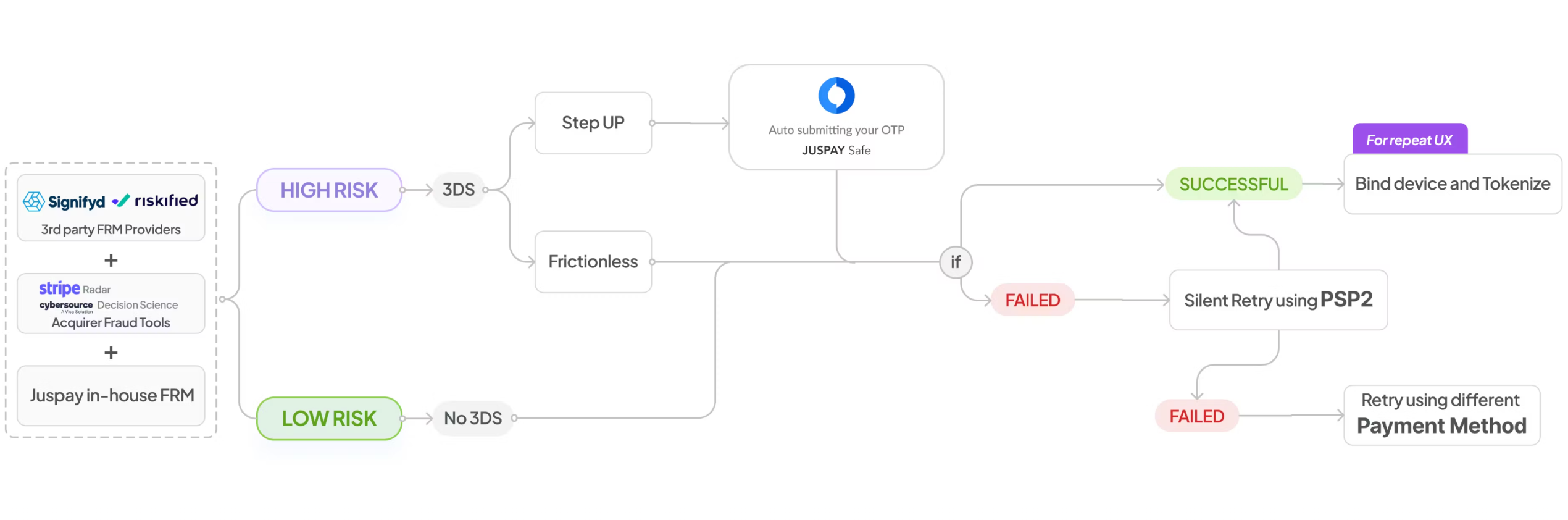

In hospitality, high-value transactions and international traffic make payments a prime target for fraud. Static fraud rules may likely fail by either letting suspicious transactions slip through or falsely blocking legitimate ones, damaging both revenue and guest trust.

Modern risk infrastructure combines third-party fraud scoring with business-specific rules that adjust in real time. It assesses each transaction based on behavior, geography, and context. For example, a booking from a new card in a high-risk country might trigger a 3DS challenge, while a loyal repeat guest completes checkout seamlessly. This layered, adaptive approach lets allos fine-tuned defenses without adding blanket friction.

The result is precision: high-risk payments are stopped without impacting the broader guest base. Chargebacks decline, fraud losses are minimized, and genuine guests enjoy a smooth experience. Risk management becomes a strategic enabler, protecting revenue while maintaining guest satisfaction.

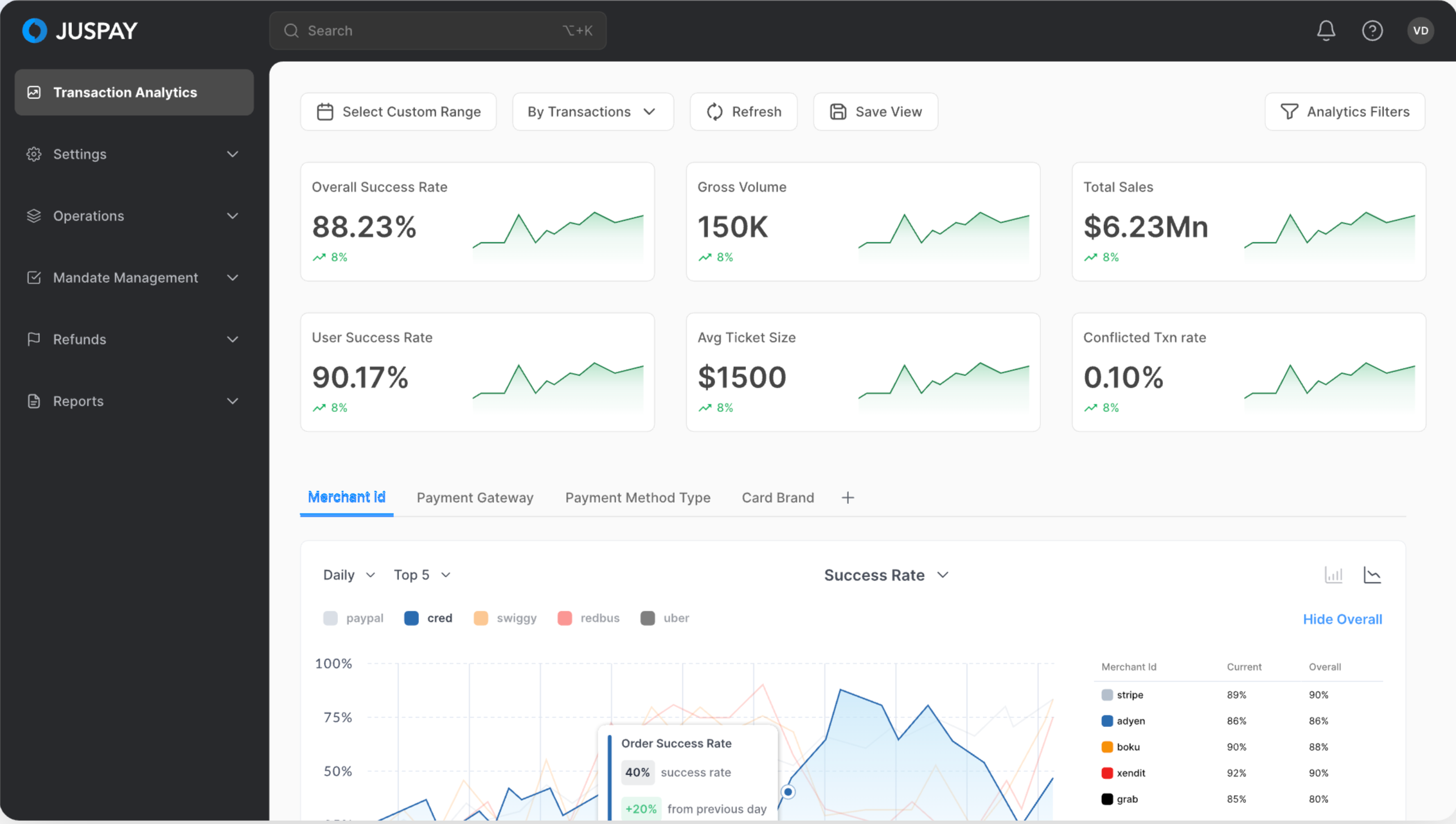

Analytics: From Data Swamps to Actionable Insights

Hotel groups generate enormous volumes of payment data, but much of it remains siloed across PSPs, acquirers, and internal tools. Without a unified view, it’s difficult to track performance, diagnose issues, or understand where revenue might be leaking.

An orchestration layer aggregates all payment activity into a single dashboard, normalizing data across providers and geographies. Teams can view real-time authorization rates by country or card issuer, identify drop-offs during 3DS, and compare PSP performance. Instead of wrestling with scattered reports, teams get clear, granular insight into every step of the payment journey.

This unified visibility transforms payments from a black box into a source of strategic intelligence. Finance and operations teams can optimize with confidence, troubleshoot faster, and make data-backed decisions that drive both conversion and efficiency.

Authorization: Boosting Success Rates

Every failed transaction is a missed opportunity and can translate into a lost guest. Poor authorization rates can stem from inadequate data sharing with issuers, leading to conservative declines, especially in cross-border transactions.

With modern protocols like 3DS 2.0, hotels can securely pass rich metadata such as device fingerprints, location, and booking context, to issuing banks. A smart payment stack automates this data enrichment process behind the scenes, boosting issuer confidence in real time and increasing approval likelihood.

Higher authorization rates mean more bookings completed, fewer guests lost at checkout, and stronger revenue performance. Smart use of authentication not only meets compliance standards, it actively drives business outcomes by turning risk controls into conversion enablers.

Reconciliation: Automating the Back Office

For multinational hotel groups, reconciling payments across PSPs, time zones, and currencies is a massive operational burden. Manual processes are slow, error-prone, and drain finance resources that could be focused on strategic work.

A unified payment infrastructure automates reconciliation by standardizing data inputs and centralizing workflows. It matches payments, fees, and settlements across providers in real time, flags exceptions automatically, and generates reports on demand. Custom logic can be applied to handle edge cases without breaking the overall flow.

This automation reduces manual effort by up to 90%, streamlines month-end processes, and provides a single source of truth for financial reporting. It transforms reconciliation from a pain point into a competitive advantage, bringing speed, accuracy, and control to the back office.

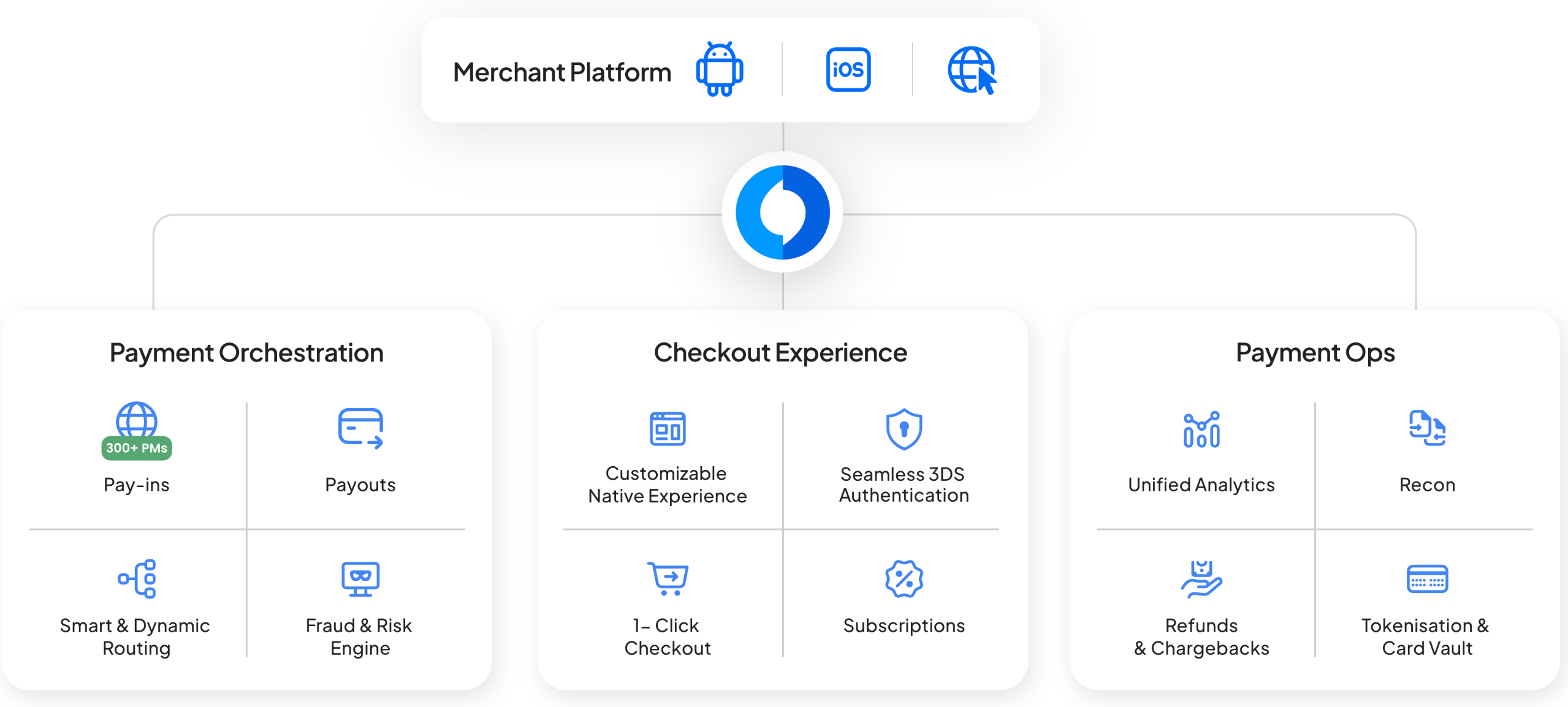

How does Juspay help?

As hospitality brands compete on experience, payments can no longer be an afterthought. That’s where Juspay steps in. Major hospitality groups have already turned payment complexity into a streamlined advantage. They are replacing rigid legacy connections with a single, programmable layer that allows them to utilize a single connection to govern their entire ecosystem, instead of relying on multiple PSPs. They are moving faster, rolling out localized checkouts in new countries within weeks, and empowering their ops teams with unified dashboards that replace manual grunt work with actionable insights.

The result is faster time-to-market, a seamless guest experience, and measurable ROI from a function previously viewed as "back-office" administration. Whether expanding across Asia or building an omnichannel boutique brand, rethinking payment architecture is the definitive step to bridging the gap between operational vision and reality.