Over the past few years, recurring payments/subscription billing has seen rapid growth. According to a report by Mordor Intelligence, the recurring payments/subscription billing management market size is estimated at USD 7.97 billion in 2025, and is expected to reach USD 17.02 billion by 2030, at a CAGR of 16.38%.

The primary reason for this increase is the convenience that it offers to the end users and a predictable source of revenue to the businesses. This guide will walk you through everything you need to know about recurring payments

What Are Recurring Payments?

Recurring payments are automatic transactions that happen on a predetermined schedule without requiring manual action from your customers each time. Think of them as the digital equivalent of old-school magazine subscriptions, but much more versatile and powerful.

When a customer sets up recurring payments with your business, they authorize you to charge their payment method – whether that's a credit card, bank account, or digital wallet – at regular intervals. This could be weekly, monthly, quarterly, or any schedule that makes sense for your business model.

Here's what makes recurring payments different from regular one-time transactions:

- Automation: Once set up, payments process automatically

- Predictability: Both you and your customers know exactly when payments will occur

- Continuity: Services or products continue uninterrupted as long as payments succeed

- Convenience: Customers don't need to remember to make payments manually

Business Use Cases for Recurring Payments

Businesses across virtually every industry are finding ways to use subscription billing and recurring payment models. Let's explore how different types of businesses benefit from this approach.

Software and SaaS Companies

Software companies were one of the top beneficiaries of recurring payments. Instead of selling software licenses for thousands of dollars upfront, companies like Adobe, Microsoft, and countless SaaS providers now offer monthly or annual subscriptions making their solutions more accessible..

Membership and Subscription Services

Gyms, streaming platforms, and professional associations rely heavily on recurring billing. Netflix charges you monthly to access their content library. Your local gym automatically debits your account every month for membership access.

E-commerce and Retail

Subscription boxes have exploded in popularity. Companies are now sending healthcare products, grooming products or even food & beverages regularly and charging customers automatically.

Service-Based Businesses

Professional services are moving to retainer models with recurring payments. Agencies, accounting practices, and consulting companies often set up monthly retainer agreements. This gives them predictable cash flow and allows clients to budget more effectively.

Utilities and Essential Services

Utility companies, internet service providers, and phone companies have been using recurring billing for the past few years. These essential services work perfectly with automatic payments because customers need them consistently.

Healthcare and Wellness

Medical practices, therapy services, and wellness programs often use recurring payments for ongoing treatments or programs. A physical therapy clinic might set up weekly payments for a treatment program, or a nutrition coach might charge monthly for ongoing support.

How Do Recurring Payments Work?

Understanding how recurring payments function behind the scenes helps you make better decisions about implementing them in your business. The process involves below mentioned steps that happen automatically once everything is set up.

The Step-by-Step Process

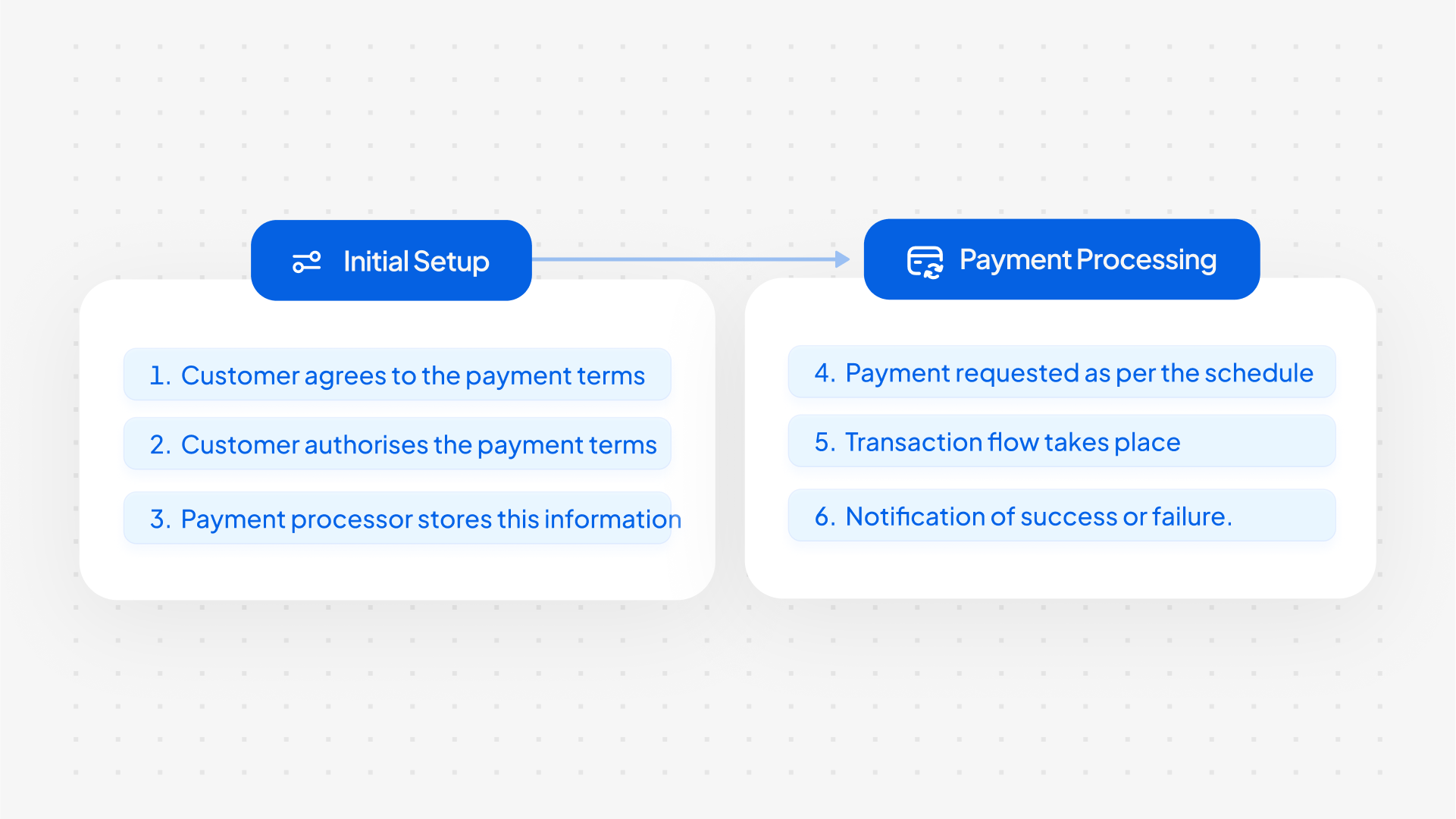

Initial Setup:

- The customer agrees to the payment terms like amount, payment schedule, expiry date, etc, and provides payment information (card details, bank account, etc.)

- The customer authorizes automatic charges on the agreed schedule

- The payment processor or vault provider securely stores this information (usually tokenized for security)

Payment Processing:

- The payment processor attempts to charge the customer's payment method as per the scheduled date.

- The rest of the transaction flow happens like a normal payment - the acquirer passes the payment information to the network (Visa, Mastercard, etc. in case of card transactions), which then passes the payment information to the issuer, the issuer authorizes/declines the transaction and sends response back to the acquirer via network.

- Both the business and the customer receive notification of success or failure.

Behind the Scenes

Modern recurring payment systems use advanced technology to make this process seamless:

Tokenization: Instead of storing actual card numbers, systems store secure tokens that represent the payment method. This significantly reduces security risks.

Smart Retry Logic: When payments fail. They might retry the payment a few days later, try a backup payment method, or follow other rules you configure.

Proration and Billing Adjustments: Advanced systems can handle mid-cycle changes, refunds, and complex billing scenarios automatically.

Types of Recurring Payments

Not all recurring payments work the same way. Understanding the different types helps you choose the right approach for your business model and customer needs.

Based on Payment Schedule

Fixed Recurring Payments These charge the same amount on a regular schedule. Examples include:

- Monthly software subscriptions ($29/month)

- Annual membership fees ($299/year)

- Weekly meal delivery ($75/week)

Fixed payments are the simplest to understand and manage. Customers know exactly what they'll be charged and when.

Variable Recurring Payments The schedule is regular, but the amount changes based on usage or other factors:

- Utility bills (monthly, but amount varies by usage)

- Cloud hosting (monthly, but varies by server usage)

- Phone bills (monthly base rate plus usage charges)

Variable payments require more sophisticated billing systems but can be fairer for customers who use different amounts of your service.

Based on Usage Models

Subscription-Based Payments Customers pay a regular fee for ongoing access to a service or product. The payment continues as long as they want to maintain access. Examples include:

- Streaming services like Netflix or Spotify

- Software subscriptions like Adobe Creative Suite

- Membership sites with exclusive content

Usage-Based Recurring Payments These combine a base fee with charges based on actual usage:

- Cloud services that charge for storage and bandwidth

- Communication tools that charge per user or per message

- API services that charge based on the number of calls

Based on Payment Method

Credit Card Recurring Payments The most common type, where customers authorize automatic charges to their credit cards.

Bank Transfer (ACH) Recurring Payments These pull money directly from customers' bank accounts.

Digital Wallet Recurring Payments Digital wallets like PayPal or Google Pay can handle recurring payments.

How to Accept Recurring Payments: A Step-by-Step Guide

Setting up recurring payments for your business involves several important decisions and steps. Here's how to approach it systematically.

Step 1: Building Infrastructure

A merchant needs two tools before collecting recurring payments. One, a billing engine to set up billing logics and a payment processor to receive payments.

Businesses can choose to build their own billing system or opt for a specialized recurring billing platform to handle billing logic, depending on the complexity of their pricing models and requirement of other features like dunning management, detailed analytics, etc.

Lets move on to the other tool, which is a payment processor. You need to take a few factors into consideration before selecting a payment processor

- Does it support your billing logic

- What payment methods does it support

- Is it offering a seamless checkout experience to your customers

Once you have these two tools ready, you can now set up your pricing structure

Step 2: Setting Up Pricing Structure

Recurring payments allow for flexible pricing models:

Simple Monthly/Annual Plans: Fixed prices that are easy for customers to understand.

Tiered Pricing: Different service levels at different price points, common with software subscriptions.

Usage-Based Pricing: Base fee plus charges based on consumption, good for services where usage varies significantly.

Freemium Models: Free basic service with paid premium features.

You need to evaluate the pricing structures to find the best fit for your business.

Step 3: Designing the Customer Experience

The sign-up process needs to be smooth and clear:

Transparent Pricing: Display prices, billing frequency, and any additional fees clearly.

Easy Cancellation: Make it simple for customers to cancel or modify their subscriptions. This helps in building trust.

Payment Method Options: Accept multiple payment methods to accommodate different customer preferences.

Step 4: Ensuring Security and Compliance

Recurring payments involve storing customer payment information, which creates security and compliance requirements:

PCI DSS Compliance: Your payment processor who will be handling payment information should be PCI DSS compliant

Data Protection: Implement proper security measures for customer data and follow relevant privacy laws like GDPR or CCPA.

Authorization and Documentation: Keep clear records of customer authorization for recurring charges. This helps resolve disputes and chargebacks.

Step 5: Setting Up Monitoring and Management

Once recurring payments are running, you need systems to monitor and manage them:

Failed Payment Handling: Set up automatic retry logic and customer notification systems for failed payments.

Churn Management: Track why customers cancel and implement strategies to reduce churn.

Revenue Analytics: Monitor metrics like monthly recurring revenue (MRR), customer lifetime value, and churn rates.

Challenges and Drawbacks of Accepting Recurring Payments

While recurring payments offer significant benefits, they also come with unique challenges that you need to understand and plan for.

Failed Payments and Customer Churn

Failed payments are one of the biggest challenges with recurring billing. Credit cards expire, bank account balances run low, and payment methods get blocked for security reasons. These involuntary churn issues can significantly impact your customer retention and revenue, as customers may not even realize their payments have failed until their service is suspended.

Regulatory and Legal Considerations

Recurring payments are subject to various regulations that vary by location and industry:

Authorization Requirements: You must have clear customer authorization for recurring charges. This often means specific language in your terms of service and sign-up process.

Cancellation Rights: Many jurisdictions require easy cancellation options and advance notice of price changes.

Data Protection: Storing payment information long-term creates ongoing data protection responsibilities.

Chargeback Rules: Recurring payments have different chargeback rules than one-time transactions, and customers can dispute charges months after they occur.

Technical Complexity

Implementing recurring payments properly requires more technical sophistication than one-time payments:

Billing Logic: Handling upgrades, downgrades, prorations, and billing adjustments requires complex business logic.

Integration Challenges: Recurring billing systems need to integrate with your existing customer management, accounting, and fulfillment systems.

Testing and Monitoring: Recurring payment systems have many edge cases that need thorough testing and ongoing monitoring.

Fraud and Security Risks

Storing payment information for recurring use creates ongoing security responsibilities:

Data Breaches: You become a more attractive target for criminals because you store valuable payment information.

Fraudulent Sign-ups: Fraudsters may sign up for services using stolen payment information, leading to chargebacks and fraud losses.

Account Takeovers: If customer accounts are compromised, criminals can change payment information or modify subscriptions.

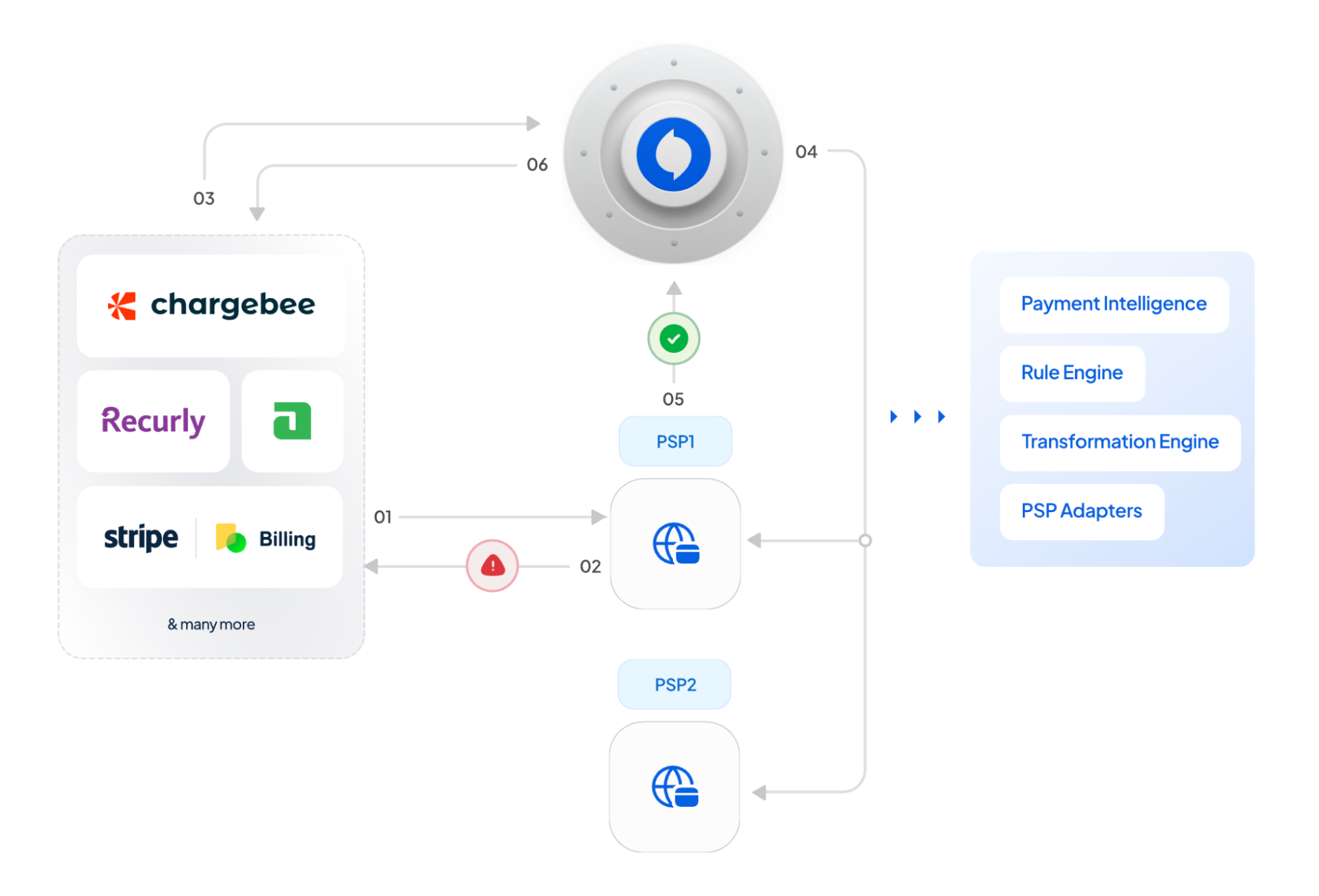

Optimize recurring payments with Juspay

Juspay's recurring payment suite is built to optimize recurring revenue, reduce churn, and power seamless recurring revenue management. Juspay offers seamless subscription payment management starting right from sign-ups till renewal.

Sign-ups - Juspay enables businesses to offer frictionless checkout experience to their customers. It supports setting up recurring payments using cards as well as local alternative payment methods (APMs)

Renewal - Juspay optimizes renewals with retries, real-time card updater and more. We enable businesses to Improve customer retention with auto-retries, prevent false declines due to expired card information and power seamless recurring payments.

Let’s take a look at how businesses can optimize their recurring payments with Juspay -

- Improve retention with account updater - Automatically update card details to minimize declined transactions and optimize recurring payments. Reduce payment interruptions by seamlessly refreshing payment information when cards expire, are replaced, lost, or stolen.

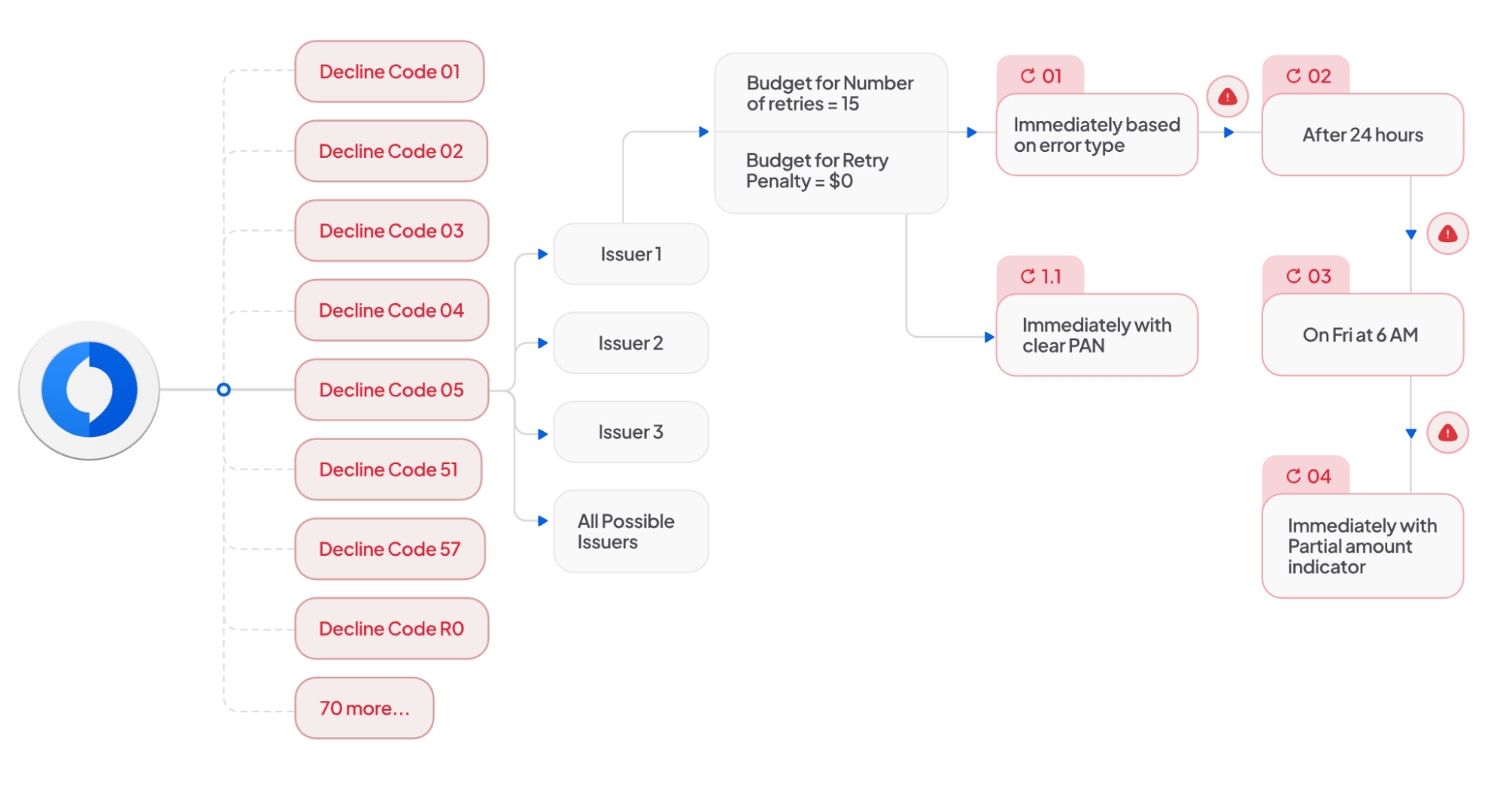

- Improve authorisation rates with smart retries - Retry failed transactions intelligently based on error codes, custom rules,and more.

- Save costs with dynamic retry rules - Multi-modal intelligent retry strategy based on decline code, error type, payment method, region, user behaviour, issuer, and more.

Click here to know more about Juspay’s recurring payments suite

Conclusion

Recurring payments represent a fundamental shift in how businesses think about customer relationships and revenue generation. Instead of focusing solely on individual transactions, you're building ongoing relationships that provide value over time.

Whether you're just starting to consider recurring payments or looking to optimize an existing system, remember that the best recurring payment strategies focus on making life easier for your customers while creating sustainable, predictable revenue for your business. When done right, recurring payments create a win-win situation that benefits both you and your customers for years to come.

Frequently Asked Questions About Recurring Payments

1. What's the difference between recurring payments and subscription payments?

These terms are often used interchangeably, but there's a subtle difference. Recurring payments refer to any automatic payment that repeats on a schedule. Subscription payments are a specific type of recurring payment where customers pay regularly for ongoing access to a service or product.

For example, automatic utility bill payments are recurring payments but not subscription payments. Netflix charges are both recurring payments and subscription payments.

2. How do I handle failed recurring payments?

Failed payments require a systematic approach:

Immediate Retry: Try the payment again immediately in case it was a temporary issue

Smart Retry Logic: Retry failed payments over several days using different strategies with Juspay

Customer Communication: Send friendly emails explaining the failed payment and asking customers to update their information

Grace Period: Continue providing service for a reasonable period while trying to resolve the payment issue

Account Suspension: Eventually suspend service if payment issues can't be resolved

Reactivation Process: Make it easy for customers to reactivate their accounts once payment issues are fixed

3. Are recurring payments secure?

When implemented properly, recurring payments can be very secure. Here's what makes them safe:

Tokenization: Modern payment operating systems like Juspay enable merchants to store tokens instead of actual card numbers

PCI Compliance: Payment processors must follow strict security standards

Encryption: All payment data is encrypted in transit and at storage

Fraud Monitoring: Processors use advanced fraud and risk management systems to detect fraudulent transactions

However, security depends on choosing reputable payment processors and following best practices for data protection.

4. What happens if a customer disputes a recurring charge?

Chargebacks on recurring payments follow a specific process:

Customer Disputes: Customer contacts their bank to dispute the charge

Chargeback Issued: Bank reverses the payment and notifies you

Evidence Submission: You can provide evidence that the charge was authorized

Resolution: Bank decides whether to uphold or reverse the chargeback

To minimize chargebacks:

- Keep clear records of customer authorization

- Use recognizable billing descriptors

- Provide excellent customer service

- Make cancellation easy so customers don't resort to chargebacks